Lashing rain pounded Japan for a second day, and the Kinugawa River has burst through a flood barrier, sending a tsunami-like wall of water into Joso, about 50 kilometers northeast of Tokyo. READ MORE: http://on.rt.com/6qyz

Lashing rain pounded Japan for a second day, and the Kinugawa River has burst through a flood barrier, sending a tsunami-like wall of water into Joso, about 50 kilometers northeast of Tokyo. READ MORE: http://on.rt.com/6qyz

All war is a crime. There is no such thing as a “good war.” As the great Benjamin Franklin said, “there is no good war; and no bad peace.”

We are now in the midst of the annual debate over the atomic bombing of Japan by the United States. Seventy years ago this week, the first atomic bomb was dropped on Hiroshima, killing or injuring some 140,000 people. A few days later, a second atomic weapon was dropped on Nagasaki, causing 80,000 casualties. Most of the dead in both cities were civilians.

Passionate debate has raged ever since between those who condemn the nuclear bombing of almost defenseless Japan as a war crime, and those who insist the attacks spared the US and its allies having to invade fight-to-the-death Japan.

I don’t know the answer to this question.

In 1945, my late father, Henry Margolis, was serving in the Pacific with US Fifth Marine Amphibious Division. The Fifth was slated to lead the amphibious invasion of Japan. After witnessing the fanatical Japanese defense of Okinawa, it appeared that invading Japan’s mainland would be a very bloody affair. My father could have died on Japan’s beaches.

But what was left of Japan by August, 1945? By spring, 1944, almost all of its maritime commerce, and all of its oil and other strategic material, had been cut off by American submarine packs and intensive coastal mining. In effect, the US did to Japan what Germany had never been able to do to that other island realm, Britain.

Japan’s air force was grounded by lack of fuel (as was Germany’s), its fleet could not leave port because of oil scarcity, the nation’s factories were shut down due to lack of raw materials, and Japan’s people faced starvation.

In March, 1945, the US Army Air Force bomber command under Gen. Curtis LeMay began carpet bombing Japan’s cities from bases in the Mariana Islands. American war planners sought to destroy Japan’s industries and will to resist. It’s from this period that LeMay’s famous quote came: ‘We’ll bomb’em back to the Stone Age.”

Continue reading “Bombs Over Tokyo: The Night The US Air Force Incinerated 100,000 Civilians”

Submitted by Roberts Higgs of The indepedent Institute via Contra Corner blog,

Ask a typical American how the United States got into World War II, and he will almost certainly tell you that the Japanese attacked Pearl Harbor and the Americans fought back. Ask him why the Japanese attacked Pearl Harbor, and he will probably need some time to gather his thoughts. He might say that the Japanese were aggressive militarists who wanted to take over the world, or at least the Asia-Pacific part of it. Ask him what the United States did to provoke the Japanese, and he will probably say that the Americans did nothing: we were just minding our own business when the crazy Japanese, completely without justification, mounted a sneak attack on us, catching us totally by surprise in Hawaii on December 7, 1941.

You can’t blame him much. For more than 60 years such beliefs have constituted the generally accepted view among Americans, the one taught in schools and depicted in movies—what “every schoolboy knows.” Unfortunately, this orthodox view is a tissue of misconceptions. Don’t bother to ask the typical American what U.S. economic warfare had to do with provoking the Japanese to mount their attack, because he won’t know. Indeed, he will have no idea what you are talking about.

I’ll bet most here have Fukushima fatigue.

Well, last month there was an 8.5 earthquake in Japan. Today there was a 7.8 that made buildings sway in Tokyo. Article here

An earthquake that further damages Fukushima will have dire consequences for a huge swath of planet earth. If you prep … prep for that also, if even possible.

=================================================== =

Fukushima’s still radiating, self-perpetuating, immeasurable, and limitless, like a horrible incorrigible Doctor Who monster encounter in deep space.

Fukushima will likely go down in history as the biggest cover-up of the 21st Century. Governments and corporations are not leveling with citizens about the risks and dangers; similarly, truth itself, as an ethical standard, is at risk of going to shambles as the glue that holds together the trust and belief in society’s institutions. Ultimately, this is an example of how societies fail.

Tens of thousands of Fukushima residents remain in temporary housing more than four years after the horrific disaster of March 2011. Some areas on the outskirts of Fukushima have officially reopened to former residents, but many of those former residents are reluctant to return home because of widespread distrust of government claims that it is okay and safe.

Part of this reluctance has to do with radiation’s symptoms. It is insidious because it cannot be detected by human senses. People are not biologically equipped to feel its power, or see, or hear, touch or smell it (Caldicott). Not only that, it slowly accumulates over time in a dastardly fashion that serves to hide its effects until it is too late.

Chernobyl’s Destruction Mirrors Fukushima’s Future

As an example of how media fails to deal with disaster blowback, here are some Chernobyl facts that have not received enough widespread news coverage: Over one million (1,000,000) people have already died from Chernobyl’s fallout.

Additionally, the Rechitsa Orphanage in Belarus has been caring for a very large population of deathly sick and deformed children. Children are 10 to 20 times more sensitive to radiation than adults.

A sudden volcano eruption on the small southern Japanese island of Kuchinoerabu-jima has forced authorities to raise the alert to the highest level and advise evacuation of the immediate area. READ MORE: http://on.rt.com/kssuds

I know Americans are math challenged. Public schools are too busy teaching diversity and environmental propaganda about global warming to spend any time on adding, subtracting, multiplying or dividing. Here are a couple charts of doom. Japan has been on a kamikaze mission to destroy their economic system for the last 25 years and the plane is about to hit the carrier. Their total debt now stands at 1.053 QUADRILLION Yen. That’s right. QUADRILLION. That equals $8.8 trillion.

Interest rates in January on their 10 Year bonds reached an all-time low of 0.20%. This morning they reached 0.46%. When you are already paying $130 billion per year in interest and your interest rates double in a matter of months, you’ve gotta problem. If the worldwide bond market reassessment of risk continues, it won’t only be Greece crashing and burning. One of the biggest economies in the world will implode. And it will take the world with it.

U.S. 10 year Treasury rates are also soaring. Politicians and central bankers across the globe have done nothing but add debt, devalue currencies, create mal-investment with 0% interest rates, and prop up financial markets for the last six years. Now the bill is coming due. The slightest increase in interest rates will trigger a worldwide financial Armageddon. Bugs will be meeting windshields across the world.

Today, I’m going to tell you about the end of the world. Not the end of the world exactly. But the end of the fiat money system President Nixon gave birth to in 1971… when he cut the dollar loose from gold.

And it may feel like the end of the world, because of the social chaos it will provoke. What follows is taken from a speech I gave at Doug Casey’s La Estancia de Cafayate …

Meet Rorschach, from Alan Moore’s “Watchmen”

I’ve been predicting the end of the world – at least the end of the post-1971 monetary world – for a long time. I hope I’m wrong about it. But sooner or later, I’ll be right. In the meantime, I’m like a surgeon who has just botched an operation. He sees the patient stiff on the table and wonders if he should go back to the textbooks. Maybe the anklebone is not connected to the shin bone after all.

But the textbooks are hopeless. They’re written by modern economists. And they believe an economy is mechanistic, not humanistic. These folks have fixes for every problem and wrenches in both hands. They also run our central banks. And they think they know what is going on… and what they’re going to do about it.

A glassblower’s shop. A used-furniture store. Luxury high-rise condos protected by double fences and electric wire. Neighborhood bars. Fancy restaurants. Sushi. Pizza. Bold glass office buildings.

The Itaim Bibi neighborhood of São Paulo seems to have been spared the zoners’ boring prescriptions. Offices, houses, shops all mingle promiscuously. A small house – modest, cheap, built in the 1950s – sits across from our hotel. It’s forgotten by time, surrounded by the commerce of the 21st century.

Another house on the Rua Floriano sits underneath an office complex. The owners refused to sell. So the developers built a huge, slick office tower right over it.

“It’s a great city,” says a colleague. “There are only a handful of cities like this in the world. London, Shanghai, Mumbai, Beijing. Paris is a small town in comparison.”

Little by little, we’re beginning to find our way around. But we’re not here for our own amusement. We’re not just drinking caipirinhas and ogling the Paulistas. No, that would be selfish. We’re here on your behalf, to learn. To study. To try to understand how this economy works.

It’s just a coincidence that it’s summer here. And that this weekend it’s Carnaval. And that we have a ticket to Rio in our pocket.

Photo credit: victorpalmer

Our subject lately has been debt. Paul Krugman says no one understands it. He proved his point in a recent New York Times column; at least he proved that he has no idea of how it works.

“We owe it to ourselves,” he wrote. That suggests that the net impact of debt is zero. But is it?

Continue reading “The First Casualty as Debt Implodes Will Be …”

In Part One of this article I explained the model of generational theory as conveyed by Strauss and Howe in The Fourth Turning. In Part Two I provided an overwhelming avalanche of evidence this Crisis has only yet begun, with debt, civic decay and global disorder propelling the world towards the next more violent phase of this Crisis. In Part Three I addressed how the most likely clash on the horizon is between the government and the people. War on multiple fronts will thrust the world through the great gate of history towards an uncertain future.

“The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it.” – Strauss & Howe – The Fourth Turning

The drumbeats of war are pounding. Sanctions are implemented against any country that dares question American imperialism (Russia, Iran). Overthrow and ignominious imprisonment or death awaits any foreign leader questioning the petrodollar or standing in the way of America spreading democracy (Iraq, Libya, Syria, Ukraine, Egypt). The mega-media complex of six corporations peddle the government issued pabulum about ISIS being an existential threat to our freedoms; Russia being led by the new Hitler and poised to take over Europe; Syria gassing innocent women and children; and Iran only six months away from a nuclear bomb (they’ve been six months away for the last fourteen years). Hollywood does their part with patriotic drivel like American Sniper, designed to compel low IQ unemployed American youths to swell with pride and march down to enlistment centers, located in our plentiful urban ghettos.

The most disconcerting aspect of Fourth Turnings is they have always climaxed with total destructive all-out war. Not wars to enrich arms dealers like Iraq, Afghanistan, and Syria, but incomprehensibly violent, brutal, wars of annihilation. There are clear winners and losers at the conclusion of Fourth Turning wars. Leaders mobilize all forces, refuse to compromise, define their enemies in moral terms, demand sacrifice on the battlefield and home front, build the most destructive weapons imaginable, and employ those weapons to obtain victory at any cost.

It may seem inconceivable that war on such a scale will happen within the next ten years, but it was equally inconceivable in 1936 that 65 million people would die in the next ten years during World War II. We valued all the wrong things and made all the wrong choices leading up to this Crisis and during the early stages of this Crisis. The accumulation of unmet obligations, unpaid bills, un-kept promises and unresolved issues will provide the fuel for an upheaval that will shake our society to its core and transforms the country’s direction for the next sixty years. The outcome of the conflict could be tragedy or triumph. Our choices will make a difference.

There will be war on many fronts, and they have already begun. The culmination will likely be World War III, with the outcome highly uncertain and potentially disastrous.

Continue reading “FOURTH TURNING – THE SHADOW OF CRISIS HAS NOT PASSED – PART FOUR”

In Part One of this article I laid the groundwork of the Fourth Turning generational theory. I refuted President Obama’s claim that the shadow of crisis has passed. The shadow grows ever larger and will engulf the world in darkness in the coming years. The Crisis will be fueled by the worsening debt, civic decay and global disorder. I will address these issues in this article.

The core elements propelling this Crisis – debt, civic decay, and global disorder – were obvious over a decade before the financial meltdown catalyst sparked this ongoing two decade long Crisis. With the following issues unresolved, the shadow of this crisis has only grown larger and more ominous:

Debt

“To honor these obligations we could (a) raise all federal taxes, immediately and permanently, by 57%, (b) cut all federal spending, apart from interest on the debt, by 37%, immediately and permanently, or (c) do some combination of (a) and (b).”

The level of taxation and/or Federal Reserve created inflation necessary to honor these politician promises is too large to be considered feasible. Therefore, these promises, made to get corrupt political hacks elected to public office, will be defaulted upon.

Continue reading “FOURTH TURNING – THE SHADOW OF CRISIS HAS NOT PASSED – PART TWO”

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it’s 1999, central bankers not only don’t take away the punch bowl – they spike it with 200 proof grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn’t really deteriorating, and the entire façade is supposedly validated by all-time highs in the stock market. It’s nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun – Japan. The leaders of this former economic juggernaut have chosen to commit hara-kiri on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn’t enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers – again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn’t need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn – excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world’s central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it’s with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender – Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

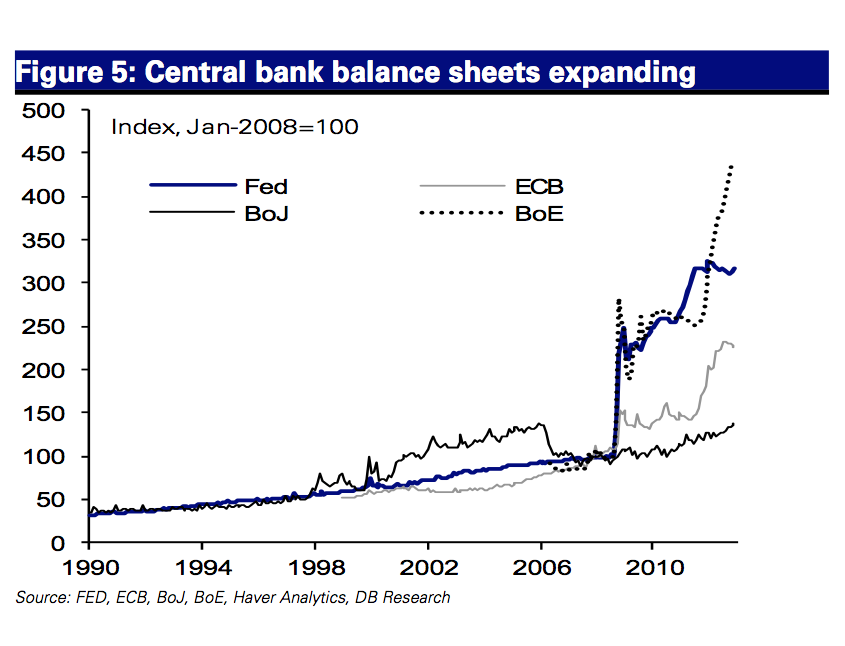

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive “surprise” increase in purchases of bonds and stocks. It wasn’t a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it’s not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn’t even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe’s solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises

Source: Wikimedia

Dear Diary,

Not much market action yesterday. So, let us turn to what is bound to be the funniest… and scariest… story in the financial world.

Once again, our hat is off to the stalwart, intrepid and half-mad Japanese. They are going where no respectable economist would go… no responsible public policy should go… and no one with his wits about him would want to go.

We begin with the latest news: Nippon is in a slump. The numbers from the third quarter confirm that the feared “triple-dip” recession is here.

Japanese growth fell at a 1.6% annual rate for the June-to-September quarter. The consensus forecast had been for a 2.2% rise in growth.

This is bad news for Abenomics. He lets fly his arrows. They end up sticking in his derriere. The idea (if you can call it that) was to stimulate inflation, growth and job creation.

How?

Easy. You print more money!

Bailouts and Boondoggles

For the last 20 years, the Japanese government has been borrowing the retirement savings of its long-suffering “salarymen” and spending the money on bailouts and boondoggles – often involving vast amounts of concrete that now covers half the country.

If that weren’t enough – and it obviously wasn’t – in March 2001, the Bank of Japan invented QE to add some monetary steel to the fiscal cement. The Bank of Japan became the largest buyer of the government’s debt… increasing the monetary base by roughly 60%.

What did all this feverish building get the Japanese people, apart from five times as much government debt?

Absolutely nothing. The index of Japanese industrial output was at 96.8 in 1989. Today, it is still at 96.8.

In other words, this entire “stimulus” has stimulated not a single electron, proton or neutron. The real economy has not grown by a single yen. Nor has a single new job been created.

Nothing succeeds like failure. Per acre, no nation has ever been abused by so much monetary and fiscal failure.

You’d think the Japanese would have had enough of it by now. Instead, like a woozy customer just before closing time, they call out for more.

Abe’s Hidden Agenda

Or at least they elect Shinzo Abe, who promises more.

Especially more QE: Instead of buying a piddling 60% of Japanese government debt, the BoJ will buy all of it.

We hold our breath. We reach for the back of a chair to steady our staggered legs.

Could we have read that right?

Yes. Bloomberg reports that the BoJ’s record stimulus “may see it buy every new bond the government issues.”

And now the scam comes into focus. The real purpose is not to stimulate the economy; it’s too late for that. The hidden agenda is to bring down Japan’s enormous government debt – about 240% of GDP – and stiff retirees and other bondholders in the process.

Abe’s plan was to announce an ambitious program of foolhardy meddling. This, he reasoned, would send the exchange value of the yen down… and make Japanese exports more attractive on world markets.

It’s an old trick: Japan would gain market share by debasing its currency.

But it didn’t work. Output is falling. Household earnings are dropping too.

Japan doesn’t just export; it also imports. The yen has fallen 23% versus the dollar since Abenomics got started in December 2012. This may have made Japanese labor cheaper, but it also made it more expensive for domestic manufacturers to import oil and other raw materials.

And it reduced the buying power of the Japanese consumers. Real household income has fallen 6% since the start of 2012.

Good Work, Abe

In the past, Japan has relied on two things to finance its deficits: the profitability of its industries and the thriftiness of its savers.

But the fall of the value of the yen increased the costs of imports so much that the trade surplus has turned into a large trade deficit.

Instead of the ¥5 trillion surplus the county enjoyed in 2010, Japan has an ¥11 trillion deficit in 2014. And instead of the 10% savings rate the nation enjoyed in 1990, it now has a 3% savings rate – and sinking toward zero.

Good work, Abe.

But that’s not the end of the story. Now, there is no hope of growing the economy faster than the debt. Tax receipts have been flat for 20 years, as the population ages and shrinks. And with a growing trade deficit and disappearing savings, Japan can only hope to cut its debt down by inflating it away by way of the printing press.

Stick with the Trade of the Decade: Buy Japanese stocks. Sell Japanese bonds.

And stay tuned… The kamikaze finance story is just getting started.

Regards,

Bill

Further Reading: Japan isn’t the only country addicted to debt. In their book The New Empire of Debt, Bill and co-author Addison Wiggin offer a frightening look at America’s precarious financial position. They also detail the steps you should take now to protect your savings from the inevitable collapse of the US “Empire of Debt.”

We’re offering Diary of a Rogue Economist readers a FREE hardcover copy of Bill and Addison’s book. All we ask is that you cover shipping. Go here for full details.

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

I can do this in just about random order, the idea should still shine through, and crystal clear at that. We’re on the verge not of a market correction, but of something much bigger. All it takes to know that is to connect a few dots. Ironically, the very same financial press that reports on the dots, refuses to connect them. Don’t they see it, or don’t they want to? It’s not even a very interesting question anymore: they’ll end up commenting only in hindsight.

What happens today in Japan is both a sign of what’s wrong with the entire global financial system, and at the same time the catalyst that will help bring that system to its knees. Japan goes where no man has gone before, because it’s further down the gutter than the rest. But they will all follow. Japan thinks it can escape collapse if the US does fine, and vice versa, and the same goes for China, Europe etc., but none of them can survive the big blow by themselves, let alone that one of them could lift any of the others up by the hair on their heads. It’s a desperate mirage. When you hear anyone say the US will lift up the world economy, switch your channel. Unless you’re already at Comedy Central.

Here’s the litany for the day: China prints $25 trillion and buys Portugal. Japan’s national debt is 750% of tax revenue. US first time homebuyers are at a 27 year low. 40.5% of Greek children grow up in poverty, as Greece is part of the eurozone that should take care of all citizens. In the UK 72% of 18-21-year olds make less than a living wage. US and Japanese QE leads to ‘consumers’ spending less, which is the exact opposite of what QE is supposed to be intended for. China is trapped in the newfangled currency war Japan’s QE has unleashed across Asia, and which will soon be exported across the globe.

The common denominator? Debt. Sovereign debt, personal debt, corporate debt. Japan doesn’t want to recognize it yet, but it’s caught in the same trap with everyone. The difference is that Japan fights debt with more debt, while other parties are starting to find a little more nuance in their approach. Does it matter? Not one bit. Other than Japan’s hole will be deeper than the others. Let’s just track through today’s news. Bloomberg:

Portugal Sees Chinese Do 90% of Bids at Property Auction

As bargain-hunters waited in a packed room at a property auction in Lisbon last month, one language dominated their chat: Mandarin. About 90% of the bidders for the government-owned apartments and stores on offer were Chinese, according to Jorge Oliveira, the official overseeing the asset sale. They ended up acquiring more than two-thirds of the 45 properties, he said. “A Portuguese investor bought a store to start a bakery and coffee shop, but most of the properties went to the Chinese,” Oliveira said in an interview after the sale. Portugal is the latest target for Chinese investors who have been acquiring buildings around the world as China allows freer movement of funds in and out of the country.

Why would you want to sell your assets to a country that simply prints the money it uses to purchase those assets? Why not print that kind of money yourself and buy theirs? China printed $25 trillion and we allow them to buy Lisbon and Madrid and Rome with that? How much worse can this get? Portugal is defenseless, because it’s adopted the euro, but Germany would never allow the Chinese money printers to buy Berlin. Need any more info on why the eurozone is such an abject and perverse failure? Guardian:

More Than One Fifth Of UK Workers Earn Less Than Living Wage

More than a fifth of UK workers earn less than the living wage, with bar staff and shop assistants among the most likely to live “hand to mouth” because of low pay, a report warns on Monday. Published to mark living wage week, the research also finds that younger workers, women and part-timers are more likely to be paid less than the living wage, a voluntary threshold calculated to provide a basic but decent standard of living. New living wage rates will be announced on Monday, with the current rate at £8.80 per hour in London and £7.65 elsewhere. The report by consultancy firm KPMG adds to evidence of low pay remaining prevalent in Britain, despite the economic recovery. The proportion of employees on less than the living wage is now 22%, up from 21% last year, the study found. In real terms, that was a rise of 147,000 people to 5.28 million. [..] It found 72% of 18-21 year olds were earning less than the living wage

22% of your working population on less than a living wage is an insane disgrace. Certainly when at the same time you’re telling everyone your economy is doing great. There’s no excuse for that. But it can get worse: if 72% of your young people can’t survive on what they work for, you’re murdering your nation’s future. And your housing market, just to name an example, people can’t start families, it all ties together. MarketWatch:

US Consumers Resisting Enticements To Increase Spending

The U.S. is adding jobs at the fastest rate since the end of the Great Recession and another strong month of hiring is expected in October, but Americans still aren’t spending like good times are here to stay. The lackluster pace of consumer spending — outlays fell in September for the first time in eight months – largely explains why the U.S. is only growing at a post-recession annual average of 2.2%. Yet most economists think that could change in the near future.

The US is adding jobs that don’t pay enough to get people spending who are still buried in debt, just like Europe, just like Japan. That clear enough? The US economy ‘grows’ despite the American people. But ‘most economists think that could change in the near future’. Get a job. CNBC:

Bank of Japan Bazooka To Spark Currency War

The Bank of Japan’s (BoJ) stimulus blitz raises the specter of currency wars as a rapidly weakening yen threatens the competitiveness of export-driven economies, say strategists. “Whenever you have these kinds of disruptive moves by central banks, there’s always going to be fall out effects,” said Boris Schlossberg at BK Asset Management. Markets were caught off guard by the BoJ’s announcement on Friday that it would expand purchases of exchange-traded funds (ETFs) and real estate investment trusts, extend the duration of its portfolio of Japanese government bonds (JGBs), and increase the pace of monetary base expansion.

“The hottest currency war today is Japan vs Korea. That’s probably the one to keep an eye on. The yen-won cross rate is very sensitive as Japan and Korea compete in a lot of key areas,” said Sean Callow at Westpac. The Japanese currency has fallen around 20% against the won since the BoJ launched its unprecedented stimulus program in April 2013. Currency strategists say the BoJ’s actions could encourage the Bank of Korea (BoK) to become more defensive against local currency strength through intervention in the foreign exchange market or a rate cut.

That’s the big one for now. It’s not just Japan and Korea, Thailand, Indonesia, Vietnam and quite a few others are in the same merry go round. And of course China, as the following MarketWatch piece identifies: “The move will be particularly problematic for China, as its slow-crawling managed rate to the U.S. dollar renders it is effectively defenseless when confronted by currency wars.”

China Faces Trap In Currency War

Last Friday, the Bank of Japan effectively tossed a grenade into the region’s currency markets with its surprise announcement of a new round of quantitative easing sending the yen to fresh lows. The move will be particularly problematic for China, as its slow-crawling managed rate to the U.S. dollar renders it is effectively defenseless when confronted by currency wars, in which countries try to steal growth from their trading partners through competitive devaluations. It also comes at a time when Beijing is already battling foes on two fronts: hot-money outflows and an economy flirting with deflation. The consensus is that the world’s largest trading nation will resist the temptation to enter the fray with a competitive devaluation or move to a market-based exchange rate. Yet Japan’s latest actions will hurt, as they hold Beijing’s feet to the fire.

As long as China holds its (semi) peg to the USD, it may wake up to some ugly surprises, certainly when USDJPY goes to 120 or beyond. But the, when that happens, China won’t be alone. The next piece by Pater Tenebrarum, h/t Durden, may be the best I’ve read on Japan‘s despair move on Friday:

The Experiment that Will Blow Up the World

In order to explain why the pursuit of Kuroda’s policy is edging ever closer to a catastrophic outcome, we have to delve a bit into the details of Japan’s monetary data. In spite of the BoJ’s “QE” reaching record highs, it mainly creates bank reserves and furthers carry trades. The economy sees no private credit growth so far. Commercial banks in Japan continue to shrink the stock of fiduciary media – this is to say, they are reducing outstanding credit, which makes more and more unbacked deposit money disappear. Hence, Japan’s money supply growth has recently declined to a mere 4.3% year-on-year.

“… the markets are pouncing on the yen because they are forward-looking: the BoJ is monetizing ever more government debt and this is expected to continue, because the public debtberg has become too large to be funded by any other means. In spite of the relatively low money supply growth this debt monetization has produced so far, it also creates the perverse situation that an ever greater portion of the government’s outstanding stock of debt consists actually of debt the government literally “owes to itself”.

Japan has debt levels that are unequalled not just in the world, but most likely in human history, and I’m not saying that to take anything away from the demise of Rome:

And then we get back home with the NAR and Lawrence Yun and all of its cheerleaders, who got their faces all full of mud and shit and sand, and will never admit to it. Zero Hedge:

Why Housing Is Dead: First-Time Buyers Collapse To 27-Year Lows

The Millennials (one of the biggest generations in US history) are just not getting with the status quo program. As we detailed previously, with lower credit scores, less disposable income, and a soaring number of people living with their parents; so it should be no surprise that The National Association of Realtors (NAR) today admitted that first-time homebuyers plunged to the lowest level in 27 years. The blame – of course – rather than low/no-growth fiscal policies, student debt servitude, and inequality-driving cheap-funding monetary policy, is price competition from ‘investors’ and too “stringent credit standards,” perfectly mirroring FHFA’s Mel Watt’s Einsteinian insanity desire to dramatically ease lending standards and slash minimum down-payments (as we noted previously). Perhaps NAR accidentally stumbles on the biggest reason no one is buying in their profiling: the typical first-time buyer was 31-years-old, while the typical repeat buyer was 53 – smack in the middle of the Millennial collapse.

We’ve been keeping the long lost idea of our long lost society alive by squeezing our own children wherever we can, and telling them that if they only work hard enough, they can be whoever they want to be. But they can’t, that notion is also long lost. When you keep home prices artificially high, homeowners don’t suffer as much, even if they bought at insanely high prices, but the suffering is switched to potential buyers, who remain just that, potential, while they live in their mom’s basements for years.

A surefire way to kill a society while everyone’s eagerly awaiting the growth that is just around the corner and will forever remain there. Take it from your kids. Take it from somewhere else in the world.

And that’s where we’re now passing a barrier: there’s no-one to take it from anymore. Not through sleight of hand or spin or propaganda. You can only keep a quarter of your people below living wage levels for so long. Japan can only wage a currency war on its neighbors for so long (not very long). Japan can only wage a consumer price war on its own people for so long.

Japan’s QE9 has set the world on fire. It didn’t need much of a spark to begin with, but it’s certainly got one now.

Japan has been in a two decade long recession. They have 50% more debt as a percentage of GDP than any developed country on earth. They have a rapidly aging population. They have no energy resources. But their central bank does have a printing press.

The master plan announced overnight by their Janet Yellen – Kuroda – is to buy 8 trillion to 12 trillion yen ($108 billion) of Japanese government bonds per month. This means the BOJ will now soak up all of the 10 trillion yen in new bonds that the Ministry of Finance sells in the market each month. This is all being done to reduce the value of the Yen and create inflation.

The central bank is already the largest single holder of Japan’s bonds, and the scale of its buying could fuel concerns it is underwriting deficits of a nation with the heaviest debt burden. The BOJ could end up owning half of the JGB market by as early as in 2018. This is the act of a desperate crazy man. He has set in motion a series of events that will lead to the collapse of Japan. It will be a failed state. It will become a modern day Weimar Republic.

“Bank of Japan Gov Kuroda, laughing like a James Bond villain who knows it’s too late to stop his plan from unfolding.” – Patrick Chovanec

Kuroda is an evil genius. He has single-handedly driven the Japanese stock market up 1,000 points in 7 hours and ignited stock markets around the world. The world is saved. He has proven that the world can be saved by printing trillions in new fiat currency and using it to buy stocks and bonds. Why didn’t we think of that? What could possibly go wrong?

I was reminded of another chart I once saw. Those Germans were in a bit of a pickle after World War I. Their central bank also provoked a stock market rally with the same master plan.

I’m sure the Japanese will successfully save their economy by printing yen at hyper-speed and using it to buy their ever increasing amount of public debt and as much stock as they can get their wily little hands on. Hyperinflation is so old school. No chance of it happening in the land of the setting sun. Right?

The only real lesson of history is that we never learn the lessons provided by history. Mitsubishi bought Rockefeller Center in 1990 for $2 billion. Sounds familiar doesn’t it? This deal marked the top of the Japanese bubble. It proceeded to burst and still hasn’t recovered after 24 years. By 1995 Rockefeller Center was bankrupt and the Japanese walked away from their investment. The Chinese real estate market has already begun to collapse. They think it is safe to buy real estate in the United States at record prices to avoid that collapse. They have been a driving force behind the cash buying of homes as investment properties. The Chinese are fools. The Waldorf Astoria will be in bankruptcy in a few years and the Chinese will be walking away from their “investment”. History will repeat, because it always does.

Shutterstock

ShutterstockHilton Worldwide Holdings Inc. has agreed to sell its most prestigious hotel, Manhattan’s Waldorf Astoria, for $1.95 billion to a Chinese insurance company, the hotel operator said Monday.

The sale price is among the highest ever for any hotel and represents the latest sign of intense international demand for luxury hotels and other trophy properties in major global cities. The Waldorf Astoria’s price of $1.3 million a room is also among the highest ever paid in the U.S. on a per-room basis.

The acquisition is the first major deal in the U.S. for Anbang Insurance Group Co., which beat out at least two other bidders for the property, according to a person familiar with the matter.

For months, Hilton HLT, +1.07% has been weighing its options for the Waldorf Astoria on Park Avenue, including converting hundreds of its nearly 1,500 rooms to condos and reinvesting the proceeds into the hotel. In recent weeks, Hilton was leaning toward an outright sale of the property. But before the hotel company could begin the formal marketing process, Anbang and at least two other groups offered pre-emptive bids around the $2 billion mark, this person said.

Hilton will continue to operate the hotel under a 100-year management contract. The company plans to use the proceeds of the sale to acquire other properties, in part to avoid a hefty tax charge on the transaction.

Keynesianism at its finest. Abenomics was pushed into high gear in 2013. Abe and his banker cronies were going to create inflation at all costs. They have succeeded. Everything is soaring in price in Japan. One small problem. Real wages are collapsing and the lives of average Japanese are being destroyed.

The Japanese are a tiny people. Maybe they’ll like sleeping in drawers.

Don’t forget to thank a banker today for their man made inflation. Thank God our central bankers wouldn’t do such a thing.