Barack & Michelle Obama just signed a multi-year contract with Netflix.

Some titles for their new shows have already been released.

– House of Race Cards

– Orange is the New Barack

– 13 Reasons Why I Was Indicted

– Stranger Things Than Michelle

– Better Call Saul Alinsky— Educating Liberals ⭐️⭐️⭐️ (@Education4Libs) May 21, 2018

Tag: Netflix

BULL IN A CHINA SHOP

“So the modern world may be increasing in technological knowledge, but, paradoxically, it is making things a lot more unpredictable.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

“Success brings an asymmetry: you now have a lot more to lose than to gain. You are hence fragile.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

I had read Nassim Taleb’s other best-selling tomes about risk, randomness and black swans – Fooled by Randomness & The Black Swan. They were not easy reads, but they were must reads. He is clearly a brilliant thinker, but I like him more because he is a prickly skeptic who scorns and ridicules academics, politicians, and Wall Street scumbags with gusto. There were many passages which baffled me, but so many nuggets of wisdom throughout each book, you couldn’t put them down.

When his Antifragile book was published in 2012, the name intimidated me. I figured it was too intellectual for my tastes. When I saw it on the shelf in my favorite used book store at the beach, I figured it was worth a read for $9. I’m plowing through it and I haven’t been disappointed.

His main themes are more pertinent today than they were in 2012. He published The Black Swan in 2007, just prior to one of the biggest black swans in world history – the 2008 Federal Reserve/Wall Street created financial collapse. His disdain for “experts” like Bernanke, Paulson, and Wall Street CEOs, and their inability to comprehend the consequences of their actions and in-actions as the financial system was blown sky high, was a bulls-eye.

The “Experimenter”: Understanding Why Shit Happens and How Conformity Kills

By Doug “Uncola” Lynn via TheBurningPlatform.com

During inclement weather days, late nights, lazy weekends, and when one’s eyes tire of small print or words and images levitating in digital ether, Netflix offers a video library of sorts allowing the viewer to recline, and imbibe knowledge in a relatively easy way. Many of Netflix’s films consist of documentaries, nonfiction stories originating from books, historical retellings, or fictionalized narratives derived from actual circumstances and people. Two such films, recently viewed by the author of this post, are historical accounts, originated from books, and retold from the perspective of the actual persons who lived the events recounted therein. These two films, currently showing on Netflix, include: “First They Killed My Father” (2017) and “Experimenter” (2015).

Continue reading “The “Experimenter”: Understanding Why Shit Happens and How Conformity Kills”

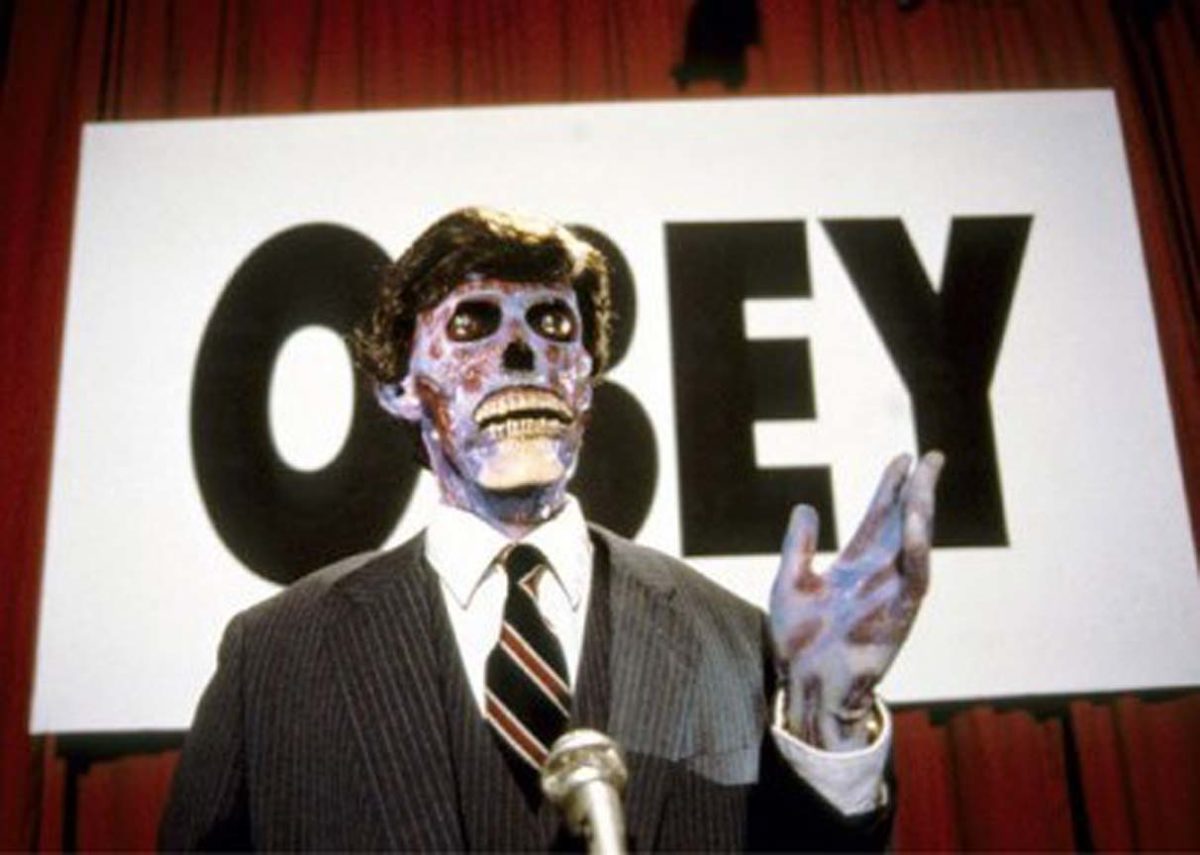

They Live: Choose Before You Die

By Doug “Uncola” Lynn via TheBurningPlatform.com

Sometimes, during the summers, I like to stay up late. When not reading or writing, I will usually resort to watching a series on television. I enjoy series because the character development and storylines are far more in-depth than what is viewed in a mere two-hour movie; although I do watch them as well. On HBO, I have experienced The Sopranos, The Wire, Boardwalk Empire, Deadwood, True Blood, and a few others. On AMC, it was Breaking Bad and I still watch The Walking Dead. What I like about Netflix, however, is the ability to access a virtual cornucopia of diverse programming on any device; at home, on the road, and easily “un-paused” with the flick-of-a-finger anytime, anywhere, within the matrix.

MAYBE VALUATIONS DO MATTER

The raging bulls were so sure of themselves a few months ago. Valuation measures were for suckers. This time was different. It’s the new Obama economy. Profits are so old school. I suddenly sense a little panic amongst the big swinging dick Wall Street traders. Not too much scorn and laughter being directed towards John Hussman lately.

I wonder if the brainless twits and shills on CNBC will be telling their audience that the S&P 500 is now lower than it was in May 2014. That’s right. Anyone in the stock market over the last 20 months hasn’t gained a penny. The S&P 500 is now down 11% from its all-time high in May 2015. Only 40% or 50% more to go to reach fair value.

Remember the can’t miss hot stocks being touted by Wall Street and their CNBC mouthpieces? The IPOs were being rolled out like crazy in 2015 and the stocks would soar to heights not seen since the good old Dotcom bubble. Let’s take a look at those fantastic can’t miss opportunities of a lifetime:

MARKET WILL BE DEFANGED

Despite all the propaganda and cheerleading by CNBC and the rest of the MSM faux journalists, the stock market has been stuck in neutral for the last year. The S&P 500 stood at 2,089 on December 26, 2014. It presently stands at 2,089 on November 22, 2015. It is trading 2% below its all-time high, reached in July. It’s up a measly 3.5% since the day the Fed turned off the QE spigot in October 2014. And that’s the good news.

Without the ridiculous “internet bubble like” ascension of Facebook, Amazon, Netflix, and Google, the stock market would be deep in the red this year. Three of these companies barely make money. They are all overvalued by at least 70%. Most of the stocks in the S&P 500 are trading in the red this year. When the breadth of advancers narrows to a few over-hyped Wall Street superstar stocks (think Cisco, Dell, Microsoft, Enron, Worldcom in 2000) the bull market is on its last legs.

Wall Street is luring more muppets into these FANG stocks before the slaughter commences. These stocks will be trading at least 50% lower in less than two years. Book it.

Facebook, Amazon, Netflix, and Google created over $440 in value over 2015

In the sixth year of the bull run, the U.S. large cap market has had its ups and downs. The S&P 500 peaked at 2134.7 in the early summer months, and promptly collapsed to 1867 points during the August flash crash.

Today, it’s back in black, but only trading just over 1% higher than it started the year.

The only reason that has made this possible is the legendary performance of four tech stocks: Facebook, Amazon, Netflix, and Google (now called “Alphabet Inc.”). Together, the “FANG” stocks have created an impressive $440 billion in market capitalization since January.

For comparisons sake: that’s over 2/3 the size of Apple’s current market cap.