This is Part Three of a three part series trying to make sense of the Crisis period we entered in 2008. Click here to read: PART ONE or PART TWO

Seeking Regeneracy

“Soon after the catalyst, a national election will produce a sweeping political realignment, as one faction or coalition capitalizes on a new public demand for decisive action. Republicans, Democrats, or perhaps a new party will decisively win the long partisan tug of war. This new regime will enthrone itself for the duration of the Crisis. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Where leaders had once been inclined to alleviate societal pressures, they will now aggravate them to command the nation’s attention. The regeneracy will be solidly under way.” – Strauss & Howe – The Fourth Turning

The 2008 election happened in the midst of the catalyst events. A sweeping political realignment did not occur. In fact, the 2010 mid-term elections produced a result which has essentially gridlocked the political process in Washington D.C. The reunification and reenergizing of society has yet to occur. Neil Howe in his recent article pondered the question of regeneracy:

“We may like to imagine that there is a definable day and hour when America, faced by growing danger and adversity, explicitly decides to patch over its differences, band together, and build something new. But maybe what really happens is that everyone feels so numb that they let somebody in charge just go ahead and do whatever he’s got to do. I’m thinking of how America felt during the bleak years of FDR’s first term, or during Lincoln’s assumption of vast war powers after his repeated initial defeats on the battlefield.

The regeneracy cannot always be identified with a single news event. But it does have to mark the beginning of a growth in centralized authority and decisive leadership at a time of great peril and urgency. Typically, the catalyst itself doesn’t lead directly to a regeneracy. There has to be a second or third blow, something that seems a lot more perilous than just the election of third-party candidate (Civil War catalyst) or a very bad month in the stock market (Great Power catalyst). We are still due for such a moment. We have not yet reached our regeneracy. When it happens, I strongly suspect it will be in response to an adverse financial event. It may also happen in response to a geopolitical event. It may well happen over the next year or two.” – Neil Howe – Dating the Fourth Turning

Regeneracy occurred within five years of the outset of the three previous Crisis periods in U.S. history. The historic year of 1776 saw the colonies come together and declare independence from Great Britain. Group solidarity and willingness to die for their cause launched an eight year war and ultimately the formation of a new republic. The Civil War regeneracy occurred after the Union debacle at Bull Run in 1861. The Washington aristocrats had treated the battle like a show, where they could bring a picnic lunch and be entertained by an entertaining skirmish between two armies. After the resounding bloody defeat Abraham Lincoln assumed dictatorial like powers over the North and ordered the immediate enlistment of a half a million soldiers. He assumed unprecedented powers of taxation, forced conscription, suspension of due process and showed a willingness to administer maximum destruction to his foes. This would be no picnic in the park, as 700,000 men died in the next three years. The regeneracy during the Great Depression/WWII Crisis occurred in 1933 with the election of Franklin Roosevelt. He immediately declared a bank holiday and confiscated all the gold in the country. In a flurry of executive orders and bills sent to Congress he rammed through his New Deal, assuming new and broader powers for the Federal government and Executive branch.

Based on these examples in American history it is clear we have not entered the regeneracy stage of this Crisis. Also based on history, it is likely to occur by the end of 2013. A second blow to our nation and our psyches is the only thing that could possibly bring together a deeply divided nation. The country was struck by a category 3 hurricane in 2008. We have been in the eye of the hurricane for the last two years and have grown complacent. The eye will pass over us in the next year and we will again be buffeted by hurricane force winds – except the hurricane has strengthened to a category 5 as the “solutions” to the storm will make part two far worse. Those with a libertarian mindset are not likely to be happy with the Federal government and President taking on even greater powers in the coming years. The usurpation of more control over the citizens of this country in the last decade has been one of the major reasons for the ratcheting down of trust in our leaders. The upcoming presidential election will likely create the dynamic that propels the country into its regeneracy. If the next downward blow can be averted before the election, the country will end up with four more years of Obama. If the Crisis suddenly worsens before November, Romney assumes the mantle of Prophet Leader in January 2013.

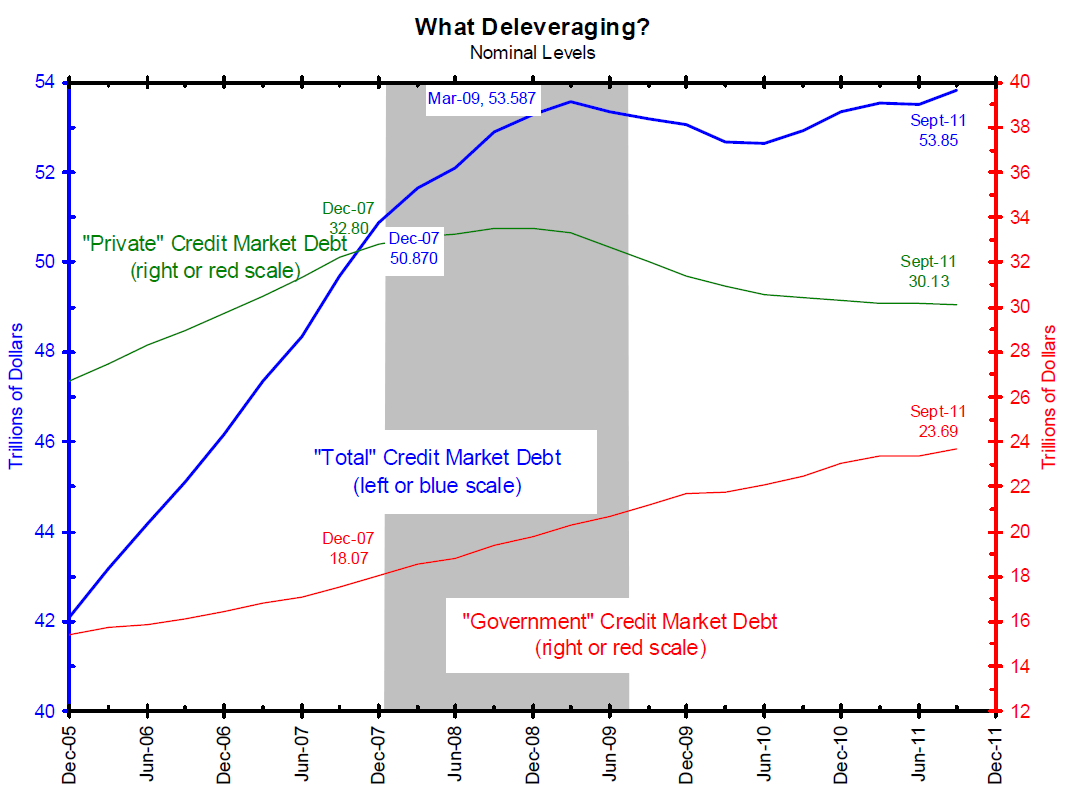

I agree with Neil Howe that the country’s reaction to an adverse financial event will be the likely regeneracy moment. The explosive mixture of the five D’s will provide the spark for the next phase: Debt; Derivatives; Default; Devaluation; and ultimately Depression. There is no way to deny the $15.6 trillion of debt this country has accumulated, with $10 trillion of it added since 2000. The debt ceiling of $16.4 trillion will be breached in October 2012 at the current rate of extreme spending. This should set up an interesting dynamic just prior to the November elections. A replay of the August 2011 showdown could be disastrous for Obama if the stock market were to crater again.

We are accumulating debt at a rate of $3.7 billion per day, or $154 million per hour. No politician of either party, other than Ron Paul, has any plan to even moderate the spending, let alone make actual cuts. The CBO projections rolled out by these congressional weasels aren’t worth the paper they are printed on. The National Debt is on track to surpass $20 trillion in 2015 and $25 trillion by 2018. And this is before the Medicare and Social Security costs blast into orbit in 2020. Kicking the can down the road works until math catches up with you. It is insane to believe we can dig ourselves out of this debt induced mess with more debt, but empires tend to act insanely in their death throes.

“In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule.” – Friedrich Nietzsche

Strauss & Howe made preparation recommendations back in 1997 that would have lessened the impact of this Crisis, but they fell on deaf ears. Their common sense suggestions included:

- Work to elevate moral and cultural standards. Toddlers with Tiaras and The Kardashians were not an elevation.

- Shed and simplify the federal government by cutting back sharply on its size and scope.

- All levels of government should prune legal, regulatory and professional thickets.

- Politicians should define our challenges bluntly and stress duties over rights.

- Require community teamwork to solve local problems without federal government intervention.

- Treat children as the nation’s highest priority.

- Tell future elders they will need to be more self-sufficient, save more, and expect fewer entitlements.

- Shift government pension plans from defined benefit plans to defined contribution plans.

- Begin to trim Medicare, Medicaid and Social Security benefits.

- Raise the national savings rate, reduce consumption and work towards federal budget surpluses.

- Expect the worst, conserve our forces, and be prepared for an epic struggle down the road.

I would reckon we went 0 for 11 on the preparation front. We took the exact opposite course in most cases. Each generation has their own crosses to bear. No one will escape the bitter gale force winds of this Crisis. Strauss and Howe must have had a crystal ball looking fifteen years into the future when they made this supposition:

“The Boomers’ old age will loom, exposing the thinness in private savings and the unsustainability of public promises. The 13ers will reach their make or break peak earning years, realizing at last that they can’t all be lucky exceptions to their stagnating average income. Millenials will come of age facing debts, tax burdens, and two tier wage structures that older generations will now declare intolerable.”

Thus far the older generations have refused to yield. They demand promises made be promises kept. The Boomers did not save enough to sustain themselves during their retirement. Many are entirely reliant upon Social Security and Medicare as their only savings and health insurance. Generation X is caught between aging parents and indebted jobless children. The Millenials are saddled with $1 trillion of student loan debt and few decent job opportunities. In prior Fourth Turnings the Prophet generation led and the Hero generation followed, doing the heavy lifting. This dynamic is yet to be realized during this Crisis. Maybe the regeneracy event will create this dynamic.

That event will likely be triggered by another debt crisis. Rogoff and Reinhart studied 44 countries over 200 years and concluded that once government debt exceeded 90% of GDP economic growth slowed and the likelihood of disaster rose dramatically.

“Those who remain unconvinced that rising debt levels pose a risk to growth should ask themselves why, historically, levels of debt of more than 90% of GDP are relatively rare and those exceeding 120% are extremely rare. Is it because generations of politicians failed to realize that they could have kept spending without risk? Or, more likely, is it because at some point, even advanced economies hit a ceiling where the pressure of rising borrowing costs forces policy makers to increase tax rates and cut government spending, sometimes precipitously, and sometimes in conjunction with inflation and financial repression (which is also a tax)? Historical experience and early examination of new data suggest the need to be cautious about surrendering to “this-time-is-different” syndrome and decreeing that surging government debt isn’t as significant a problem in the present as it was in the past.”

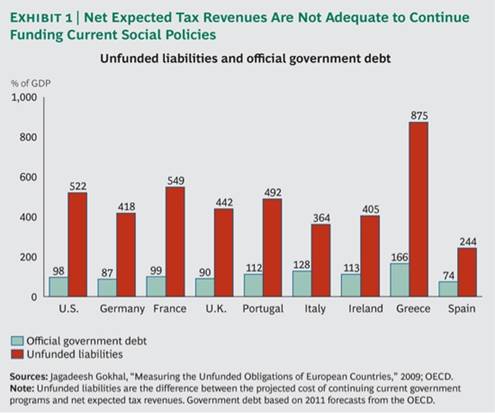

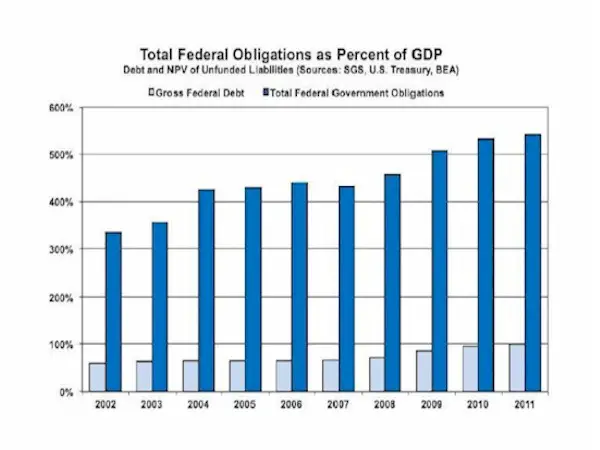

On this date the U.S. debt to GDP ratio is 102%. Our debt accumulation is on automatic pilot and the national GDP is incapable of growing above 3%. Anyone with the most basic math skills (this excludes Wall Street economists, CNBC bimbo anchors, and Bernanke) can determine the ratio will pass 120% in 2015. This doesn’t even include the Fannie, Freddie, and Student Loan debt that are guaranteed by the Federal government, along with trillions of unfunded social program liabilities and state and local debts. In reality the true debt obligations of this country exceed 500% of GDP, as no politician plans to willingly renege on Medicare and Social Security promises made to voters who would boot them if they voted to cut these entitlements.

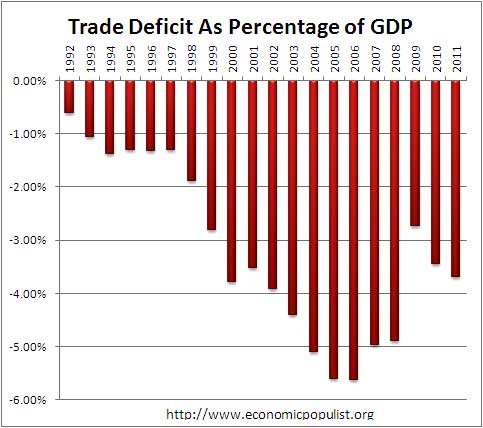

The linear thinking deniers of reality (Krugman) will use Japan as their example of a country whose debt ratio is above 200%, without disastrous consequences. I guess a 22 year recession is not considered disastrous. Japan has been able to fund themselves internally because their citizens had a 15% savings rate in and they have run gigantic trade surpluses for decades. That game is over and they will hit the wall in the near future. The savings rate in the U.S. is 3.7% and we run $550 billion trade deficits, or 3.7% of GDP. The United States has no advantages other than the U.S. dollar currently being regarded as the worldwide reserve currency. We are hanging our hat on being the best looking horse in the glue factory.

The cracks in the façade are already painfully visible. The U.S. ran a $1.4 trillion deficit in 2009; $1.3 trillion in 2010; and $1.3 trillion in 2011. In the chart below you can see foreigners’ appetite for U.S. debt since 2007 has plunged. Maybe it has something to do with getting a negative real return by investing in U.S. Treasuries paying 2%. Maybe it has something to do with Ben Bernanke attempting to inflate away our debt burden. Maybe it has something to do with Congress and the President accelerating spending and creating massive deficits for as far as the eye can see. Maybe they are losing trust and confidence in the American Empire.

In the last three years we have run $4 trillion in deficits and foreigners have only funded $1.4 trillion of that debt. That means someone else had to buy $2.6 trillion of our long term Treasuries. Some of it was funded by little old ladies and pension funds that are setting themselves up for enormous losses. The vast swath was purchased by Ben Bernanke with his QE for eternity programs. As foreigners rationally reduce their Treasury holdings and we continue to run $1.3 trillion deficits, Bernanke must keep buying the debt. This cycle will continue until we reach our Minsky Moment, then Strauss & Howe’s forecast will be realized:

“This might result in a Great Devaluation, a severe drop in the market price of most financial and real assets. This devaluation could be a short but horrific panic, a free-falling price in a market with no buyers. Or it could be a series of downward ratchets linked to political events that sequentially knock the supports out from under the residual popular trust in the system. As assets devalue, trust will further disintegrate, which will cause assets to devalue further, and so on.” – Strauss & Howe – The Fourth Turning

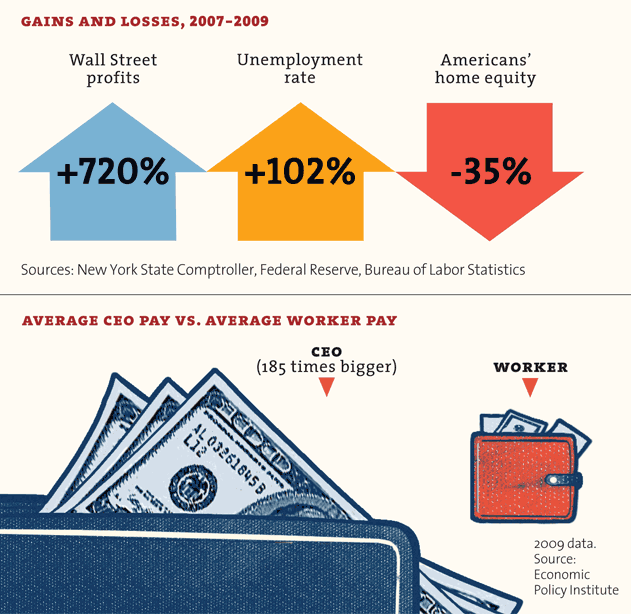

Who will buy our debt in the coming months and years? Europe is saturated with debt and doesn’t have the means to purchase our debt. Japan is a train wreck waiting to happen. China’s customers aren’t buying their crap, so their economic miracle is about to go in reverse. The Federal Reserve cannot buy $1 trillion of Treasury bonds per year forever without creating more speculative bubbles and raging inflation in the things people need to live. The Minsky Moment will be the point when the U.S. Treasury begins having funding problems due to the spiraling debt incurred in financing perpetual government deficits. At this point no buyer will be found to bid at 2% to 3% yields for U.S. Treasuries; consequently, a major sell-off will ensue leading to a sudden and precipitous collapse in market clearing asset prices and a sharp drop in market liquidity. In layman terms that means – the shit will hit the fan. The Federal Reserve and Treasury will be caught in their own web of lies. The only way to attract buyers will be to dramatically increase interest rates. Doing this in a country up to its eyeballs in debt will be suicide. We will abruptly know how it feels to be Greek.

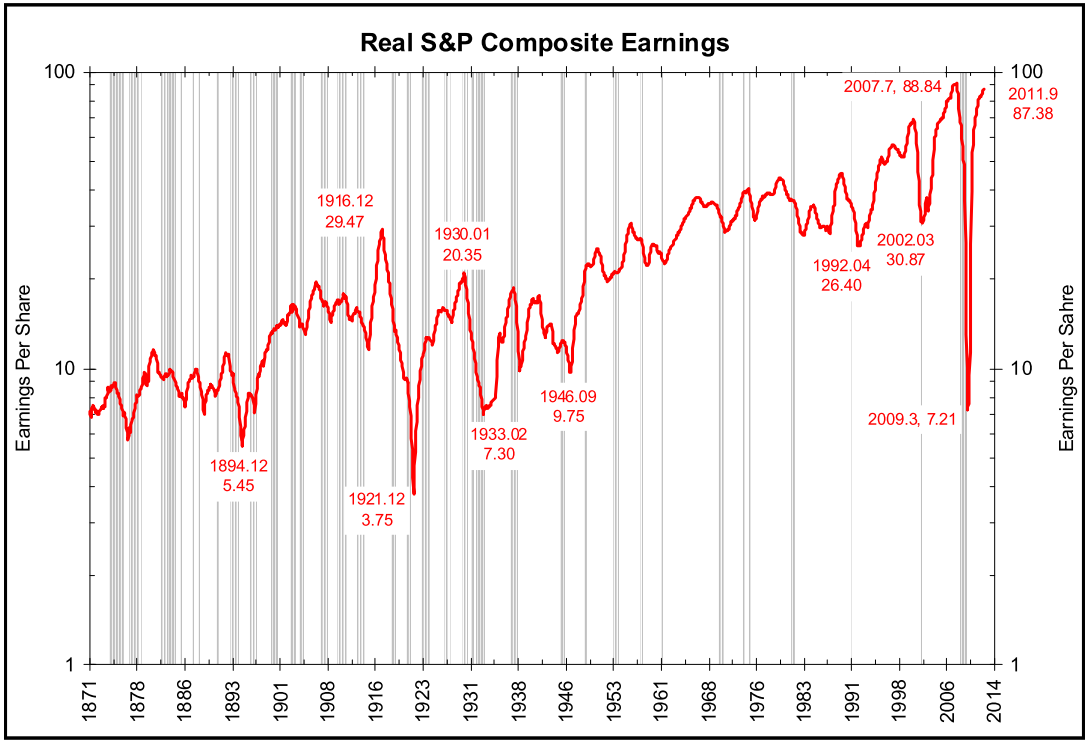

Linear thinkers like Krugman and most of the mainstream media opinion leaders can’t fathom the possibility of a complete collapse of our economic system. Most of their little models and economic data points don’t even go back to the last Fourth Turning period. They make projections about a housing recovery based on historical data that starts in 1962. Housing sales linger at historical lows with mortgage rates at 4%. The entire housing market would cave in if mortgage rates reached 6%, where they were in 2008. The forty year average mortgage rate has been 9%. Everything about our economic system is abnormal. Even reversion to the mean would be disastrous. The Minsky Moment headed our way will not be a single uncorrelated event. The entire financial world is hopelessly entangled by the $700 trillion of derivatives that ensure mass destruction if one of the dominoes falls. This is the reason an otherwise inconsequential country like Greece had to be “saved”.

Everyone knows Greece, Portugal, Spain and Italy are broke. One or more will eventually default on their debt. It is highly likely that a butterfly will flap its wings in Europe and cause a hurricane in the U.S. The default will spark a worldwide contagion as trust in a system of false promises disintegrates. China’s already crumbling real estate market will implode. As interest rates soar and stock markets plunge, global tensions will intensify. Continued oil supply constraints will be the cherry on top. Based on historical precedent, this is likely to strike before 2014 arrives. The wealth destruction and pain will be so intense a regeneracy will be at hand. Our very survival will feel at stake.

“Eventually, all of America’s lesser problems will combine into one giant problem. The very survival of the society will feel at stake, as leaders lead and people follow. The emergent society may be something better, a nation that sustains its Framers’ visions with a robust new pride. Or it may be something unspeakably worse. The Fourth Turning will be a time of glory or ruin.” – Strauss & Howe – The Fourth Turning

And here is the rub for those who argue for less government intervention in our lives. Which leaders will lead and who will follow? The actual events do not matter as much as how the people react to the events. Fourth Turnings are always chaotic and tumultuous. In the frenzied period during the next leg down, people will demand order. They will call for the government to do something. Obama or Romney will use the fear and uncertainty to assume more power over our lives. Executive orders, new legislation, and another stripping of our liberties will be attempted. How the generational cohorts react to these deeds will determine what happens next. There are 97 million Millenials, 83 million Generation X and 73 million Boomers. The Boomers hold most of the positions of power, but their credibility as leaders has been damaged by their actions over the last two decades.

How the Millenials react to Boomer commands will determine the course of this Fourth Turning. The great devaluation will provide our leaders the opportunity to address the structural imbalances that haunt our nation. They could force Wall Street bankers, shareholders and bondholders assume their losses. They could rewrite the social contract with all generations, balancing the needs of elders with the futures of our youth. They could dramatically scale back the military industrial complex. They could completely scrap the ridiculous tax code and shift from taxing income to taxing consumption. They could revamp our political system and remove money from the political process. They could choose to balance budgets and reduce the size of government. They could ask for proportional sacrifice from everyone in order to keep this ship from sinking. If you believe this will happen, I have nice home near an Iranian nuclear power plant I’d like to sell you.

The regeneracy does not mean the actions taken by our leaders will be wise, well thought out, rational or beneficial to all people. Many believe the actions taken by Abraham Lincoln and Franklin Roosevelt during the previous Fourth Turning Crisis periods were detrimental, foolish, and enhanced the power of the state at the expense of liberty for the people. The leader when the regeneracy events strike is more likely to respond with more government control as the solution. He will invoke executive orders giving government control over important industries and crucial institutions. The government politician leaders will pick the winners and losers, with their cronies and contributors winning again. Dissent will not be acceptable. The NDAA will be invoked to imprison those who disagree with the mandates handed down by those in power. Congress would pass SOPA and lock down the internet and shutdown any websites they consider dangerous to their central authority. Lastly, with the biggest and baddest military machine on earth, the leader will attempt to rally the masses and distract them from our dire economic situation by seeking an external threat to confront. It just so happens that China is also in the midst of their own Fourth Turning. History has shown that armed confrontation is likely around the climax of the Crisis:

“History offers even more sobering warnings: Armed confrontation usually occurs around the climax of Crisis. If there is confrontation, it is likely to lead to war. This could be any kind of war – class war, sectional war, war against global anarchists or terrorists, or superpower war. If there is war, it is likely to culminate in total war, fought until the losing side has been rendered nil – its will broken, territory taken, and leaders captured.” – Strauss & Howe – The Fourth Turning

No one knows the exact events that will mark this Crisis period in our history. But there is no turning back. We’ve entered the Winter season and the beautiful calm days of autumn are long past. Nothing but turmoil, bitterness and sacrifice lie ahead. We entered this Winter of our discontent unprepared like the grasshopper in the fable. This has insured this Crisis will be far worse than it needed to be. The grasshoppers want solutions and easy answers to problems created over decades of ignorance, sloth, greed and stupidity. It’s too late. There are no easy answers and the solutions are all painful and bitter. This is not some theoretical exercise. This is the reality of our situation. I have three teenage sons and their futures depend on the outcome of this Crisis. I will do whatever it takes to support them. I will not allow them to be cannon fodder in some war for oil in the Middle East. If their future requires me to oppose a tyrannical government, so be it. If their future requires me to give up my Social Security and Medicare security blanket, so be it. If I have to die so they may live, so be it. There are no guarantees in this life. We get about 80 years on this planet to make a difference. The choices we make in the next few years will matter. Are you ready? I am.

“The seasons of time offer no guarantees. For modern societies, no less than for all forms of life, transformative change is discontinuous. For what seems an eternity, history goes nowhere – and then it suddenly flings us forward across some vast chaos that defies any mortal effort to plan our way there. The Fourth Turning will try our souls – and the saecular rhythm tells us much will depend on how we face up to that trial. The saeculum does not reveal whether the story will have a happy ending, but it does tell us how and when our choices will make a difference.” – Strauss & Howe – The Fourth Turning

Click here to read: PART ONE or PART TWO