Tag: oil

Trump Betrays MAGA Over Venezuela

Guest Post by Tom Luongo

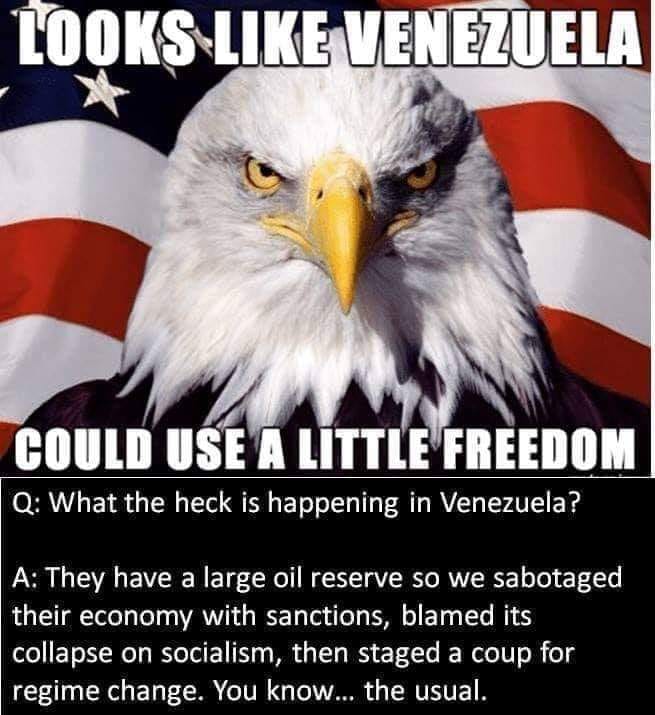

The U.S. backed a coup in Venezuela that has failed. And President Trump was the architect of it. This is a farce surrounding an intrigue contained within a tragedy.

What has happened in Venezuela is tragic. Nicolas Maduro is a comical figure straight out of central casting for a South American leader of a junta. But it has been the U.S.’s designs on Venezuela’s oil and gas reserves (the largest proven in the world as of 2017) that is the real story behind this week’s events.

For anyone still harboring doubts as to who Trump truly is Venezuela should end them. Trump’s Energy Dominance policy is at the core of his foreign policy. And he will do whatever it takes to secure that policy and deliver a long-standing order to the U.S. and European oligarchy to gain control over Venezuela.

THIS DAY IN HISTORY – Gusher signals start of U.S. oil industry – 1901

On this day in 1901, a drilling derrick at Spindletop Hill near Beaumont, Texas, produces an enormous gusher of crude oil, coating the landscape for hundreds of feet and signaling the advent of the American oil industry. The geyser was discovered at a depth of over 1,000 feet, flowed at an initial rate of approximately 100,000 barrels a day and took nine days to cap. Following the discovery, petroleum, which until that time had been used in the U.S. primarily as a lubricant and in kerosene for lamps, would become the main fuel source for new inventions such as cars and airplanes; coal-powered forms of transportation including ships and trains would also convert to the liquid fuel.

Continue reading “THIS DAY IN HISTORY – Gusher signals start of U.S. oil industry – 1901”

Ecuador Reportedly Preparing To Hand Assange To UK In “Coming Weeks Or Days”

Ecuador is preparing to hand over WikiLeaks founder Julian Assange to the UK in “coming weeks or even days,” RT editor-in-chief Margarita Simonyan reported, as political support and sympathy for Assange’s predicament have more or less evaporated since the arrival of an administration that largely views Assange as an inherited problem, and would like more than anything to finally be rid of him. “My sources tell [Julian] Assange will be handed over to Britain in the coming weeks or even days,” Simonyan wrote in a recent tweet which was reposted by WikiLeaks. “Like never before, I wish my sources were wrong,” she continued.

Editor-in-chief of RT: "My sources tell me that @JulianAssange will be handed over to the #UK in the next weeks or days. Like never before I wish that my sources are wrong'' https://t.co/rvN3ne3ifd

— WikiLeaks (@wikileaks) July 20, 2018

Continue reading “Ecuador Reportedly Preparing To Hand Assange To UK In “Coming Weeks Or Days””

Trump Is Seeding War Clouds Over Iran

Guest Post by Michael S. Rozeff

Trump and Pompeo are squeezing Iran where it hurts. They are trying to prevent Iran from selling oil internationally. They are applying maximum pressure upon Iran. This is overt. It is announced policy. For example, the State Department says:

Very broadly, Saudi Arabia is a key partner in our effort to isolate and pressure Iran. And as I said, we had a number of bureaus from the State Department to discuss energy, diplomacy, security, and economic pressure. We were also joined by Treasury Under Secretary Sigal Mandelker for some of these meetings so that they can hear from Treasury officials and coordinate our efforts on applying maximum economic pressure on Iran.

The US is threatening China and India if they buy Iranian oil:

Russia Deploys Exotic New Weapon: A “Budget Surplus”

Authored by John Rubino via DollarCollapse.com,

The price of oil is rising, which is obviously good news for those who sell it to the rest of us. Russia in particular seems to be enjoying the current trend, so much so that – if I’m understanding this correctly – Moscow is now receiving more in taxes than it’s spending. This is producing something called a “budget surplus,” which is a kind of currency war weapon that can be deployed to improve a country’s geopolitical position. Here’s a quick overview:

Russia To See Oil Revenues Jump Fivefold

(Oil Price) – Due to the oil price rally, Russia expects its oil and gas revenues to jump fivefold compared to the expected revenues set in its 2018 budget, according to the Finance Ministry that now expects Russia to post a budget surplus for the first time since 2011.

Oil and gas exports account for around 40 percent of Russia’s federal budget revenues.

Russia’s revenues from oil and gas sales are now expected at US$44.4 billion (2.74 trillion Russian rubles) for 2018, up from US$8.5 billion (527.6 billion rubles), according to a budget amendment by the Finance Ministry.

Due to the unexpectedly high oil prices, Russia is currently on track to book a first budget surplus since 2011, at 0.45 percent of gross domestic product (GDP), compared to previous expectations for a 1.3 percent of GDP deficit. The previous forecasts, however, were based on assumptions that the Urals crude blend would average around $40 a barrel. Between January and April, the price of Urals has averaged $66.15.

The additional oil revenues that Russia has earned above the Urals price assumption of $40 a barrel will be allocated to reserves instead of to spending, TASS news agency reports.

Analysts commented on the proposed budget amendment that Russia will have more revenues while it continues to plan for expenditures close to the original budget law.

“This will provide a very useful cushion to lean on if there are some adverse macro or geopolitical shocks,” Ivan Tchakarov, chief economist at Citi in Moscow, told Reuters.

WHY WE GO TO WAR

De-Dollarization Accelerates: China Readies Yuan-Priced Crude Oil Benchmark Backed By Gold

This means war.

Authored by Tsvetana Paraskova via OilPrice.com,

The world’s top oil importer, China, is preparing to launch a crude oil futures contract denominated in Chinese yuan and convertible into gold, potentially creating the most important Asian oil benchmark and allowing oil exporters to bypass U.S.-dollar denominated benchmarks by trading in yuan, Nikkei Asian Review reports.

Why The Wall Street Journal Is Wrong About The US Oil Export Boom

Authored by Arthur Berman via OilPrice.com,

The lead editorial in Friday’s Wall Street Journal was pure energy nonsense.

“Lessons of the Energy Export Boom” proclaimed that the United States is becoming the oil and gas superpower of the world. This despite the uncomfortable fact that it is also the world’s biggest importer of crude oil.

The Journal uses statistical sleight-of-hand to argue that the U.S. only imports 25% of its oil but the average is 47% for 2017. Saudi Arabia and Russia–the real oil superpowers–import no oil.

The piece includes the standard claptrap about how the fracking revolution has pushed break-even prices to absurdly low levels. But another article in the same newspaper on the same day described how producers are losing $0.33 on every dollar in the red hot Permian basin shale plays. Oops.

Continue reading “Why The Wall Street Journal Is Wrong About The US Oil Export Boom”

THIS DAY IN HISTORY – Gusher signals start of U.S. oil industry – 1901

On this day in 1901, a drilling derrick at Spindletop Hill near Beaumont, Texas, produces an enormous gusher of crude oil, coating the landscape for hundreds of feet and signaling the advent of the American oil industry. The geyser was discovered at a depth of over 1,000 feet, flowed at an initial rate of approximately 100,000 barrels a day and took nine days to cap. Following the discovery, petroleum, which until that time had been used in the U.S. primarily as a lubricant and in kerosene for lamps, would become the main fuel source for new inventions such as cars and airplanes; coal-powered forms of transportation including ships and trains would also convert to the liquid fuel.

Continue reading “THIS DAY IN HISTORY – Gusher signals start of U.S. oil industry – 1901”

What Can Be Made from One Barrel of Oil?

How Oil is Formed

The Volatile History of Crude Oil Markets

GAS PRICE UP & DOWN

It’s all a matter of perspective. The two charts below reveal the volatile nature of gas prices over time. Here are some unequivocal facts:

- Gas prices have risen by 37% in the last 100 days.

- Gas prices are exactly where they were last September.

- Gas prices are 16% lower than they were last Memorial Day weekend.

- Inflation adjusted gas prices are 50% lower than their 2008 record high.

- Inflation adjusted gas prices are 38% below 1980 levels.

- Inflation adjusted gas prices are 46% above the December 2008 financial crisis lows.

How’s that for volatility. Anyone who authoritatively acts like they know where oil/gasoline prices will go in the future are lying. The current uptrend will likely collapse, as financial shenanigans by Wall Street are the main reason for the surge in prices. Longer term, as the shale oil miracle disappears and conflict in the Middle East surges, prices will likely blast through the $3.00 level again. So, in conclusion – gas prices will rise and fall.

THIS IS WHY WE ARE BRINGING “FREEDOM” TO THE MIDDLE EAST

I can’t figure out why we are so concerned about the Middle East. Can you?

If we are swimming in shale oil and our future is driver-less electric cars, why are we so concerned about the Middle East?

After 15 years in Afghanistan, the opium crop is at record high levels. How could that be? I thought we were there to modernize and democratize their country. At least heroine in the U.S. is now cheaper than a happy meal at McDonalds.

Saudi Arabia, Iraq, United Arab Emirates, Kuwait, Iran, and Oman were all among the top 15 exporters of crude oil in 2015. Russia and Kazakhstan, countries on the Central Asian part of the map, were also members of that same group.

Regimes in the region found that there were many other corollary benefits from this economic might. Unrest could be stifled by rising wealth, and these countries would also have more influence than they otherwise would in global affairs. Saudi Arabia is a good example in both cases, though a major driver of Saudi influence has been slipping in recent years.

Continue reading “THIS IS WHY WE ARE BRINGING “FREEDOM” TO THE MIDDLE EAST”