Via International Man

International Man: What are Rare Earth Elements (REEs), and why are they so important?

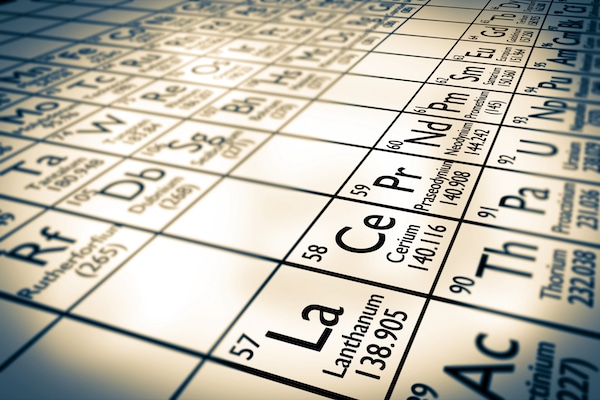

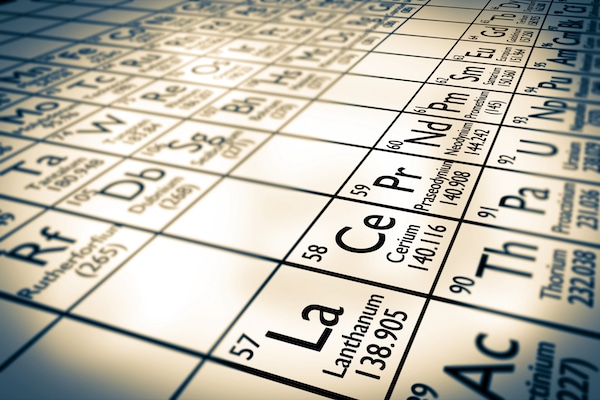

Doug Casey: The REEs are a group of 17 elements that you may recall from your high school chemistry class. They take up two rows in the periodic table, sitting by themselves at the bottom of the chart. They’re chemically similar to each other.

REEs are widely dispersed on the Earth’s surface. They aren’t “rare” per se, but since they’re not generally concentrated, you only rarely find deposits that are rich enough to qualify as a mine for elements like germanium, gadolinium, ytterbium, yttrium, or 14 others with exotic and obscure names. They’re basically all minor byproducts of mines for other elements—largely aluminum or zinc. They’ve only recently found significant uses with the development of high-tech, especially electronics and magnets. Fifty years ago, they were basically just chemical curiosities.

Continue reading “Doug Casey on China’s Dominance of Crucial Rare Earth Elements and What Comes Next”