“Already long ago, from when we sold our vote to no man, the People have abdicated our duties; for the People who once upon a time handed out military command, high civil office, legions — everything, now restrains itself and anxiously hopes for just two things: bread and circuses” – Juvenal – 100 A.D.

Juvenal makes reference to the Roman practice of providing free wheat to Roman citizens as well as costly circus games and other forms of entertainment as a means of gaining political power through populism. Roman politicians devised a plan in 140 B.C. to win the votes of the poor: giving out cheap food and entertainment, “bread and circuses”. The Roman politicians realized this would be the most effective way to rise to power and stay in power.

With the revolting display of political theater in the last few weeks, I couldn’t help but consider the parallels between the Roman Empire and the American Empire. The entire debt ceiling farce was a circus on an epic scale – The Greatest Show on Earth. The American public was treated to high wire acts of near debt experiences, Senators putting their heads into the mouths of lions, and hundreds of clowns riding tiny bikes with squeaking horns. In the end, American politicians did what they do best – pretended to solve a spending problem without cutting spending. Only in America could politicians put the country on course to increase its national debt from $14.5 trillion to $23 trillion by 2021 and declare they are cutting spending. For those that need to visualize the lies of politicians, take a gander at this chart and try to find the cuts in spending.

You have a better chance of finding a unicorn in your backyard than finding actual cuts in spending from the corrupt clowns inhabiting the halls of Congress. If you are driving your car towards a brick wall at 120 mph and you slow down to 118 mph, the ultimate result will be the same. The only way to avoid disaster is to jam on the brakes. But, the liberal and conservative politicians are both enjoying the ride fueled by millions in corporate, union, Wall Street and a thousand other special interest payoffs.

The Roman authorities provided free wheat to the peasants as a superficial means of appeasing the masses and distracting them from the fact that public policy and public service had failed, as corruption and decadence engulfed those in control of government. Free bread, chariot races, and feeding Christians to lions kept the small-minded peasants satiated and ignorant of their civic duty. Today, the authorities don’t hand out bread they hand out EBT cards to 45.5 million Americans, or 14.6% of the entire population.

There are almost 5 million Americans on welfare. There are 50 million Americans on Medicaid. There are 8 million Americans receiving unemployment compensation. There are 10.5 million Americans on Social Security disability. This is the symbolic bread being provided to the masses to keep them tranquilized, pliable, satisfied and ignorant of their civic duty. The government has renamed bread as “social benefits” and now distributes $2.3 trillion of bread per year to the “needy”. This constitutes 15% of the country’s GDP and will continue to grow for decades or until the American Empire collapses.

Aldous Huxley in his 1958 assessment of his 1931 novel Brave New World – Brave New World Revisited said that “any bird that has learned how to grub up a good living without being compelled to use its wings will soon renounce the privilege of flight and remain forever grounded. If the bread is supplied regularly and copiously three times a day, many of them will be perfectly content to live by bread alone – or at least by bread and circuses alone. ‘In the end,’ says the Grand Inquisitor in Dostoevsky’s parable, ‘in the end they will lay their freedom at your feet and say to us, make us your slaves, but feed us.” Bread is not the opiate of the masses, it is the cyanide. Huxley saw the Welfare state arising before it really got kick started in the late 1960s. By trying to support the less fortunate by transferring trillions to them, with no strings attached, we have insured the ultimate bankruptcy of our country. Americans have willingly sacrificed liberty, freedom and civic responsibility for safety, security and bread.

Huxley hadn’t lost all hope. He seems to have foreseen the rise of the Tea Party and the coming revolution, led by the youth of this country who are being left with the bill for the bread and circuses promised by myopic politicians over the last four decades:

“When things go badly, and the rations are reduced, the grounded do-dos will clamor again for their wings… The young people who now think so poorly of democracy may grow up to be fighters for freedom. The cry of ‘Give me television and hamburgers, but don’t bother me with the responsibilities of liberty,’ may give place, under altered circumstances to the cry of Give me liberty or give me death.”

I hope Huxley is right. The welfare state is bankrupt. The rations are going to be cut. There is no choice. The money is gone. The jobs are gone. The do-do’s that haven’t flown in years are unlikely to clamor for their wings. They are already clamoring when even the potential of cuts in their bird feed are mentioned. The Millenial generation is our last great hope to reverse our decline. They have not become addicted to “social benefits” yet. Their parents and grandparents are handing them an un-payable bill as they graduate college with no jobs. A generational war is in the offing. I for one will side with the youth against the Boomers. The future of the country depends upon the outcome of this war.

Striking Similarities to Rome

“There are striking similarities between America’s current situation and the factors that brought down Rome, including declining moral values and political civility at home, an over-confident and over-extended military in foreign lands and fiscal irresponsibility by the central government”. –David Walker

![]()

David Walker, the former head of the GAO from 1998 until 2008, compared the U.S. Empire to the Roman Empire in August 2007. He has been warning the country about our unsustainable fiscal path for over a decade.

- Since August 2007 the National Debt has increased from $8.9 trillion to $14.6 trillion, a 64% increase in four years.

- We’ve increased our cumulative expenditure on our wars of choice in the Middle East to $1.3 trillion since 2001.

- Our annual military spending rose from $653 billion in 2007 to the current $966 billion, a 48% increase in four years.

- Federal government transfers for Social Security, Medicare, Medicaid, Unemployment, Veterans, Food Stamps, and Welfare increased from $1.7 trillion in 2007 to the current level of $2.3 trillion, a 35% increase in four years.

It goes without saying that Mr. Walker’s advice was not heeded. And regarding declining moral values and political civility, I would point you to the fine examples of morality displayed by Wall Street since 2007 along with the display of civility seen in Washington DC over the last few weeks. The striking similarities that David Walker acknowledged are in full bloom for the world to see.

English historian Edward Gibbon wrote his masterpiece The Decline and Fall of the Roman Empire in 1776, ironically in the year the American Empire was born. He detailed the societal collapse encompassing both the gradual disintegration of the political, economic, military, and other social institutions of Rome and the barbarian invasions that were its final doom in Western Europe. Gibbon concluded there were five marks of the Roman decaying culture:

- Concern with displaying affluence instead of building wealth.

- Obsession with sex and perversions of sex.

- Art becomes freakish and sensationalistic instead of creative and original.

- Widening disparity between very rich and very poor.

- Increased demand to live off the state

Gibbon’s analysis captured the essence of what happens to all empires. It subsequently happened to the Dutch, Spanish and British empires and has been eating away at the greatest empire of all over the last several decades. Larry Elliot, writer for the UK Guardian, recently described the rot that has destroyed every empire in history:

“The experience of both Rome and Britain suggests that it is hard to stop the rot once it has set in, so here are the a few of the warning signs of trouble ahead: military overstretch, a widening gulf between rich and poor, a hollowed-out economy, citizens using debt to live beyond their means, and once-effective policies no longer working. The high levels of violent crime, epidemic of obesity, addiction to pornography and excessive use of energy may be telling us something: the US is in an advanced state of cultural decadence.

Empires decline for many different reasons but certain factors recur. There is an initial reluctance to admit that there is much to fret about, and there is the arrival of a challenger (or several challengers) to the settled international order. In Spain’s case, the rival was Britain. In Britain’s case, it was America. In America’s case, the threat comes from China.”

For the last forty years America has shifted from a society that created goods into a society that created debt. Displays of affluence like McMansions, Mercedes, BMWs, Rolexes, summer mansions in the Hamptons, designer clothes, granite and stainless steel kitchens, and 85 inch HDTVs, all purchased with debt provided like candy by the Wall Street banks and their sugar daddy – the Federal Reserve, have trumped true wealth building. The result is a nation with $52.6 trillion of debt outstanding, or 350% of GDP. The basic rule for maintaining a healthy economic system requires the population to spend less than they earn and save the difference. The savings can then be invested in domestic companies, plants and equipment which keep the country growing. Americans bought into the lie that purchasing cheap foreign goods with cheap credit was as valid as actually building wealth. The national savings rate, which exceeded 10% in the 1970s and early 1980s, dropped to less than 1% by 2005. Why save when you could whip out one of your 13 credit cards.

America’s obsession with sex and perversion of sex makes Caligula look like a Boy Scout. There are 4.2 million pornographic websites serving 72 million visitors per month and generating $5 billion of revenue for these fine capitalists. More than 40% of internet users view porn. What passes for art today is a crucifix in the artist’s urine. The true art of the American empire consists of reality TV shows like Jersey Shore and Housewives of NY, OC, NJ, Miami, and Atlanta. America has taken shallow, mindless, and superficial to an empire crushing low.

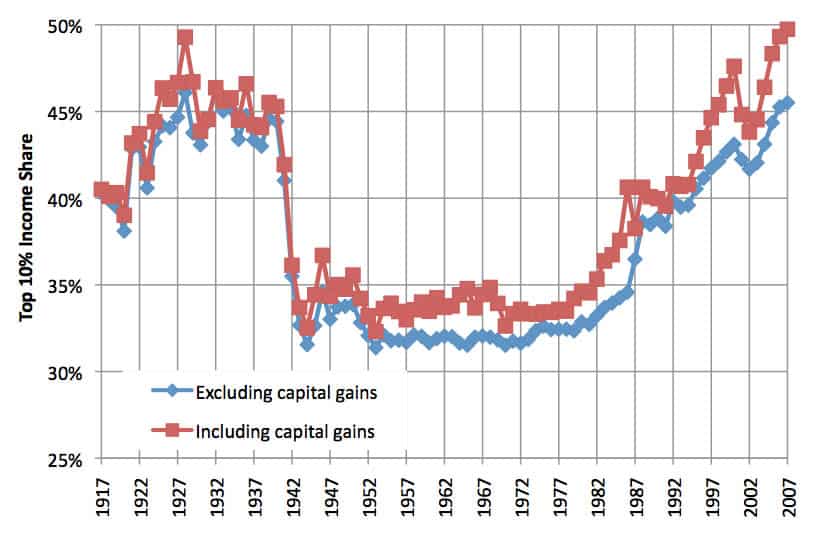

The disparity in wealth between the super rich and the working class has never been greater. The working middle class that built this country has been systematically destroyed as the super rich have used inflation and debt to lure them into servitude, while the unproductive parasites have learned it is easier to feed off their middle class host than work for a living. It is clear to anyone, except a Republican ideologue, that when the top 10% richest Americans abscond with 50% of the income in the nation through their control of politicians, Wall Street and the few mega-corporations that set the economic agenda, a convulsive change is necessary. It is not a coincidence the heyday of the American Empire was from 1946 until 1971 when the working middle class was able to advance their station in life through education, hard work and a level playing field.

The playing field got tilted against the working middle class in the late 1960’s with LBJ’s Great Society welfare state and got turned upside down in 1971 when Nixon closed the gold window and allowed bankers and politicians unfettered access to money printing with no immediate consequences. The result has been a slow steady descent into hell as politicians have made $100 trillion of unfunded promises of bread to the masses and bankers have gorged themselves with riches from peddling debt to the same masses, so they could enjoy the circuses. We are now left with the top 1% hoarding 33.8% of the wealth and the top 10% clinging to 71.5% of the wealth in the country. The bottom feeders are thrown scraps of bread in the form of food stamps, welfare, disability payments, and unemployment compensation. They have grown dependent and no longer participate in productive society. With more than 50% of adults paying no income tax, they vote for politicians that promise to not “cut” their social benefits.

When you see your leaders take actions that clearly are not in the long term best interests of the American people, you need to ask why. Since September 2008 your leaders have funneled trillions of dollars to the Wall Street bankers that nearly destroyed the worldwide economic system. They have funneled billions into the coffers of the mega-corporations that outsourced your jobs to Asia. They ramped up their wars in the Middle East to reward their friends in the military industrial complex. And lastly, they handed out a few hundred billion more to the masses to keep them from rioting in the streets.

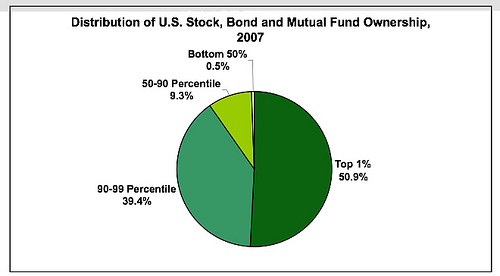

We know for a fact QE2 was designed to prop up the stock market because Ben Bernanke told us so. And it worked. From the day he announced he was going to do it at the annual meeting of the ruling moneyed classes at Jackson Hole until it ended on July 1, 2011, the market went up 30%. The average American dealt with the 30% to 50% increases in food and energy costs, while the richest 1% partied like it was 1999. Considering they own 50.9% of all the stocks in the country, the last couple years of free money and stock appreciation created by the Federal Reserve have been a windfall for the privileged moneyed class. The bottom 50% who own 0.5% of the stocks in the country haven’t fared so well.

When you watch the talking heads and contemptible pundits on Fox, CNBC, MSNBC, CNN and the other mainstream corporate media spinning our economic situation in a positive way, remember that every person you are listening to is a member of the top 1% richest Americans. They have large portfolios of stocks and will not let reality or truth interfere with their ambitions of further wealth and power. This country is controlled by the few for the benefit of the few at the expense of the many. Less than ten banks control more than 50% of deposits and 75% of the lending in the country. One private banking organization – the Federal Reserve – controls the currency of the country. A handful of mega-corporations control the commerce of the country. Less than ten arms dealers dictate the war spending in the country. A few media conglomerates control the message fed to the masses. A few hundred corrupt politicians pay off their corporate and banking masters with laws, tax breaks, and pork. These people make up the ruling class of America.

As their messages of “efficiency” and “job creation” have proven to be lies, the financialization of America by the ruling class is almost complete. Real earnings for real people are 10% lower than they were in 1972. They have transformed a productive society based on saving and investment into a hollowed out shell of a society based on financial manipulation and debt. The endgame approaches.

The moneyed interests have gone too far. The debts are too large. The burden placed on the middle class is too great. The Federal Reserve has proven to be the lackeys of the Wall Street fat cats and the slithering political class in Washington DC. QE2 was a miserable failure. The American middle class is angry. Their anger could lash out in many possible directions. Their benefits will be cut. Their home values will fall. Their 401ks will be cut in half. Their standard of living will fall. Will they accept this fate without a fight? I doubt it.

Democracy Never Lasts Long

The decline of the American Empire may be a surprise to those who cling to the laughable American Exceptionalism dogma, but every previous empire in history has declined. The Dutch Empire lasted for just over a century. The Spanish Empire survived for just over two centuries. The British Empire reigned for just over three centuries. And the Great Roman Empire ruled for almost five centuries.

The American Empire has been expanding for over 220 years, but based on all indications has peaked. Were we destined to implode as all previous democracies have done, as described by Greek historian Polybius?

“Monarchy first changes into its vicious allied form, tyranny; and next, the abolishment of both gives birth to aristocracy. Aristocracy by its very nature degenerates into oligarchy; and when the commons inflamed by anger take vengeance on this government for its unjust rule, democracy comes into being; and in due course the licence and lawlessness of this form of government produces mob-rule to complete the series.” –The Histories 6.4.7-13

As a democracy this country was supposed to be governed by the people, for the people. We were supposed to have an equal say in how we were governed and participation in adopting the laws of the land. Over time civic duty was outsourced to politicians that promised the masses safety and security at the expense of liberty and responsibility. The general population has grown accustom to the bread and circuses provided by their “protectors”. The fledgling democracy has degenerated into a corporate fascist oligopoly that benefits the few in control. Recent events prove beyond a shadow of doubt the privileged few are losing control of the situation. A worldwide upheaval is brewing as the toxic debt is strangling the economic systems of the world. Confidence in this ponzi finance system is waning. The American population is beginning to realize their fatal mistake in trusting bankers and politicians to do what was right for the country.

Polybius believed that democracies always killed themselves:

“And hence when by their foolish thirst for reputation they have created among the masses an appetite for gifts and the habit of receiving them, democracy in its turn is abolished and changes into a rule of force and violence. For the people, having grown accustomed to feed at the expense of others and to depend for their livelihood on the property of others, as soon as they find a leader who is enterprising but is excluded from the houses of office by his penury, institute the rule of violence; and now uniting their forces massacre, banish, and plunder, until they degenerate again into perfect savages and find once more a master and monarch.” – The Histories 6.9.7-9

The average American does not understand what is swirling around them. They have a sense of unease, but they are still receiving their government issued bread and their 52 inch TV is providing 24 hours of circuses. The monetary system upon which that bread and those circuses are based is collapsing as we speak. Ernest Hemingway captures what is happening to the American Empire in one brief quote from his novel The Sun Also Rises:

“How did you go bankrupt?” “Two ways, gradually and then suddenly”

As the political theater of the absurd played out last week in Washington DC, it became clear to me the ruling class has no intention of changing our path. Politicians will keep spending and central bankers will keep printing more money. There are people like David Walker that will continue to sound the alarm:

“We are less than three years away from where Greece had its debt crisis as to where they were from debt to GDP. With the recent increase in the debt ceiling and continued higher budget deficits at the federal level, the US is on course for its own crisis. We are not exempt from a debt crisis. We’re never going to default, because we can print money. At the same point in time, we have serious interest rate risk, we have serious currency risk, we have serious inflation risk over time. If it happens, it will be sudden and it will be very painful.”

But, it appears we are destined to commit suicide as a nation. I doubt the American Empire will linger on for centuries. The world moves rapidly. The Vandals (Goldman Sachs) and the Huns (JP Morgan) are at the gates. The final battle is underway – the battle for the soul of America. When the existing social structure is swept away by the tsunami of un-payable debt, who and what will replace it? Will the American people turn to someone that promises them liberty and freedom with no promises of bread and circuses? Or will they turn to a strong demagogue that promises them more safety and more security?

What do you think?