Month: January 2014

GREENWALD CALLS OBAMA NSA REFORM A JOKE

PEOPLE OF WAL-MART – WE’RE ALL DOOMED

Is there a FUPA season? I mean, if I had to guess I’d say the springtime due to excess winter weight being gained unnoticed but I kinda have a bad “gut” feeling that we can’t limit these atrocities to just one time of year.

What’s the point of having underwear on if the world doesn’t even know you’re wearing them? These fine ladies are forward thinkers I say. I’m tired of spending my good money on some stylish undies only for them to go unnoticed. Who’s with me?!?!…nobody? Ok, nevermind then.

Attention shoppers, we have a special on parties located in every frickin’ aisle this dude goes in!!!!!

HA! Ok, when you come down from your incredible level of disbelief and disgust in humanity let me know which one you think is worse.

That will certainly deter anyone thinking about breaking into your car. I know I wouldn’t go near it now just because I’d assume you also have a bear trap on the seat cushion or something. Maybe our friends over at whitetrashrepairs.com could help let us know where this security system ranks in their books.

What’s so creepy about having a homemade shirt with multiple pictures of Winona Ryder on it? Oh, everything? Yeah that’s what I figured. Not stalkerish at all.

Who doesn’t like a classic Battle of the Sexes matchup? For this bout we’ve got a couple of over-the-top mooners. So make sure you pick a side before you hurriedly look away.

I’m sure by now you’ve all heard about 49ers coach Jim Harbaugh and how his wife hates that he buys his pleated khakis for $8 at Walmart. Obviously the reason you’ve heard about that is because Sportscenter is less about sports and more about useless crap. However, we here at POWM are all about useless crap that happens at Walmart, so we’d like to say thanks to Jim for getting caught in the act and remember $8 khakis are still 1,000X better than Belichick’s awful cutoff hoodies.

Nothing says “I’m cheap as hell” like homemade bumper stickers! Also, if you need to resort to making homemade bumper stickers about people being on your ass so much, chances are good the problem is you.

Someone asked me if there is anything better than a rat tail and to be honest I was stumped. I assumed there was not. Then BOOM! Right in my face I get hit with the Siamese twin rat tail and it turns everything I thought I knew about this world upside down.

Ummm ok, couple of ladies on the prowl that might have just missed their prime hunting season by a few decades. But perhaps these cougars still got some bite left? Anyway, I’m sure there are such things as a GILF, not sure these two fit the bill but I don’t know what else to call them when I make you pick one.

Okay, yup I see it’s suppose to be ‘Ducks’ but that’s a little too close for comfort for the kiddos. However ma’am, you don’t get to use that excuse. Your shirt is clearly expressing joy over a poop.

Hey, real men wear pink capris!…not real manly men, but yes technically still male.

I’ll tell ya what buddy let me go ahead and take a worldwide vote and see who all wouldn’t want to be born a white male in America. I’m sure you and the 3 other idiots will be new best friends. Geez, this guy would hit the lottery and bitch about the taxes.

Well that’s certainly a different approach to looking foolish. Totally successful by the way, but definitely a different route there. You’re a pioneer of foolish!

You look like you messed up being a juggalo, which is about the saddest, most depressing thing I could think of saying to someone else.

Hell ya! ‘Bout time Walmart hired a real gardener to work there. I can’t wait to talk to you all about your bare white pasty tulips.

You’d figure that black hole would have sucked in that excess thigh cheese.

COVER-UPS R’ US

KRUGMAN CALLS HIMSELF AN IDIOT

Krugman Can’t Understand How Someone Could Be So Stupid As To Believe What He Used To Believe

Submitted by Robert Murphy via The Ludwig von Mises Institute of Canada,

Over at CafeHayek, Russ Roberts is mystified at a recent Paul Krugman blog post. Concerning the debate over whether the US federal government should extend unemployment benefits, Krugman wrote on January 12:

There’s a sort of standard view on this issue, based on more or less Keynesian models. According to this view, enhanced UI actually creates jobs when the economy is depressed. Why? Because the economy suffers from an inadequate overall level of demand, and unemployment benefits put money in the hands of people likely to spend it, increasing demand.

You could, I suppose, muster various arguments against this proposition, or at least the wisdom of increasing UI. You might, for example, be worried about budget deficits. I’d argue against such concerns, but it would at least be a more or less comprehensible conversation.

But if you follow right-wing talk — by which I mean not Rush Limbaugh but the Wall Street Journal and famous economists like Robert Barro — you see the notion that aid to the unemployed can create jobs dismissed as self-evidently absurd. You think that you can reduce unemployment by paying people not to work? Hahahaha!

Before continuing, let’s be clear at the rhetorical devices Krugman uses here. First, he sets it up as the “standard view” that extending unemployment benefits (in a depressed economy) will boost job growth, through Keynesian demand-side effects.

Then, Krugman racks his brains trying to figure out how somehow could possibly disagree with this “standard view.” He says “I suppose” you might worry about the larger budget deficit that this would cause. He doesn’t offer any other possible mechanism by which someone might oppose it.

Finally, Krugman says that that’s not the argument that opponents are using. Instead, they are relying on a supply-side argument, claiming that it would reduce the incentive to work if you paid people not to work. In the context, it is clear that Krugman thinks this is NOT a good objection to the “standard” Keynesian view.

Against this backdrop, then, Russ Roberts is simply astounded because we can turn to Paul Krugman’s own (recent) books to elucidate this very argument–the one that “right-wingers” such as Robert Barro are advancing, much to Krugman’s horror. For example, in the 2010 edition of Krugman’s Essentials of Economics he writes:

People respond to incentives. If unemployment becomes more attractive because of the unemployment benefit, some unemployed workers may no longer try to find a job, or may not try to find one as quickly as they would without the benefit. Ways to get around this problem are to provide unemployment benefits only for a limited time or to require recipients to prove they are actively looking for a new job.

And, in the 2009 edition of Krugman’s textbook Economics he writes: “Generous unemployment benefits can increase both structural and frictional unemployment. So government policies intended to help workers can have the undesirable side effect of raising the natural rate of unemployment.”

So we see here, that the type of supply-side argument that Barro et al. bring up is one that Krugman himself endorses. Indeed, this is literally the “standard view on the topic.”

To be sure, a Keynesian like Krugman could argue that in the middle of a big economic slump that such supply-side issues are of only minor importance, and get trumped by demand-side factors. But that’s not at all the argument Krugman is making in this latest blog post. Instead, he is making it sound like Barro et al. are grasping at straws, and not even relying on a coherent argument (such as fear of bigger deficits) when trying to oppose extension of unemployment benefits.

Krugman does this in other contexts, too. To take just one other example: He has coined the terms “confidence fairy” and “invisible bond vigilantes” to mock economists who believe that investors might worry about rising government debt levels, and consequently favor faster action on bringing down deficits even though market interest rates are quite low for US government debt. Yet back in 2003 Krugman wrote:

With war looming, it’s time to be prepared. So last week I switched to a fixed-rate mortgage. It means higher monthly payments, but I’m terrified about what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits.

My point in the present post isn’t to accuse Krugman of outright contradictions, or to say he’s forbidden from ever changing his mind.

Rather, my point is that Krugman frequently accuses his opponents of being stupid and/or evil, when they present a view that he himself advanced in other circumstances. His typical readers would have no idea that Krugman once worried about bond vigilantes, or that his books lay out the standard case for why generous government unemployment benefits might contribute to structural unemployment. No, Krugman has led such typical readers to believe that anyone espousing such views is either a complete idiot–immune to theory and evidence that we’ve had since the 1930s–or is a paid shill who hates poor people.

QUOTES OF THE DAY

“The term propaganda rings melodramatic and exaggerated, but a press that—whether from fear, careerism, or conviction—uncritically recites false government claims and reports them as fact, or treats elected officials with a reverence reserved for royalty, cannot be accurately described as engaged in any other function.”

Glenn Greenwald

“Sooner or later everyone sits down to a banquet of consequences.”

Robert Louis Stevenson

CLIP’S SATURDAY MORNING MONTAGE

My fellow monkeys – It’s a generally accepted fact that we like guns. We also enjoy seeing maroons fuck up. Here, for your entertainment I would like to present 9 minutes of maroons with guns and they’re doing exactly what you’d think they would do. Fucking up with guns!!!

https://www.youtube.com/watch?v=dmtOEI7sAAs

THANKS CHINA!

The government signs people up for welfare, gives ’em food stamps, free cash, free housing, free healthcare, free phones, free transportation. Over 100 million people are on welfare alone. And 12 million on disability, and 30 million union government drones (soft welfare), and all the pensions. It’s called “stimulus” by Obama and the liberal progressive socialists. And paying people infinite unemployment benefits “creates jobs”. It’s all become part of the normal USSA lexicon.

Thank God for China, taking our IOU’s for there products, and loaning us money. It’s a great big circle jerk: FSA gets EBT cash and SNAP; goes to Wal Mart and spends it all; 80% of the products at Wal Mart are made in China; China gets the cash; China loans the cash back to the USSA to redistribute to the FSA; and the whole cycle starts again. The only problem is our debt. But idiots like Krugman say the debt doesn’t matter. So thanks China, for loaning us money and allowing socialism.

How China helps pay for Medicare, Welfare, U.S. aircraft carriers

By Rick Newman

Chinese holdings of U.S. federal debt hit a new record high toward the end of 2013. We should probably be grateful.

At the end of November (the latest data available), China held $1,317,000,000,000 in U.S. Treasury securities. If all those zeroes make your head swim, that’s about $1.32 trillion, which exceeds the prior record, from 2011. China has been the largest foreign holder of U.S. debt since 2008, when it overtook Japan, which is now No. 2.

Chinese holdings of U.S. debt strike some people as a national-security vulnerability, but that’s largely a myth fed by fear-mongering xenophobes. For one thing, the debt held by China only amounts to about 7.6% of the entire $17.2 trillion in U.S. debt. About two-thirds of the national debt is held in the United States, with roughly 45% of that held by government trust funds and other federal agencies, much of it taxpayer money slated to be spent on Social Security and other entitlements.

Borrowing from all sources, including China, also helps Washington pay for more programs than Americans finance on their own through taxes. A trenchant irony of China’s lending to the United States is it helps pay for aircraft carriers, fighter jets, missiles and other military hardware that would menace China if there were ever a standoff between the two nations.

“One big pot of cash”

Funds from China also help pay for Medicare, welfare, highways, education grants, prisons, food stamps and most other things the federal government spends money on. A few programs — most notably, Social Security — have a dedicated source of funding. Medicare is partly funded that way, but money for some parts of the popular healthcare program for seniors comes from the Treasury Department’s general fund. For the most part, money from taxes and borrowing goes into the same pool at the Treasury, with no distinctions on how dollars from different sources are spent. “Whether the payments are derived from debt or taxes, it’s all one big pot of cash,” says Deborah Lucas, a finance professor at MIT’s Sloan School of Management.

China’s holdings of U.S. debt may actually be a bigger worry for China than for America. “When people ask ‘how bad would it be for the United States if China withdrew its money,’ the answer is, ‘how bad would it be for China if the United States went bankrupt?’” says Richard Kogan of the Center for Budget and Policy Priorities. “China has a big stake in the solvency of the United States. They want us to pay all their principal and interest and keep buying the stuff they make.”

There’s little or no evidence, in fact, that China’s foreign-debt holdings have ever been used for political purposes. China mostly invests its reserves the way any nation seeking financial stability would.

The vast scale of borrowing by the U.S. government is a different story altogether and a legitimate worry. Washington has made halting progress on its debt recently, with the annual deficit dropping from $1.1 trillion in 2012 to $980 billion in 2013. That should fall to about $860 billion this year, according to the Congressional Budget Office, and perhaps lower if the economy exceeds expectations and tax revenues rise.

There’s still no plan, however, for addressing federal budget gaps that are expected to explode starting around 2020, as spending on retiring baby boomers skyrockets. With luck, China will still have a lot of money to invest by then — and remain in an accommodating mood.

FRIDAY FAIL

Amou Haji is an 80 year old man who has chosen to live a solitary, nomadic life in Southern Iran. He hasn’t bathed in 60 years and smokes a pipe filled with animal feces. Haji believes “cleanliness brings him sickness,” according to the Tehran Times.

Though his chosen lifestyle may seem a little off, including eating his favorite meal of dead, rotten porcupine, Haji may be happier than many who live that of a more conventional lifestyle. He says the lacking of material possession actually makes him happy.

OBAMA PROMISES ARE WORTHLESS

I Don’t Support CCW Permits

I, like Slavo, am against the idea of them. If I own the firearm and I own my person then whose permission do I need to conceal carry (or open carry) in a public place. A crime cannot occur until someone is harmed or threatened, but that does not stop the government from “outlawing” things at worst or requiring you bow at their altar to receive a permission slip at best.

I am sure there will be detractors that says this is “necessary” and that the Md pigfuk doing this is only an isolated incident or that he was just doing his job or better safe than sorry. But the problem with people who use that rationale is that they have shit for brains.

It’s a crock of shit; this is my CCW:

Original HERE.

MASSIVE OBAMACARE TAX FRAUD ON ITS WAY

This is an exchange between Congressman Gregg Harper and a senior administration official for Medicare named Gary Cohen.

So Obamacare is live. Over 2 million people have supposedly enrolled. The entire system is based on various tax subsidies for poor people to get healthcare coverage. These subsidies will run into the billions. And these blithering idiots have absolutely no fucking idea who has paid their premiums. The functionality DOES NOT EXIST yet. If you think Obamacare has been a clusterfuck so far, wait until the massive tax fraud hits the taxpayer bottom line. How do they expect the IRS to verify tax credits if they have no idea who has paid? Obama doesn’t care. His voters will be getting free healthcare and defrauding the government. It’s a win win for him.

The free shit army criminals are salivating over the billions in fraudulent taxpayer money they will be reaping from Obamacare.

The silence is deafening from MSNBC and the rest of the liberal MSM.

JIM CRAMER & CNBC ARE A JOKE

Does it ever get old watching the lying sack of shit Jim Cramer and his discredited Wall Street Shill network CNBC get raked over the coals for their blatant propaganda and absolutely horrible investment advice?

A Brief History Of Jim Cramer’s Opinions On “Pillar Of Strength” Best Buy

Submitted by Tyler Durden on 01/16/2014 17:36 -0500

You really can’t make this shit up. From the funniest person on financial comedy TV (whose most memorable TV appearance will always be roaring that Bear Stearns is fine days before its collapse), here is his “opinion” on Best Sell Buy, entirely in his own words.

November 20: Jim Cramer opines on Best Buy:

Pillars of Strength in Retail

The homework doesn’t dovetail with the shares. That’s how I felt about the way Best Buy (BBY), Home Depot (HD) and Dick’s (DKS) traded in the wake of the earnings calls — because all three were basically in all-systems-go mode for suppliers.

Regarding Best Buy, it looks as if the tablet is the standout. I know that Apple (AAPL) has become a hated equity, but I keep hearing good things, so I can’t join the nitpicker mob. You did get a nice Chrome call-out for Google (GOOG), but that’s just icing on the Google lovers’ cake.

All three chain stores — Home Depot, Dick’s and Best Buy — are pictures of strength, not weakness. All three stocks should be bought, not sold, on share weakness, despite whatever the “action” says about how well the companies performed. They have performed superbly against both their fields and against retail in general.

Then the next day, November 21, just in case the message was lost:

Best Buy Co. Inc. Jim Cramer ranked this stock a Buy. Cramer previously ranked this stock a Buy on November 15, 2013. The news about tablets also bodes well for Best Buy, a company that has turned around its ailing retail position to once again become one of the stronger names selling technological products to consumers. Cramer said that retail stocks were especially well-positioned at the moment, and he did not neglect to mention Best Buy near the top of his list of retail all-stars.

Fast forward to today, following a 30% collapse in the stock price in one day. From TheStreet:

It really makes you wonder what went wrong when you see a company down 30% in a single trading session, TheStreet’s Jim Cramer said of Best Buy.

The co-portfolio manager of the Action Alerts PLUS portfolio said most analysts had been bullish on the stock, all the way into the upper $30s.

Uhm, just the analysts?

Those expectations were way off, Cramer said. The company reported sales fell 0.8% for the nine weeks ended Jan. 4, while analysts had expected growth and no real degradation in gross margins.

Cramer advised investors who want to buy the stock to wait until Friday because these types of violent moves tend to pan out over a two-day period.

So buy, buy, buy Best Buy at $40, but wait at $26? Gotcha.

And the piece de resistance comes from CNBC this morning:

Cramer said the electronics retailer needs a “big reset,” and that analysts erred in thinking the company could compete with online shopping outlets. He said the holidays were an “Amazon quarter.”

…

A steady stream of positive analyst notes before the busy holiday season helped set up Best Buy for its huge 30 percent drop Thursday, CNBC’s Jim Cramer said.

“Each day one came out and then another came out,” Cramer said Thursday on “Squawk on the Street.” “If they had all come out at once, the stock wouldn’t have been pumped to where it was. It was a serial rollout of positives.”

Wait a minute. It was precisely the “steady stream of positive analyst notes” that Cramer used to pitch as the buying catalyst in Best Buy just back on November 19 and as the reason why people should not sell the stock!!!

The people who are selling [Best Buy] don’t realize the power of the reiteration of [analyst] recommendations we are going to get in the next few days.

But… but… less than two months later it was this very reason that Cramer used as an excuse why the company sold off! It really isn’t… it doesn’t… it can’t… it makes no…

Aghhhh #Ref!

Summarizing it all below:

And now we eagerly await the sequel: “Get Poor Instantly”

TARGET STILL COVERING UP THEIR GROSS NEGLIGENCE

Do not shop at Target. They are incompetent boobs. Their entire system was compromised. They are lying to you about your information being secure. Make them pay for their gross negligence.

A First Look at the Target Intrusion, Malware

http://krebsonsecurity.com/2014/01/a-first-look-at-the-target-intrusion-malware/

Last weekend, Target finally disclosed at least one cause of the massive data breach that exposed personal and financial information on more than 110 million customers: Malicious software that infected point-of-sale systems at Target checkout counters. Today’s post includes new information about the malware apparently used in the attack, according to two sources with knowledge of the matter.

In an interview with CNBC on Jan. 12, Target CEO Gregg Steinhafel confirmed that the attackers stole card data by installing malicious software on point-of-sale (POS) devices in the checkout lines at Target stores. A report published by Reuters that same day stated that the Target breach involved memory-scraping malware.

This type of malicious software uses a technique that parses data stored briefly in the memory banks of specific POS devices; in doing so, the malware captures the data stored on the card’s magnetic stripe in the instant after it has been swiped at the terminal and is still in the system’s memory. Armed with this information, thieves can create cloned copies of the cards and use them to shop in stores for high-priced merchandise. Earlier this month, U.S. Cert issued a detailed analysis of several common memory scraping malware variants.

Target hasn’t officially released details about the POS malware involved, nor has it said exactly how the bad guys broke into their network. Since the breach, however, at least two sources with knowledge of the ongoing investigation have independently shared information about the point-of-sale

malware and some of the methods allegedly used in the attack.

‘BLACK POS’

On Dec. 18, three days after Target became aware of the breach and the same day this blog broke the story, someone uploaded a copy of the point-of-sale malware used in the Target breach to ThreatExpert.com, a malware scanning service owned by security firm Symantec. The report generated by that scan was very recently removed, but it remains available via Google cache (Update, Jan. 16, 9:29 a.m.: Sometime after this story ran, Google removed the cached ThreatExpert report; I’ve uploaded a PDF version of it here).

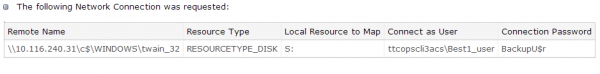

According to sources, “ttcopscli3acs” is the name of the Windows computer name/domain used by the POS malware planted at Target stores; the username that the malware used to upload stolen data data was “Best1_user”; the password was “BackupU$r”

According to a source close to the investigation, that threatexpert.com report is related to the malware analyzed at this Symantec writeup (also published Dec. 18) for a point-of-sale malware strain that Symantec calls “Reedum” (note the Windows service name of the malicious process is the same as the ThreatExpert analysis –”POSWDS”). Interestingly, a search in Virustotal.com — a Google-owned malware scanning service — for the term “reedum” suggests that this malware has been used in previous intrusions dating back to at least June 2013; in the screen shot below left, we can see a notation added to that virustotal submission, “30503 POS malware from FBI”.

The source close to the Target investigation said that at the time this POS malware was installed in Target’s environment (sometime prior to Nov. 27, 2013), none of the 40-plus commercial antivirus tools used to scan malware at virustotal.com flagged the POS malware (or any related hacking tools that were used in the intrusion) as malicious. “They were customized to avoid detection and for use in specific environments,” the source said.

That source and one other involved in the investigation

That source and one other involved in the investigation

who also asked not to be named said the POS malware appears to be nearly identical to a piece of code sold on cybercrime forums called BlackPOS, a relatively crude but effective crimeware product. BlackPOS is a specialized piece of malware designed to be installed on POS devices and record all data from credit and debit cards swiped through the infected system.

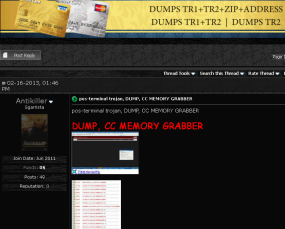

According the author of BlackPOS — an individual who uses a variety of nicknames, including “Antikiller” — the POS malware is roughly 207 kilobytes in size and is designed to bypass firewall software. The barebones “budget version” of the crimeware costs $1,800, while a more feature-rich “full version” — including options for encrypting stolen data, for example — runs $2,300.

THE ATTACK

Target has yet to honor a single request for comment from this publication, and the company has said nothing publicly about how this breach occurred. But according to sources, the attackers broke in to Target after compromising a company Web server. Somehow, the attackers were able to upload the malicious POS software to store point-of-sale machines, and then set up a control server within Target’s internal network that served as a central repository for data hoovered by all of the infected point-of-sale devices.

“The bad guys were logging in remotely to that [control server], and apparently had persistent access to it,” a source close to the investigation told KrebsOnSecurity. “They basically had to keep going in and manually collecting the dumps.”

It’s not clear what type of software powers the point-of-sale devices running at registers in Target’s U.S. stores, but multiple sources say U.S. stores have traditionally used a home-grown software called Domain Center of Excellence, which is housed on Windows XP Embedded and Windows Embedded for Point of Service (WEPOS). Target’s Canadian stores run POS devices from Retalix, a company recently purchased by payment hardware giant NCR. According to sources, the Retalix POS systems will be rolled out

to U.S. Target locations gradually at some point in the future.

WHO IS ANTIKILLER?

A more full-featured Breadcrumbs-level analysis of this malware author will have to wait for another day, but for now there are some clues already dug up and assembled by Russian security firm Group-IB.

Not long after Antikiller began offering his BlackPOS crimeware for sale, Group-IB published an analysis of it, stating that “customers of major US banks, such as such as Chase (Newark, Delaware), Capital One (Virginia, Richmond), Citibank (South Dakota), Union Bank of California (California, San Diego), Nordstrom FSB Debit (Scottsdale, Arizona), were compromised by this malware.”

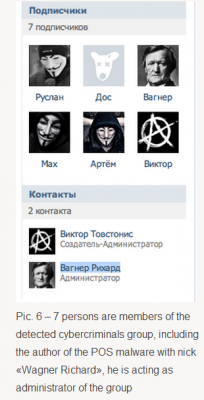

In his sales thread on at least one crime forum, Antikiller has posted a video of his product in action. As noted by Group-IB, there is a split second in the video where one can see a URL underneath the window being recorded by the author’s screen capture software which reveals a profile at the Russian social networking site Vkontakte.ru. Group-IB goes on to link that account to a set of young Russian and Ukranian men who appear to be actively engaged in a variety of cybercrime activities, including distributed denial-of-service (DDoS) attacks and protests associated with the hackivist collective known as Anonymous.

One final note: Dozens of readers have asked whether I have more information on other retailers that were allegedly victimized along with Target in this scheme. According to Reuters, “smaller breaches on at least three other well-known U.S. retailers took place and were conducted using similar techniques as the one on Target.” Rest assured that when and if I have information about related breaches I feel confident enough about to publish, you will read about it here first.

HOW TO RENOUNCE YOUR U.S. CITIZENSHIP

How I Renounced My US Citizenship and Why, Part I

The following is a firsthand story of how and why a former US citizen—who kindly shared this information on condition of anonymity—decided to renounce his US citizenship. It’s packed with practical advice and priceless insights into this momentous decision. Whether or not you take the ultimate step of renunciation, I believe you will find value from the author’s experiences.)

By Citizen of the World

Having evolved philosophically in my adulthood to a fairly hardcore libertarian worldview, I had read the writings of people like Doug Casey, which encouraged people even some decades ago to take concrete steps to internationalize themselves. Not just “talk the talk,” but to actually “walk the walk.”

My professional career offered me the chance to travel abroad quite a bit, so it was not too difficult for me to begin taking baby steps to internationalize.

I rented an apartment in one of the Asian cities that I frequently visited. A few years later, I made my first overseas real estate purchase of a small apartment in another Asian city, followed by several more in the next few years.

By this time, I was managing to spend about 2/3 of each year outside the US—you could say that I waded into the pool, rather than just diving in.

The passage of the first of the three recent “exit tax” laws by Congress in 1996 had alerted me to how high-stakes the US government regarded full expatriation to be—and inclined me toward doing so.

I reasoned that if they were that anxious to discourage people from leaving, it might well be time to seriously consider doing so.

Still, for about another decade, I wasn’t in a good position financially or logistically to do so, although I did begin seriously collecting more information about residency abroad, second passports, etc.

Shortly after my financial and logistical impediments cleared up, Ron Paul began achieving astounding success in the early phases of the 2008 presidential campaign. Encouraged once more at the prospect of there perhaps being a chance to turn things around after all, I put my international plans on hold and devoted nearly the entire first three quarters of the year to his campaign.

But the unremitting ferocity with which mainstream Republicans opposed our every effort led me to renew my efforts to abandon the sinking ship.

Another imperative for me has been the maxim “silence implies consent”—that is, by not acting (especially now that I was in a reasonably good position to do so) to separate myself from the manifest evils of the regime in DC, I would continue granting it my consent.

So, believing at that time (incorrectly, as it turns out) that you had to have another passport before you could give up US citizenship, I settled on the economic citizenship of the Commonwealth of Dominica, which is the quickest legitimate and least-expensive way to clear that hurdle.

I engaged a US-based consultant/agent to undertake the process of applying for Dominica’s program—something I definitely recommend.

Even though the agent may not want to hold your hand the whole time or answer every last question you may have, he or she can be quite helpful in navigating any significant rough spots or ambiguities. But be careful: the fees can mount up quickly. Keep in mind that obtaining a second citizenship (so you won’t be “stateless” and unable to travel after giving up your US citizenship) and the actual Relinquishment/Renunciation are two distinct phases (there’s a third expatriation phase, if you will be a “Covered Expatriate” and have to deal with the “mark to market” exit tax). You’ll likely be expected to pay fees to an advisor/agent for each phase, unless you spring for a (much more expensive) “package deal.”

Do be careful to choose only a legitimate agency—there are any number of dubious ones offering their “services” on the Internet. If in doubt about one you’re considering, you should inquire directly to the government officials of your chosen country whether that agency is in good standing with the officials there.

Initially, it was expected to take about three months to receive the Dominica passport, after all the required documents and preliminaries had been done.

But even as I got those things ready to submit (the required FBI criminal check was routinely quoted as taking up to 12 weeks at that time), the expected approval and completion dates were being pushed out at least several more months.

I had originally considered doing the St. Kitts program, which offered a considerably more useful passport—visa-free entry to all of the EU, as well as to Canada, which is about two dozen more countries than the Dominica passport allows.

So faced with a possibly quite extended delay in getting the Dominica passport and by now having a fair amount of experience in making such an application, I decided to apply for the St. Kitts one as well—and without the additional expense of a consultant/agent.

Since most of the documents and preliminaries I had done for Dominica were also needed for the St. Kitts application, I got the St. Kitts one done much sooner and had everything for it filed about a month after filing for the Dominica one. In the end, the St. Kitts passport was issued about three months before the Dominica one.

With the passport hurdle soon to be cleared, I had to make financial preparations. Not so much on account of the exit tax itself, but much more because of the very punitive, but much less known Section 2801 gift/inheritance tax imposed on all post-expatriation gifts and/or bequests to “US persons” by a “covered” expatriate (which I have the dubious pleasure of being).

[Editor’s Note: The term “covered expatriate” refers to the former US citizens who qualify to be stung with the exit tax. See this IRS article for more details.]

Because most of my low-to-mid seven-figure wealth had already been taxed at least once (and also having considerable loss carry-forwards ensuing from the aftermath of the 2008 panic), I was not facing much of an exit tax liability itself.

Once I had the passports in hand, but well before I had finished financial preparations, I made the first of the two visits to a US embassy or consular office abroad required for the actual renunciation process.

On the first visit, you must allow the consular staff to inform (lecture?) you about the “grave” consequences and irrevocability of what you seek to do; and you must assert to them that you understand what you are doing, that you really do intend to do so, and do not expect to retain any rights or privileges of US citizenship.

However, you are not allowed to complete the renunciation process at that first visit. You must go away for at least a short while and then come back on a second appointment, “to be sure you really want to do this.”

In my case, the consular official whom I met with on that first visit did not try very much to dissuade me, nor did I have any difficulty convincing her that I had thought about it extensively and knew what I was seeking to do.

Another half-year elapsed before I finished all the required property transfers into irrevocable trusts (to avoid Section 2801 gift/inheritance tax), after which I was finally ready for my actual expatriation appointment.

There are actually two somewhat distinct procedures by which you can give up US citizenship: relinquishment or renunciation. The State Department forms and consular staff procedures are similar, but not identical, for both ways.

Renunciation is the more affirmative way, and may be preferable for that reason alone.

Professional and informal advisors have differing opinions on which is better—and even whether there’s any substantive difference at all—apart from the $450 fee now required for a Renunciation filing (no fee at all is currently required for filing a Relinquishment—if one is in a position to choose that route).

There are no differences in IRS/tax consequences, and it’s said that the State Department makes no distinction between those who relinquish versus those who renounce.

But the fact remains that there are the two different procedures, and some knowledgeable people do recommend relinquishment (if one’s situation permits using that method) instead of renunciation.

Be aware though that pursuing a relinquishment requires the applicant to demonstrate to the satisfaction of the State Department people involved (both in the embassy/consular office and the application reviewers in Washington), that the applicant’s “potentially expatriating act” (which is usually the act of obtaining citizenship in another country) was truly done “with the intent to give up US citizenship” at the time of “performing the potentially expatriating act.”

In contrast, making a renunciation filing, which involves performing an Oath of Renunciation before a consular officer, provides convincing prima facie evidence of intent to give up US citizenship.

The State Department may reject a renunciation filing only if there’s clear evidence that the applicant was under some sort of duress to take the oath, or that the would-be renunciant intends to retain any prerogatives of US citizenship (such as continuing to reside in the US without obtaining any residency visa/permission as an “alien”).

Because so much time had elapsed since my first visit, I had to re-do it. Mercifully, the consular staff allowed me to return quite soon for the actual renunciation process.

There are numerous reports of delays of weeks to months in getting appointments (for either or both of the two required visits) at many of the busier embassies. I have personal knowledge of an embassy in a major Asian city requiring a two-week interval between an applicant’s first and second renunciation visit regardless of how full or slack its appointment calendar was.

A note about embassy/consular office practices: The expatriation requirements and procedures are stated in fairly thorough detail in in Volume 7, chapter 12 of the State Department’s Foreign Affairs Manual (FAM).

In practice though, each embassy/consular office seems to operate with a fair amount of discretion.

As just one example, FAM explicitly states that an embassy or consular office must allow any US citizen to expatriate who applies there to do so. Yet I was told by consular staff in one major Asian embassy that it refuses to let anyone who is not a legal resident of that country expatriate at that embassy.

Though they’re primarily focused on the plight of the many Americans who permanently moved to Canada, the Isaac Brock Society maintains an excellent website. It keeps an extensive—if anecdotally based—log of people’s expatriation experiences at various embassies/consular offices around the globe.

The actual process of formally doing the renunciation was straightforward and was conducted without any further hassle or delay at my next appointment.

How I Renounced My US Citizenship and Why, Part II

By Citizen of the World

There are two forms for the applicant to fill out: DS-4079—a questionnaire about the applicant’s intentions to give up US citizenship; and DS-4081—a “Statement of Understanding” (that the applicant knows and understands the consequences of giving up US citizenship, and that doing so is irrevocable). DS-4079 is technically only for a “Relinquishment” filing, but may also be requested for a “Renunciation” filing. For a Renunciation proceeding (but not for a Relinquishment), the consular officer also prepares DS-4082, the Oath of Renunciation. The Oath is administered orally, after which the applicant as well as the consular officer signs the DS-4082.

Then the consular officer prepares a DS-4083, Certificate of Loss of Nationality (CLN). But the applicant will not be given a copy of the CLN at this time, as the application must first be approved by a State Department bureau in Washington. Embassy/consular staff were careful to remind me that my expatriation would not be finalized until these documents were reviewed in Washington—in particular my CLN, and my application was approved in Washington.

The time necessary for that State Department review process apparently has varied quite widely in recent years. Its duration may also depend at least somewhat on the embassy or consular office where one makes their expatriation application (perhaps taking longer from embassies with higher expatriation caseloads). Again, it may be useful to shop around among various embassies/consular offices which may be relatively accessible to an expatriation-seeker. The Isaac Brock website may be a very useful resource in this regard.

In my case, approval of my renunciation was fairly prompt—only about a month. As soon as the embassy or consular office receives confirmation from the State Department in Washington that the applicant’s filing has been approved, the embassy/consular office will provide the applicant an approved, sealed copy of the CLN.

For a renunciation, the effective date of expatriation is the date the Oath of Renunciation was performed; but for a relinquishment, the effective date of expatriation—as far as the State Department is concerned (but not the IRS)—is the date the “potentially expatriating act” (such as obtaining citizenship in another country) occurred. The IRS considers one’s expatriation date to be the date the applicant completes his or her filing with the embassy/consular office—provided only that that filing is subsequently approved by the State Department.

Of course, the “potentially expatriating act” may have occurred quite some time before one’s expatriation filing is made—but in such a case, it’s important for the person seeking to expatriate to avoid availing himself of any significant privileges/benefits of US citizenship, such as voting or using his or her US passport.

The State Department seems to have developed formulaic criteria for whether an applicant really intended to give up citizenship at the time they performed the “potentially expatriating act.” Even if one really did intend at the time one did the “potentially expatriating act” to give up citizenship and declares so in the application, the State Department will apparently refuse to accept that fact, if the person subsequently “continues to avail oneself” of any “significant”—whatever that means—benefits of US citizenship.

Once you’ve succeeded in expatriating, it will be important to be able to produce your CLN at various times in the future, as there will be no other official document you can offer as proof that you really did give up US citizenship. As FATCA and similar measures eventually become widespread (which unfortunately seems much more likely than not), the few remaining foreign financial institutions which have continued to accept US individuals as clients will dwindle further. So providing your CLN will likely become essential to open or even retain already existing financial accounts.

You should probably make several good copies of your CLN, including a high-resolution color scan (quite useful for online purposes). Sometimes it may be important to have some sort of notarization or other official recognition of it. You may want to do that sometime when you’re in the US, as notaries abroad tend to be a lot more expensive, less prevalent, and may refuse to even deal with documents not originating in their own country. Because loss of citizenship is irrevocable, there is logically no expiration to the CLN, so it should not matter when a copy of it is notarized. But alas, bureaucrats everywhere are not well known for their reliance on logic.

Once you’ve been notified that your expatriation application has been approved in Washington, you will be able to begin the process of applying for a visa to enter the US, if you wish to—that is, if you don’t hold a passport from a country on the US visa waiver list. Some people advise waiting for some time before applying for a visa, but there’s no formal requirement to do so.

Do keep in mind that the State Department considers that every applicant for a visitor visa to the US has the burden of proving (to the consular officials where the visa application is made) that the applicant will not try to stay illegally in the US. One might think that an expatriate, having gone to the considerable trouble of giving up citizenship, would be highly unlikely to want to stay too long in the US—but there’s no evidence that the State Department recognizes such an argument. One factor which does lend considerable support to an applicant’s (implied) assertion that they will not try to stay illegally in the US is to have “substantial ties” to another country—residency, social and/or familial ties, etc.

There’s no hard and fast requirement to apply for a US visa only at your “home”-country US embassy or consular office, but it’s generally considered better to do so. For instance, it’s likely easier to provide evidence of one’s substantial ties to that other country from within that country (and easier for the consular staff there to verify that evidence).

One very critical point to understand is that you should NEVER state that you are expatriating to avoid taxes. It could end up complicating matters if you ever intend to return to the US.

If your dossier with the US government states that you renounced for tax purposes, that information should be assumed to be readily available to any number of agencies—including those dealing with visas and immigration—and likely could be used to deny you a visa or otherwise deny entry into the US.

Although the authority to exclude a person from re-entering US on that basis is of questionable validity, and formal regulations on this have never even been proposed or implemented, State Department guidance to overseas posts does explicitly state this as a reason to reject a visa application.

The increasingly great difficulty (largely due to FATCA, FBAR, and Form 8938 reporting requirements) of trying to lead a normal life while living overseas as a US citizen is—and ought to be—reason enough for many to give up their US citizenship.

Some experts advise against giving any reason for why you’re expatriating in any of your interaction with US consular officials at any point during the expatriation process—and particularly in any of your responses on the DS-4079 Questionnaire. But these responses may be useful later on to have established that one did have substantial non-tax-avoidance reasons for expatriating. In any case, it would probably be best not to express opposition to the regime in DC too strongly or explicitly as the reason for expatriating—even if that is a major factor in one’s decision.

Do keep in mind that visa applicants are required to have a face-to-face interview with a US consular agent before a visa can be approved. The application (using form DS-160) must be completed using the State Department’s online system. The interview itself may be conducted in a more or less assembly-line manner, in a bank-teller-window-like setting. The main purpose of the interview requirement seems to be to assess the general nature of the applicant and his or her situation—and to attempt to ferret out any adverse factors for which US officials there might want to reject the application (such as lacking strong enough ties to one’s new home country, or an actual—or even fleeting—thought on the applicant’s part to remain illegally in US).

The lead time for getting the interview appointment will vary considerably by location and time of year, ranging anywhere from just one day up to several weeks, maybe even months. Consult the online appointment calendar of the embassy/consular office where you plan to submit your application and try to avoid applying during whatever peak periods may exist there.

It will probably only take a few business days after successfully completing the interview to receive your passport back with your visa. You’ll be advised at the end of the interview whether or not your application is being recommended for approval; apparently an application is very rarely rejected after a successful interview.

The parameters of any US Visitor visa you may be issued—its validity period (in years), number of entries allowed, and maximum length (in days or months) of each visit—will depend on the passport under which you apply for that visa.

It’s not very easy to locate country-specific State Department policy on these parameters, but this page on the State Department’s website has a selection box to check at least the default visa validity period and default number of entries allowed for any particular country. Unfortunately, this page has no information about the default length of stay permitted for US visa holders of a particular nationality.

(Editor’s Note: See the VisaHQ website to see what kind of visa passport holders from country X need to enter country Y while living in country Z.)

Another point to note: regardless of whether you enter the US under the visa-waiver rules or under your own visa, doing a “visa run” (a quick trip to a nearby country to reset one’s visa or visa waiver period) is not so easy. US Immigration authorities require you to perform a “substantial” departure, meaning you must go at least as far away as continental South America—no quick trips to Canada, Mexico, nor even any Central American or Caribbean country!

Without question, you’re likely to have some fairly keen feelings at least the first few times when you come back to the US as an “alien” (what a horrible word—as if people living elsewhere are some sort of suspicious or even dangerous intruders). When you come back to the US, you’re likely to be quizzed a little bit by the immigration officer (and maybe also the Customs inspector), but in the half-dozen or so times I’ve been back so far, I’ve not been given a hard time at all.

Of course, past performance is no guarantee of future results, so one will always face the risk of more hassles down the road. But given that US border authorities already claim that even US citizens have no Constitutional rights at entry points, there are risks for everyone.

I didn’t expatriate because I expected it to make my life easier overall—it has not made it easier overall (at least for me). Yes, some things are easier now: I can open financial accounts overseas and invest directly in overseas securities, many of which have become effectively off limits to US individuals.

Also, I sleep better at night, relieved to no longer be even an unwilling, passive participant in the ever-escalating wars against the growing assortment of “evils” declared by Washington. And I no longer have to worry about making an honest mistake or omission on any of the ever-increasing IRS reporting requirements. But it’s at least somewhat more difficult to travel—this depends a lot on the other passport(s) one has.

Another significant trap to be wary of is the IRS’s Substantial Presence criteria, which risks you getting sucked back into the whole US tax regime (including all the overseas reporting requirements). This occurs if you stay too long while visiting in the US. Not only must one stay in the US no more than 182 days in any one year, you must also ensure that your weighted average number of days within the US over the most recent three years isn’t too high.

There are several other ways one may be required to continue dealing with the IRS after successfully expatriating, especially if you continue to have any US-based assets. At a minimum, in the first year after expatriation, it will be necessary to file Form 8854.

If you are considered a “covered expatriate”, preparing Form 8854 (and both of its associated 1040 forms) will be at least fairly complicated, and will almost certainly require the services of one of the small number of professionals who are experienced with Form 8854 and the “mark to market exit tax.”

I’m still in the early days of my post-expatriation life—really far too soon to judge with any certainty whether I made the right decision (even according to my own thinking, let alone what anyone else thinks). But so far, I’m satisfied that I did do the right thing—for myself. The “silence implies consent” credo is very deeply ingrained in my outlook; this tends to trump the drawbacks, at least for myself. I find implied endorsement of this thinking in Nassim Taleb’s Antifragile, especially in a number of passages in chapter 22. In the end, expatriation is a momentous decision and will be unique for each person considering it—there’s no one right answer for everyone.

RETIRING AT 30

How to retire early — 35 years early

Blogger who retired at 30 says it’s time to rethink spending

For many Americans, the idea of an early retirement is pure fantasy — many surveys suggest that a good portion of us are convinced we’ll never be able to retire at all. But what if retirement saving isn’t quite as insurmountable an obstacle as you think?

The idea that retirement — even early retirement — is within anyone’s grasp is a big part of the appeal of a popular personal-finance blog called “Mr. Money Mustache,” written by a 39-year-old man named Pete, who lives with his wife and 8-year-old son in Longmont, Colo. (The blog recently had 417,000 monthly unique visitors, and has had a total of 4 million unique visitors since it launched in April 2011.)

Pete, who prefers not to divulge his last name to protect his family’s privacy, retired when he was just 30. His wife retired with him and for the past nine years, they’ve been stay-at-home parents. Their investment income supports their lifestyle, but they also work when they want, on their own terms.

One secret to their success? They live on very little: About $25,000 a year for a family of three. They own a car, but mostly bike. Dining out is an occasional luxury. And shopping for stuff? That’s best avoided. But their philosophy goes beyond just scrimping, says Mr. Money Mustache. It’s about enjoying life with less.

MarketWatch asked Mr. Money Mustache about his philosophy on spending, how he retired early, and his take on retirement planning. Our Q&A is below. And, if you’re wondering about the name?

“Mr. Money Mustache is meant to be a bit of a character — a financial superhero,” Pete said. “He’s me, but a slightly bossier and more opinionated version of me. I find that people gladly obey the commandments of Mr. Money Mustache, even while they would scoff if plain old Pete, the former software engineer, stepped up and started giving them advice.”

How old were you when you decided to try to retire early, and how long did it take you to get to the point where you could retire?

It was a gradual process. I brought some frugal instincts along with me from childhood so I always tended to save a bit of money rather than spending it all. My wife has been a pretty reasonable spender since the time we met as well. So I graduated from college in 1997, we eventually moved in together, and after several years of full-time work, some cash was starting to build up in our investment accounts and we wondered if there was something useful we could do with it.

Sometime around 2002, we decided we wanted to be parents eventually, and that it would be great if we could retire from our relatively demanding careers in the tech industry before any babies came along. This really increased our motivation to spend less and invest more, and we cranked things up. At the end of 2005, our savings were sufficient to generate passive income that we could theoretically live off forever, so we quit the regular jobs and have been winging it ever since. And we now have an amazing 8-year-old-boy.

How did you decide how much money was enough to retire?

Based on a long-lasting hobby of reading books on stock investing, I realized that you can generally count on your nest egg to deliver a 4% return over most of a lifetime, with a good chance of it never running out. In other words, you need about 25 times your annual spending to retire. So we tracked our spending and our net worth, and when we hit the magic number, we declared ourselves “retired.”

(For more on Mr. Money Mustache’s take on the 4% rule here, read this blog post.)

Did you have a written retirement plan in place early on, or more of a ballpark figure you were trying to save up?

We did most of the saving before we knew all that much about early retirement. But once the picture became a bit clearer, we had a clearer goal. For the last few years, the mantra was “$600,000 in investments, plus a paid-off house.” This is enough to generate $24,000 of spending money, which goes quite far if you have no rent or mortgage to pay.

How important is it for people to have a written retirement plan, in your opinion?

It doesn’t matter to me if it’s written, verbal, or mental. But I do encourage people to open their minds to how real and possible an early retirement can be. It isn’t a vague, fluffy concept like, “someday,” “never” or “when I’m 65.” Retirement (or financial independence) simply means that you have your living expenses covered by nonwork income. In the worst case, this requires 25 to 30 times your annual spending, socked away into investments. If you’re eligible for a pension or Social Security, it’s even easier.

Do you work with a financial planner or manage your finances on your own?

I have always enjoyed managing my own finances. On the blog, I maintain a good-natured battle with the financial planning industry in general, because they focus too much on retiring at a very old age with many millions in savings — just so you can continue to spend $100,000 a year until you die. It is much more efficient to get a handle on your materialism and spending so you can live more happily on a fraction of that amount, which can shave 20 years or more from the time you need to keep commuting in to that office.

How crucial is it, in your opinion, for people to have a monthly or annual spending plan or budget?

This really depends on your personality type. I’ve never had a spending plan or a budget at any point in my own life. Instead, it was a simple set of values to apply just before I make any purchase or commit to any expense: “Is this the best possible use for this chunk of money, if my goal is creating lifelong happiness for myself?”

Since I valued freedom and financial strength, this automatically ruled out quite a few purchases. For example, as a young man I was a major car enthusiast. But I didn’t run out to borrow money to buy an Acura NSX, because I valued having that money for other things more than I valued a fancy car. Nowadays I can finally afford a car like that without even borrowing, but I am happy to discover that the desire has disappeared.

See this Mr. Money Mustache article for details on the family’s spending in 2013

Some people might think so much cost-cutting is akin to living like Scrooge and not having any fun. How would you respond to that?

If you tell yourself that is how it will be, then you will create your own truth and life will not be fun. But if you understand the fundamentals of what it means to be a happy person, you realize that buying more stuff for yourself has no relationship at all to how happy you are. These fundamentals include things like close relationships with other people, health, rewarding work, a chance to be creative and help others.

Work on those things and you’ll start living a much better life immediately, and soon wonder where the odd compulsion to own a yacht with a submarine came from in your old self.

Surveys suggest there are a lot of people out there who are worried about retiring, who don’t have enough money saved, who feel like they may never retire. Can you offer people in that situation any words of advice in terms of how to turn their situation around?

The quickest way to turn things around is to realize that you are in much more control than you realize. The time to reach retirement depends on only one thing: your savings rate as a percentage of your take-home pay. And this depends entirely on how much you spend. So the moment you can learn to live a less expensive life, suddenly the clouds clear up and the financial picture brightens considerably.

Read Mr. Money Mustache’s 5 most important strategies for planning an early retirement.

What would you say to someone in his 50s or 60s who maybe doesn’t have any credit-card debt, but is paying a mortgage and has about $100,000 saved for retirement? Is there any scenario where that person would be able to retire in, say, his early 60s?

That’s not a great starting point, but the turnaround can be incredibly fast once you realize where your money has been leaking out, and change your life so that you can save much more of your income. Ten to 15 years is plenty of time for most people to go from zero to financial independence, so with a $100,000 head start and the kids all out of the house, this 55-year-old might be in a good place. Adding in Social Security income, the time to retirement would be even faster.

Do you think that the rule of thumb of needing about 85% of pre-retirement income in retirement is accurate, useful, dangerous, innocuous?

This is a good guideline for people who currently spend almost everything they earn, and plan to continue that habit in retirement. But for the rest of us, it is ridiculous!

A much more useful idea is to separate the idea of income from that of spending. Your income is determined by what you do for a living. But your spending should be decided based on your needs — the things and experiences that truly make you happy. As an example, my family’s needs and wants have always ended up adding to about $25,000 a year. So that’s how much we spent, whether we were making $25,000 or $200,000.

So as soon as our retirement income safely exceeded $25,000 a year, we were financially independent and we decided to retire.

I hate to get morbid, but the idea of how long one is going to live is sort of a crucial piece to a retirement plan. How are you handling this impossible-to-answer-yet-essential question? Are annuities and/or long-term-care insurance part of your long-term financial plan?

If you plan your retirement right, your expected longevity might actually have nothing to do with your planning. This is because the amount of money required to fund a 30-year retirement is almost identical to the amount to fund a person forever — an odd behavior of the equation for amortization of a large sum of money.

I’m not into annuities or any type of insurance myself, although those products do have value for some. Both of those ideas are based on statistics and probabilities, and when you do the math you can actually be safer handling things yourself. With a big enough collection of income-producing assets (stocks, rental property, etc.), your savings will easily outlive you, and probably be much larger by the time you die. This big chunk of savings also allows you to pay for unexpected expenses without rocking the boat too much — you have many years to adjust if you do hit a bump that forces you to deplete part of it for something like a medical expense.

You have said in the past that it’s important to “make your dollars work for you.” Does that mean the idea of an emergency savings account at the bank is overrated? Should people be investing more of their savings in the financial markets, via a taxable account, rather than using bank accounts?

Yeah, I’ve always questioned the idea of an emergency fund. It’s a great tool for the financial beginner who lives from paycheck to paycheck, and for whom a broken water heater would make the difference between making ends meet and borrowing via a credit card. But once you get off the ground, your credit card is a monthly buffer and your investment accounts are the emergency fund.

So I have no savings account at all, and keep just a few thousand dollars in the checking account. If a huge unexpected expense ever came up that was greater than my income, I would put it on the credit card along with all other monthly spending. Then just sell some shares of an index fund and transfer that back to the bank before the credit-card automatic payment happened at the end of the month. And I’ve still never had to run a credit-card balance in my life.

The great part is that if your spending is much lower than your income, these emergencies become very rare, because there is always a surplus which you have to sweep away into investments each month. So if the water heater dies, you buy a new one and just invest a little bit less that month.

To what degree would you say rental income was key to your ability to retire early?

A small degree — I haven’t had the most brilliant landlord career so far, so my results have been only average. But rental properties chosen wisely can return much more than stocks, which could really speed up a savvy person’s retirement program. In my own case, I probably saved only about one year of work by using rental houses along with stocks.

Would you say it’s better to use extra savings to pay down one’s mortgage, or to invest in the financial markets?

For people in a high tax bracket, 401(k) plans in low-fee index funds win this battle pretty easily, especially if there is an employer match. For investment in taxable non-retirement accounts, it all depends on the interest rate (and if you’re pretty well-versed in investing, the stock market’s valuation or P/E 10 ratio).

Right now, with stocks expensive and interest rates very low, it’s probably a somewhat uninspiring tie in my opinion and you could do either. But if mortgage interest rates were 6% or more, I’d start getting more excited about paying off a house.

For people with other debts, like student loans, car loans, or credit-card debt at higher rates, I’d prioritize debt payoff even more.

It sounds as though a lot of your success has to do with cutting costs. But I know that some of my readers are really tired of hearing the “cut out the lattes” idea. What would you say to those readers?

For most people, cutting costs is by far the most powerful way to increase wealth. This is because it is easy to burn off almost any amount of money — just ask the 78% of NFL players that have financial problems shortly after turning off the cash fire hose of a pro-sports career. It is also possible to cut almost any budget in half, leaving the happy latte-cutter saving 50% or more of her income.

But the key to making this work is not cutting out treats — it’s eliminating your desire for those treats in the first place. Driving my 2005 Scion hatchback would be a chore if I had a desire for a 2014 BMW. But since this little Scion is more than enough car for all of my wants (and I usually ride a bike anyway), I am actually winning and living a happier life even while saving $20,000 a year in depreciation and other costs. The handy part of all this is that anyone can eliminate the desire for any of the expensive luxuries currently dominating most of our spending.

Do you have any sorts of items you love to buy and won’t give up?

That’s a tricky question, because our lifestyle does include quite a few luxuries that are fun to have around. I enjoy nice coffee at breakfast and wine many nights at dinner, and the food we eat is very high-end these days. And we live in a pretty fancy house full of nice stuff and take a lot of trips. While I enjoy all of these things, I also make fun of myself for living such a decadent lifestyle, as a reminder that none of these things are essential components of happiness. I would give them up in a heartbeat if we couldn’t afford them — for example if we were in debt or if they compromised our ability to live a free life. But since life is an adventure and there is no need to seek perfection, we dabble in all of the normal treats of American life.

You write a lot about doing things oneself — including being your own handyman. What would you say to people who feel they aren’t good at fixing things and aren’t confident enough to work on their own homes? Is home maintenance going to be a budget killer for them?

You get better at what you do. I think that every homeowner, with possible exceptions for very busy CEOs and rock stars, should be able to take care of a house and can easily learn how to do it. Outsourcing these basic chores is expensive and fussy — it often takes more time to find and supervise a contractor than it takes to do the job yourself.

The key is starting with the assumption that everything is easy, because it is. Then you just grab a book from the library and watch a few YouTube videos on the topic, and dive in. You can also attend the free workshops at Home Depot and ask for help from the handy people within your network of friends. People generally love to help others, and I spend a lot of my own free time giving free home-renovation advice and help to my own friends when they ask for it.

When it comes to spending, what about travel to foreign lands? A no-no because of the steep expense?

Travel can be as expensive or as inexpensive as you choose to make it. We do quite a bit of it these days, spending every summer in Canada and a good part of last winter in Hawaii, with other trips to quite a few other countries in recent years as well. But if you live like a local once you get there, going for the slow and authentic experience rather than flashy hotels and bungee jumping every day, it costs a lot less. One of my favorite trips was a winter driving trip from Colorado down to the Gulf Coast, where we brought along a tent and a kayak and hung out on as many beaches and waterways as we could find in the tropical belt of Texas for a month.

Why did you start your blog?

It was a 50/50 mix of inspiration and exasperation. My wife and I retired from real work at the end of 2005, but all of our friends and peers kept working around us. As their careers blossomed and earnings grew, I kept hearing these complaints about money being tight and retirement being an impossibility. But looking at their lifestyles, I could see exactly where the money was leaking out unproductively — even while they seemed to be missing it. So I decided to start the blog and share the ideas with the world, rather than annoying friends with unrequested financial advice.

http://www.marketwatch.com/story/how-to-retire-early-35-years-early-2014-01-17