The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

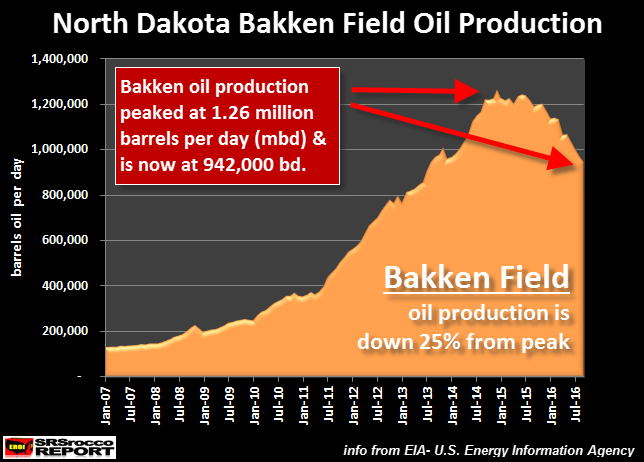

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article [5])– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession [6]“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article [7])– Published, APRIL 2015:

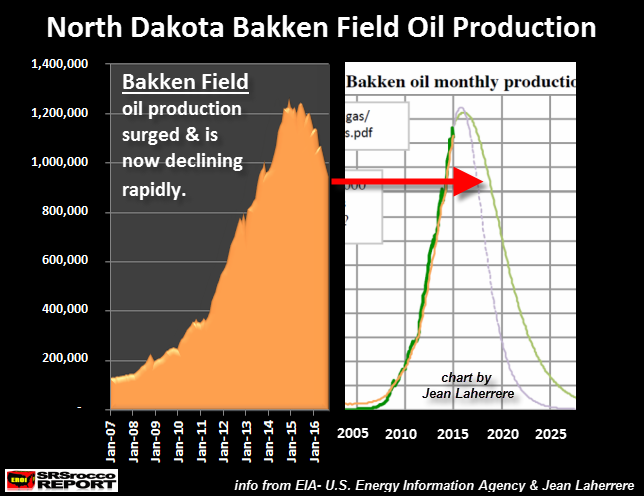

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

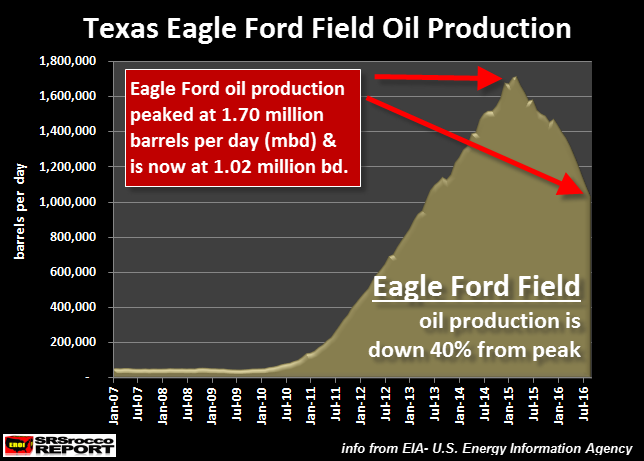

According to the most recent EIA Drilling Productivity Report [8], the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

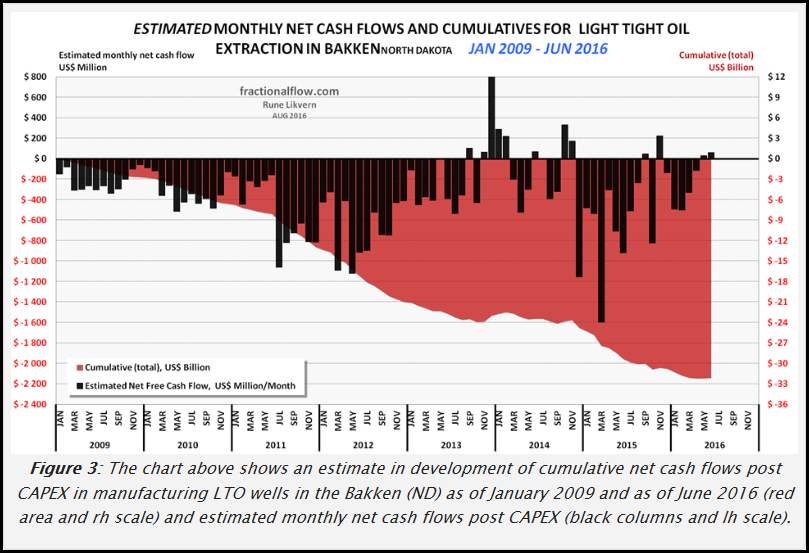

Rune Likvern of Fractional Flow [9] has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING [10] section or our new LOWEST COST PRECIOUS METALS STORAGE [11] page, I highly recommend you do.

Check back for new articles and updates at the SRSrocco Report [4].

http://www.zerohedge.com/print/572497

Yupsir, just another “Buy Gold Now!” article. This cat’s angle is peak oil, rather than the usual litany of WWIII-Economic Collapse-Race War-Plague!

I was a true believer in peak oil 14 years ago. It suited my doomerist fantasy of Warlord with harum and payback to all who pissed me off. This cat sounds like our buddy Jimmy Kunstler when jimmy was in his peal oil prime. Except Jimmy wasn’t selling gold, no sir! He and all his fellow peak oil snake salesmen were selling books and lecture tours.

I bought several books. Boy were they convincing. They made all sorts of dire predictions about our immediate future, none of which even remotely came true. Instead, the exact opposite has happened….oil prices are lower (adjusted for inflation) than they were in 1965!

Boy, am I pissed. By now the cities were to be in ruins, billions dead, a feudal society developed organically and my fat ass sitting at the top of the heap here in CT with slave girls fanning me and serving my every desire as my mighty warriors loot and plunder the next village.

What a bummer.

Peak Oil……….you let me down baby, and I’m not taking you back.

We downloaded the whole Chris Martenson Crash Course on TEOTWAWKI and loaned it to friends. LOL.

Oh well… we are lots happier out here in the boonies, even if we aren’t going to use our wood cookstove anytime soon.

Lysander….very enjoyable read; reminds me of the GloBull Warming doomsters – THE END IS NEAR, repent by allowing the western developed bankrupt economies to remove more cash from the poor and middle class. This will assist the wealthy elite with continued crony capitalism (financially) at your expense.

So even though thermodynamically and economically shale oil is an unsustainable activity, because the predictions of peak shale oil did not happen on a timeline exactly as predicted you are willing to rejoin the rest of the herd and run for the cliff.

If your teenage son was drinking and driving and you warned him that if he kept it up he’d lose his license or have a serious accident within a year and if after a year he had not had either then he’d be right to say “fuck you Dad – you were wrong, now I’m gonna get even more drunk and drive even faster”.

People were saying we’d never recover and be strong again during the depression.

They were wrong.

Will they right this time?

They will be if we elect Hillary, but not if we elect Trump.

Finite planet.

Ok then Mr. Smug told-you-so…well, sputter sputter,

a person can live in an SUV if need be. It beats a cardboard

box under a bridge.

Did Kunstler write this piece and channel it to Stockman?

Maggie, we love our little town and all of our new farmer

friends. I am planning a green house! When I get done

researching I will send a word out to you in case you have

been thinking about such a project. Or do you already have

a greenhouse? (((hint))) some folks are gloating we hick

whites may run out of gas for our filthy utility vehicles.

The New York and DC crowd. Boys, go frog yourselves.

I drive a few miles here and there. I could walk but I want

metal around me because of the bears.

To the author…..the majority of the oil price decline is related to supply and demand. The shale fields were causing an over-supply (which reduced oil prices), so the Saudi’s pumped even more oil to attain even lower oil prices due to even more over-supply in order to bankrupt the U.S. shale producers due to the low oil price.

Instead of patting yourself on the back, you should shove a dildo up your butt.

Depleting resources are the root of nearly every economic ill we suffer in the U.S., and the failure of both policy makers and the general population to recognize that the entire post WW2 economic paradigm is unworkable, is making the inevitable economic contraction much nastier than it has to be.

As it is, people in my own circle of acquaintance are having to choose between car ownership, and having a roof over their heads. This is not an easy choice for, say, a low wage worker living in one outer suburb, and having to commute to another outer suburb up to 80 miles away.

We are not helping ourselves by clinging to the Post-ww2 paradigm and the wasteful, car-dependent suburban lifestyle it promoted, which is the most wasteful, inefficient lifestyle every invented, and it is the reason most Americans live their entire lives in debt, never free of house mortgages and car loans, never mind credit card debt. Going forward, those who wish to live decently, free of crushing debt and with a decent roof over their heads will have to choose from among A. self-sufficiency in a rural setting, where you grown most of what you eat, spend minimally on essential goods, and eschew the amenity and ease of town life, or B. you will live in a high-density area of a town or city, in a much smaller house or apartment, with no car, in proximity to retail and transit. Suburban life, where you live with all the urban amenities but in a house on a large plot of land that is not farmed, will once more be something only the economic elite can afford. If you are wise, you will plan for one or the other, and if you can’t see yourself doing the work of a small farmer, you might want to work on downsizing into much smaller quarters close to work, so you can at least reduce to one automobile without too much discomfort. Municipalities need to completely revamp pensions and finances, and as they do, many promises, made by politicians of a wealthier era, who are now long gone to their graves, will have to be broken as pension plans fail and it becomes clear that an ever poorer population can no longer support an expanding and evermore greedy public sector.

Unfortunately, we will fight tooth and nail to cling to the entitlements and luxury of the post WW2 era, even though it is breaking us financially. As a result, we will experience rising levels of poverty and homelessness, while our cities and towns devolve into failing sumps that cannot afford to offer the most basic services.

Get smaller, get simpler, save your money, reduce your footprint. Move close to your job and consider how you will make a living when it disappears. If you are old, as I am, consider how you will live if the SS checks stop coming. Move close to friends and relatives, build your community networks and nurture your neighborly associations. Decide what tradeoffs you will make, because methinks we will have to make a lot of sacrifices and “tradeoffs” going forward.

You paint a very dark, depressing picture while reality presents a much worse picture. I don’t believe more than a very small segment of the population understand how Capital Intensive Industrial Agriculture is and how labor intensive produce production is.

I live among the largest Old Order Mennonite group in the country and am distantly related to some. The family on the top of the hill behind me has twelve children born at home by a midwife as are most Mennonites. They farm 15 acres of produce with 3 Belgium draft horses. The husband has to work to cover Government caused expenses. Without Government most small farmers could survive. Small farmers and the middle class are slowly being exterminated by Government by what I call trickle up economics where wealth is transferred to the top x% of the population.

Industrial farming can produce thousands of acres using 10 calories of energy to produce 1 calorie of food which is impossible with finite resources. Most of the energy used for Industrial Agriculture is diesel. Gasoline was a waste product dumped in the rivers until the invention of the internal combustion engine. The largest diesel engine produces 106,000hp with 50% efficiency. Gasoline engines were 15% efficient but with technology are at 25 to 30% efficient. You cannot build a gasoline engine of any where close to the power of a diesel engine.

Diesel is distilled from crude oil of a certain specific gravity between 300 to 400 C. You cannot make diesel from fracked tight light oil or tar sands bitumen. Depending on whose numbers you use we reached peak real crude capable of producing diesel in 2005 or 2012 and are now starting down the Seneca Cliff. How the rationing of diesel plays out will be interesting. At some point the food shortages will start.

The food shortages will be worse than they had to be because so much of our prime farm land has been committed to suburban sprawl development since the 70s. There are still cornfields abutting new shopping malls in Schaumburg, a northwest Chicago suburb that now contains over 50, 000 people, and is packed with bland subdivision housing with property taxes that exceed the owner’s mortgage payments, and shopping malls that are now going dark as quickly as they were built. Yet the sprawl extends far past Schaumburg, clear out to places like Woodstock, that were sleepy country villages a few decades ago. The waste is criminal, when you consider that Illinois, Iowa, and Minnesota are blessed with the most fertile, level farmland in the U.S.

I imagine that there will be a frantic effort to reclaim places like this for farming in decades to come, but it’s difficult to see how land blighted with crumbling malls and hundreds of miles of asphalt paving, can be reclaimed for production in the time people will have to replace industrial, fuel-intensive agriculture with traditional farming methods.

Too bad he ruined a good article by shilling precious metals at the end.

The trouble with precious metals is that they have no intrinsic use other than as an agreed store of value. Also, when others figure out you have them they will resent you and maybe try and take them from you.

Owning some arable land with woodlot/hunting/fishing possibilities is very useful for survival and impossible to cart away. So long as your community believes the land is yours you have a good chance of retaining it through hard economic times.

Frack me, Cdubbya wrote something I can agree with! Even a stopped clock ….

It may develop that islands of technology are created, such that an area A has hot and cold running water, working sewage processing and farmland (I’m having a hard time imagining civilization with less). Area B has all that and a decent diesel mechanic (who commutes), so they also have minimal transportation and emergency / small power supplies (no grid) and provide tractor repair services to Area A. Area C has all that plus a small oil refinery (10,000 bpd) so they supply the tractor fuel to Areas A & B, propane to Area C only (no pipeline service as yet) and asphalt / resid for the only shingle plant in the state. A small electrical grid might be up.

The remaining areas are versions of A, B or C (with an occasional D if hydropower or something similar remains functional) and maybe even an E if there’s a large stockpile of leftover PCs and someone who can fix them. The majority, however, is wasteland; either not enough water (rainfall), not enough productive farmland (desert) or similar missing pieces that people cannot hope to live there. Wild gangs and roving bandits make keeping civilization going tougher, but it will survive. In what condition it survives depends on the luck of the draw as far as population goes.