Guest Post by Bill Bonner

More Mumbo-Jumbo

OUZILLY, France – Imagine the poor economist without a sense of humor. How he must suffer! This week was to be dominated by central banks. Two big ones – the Bank of Japan (BoJ) and the Fed – were to make important policy announcements.

The BoJ’s chief lunatic Haruhiko Kuroda with one of his famous diagrams. How can this not work? It looks so neat!

The BoJ’s chief lunatic Haruhiko Kuroda with one of his famous diagrams. How can this not work? It looks so neat!

Photo credit: Yuya Shino / Reuters

The speculators placed their bets, front-running the news, and sat on the edge of their chairs. This week, the BoJ came out with more mumbo-jumbo. “Yield curve control,” it promised. The central bank says it will target a 0% yield on 10-year Japanese government bonds.

It added that it would continue buying the nation’s stocks (by way of exchange-traded funds) and charging a negative interest rate of 0.1% on the accounts banks keep with it.

Japan’s stock market crashed in 1989. Since then, the no-luck Japanese have had sluggish growth, recession, and on-again/off-again deflation. For more than a quarter-century, the gears of Japan, Inc. have turned slowly. And not for lack of trying.

The government spent hundreds of trillions of yen on “infrastructure” projects in an attempt to “jump start” the economy with fiscal stimulus. At one point, they were pouring more concrete – on roads, bridges, dams, and other public works – than the entire U.S.

Critics charged that so much cement was used – channeling rivers in the countryside and building ugly bridges to nowhere – that it amounted to the largest vandalization program in history.

The Japanese feds tried monetary policy, too. ZIRP (zero-interest-rate policy) began in Tokyo. They invented QE (quantitative easing) too; it was supposed to get more “liquidity” into the system and boost stock and bond returns. And yet, nothing seemed to work.

Japan’s Nikkei crashed in the early 90s after peaking at nearly 39,000 points on the last trading day of 1989. It has never come anywhere near its peak again – in spite of Japan’s government and the BoJ engaging in an unprecedented (for the post WW2 era) deficit spending and money printing orgy. In 1969, the Nikkei and the DJIA traded at roughly the same level, at just under 1,000 points. By the end of 1989 the Nikkei had increased to roughly 13.6 times the DJIA’s level. Today the DJIA is actually higher than the Nikkei – click to enlarge.

Japan’s Nikkei crashed in the early 90s after peaking at nearly 39,000 points on the last trading day of 1989. It has never come anywhere near its peak again – in spite of Japan’s government and the BoJ engaging in an unprecedented (for the post WW2 era) deficit spending and money printing orgy. In 1969, the Nikkei and the DJIA traded at roughly the same level, at just under 1,000 points. By the end of 1989 the Nikkei had increased to roughly 13.6 times the DJIA’s level. Today the DJIA is actually higher than the Nikkei – click to enlarge.

From Tokyo to Harare

But rather than admit its manipulations have done no good – rather than raise a white flag, back off and let the market sort itself out – Japanese authorities march on with more claptrap announcements, more pigheaded interventions, and more of the nation’s real wealth squandered on dumbbell projects.

Like soldiers of the Imperial Japanese Army abandoned on a remote atoll in 1945, they continue to fight a lost war. The Japanese government already has the highest debt load in the world, at 230% of GDP.

Now that the older Japanese, in retirement, are selling their Japanese government bonds rather than buying them, the central bank funds the entire government deficit. And the BoJ buys so many stocks and bonds, hustlers are said to be creating new investments just so the naïve geniuses can buy them.

BoJ assets vs. the Nikkei – the Bank of Japan’s policies are well on their way from “monumental failure” to “earth-shattering financial catastrophe”. We are getting to watch the reenactment of a game that has played out many times in history: a bunch of erudite high IQ morons manage to talk themselves into “rescuing the economy” by utterly destroying it – click to enlarge.

BoJ assets vs. the Nikkei – the Bank of Japan’s policies are well on their way from “monumental failure” to “earth-shattering financial catastrophe”. We are getting to watch the reenactment of a game that has played out many times in history: a bunch of erudite high IQ morons manage to talk themselves into “rescuing the economy” by utterly destroying it – click to enlarge.

Last week’s announcement tells us that the central bank will buy more government debt, adding to its pile – already about one-third of all outstanding Japanese government debt.

This is what Zimbabwe and Argentina did. It is a classic way to ruin an economy, by “monetizing” debt. It amounts to paying government expenses with newly invented money. Eventually, the extra money leads to consumer price inflation.

Rude Shock

Consumer price increases are what the BoJ is aiming for. It has even developed an Orwellian lie to describe its main policy goal. It says it wants “price stability of 2%.” No kidding. It describes 2% annual inflation as “stability.” Maybe it’s a translation problem.

But just as the authorities have been unable to lure price increases up to their quacky 2% level, so will they be unable to keep them there once they arrive. Instead, inflation will keep right on going.

The authorities, who built an economy where companies, households, and the government can barely survive at zero interest rates, will be unable to bring it under control.

Then retirees will get a rude shock. They put their savings into government bonds yielding almost nothing. They’ll find out what they’re worth when consumer price inflation is running at 3% or 5% or 10% (ZILCH is the answer).

And then, the whole illusion that the authorities know what they are doing will give way to the reality that they are no better than witchdoctors, fortune-tellers, or presidential candidates. Meanwhile, Wednesday has been a big day for the Fed, too.

Data dependency is the strategy by which central planners make decisions affecting the future by firmly looking at the past. It is a bit like driving a car forward with one’s eyes glued to the rear-view mirror. It is working similarly well. As an aside: the most important datum these days is apparently what the stock market has done in the days leading up to the FOMC meeting.

Data dependency is the strategy by which central planners make decisions affecting the future by firmly looking at the past. It is a bit like driving a car forward with one’s eyes glued to the rear-view mirror. It is working similarly well. As an aside: the most important datum these days is apparently what the stock market has done in the days leading up to the FOMC meeting.

Cartoon by Bob Rich

Again, speculators sat on the edge of their seats, awaiting the latest gibberish. Would the Fed tell us that, since the economy is strengthening, the time has come for another 25-basis-point increase (effectively, nada)?

Or would it say that it will remain watchful… “data dependent”… like a sentry at a volcano ready to throw a maiden over the edge if the rumblings increase? We didn’t know. But here at the Diary, we were on the alert – ready to laugh when the news came out.

Charts by: BigCharts, St. Louis Federal Reserve Research

Chart and image captions by PT

If everything else fails, you can always throw a maiden into a volcano or some other chasm. In terms of effectiveness it cannot possibly be worse than what is being done now. The maidens are apt to voice objections though.

If everything else fails, you can always throw a maiden into a volcano or some other chasm. In terms of effectiveness it cannot possibly be worse than what is being done now. The maidens are apt to voice objections though.

Illustration by H.M. Herget

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Don’t believe a word of it.

Bill Bonner has a sense of humor!! I pay v little attention to Japan,

but “news” about the Fed does catch one’s eye. The sharp anticipation

about what Mrs. Yellen is going to say is becoming absurd. It tends to be

something about inflation not being on target. What?

“They” will print until the country is looted.

Netanyahu: “Once we squeeze all we can out of the United States, it …

https://middleeastatemporal.wordpress.com/2012/11/07/… Proxy Highlight

Nov 7, 2012 … “Once we squeeze all we can out of the United States, it can dry up … it is a universal social and economic concomitant of Jewish immigration, ..

Just lovely…well, that is one guy’s opinion anyway.

I’d keep a closer eye on Japan, China and the EU. They will likely blow up first and when one of them does there will be a rush on US dollars then into the final collapse where only tangible items can be bartered.

Inflation will come but not because of demand but when everyone loses confidence in the matrix!

Martin Armstrong said gold will go up as well as stocks / equities, but then he insinuated that the values will be relative, in other words , what the stock or gold is, compared to when they start to jump and when they hit peak, the average price of things at that time will rise or increase , thus inflation will be tremendous!

If the rise is, as per his machine, topping out at Dow average of 30 to 40 thousand and gold at 5000 or a little more, then prices will be what double ? meaning you didn’t really go anywhere in value but you just rode the adjustment wave! Say an 80 percent rise in prices !

What of the not participators , whoa is me!

What will a 150000 in the bank be worth then ? anyone care too do the math? 150000 – 80% … 30000.00 not much more than a half dozen hamburgers at fleur de lys in las vegas!

[img [/img]

[/img]

Extend and Pretend

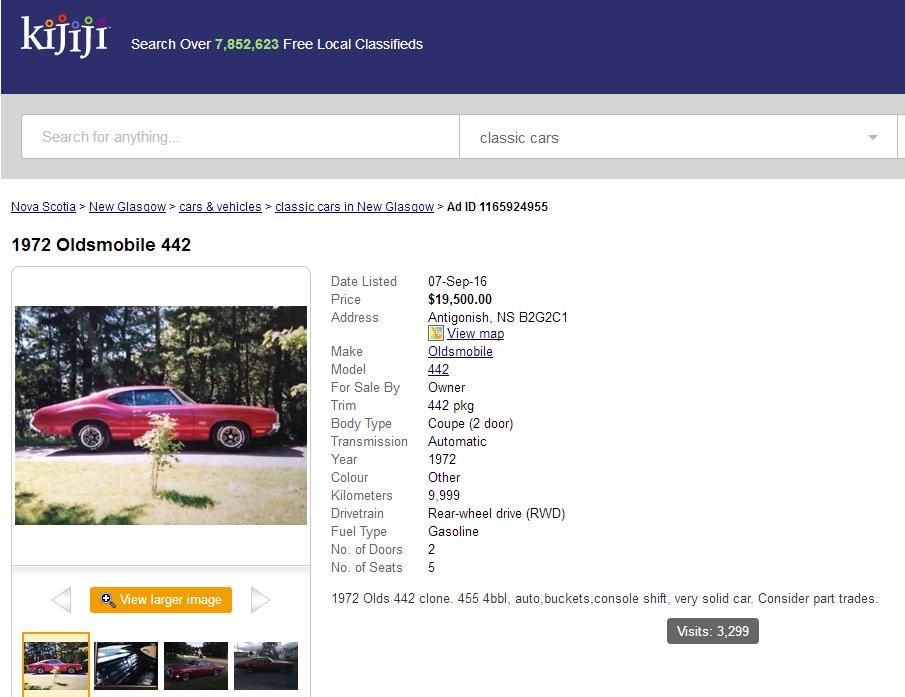

You folks might be wondering why I am posting a picture of an old car. I moved here 11 years ago. For about ten years now I have driven by this car sitting in a yard on way to work that is for sale. Owner seems to think car is worth 20 grand. I guess he hasn’t got the hint. But as long as he doesn’t sell car it is worth whatever he wants it to be.

It is the same logic used at Bank of Japan.

Well there you have it.

The same Pinon expressed four different ways.

Pathetic.

Granmpa

Not sure what to make of your comment. Are you insulting us or Kuroda and Yellin.

It’s all financial geek speak gibberish when someone who either clearly knows the countries and most of the worlds economy is circling the drain or they are a babbling idiot . My bet is on the idiot ! So investing in stocks no more just sitting tight , precious metals , no unless you consider lead and brass ? $$$

What is it you think you added Grandpa? Absolutely jack shit thats what, piss the fuck off douche. Japan has clearly been the vangaurd for the entire host of western money changers, by iniative or orders.

Tells us again about the bullshit. Oh yeah, you dont have that trick, just cheap blow jobs, one trick pony.

You took your two bit anti Quinn show to ZH as well, ive seen it, funny. You got laughed the fuck out of there too. Where is left for you? It would be sad, if it wasnt so damn funny. Ha ha, no where to go, enjoy the solitude.

They start to turn on each other, accusing former ‘friends’…