It is a curse and a blessing that my brain only allows me to deal with facts. I don’t believe anyone or anything unless I see the facts to back up their case. This is why I never get caught up in or profit from the irrational exuberance phase of every bubble. I steered clear of the internet bubble, the housing bubble and the current QE fueled stock market bubble. The facts in all three cases pointed to an eventual collapse. I enjoy John Hussman’s highly factual articles every week because emotion plays no part in his analysis. The quote below from his latest article echos the exact argument made by David Stockman in his book The Great Deformation. The Federal Reserve has been solely responsible for all three bubbles. Their monetary policies have been designed to enrich Wall Street gamblers. The result is the destruction of our economic system.

In my view, it is incorrect to believe that the 2008-2009 market plunge and financial crisis were caused by the housing bubble. The housing bubble was merely the expression of a very specific underlying dynamic. The true cause of that episode can be found earlier, in Federal Reserve policies that suppressed short-term interest rates following the 2000-2002 recession, and provoked a multi-year speculative “reach for yield” into mortgage securities. Wall Street was quite happy to supply the desired “product” to investors who – observing that the housing market had never experienced major losses – misinvested trillions of dollars of savings, chasing mortgage securities and financing a speculative bubble. Of course, the only way to generate enough “product” was to make mortgage loans of progressively lower quality to anyone with a pulse. To believe that the housing bubble caused the crash was is to ignore its origin in Federal Reserve policies that forced investors to reach for yield.

Tragically, the Federal Reserve has done the same thing again – starving investors of safe returns, and promoting a reach for yield into increasingly elevated and speculative assets.

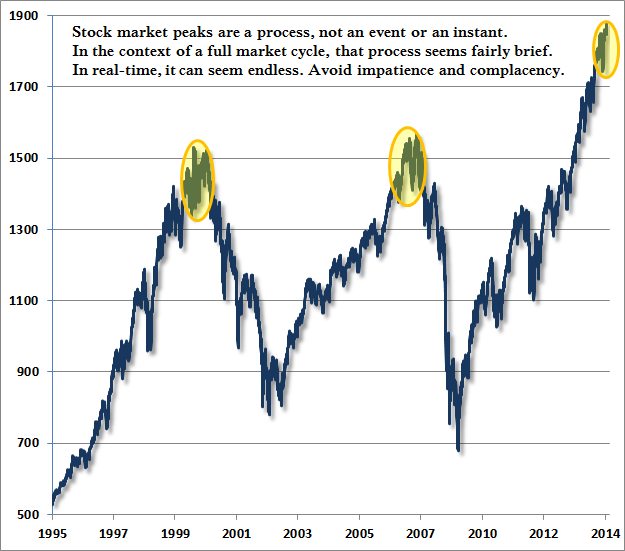

The current bubble has not burst YET. It will burst. All bubble burst. The losses will be horrendous. The muppets will be slaughtered again. The insiders will insist that the Fed save them again. The common person will suffer the most. Human beings never learn from the past. That is the true lesson about history. The chart below couldn’t be any clearer.

It’s instructive that the 2000-2002 decline wiped out the entire total return of the S&P 500 – in excess of Treasury bills – all the way back to May 1996, while the 2007-2009 decline wiped out the entire excess return of the S&P 500 all the way back to June 1995. Overconfidence and overvaluation always extract a terrible payback.

The stock market will deliver NEGATIVE real returns over the next decade. That is guaranteed. With 10 year bond yields at 2.7%, you will also get a NEGATIVE real return on bonds over the next ten years. With short term interest rates at 0%, you will get a NEGATIVE real return on cash. There is nowhere to hide. We are entering the depths of this Fourth Turning and if you think it has been unpleasant so far, you ain’t seen nothing yet. Facts are very inconvenient to people selling story lines and delusional people wanting to believe them.

Based on valuation metrics that have demonstrated a near-90% correlation with subsequent 10-year S&P 500 total returns, not only historically but also in recent decades, we estimate that U.S. equities are more than 100% above the level that would be associated with historically normal future returns. We presently estimate 10-year nominal total returns for the S&P 500 averaging just 2.2% annually over the coming decade, with zero or negative nominal total returns on every horizon of less than 7 years. Regardless of very short-term market direction, it is urgent for investors to understand where the equity markets are positioned in the context of the full cycle.

Importantly, this expectation fully embeds projected nominal GDP growth averaging over 6% annually over the coming decade. To the extent that nominal economic growth persistently falls short of that level, we would expect U.S. stock market returns to fall short of 2.2% nominal total returns (including dividends) over this period. These are not welcome views, but they are evidence-based, and the associated metrics have dramatically higher historical correlation with actual subsequent returns than a variety of alternative approaches such as the “Fed Model” or various “equity risk premium” models. We implore investors (as well as FOMC officials) to examine and compare these historical relationships. It is not difficult – only uncomfortable.

Read the rest of Hussman’ article HERE.

In other words, we’re screwed.

Got gold?

Prepare for the aftermath of SHTF Day. BC-LR to all