It’s just a coincidence.

Margin debt at all-time highs. Corporate profits at all-time highs and now falling. Bullish investor sentiment at all-time highs. Valuations at highs seen in 1929, 2000, and 2007. QE is done. Issuance of subprime debt at record levels. High yield rates soaring. Japan in a depression. Europe in a recession. China slowing rapidly. Middle East crumbling as oil revenues evaporate and chaos ensues. Russia headed into recession. Consumer driven American economy only sustained by rapid expansion of auto and student loan debt. The similarities to the 1928-1929 boom and bust are just a coincidence. Right?

Well if AU has taken a 37% haircut and is the leading edge down, the DOW will hit 11370 maybe as its first leg down. When this unravels, I at least want a chair and some popcorn. This country has been fed this exceptionism BS way too long.

We could’ve had a nice orderly recession – a hard one at that, but noooooooooo, we gotta have a no warning implosion that’ll scare the shit out of even the most aware folks. Its one thing to feel like a tough nut at some point during the week, but how ’bout when you’re taking a leak at 2:00 a.m. and you wonder how in the hell do folks – did folks, manage during times of war….like Bosnia or currently the Ukraine. I get to go back to a warm bed with a pretty lady and nobody’s after me or shelling me or about to storm my castle. The unkowns are just beginning I’m afraid – and to a control freak that is just one seriously black cloud.

Yes but its december 2014 and no crash yet so pattern is invalid.

” its december 2014 and no crash yet so pattern is invalid.”

RIGHT!

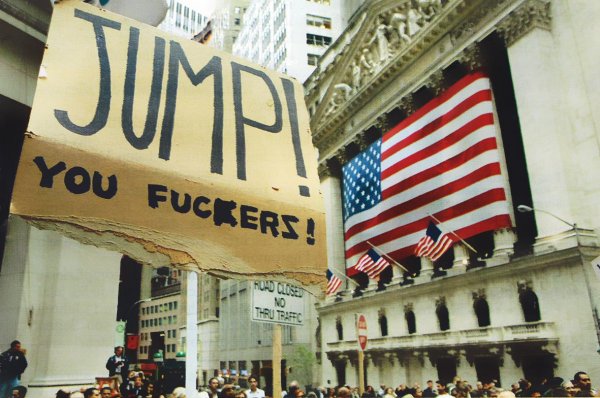

[img [/img]

[/img]

Preceeding ( 1988 – 1989 ) the Recession of 1990 things were booming so much that a lot of guy’s got into Day Trading. Yeah, a working stiff Day Trading. What could possibly go wrong? Then the SHTF.

The scary thing is that this same attitude has come back. Check out tradingacademy.com. This is where fools pay up to $16,000 to learn how to trade stocks / margins / options / etc. Make money in any market!

This looks like the harbinger of the next recession.

A BEAST IS ABOUT TO BE UNLEASHED UPON THE WHOLE WORLD, HE IS RABID AND RAVENOUS WITH HUNGAR AND HE IS ABOUT TO FEAST ON HUMAN FLESH AND HIS HUNGAR WILL NOT BE QUELLED AS HIS THURST FOR HUMAN BLOOD WILL NOT BE QUENCHED.

Economic Collapse, EMP, Grid Down Terrorist Attack, CME, Bond Market Crash, Derivatives Implosion, WWIII, Pandemic, GMO’s, Chemtrails, Yellowstone Super Volcano, Asteroid Impact, Famine, Cannibalism, Zombies, Martial Law and many more. You get the picture, tick tock, tick tock!

I PRAY YOU ARE RIGHT WITH GOD? Oh and good luck with your new ipad.

GET YOUR FREE COPY OF “I PLAN TO SURVIVE” THE ULTIMATE HOME SURVIVAL GUIDE AND IT’S TOTALLY “FREE”,

GET YOUR COPY (before it’s to late) AT:

http://www.iplantosurvive.info

So we are close to the peak, I see the chart stops in April 2014. Meh, don’t think most of the country will care if the stock market crashes. It is just a side effect, not the cause.

Clearly there will be a debt event, all of the visable pieces are being moved in preparation. The villification of Putin is indicative of his unacceptance of the ‘East’s’ position after it occurs. I suspect he is not alone, and many have quitely joined ranks even from the ‘West’. One has but to wonder why there are no participants in our T-bill auctions other than the fed.

When the flames start it will be a paper bonfire unlike any have ever bore witness to.

We American Serfs are on the hook for every penny, the road has been paved with socialist machinations of every flavor.

Beast with hungar? So we all stays away from Budapest and Pecs — problem solved!

The pattern may look the same but it’s different now. We all have airbags and antilock brakes so crashes are no big deal. Doesn’t a fall in price of equities merely mean the supply of credulous purchasing suckers has dried up? This time the sky’s the limit for enterprises to keep devouring themselves with repurchases. And logically, we can’t go full commie anyway while ownership of any corporation rests partially in public hands. So let them shares tumble — makes each serpent better able to swallow his tail.

Remember folks, our brains evolved to see patterns even where none exists. Nothing to see here. And surely there wouldn’t be somebody somewhere juicing things to fit a known formula, right:?

Aging dude, most of us here are INTJ’s dude……INTJ’s, there’s PLENTY to observe unlike the masses that see nothing. For you to be right the celebrity/ESPN/reality addicted masses have to be right… so not to put to fine a point on it, but you’re wrong. Troll on.

[img [/img]

[/img]

During the ’08, ’09 recession I refused to watch television or listen to anyone tell me anything about the economy. I simply didn’t pay any of it one bit of attention. I put my head down and soldiered on, never missed a paycheck and retired just fine in December of ’09. I figured if someone had to tell me there was a recession then it really wasn’t all that bad anyway.

THIS crash will be UNLIKE anything in history,THE RICH keep forgetting one thing,NO ONE IS GOING TO WATCH THEIR FIVE YEAR OLD SLARVE TO DEATH,you dreamers who think your money will save you,YOUR THE ONES who are dreaming how your gold and silver will save you,I got news for you,you have one foot in your grave RIGHT NOW,and your to blind to see,YOUR GREED and stupidity has cost you your life,YOU’VE GOT A PISSED OFF WORLD who fully intends to kill every american they can find,and they will,GET CLOSE to the LORD right now,cause your leaving soon….and its your choice where you GO……………

Re: Arizona

You are a raging cuckoo bird!

Richard Russell: Buy Stocks As We Enter Market’s Final Boom Phase

For a month, I’ve told subscribers that I believe we’re now entering the third phase of the bull market. Strangely, most market analysts – almost all of whom are considerably younger than I am – are not acquainted with the sentiment phases of a bull market.

Normally, following the second phase, we have a deep correction followed by a continuation of the bull market into a third and final speculative phase.

From here on, the character of the third phase trumps everything else. All minor ripples in the market, all dips or pops, all of these are contained within the third psychological phase.

Is it too late to enter the market? Readers should remember that stocks often advance as much in their third phase as they did in the first and second phases combined. Like a giant magnet, the US stock market is in the process of attracting money from all over the world. For this reason, I hesitate to predict a future high number for the Dow.

My old friend John Magee used to say, “Don’t tell me what to buy. Tell me when to buy it.” The time to enter this third phase of the bull market is now.

I realize that there’s a great deal of skepticism regarding my third phase thesis. But the skepticism is healthy and it will be followed by shock and awe as the stock market surges steadily higher. My belief is that the coming of the stock market boom will envelope everything from housing prices to precious metals to all commodities. Perhaps a symbol of the coming third phase was the recent Sotheby’s auction of a seven-karat blue diamond for the mind blowing price of $26 million. This is the highest price per karat of any gemstone in auction history.

As the third phase boom continues, I expect the Fed to gradually raise interest rates. The stock market will ignore rising interest rates up to a point, and continue to push higher. But eventually rising rates will tend to halt the market’s rise. At what level will interest rates restrain the third phase? I don’t have the answer to this; it’s like the question, “How hot is hot?” or, “How greedy and courageous can stock buyers become?”

Sentiment among the retail crowd is negative and sour. Against the skeptical sentiment, stocks on all the US exchanges are climbing relentlessly higher. Once the retail public sees that the market is getting away from them, out of fear, they will plunge into the stock market. Consequently, I expect to see fireworks on all the US exchanges as we head further into the third phase. All historic measures of valuation will be ignored as this mighty third phase heads higher.

What will propel the stock market higher? Never before seen multiples in price-earnings ratios. If we are heading into a market that will break records for excitement and overvaluation, the forthcoming third phase will be driven by the fear of being left behind. The third phase will encompass housing prices, commodities, precious metals, and common stocks. Decades from now, people will talk about having been there in the third phase of the great bull market. As for my subscribers, the question is – should you enter the market, and if so, when? The answer is – yes, you should be in this market, and the time of entry is today – now.

Question: Russell, what makes you so sure that we are entering the third phase of this bull market?

Answer: Sixty years of experience in the markets, plus my intuition.

I stopped subscribing to Richard Russell’s letter after he made this brilliant call in May 2007. He turned bullish at the absolute peak in the market. Read it and weep. He was wrong then and he will be wrong now.

What brilliance. He called for a worldwide boom coming. Hysterically WRONG call.

“We saw something that is extremely rare [on April 20 and April 25], in fact I can’t remember ever having seen this before. What I’m referring to is that on those two dates all three Dow Jones Averages — Industrials DJIA, -0.09% Transports DJT, +0.19% and Utilities DJU, +1.23% — closed at simultaneous historic highs. To me, a fellow steeped in Dow Theory for over half a century, this was like a clap of thunder… My take on the situation is that the stock market (and the Dow Theory) told us that an unprecedented world boom lies ahead.”

http://www.marketwatch.com/story/dow-theorist-sees-an-unprecedented-world-boom-signal?siteid=rss

Richard Russell predicted a worldwide BOOM, only months before a worldwide financial collapse. He now predicts a soaring stock market that will take the Dow up another 100%. Who pays this dude for his insights?

Yes Admin, Russell has made many mistakes, I am thoroughly familiar with his long term record.

The only reasons for giving this credence and consider it a possibility are two fold.

Firstly I believe in the third and final phase or blow off phase that bull markets usually end in. It is usually marked by heavy public participation and wild manic moves to the upside in stock market darlings in a very short time period. Both are missing in the current bull in my opinion.

Secondly the inflation that I envision happening from the maniacal amount of money creation by the world’s central banks has yet to materialize on main street in a meaningful way where they notice and act, usually by buying stocks and other assets to protect themselves from inflation materialize.

Of course the market is absurdly overvalued presently, and the fact it could arrive at such levels right before our eyes is proof enough to me that the insanity can continue.

Greed, Speculative Fever, Fear, are very emotional things that do not lend themselves well to sober rational analysis.

I am hardly bullish, but have been around the street long enough to know that the market can do anything.

2007 wasn’t a manic surge upwards. The market just tipped over due to bad debt going bad. The average joe doesn’t have money to invest in the stock market. Their real household income is lower than it was in 1999. The IPOs this year have been ridiculous. Social media stocks are at absurd levels (aka 2000) and money losing companies like Amazon and Tesla sell for $300. That sounds ridiculous enough for me.

The mal-investment, issuance of billions in bad debt, declining profits, stagnant wages and end of QE will result in this market collapsing.

The problem with equities is what do you really own? If you think you own the company, you are wrong. Common stockholders are last in line to recover monies from bankruptcy, or the like. There is no doubt the US stock market will end in tears. Timing is the bitch of it.

I sleep better at night investing and buying things people will always need. Rental properties, metals, food almost anything but stocks. Stocks are not on the short list of needs for survival. I think to look back on history and charts and say we are not in a blowoff phase is insane. Much like America, the stock market must be taken down, with the existing order for real change to occur.

I may be poorer for it, but to participate in the ponzi scheme is to support it. I choose not to. I will see the rest of you who feel this way in my van down by the river.

Yes Admin, Black swans everywhere, Junk bond market collapse due to fracking bubble break is my current swan du jour.

Valuations are absurd as well , no argument. Facebook is terrifying in my opinion.

As to the amount of dough out there not in the market yet;

M1 represents all of the currency in the M0 money supply, plus all of the money held in checking accounts and other checkable accounts, as well as all of the money in travelers’ checks. In June 2013, the M1 money supply for U.S. dollars equaled about $2.5 trillion [source: Federal Reserve].

M2 is the M1 supply, plus all of the money held in money market funds, savings accounts and CDs under $100,000. In June 2013, the M2 money supply was about $10.5 trillion [source: Federal Reserve].

The Fed is trying to force this money into the market imho. My honest view is ; not withstanding your excellent points, the market is capable of a blow off third faze move.

“Firstly I believe in the third and final phase or blow off phase that bull markets usually end in. It is usually marked by heavy public participation and wild manic moves to the upside in stock market darlings in a very short time period. Both are missing in the current bull in my opinion.”

Uh, that is because they were wiped out in the 2008 crash and the only investors left in the current bull are those who benefit from QE and 401k contributors.

Uh, that is because they were wiped out in the 2008 crash and the only investors left in the current bull are those who benefit from QE and 401k contributors.

Hi Stephanie, Yes what you say is very true.

My feeling is however, that stocks rising every day for 6 years and zero interest rates have a way of causing them to forget the lessons of 2008.

If history is any guide they forget very close to the top and come rushing in with a wild rush to get even for being so foolish. The resulting orgy and blow off creates a massive top resulting in a wipe out for them again shortly after their entrance.

“Social media stocks are at absurd levels (aka 2000) and money losing companies like Amazon and Tesla sell for $300. That sounds ridiculous enough for me.”

I saw this on twitter earlier today.

[img :large[/img]

:large[/img]

“My feeling is however, that stocks rising every day for 6 years and zero interest rates have a way of causing them to forget the lessons of 2008.”

Who are the common folk buyers who are going to jump in too late? Those who lost their house in the mortgage bubble busting? The Millennials with $1 Trillion in student loans and interest rates increasing every July 1st? The Boomers who have either already retired or clingy onto their 9 to 5? How about the part time workers because of the healthcare mandates?

Hey, I know, maybe it is the Detroiters who were saved from the auto bailouts. Whoops, I forgot, Detroit just exited chapter 9 bankruptcy two weeks ago.

Please, for the love of God, tell me what demographic of Americans are thinking “happy days are here again”.

My buddy Dallas said the 90’s bubble was nothing but hot air which they let out of the market in 2000. Maybe this time it’s different.

I saw this on twitter earlier today.

All that chart says to me is the NASDAQ is about back to where it was 15 years ago Stephanie.

https://www.youtube.com/watch?feature=player_detailpage&v=5dd-Un22DzA

STEPH

This may surprise you, the average Joe schmuck , Fox News watching clients of mine REALLY believe it’s all good. Granted it is only about thirty percent of them.

Please, for the love of God, tell me what demographic of Americans are thinking “happy days are here again”.

The ones who have over 10 trillion parked in liquid cash equivalent assets receiving near zero interest rates would be the ones most likely to start singing that famous tune.

In the Sony leaks last week some emails of Snapchat’s CEO Evan Spiegel were apart of the leak. In the emails he specifically stated the tech stocks were only rising because of QE.

Fed has created abnormal market conditions by printing money and keeping interest rates low. Investors are looking for growth anywhere they can find it and tech companies are good targets – at these values, however, all tech stocks are expensive – even looking at 5+ years of revenue growth down the road. This means that most value-driven investors have left the market and the remaining 5-10%+ increase in market value will be driven by momentum investors. At some point there won’t be any momentum investors left buying at higher prices, and the market begins to tumble. May be 10-20% correction or something more significant, especially in tech stocks. Facebook has continued to perform in the market despite declining user engagement and pullback of brand advertising dollars — largely due to mobile advertising performance – especially App Install advertisements.

This is a huge red flag because it indicates that sustainable brand dollars have not yet moved to Facebook mobile platform and mobile revenue growth has been driven by technology companies (many of which are VC funded). VC dollars are being spent on user acquisition despite unknown LTV of users – a recipe for disaster. This props up Facebook share price and continues to justify VC investment in technology products based on abnormally large mkt cap companies (i.e. “If this company attracts just 5% of users that FB has, it will be HUGE” – fuels spend on user acquisition as user growth is tied to values). When the market for tech stocks cools, Facebook market cap will plummet, access to capital for unproven businesses will become inaccessible, and ad spend on user acquisition will rapidly decrease – compounding problems for Facebook and driving stock even lower. Instagram may be only saving grace if they are able to ramp advertising product fast enough. Total internet advertising spend cannot justify outsized valuations of social media products that derive revenue from advertising. Feed-based advertising units will plummet in value (in the case of Twitter, advertising spend may not move beyond experimental dollars) similar to earlier devaluing of Internet display advertising.

Read more: http://www.businessinsider.com/snapchat-ceo-on-tech-bubble-and-facebook-overvaluation-2014-12#ixzz3NLdxAauG

Fed has created abnormal market conditions by printing money and keeping interest rates low.

Stephanie I’m on your side, everything you say is true. Where you and I differ is that you are telling the market what it must do, which is go down. My belief is the market can blow off, for the reasons stated in my postings. it cares little for what you or I think it should do; and has already shown itself to be quite irrational and immune from sane rational thinking or it would not be where it is.

Oxen, there is really no way to ever know for sure where it will go. I never thought it would raise over 10,000 points in less than 5 years but here we are. All I do know is the growth in the stock market is in no way a barometer of the real economy. Somebody should have told both Bernake and Yellen that micoeconomics matter. Not only does the average American have less disposable income I read an article recently where they have the gall to say Millennials have “negative savings”. What the hell kinda bullshit is that? I also heard the MSM saying the economy was going to experience “negative inflation”.

Exactly Stephanie, no one knows for sure what is going on. We are in a Financial Tower of Babel.

That was my only point in bringing in an opposing view to the waterfall. When it comes to the Market there is always two sides to the coin.

The financial mumbo jumbo of which you speak is just another bunch of spin doctor bull shit, talking in riddles and half meanings to obfuscate and confuse the situation further.

As to your comment Steph about the stock market having nothing to do with the real economy, no truer words were ever spoken. If the stock market were reflecting the real economy it would be closer to 1800 rather than 18 000.

I multiplied the price of gold by the 2000 Dow/Gold ratio and called for Dow 55,000 by 2030. Therefore, Dow 18,000 I looking piss-weak to me.

I wouldnt worry about who is going to jump in at the last minute…Grandma Yellen will bail you all in when things go BLAMMO.

If there was any truth to a possible end to the great bull run , it would have been discussed on network news by now…you can’t win, if you’re not in!!!

[img ?oh=bf4a51840e4784016a5e4e2c18f25d2b&oe=55427D43[/img]

?oh=bf4a51840e4784016a5e4e2c18f25d2b&oe=55427D43[/img]

Well, thankfully for the big six propaganda machines, sugar coated bullshit spoon fed to the ‘murican sheeple is now legit and none can be retroactively prosecuted. We have arrived!

[img [/img]

[/img]

Every one agrees. The stock market is being manipulated in various ways by numerous entities. Would you sit down to a poker game if you knew it was crooked? Why then would one get into the stock market? Ever since Glass-Steagal was repealed, the crooks took over the market and have become more and more blatant about it ever since. They do not care if you know it. They run it up until they get enough people in and then they crash it. Rinse, and repeat.

The Nasdaq has not regained it’s value since it crashed 15 years ago. You would have made more money investing in bonds, or gold these past 15 years than the Dow. In fact, you would have done better in a lot of investments other than the Dow. Now that the Dow is at an all time high people think it is time to get in? Didn’t your momma ever tell you not to swim with sharks?

Front running, congressional insider trading, high frequency trading; nothing to worry about, plunge right in.