Guest Post by Dr. Housing Bubble

The Canadian housing bubble makes California real estate look sensible: Crash in energy prices will put pressure on home values up north as Canadians go into maximum leverage.

As the year comes to a close, it is useful to put things into perspective. Sure, California has a love affair with real estate and we go through our traditional booms and busts. $700,000 crap shacks now litter the landscape but there are fewer and fewer lemmings taking the plunge. In Canada there was no correction. In fact, households continue to go into deep debt to purchase real estate. The argument goes that mortgage standards are much tighter in Canada so therefore, they are much more enlightened when it comes to financing homes. People forget that the bulk of the 7,000,000 foreclosures in the US came in the form of standard loans. Garbage loans imploded in more dramatic fashion but people lost their homes because the economy shifted. At that point, it merely meant covering the monthly nut. We were housing dependent and that market contracted aggressively. Canada is housing and oil dependent. And oil just got a big kick to the shins.

In Canadian debt we trust

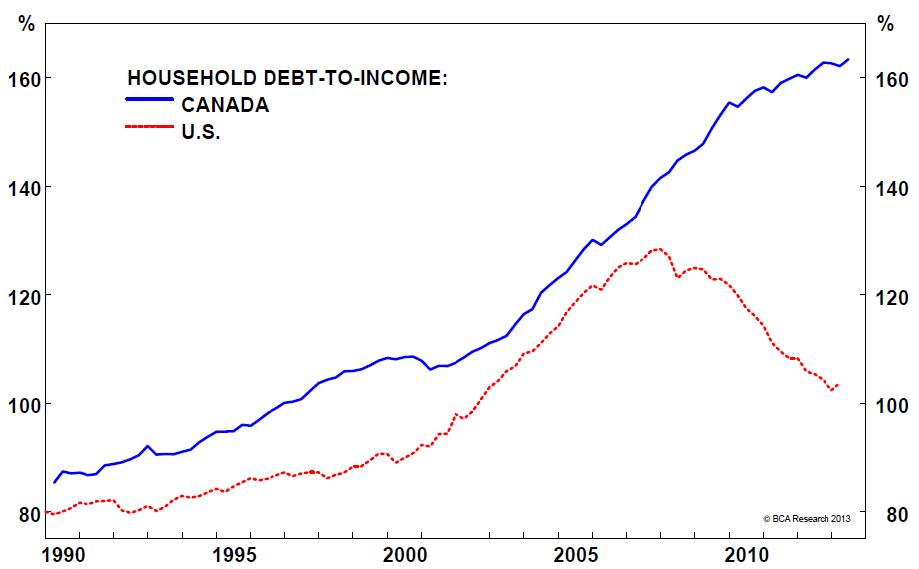

There was an inflexion point for US markets when household debt surpassed household income. People kept saying it was a liquidity crisis initially but it was truly a solvency crisis. People took on too much debt and were walking on a financial tightrope. In the US, this peaked above 120 percent. Canada is well on its way above 160 percent:

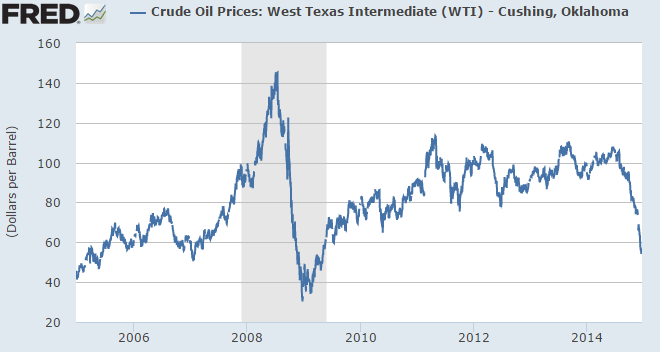

Basically Canadians are deeper in debt relative to their income. And a large part of this debt is housing related. A large part of the economy is also tied to oil and as you may know, oil just took a massive cut:

It was interesting to hear that we would never see oil drop below $100 a barrel. Oil is now trading at $52.84 a barrel. Similar arguments were made about US housing never having one negative year-over-year price drop until we did.

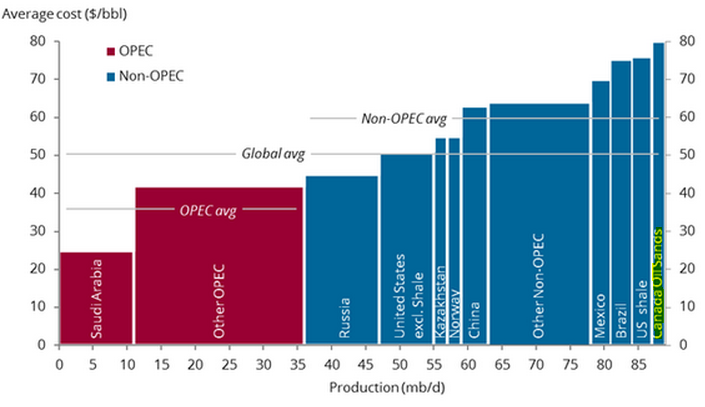

Large part of Canada’s oil is costly to extract

A large portion of Canada’s oil is costly to extract. With oil sands for example oil would need to be at $80 a barrel to make a profit:

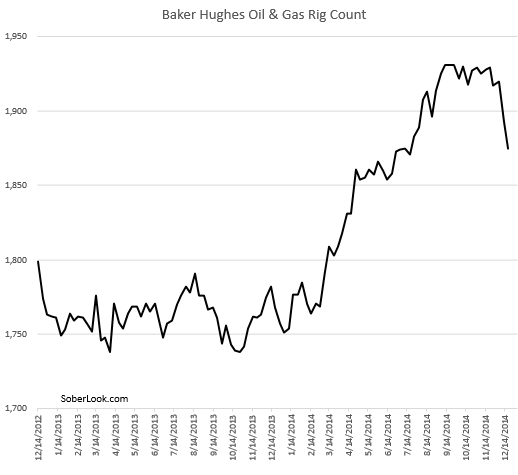

I doubt people want to run money losing operations for a long period of time. So it is no surprise that oil rigs are closing:

Fewer jobs and less money. And for a large part of the Canadian economy, much of this money has been flowing into housing. In Canada, there seems to be a cult belief that housing simply will not correct. They are full on drinking the good old tasting real estate Kool-Aid. In the US, we already lived that correction and understand that yes, housing does go through booms and busts especially when debt is used to supplement a lack of income growth. As the debt to income chart shows, many US households were forced to deleverage via foreclosures and bankruptcies.

Home prices out of sync

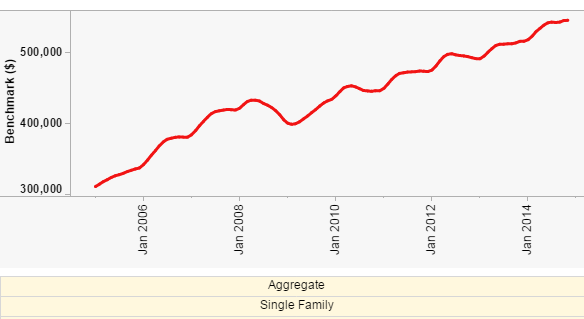

Home prices are fully out of sync with incomes. Take a look at this rise in home values:

Canada has enjoyed many years of the global commodities boom and now finds itself contending with a market full of debt and inflated housing values. Short of oil rising back up to $80 a barrel and higher Canada is likely going to face some short-term pain. The housing market is due for a correction. Those of us in California realize that booms and busts can occur all of a sudden but the events leading up to this are largely foreseeable.

I’m sure many in Canada assume that home values will simply continue to go up and just because banks check incomes doesn’t mean squat. As the above data shows, households are already deep in the quicksand of massive debt. It is all dandy when everything is going up including oil. When oil gets smashed as it did, it came on quickly. Canada has their versions of $700,000 crap shacks usually in the form of condos. Hey, at least with a crap shack you don’t have to share a common wall. When you look at the Canadian housing market it makes the US look like a frugal uncle.

Hmmmm….. Debt fueled bubble pops worldwide.

Looks like all this free and easy money going to corporations and banks was the real market after all, there is no one left to sell to, and so the EU is now thinking of printing more.

Why not…..

card – it’s going to get interesting. Ambrose Evans-Pritchard had this to say:

“The European Central Bank cannot save the day for asset markets as the Fed pulls back: it does not print dollars, and dollars are what now matter. Nor is it constitutionally able to act with panache in any case. While Mario Draghi and the Latin bloc could theoretically impose full-fledged QE against German resistance, such Frechheit would sap German political consent for the EMU project. Mr Draghi will accept a bad compromise: low-octane QE that makes no macro-economic difference, but noisy enough to provoke a storm.

The eurozone will be in deflation by February, forlornly trying to ignite its damp wood by rubbing stones. Real interest rates will ratchet higher. The debt load will continue to rise at a faster pace than nominal GDP across Club Med. The region will sink deeper into a compound interest trap.”

http://www.telegraph.co.uk/finance/economics/11312671/The-year-of-dollar-danger-for-the-world.html

As far as Canada goes, Chinese flooding into the country with cash has been the biggest factor of all. It put tremendous pressure on prices.