No bubble here. This is completely rational. QE had nothing to do with this. ZIRP had nothing to do with this. Wall Street hedge funds had nothing to do with this. They ain’t making more land. Home prices never fall. Paying $600,000 for a 1,200 square foot dump in the paradise of Pasadena is a brilliant investment. What could possibly go wrong? Some people never learn.

Guest Post by Doctor Housing Bubble

We have an astute audience that reaches beyond the confines of the 405 and 10 freeways. I know it is hard for some readers to see beyond PCH but it is true, the U.S. is an expansive and far reaching country. It is hard for some readers to grasp the endless boom and bust cycles of Southern California real estate. So today, we’ll take a trip to three fairly popular cities and see what we can get with a $600,000 to $650,000 budget. I’d be interested to see what those outside of the area and those within it have to say about these properties and their current prices. What you will find is that inventory is growing and house horny buyers are itching to dive into housing even if it means taking on ARMs once again. Those that bought a few years ago will now find it difficult if not impossible to purchase today. Has the economy so radically changed to justify 20 to 30 percent price increases within one year? This market is still being driven by hot money although it is starting to cool off. Visually seeing what we can get for $600,000 to $650,000 in Pasadena, Arcadia, and Torrance might give you a good idea of what the current market is like. For those outside of the area, welcome to SoCal housing!

A trip into three L.A. County cities

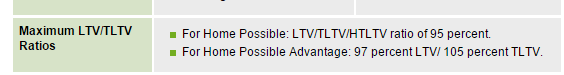

It is important to note before diving into these examples that most traditional buyers are not entering the housing market with big down payments. In fact, here in SoCal, we have ARM usage doubling in the last year as households try to stretch their budgets to the maximum potential. It would be useful to note that the 30-year fixed rate mortgage is still hovering near all-time historical lows. The ideal scenario is always bandied about with a 20 percent down payment as if many people have $120,000 laying around to throw into a pre-World War II property.

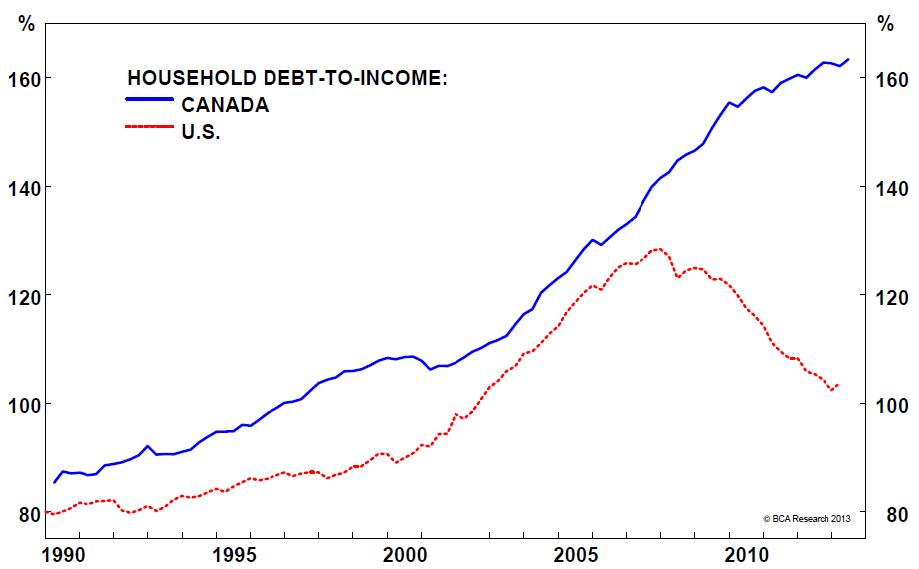

The facts simply do not show that to be true. You have cash investors buying properties as investments. You have other markets being driven by foreign investment. In the middle of all of this you have traditional buyers stretching their budgets to cram into properties. It is an odd mix that is fully unsustainable. I’ve seen a few booms and busts and this goes back to the 1980s so why are we to expect any different outcome this time especially given the current market outlook?

Let us first look at a property in Pasadena.

1024 N Sierra Bonita Ave, Pasadena, CA 91104

3 beds, 2 baths listed at 1,200 square feet

Year built: 1924

List price: $635,000

A nice property albeit rather small for $635,000. The last sale on this home took place in 2004 for $489,000. It has had some work done in the interior but again, this place was built in 1924 (before the Great Depression). What is interesting is looking at the tax data. In 2004 the place was assessed for tax purposes at $226,183. When it sold, it was then reassessed for $504,981 in 2005. Taxes slowly went up peaking in 2009 at $535,887. Then in 2010, it looks like it was reassessed at $489,000 and remained there until 2013, where it was upped once again to $529,000. If this sells at $635,000 we will have a much higher tax assessment. Of course the government loves nothing more than higher home prices to collect more taxes. You can see how tricky things can get especially with that jump in 2004 from $226,183 to $504,981. Did the joy of living in this house with all public access suddenly get twice as good in one year? Probably not but the tax bill did.

Our next home is in Arcadia.

5520 N Santa Anita Ave, Arcadia, CA 91006

3 beds, 2 baths listed at 1,232 square feet

Year built: 1965

List price: $650,000

This home is slightly newer than the other home being built in 1965. I love that the ad says this place is a “must see home for people that love their privacy.” Of course all other homes are for suckers that hate privacy and want their life an open exhibition to the public. California housing affordability sucks. It has gotten dramatically worse in the last year. Some of these homes are the golden tickets being offloaded by baby boomers onto a market were housing fever is still raging on. This home last sold in 2004 for $400,000. No surprise that we see an assessment jumping from $259,760 to $416,160 from 2004 to 2005.

Let us finally look at our last example on our $600,000 house hunting trip in Torrance.

2378 W 233rd St, Torrance, CA 90501

3 beds, 2 baths listed at 1,296 square feet

Year built: 1959

List price: $619,900

This home was built in 1959 and the last sale occurred in 1986 for $100,000. I love how the ad mentions the following:

“Large Private Backyard With Rv Access! Plenty of Room For Your Boat, Jet Ski’s Or Rv. Move In Condition! Welcome Home!”

Caption every word because you are spending $619,900 here. What is the current tax assessment? $158,524. So good luck to the new buyer that will be paying nearly 4 times the amount in taxes as the current owners here.

I assure you that folks with serious cash are not spending their weekends trying to outbid each other here. That is simply the truth. Do you see a couple made up of a lawyer and accountant buying these places? The people I do see buying these properties are house horny buyers simply trying to chase the aspiration of getting a hold of SoCal real estate and justifying that $600,000 and $700,000 is somehow affordable. The Torrance property is likely to be an offloading from a boomer.

It is interesting that when I post articles like this one with actual examples, people try to refute it by saying “well look at the history here, it is clearly going up therefore buying is an easy decision.” But when I respond that they should buy this place and let me know when they close escrow since it is such a no brainer they usually want someone else to take the dive. If you found a great stock that you just “knew” would go up, you would be silly not to buy. The same should be the case with real estate. The problem of course is that at these prices, it is not an easy decision. In fact, it looks like a mini-bubble with a different flavor. With these properties, even with a $120,000 down payment you are looking at a monthly carrying cost of $2,800 to $3,000 for 30 years. Most of those in the industry usually fail to look at the opportunity cost lost by the down payment after 30 years in alternative investments and the net difference between renting and buying. Then again, that is usually how we end up with baby boomers with inadequate retirement accounts living in these million dollar tickets while eating canned tuna to stay afloat. Just because the momentum is up, doesn’t mean it is a good time to buy. You can ask the 7,000,000+ U.S. homeowners that recently faced foreclosure if the “housing always goes up” argument is enough to make housing a great investment no matter the underlying price.