Guest Post by Dr. Housing Bubble

The return of risky loans: Freddie Mac offering a 3 percent down loan called Home Possible Advantage targeted to cash strapped buyers. FHA loans and interest only loans also permeate market.

I love when mortgage products get creative in their titles. We had those wonderful “option ARMs” that basically gave you the option to not pay your mortgage principal. But what people forget beyond the egregious toxic mortgages, most foreclosures hit people with vanilla 30-year fixed mortgages. That is right, of the 7,000,000+ completed foreclosures most were boring traditional mortgages. Since the stock market has been on a massive run for six years now, people have forgotten that recessions routinely hit our economy. It is part of the economic system. If you can’t pay your mortgage, it doesn’t matter if you have a 30-year fixed, ARM, interest only loan, or other variety of payment you are making to the bank. Now that banks know they can boot you out and sell to an investor, the foreclosure process started humming along. A reader pointed out that Freddie Mac is entering once again into offering low down payment loans to cash strapped borrowers dreaming of their first crap shack. The product is called Home Possible Advantage but in reality, you are making a big bet with little equity.

Home Possible Advantage

For all intents and purposes, Freddie Mac and Fannie Mae were nationalized during the housing crisis. Free market Kool-Aid drinkers conveniently forget that we conducted some massive socialism in bailing out the financial sector. In theory the free market sounds good for housing but the housing market is one heavily subsidized segment of our economy (i.e., government backed loans, mortgage deductions, property taxes, etc).

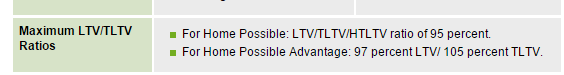

So it was interesting that resurrected and nationalized player Freddie Mac is introducing a very low down payment product:

This is adding a high level of risk for new buyers. Since Americans are tapped out and the banking industry has juiced home values up thanks to investors, it is time to hand this game off to cash strapped Americans. That is, unless you can offer riskier products.