Deferred gratification is an unknown concept to most Americans. Wall Street and Madison Avenue have colluded to brainwash a dumbed down populace into going into perpetual debt in order to keep up with the Joneses and live for today. Saving for the future is for suckers. When 65% of Americans roll a credit card balance at 10% to 25% interest, you know our government run public educational system has succeeded in producing brain dead dumbasses. Charge!!!!

Credit cards are an addiction that most Americans never shake.

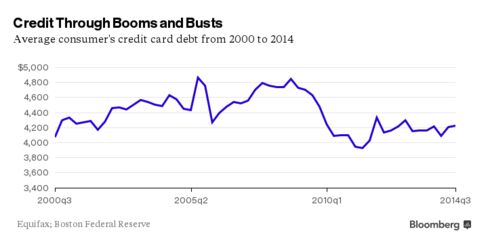

Through the booms, busts, and recessions of the last 15 years, U.S. credit habits have been remarkably consistent, according to a recent study from the Federal Reserve Bank of Boston. Most people carry over a balance from month to month, the study said, and they eagerly gobble up any additional credit their card-issuers offer.

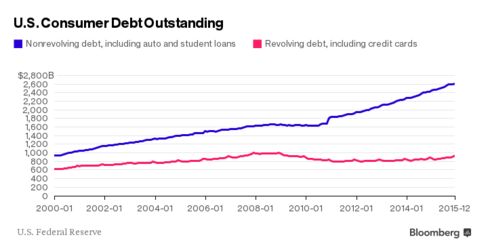

It adds up fast. Consumers owed a total of $936 billion in credit-card and other revolving debt in December, according to Federal Reserve data released on Feb. 5. They’ve added $103 billion since April 2011, but they still have less revolving debt than just before the financial crisis in 2008, when they owed $1.02 trillion.

To see how individual Americans’ relationships to credit cards has changed through time, researchers at the Boston Fed’s Consumer Payments Research Center analyzed a huge data set, a sample of 5 percent of U.S. credit report accounts from 2000 to 2014. Here are some findings:

1. The Typical American Is Always in Credit-Card Debt

About 35 percent of those aged 25 to 50 with credit cards are “convenience users,” who pay off their balances each month. The majority, whom researchers call “revolvers,” carry debt forward from month to month and usually pay high interest charges in the process.

Americans don’t really taper their credit-card borrowing until their fifties. Even at age 70, 45 percent of credit-card users aren’t paying off their credit cards each month. And the typical 80-year-old still has more than $600 on a credit card. “The median person is always borrowing, although at the end of life she is not borrowing much,” the study concludes.

2. Americans’ Debt Addiction Begins in Their Twenties

Between ages 20 and 30, Americans rush to embrace credit-card debt. Their credit-card limits jump about 450 percent in that time, while their debt rises almost as quickly, by more than 300 percent.

For young adults just starting out, credit cards become a substitute for savings. “People in their 20s don’t seem to save much,” said Scott Fulford, a Boston College professor who wrote the study with Scott Schuh, director of the Boston Fed’s Consumer Payments Research Center. “Well, maybe they’re not saving very much because the way they’re ‘saving’ is just by getting higher credit limits. That provides the funds for emergencies that they need,” Fulford said.

3. Old Habits Die Hard

As Americans get older and more mature, they still rely heavily on credit cards. While 20-year-olds use more than half their available credit on average, 50-year-olds use almost 40 percent.

The study finds that individuals have “very stable” credit habits over time. Some might typically use more of their available credit and others less, but each person’s use of credit cards doesn’t vary much during the course of his or her life. Finances are sometimes disrupted by shocks—perhaps a car repair, a medical emergency, or even a bonus—that do cause people to alter their credit habits. Any disruption is temporary. Within two years, an individual’s credit use is mostly back to its ordinary pattern.

4. If You Can Borrow More, You Probably Will

Americans borrow more in good times and less during recessions. The driving factor isn’t our mood about the economy. Borrowing seems driven by our credit limits. When banks offer us a higher limit, we use it. When they cut us off, we tighten our belts.

Banks are constantly adjusting how much credit they give customers. The average credit-card limit rose about 40 percent from 2000 to 2008, then plunged about 40 percent during 2009.

Credit limits have the biggest effects on people who carry debt forward from month to month. When offered a 10 percent increase in credit limits, these “revolvers” subsequently increase their debt by 9.99 percent, the study finds. In other words, revolvers—the majority of U.S. consumers—typically use almost every extra cent offered by their credit card issuers.

This is a striking statistic, but it’s hard to know what conclusion to draw from it. Are most people just incapable of resisting temptation? Or are they in such desperate economic straits that they need more credit to get by? It may be a combination of the two, and the study’s co-authors are planning follow-up studies on these questions.

Hmmm

To suggest categorically as you have done that the American people are in debt to credit card companies for lack of self control is simply bullshit. It is an age old tactic of blaming the victim. In point of fact the victim is the American worker who has seen his pay in real world terms dwindle straight into poverty. And your assertion that “debt addiction” with all its negative implications is a root cause is not just insulting, it is a lie.

DDearborn

You don’t know what the fuck you are talking about. Americans are addicted to shit they can’t afford. You one trick ponies who think personal responsibility isn’t an essential part of being an adult tire me out.

Keep playing the victim card. Make sure you vote for Bernie so you can get more free shit.

Globalization = lower pay and fewer jobs of U.S. citizens.

Hey Ddearborn

Why has auto loan debt absolutely SKYROCKETED in the last four years? Were the poor victims of the car companies forced to buy those $35,000 SUVs?

Please regale me with how the big bad guys forced the little guys to buy those cars.

Sound of fucking crickets.

Hey Ddearborn

During the height of the housing boom, dumbass Americans extracted $900 billion of home equity and bought cars, granite counter tops, stainless steel appliances, exotic vacations and new boobs for mommy.

Were these poor victims forced to do such dumbass things?

I await your detailed fact based response.

There’s no excuse for the debt load of the average American.

But it is also true that TPTB have made saving money a losing proposition by destroying the ability to stay ahead or even abreast of inflation.

Dipshit Dearborn,

Who is making people buy shit they dont need with money they dont have to impress people they dont know or like?

Cant afford what they think they deserve, boo-fucking-hoo.

For fucksake, everyone is a fucking victim from all these “predators”, even if this were true then that means they are the stupid shits caught in these nets.

You know what you call potential victims that avoid being caught by predators?

Smart and alive. Its natural selection and trying to fight that reality by protectingeveryone from their own stupidity is one of the most monumental fuckups of recent humanity.

Regardless of whether they are victims, it is still their responsibilty to unfuck their situation.

I dont expect you to get it because you literally have shit for brains.

I await the arrival of llpoh with great anticipation.

Got my first credit card in 1982, had it taken away in 1984 for busting my credit limit. Had a charge card until 2007, paying in full every month, and have managed without either ever since. Gave up the charge card because of online fraud.

Life can be difficult sometimes, but with planning even airline tickets can be bought with cash. Online shopping, thankfully, is not an option.

Perhaps the public sees what the government is doing, skyrocketing debt with no consequences.

If government can get away with it, why can’t they? This is not gonna end well.

EF

efarmer

I was glad to hear you are doing well. I still have the picture you sent me a few years ago.

We prefer to purchase things with cash or debit card but we do use our credit cards quite a bit. But one thing we don’t do is ever carry a balance month to month, ever. If you can’t afford to pay the bill at the end of the month then you can’t afford to buy whatever the hell you thought you needed.

Fools and their money are soon parted and the banks invented that game with their minimum monthly payment trap. You charge $4k on your credit card for the month and your minimum payment is $56 or some stupid shit, that’s great until the next month’s bill comes in and you ran up another $4k plus the interest from the previous month because you chose the minimum payment. Game over you never catch up. And so it goes…………….

In the news today… merchandise trade deficit with China…365 billion dollars in 2015. But, we have real unemployment in the 10-20% range. Seems like this would be a big enough of a target for some politico to hit.

Financial irresponsibility seems to be an inherited characteristic.

I’ve known numerous people that got so helplessly in debt they had to declare bankruptcy but then started on the same path again to end up in bankruptcy a second time, and one even a third time.

And none of them were in a position where they got forced into it by dire circumstances beyond their control, they just spent too much on things they didn’t need with no thought for the eventual outcome.

Anon says I’ve known numerous people that got so helplessly in debt they had to declare bankruptcy but then started on the same path again to end up in bankruptcy a second time, and one even a third time.

You know the Donald ?!

A long time ago I got into trouble with credit cards. It took me a couple of years to get my shit together after a divorce but I learned a valuable lesson. If you can’t pay for it then you don’t need it. Grant it there will always be emergencies when money is needed. However the problem I see right now is too many live life based on nothing going wrong. Laissez bon temps rouler.

When it does it’s boo fuckin’ hoo!

People live in houses and have a roof that needs replaced. Do most people put money aside to pay to fix it. Fuck no! They spend spend spend! Worse still they spend that money on shit they don’t need. Car needs replacing. Are these folks buying an inexpensive Econobox. Fuck no! They need a 50,000 dollar truck that gets ten miles to the gallon. Don’t have enough money for groceries. No problem. Let’s go to Domino’s and bury our fat faces in a couple of pizzas.

But we are supposed to all be victims. At least that is world that Ddearborn lives in. What really pisses me off is that there are people/households out there making far more money than me that are whining about how tough it is. I just got back from Montreal. Went there to watch hockey and get shit-faced on Rue Ste. Catherine. Just as an aside to all the Doomers out there I strongly recommend the place. I was sitting in a bar talking to my friends. At some point thru the haze I said the following.

We live in the best place and best time in history of world. There is too much moaning and groaning going on right now. Enjoy what we got and not wish for stuff we can’t get.

I’ll end by saying that my trip was charged to my credit card sure but once I get bill later this month it will be paid. How Ddearborn you ask. Well it’s easy. After all my expenses I have somewhere around 1200 dollars/month. I usually put it on mortgage but every once in a while I go on a tear. There are many who don’t do this. Worse still many make much more than me. Living paycheck to paycheck. I really don’t care how tough it is for someone who lives in a house twice as big as mine. Drives a truck that costs twice as much as mine. Collecting shit they don’t need hoping that if they run into bad patch someone is going to feel sorry for them and bail them out. What really pisses me off is that me living within my means makes me a target for confiscation by the predators on Wall Street, Main Street and Ddearborn Street.

To all the victims out there I say. you “can go pound sand”

Orwell missed

WISDOM is FOLLY

and

DEBT is WEALTH.

Of course, there are people who are in dire straights and need to borrow just to keep going…more often than not, these people will aggressively pay down debt if/when conditions improve.

Of course, there are people whom are victims of a predatory lending culture…who is at fault…the far shorter list would be who/what is not. The lenders are at best assholes and at worst psychopaths…the victims have no understanding of basic monetary concepts–BOTH because they are not ever taught in the indoctrination facilities masquerading as schools in this country AND because they never bothered to learn them on their own.

And, of course, there are just consumers who borrow and spend because they can and because ubiquitous advertising insists they need ever more shit and because our consumer culture tells them they must keep up or die.

The point is finding fault is all but useless. It spreads every which way, including the fellow that resides in the mirror. Shit is fucked up and bullshit.

Two quick questions for you “I only use cash” and “I am an aggressive saver” crowd:

1) What is the fundamental difference between a debt instrument printed on a green piece of paper vs a debt instrument imprinted on a magnetic strip vs. electronic digits residing on an endless network of computers?

2) What is the endgame you envision? One day living on a secluded beach without a care in the world because you have a massive “nest egg” and can live on the interest? Corollary questions would be where does that nest egg reside and who has control of it? Also, who controls the interest you receive?

I hate this shit. I’m naturally a saver and naturally thrifty. It is wisdom that has served my parents very well. But, once again, in a world where

WISDOM is FOLLY

and

DEBT is WEALTH

all the old rules no longer apply.

Before, I hear responses…I DO understand that credit cards charge very high interest rates, so please don’t bother.

BUT, let me give you a scenario: I go to Cabelas and max out my credit limit (9K) there to buy a shitload of guns and ammo, which I carry out having given up nothing more than my signature. Then I make minimum payments for 10 years of until the whole financial system blows up.

OR

I go take 9K out of my bank account and invest in a ROTH IRA and manage as best I can in financial markets.

Both scenarios involve moving electronic fiat from one virtual account to another. Which will serve me better 10-20 years down the road?

Fuck if I know.

And that is just how fucked up this situation is.

DRUD

In the 1st scenario at 17% interest, you will pay off your purchase in 13 years, having paid $13,820 for your $9,000 purchase.

In scenario 2 you could put the $9,000 in short term bonds paying 2% and after 13 years you would have $11,642.

Which would be your preferred outcome?

The anti-credit card people are full of shit. I’m aware that I’m paying extra by using a credit card instead of deferring the purchase until I have the money saved. It amounts to an extra maybe 1% a month of the purchase price. It’s worth it to me to have the thing now instead of later.

I’m not an anti-credit card person. I put all my purchases on my credit card. Then I pay it off every fucking month, because I understand math. If you want to be a dumbass, that’s your choice.

AnarchoPagan chooses to be the poster boy of not understanding deferred gratification. Thanks for playing.

Using the Upromise CC I haven’t paid a penny of interest and have accumulated $9,000 towards my youngest son’s college account without me putting a penny into it.

At this point, what difference does it make? When they tank our toilet paper currency, we are supposed to get a Jubilee that cancels our debts……..Oh wait…..is that just for the tribe?

Forget plan (A) what about plan (B) …….Hyperinflation will just inflate away that debt. John Q. Sheeple could pay off ALL of his debts with but one Trillion Dollar US note, right? The trick to that is not to starve to death until a new currency is implemented.

That’s just it, Admin…there’s no way to know. Making a couple grand over a ten year period with a 9k initial investment is pretty ho-fucking-hum, despite being the “wise” and “delayed gratification” thing to do. However, in the event of an EMP, pandemic or total systemic banking failure…having a shitload of guns and ammo would be an incredible investment.

DRUD

Your scenarios don’t match up. If you had $9,000 to put in a Roth, you should have $9,000 to buy the guns and ammo outright. You then would have the $4,800 of savings in interest to buy more guns and ammo over the 13 years.

By the way, Admin, I do the exact same thing with credit cards. I use my DoubleCash for everything I possibly can, then pay of the balance every month. I make 2%/month. Try to get that kind of guaranteed “yield” anywhere.

Yeah, I know they don’t match up. And I would do the way you suggest. The point is to illustrate how fucked up our current system is. What was wisdom 20-30-50 years ago may be ridiculous folly now. What has always been folly, may end up being wise.

The point is moot, however, because the average idiot running up CC debt is doing so on flat screens and dinners out. This is idiocy no matter how you slice it.

But, for a cash-strapped prepper type, running up CC debt for storable food, water filters, guns/ammo, etc. may very well turn out to be a great idea.

The more I think about it, what I am saying is that risk analysis has changed. In investment strategies, one must include the possibility of total systemic breakdown/civil war. in this case, investment vehicles could be things never considered to be such, like batteries, lipsticks, pint bottles of vodka or whiskey, solar panels, what have you.

This is above and beyond prepping for your family’s own survival.

Admin becomes the poster boy of not understanding time-preference. Thanks for playing.

Time preference = math illiterate & unable to defer gratification

I read once that the banks are the modern temples of our time and the interest payments to them are tithes from the people. Even in small towns in rural areas, the bank buildings are the most pristine and beautiful. Personally, I would rather own what I can afford as opposed to be indebted. Like the old proverb says: “The borrower is servant to the lender”.

Don’t get me wrong, I would love to obtain $10,000 of stuff on my signature, but if times later get tough, the banks can later trash my credit rating and make my future hell because I allowed them too. This is why I would rather pay down debt, live below my means and be free. IMO.

As I side note – I read an earlier version of this book years ago (link below) . It talked about working towards the goal of becoming your own “free agent” in the workplace, paying cash and “dying broke”. In other words, being beholden to no one. It may not be for everyone, but I thought the concepts presented in the book were very intriguing and many of them have worked for me. The only difference is that I don’t plan to die broke. I hope to leave what I can to my kids.

Anyway, here is the link (I went through TBP’s Amazon button this time). Maybe check it out if you are interested:

ue

[img [/img]

[/img]

Ddearborn talks like a socialist. I’m guessing he/she will be voting for Clinton/Sanders and yearning for the great reset. Hoping against hoping along with Goldman Sachs, Jon Corzine et al that they can keep all the shit they have acquired. But like the reset button presented to Lavrov some years ago. It will have two meanings.It will be called a reset but for the ones who have to pay it will read overcharge. Drud said earlier the world is a truly fucked up place. It makes more sense right now to buy guns and ammo than to save it for rainy day. Reason being when the reset comes it will be like the 1930’s. The few will get the spoils the rest will get the shaft. I will as I have always done “roll with the punches”. However many who have spent their entire lives indulging in every whim will resort to taking what they think they deserve from others. It will be then that the trip to Cabelas will pay for itself.

I was irresponsible when I was younger. I charged everything and never thought about paying the bill in full.

The best feeling I ever had in my life was the day I finally got out of credit card debt. That was in early 1992, and I haven’t paid the banker bastards one penny of interest in the last 24 years.

I still use credit cards that offer cash back, but I pay them in full every month. Period.

Ringing up day-to-day purchases on credit cards and then paying the bankers interest is a lot like buying a pack of cigarettes and then lighting the cigarettes with dollar bills. A lot of money goes up in smoke and there is absolutely nothing to show for it.

head smack!! Now I am realizing that the eg, 20K CC limit, is

not about how much the holder can charge, but how much

interest money they can accrue/owe.

I am a convenience user. Smarties get cash back.

You know, 5 years ago people were speculating, theorizing, if

you will, regarding the true structure of our “gov.” Some of their

ideas were far out and unbelievable. We called them nuts, paranoid,

and conspiracy theorists. Now some of those “theories” have proven

to be fact. Think outside the box.

Credit cards are very helpful for me when I’m on the road.Most Motels and Rental car companies require a major credit card. I use a Comdata card for fuel purchases . All very convenient but you have to pay them off monthly . That’s the key .Pay the cards off every month. I use cash for everything else.

If the government ever does eliminate cash then I’ll be fucked .I pay cash for daily expenses on the road and at home.

Hmmm

The fact that partisan politics, as well as a host of other inconsequential emotional hot bottoms have been proffered as rebuttal suggests that objectivity on this thread has gone straight out the window.

There is an obvious cause and effect in play regarding this issue of credit card debt. Until the mid seventies, consumer “debt” consisted primarily of a home mortgage and a car payment. The salient point to consider there is that generally speaking, earning power was sufficient to easily cover these expenses. Furthermore, these “payments represented about a 1/3 of their net income. As the 70’s came to a close, inflation started to very quickly destroy that earning power. Combine that erosion with the gradual offshoring of jobs paying a “living wage” and drastic increases in ancillary taxes and you have created a situation that is ripe for exploitation by credit card companies. People simply did not have money at the end of the month to make ends meet. And low and behold the bankers began to change the laws that had protected consumers since the late 50’s and early 60’s. For example; in my early days, 25% interest was considered loan sharking and a criminal offense. If you back out interest on credit card debit over the last 30 years above say 5% you are looking well over a trillion dollars. Penalties charges currently being collected to the tune of billions of dollars a year were also a fraction of the amount allowed today. In short the working class has been set up in a big way. And for the record a whole lot of Republican politicians had their hands in creating this scam.

Now in the context of this discussion, none of the factors above which have directly contributed to the massive increase in consumer credit card debt are in any way shape or form attributable to the will power, morals or ethical behavior of the consumer. Therefore to categorically state otherwise is simply untrue. And I am directing these comments to the administrator who clearly has an agenda and is just as clearly wrong.

And for the record I have been an independent for a very long time. And prior to that, I was a registered Republican. And I just voted today for a Republican for President. Though it would seem, not for any the reasons implied here on this forum. I cannot believe that anyone who has taken even a moment to review the current political scene, still believes that the issues destroying this country today, in any way hinge upon partisan politics.

Ddearborn blathers on with paragraph after paragraph addressing none of the questions directed his way, because he has no answers. I clearly have an agenda that every American has a personal responsibility to live within his means. You blather on about 25% interest when anyone can avoid the interest by paying off your monthly bill.

You are clearly deficient in math skills. I don’t really give a fuck about who you vote for, but it looks like I hit a nerve.

Now I await your response to my previous questions.

Let’s know a little more about you. How much credit card debt do you have? Do you have any auto loans? Inquiring minds want to know about Ddearborn, the champion of dumbasses across the land.

DDearborn,

If you hang around this site for a while, you’ll find out that no one denies that the middle class has been screwed in various ways by the system, which by the way consists of many moving pieces of fuckery. The point is, though, that a large portion of the public is either vastly ignorant about finances, or that they’d rather be in debt than deny themselves the new ithing, new car, or house with the “mandatory” updated kitchen. In other words, they are in debt largely bc they like to buy shit they don’t need, but want.

DDearborn – thanks for posting. Am trying to be nice, here. Whatever. Personally, I am sorry that you have too much month at the end of your money. But what some of us here are trying to say is this: Perhaps you (and others) are victims of your own decisions, ya know? You simply can NOT blame politics & predatory bankers for signing your own name to the bottom line. We are trying to tell you truth here…

DDearborn and Spinoloator are both correct. The sad part is that most would (and will) have to or be forced to adjust their standard of living dramatically down to avoid taking on debt. Of course, what we are conditioned to think of as living standards is mostly meaningless consumption when real quality of living comes from appreciation of the world around us, family, and the like.

Ddearborn

If you don’t make as much you can’t have as much. If people can’t afford a Cadillac then they should drive a Chevrolet. I have gone thru bad patches but instead of running up tick I cut back. The thing I don’t get with your argument is that trying to justify spending money one doesn’t have now on the hope that things will get better is losing strategy. Worse there is plenty of actual evidence that the vast majority of spending is over and above what is needed to survive. How can anyone complain about the price of bread when you can make your own. Anyways Admin asked, maybe not in a nice way, for you to provide actual facts to back up what is basically an Ad Homenin attack on people who live within their means. Of which I count myself one.

DDearborn – a final addendum here: Learn about “fractional reserve banking” and study it. It goes beyond partisan politics and is, indeed, not what you think. So – please – suck it up – put on your big girl panties – use your brain & quit acting like a whiny bitch. You can do it. Dig deep & find the courage. Otherwise, you will find no mercy here. Personal responsibility is always better than “vacuous unaccountability”. You got this….

ummmmm …. all you folks responding to Dipshit Dearborn ………….. I think he left the show!! lol

Great comments.

Sorry, Admin. Busy building infrastructure on my doomstead.

You were too kind to dumbborne. Stupid is as stupid does.

Staying out of debt is critical to avoid serfdom imposed by the banks. It grants the possibility of financial freedom. It is key for the totality of society to do it so as to create productive capital.

But, hey, what work and be productive when 1) free shit, or/and 2) big screen TV today, pay it off forever, who cares?

I care. Free shit is coming to and end, and folks with debt are going to be slaves.

And no amount if talking will wake them up.

An older friend of mine decided that he was going to live off of credit cards after his wife died. He was a sharp dude like most of us here. He was in his late 70’s with money of his own but he was incredulous at how all these banks kept offering him, a retiree on a mostly fixed budget & unemployed etc, credit cards with huge credit limits. He thought they were insane and decided to prove it to them.

True to his word, when his wife died he packed up his motor home with his dwindling supply of “stuff” leaving an area in N. Idaho near Canada and headed for an area south of Three Points, AZ on the beaner border and charged all his living expenses, wants, needs, desires and gift giving (lots of gift giving) to an endless stream of credit cards. Even taking large cash advances was ok. He was amazed that the more he charged, the more they raised his limits and paying one credit cards minimum payment with another credit card had no influence at all. He would even call the billing departments to ask if they realized that at his age they were never going to be paid back. The “nice people” just told him all he had to do was make the minimum payment. Righty ho!

I never pried into just how much debt he racked up but just doing quick math in my head when he’d go on a rant put the total well north of $250,000. I’d love to know just how much he owed in the end. He even charged and donated a fully outfitted astronomical observatory to the place where he lived that cost at least $50k. The banks had no hope whatsoever of collecting that debt yet they raised his limits and continued to send more offers. He died after about 10 years and never made more than minimum payments using another card to do that. I might just pay $5 to run a background check on him to see if they ever tried to go after him once he died and the minimum payments stopped rolling in. If that kind of insanity is possible when I’m that old I might just do the same thing. Heh! The Sandy Rea Method of Living Large!

IS – the reason cc interest rates are so high is because if the huge default rate. They make their money, don’t worry about that.

Looking at it from this age, I think people find a way to live a purpose driven life even if that purpose is to service debt forever.

Some men enslave themselves to a woman. (flash, how else are those damn women going to live large?)

Others enslave themselves to a credit card company and pretend they put themselves first, buying toys and shit to fill their garages to the brim.

I worked with a guy like that. He bought himself every toy a teenage kid could dream of buying. Yet he was in his 40’s. He had dirtbikes, guitars, dune buggies. His credit rating was so good because he had applied for every damn card ou there, he had at least 300 cards which gave him so much available credit that he looked golden to every lending firm. The fucker outdid himself when he bought an ark-size RV.

I understand that llpoh. They also get to write it off as a loss. But it is a great way for a little guy to stick it to them. Still makes me laugh too!

They make their money off the morons who carry the balances yet so few of them understand that.

First, to the long list of respondents who resorted to ad hominem attacks against me; you do realize that such behavior not only reflects poorly on you as individuals, but on your attempts at legitimate rebuttal as well. The irrational notion that my statements were tantamount to personal attacks against those that are not in debt notwithstanding. To those that attempted to conflate contrived personal narratives with the actual facts at hand, I suggest you think again. Regarding the logic behind the “math” examples; I suggest you think about that old saw about not being able squeeze blood out of a rock.

There is no doubt that acts of fiscal irresponsibility are the cause of some portion of the credit card problem here in the United States. But it is not, in my opinion the root cause. In fact, it is not even one the primary causes of the problem. To the “administrator”, it is you that continues to blather on and on while conveniently ignoring the entire thrust of my argument. And that is that the key players at the top of the pyramid have rigged the “system”. And there is no doubt that Fractional reserve banking, and the power it bestows upon those that employ it, is one of tools used to exploit the working class. A fact I might add that supports my contention. Speaking of “digging deeper”, one must consider the power derived from having nearly total control over of the entire media spectrum here in the US. The impact that dominance has on social standards cannot be under estimated. We are still just scratching the surface as the problem exists on many levels.

And just for the record I am retired, we own our home and 2 cars outright. We generally zero out our credit cards monthly. We do have several purchases on revolving credit which have zero percent interest. But just to restate the obvious; my personal finances have nothing to do with my stated position on credit cards presented above.

Without a shadow of a doubt, I have been humbled by the intellectual prowess on display here. Clearly I got in way over my head and don’t belong here. It is late and time for me to retire.

Ddearborn

I have written hundreds of articles about the Federal Reserve cabal and the corporate fascists pulling the strings at the top. You are a narrow minded ideologue one trick pony. We had someone just like you on the site – Reverse Engineer. He’s long gone. See, I’m capable of seeing there are multiple reasons for the fucked up situation we have gotten ourselves into.

Don’t whine about the devastating ass kicking you’ve received on this thread. Put your big boy pants on and man up. You blame the entire thing on the shadowy oligarchs and their dastardly plan. It seems 35% of Americans can manage to pay off their credit cards every month. More don’t use credit cards at all. How did middle class people like myself and many others on this site manage to stay out of debt and save money for our future? Are we part of the dastardly plan?

One trick ponies with a narrow minded focus on one aspect of a situation bore me to death.

Now answer my fucking question about the auto loan debt and the $900 billion of home equity withdrawn by dumbass Americans at the height of the housing bubble.

I still await your answer on who forced these dumbasses to buy $40,000 SUVs on credit and use home equity to live the good life. Man up dude.

So what’s the point of not spending all of your money when you get it? I live within my means, pay my credit cards off every month, and bank the rest. Then what? I don’t trust the stock market, returns on bonds and bond funds suck, and the inflation rate (even the one they admit to rather than real inflation) is much higher than the interest I can get (if any) on the money I have so laboriously squirrelled away. So year after year my 401Ks and IRAs and bank accounts slowly grow, but if you take inflation into account they are growing less than the amount that I put in each year. Why shouldn’t I just spend it all?

DDearborn, first off welcome. Second, this place is unlike any other you will ever find on the internet. It’s generally best to lurk in the shadows a bit before flinging poo with a troupe of professional shit flinging monkeys but we can’t undo what’s been done. It’s just as much fun for us to see your dead and rotting corpse being carried away piecemeal by army ants as it is to argue the facts logically and politely. Actually…….the rotting corpse option is more fun but I digress.

Trust me, 99% of us here realize the myriad ways that are used to control us by TPTB. Your defense of “credit card debt victims” would hold more water if those “victims of credit card debt” were only using their credit cards to buy raw, whole foods to be prepared at home, electricity, gas, gasoline, water, shelter, heart transplants, blood pressure meds and cranial shunts. I’m sure there are people who only carry credit card debt on the bare minimum of essentials to sustain life. I’ve never met one and never even heard of one but I’m sure they exist.

More often than not, the “victims of credit card debt” are basically playing a game of keeping up with the Joneses or simply giving in to instant gratification. They camp out for days in line to buy a new piece of iCrap while still utilizing the perfectly usable piece of iCrap they camped out to purchase last year. They run up debts to purchase McShits and all kinds of other phood that is nutritionally deficient at best and probably harmful when consumed daily. They pay for vacations to exotic locales, buy $2000 dollars rims for the $1500 hoopty’s they drive, purchase store bought titties and buy Louis Viton, Fossil & Chanel purses to contain and control the toxic smoke billowing from their over used credit cards and then go home and cry themselves to sleep because they just got an eviction notice and the electricity was turned off. Pffft! Fuck ’em!

The vast majority of the shit purchased with credit cards is crap they don’t NEED………used to impress people they don’t really like……….. to make themselves feel better for not taking any personal responsibility for the OWN FUCKING ACTIONS! Again…..fuck ’em!

Yeah, people are being fucked six ways from Sunday from all sides but when you find yourself in a hole you don’t double down on the retard and dig faster………..you STOP DIGGING!

Paying thousands of dollars a year in interest on shit you don’t actually NEED is stupid, irresponsible and virtually guarantees that you will be a debt slave unless you break that cycle. The first step in fixing any problem begins with the individual and credit card debt is a pretty good place to start.

On the other hand, if it is your contention that people are justified in racking up all this credit card debt because they’re getting a raw deal from da gooberment, bankers and Wall St. cronies, well……….we just can’t fix that level of stupid here. You can try Huffington Post or the AOL forums but that level of stupid is usually terminal. Vaya con Dios amigo!

Araven, do you expect things to be this way forever? Do you expect things to get better after the collapse? You do realize that when this ship goes down there will be lots of opportunities to buy low like stocks and real estate in a fully unwound market. Convert any money you truly don’t need into PM’s or other items that may become scarce yet desired in the hard times ahead.

You can always send your excess funds to me and watch as I do what I’m suggesting. Help a nigga out!

Listen here all you dipshitted mongoloidish retards – Indented Sphinter is tryin ter teach you a lesson. He’s got a shit load of his personal value invested in this interweb forum, and he don’t like it when people tinker with his version of reality. He’s all about control, so if anyone new comes in, in his own bizarre and insecure way, he let’s them know the ground rules. Except his ground rules are bizarre and insecure, ergo irrelevant.

I’m droppin uh big stinky turd right on Indented Sphincters head, in recognition of his asinine interpretation of what this site truly represents. He’s not a total idiot, but has that mixture of arrogance and didactic persuasion that any conversation he enters shuts down due to the inertia of dragging along his delusional anus. Ever body circle around and hawk a loogie at his dumb ass.

Nice to take a newbie for a spin around the block at TBP.

[img [/img]

[/img]

Ddearborn

We get it. People can’t help themselves. So your argument is you can’t fix stupid. 30 years ago the average family could afford to have more shit. Now they don’t have as much money but bank has the plastic that will paper over the holes in budget. When the shan meets fit no worries I can blame it on someone else. Got it.

But like Lloph said that is not how the economy moves forward. To create productive capital that could be used to invest in industry that creates good paying jobs we need more people, Common folk, to get off the debt train. I watched the speech last night that Bernie Sanders gave. I’m a Canuck so it doesn’t really affect me but here is a guy who is talking to millions of people and basically saying that people can keep all their shit and the goobermint will continue to backstop the excess and stupidity that the vast majority are engaged in. Inequality in wealth of households is a problem no doubt about it. But if you just landed on planet from Mars you would think that the so-called 1% have enslaved the rest of us thru no fault of the 99%. If someone doesn’t like how much they are paid then find a better job. If you can’t find a better job then start a business. But to sit around and moan and groan hoping that the Berne is going to save the world is going to end in one giant circle jerk with everyone standing, cork in hand, staring and wondering what the fuck happened.

cork

fucking speck check!

🙂