When Sarah Ballard’s kitchen tile floor shifted and tiles began to crack, she knew she’d have to come up with $2,000 to make the fixes.

“A tilted tile could have sliced my foot open,” says Ballard, 38, of Jamestown, New York. “But I just didn’t have the money in the bank at the time.”

A combination of back-to-school expenses for kids and airplane tickets for the Labor Day weekend had left the family low on ready cash.

The classic emergency fund still eludes more than half of Americans, just like the Ballards, according to a new Bankrate Money Pulse survey.

Expect the unexpected

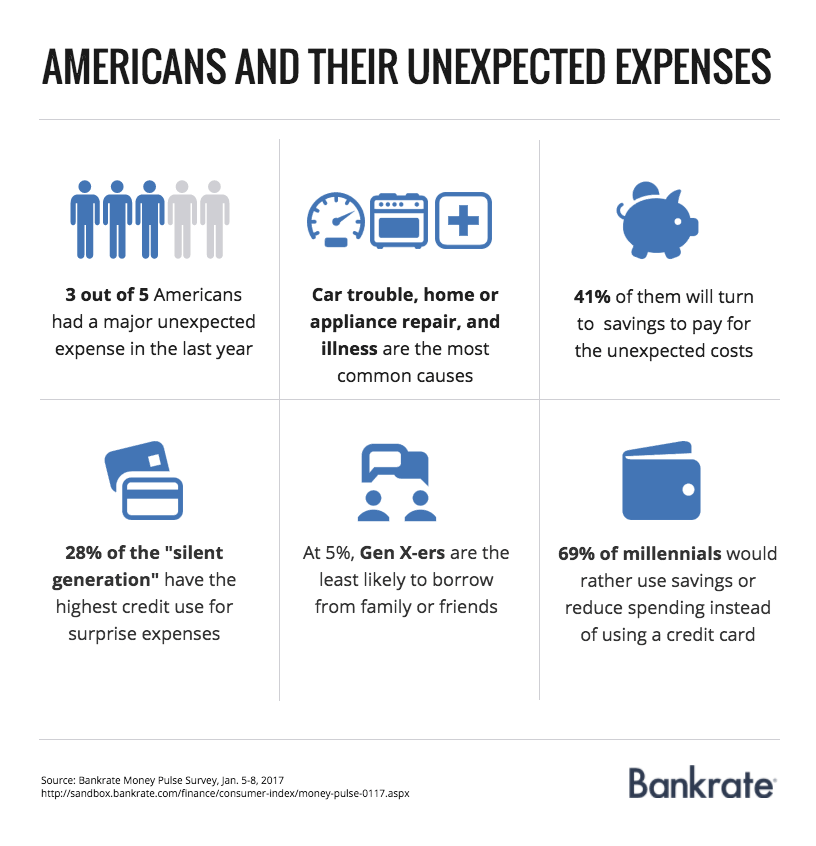

Just 41 percent of adults said they would pay an unexpected cost from savings. That’s a 4 percent increase from last year’s survey.

If you have a car, house or apartment, or a pet or child — shoot, if you’re a member of the human race — something that costs money is bound to go wrong.

In Bankrate’s latest survey, 45 percent of American adults said they or their immediate family had had a major unexpected expense in the past 12 months. That’s up 2 percent from last year.

The most common unexpected incidents are related to transportation, appliances or home-related breakdown or injury or illness.

A person’s age and work status often determines if he or she is more apt to use savings or credit cards to pay for the unexpected.

Millennials are much likelier to tap savings, with 45 percent saying so, possibly because they continue giving the cold shoulder to credit cards. Members of the “silent generation” (71 years and older) have the highest credit use for unexpected expenses, at 28 percent.

Whether or not you’re a parent definitely plays a part in cash flow. Parents were less likely, at 36 percent, to use savings for an unexpected expense than the childless, at 43 percent.

Fear factor

Americans are increasingly aware of the need to save for emergencies, says Carina Diamond, a certified financial planner professional in Akron, Ohio, and board ambassador for the CFP Board.

“I wish I could say it’s because people are smarter about it, but it’s really the fear factor,” she says. “One little thing — a new roof, a medical emergency — can set you up for financial disaster if you don’t have an emergency fund.”

People say they’ll borrow from an IRA or 401(k), tap into home equity or turn to family members, but Diamond discourages these options. None of them is without negative implications, and nothing beats emergency cash in the bank, she says.

“It is a much better alternative,” she says. “There is nothing as quick and free of negative consequences.”

Finding budget cuts

One way to put more into an emergency savings is to cut spending, and different age groups prefer to cut their spending in various ways.

Overall, 37 percent of Americans said they were very or somewhat likely to cut back on alcohol if they needed or wanted to save more money. Millennials were the most in favor of cutting back on alcohol, with 51 percent saying they’d be very or somewhat likely to do so. The silent generation had a 17 percent favorability rating on willingness to cut their alcohol spend.

Younger millennials were the biggest group, at 46 percent, to say they were very likely to cut back on buying coffee in a coffee or doughnut shop. Overall, 44 percent said they’d cut back on coffee purchases.

Set reasonable goals

Paul Golden, a spokesman for the National Endowment for Financial Education in Dallas, is not a fan of the recommendation that you keep the equivalent of six to nine months’ expenses in your emergency account.

It’s simply unrealistic at some income levels to accumulate that much cash.

“If you tell a family making $60,000 that they need to have $40,000, it’s very unrealistic,” he says.

When the very goal becomes discouraging, an individual can find it all too easy to give up. Instead, Golden recommends starting with a smaller amount.

“Even $500 has been proven to have a psychological benefit,” he says. “It improves people’s psychological well-being and shows you have the ability to set (and meet) an achievable goal.”

Once you meet that amount, reset the bar.

“Reach a $500 goal, then $1,000,” Golden says.

Building emergency cash

The way to build up a fund is to set priorities and track where your money is going. It takes diligence, Golden says, and it is best done over several months, not just one.

“That gives you a sense of where you can find gaps, impulse spending to find money to put in that emergency account,” Golden says.

Diamond strongly discourages borrowing from a retirement account in an emergency situation.

“You’re compromising your future,” she cautions.

Diamond advises you to pay yourself first.

“Every month, you put money in your 401(k), you pay off debt. Putting month in an emergency fund each month is just another monthly expense,” she says.

If you’re a homeowner, she recommends using a home equity line of credit.

“Have that as an emergency fund,” Diamond says.

While you’re paying it off, the interest is tax-deductible.

The lesson is to expect the unexpected.

“It’s not a matter of if but when an unexpected expense will pop up,” Golden says. “It’s only a matter of time.”

Oh come on, who needs savings when we have credit cards? (or home equity!)

“A combination of back-to-school expenses for kids and airplane tickets for the Labor Day weekend had left the family low on ready cash.”

It sounds like Sarah Ballard did have $2,000 to fix her kitchen floor but spent it on a Labor Day vacation instead of home repair. She prioritized her expenses.

Ya that was my thought as well. If you don’t have 2000 in cash, in an envelope, somewhere in you house, you have no business going on vacation. Come on.

Keeping some of your emergency fund in the bank is fine, but a good portion of it should be cash. You can get to it, instantly. Another side bonus, the types of people who will most likely be installing your new floor will probably give you a slight break on the price of you pay them in cash.

A lot like people that used their home equity like an ATM CARD and then cried poor me after borrowing more than they could possibly ever pay back

Really?

Banks can seize your deposits to pay off their bad bets. Keep any short-term funds in your mattress – or, perhaps, a credit union. They’re less likely to make bad bets to begin with.

Some households are cyclic – I’m a consultant, so my income is variable. Right now, I’m paying down credit card debt, putting savings away and rebuilding small investments – all of which I spent from last March to the end of October, during a dry spell for income. I never used up ALL my savings, or touched the retirement funds – making me a national rarity. Another few months of no real income would have made me liquidate an IRA, though – just to pay expenses.

Obama can’t leave office soon enough. I’m now paying more for ObamaDontCare premiums than my house note (mortgage), so his legacy is waste, fraud and expense as far as I’m concerned.

Da Nigga is a lying low life mutha fucka “Just Saying”

When everything this president put his dick beaters on is a train wreck and he and his supporters claim what a grand success he is , I must wonder all the mechanical projects I had to successfully complete on time and under budget and warrenty . In any level of government how bad do you get to fuck up and not get fired and maybe prosecuted ?

Nobody, I love these kind of bullshit articles that normalize the absurd. A single mother with no money in the bank flying a bunch of kids around is absurd. Money only buys two things, security and lifestyle, in that order. Forget that at your own risk. Two grand for some cracked floor tile? Ooooookay. Sounds like an emergency to me.

4 in 10 have savings for an emergency, eh? That number should plummet if the banksters get their way and ban cash.

Simple idea- live on less than you earn! Duh. Anyone can do it, but how many will? Do for yourself instead of hiring it done. Make your own coffee. Work for your future, not your present. Shop more carefully. Again, Duh.

News flash….

Most Americans are stupid. And entitled.

That being said, I have more saved in gold, silver, and platinum then cash. I should have a bit more cash on hand.

Low wage jobs , low life employers sponsored and supported by low life politicians created more poor people than ever since WW2 and Bushes Clinton’s and Obama only made matters worse ! Our government and its insiders threw average Americans overboard 40 years ago ! We must remember 2 facts

1) “THEY” don’t give a fuck about you !

2) You can never believe anything our government tells us “NOTHING”

Saving is a habit almost impossible to acquire and also almost impossible to break.

Sarah Ballard is an idiot. She’s got money to piss away for plane tickets for a Labor Day weekend but not two grand to fix her floor?

NEXT!

I always keep enough cash around to rent a couple of hookers for golden showers. Doesn’t everybody?