Guest Post by Michael Batnick

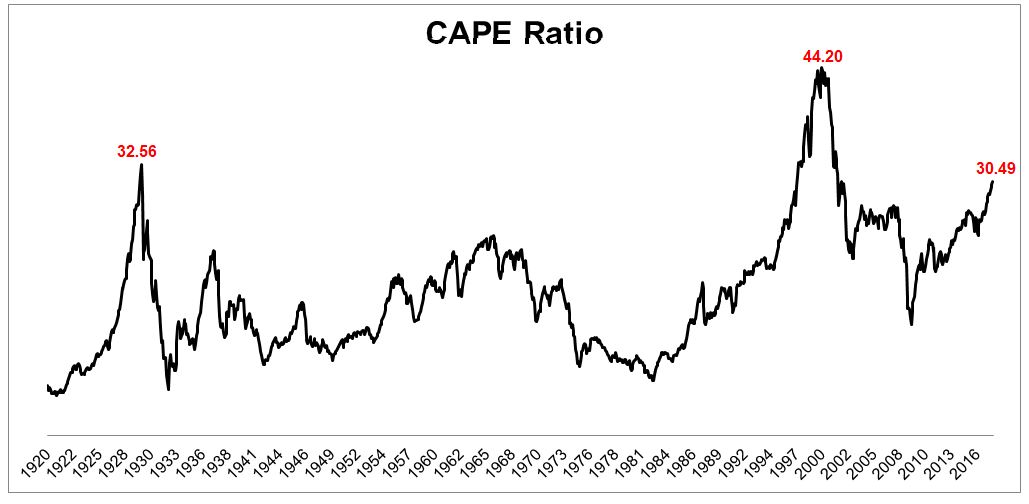

Eight days before the market bottomed in July 1932, Ben Graham wrote an article in Forbes, Should Rich But Losing Corporations Be Liquidated? In it he wrote, “More than one industrial company in three selling for less than its net current assets, with a large number quoted at less than their unencumbered cash.” At a time when the CAPE ratio was just above 5, many businesses were worth more dead than alive.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

What would have to happen for companies to be selling for less than their net current assets? I don’t have the slightest idea. An asset bubble built on the back of artificially low rates seems like the obvious answer, so that can’t be right, but if it is, I warned ya. But honestly, for the market to fall 90%, I’m thinking aliens, an asteroid, or another world war seem the most likely culprits.

The aftermath of the depression was a gold mine for value investors. Well, really for any investors, but for those that measured intrinsic value, it was nearly impossible to miss. From The White Sharks of Wall Street:

Here was a company being offered for sale for less than the cash in its pocket! All a fellow had to do was borrow the purchase price, buy the company, and use the company’s own cash to pay off the loan- it was like getting the company for free. Why wasn’t everyone lining up to bid against him? The answer lies partly in the psychological baggage that American industry carried out of the Depression. Despite the almost unprecedented prosperity brought by government wartime contracts, many American business leaders believed that the nation would slide promptly back into a depression the moment the war was over. A gamble on the scale that Evans was prepared to take was simply unthinkable for most of them. The engine for the deal, after all, was debt. And going into debt to finance a speculative venture- well, wasn’t that what the 1920s had been about? And didn’t it end very badly?

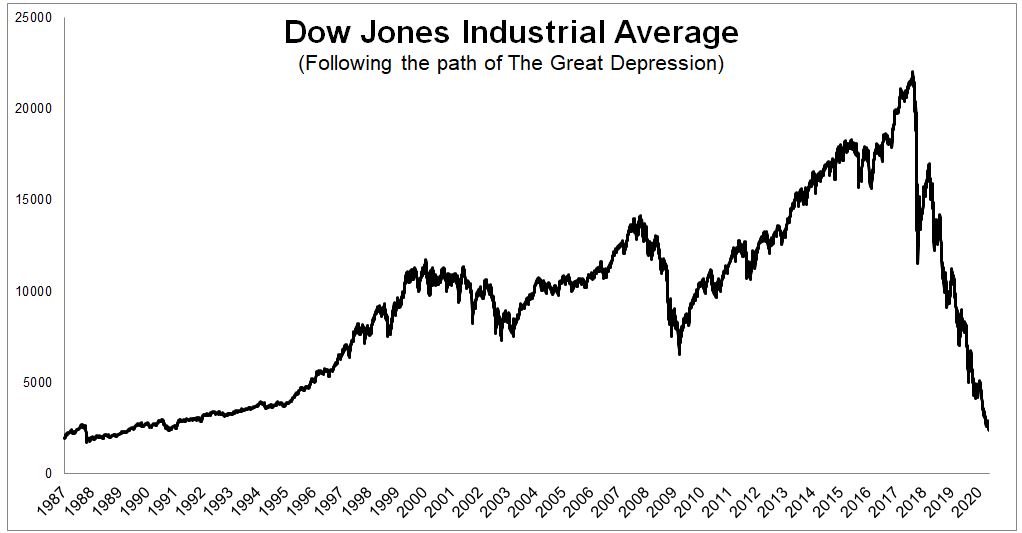

A Great Depression style crash would take the Dow back to where it was in May, 1989, wiping out 28 years of gains (not including dividends).

What would a 21st century bargain look like? Let’s use Amazon as an example. According to data compiled from Ycharts, Amazon’s net current assets are $2.061 billion. If you could purchase Amazon for this price, each share would cost you $4.29, down from the $994 its currently trading at; a cool 99.57% discount. This sounds absurd and unimaginable. The latter it is, the former it is not.

In October 2008, Jason Zweig wrote an article, What History Tells Us About the Market . In it, he shared that depression style discounts were not just a thing of the past. Charles Schwab Corp had a market capitalization of $28.8 billion, while holding $27.8 billion in cash. There were 875 other stocks that traded below the value of their per-share holdings of cash.

U.S. stocks have a valuation that is in line with two of the biggest market peaks of all-time, so if this is 1929, it will be a nightmare for this generation, and a gift for future ones. And while I can’t imagine a scenario that takes us to Dow 2,400, Dow 15,000, a 32% decline, seems well within the realm of possibility.

Josh Brown nails the mindset that we should take with respect to market risks: “We should always invest as though the best is yet to come but the worst could be right around the corner.”

Factor in that in 1929 our money was gold and silver and adjust things accordingly.

ADMIN

Just a possible idea for a new article for your consideration.

The idea popped into my head because Ms Freud’s son is a NYC stockbroker …. who thinks things have never been better.

I googled — “does the stock market accurately reflect the economy”.

Pretty much most of the articles said “yes”. This article below even lampoons those who say no.

https://www.forbes.com/sites/jerrybowyer/2013/04/28/the-economy-has-nothing-to-do-with-the-stock-markets-right/#6b1caa50140a

Now, I’m pretty sure Ms Freud’s son and these pro-stock-market/economy articles are totally full of shit.

But, I don’t know why . or at least I can’t explain it.

You, otoh, could probably write a killer article. IF you want to — (no big deal if you don’t).

For the 5%, it is the economy.

How about the similarities of Pimps and Wall Street Brokers?

Remember that episode of the Twilight Zone where the tycoon makes a deal with Julie Newmar as the devil. He gets to go back in time and do it all over again plus with what he knows of the future. He makes a deal to buy some oil lands outside his hometown and thinks he has cheated the hick realtor and banker. Problem was the oil lay too deep and it would be twenty years before it could be drilled but he invested all of his capital in the deal!

Watch the upcoming correction closely. If the S&P plunges through the 1500+/- level, then we are looking at the start of something big. If it bounces off that level (or higher) and resumes upward, we’re looking at 10+ years of same-economy-but-more-of-it.

And just a reminder, for the sake of perspective: the world as we know it didn’t end when the S&P fell to 666 (EGAD!) in March 2009.

The stock market is not reality it’s some flash trade bizarro world where real facts and figures mean nothing . Reality is 20 trillion in national debt 200 trillion in unfunded mandates and some pie in the sky derivetes in a quadrillion figure which places everything in some sort of free fall la la land . The fall is nothing it’s the sudden stop at the end . Prepare to pull the rip cord accordingly or aim to hit something soft or hard just so somebody else can clean up the mess .

What ever happened to the guy in 2008 singing “JUMP YOU FUCKERS” ?

Another question I have is just how honest the numbers are that are being presented online as reality.Do those companies really have cash or assets or is it just funny accounting?