I’m frequently asked, “Should I count on social security when doing retirement planning?” The best approach is to discuss what my wife Jo and I have experienced.

I’m frequently asked, “Should I count on social security when doing retirement planning?” The best approach is to discuss what my wife Jo and I have experienced.

I compared our 2018 benefit statement with 2015. Our Cost of Living Increase (COLA) was 2.3% – (1.15% annually). Our net payments dropped approximately 1.75% – we are clearing less today than we did in 2015. Why did that happen?

The government reduces our benefits for Medicare and drug insurance premiums. In 2015, we paid a combined $2,517.60 in Medicare premiums and $575.40 for drug insurance premiums. The government increased our 2018 Medicare Premiums 23.9% to $602.40. Our drug premiums increased 161% to $924.60. Since 2015, Jo’s net monthly benefit dropped by 5%. That does not bode well for the future.

Will our net monthly income from social security ever really keep up with inflation?

Don’t waste your time trying to convince a retiree that inflation is under control. While receiving small COLA increases in benefits, medical costs are increasing by double to triple digits with no end in sight.

Been to a restaurant or grocery store lately? With the increases in the minimum wage, double-digit price increases are much too common.

Good friend Chuck Butler regularly writes about the “hedonic adjustments” made by government economists to suit the needs of the government – particularly when it comes to inflation. Government reported inflation is low when it’s tied to benefits, but when it comes to charging for Medicare and drugs the charges skyrocket.

US Inflation Calculator tells us inflation increased 2.8% over the same time frame.

Renowned economist John Williams’ website, Shadowstats.com provides detailed charts outlining the magnitude of the “hedonic adjustments”. If inflation were calculated in the same manner it was in 1980, today it would be approximately 10%. Using the calculation methods from 1990, it would be approximately 6%.

Lord knows how much higher the government debt would be if retired government workers and social security recipients received honest COLA increases annually.

| A math major and government economist are discussing how much is 2 plus 2? The math major says, “Exactly 4.0.” The government economist grins and asks, “How much do you want it to be?” |

What the government giveth, they take away and more!

While social security was originally sold as retirement insurance it has changed dramatically. The government decided to get into the healthcare business and the premiums are skyrocketing.

The U. S. Debt Clock currently indicates UNFUNDED US liabilities over $111 trillion. Social Security and Medicare combined amount to approximately $44 trillion.

Hang on a minute! Isn’t there supposed to be a social security trust fund? How can the liability be “unfunded?”

Theoretically, when money was deducted from your paycheck it was to be held by the government in trust, invested, and be waiting for you when you retire. Social security was not a gift from the government, but rather returning YOUR money.

The trust fund may exist but it consists of government IOU’s. The government spent your money to pay current bills, banking on the fact the population would continue to grow and pay more in taxes than was required to be paid out in benefits.

It’s no longer happening that way. Benefit payments are exceeding revenue collected; requiring the government to borrow money to pay the difference.

The Heritage Foundation provides a graphic showing the problem is increasing rapidly.

While Congress prefers to ignore the situation, the day of political reckoning will eventually arrive.

State pension funds also are inadequately funded

Good friend Doug H. sent me an article, “Mass Exodus: Hundreds of Thousands of People Fled These Three Deep Blue States in 2017”. He highlighted the portion about Illinois:

“Long beset by twin budget and pension crises and the erosion of its tax base, Illinois lost so many residents that it dropped from the fifth to the sixth-most populous state in 2017….”

What’s the difference between the states who are facing huge underfunded pensions, versus the federal government and Social Security?

Some state courts have required honest accounting and reporting. In late 2016 the “CalPERS board gives green light to cut assumed rate of return to 7%”. In the current environment, a 7% return sounds like a lot of high-risk investments, but it is at least a step in the right direction. Unfortunately, there is little oversight at the federal level.

State pension funds invest in debt instruments of others. The social security trust fund is all federal IOU’s.

Many Illinois pensions are guaranteed by the state constitution. The Illinois Supreme court ruled that a constitutional amendment is required to change the benefits. With Social Security, the federal government can amend the plan at will and has a history of doing so.

While I doubt that this will ever come out of committee, in December 2016 Yahoo Finance published this; “Here’s a First Draft of GOP’s Plan to Overhaul Social Security.”

Here are some highlights:

- Gradually increasing the retirement age for full benefits from age 67 to 69.

- Adopting a less generous Cost of Living Adjustment (COLA) formula.

- Means testing, reducing benefit payments to wealthier retirees.

- Eliminate COLA increases for wealthier individuals.

- Increase the minimum benefit for lower-income workers.

The article summarizes, “(This) proposal … is little more than an opening bid in a much larger conversation about entitlement reform (emphasis mine) in the coming year.”

Social security went from a trust fund holding your money to another government entitlement program. It’s now nothing more than political promises.

The major difference between social security and any state, local or private pension program is simple. The federal government can create money. The political class willingly prints away increasing government debt as opposed to using any fiscal restraint. State pension benefits are paid by investment income, current taxes and borrowing.

| The similarity of social security versus state pensions promises is simple. Both are political promises that are financially impossible for governments to keep. |

The political class looks for ways to reduce benefits and increase taxes without creating a rebellion. Social Security benefits must be cut and taxes increased. Every generation will be affected; the political fight will be over who will bear the largest burden from the broken promises.

Can you count on social security in the future?

My opinion is nothing more than an educated guess based on what my wife and I are experiencing. Were we 20 years younger doing our financial planning here are things we would consider.

- Count on receiving some social security, just don’t bank on it. Social security is called “The third rail of politics”. Politicians know radically cutting benefits will cause them to lose their job. Don’t count on social security as a major plank of your retirement security, maximize your 401k, IRA and any other retirement savings plan you might have.

- Your first social security check is the biggest one. With each passing month, the buying power of your benefit will go down due to inflation. The government manipulates the COLA numbers to save money, while increasing the costs of medical and drug premiums. Note the mention of “Adopting a less generous Cost of Living Adjustment (COLA) formula” in the Yahoo Finance article. “Less generous??” What a joke!

- Expect the full retirement date to be pushed back. Our society is living longer. A person retiring at age 65 today has a good chance of living another 20 years or more. That’s a long time to pay benefits. Expect the government to gradually move the full retirement date to age 70 or higher; plan on working longer.

- Expect your full benefits to be taxed. Depending on your income up to 85% of your benefits are currently taxed. Expect that to be raised in the future as a prelude to means testing.

Take action now! It’s never too early to begin your retirement savings plan. You can’t count on the government to take care of you. For generations, politicians made promises to get elected. Today many of those promises are coming due – and are impossible to keep.

The longer Congress ignores the problem, the more draconian the solution will be. Those who see things clearly, and work around it will be much better off. Unless you plan on working until you die, you better get serious about saving money!

If you are thinking about when you should file for social security, I suggest you download our free report, “The #1 Secret You MUST Know Before Filing For Social Security”.

You paid a lot of money into the system and want to have as much of YOUR money returned as possible before you die. Do your homework and don’t make your decision hastily.

CLICK HERE to access the FREE report.

And Finally…

“If you always protect your offspring in a cocoon they will never learn how to fly…”

For more information, check out my website or follow me on FaceBook.

Get your FREE Special Report:

10 Easy Steps To The Ultimate Worry-Free Retirement Plan

Until next time…

Dennis

www.MillerOnTheMoney.com

Retirees can ‘hedonically’ adjust their protein intake from beef, to chicken to Ken’l’ Ration.

“In 2015, we paid a combined $2,517.60 in Medicare premiums and $575.40 for drug insurance premiums. The government increased our 2018 Medicare Premiums 23.9% to $602.40. Our drug premiums increased 161% to $924.60. ”

That seems like a rather glaring math error. 2,517.60 * 1.239 = 3119.30. Not sure where the 602.40 comes from. Ah, the $602.40 is the amount it increased. What the heck they complaining about? Millions have taken it up the butt for 10 times that increase.

Math is usually a shortcoming in articles like this.

As are charts predicting deficits that don’t take into account changes in collections over the same period.

In any event, if your Medicare premiums are getting out of hand you can leave the system (but can’t reenter it) and get private insurance instead. Few people do this.

Hardly anybody is go retire any more – at least not at 65. Maybe 75. A lot has changed since 1935 when SS was enacted 83 years ago. I’m 68 and I’ll be designing and writing code as long as I can.

Expenses still continue – cars / appliances / electronics / property taxes / roofs / on and on. SS will never cover that – and I don’t think investments in 401k’s will cover it either. One needs income.

I pay $136 for Medicare part B, and $120 for a Health Partners supplemental policy – about $250 a month total.

I just had authroplasty of my left hip (hip replacement) – I had to pay a $200 co-pay. Doesn’t seem bad to me – you younger fuckers – just keep workin’ you ass off 🙂

Hi Iconoclast,

While I agree that others have taken much larger increases, two wrongs don’t make it right. Those who have had larger increases are also being scammed by politicians using our money to buy votes…..

What they have done to baby boomers is taken social security from a retirement program to another welfare program.

Bottom line is simple, retirees will get something but the buying power will decrease with each passing year, making the retirement challenge even more difficult.

Best regards,

Dennis Miller

I guess we’ll see the Bonus Veteran’s type march one day ? Folks caring signs demanding their money from SS. I wonder who’ll have the balls to tell them that it was a tax and they aren’t “Entitled ” to shit !

Hmm…Patton led the charge on the Bonus Veterans under the orders of MacArthur …..I wonder who’ll led the charge this time ? Probably the soldiers who aren’t getting paid either . The only difference is these old farts marching are well armed this time .

Don’t expect anything.Even from 401s or IRAs which will probably be taken at some point in placed into the general public fund.

If I was still a young man I would want this whole damn system to Collapse in on its self.Now that I’m 56 I’m not so sure as much as I hate this damn ” system “.

Hi BB,

Many may not know that Pelosi wanted to force those with IRA and 401k’s to be required to hold government debt in them because it was “safer”. Fortunately that bill never got passed.

You may be right, the day may come when they force savers to hold government IOU’s.

Best regards,

Dennis Miller

The city of Galveston Texas was the last municipality “allowed” to “opt out” of the federal Social Security system. The average retiree of the Galveston system collects approximately THREE TIMES what the average social security system recipient gets…sorta tells you something…

Despite the “supreme court” calling “Social Security” a “tax” and that the “rules of the game” can be changed at any time, most people feel that it is not an “entitlement” for those who have “skin in the game”–employees AND employers…

FICA is defined as “Federal INSURANCE Contributions Act”…

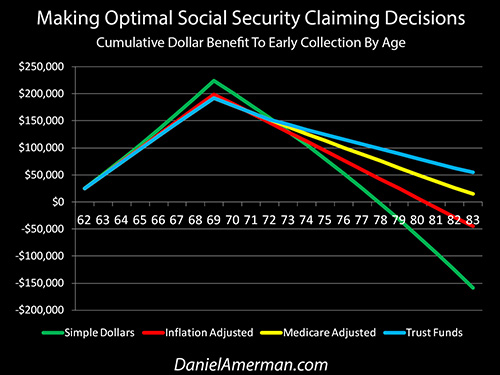

Jannis Joplin-“get it while you can” comes to mind regarding SS. Don’t fall for that “wait until you’re 70 and get a bigger check” BS. You won’t. The guy below has many “eye openers” that will really open your eyes.

http://danielamerman.com/articles/2017/Lag3A.html

I seem to recall if you start taking SS at 62 and ,assuming you have ‘ other income ‘ under the tax threshold, the breakeven for getting even is 76. I figure I took about 80 grand from these fukkers by filing at 62 and collecting for 6 years. My financial plan is to always do the opposite of what .gov recommends and simply drop dead the day before all my money runs out. Cheers !

Close Zigzag, the cross over is 79 for simple dollars, 83 for inflation adjusted and 89 for medicare adjusted. See the bottom of this page.

yo “steve” – I be a “steve” and a “Joplin lover”. My favorite: “piece of my heart”. hoo-wah.

I remember (from what I remember) sneaking backstage at a Hollywood (Fla) pop festival held at the old Sportatorium on the edge of the Everglades. Dec 27-29 1969. Anyway, there’s Johnny Winter and Janis at a campfire passing a bottle between themselves of Jack(?). Bliss for a 16 yo…

Soooo . . . what the HELLo else is new?! As a FIRST-year “Boomer” (’46), when the carnage/violent mass blood-letting was replaced with ejaculate of mass “divine co-minglings” of [returning war vet] Man to [waiting] wo[mb]Man; now at 71+, after being drafted and experiencing war myself “up close and personal” in ‘Nam (’69), followed by a couple of years of int’l careening – pretty-much ripped to the tits 24/7, culminating in 5 years at BangKwang, Thailand’s notorious maximum security prison, I am now increasingly mollified daily by the thought of being “a little closer to Home”. Considering the “State” of absolutely blatant and pervasive “official/gov” criminality, PRIVATELY-held [NOT]Federal[NO]Reserve on-going FIAT debt-enslavement, corp-owned media “DISinfo-tainment” DISTRACTION, BigPharma/al-CIA-da mass drug-trafficking/pushing, debilitating “MonSATAN” GM/chem saturation, forced adjuvant/chem-adulterated vaccines, corp/gov-subsidized lib-turd academic cry-bullies, AI killer drones/robots, cyber-war, space weapons, brain chips etc; I hope said “almighty Author”[Lord] has already “checked me out” before – as Jim Morrison of the Doors was purported to once not-so-eloquently have stated, “. . . the whole sh*thouse goes up in flames”, and the radioactive ash begins to settle along with that of the on-going Fukushima catastrophe. Now, as a [daily] REPENTant and therefore REDEEMed reprobate, it is [continuously] incumbent upon me to both “give NOTICE” and humbly seek the forgiveness of each and every other very special and unique Man/wo[mb]Man, created in the image of said “Author” and manifested IN to this world, but . . . “NOT OF it”.

I talked to my financial consultants Dewey Cheathem and Howe. They said I could retire at 66….for eight minutes then I have to go back to work .