Authored by Brandon Smith via Alt-Market.com,

The crash of 2008 brought with it a host of strange economic paradigms rarely if ever seen in history; paradigms which have turned normal fiscal analysis on its head. While some core fundamentals remain the same no matter what occurs, the reporting of this data has been deliberately skewed to hide the truth.

But what is the truth? Well, at bottom, the truth is that most economies around the world are far weaker than the picture governments and central banks have painted. This is especially true for the United States.

That said, one country has been pursuing an opposite strategy for many years now — meaning, it has been hiding its economic preparedness more than its weaknesses. I am of course speaking of China.

When we mention China in the world of alternative analysis, several issues always arise: China’s expanding debt burden, government spending on seemingly useless infrastructure programs like “ghost cities,” China’s central bank and its corporate subset misreporting financial figures regularly, etc. All of these things fuel the notion that when a global fiscal disaster inevitably takes place, it will emanate first from China. They also give the American public the false impression that a trade war against China will be easily won and that China will immediately falter under the weight of its own veiled instabilities.

However, if one actually studies China’s behavior and activities the past decade, they would see a method to the apparent madness.

In fact, some of China’s actions seem to suggest that the nation has been preparing for years for the exact geopolitical conditions we see today. It’s as if someone warned them ahead of time…

In terms of prepping for a trade war with the U.S., China has implemented several important steps. For example, for at least the past 10 years the country has been shifting away from a pure export economy and reducing its reliance on sales of goods to the U.S. In 2018, Chinese consumer purchases of goods are expected to surpass that of American consumers. For the past five years, domestic consumption in China accounted for between 55% to 65% of economic growth, and private consumption was the primary driver of the Chinese economy — NOT exports.

The argument that China is somehow dependent on U.S. markets and consumers in order to keep its economy alive is simply a lie. China is now just as enticing a retail market as the U.S., and its domestic market can pick up some of the slack in the event that U.S. markets are suddenly closed to Chinese exports.

The problem of swiftly growing Chinese debt is presented often as the key argument against the nation surviving a global economic reset or trade war, with its “shadow banking” system threatening to unleash a long hidden credit crisis and stock market plunge. But this is not the complete story.

The exact amount of fiat printing that China’s central bank undertook after the 2008 crash is not known. Some estimates calculate China’s debt to now sit at around 250% of its gross domestic product. By normal standards this would suggest a credit crisis is imminent. But was China’s sudden interest in debt expansion a reactionary matter, or was it part of a bigger plan?

Just after 2008, a common argument against China’s resilience was the notion that China was dependent on holding U.S. dollar reserves in order to keep its own currency weak. Meaning, Chinese companies had to sell goods to the U.S. in exchange for dollars, which they then exchanged to the central bank for Yuan. China’s central bank then held those trillions of dollars in reserve as a means to keep the dollar artificially stronger on the global market, and the Yuan weaker, thus supporting and perpetuating the old export model.

Obviously this argument is no longer applicable, or outright absurd.

China’s own debt expansion and Treasury bond issuance actually started way back in 2005 under the “Panda Bond” program. At the time it was treated like a novelty or a joke by the mainstream economic community. Today, it is a powerhouse as Yuan denominated assets are spreading around the world.

China no longer needs to hold dollars or dollar denominated assets in order to keep its currency weaker for export markets. It can simply inflate and monetize its own debt, just like the U.S. does. But why would China bother to do this at all? Why jump into the same debt game that has caused so much trouble for western nations?

Perhaps because they know something we don’t. During the initial phase of the derivatives crisis, the possibility of China joining the International Monetary Fund’s Special Drawing Rights basket leaped to the forefront. With the Yuan as an SDR basket member, its potential to become a financial center for global trade rather than just an export and import hub would be assured. But the IMF set certain requirements before China could join. One of these requirements was far greater currency liquidity and a more “freely usable” Yuan market. In other words, for China to join the SDR basket they would first need to go into considerable debt.

This is exactly what they did; not to prop up their banking system (though this made for a valid excuse) or to necessarily prop up their stock markets. Rather, China wanted a seat at the table of the “new world order,” and they bought that seat through massive debt expansion. China was officially included in the SDR basket in 2016.

China has been a very vocal proponent of the SDR basket system, and it becomes clear why if you understand what the globalists intend for the future of the world’s monetary framework. This plan was first outlined in the globalist controlled Economist magazine in 1988 in an article calling for the beginnings of a global currency in 2018. The article states that the U.S. economy and the role of the dollar as world reserve would have to be diminished, and that the IMF’s Special Drawing Rights basket could be used as a bridge to set up a single currency for all the world’s economies.

This currency would of course be administered and controlled by the banking elites at the IMF.

Since 2009, China’s central bank has called for the SDR to become a “super-sovereign reserve currency,” in other words, a global currency system. In 2017, the vice governor of China’s central bank stated that central banks should increase their use of the SDR as a unit of account and that greater SDR liquidity should be encouraged. In 2015, China’s central bank suggested that the SDR system should “go digital,” creating a digital version of the reserve so that it could spread quickly.

It should come as no surprise that the IMF is in full agreement with this plan and has even suggested in recent articles on its website that cryptocurrencies and blockchain technology are the future evolution of the monetary system.

Notorious globalist George Soros revealed a few darker details of what the IMF calls the “global economic reset” in an interview in 2009; these details included a diminished American economy, a diminished dollar and for China to become a new economic engine for the world.

Finally, China has clearly been prepping for a considerable crisis in the dollar or in the world’s economic stability as shown in its sudden and aggressive stockpiling of gold reserves the past decade. Only recently surpassed by Russia in purchases, China is one of the most aggressive national buyers of gold. An expanding gold stockpile would be an effective hedge against a collapsing dollar market. If the dollar loses its world reserve status, nations like China and Russia are placed well to mitigate the damages. Considering the fact that the IMF officially holds around 3,000 tons of gold, the globalists are also well placed for a dollar crash.

It would appear that China has been included at many levels in the plan for the global reset. All of the previously mentioned actions suggest foreknowledge of a dramatic shift in the dollar model. The trade war itself provides perfect cover for the economic reset, as I have been warning in my latest articles. China would play an important role in the reset, as they have the ability to dump U.S. Treasuries and the dollar as world reserve, causing a chain reaction through global markets as their trading partners follow along in a domino chain.

They will likely do this quietly (as Russia recently did), in order to pawn off their T-bond holdings before news of a Treasury dump hits the mainstream. The primary beneficiaries of this act will be the globalists, while China has placed itself to survive (not necessarily to thrive) during the chaos. The same cannot necessarily be said for the U.S., which suffers from the Achilles Heel of total dependency on the dollar’s primacy.

* * *

If you would like to support the publishing of articles like the one you have just read, visit our donations page here. We greatly appreciate your patronage.

Since China exports far more to us than we do to them (a net income for them and a net expense for us) they have nothing to win and everything to lose if they want to play the trade war game.

That’s nuts. The exchange is exactly equal, from an accounting view. China is exporting actual usable goods to us and importing dollars. That’s the same thing that happens when you buy groceries. Most of us don’t consider ourselves to have a “trade deficit” with the grocery store.

What they lose if trade slows down is an influx of increasingly worthless FRNs. What we lose is cheap access to things that make our lives better (why else would we buy them?).

I don’t think you understand the term “trade”, and probably don’t realize that those dollars that China is “importing” are promissory note, a debt obligation that we have to make good on by paying them off at some future dates with our own real goods and property.

It would be like giving your grocery store an IOU that has to be made good on in the future in exchange for groceries.

https://www.youtube.com/watch?v=30knrJBeyr0

I think I do understand “trade”. If we were using real money, gold, which is also a commodity, we would be trading goods, commodities (including gold), and services in return for goods, commodities, and services. There would never be a “trade deficit”. If the gold ran low, then we would have to trade more goods, services, and non-gold commodities to be able to import the same amount of stuff.

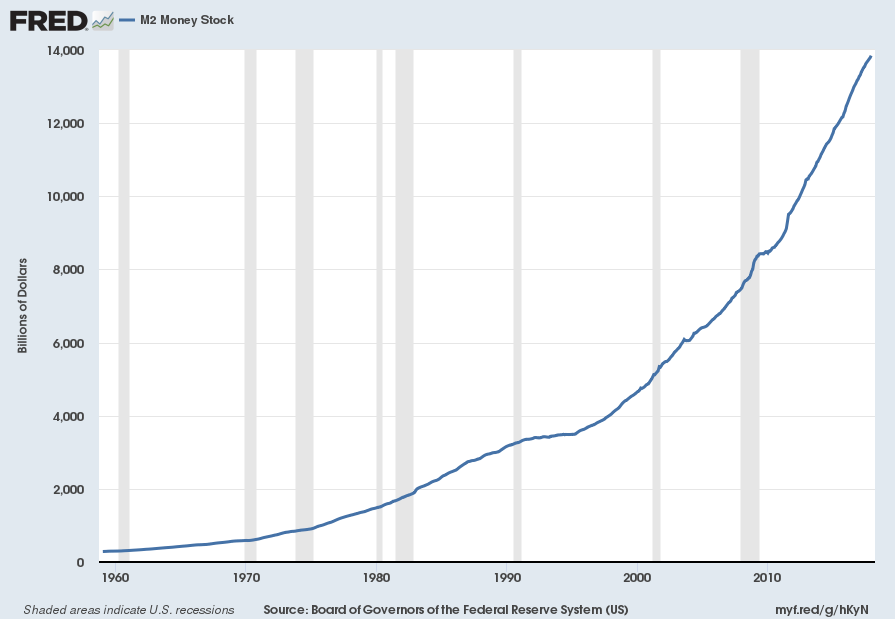

But we’re not using gold; we’re using something purportedly as good as gold: the U.S. dollar. Now, nobody with more than two brain cells to rub together really believes the dollar is as good as gold. Hell, the FED, guardian of the dollar’s stability, publicly claims to want to devalue the dollar by exactly 2% per year. My maff’s a little rusty, but I think that would mean the dollar losing half it’s value every 35 years or so. NOT the same as gold. Anybody who has to live in the real world knows it’s already far higher than that. The FED and USG can create as many FRNs out of thin air as they please and that’s just what they do:

[img [/img]

[/img]

You kind of made my argument for me, “It would be like giving your grocery store an IOU that has to be made good on in the future in exchange for groceries”.

Well, that’s exactly what I do. I write a check denominated in dollars the same way we buy things from China with dollars. And the deal is done. According to the legal tender laws, the transaction is now complete. I don’t owe the store anything. True, dollars represent debt, but who actually pays?

The real problem is that the value of those dollars is tanking by the minute. For whatever reasons, China and the rest of the world are willing to play along for now and pretend dollars are real money, but it’s like a game of Hot Potato. Nobody wants to be the last one holding them. Because that’s who actually finally pays for that dollar. The original counterfeiter gets off scot-free.

In an honest money system, you would be completely correct. Those dollars would be a claim on a specific amount of gold. It even said so on the money:

[img [/img]

[/img]

But given that we’re talking about fiat money, the only way the Chinese would lose out would be if they were too dumb to unload those dollars. From what I read, they’re using more and more of them to buy … do I need to say it?

Finally, lots of repeated edits by me. Can’t seem to get them to stick. Hope whatever shows still makes sense.

China have been around much longer than the USA. During the economic reset they used their quantative easing to build infrastructure (ghost cities). USA chose to enrich bankers where their money sits earning dividends in a fake robust economy. These US elitist are not hiring, not manufacturing, not buying (they already have everything they want or need). They sit and compound their riches. I see a great migration from the world to China’s ghost cities when the next big crash occurs making China the worlds dominate power many fold…..they are fully prepared to allow proper immigration of those wanting to assimilate and produce and become part of a profitable society. Unlike what our Marxist democrats want. (Illegal immigration of people’s with IQ’s of 70.)

“All of these things fuel the notion that when a global fiscal disaster inevitably takes place, it will emanate first from China.”

——

The wealth transfer from the West to Asia has been going on for decades; always accompanied by war and economic bubbles. The economic “canary in the coal mine” could be Japan and the war canary will likely be Israel? Watch.

Normally a fan of Smith’s writing, I can’t get past the obvious ‘I call bullshit!’ at the title alone. So, China – who was in bed with the left/progs/deep state for decades….has been preparing for a trade war with the U.S…….for ten years. How? Why? Answer, nope. The chinese and the cunt didn’t expect Trump to win. They weren’t planning a trade war when they were going to get it for free! What utter crap.

I hate to say it, but I’ve noticed many, many great writers pushing fear for the last few years scrambling to stay relevant in light of Trump’s actions, and dare I say it – Q’s ‘play by play’. That…..and that alone, has made me deeply suspicious of otherwise great sites. Maybe that’s a good thing. But I know for a fact, a few sites have been ‘realigned’ in the last few months – from subtle tweaks to something less. Now the only safe space is to paint Trump as a deep state actor lulling us into a false state of calm. To the point where even people who saw the cunt for who she was, WILL NOT even spend an hour looking through the Q proofs ….. but will spend HOURS bashing Q with nothing more than hearsay, hyperbole, innuendo, rumors and more.

You nailed it Tommy, and Brandon Smith and JC Collins are the worst. Still trying to cram current events into their five-year-old theories

the us has problems but the major problems are a lack of will/resolve and a lack of confidence,along with apathy–imo,these all stem mostly from a loss of spirituality among americans–

as long as we can produce/distribute food & defend ourselves we will be ok,provided we have the will to do so–

many countries do not have the ability to do either one of those things–

imo , china’s biggest threat to the us is also the biggest threat to the communist party–

christianity is growing rapidly in china & nothing will focus a nation’s people like committed religious beliefs–

When you owe your creditor a million dollars, he has you by the balls. When you owe your creditor a trillion dollars you have him by the balls.

That goes for banks as well as Chinese or Japanese or Germans.

Which is why Russia has quietly dumped Treasuries…