Authored by Jeff Desjardins via VisualCapitalist.com,

Months ago, we showed you a set of data visualizations that highlighted how people make and spend their money based on income groups.

Today’s post follows a similar theme, and it visualizes differences based on education levels.

Below, we’ll tackle the breakdowns of several educational groupings, ranging from high school dropouts to those in the highest education bracket, which is defined as having achieved a master’s, professional, or doctorate degree.

Income and Spending, by Education

The data visualizations in today’s post come to us from Engaging Data and they use Sankey diagrams to display data from the Bureau of Labor Statistics (BLS) that shows income and expenditure differences between varying levels of education in America.

The four charts below will show data from the following categories:

- Less than high school graduate

- High school graduate

- Bachelor’s degree

- Master’s, professional, or doctorate degree

It should be noted that the educational level listed pertains to the person the BLS defines as the primary household member. Further, people in households can be at different ages and at different stages in their career – for example, someone with a Master’s degree could be 72 years old and collecting pension payments, and this impacts the data.

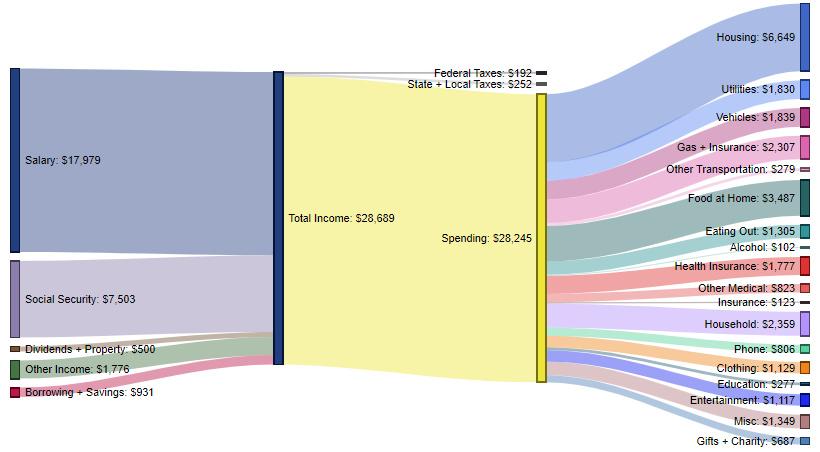

Less than High School Graduate – $28,245 in spending (98.5% of total income)

These contain an average of 2.2 people (0.7 income earners, 0.6 children, and 0.5 seniors)

The average household in this category brings in $17,979 of salary income, as well as an additional $7,503 from social security programs.

Almost all money (98.5%) is spent, and on average these households are actually pulling money from savings (or taking out loans) to make ends meet. The biggest expenditure categories include: housing (23.5%), foot at home (12.3%), household expenses (8.4%), and gas/insurance (8.2%).

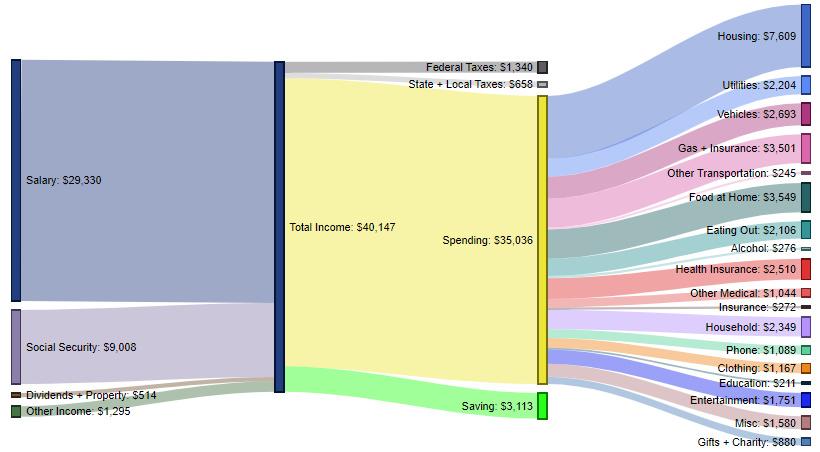

High School Graduate – $35,036 in spending (87.3% of total income)

These contain an average of 2.3 people (1.0 income earners, 0.6 children, and 0.4 seniors)

The average household here brings in $29,330 of salary, as well as $9,008 from social security.

These households spend 87.3% of their income, while putting $3,113 (7.8%) away in savings each year. The biggest expenditure categories include housing (21.7% of spending), food at home (10.1%), gas/insurance (10.0%), and vehicles (7.7%).

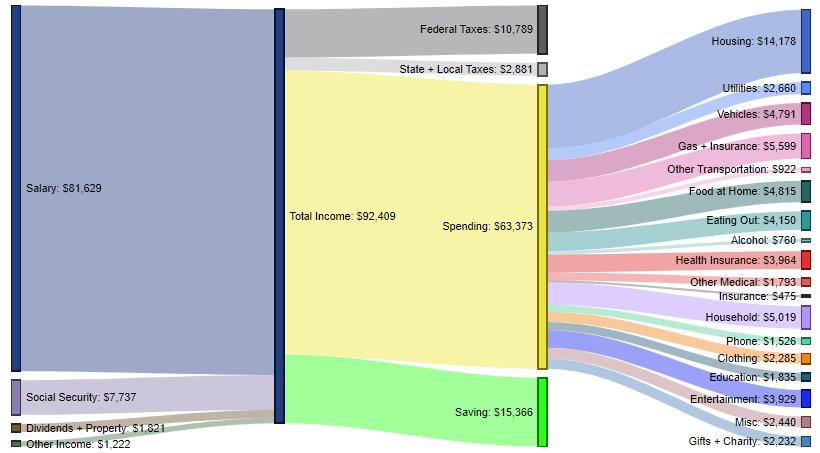

Bachelor’s Degree – $63,373 in spending (68.6% of total income)

These contain an average of 2.5 people (1.5 income earners, 0.6 children, and 0.4 seniors)

Households with at least one person with a Bachelor’s degree earn $81,629 per year in salary, as well as nearly $11,000 stemming from a combination of social security, dividends, property, and other income.

Roughly 68.6% of income is spent, with 16.6% going to savings. Top expenditures include housing (22.4%), gas/insurance (8.8%), household expenses (7.9%), and food at home (7.6%).

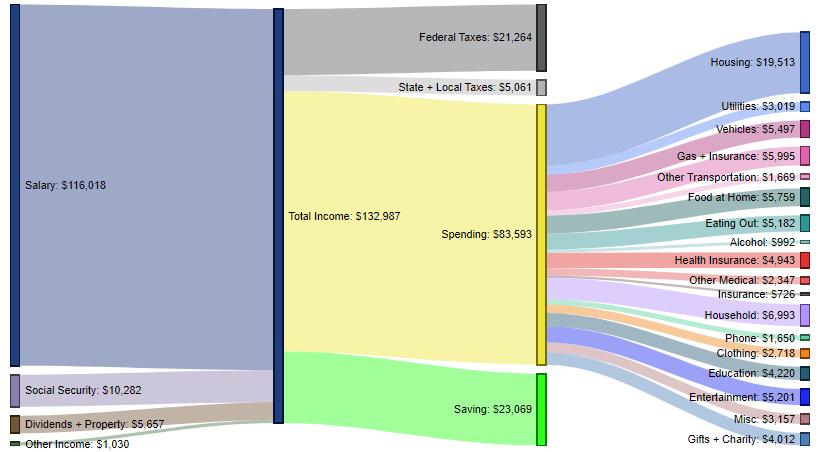

Graduate Degree – $83,593 in spending (62.9% of total income)

These contain an average of 2.6 people (1.5 income earners, 0.6 children, and 0.4 seniors)

Finally, in the most educated category available, the average amount of salary coming into households is $116,018, with roughly an additional $17,000 coming in from other sources such as social security, dividends, property, and other income.

Here, 62.9% of income gets spent, and 17.3% gets put towards savings. The most significant expenditure categories are housing (23.3%), household expenses (8.4%), gas and insurance (7.2%), and food at home (6.9%).

A Changing Role for Education?

For now, there is a clear link between certain types of college degrees and higher salaries.

However, as total student debt continues to hit record highs of $1.5 trillion and as more remote educational options proliferate online, it will be interesting to see how these charts are impacted in the coming years.

By the year 2030, do you think education will still have the same strength of correlation with income levels?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“By the year 2030, do you think education will still have the same strength of correlation with income levels?”

No. Rapidly, the correlation will shift to area of education. In other words, Black and Women’s Studies majors will starve, while computer science majors will do better.

Every man and his dog is getting a degree. Most of them are valueless. There is little education attached anymore. Used to be a degree was a fairly good indicator of having attained an education. Not anymore.

When I graduated from college, you could say this about every single one of the graduates of my college, with no exceptions: they could write, they could speak a foreign language fluently (or damn close), they were math educated through calculus, they had a good grounding in basic science, they could program a computer to a basic level, and they could swim.

How many current grads can say the same?

It will be the education that matters, not the degree.

I would disagree somewhat. Certainly some degrees have more value than others, but having any degree is a signifier. It’s not what you learned – it’s that it demonstrates 1) you’re not a total idiot (you probably have to have an IQ>95 to get a degree), 2) you can do work – some work, no matter how badly and 3) you have some ability to delay gratification. I realize that these are not high bars, but they do explain why many companies require a degree – without even any regard to what degree. It weeds out the 1/3 of the population who are totally retarded and/or incapable of even waking up and showing up on time. I realize that there are smart high school dropouts and many people who never set foot in a college classroom who are diligent workers. Most employers – and people in general- don’t have the time or inclination to do a deep assessment of people.

College should be a place for the top 1/3 of students. Beyond that, it is devalued. And that is what is happening.

Correct.

I’d like to see the stats on percentage of income spent on cigarettes and tattoos.

How about those of us who say spent years working in trades getting licenses/certificates ect.along the way,or,is not a “professional “level of education?!

On a side note,though one does not get “credits”MIT has all of their courses online if one wants to further their education,a lot of other great sources to do that,screw the high prices for a piece of paper.

Too right, James.

There is a vast gulf between having a degree

and being educated.

But as Iska points out, most companies have

neither the time nor the inclination to properly

assess this.

Or are prevented by various federal labor statutes from being able to. Never forget that we didn’t get here in the absence of government micromanagement and control of the labor market.