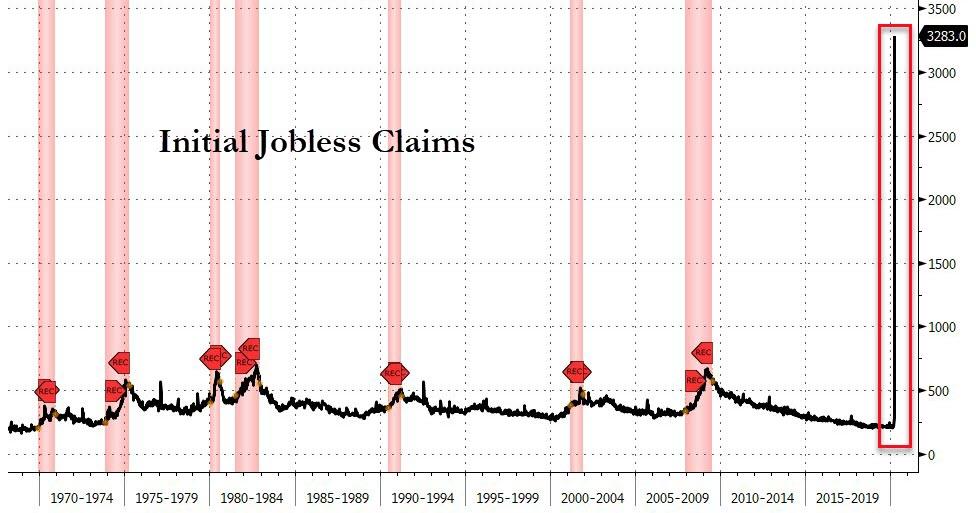

The pace at which Americans are losing their jobs is absolutely breathtaking. According to the Wall Street Journal, the largest number of new claims for unemployment benefits ever recorded in a single week prior to this year was 695,000 during the week that ended October 2nd, 1982.

So that means that what we are now witnessing is completely unprecedented, as The US Department of Labor reports a stunning increase of 3.283 million people sought initial jobless claims last week amid the virus lockdowns (almost double the expectation of a 1.7million increase).

The Bureau of Labor Statistics says that nearly every single state cited Covid-19 in its reporting.

Service industries were hit hard, but the BLS says other industries were cited: health care and social assistance, arts, entertainment and recreation, transportation and warehousing, and manufacturing.

Only three states had estimated claims.

We know that several states’ unemployment websites crashed, were running slow, or malfunctioned in recent weeks as an unprecedented number of applicants tried to file at the same time.

The states with the biggest jump in advance claims from the prior week were Pennsylvania, Ohio and New Jersey.

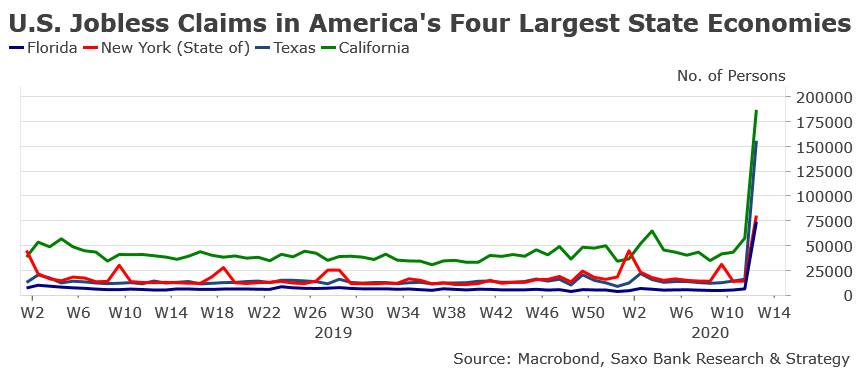

As Saxo Bank’s Christopher Dembik also warns, keep in mind that an undefined number of claims went unreported as states’ unemployment insurance program offices were overwhelmed by the massive number of applications both by phone and online. Some states even informed that their phone lines was saturated and their website crashed due to high demand. It means that next week’s data might be very ugly as well, or even worse.

Look at the situation in America’s four largest state economies that represent roughly 1/3 of US GDP:

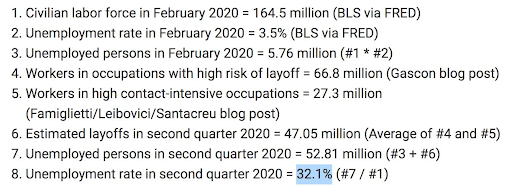

So what will this mean for the unemployment rate?

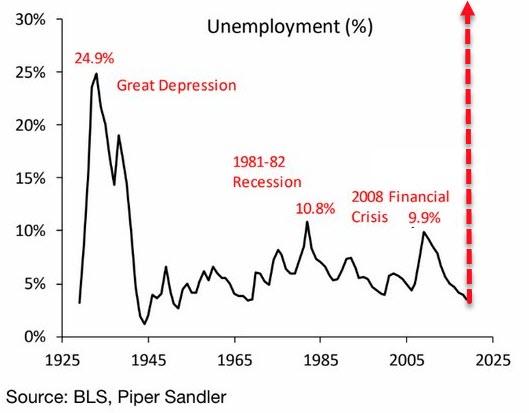

As Bloomberg wrote earlier, St. Louis Fed President James Bullard made a shocking prediction the other day that U.S. unemployment may hit a 30% in Q2. St. Louis Fed economist Miguel Faria-e-Castro published a blog post today explaining the back-of-the-envelope methodology used to arrive at a 30% unemployment rate. He noted that about 67 million people work in jobs with high risks of layoffs, including sales, production and food preparation. In addition, 27 million people work in businesses that require close physical contact, such as barbers and restaurant wait staff.

Considering the overlap between those two groups, Faria-e-Castro averaged them and concluded that 47 million people could lose their jobs. Add the current 5.7 million unemployed workers and divide by the 165 million people in the labor force, and he got 32% unemployment.

Of course, there are many caveats. About 10 million people work in education and health care, and they’re less likely to be laid off because their services are needed. So by simply deducting that the peak of jobless rate falls to 10.5%. Also, the 32% scenario assumes no fiscal stimulus to help small businesses – and Congress just passed such a plan. And then there’s the reality that employers may just send workers home with pay instead of laying them off.

However, as Powell said on The Today Show this morning – “it would appear we are already in recession” -$2 trillion bailout or not!?

In recent days, as Michael Snyder notes, so many newly unemployed Americans have been trying to file for unemployment benefits that it has been crashing websites all over the country.

For example, a newly unemployed worker in Michigan named Aaron Garza never was able to file for benefits through Michigan’s unemployment website although he kept on trying throughout Monday and Tuesday…

When Aaron Garza was dismissed this week from his job as a parts specialist at a Toyota dealership in Grand Rapids, Michigan, he joined a tidal wave of unemployed people swamping systems to help them and straining state finances to the breaking point.

On Monday, Garza went to Michigan’s unemployment website and tried logging on to apply for benefits electronically. After 30 minutes, he was able to sign on, but by the time a verification code was sent to his phone 25 minutes later, he had already given up. As of Tuesday afternoon, he still hadn’t been able to get through.

Last week, 108,000 workers filed for unemployment benefits in the state of Michigan.

That is 20 times more than normal.

Ouch.

In Louisiana, things are even worse. If you can believe it, the number of people filing for unemployment benefits is more than 40 times higher than usual…

In Louisiana alone, 71,000 people filed new unemployment applications last week, compared to the usual 1,400 or 1,500 people per week, said state labor secretary Ava Dejoie.

Louisiana has one of the highest per capita counts of coronavirus cases in the U.S. Democratic Gov. John Bel Edwards has ordered nonessential businesses to close, limited restaurants to takeout and delivery, banned gatherings over 10 people and directed residents to remain at home.

And in California, Governor Gavin Newsom says that a million residents of his state have filed for benefits “just since March 13”…

California Gov. Gavin Newsom said Wednesday that the state has seen 1 million unemployment claims in less than two weeks as the coronavirus pandemic has led to businesses being shut down across the state.

“We just passed the 1 million mark, in terms of the number of claims, just since March 13,” Newsom said.

Of course similar things are happening all over the world. Approximately one-third of the entire population of the globe is currently under some sort of a lockdown order, and that means that hundreds of millions of workers are sitting at home not working.

Here in the United States, so many people are already absolutely sick and tired of being idle at home, but the truth is that it looks like this pandemic is just getting started.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Tis but a scratch.

Taxes, mortgage, and monthly payments are all deferred for 3 to 9 months.

I don’t do stock market or bonds.

It’s time to take a vacation and chill.

Where have you been?! Missed you.

Gimme sum o dat swete gubamint $$!!!!!!!!

Meanwhile well over a million new job openings have been posted by Kroger, Publix, Walmart, 7-11, and so many others. So much easier to jump on the gubmint’ gravy train than take a readily-available option that may even pay better. The constant presence of social safety nets (combined with massive – 50% when all are factored in theft of monies through taxes) leaves most in society complacent and unable to save for the “rainy day.” And when it is all over, the worship of the state will likely be worse than ever….despite their 100% failure record from day one of this situation.

Sorry, 100% failure from day one PERIOD.

This is a slow motion train wreck. The government bail out will tie people over for about a month. In that month the States budgets will be completely blown out due to the massive jump in unemployment benefits combined with a massive drop in tax revenues. While this is happening, the health insurance companies are being slammed by skyrocketing claims for jam packed ICU units at exorbitant costs. Expect the health insurance companies to announce they are going to need massive government bail outs.

The Federal government will soon be faced with the problem of realizing they cannot bail out everyone who needs money. They will need to prioritize spending and begin to look at their own budgets as servicing their own debt will become an issue. Their priority will be to keep the States and essential services going, and programs to help individuals will soon need to be abandoned. They will have no choice but to start to look at raising revenue, which means more taxes. Top tax rates during the great depression, when government was faced with similar circumstances went to 90%.

Many of the jobs that are being lost, are not going to return, as businesses close. The real estate those businesses used to occupy will loose their value as they sit empty and become a liability rather than an asset.

Wages will suffer as employers struggling to keep their businesses going will realize in a 30% unemployment environment they cannot afford to pay what they did before.

This is a reckoning. The bill for all debts will soon come due, and the fact is there is no money to pay the bill.

The perceived net worth of all business and individuals is based on inflated asset values, while the amount of their debt is absolute. When the value of their assets drops, even moderately, the debt soon becomes more than the value of the assets, and they are broke.

A very large percentage of the both the business world, and individuals are going to realize in the not too distant future that they are broke. They are broke because they based their financial calculations on a lie, perpetrated on the false belief that inflation and asset values always increase. They are about to learn about the long term bushiness cycle in a very cruel way.

This isn’t the Great Depression. Not by a long shot. It is far worse and we have very little ammo. A virus will be the least of Washington and NYC’s problems once people are hungry and pissed off. And our annual trillion dollar military best learn to adjust to their new countries and cultures, because they won’t ever be coming home unless it’s on their dime.

I will not shed a tear.