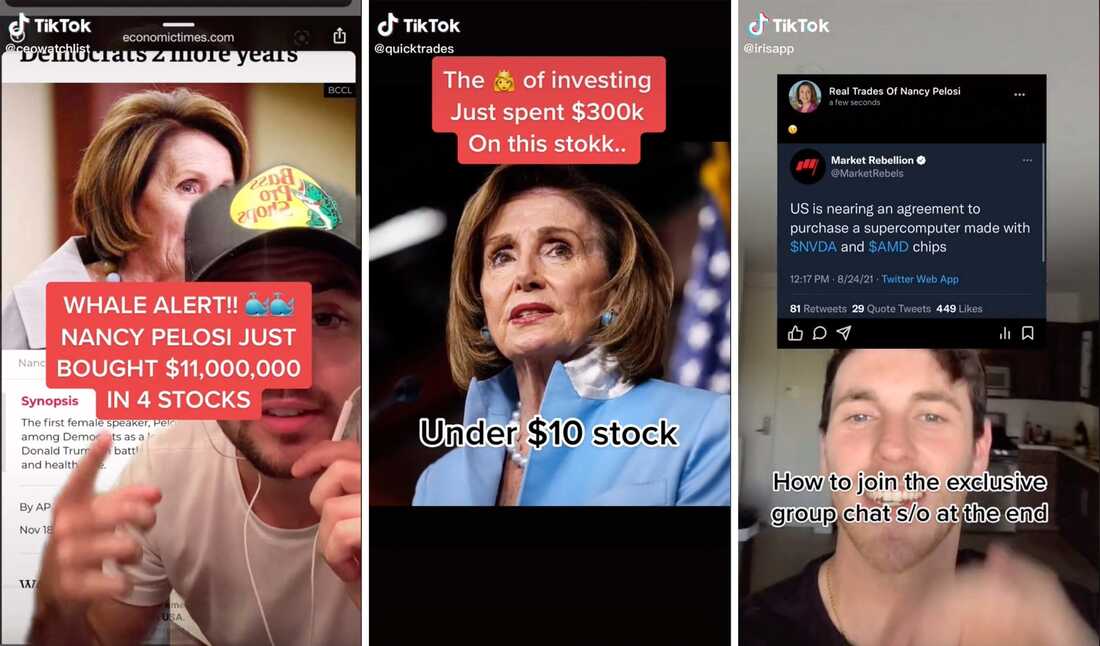

Young investors have a new strategy: watching financial disclosures of sitting members of Congress for stock tips.

Among a certain community of individual investors on TikTok, House Speaker Nancy Pelosi’s stock trading disclosures are a treasure trove. “Shouts out to Nancy Pelosi, the stock market’s biggest whale,” said user ‘ceowatchlist.’ Another said, “I’ve come to the conclusion that Nancy Pelosi is a psychic,” while adding that she is the “queen of investing.”

“She knew,” declared Chris Josephs, analyzing a particular trade in Pelosi’s financial disclosures. “And you would have known if you had followed her portfolio.”

Last year, Josephs noticed that the trades, actually made by Pelosi’s investor husband and merely disclosed by the speaker, were performing well.

Josephs is the co-founder of a company called Iris, which shows other people’s stock trades. In the past year and a half, he has been taking advantage of a law called the Stock Act, which requires lawmakers to disclose stock trades and those of their spouses within 45 days.

Now on Josephs’ social investing platform, you can get a push notification every time Pelosi’s stock trading disclosures are released. He is personally investing when he sees which stocks are picked: “I’m at the point where if you can’t beat them, join them,” Josephs told NPR, adding that if he sees trades on her disclosures, “I typically do buy… the next one she does, I’m going to buy.”

Still Josephs views trades by federal lawmakers as “smart money” worth following and plans to track a large variety of politicians. “We don’t want this to … be a left vs. right thing. We don’t really care. We just want to make money,” he said.

Pelosi is hardly the only lawmaker making these stock disclosures. So far this year, Senate and House members have filed more than 4,000 financial trading disclosures — with at least $315 million of stocks and bonds bought or sold. That’s according to Tim Carambat, who in 2020 created and now maintains two public databases of lawmaker financial transactions — House Stock Watcher and Senate Stock Watcher. He says there is a significant following for his work.

“I knocked out a very, very simple version of the project in like a couple of hours. And I posted it actually to Reddit, where it gained some significant traction and people showed a lot of interest in it,” Carambat said.

Dinesh Hasija, an assistant professor of strategic management at Augusta University in Georgia, has been studying whether the market moves based on congressional disclosures. His ongoing research suggests that it does.

“Investors perceive that senators may have insider information,” he said. “And we see abnormal positive returns when there’s a disclosure by a senator.”

In other words, Hasija’s research shows that after the disclosures are published, there’s a bump in the price of stocks bought by lawmakers.

At least one financial services consultant, Matthew Zwijacz, is planning to set up a financial instrument that automatically tracks congressional stock picks, because, in his view, lawmakers are “probably privy to more information than just the general public.”

Both investors and government watchdogs are interested in these trades because of the possibility that lawmakers could use the private information they obtain through their jobs for money-making investment decisions.

“If the situation is that the public has lost so much trust in government that they think … the stock trades of members are based on corruption, and that [following that] corruption could benefit [them]. … We have a significant problem,” said Kedric Payne, senior director of ethics at the Campaign Legal Center.

A surge of interest following congressional financial disclosures came near the beginning of the COVID-19 pandemic, when a flurry of reports indicated that lawmakers sold their stocks right before the financial crash.

NPR reported how Senate Intelligence Committee Chairman Richard Burr privately warned a small group of well-connected constituents in February 2020 about the dire effects of the coming pandemic. He sold up to $1.72 million worth of personal stocks on a single day that same month.

A bipartisan group of senators also came under suspicion, including Sens. Dianne Feinstein, James Inhofe and Kelly Loeffler. After investigations by federal law enforcement, none were charged with insider trading — a very difficult charge to make against a sitting lawmaker.

Congressman Raja Krishnamoorthi, a Democrat from Illinois, is part of a bipartisan group of House and Senate members who have introduced legislation banning lawmakers from owning individual stocks. He has run up against a lot of opposition to the idea.

“As I understand it, one of the perks of being a member of Congress, especially from the late 1800s on, was to be able to trade on insider information. That was a perk of being in Congress. And that has got to come to an end,” Krishnamoorthi said.

Polling shows that there is wide support for enacting this prohibition. According to a survey done this year by Data for Progress, 67% of Americans believe federal lawmakers should not own individual stocks.

There’s a deep cynicism that forms the foundation of a trading strategy based on mimicking the stock picks of lawmakers and their spouses: the notion that politicians are corrupt and that you can’t trust them not to engage in insider trading — so if the information is public, you might as well trade what they’re trading.

But despite all the skepticism about politicians and their ethical standards, the evidence doesn’t show that members of Congress make great stock pickers. While a 2004 paper found that senators generally outperformed the market, more recent academic studies in 2013 and over the last few years have suggested lawmakers are not good at picking stocks.

“Those papers have found that in fact, the trades made by senators have underperformed,” Hasija said.

This means if you ever take a stock tip from a lawmaker — cynicism aside — it might not be a very good trade.

I will invest in this ETF the day it comes out.

Hear you but don’t forget you may be a bagholder if they’re trying to exit.

Be careful. Beware the pump & dump.

Bagholder? The description of the fund is that it actively tracks congressional stock picks, which means it sells when they sell, too.

I have a bridge I’d like to sell you…..

Wow, oldvet – that was a very creative reply. I applaud your originality.

They have 45 days to make the disclosures. That’s the earliest that they get the trade signals.

When you’re trading on event-based information (legally for them, illegally for us), 45 days is an eternity. There’s plenty of time for you to end up the bagholder due to those lags. And it may not even be soon enough to catch the bounce up.

Remember that there is a reporting delay of about 3 months. So it could be pumped and dumped before the ETF gets the information.

12 Days Before ’08 Crash, Congress was Secretly Told to Sell Off Their Stocks

http://www.cbsnews.com/news/congress-trading-stock-on-inside-information/

I pray for Nancy Pelosi’s death every day. It doesn’t have to be long and painful, I’m not a sadist. Quick and painless is fine by me. Stroke, heart attack, anything natural causes. I’m not advocating violence.

This 81 year old witch needs to go go go. You can make it happen, God. Please help. Thanks.

They aren’t just random market events that nobody could have foreseen? Get outta town!

The US intel agencies are in this up to their necks along with the various corps that will benefit from major .gov contract awards. Sitting Congress members with financial and intel ties will be “in the know” as insiders long before the contract hits the newswire services for lemmings and muppets.

I see a fund like this as just another way for .gov connected investors to soak the lemmings who provide a huge amount of momentum capital. Scumbag hedge fund trader Jim Cramer would do this by pumping a stock, selling it, then pushing an ass-load of put options immediately afterward to profit on the way up AND on the way down. Now we learn Gary Gensler is going after Michael Burry over Gamestop trading information but ignoring the major crooks in Citadel doing their naked short trades.

SSDD.

The small guy who has limited funds and information can’t play in this casino, so it’s wise to average in over time with counter-intuitive choices. When the bottom falls out I’m ready to grab miners and hydrocarbons up when the whales move to commodities.

*ucking brilliant!

Remove the power of government to pick winners and losers, and all of this stops being a problem. Better yet, remove government.

Now that’s funny, two ways. First, every congress critter is engaged in creating scenarios that determine any business’ ability to succeed or fail. So they know instantly as soon as a meeting is over, what to invest or divest in. Secondly, that someone is onto them and aping their own actions is wonderful. I think I might give it a go.

Pelousy….like many congresscritters….engages in what is called ‘Insider Trading’. The practice of making stock transactions based upon information they have that is NOT available to the vast majority of the public. It is of

course illegal….if you or I engaged in the practice. But the law does NOT apply to them. So they get filthy rich

based upon knowledge they gain from their position and from decisions made in the government that they have

influence over. It’s a text book example of corruption.

A month and a half after the trade is almost worthless information at that point. The same info. on Buffet’s trades and those of other professionals is readily available public information. They can actually buy, wait 45 days for retail to catch on, and then sell into that strength.

Buffet knows this and got insider info on the banks during the 2007-2008 downdraft. In order to save the banks, Uncle Warren supplied needed liquidity for tons of cheap warrants he could sell in the future once the bank stocks stabilized. It’s a variation of a deal J.P. Morgan once made in order to bail the US government out of bankruptcy.

The real key to Buffet’s success is being old and having connections.

I once used warrants and Class B to Class A convertible stock to double down on shares. The stock paid a dividend and I held for years. The stock eventually dropped to one quarter of what I paid for it to a price under two dollars. We tripled down, sold, and booked a 488% profit when the underlying commodity spiked. It took years but it was worth it – and it will happen again.

They do allow us our scraps now and then, but overall “it’s a big club and we aint in it.” 🙂