Authored by John Rubino via DollarCollapse.com,

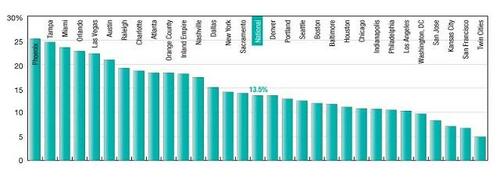

US headline inflation exceeded 7% in 2021. But rent increases put the Consumer Price Index to shame, soaring an average of 13.5%. And within that already-brutally-high average, there were some absolutely astounding outliers. Phoenix rents soared 25.3%, followed by Tampa, Miami, Orlando, Las Vegas, and Austin, all of which exceeded 20%.

That means an Austin barista could receive a 10% salary bump and have most of it wiped out just by an increase in their rent. Add in the soaring costs of food and gasoline, and our hypothetical worker is actually losing ground despite their double-digit pay raise.

A confluence of things

Rents do tend to rise a bit each year, with 3%-4% being typical. So how did 3% become 20%+ in so many markets? A confluence of factors, including:

Rent forbearance. State and federal programs designed to prevent evictions during the worst of the pandemic lockdowns hit landlords – who have loans of their own to pay off and can’t do so without rental income – especially hard. Many are now raising rents where they can to offset where, for over a year, they couldn’t.

General inflation. Pretty much everything required to manage rental properties – including construction materials, labor, and electricity – is up, in some cases dramatically. To stay solvent, landlords have to pass on at least some of these costs to tenants. So 7% headline inflation equals (at least) a comparable increase in rents.

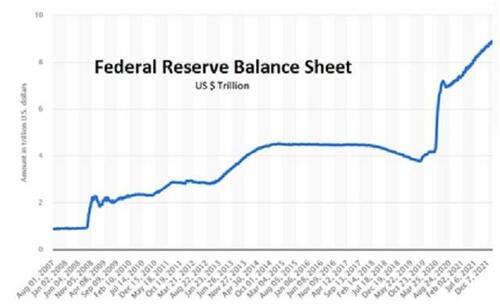

Soaring home prices. As the world tipped into pandemic-induced recession in 2020, governments responded with an epic money-printing binge. The Federal Reserve’s balance sheet – a proxy for the number of newly created dollars the central bank has created and dumped into the economy – has more than doubled since 2019. Expressed another way, 40% of all the dollars ever created came into being in the first two years of the pandemic.

Combine this tsunami of new money with artificially low mortgage rates – another side effect of QE – and the result is soaring home prices. This impacts the rental market in two ways: First, more expensive houses price ever more would-be buyers out of the market, thus increasing the pool of renters competing for a limited supply of available units. Second, a rental house bought at today’s higher price requires more monthly income to cover its costs, which ratchets up rents.

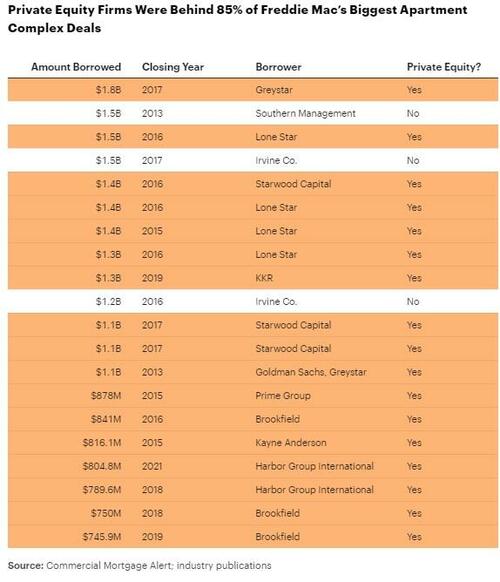

Wall Street. Private equity firms and investment banks developed a taste for rental property during the Great Recession, and now they’re back for the main course. The vast majority of apartments sold in recent years have been gobbled up by Wall Street:

From ProPublica’s When private equity becomes your landlord:

Private equity firms often act like a corporate version of a house flipper: They seek deals on apartment buildings, slash costs or hike rents to boost income, then unload the buildings at a higher price.

The companies’ size allows them to influence market rates and lobby against reforms that could dilute their power. And their goals — quickly hiking a building’s profits so they can sell it at a premium — are often at odds with those of the tenants who need to live in them. In contrast, so-called mom-and-pop landlords usually look for steady streams of rental income over time while their buildings grow in value.

And the sharks are still hungry:

The deal includes more than 40 rental apartment properties including 12,000 units in states including Florida, Tennessee and Georgia. Preferred Apartment also owns 54 grocery-anchored shopping centers anchored by grocery stores. About 70% of the deal’s value is in its rental apartments.

Blackstone has been aggressively ramping up its bet on U.S. rental housing. The firm has agreed to buy two other companies that own apartments in the past two months, building up its presence in states including Colorado, Texas, Arizona and Georgia.

Multifamily properties particularly in high-growth Sunbelt states have been one of the hottest commercial property types in recent years because businesses have been relocating to those regions. Owners have been able to raise rents well above the inflation rate throughout the Covid-19 pandemic.

Blackstone, the world’s largest commercial property owner and until recently America’s largest landlord after scooping up tens of thousands of single-family homes in the aftermath of the 2009 subprime mortgage crisis, has been feverishly working to regain the title by bidding up rental apartments for years. The firm is purchasing Preferred Apartment through its largest fund, Blackstone Real Estate Income Trust, which has raised more than $50 billion since it started five years ago and mostly targets individual investors

It’s a similar story in rental houses, where private equity firms have taken to swooping in and buying entire neighborhoods at above-market prices, then converting the houses to rentals at inflated rates.

The implication? With market power firmly on the side of our new corporate landlords, rents aren’t coming down anytime soon. Just the opposite.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

A/C had this posted to his blog earlier today.

Somehow Blackrock wouldn’t be affected by Albany’s policy, or would find a way to deal with a

deadbeat renter.

https://nypost.com/2022/02/18/albanys-no-eviction-ever-bill-will-devastate-landlords-and-nys-housing-stock/

7%.

What a crock of shit. Try something on the order of 20%+.

This is the perfect storm the socialists/communists want. Property values up, more properties becoming rentals. Meanwhile the government increases the fiat money supply in multiple ways at the same time: huge cash handouts to EVERYONE including non-citizens; issues more debt; the Fed buys the debt (with more phantom money) and essentially reduces the commercial bank reserve requirements to zero, making that money supply multiplier infinite:

We deposit money into a bank. $1 million.

With zero reserve requirement, the bank lends Blackstone a million dollars, which

Blackstone deposits in the bank, which

With zero reserve requirement, the bank lends again to 50,000 individuals to buy cars

Car companies put the million dollars in the bank, which…

…you get the idea. A single million dollars can become in theory a billion dollars–or more. All from a single million with no bank reserve requirement. Nothing has been created but more dollars for the same goods. How could you not have inflation?

You left out how the banks have been getting this almost free money since 2008, and they were supposed to lend it to the people. Which they did not do. This was the big scam that our buddy Berry let them do.

Then BlackRock hires Greystar to manage their apartments. Greystar is the 800 lb gorilla in that market segment.

I bet the Chinese Government does stuff kind of like this.

Renters are doomed