By Nick Giambruno

The Fed has already printed trillions—and shows little sign of slowing down—which means much higher inflation is already baked into the cake.

The only question is how the Fed will respond to it.

Ludwig von Mises, the godfather of free-market Austrian economics, summed up the Fed’s dilemma:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

The Fed has two choices:

1) keep printing trillions and let inflation skyrocket

2) tighten monetary policy and watch the markets crash.

In other words, it can sacrifice the stock market or the dollar.

#1 Keep Printing Trillions and Let Inflation Soar

Stopping the money printing would go a long way to cleansing the economy of its massive distortions.

It would be painful in the short term, but it would enable the economy to rebuild on a better foundation.

However, that is politically unacceptable.

When faced with the choice, politicians usually choose the most expedient option. Therefore they are likely to choose the easy option—keep printing money and pretend inflation is under control for as long as possible.

Further, unless Congress makes some politically impossible decisions to cut spending, the US government will have endless multitrillion-dollar deficits that ever-increasing money printing will have to finance.

The Congressional Budget Office estimates the total deficit between 2021 and 2031 will be close to $20 trillion, but that will almost certainly understate the actual numbers.

Who is going to finance this, conservatively, $20 trillion shortfall? The only entity capable is the Fed’s printing presses.

But there’s another compelling reason the US government won’t tone down the printing presses. That is because inflation reduces the real debt burden. It allows you to borrow in dollars and repay in dimes.

Inflation is a boon to debtors, and there is no bigger debtor in the history of the world than the US government, with its more than $30 trillion debt.

That’s why the US government, and those connected to it, are the biggest beneficiaries of inflation. It’s also why you hear ridiculous gaslighting from the Fed and its apologists in academia and media about how inflation is a good thing.

As inflation soars, you can expect other measures.

For example, in Argentina, where prices regularly rise 40% or more each year, they made it illegal to publish inflation statistics that differ from the official government numbers.

I wouldn’t be surprised if the US government did something similar. At a minimum, discussing inflation statistics other than the CPI might be deemed disinformation and cause you or your business to be de-platformed.

Out-of-control inflation is also a common excuse for governments to implement capital controls, price controls, and other destructive measures.

Here’s the bottom line.

The US government is incentivized to continue creating ever-increasing amounts of inflation.

That’s terrible news for the US dollar but excellent news for free-market monetary alternatives such as gold and Bitcoin.

It’s only prudent to be prepared for higher inflation.

However, there will come a time—which may be soon—when rising prices create enough political pressure that could force the Fed to act otherwise.

That’s why we also need to be prepared for scenario #2.

#2 Tighten Monetary Policy and Collapse the Stock Market

The markets have become dependent on the Fed injecting over $120 billion a month of freshly printed dollars into the system. So even the slightest hint that the Fed could cut back on printing could tank the markets.

When Greenspan crashed the markets by saying “irrational exuberance,” he wasn’t trying to signal that the Fed was about to tighten its monetary policy. But the markets plummeted anyways.

Today the situation is much more severe. The markets will understand that the Fed is under pressure to tighten to tame soaring inflation. So they’ll be even more attentive to the slightest sign that the Fed could tone down the money printing beyond a token amount.

If and when the Fed signals tightening—deliberately or not—the stock market will be poised for a crash of historic proportions.

That’s because stock market valuations are nearing the highest levels in history.

The cyclically adjusted price-to-earnings (CAPE) ratio for the S&P 500 is now the second-highest it’s ever been. And at its current level of 35x, it’s well over double its long-term median of 15.6x.

The CAPE ratio is a valuation metric that smooths out earnings volatility by using ten years’ worth of earnings instead of one. But just like the better-known P/E (price-to-earnings) ratio, a high CAPE ratio means stocks are expensive.

As we can see in the chart below, the only other time in history that it’s been higher was just before the tech bubble burst. A major crash has followed each time stocks have approached valuations at these nosebleed levels.

One of Warren Buffett’s favorite market valuation metrics is the total market capitalization-to-GDP ratio. The higher it is, the more expensive the stock market is.

And right now, it looks overvalued in the extreme. It’s at an all-time high.

At 186%, it’s over 40% higher than it was at the height of the dot-com bubble, the second-highest reading on record.

We all know what happened next. The dot-com bubble burst, producing one of the scariest market crashes in history. Unfortunately, the coming crash is poised to be much larger.

Wilshire 5000 to GDP Ratio

In the ultimate aftermath, I think we’ll see this ratio not only hit its historical mean of around 86% (noted in the dotted line above) but dive below it. As you can see in the chart above, the same thing happened after the dot-com and housing bubbles burst.

That means the stock market has a lot of room to fall from here.

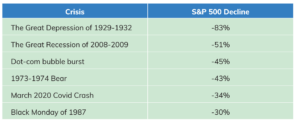

The table below shows the top six worst episodes in the US stock market’s history.

The crisis on the menu in the months ahead could be far worse than any of these.

Remember, the Fed’s reckless money printing has warped today’s economy far more drastically than it did in the 1920s, during the dot-com or housing bubble, or any other period in history. So I expect the resulting stock market crash to be that much bigger.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The numbers are mind-numbing. One single trillion seconds ago is 31,000 years ago. A trillion seconds ago friggen mastodons walked the earth with 18,000 years to spare.

If the stock market crashes, many trillions of dollars will vanish. That may go a long way toward taming inflation.

‘When’ the stock market crashes (the Plunge Protection Team has been working lots of OT)…then the real depression maker (the bond market) will follow and implode (as per the 1 -2 punch the last time the FED brought U.S. down)…and the approaching Greatest Depression will make the Great Depression look like the good ole days…and 2008/9 like an economic speed bump.

Then famine and wars (no rumors) will be much, much easier for TLPTB (L=Luciferian) to ignite.

However, I believe they have overreached in their demonic hubris…if we (or me and mine) do not have a Red Sea moment…I’m turning around and taking out the first chariot before I go home.

That’s the ridiculous notion of today’s “Deflationists”:

They believe everything will crash in value/vanish except the stuff that they themselves own.

Good luck with that theory!

Volker jacked up the interest rate in the early ’80’s to 15% to stomp inflation, but that was a different time. Now it would have to be 20% easy, and there is no one who will do that when they’re squabbling over basis points (a percent of a percent…)

They will just keep printing until the wheels come off, they have no choice, and one day we’ll wake up in Zimbabwe (sounds figurative but might be pretty close to reality for some folks)

… it’s all part of the plan

Zimbabwe for Thee and Me but not for “They”.

It is the tech stocks distorting the P/E ratios. Old style stocks not so much, if at all. Some of the tech stocks are running on hundreds or even thousands to one. Tesla is on 205:1, for instance. How quaint.

99/2000 on roids..

Seems to me that what we are calling money, are just 1’s and 0’s in a computer system. Trillions, Quadrillions these are numbers so big that even real science has very little use for these volumes. Seems to me that money should be measured in hard assets. In the end that’s all money can really be.

So, that leads us to a third option: just do away with hard currency. Poof gone, A mere stroke of key. I ask myself, if I had what accounts to billions or even trillions of fiat currency, what would I do. Well, I would buy hard assets with every last digital dollar. I would prepare for the day when a banana is worth more than my entire accountable digital gross worth. I would buy the farm that makes the banana while I can, and so on and so fourth. Now that would work if it wasn’t for the fact that when the whole thing comes crashing down, though on paper I own these assets, the “strong man” will arise, and simply just take that what was technically mine. So, I would be aware of this and begin to use my digital fiat currency to control the “strong man” and make him loyal to me. I would become the “strong man”. Then, I can keep my assets, and just simply take yours. You, now work for me. I will make sure you stay alive, because a sick and hungry worker is bad worker. So if you work hard and work well I will make sure you have what you need.

“From each according to his ability, to each according to his needs”

“You will own nothing, but you will be happy”

I would use the bankers fiat against them. Because while they where out I bought up every asset of value with their monopoly money. ( Black Rock)

The Strategy of the (WEF) World Economic Forum.

And maybe that’s why the East vs West, they are preparing for whom gets to be this “strong man”

Western bankers are convinced fiat can purchase resources with fiat. While they understand extracting and utilizing those resources will require compliant people they are discounting the fact some very strong people with intensely nationalistic feelings and nuclear weapons will not play the banker’s economic games.

There’s nothing new under the sun. Ideologies have always clashed over economics and resources, and in the end, war.

As noted, governments always elect to print more money. They have no choice now that hyperinflation is underway.

In the end the debt will kill the system. It’s only reasonable to think – at some point – the countries backing the dollar system will lose the faith and backing of other countries unwilling to participate in the system. Something else will replace the dollar and it looks to be digital currency in some form.

I gotta get into the wheelbarrow business.

It is all over but the shooting.

If you ignore inflation it will consume everything you have and that will devastate all markets

It’s a trap they can’t get out of. GDP includes government spending. The last year I can find statistics, 2020, government spending was 40% of GDP. fUSA is far from the worst. https://tradingeconomics.com/country-list/government-spending-to-gdp

If almost half of GDP is government spending, and 60% (or more) of that is deficit spending where do those dollars come from? The Fed prints them. And there is the trap. No money creation = vastly lower GDP.

Because GDP is juiced by government spending it is not a good metric imho.

There IS a 3rd option!

=====> Continue kicking the can down the road

My entire future and well being depends on this option. Please, oh Gawd, just 10 mo’ years before you rain judgement on Babylon!