Authored by Michael Maharrey via SchiffGold.com,

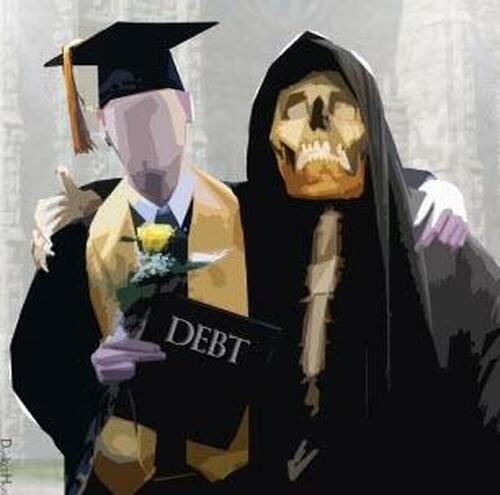

After a more than 3-year pause, government student loan repayments started again this month and it’s already putting the squeeze on borrower’s wallets. This is bad news for an economy already strained by massive levels of debt and rising interest rates.

Interest accrual on student loans resumed on September 1 with the first payments coming due in October.

According to a recent survey reported by Yahoo Finance, about 40% of people with student loans expect to cut spending in order to make payments. Consumers planning to tighten their belts to cover student loan payments said they would likely cut back spending on restaurants, apparel, and electronics.

A separate Morgan Stanley survey found that only 24% of student borrowers can make monthly student loan payments in full without reducing spending. That was down from 29% just three months ago, indicating growing financial stress on consumers.

The Trump administration paused student loan repayment for the first time in March 2020 as governments began locking people down due to COVID-19. The Biden administration extended the pause eight times. Nearly three and a half years later, borrowers must start paying again and that’s a big shock to many budgets.

Even with loan payments paused, many student loan borrowers said they are struggling to keep up with expenses. In a survey earlier this year, 53% of borrowers said they were struggling to pay other bills (e.g. auto loan, mortgage, credit card), even though they have not been making their student loan payments.

Around 43 million Americans have outstanding student loans totaling $1.8 trillion, according to the most recent data from the Federal Reserve. Student loan debt has tripled since 2008.

When the US government stopped defaults and allowed borrowers to pause payments due to the COVID-19 pandemic, 11.1% of student loans were 90 days or more delinquent or were in default. This didn’t include the people who were in various deferment programs and were not counted as delinquent.

Wedbush analyst Tom Nikic crunched Fed numbers and concluded that the typical student loan payment ranges between $200 and $299 per month. That means some 43 million Americans just had their discretionary spending budget cut by at least that amount. This comes to about $120 billion annually.

Nikic estimates that if consumers incrementally spend $120 billion annually on student loan payments, it could wipe out 2.5% of the total $5 trillion in annual discretionary spending.

He called that “brutal news” for retailers.

With consumers now needing to divert some of their monthly income towards student loan payments, there is risk that this could ‘crowd out’ other spending items. Furthermore, this comes at a time when US consumers are increasingly feeling pressures from a variety of sources, including waning pandemic savings, rising gas prices, record-high credit card debt, and a continued normalization of spending on services vs. goods. Thus, these factors could combine to weigh on a variety of companies, including retailers of discretionary goods.”

There is some indication retailers are already feeling the effects. Macy’s reported a 36% reduction in credit card sales year-on-year in the second quarter. Nordstrom reported a similar trend.

Meanwhile, it appears that some student loan borrowers started making payments early to avoid accruing interest. While credit card debt spiked by over 13% in August, non-revolving credit, which includes student loans, fell by 9.8%. This is a sign of a strained consumer trying to make ends meet by charging everyday purchases on credit cards.

“The unexpected contraction in consumer credit in August appears to have been driven by the one-off jump in voluntary repayments of student loans early ahead of the October resumption deadline,” Oxford Economics lead US economist Michael Pearce told MarketWatch.

The resumption of student loan payments will reverberate through the economy. Consumer spending primarily drives economic growth in the US. As spending shifts from buying goods and services to paying student loans, it will add to recessionary pressures.

This is yet another reason to question the “soft landing” narrative. Despite all the rosy economic narratives out there, Americans are under a tremendous amount of financial stress.

On Aug. 22, the Biden administration announced the “Saving on a Valuable Education” (SAVE), a new repayment program that will reportedly lower or eliminate monthly payments for more than 20 million borrowers.

The plan might take the weight off some student loan borrowers, but in effect, it just shifts that burden to the taxpayer.

Nothing the government does is free. Ultimately, student loan debt relief will add to the already massive budget deficits. That means Uncle Sam will have to borrow more money that taxpayers will have to repay, either in higher taxes or the inflation tax.

This is yet another example of government trying to fix a problem it created in the first place.

The widespread availability of student loans drove up college tuition in the first place. Studies have shown the influx of government-backed student loan money into the university system is directly linked to the surging cost of a college education.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

As long as Starbucks exists, there’s still more stress coming.

You took out the loan, Pay it back

Amen

Agreed. My son came out of school with $32,000 in debt back in May. I told him to live at home until he gets it paid off, then he will have the financial flexibility to figure out his next steps. He’s paid half of it off in the last 5 months.

I will ask employment candidates if they are current on their student loans going forward.

They’d better be.

If not, send them to the moon on the next manned mission.

Shoulda been a cowboy, learned to rope and ride says the song. Much cheaper than a useless degree in gender studies.

You mean theres no such things as a confident transexual nonbinary person??

Banker’s Dictionary:

suck·er (sŭk′ər)

n.

1. Student loan applicant.

2. One that sucks, especially an unweaned domestic animal.

3. Informal:

a. One who is easily deceived; a dupe.

b. One that is indiscriminately attracted to something specified: I’m always a sucker for a good crime drama.

20 years ago, my legal guardian found a Banker’s Box that contained all my checks & other stuff from 1970-74. Fall tuition(1970) at Starkvegas was $108, Spring 1974 was $140.

I do remember that MBA Skool in Tuscaloosa was around $300 or so (’74-76).

Compare these to today. Younger daughter ’04-08 at UNC was roughly $2500/semester. It’s now $3509, plus mandatory “Student Fees” of $989.

Plus, they’re getting worthless degrees in SJW navelgazology. About 10,000 Americans, all well above 100 IQ (probably above 115 or 120) need to attend higher ed every year and train in engineering, physics, chemistry, medicine (and that needs serious reform), actual education, history, mathematics, etc. Jury’s out on doctorates in philosophy, as far as I’m concerned.

The rest need to be small businessmen, farmers, machinists, carpenters, plumbers, electricians, house painters, roofers, shoemakers and cobblers, auto mechanics, factory workers, furniture and appliance makers, grocery and warehouse stockmen, butchers, etc. Even musicians. And apprenticeships must become the norm again.

My brother went to M.I.T. decades ago. He did maniacally fast, accurate data entry, several hours per week for a steep hourly rate, and left college barely in debt. Of course, even M.I.T. tuition was far cheaper then. One semester, IIRC, he paid off half his tuition by winning $400 in a Massachusetts lottery game, Megabucks (which he maybe spent a dollar on occasionally – 800 on your math SAT and you know the lottery’s a sucker’s game).

Merry Christmas retailers!