Guest Post by Doug Bailey

Despite some signs that excess mortality rates are declining, life insurance executives and actuaries believe the numbers are alarming and could continue to drag earnings and surge death claims for years to come.

Excess mortality is the difference between the total number of deaths for a specific time period and the number that would have been expected. The numbers were naturally forecasted to climb during the pandemic, but some industry and health authorities are concerned the rates haven’t greatly diminished as COVID infection rates have declined.

Life insurers paid record levels of claims in 2021 as the pandemic drove mortality higher and the issue was widely cited in earnings reports as the drag on profits. In 2021, the most recent year for which data is available, the industry distributed a record $100.28 billion in total death benefits, according to BestLink.

The higher-than-normal payouts began in 2020, the first year of the pandemic when insurers saw death benefits rise 15.4% , the biggest one-year increase since the 1918 Spanish Flu epidemic. The 2021 increase was 10.8%, but fell during the first nine months of 2022, from $74.27 billion in the same period in 2021. But that’s still higher than the $59.18 billion paid out during the same period in 2019 before the pandemic hit, according to BestLink.

No standard for measuring excess mortality

“There’s no standard way to measure excess mortality,” said Josh Stirling, founder of the Insurance Collaboration to Save Lives, a non-profit organization that seeks mitigate mortality losses by providing life insurers with tests to screen policyholders for health problems. “But if you use the data that seems most reliable it looks like, generally, we’re at 13.9 deaths per 100,000, which is up perhaps 7% from where it should have been. Is that catastrophic? Maybe not, but it should be lower.”

The Society of Actuaries polls of its members found that in August of last year 85% thought excess morality rates would continue to 2025. Two months ago, the same poll found that 79% believed excess mortality rates will continue through 2026.

The issue is clouded because figures vary widely depending on how the data is cut and adjusted for the time period, age, specific pathologies, and many other factors. Some executives think the current numbers are temporary or seasonal and don’t require the industry to react.

“We believe that insured population will continue to see declining excess deaths over the next several years reaching about 0% excess deaths by 2030,” said Fred Tavan, chief pricing officer at Legal & General America, a Maryland-based insurer and major provider of term life insurance in the U.S. “This is one of the reasons there haven’t seen any significant changes in insurance premiums during COVID or even after. A scan of insurance premiums across the industry from different carriers proves this out.”

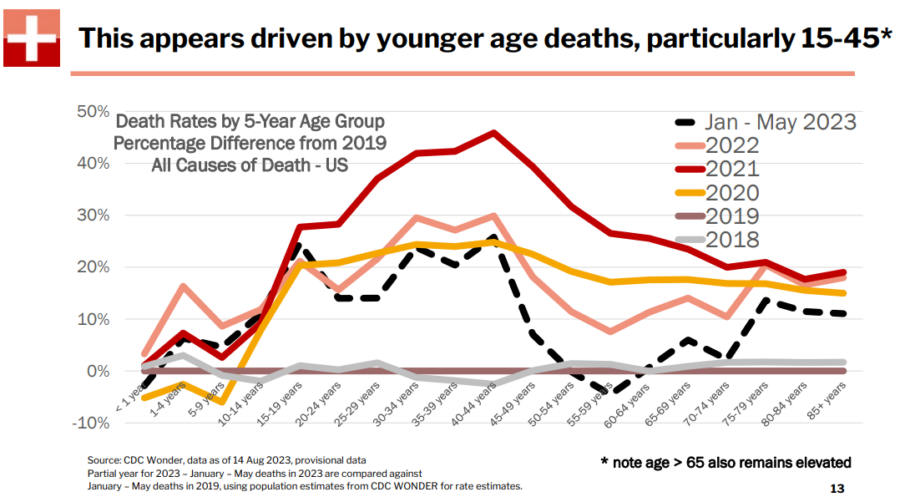

Younger adult death rate up 20% in 2023

Others aren’t so sanguine and point to statistics from the U.S. Center of Disease Control that show mortality rates alarmingly rising for different categories. For example, younger adult mortality rates are up more than 20% in 2023, the CDC said. Cause of death data show increased cardiac mortality in all ages. And even as COVID-related causes declined in 2022, others rose, particularly stroke, diabetes, kidney and liver diseases.

“Consider the ripples of COVID-19 and its varying impacts, leading to higher rates of depression, suicide, and increased substance abuse,” said Samantha Chow, global leader for Life, Annuity and Benefits Sector at Capgemini, the giant multinational Paris-based consulting company. “This has set off a domino effect. From a life insurer’s standpoint, and those dealing in retirement and long-term care solutions, there’s a larger conversation at hand. Can the industry handle a sudden spike in claims? The surge in excess deaths caught carriers off guard, and our aging population is becoming more susceptible to illnesses or passing due to natural causes.”

Chow said there’s a real question of whether the insurance industry can sustain the enormous payouts the excess mortality rates will dictate.

“The real concern for life insurers lies in preparing for an unexpected wave of death claims and the impact on their assets under management,” she said. “Do they have enough reserves to weather these outflows, given the excess deaths? It’s not just about death or health. It is about the industry’s ability and readiness to manage this monumental outflow.”

Capgemini just published its World Life Insurance Report that revealed the upcoming largest inter-generational wealth transfer in history that is expected to cause a massive outflow of nearly 40% of life insurers’ assets under management (AUM), totaling $7.8 trillion, by 2040.

“When we factor in the rise of payouts on death claims, the magnitude of the situation demands urgent attention by the industry,” the report said.

Industry response questioned

Some observers think the industry has been slow to grasp the burgeoning problem, relying on old industry models that say “mortality rates always give back, and have for nearly 500 years,” according to one senior executive.

Stirling believes that expanded, aggressive and proactive health screening of policyholders would save lives and be a significant cost benefit for insurers. Though a startup, Stirling says his organization is poised to announce partnerships with major carriers to institute its mitigation programs. Members of his organization’s board include current and former executives from Farmers Group, Progressive, the Fortegra Group, the Indiana Public Retirement System, and the life and health actuary for the state of Georgia’s Commissioner of Insurance.

“We are led by insurance people trying to drive risk management around health into the insurance industry to empower and engage global insurers to save lives through bracket screening and intervention,” he said. “Screen test and triage is sort of our tagline. We would look a lot like the Insurance Institute for Highway Safety for life insurers, which was funded by the industry and brought airbags and seatbelt to autos year ago. However, we’re also trying to disrupt the industry and create an ecosystem of for-profit companies that will make this happen.”

-----------------------------------------------------

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“Anything but the shots,” I hear them cry.

Term life policies only pay out a miniscule percentage, something like less than 1%. No worries there.

The life insurers aren’t worried because most people have coverage through their job. And when they’re laid off it costs a fortune to continue that coverage so almost everyone lapses their policies.

Layoffs are ongoing and won’t be abating anytime soon, so no worries there.

And your life insurance policy death benefit isn’t paid if you are killed via war, riots, civil insurrection. (If any life insurance salesmen visit this site, they can clarify those exclusions.)

In any event, no worries there, either.

Their final backstop is Congress, where they’ll just bribe their way into a bail-out if push comes to shove.

So the premium collections will continue for the foreseeable future.

I’m Matt Perry, and I don’t even play a doctor on TV, but I beg you to get the jabs.

Soap star Christian LeBlanc diagnosed with cancer; Erik Jensen (“Walking Dead”) diagnosed with cancer; “Mrs. America” Regina Stock has kidney cancer; Hank Green has Hodgkin’s lymphoma

“Medical drama halts American Ballet Theatre gala in front of starry audience”; Alaska Airlines pilot, off-duty, has “nervous breakdown” mid-flight, tries to shut down plane’s engines

https://markcrispinmiller.substack.com/p/soap-star-christian-leblanc-diagnosed

Mary Lou Retton “fighting for her life in ICU”; Deion Sanders has “bad reaction to IV therapy”; WVU’s Akok Akok collapses on the court; gymnast Suni Lee’s “incurable kidney disease”

WWE Hall of Famer Kevin Nash has cancerous mole removed; Duke asst. coach “reveals cancer diagnosis”; Southern U. asst. coach “fighting cancer”; LSU golf coach resigns for “health reasons”

https://markcrispinmiller.substack.com/p/mary-lou-retton-fighting-for-her

Christiane Amanpour battling ovarian cancer; “Taylor Dayne talks cancer diagnosis”; DJ Eddie Cheba has 3rd stroke; Frank Fritz recovers from “debilitating stroke”; Britney Spears’ dad “severely ill”

Heather Rae El Moussa diagnosed with Hashimoto’s disease; “Pete Davidson’s friends concerned after comedian has second car accident in 3 months”

https://markcrispinmiller.substack.com/p/christiane-amanpour-battling-ovarian

In memory of those who “died suddenly” in the United States and worldwide, October 17-October 23, 2023

Athletes in the US, Canada, Mexico, France (3), Belgium, Czech R., Slovakia, Spain, Russia; coaches in US (2), Denmark, NZ; musicians in US (4), Canada, Paraguay, Chile, Algeria, Malawi; & more

https://markcrispinmiller.substack.com/p/in-memory-of-those-who-died-suddenly-3c7

Thousands more: https://markcrispinmiller.substack.com/

And not ONE person will even CONSIDER that it was the shot. These shots cause ADE. That was said from day one by Dr. Sherri and now we are seeing it pan out. The body is full of spikes and that causes the immune system to attack the body. It’s like lupus on steroids.

thank goodness for my vaccine or it could have been worse!

For TPTB, the “coincidences”, aka excess mortality, is running far behind schedule. Just wait until they release their new and improved pandemic pathogen in mid to late 2024. It should be a doozy.

Did I read that correctly? Excess mortality rates are declining? Oh no, what will the “Barillions are gonna die” crowd gonna say now?

.

17 million dead isn’t enough for you? If a piece of Halloween candy made one person sick it would be off the shelf already.

no, you did not read that correctly. some speculate that they may decline while others fear that they will continue or accelerate. you are reading the prejudices of stupid author – and count yourself in that category as well.

the deaths will take time to mature. the very fact that they are high guarantees that they will continue because the cause of death is all the same – the bioweapon. with many formulations of the bioweapon, some will take longer than others to terminate the victim’s life.

finally, in your most stupid moronic moment of imbecility, you think that declining is a big deal. declining will never go back to 0.

the insurance companies were subsidized by the “vaccine” president’s 6 trillion budget give away. insurance payouts will never proxy the death rates.

like global warming idiots, you will see a transient decline or increase as vindication of your retarded beliefs.

You could just as easily be wrong. If billions are going to die, you don’t things need to pick up speed vs. slowing down? A quick Google search says birth rates are holding steady since 2019 as well.

Declined as jab participation rates fell.