Why Are Gold Prices Are Jumping Around? Is Gold Really An Investment?

Guest Post by Dennis Miller at Miller On The Money

Guest Post by Dennis Miller at Miller On The Money

The 2000 dot-com crash, the events of 9/11/2001 the 2008 bank bailouts turned the investment world upside down. The Federal Reserve injected trillions into the financial system. “Too big to fail” banks were bailed out – not broken up. The negative effects of these decisions have now arrived.

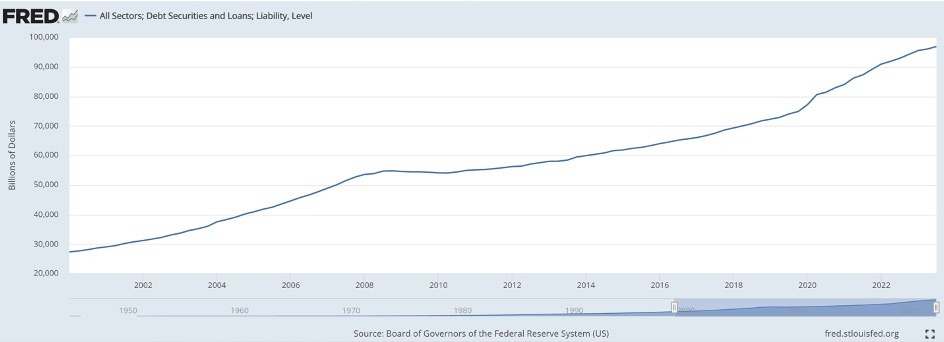

Historic cheap credit-fueled reckless government and private spending, tripling total public and private debt. When lenders wouldn’t lend at stupid low rates, the Fed created money out of thin air, with little regard for the negative consequences.

Since 2000, total US debt has gone from $27 trillion to $100 trillion. The Fed, finally fearing the inevitable inflation would spiral out of control, raised interest rates back to the historic normal, around 5%.

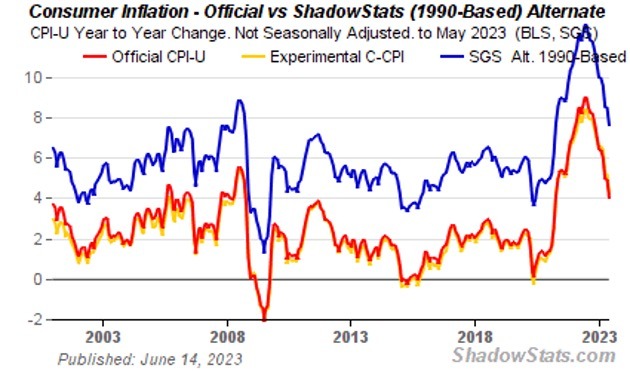

When government spends money it doesn’t have, it creates inflation. John Williams, shadowstats.com provides true inflation charts. If inflation was calculated today as it was in 1990 it would be reported much higher than the current government gerrymandered number:

When government spends money it doesn’t have, it creates inflation. John Williams, shadowstats.com provides true inflation charts. If inflation was calculated today as it was in 1990 it would be reported much higher than the current government gerrymandered number:

Adrian Day explains what’s happening:

Adrian Day explains what’s happening:

“Inflation is far from vanquished. The latest reading of the core PCE—the Fed’s preferred inflation measure—showed a month-on-month increase of 3.7% annualized. That’s close to twice the Fed’s arbitrary 2% target. But the situation is worse than that of course.

Most consumers think the notion of a cost-of-living index that excludes food and energy is nonsensical to begin with.

And even using the government’s figures, we see inflation slowly moving back up. This will likely continue.”

And even using the government’s figures, we see inflation slowly moving back up. This will likely continue.”

After the bank bailouts, I’m convinced inflation is inevitable and gold would be the ultimate hedge. What baffles me is what took so long? Gold prices have jumped all over the map – why?

Since 2020 federal spending has jumped over 50% and government reported inflation jumped around 9%. Gold began 2020 around $1520/oz. and closed the year at $1895. In January 2023 it opened at $1824, hit an all-time high of $2152 in November, then sharply dropped almost 10% – finally closing the year at $2063.

Double digit inflation arrived, historic deficit spending and money creation is rampant, we are involved in two significant international conflicts; yet gold trades in a fairly close range.

You should ad a share link for GAB. Just a thought.

Gold has never been an investment. One does not buy gold in order to sell it for more devalued fiat currency later. It is money and a store of wealth.

It’s one or the other, tard…and it AIN’T “money”.

And it has ALWAYS been an “investment” unless you’re digging it out of the ground yourself. Even then it is still an investment of time and labor. You find it, you steal it, or you BUY IT. That is the fucking DEFINITION of investment.

Scru’s a bot, so this is only more edification, appended to my original post: gold (and silver) is money, as mandated by the US Constitution.

It’s like the saying, ‘Cash is king until cash is trash.’ Gold is money until it’s not. Only then after it stops being money is it an investment or a storage of wealth.

I’m all for anything Scrotum is against. The stupid, it hurts!

Hey Tard. For 99.99% of human history, until very recently, Gold has either been used directly for coinage or backing of paper currency. That’s called money. And if you have a lot it its also a “store of wealth”. Duh.

MONEY TO WHO THOUGH??? GOLD IS NOT WORTH THE EXPENSE TO EVEN HAVE AROUND THE HOUSE. TO USE IT YOU HAVE TO TRADE IT IN TO GET CASH AND WONDER IF THERE’S NO CASH AROUND AND SOCIETY HAS GONE DOWN HILL, WILL GOLD STILL BE USED FOR MONIES OR WILL BARTER AND TRADE AGAIN BECOME THE HALLMARK OF LIFE. GOLD IS ONLY WORTH WHAT SOME BUERACRAT IN SOME OFFICE SAYS IT’S WORTH. GOLD WAS 35 DOLLARS AN OZ WHEN ROOSEVELT SIEZED EVERYONE’S GOLD BACK IN THE 30’S NOW IT’S SUPPOSEDLY WORTH WHAT, 2100 AN OZ… WHY NOT 5000 AN OZ??? IT A NICE PRETTY METAL THAT ONLY GOOD FOR MAKING PRETTY JEWELRY AND ELECTRONICS FOR IT CONDUCTION OF ELECTRICITY.

Worth more than paper

you don’t have to shout

No one is shouting or yelling. Upper case is just upper case.

Stop yelling dude.

No Name, Joe, ILuvCO2,

All the world is a stage and JOSEY WALES, ARIZONA & SGT SNUFFY are just actors (or the same troll actor.)

Paper gold is used to suppress the price. Because so many investors don’t take delivery, it’s possible to manipulate the price downward by rehypothicating gold. Essentially selling the same bar of gold multiple times.

For every bar in the vaults, there’s over a thousand claims against it.

It’s like a big game of musical chairs, only one with 1000 players and one chair.

As the man said regarding precious metals, “If you can’t touch it you don’t own it.”

Finally, someone who understands. Thanx, Warren.

This is what is coming…

CLICK ON TO ENLARGE ESPECIALLY JOSEY WALES…ARIZONA & SGT SNUFFY!!!

Is gold really an investment?

I’ll play.

Not as a primary reason for securing some.

But, historically, it has proven to offer decent ROI for fiat invested.

Long holders cop the mindset of securing some as wealth preservation first.

If it proves to bring a good or great return on investment over time, even better.

Knowledgeable folks on the topic are aware of how 1 oz. coins have held their purchase power down through the centuries. 1 oz. could always buy a fine suit & pair of shoes.

Still will, to this day, as well as in Roman times.

Here’s a more modern tale.

Circa 1995, lunchtime TV ads were pitching gold coins similar to the peddlers today.

I bought one, for $400 U.S. dollars.

A mere year or two later, spot price dropped to $300 / oz., so those subsequent pitches were ignored, after having seen the $400 “investment” lose 25% of it’s value in a short time.

I should have backed up the truck and loaded it up. That would have been ballsy.

Right, mark?

And what happened after that was, spot gold prices climbed to $800 / oz. and held.

Where the hell are we now?

Kitco has spot gold hovering around $2k.

But, again, the correct way of looking at that isn’t that gold is more expensive.

More accurately:

It now takes way more fiat dollars to exchange for a 1 oz. gold coin than it did a mere 3 decades ago in 1993.

Therefore, the purchasing power of fiat currencies has diminished (slowly, but)

drastically since the shenanigans began in 1913. It was $20 / oz. back then, and your fiat was redeemable for the gold coin.

Research what is says on old green sheets backed by metal, called Silver Certificates and Gold Certificates, by the U.S. Treasury way back before 1971, a significant date for those knowledgeable on the topic, yet again.

The CAUSE of this can be debated, but Austrian economics advocates cite the increasing frequency of the hum of printing presses that have increased the fiat money supply, being used to chase fewer goods. There’s the real definition of inflation, a cause.

Hmmm…a Cause? To what Effect?

Why, higher prices, of course.

For EVERYTHING!!!

Always laugh when the tut-tut claims of “you can’t eat your gold”,

and “they won’t make change for your 1 oz. Eagle at 7-Eleven for bread & milk”

–>Laughable arguments.

If it comes down to hyperinflation, that’s where pre-’65 silver coins come in, as lower denomination metals that will be given strong consideration for barter by the farmer willing to unload some of his free range chicken products to interested buyers.

For gold products that have increments larger than junk silver, but fractionally less than a full oz. gold Eagle, there are other options:

-Current 1 oz. silver Eagles, Maple Leafs, etc., or:

-Valcambi scored cards of gold, credit card sized, breakable into fragments of grams.

-1/10th ounce gold coins;

-Credit Swiss or PAMP gold ingots, in 1,2,3,5,and 10 gram sizes.

Good luck eating that lettuce salad of green and white colored scraps of paper,

or worse, a plastic credit card, when those hunger pangs hit.

Might want to secure a wheelbarrow, in shades of Wiemar.

It’s going to need to be full, when you head to the bakery for a loaf of bread,

if the trajectory continues, which it seems to be doing.

Parting shot: Going all in on gold, metals, or anything else, is a fool’s errand.

But a 10-20% stake of your wealth, preserved via securing some metal,

just might be the tactic that saves your survivorship chances when TSHTF.

It’s coming.

Prepare accordingly.

Excellent analysis AuGee!

IS GOLD REALLY AN INVESTMENT??? NO IT’S NOT, WHY NOT YOU ASK??? WELL YOU CAN’T EAT IT, YOU CAN’T USE IT TO MAKE BULLETS OR TOOLS OR ANYTHING THAT YOU WOULD USE FOR SURVIVAL. CAN YOU BUY FOOD WITH IT??? NO. WATER?? NO. GAS FOR YOU ENVIRO KILLING CAR??? NO. CAN YOU WALK INTO ANY STORE IN THE WORLD AND BUY ANYTHING WITH IT??? NO. WELL MAYBE IN SAUDI ARABIA YOU CAN. BUT NO WHERE IN THE WESTERN WORLD CAN YOU USE IT LIKE EVERYDAY CASH. THING IS WHEN YOU REALLY LOOK AT GOLD IT’S JUST A PRETTY SHINY METAL USED TO MAKE PRETTY JEWELRY OR ELECTRONICS. EVEN THE NORTH AND SOUTH AMERICAN TRIBES AND EMPIRES NEVER USED GOLD OR SILVER FOR MONIES THEY MADE PLENTY OF PRETTY IDOLS AND JEWELRY, IT WAS ONLY EUROPEANS THAT PUT A VALUE ON GOLD. THINK ABOUT IT BEFORE YOU SEND YOUR CASH INTO SOME BUSINESS JUST TO GET BACK A PIECE OF WORTHLESS PAPER SAYING YOU HAVE SUCH AND SUCH AMOUNT OF GOLD. JUST SAYIN.

So SHOUTS Josey Langley….who is probably ARIZONA and SGT SNUFFY…same Bankster/Government paid troll…saying/using the same Bankster/Government paid troll message tactics.

Pretending to be a clueless Boomer…BLAH…BLAH…BLAH…

My name is JOSEY WALES…ARIZONA…SGT SNUFFY…and I always SHOUT the same BOOMER BULLSHIT because I get paid to create an image by the Banksters who own the government.

Methinks Josey can’t afford any gold or silver soooo……..might as well hate it!

Scott,

Josey Wales is supposed to play the part he is playing…that is all him, ARIZONA and SGT SNUFFY do …they are identically interchangeable…most likely the same troll/bot whose mission is feeding the stereo type.

Any regular can see their almost identical style, WORDING, views, and pretend ignorance…and none of them will ever post a follow up to a challenge…to date.

They get paid by the post…or they are the THREE BOOMER STOOGES!

Hello…Hello…Hello…’HELLO’!

JOSEY WALES…ARIZONA…SGT SNUFFY…

You really miss the point here JOSEY WALES. As long as there’s an Indian, a Chinee or a Whi-Tee with sense around gold will buy things, so will silver. Your dollar bill used to be redeemable for gold or more likely silver. It was the ONLY WAY THE GOVERNMENT COULD PERSUADE PEOPLE TO USE THE PAPER. After they got folks accustomed to the paper they removed convertibility into gold, then silver, leaving you with a promise… of NOTHING AT ALL! That’s only slightly worse than SENDING YOUR CASH INTO SOME BUSINESS JUST TO GET BACK A PIECE OF WORTHLESS PAPER SAYING YOU HAVE SUCH AND SUCH AMOUNT OF GOLD. JUST SAYIN. If’n y’all ever get the whim ta buy some worthless gold or silver, ‘member, you ain’t holding it, it ain’t your’n. Paper ain’t shit, son, ‘nless it’s shit paper.

To all the gentlefolk out there, sorry about the yelling.

Is Gold Really An Investment?

No!

If you think Gold is an investment, then you need to buy US Dollar futures.

Gold is hard money. It can be used as money. It stores its value forever.

I view gold and silver as insurance and collateral.

Gold and Silver are not investments but a hedge for when the fiat currency, that is the US dollar, officially becomes worthless.

hey Dennis, FIFY:

Why Are Gold Prices Jumping Around? Is Gold Really An Investment?

ocd was killin me.

Buy physical, stick it in the safe and forget about it…all markets are manipulated and nobody knows the true value of anything…BTW, it’s Silver you want in the long run.

US Debt (ex unfunded liabilities) is about $34T not $100T.

https://www.pgpf.org/national-debt-clock