Guest Post by David Stockman

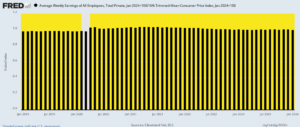

There should be no doubt that the UniParty has left main street households high and dry. During the past five years inflation-adjusted weekly earnings have barely limped forward at a 0.4% annual rate.

Self-evidently, the Fed’s pro-inflation policy has backfired. Rather than functioning as a stimulant to growth, it has ended up devouring nearly all of the modest nominal wage gains that have been realized by private sector workers in America.

Index of Inflation-Adjusted Average Weekly Earnings, January 2019 to January 2024

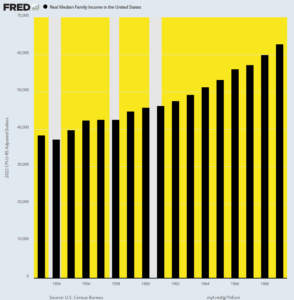

Needless to say, this has been far from the case historically. In fact, real median family income grew at a robust 3.54% per annum between 1954 and 1969. But shortly thereafter, the Fed’s shackles were removed with respect to gold convertibility in August 1971, and it was off to the inflationary races from there.

During the next 53 years, family incomes barely won the footrace against the waves of inflation generated by the nation’s central bank. Real median family income rose by only 0.74% per annum between 1969 and 2022 or by just 21% of the 1954-1969 average.

That’s right. Median family income growth in inflation-adjusted terms has decelerated by four-fifths since 1969. So the question surely recurs: Did the lapse of fiscal and monetary policy into Keynesian deficits and money-printing actually stimulate the growth of main street living standards and real wealth?

Most surely it did not.

Real Median Family Income, 1954 to 1969.

To be sure, we don’t believe the Fed is intentionally trying to monkey-hammer the middle class. The explanation is actually both more direct and more sinister. To wit, especially since the arrival of Alan Greenspan at the Fed, the nation’s central bank has increasingly become the outright captive of Wall Street money shufflers and speculators.

Moreover, the latter is inherent in the Keynesian form of modern central banking because its policy transmission mechanism runs right through the canyons of Wall Street. The Fed’s policy-making arm, the FOMC, is not only located on Liberty Street at the foot of the financial district but utterly depends upon Wall Street traders of stocks, bonds, money and their derivatives to transmit its policy directives to the main street economy. That is to say, the Fed funds rate is the financial lever from which the Fed cascades price signals to the money and bond markets and from there to equities, real estate and other financial assets, which, in turn, are supposed to levitate the rate of investment and real growth on main street.

It was never intended to function in this round about manner, however. The original design of the Federal Reserve System as wrought by Carter Glass in 1913 operated through the main street banking system, not the Wall Street capital and money markets. Its essential mechanism of policy transmission was the discount windows of the 12 regional reserve banks.

But in this modality, the policy mechanism was essentially passive. It was not designed to steer the macroeconomy because Congressman Glass and his fellow legislators of that era fully understood that free market capitalism operating on gold standard money was fully capable of generating the maximum growth, prosperity and wealth available from the population and technology of the day.

Accordingly, there was no silly belief, as today, that capitalism was always on the verge of plunging into a black hole of recession or depression or that it was inherently incapable of reaching its “potential” GDP. There was no need, therefore, for an arm of the state to target employment levels, real growth, capital investment, housing starts or inflation rates. All of that was understood to be the province of free men on free markets interreacting through the medium of sound money linked to an enduring weight of gold.

To the contrary, the remit of the Glassian Fed was far more modest and narrower. It was designed to keep the commercial banking system liquid during times of seasonal or financial stress by standing ready to discount sound commercial papers at a penalty rate of interest, which, in turn, floated above the ordinary free market rate.

Accordingly, the Fed was a rate taker, not a rate setter. And it was a lubricator of the commercial loan market, not the financier of government debt. And most of all, it was pro-market, not an incipient monetary politburo.

That made all the difference in the world. The Glassian Fed did not need to be clairvoyant about the economic future since the latter is impossible to know where even a modicum of free market choice and dynamics are operative. It therefore had no bias with respect to whether market interest rates were low, high or in-between at any given point in the business cycle. Nor did it fret about Wall Street based capital markets and the level of stock and bond prices, either.

By contrast, the essential business of Wall Street is speculation in existing financial assets, with the syndication and distribution of new stock and bond issues holding a distinctly secondary status in terms of activity levels and profitability. Consequently, speculators are inherently and irredeemably biased toward low, lower and still lower interest rates.

That’s because speculation in all its forms is ultimately based on the carry trades. That is, a positive spread between the financial cost of carrying a tradeable asset and the returns being earned upon that asset. And this includes, importantly, not merely so-called “cash” market stocks and bonds, but every form of futures and options derivatives, which are priced in part based on the implicit cost of money over their term.

Beyond that, the yield curve pegged to the money market also sets the capitalization rate or valuation multiple for longer-duration assets. Self-evidently, therefore, speculators want the cost of money to go down since that reduces the funding cost of their trade on the liability side of balance sheets, even as it causes the market to bid up the valuation multiple of their asset.

The very greatest mistake of state economic policy, therefore, is to allow the central bank to become hostage to Wall Street speculators. Everywhere and always they will push central bankers to set rates lower for longer, or even less high for less time whenever inflation breakouts force them to apply the so-called monetary brakes.

For avoidance of doubt just consider a crucial ratio in that regard during the era since Greenspan went full retard with respect to the so-called “wealth effects” doctrine, which is just a conservative sounding cover story for money-printing. To wit, asset prices have soared by orders of magnitude more than wages and incomes, yet there would be no logical or sustainable basis for that on a sound money based free market.

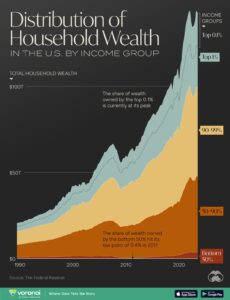

Yet during the one-third century since Q3 1989, real median family incomes have risen by only 0.70% per annum, while the real net worth of households has increased by 3.18% per annum. That’s a ratio of 4.5X when for all intents and purposes it should have been 1.0X.

Needless to say, even in the scheme of honest capitalism, household asset and net worth holdings are not evenly distributed because contributions of work, enterprise, investment and invention are not evenly distributed, either. But when the natural winners on the free market get an extraordinary boost from central bank-fostered inflation of financial assets, the spiral of ill-gotten gains can quickly compound upon itself, leading to egregiously unfair accumulations of net worth over time.

Thus, between Q3 1989 and Q3 2023, the net worth of the top 0.1% of households rose from $1.75 trillion to $19.85 trillion or by 11.3X. By contrast, the net worth of the bottom 50% of households rose from $0.71 trillion to $3.64 trillion or by just 5.1X.

The point is, the distributional pattern from the natural winners of capitalism was already in full force as of 1989. There is no reason at all why the net worth gain of the top 0.1% was more than double the relative gain of the bottom 50%. In fact, however, those that have the assets are far better positioned to engage in leveraged gambling with FU money than average households struggling to make ends meet in the face of the relentless goods and services inflation—a scourge embraced by the Fed as a matter of fundamental policy.

Accordingly, when these figures are put in the practical term of net worth per household the distortion becomes abundantly clear. In 1989 the 92,000 households comprising the top 0.1% had net worth of $18.86 million each. That was 1,230X the $15,300 average net worth of the bottom 50% or 46.4 million households.

However, the gain over the next 34 years was $138 million each for the top 0.1% or 131,000 households compared to the gain of $44,000 each for the bottom 50% or 65.7 million households. That’s a ratio of 3,175X.

In short, when it comes to central bank money printing owing to its captivity by Wall Street speculators and traders the old saying about the rich getting richer could not be more apropos.

Moreover, the data leave no doubt that the gains from financial asset inflation are systematically asymmetrical. Over this 34-year period, net worth has increased as follows by wealth bracket:

- Top 0.01%: +$18.1 trillion or 11.3X.

- Next 0.99%: +$20.7 trillion or 8.1X.

- Next 9%: +$43.6 trillion or 6.6X.

- Next 40%: +$36.6 trillion or 6.0X.

- Bottom 50%: +$2.9 trillion or 5.1X.

So the question recurs. What would happen if the Fed’s open-ended mandate owing to decades of mission creep were to revert to the Glassian Discount Window model?

We’d suggest several outcomes, all of which would be more than welcome.

- The banking system would remain liquid and safe.

- Economic growth and prosperity would be a function of the free market, which cannot be improved upon by the state in any event, as the record since 1987 amply proves.

- There would be no massive monetizaiton of government paper or explosive growth of the public debt because deficits would be honestly financed in the bond pits, causing crowding out, rising interest rates and potent political reactions.

- Inflation of both asset prices and goods and services on main street would end.

- The government contribution to the growing maldistribution of wealth would be eliminated.

What’s not to like about that?

Distribution of U.S. Household Wealth

Note: The share gains since 1990 have been concentrated in the top 0.1% and next tier of the top 1%.

Editor’s Note: The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming.

That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Neither party, or any individual candidate, ever discusses government debt or government spending. Massive cuts are needed, and will never happen under the current regime.

They’ll never happen, because the masses believe in them. The regime is comprised of mass belief, not of individuals. Replace the individuals, but the system remains.

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.”

― R. Buckminster Fuller

“In truth, the belief in “government” is a religion, made up of a set of dogmatic teachings, irrational doctrines which fly in the face of both evidence and logic, and which are methodically memorized and repeated by the faithful. Like other religions, the gospel of “government” describes a superhuman, supernatural entity, above mere mortals, which issues commandments to the peasantry, for whom unquestioning obedience is a moral imperative.” ― Larken Rose, The Most Dangerous Superstition

“Just as everyone in a tribe praying to a volcano god would reinforce the idea that there is a volcano god, so begging politicians for favors reinforces the idea that there is a rightful ruling class, that their commands are “law,” and that obedience to such “laws” is a moral imperative.”

― Larken Rose, The Most Dangerous Superstition

https://www.goodreads.com/work/quotes/15750971-the-most-dangerous-superstition

Yeah, it is as bad as worshipping corporations. Government by another name is still government. But we all know that governments are just one or more mortals acting in some concerted way, right?

Budget cuts hurt, politicians know that, people will never vote for hurt, but it will come anyway.

They’ve hurt us in every other way. Why should this be any different?

It is different, because deficits keep them in power, cuts remove them from office. The average American is something between ignorant and stupid when it come to economics. i.e. buying greed as the cause of shrinkflation.

Wage increases wage shmncreases. Why do you think they lied by a factor of 3 on CPI for decades?

If you can’t beat them join them.

Pay off your debt then buy assets stocks real estate and precious metals.

If you can’t beat them join them.

Yea, I used to hear that as a kid.

What does that mean?

That person stole from me!

So become a thief?

They lied to me!

So become a liar?

They are parasites!

So become a parasite?

Truth is my sword.

” If you cant beat them join them , and then subvert them from within ” . People always leave that last part out .

People live beyond their means.

If you want something, you wait until you can afford it. House, car, college degree, whatever.

You develop generational wealth, built over decades, not pay periods.

Whatever.

Just be careful WHERE you say that! LOL!

I would not recommend ANY college campus…just for example.

Yep , that’s still “Realville “,but for a myriad of reasons ,unrealistic expectations have taken hold in most peoples minds and are now taken as the new baseline “given ” .Realville has a very small population indeed . This is another area where with age comes the ability to contrast modern assumptions . I think about what my life anyway ,looked like in the early 1970’s for instance , where we had one rotary phone hanging on the wall in the kitchen , the same kitchen where the one 26 dollar airtight stove heated the whole house. There was one cathode ray tube in the living room , along with a console stereo and so on and thats just the way it was and we didnt expect anything more . Anonomous above cited the line ” if you cant beat em join em ” and I can remember being dissapointed when Popeye said that at the end of an episode . But the line that sums up the thinking that got us here is Whimpy’s signature line ” I’ll gladly pay you tommorow for a hamburger today ” .

Leaving the farm and becoming a wage slave to the dollar was the biggest mistakes humans ever made in this country.

It dictates every facet of ones behavior…

A false sense of ones worth…

A false sense of values which are for sale for the right price…..

A false sense of the true VALUE of an individual.

A false sense of the worth of ones LABOR!

This was called “progress”……