Just when you thought US consumers had finally learning their lesson, and had stopped buying stuff they can’t afford with money they don’t have… we got the latest consumer credit data which collapsed that particular thesis in a millisecond.

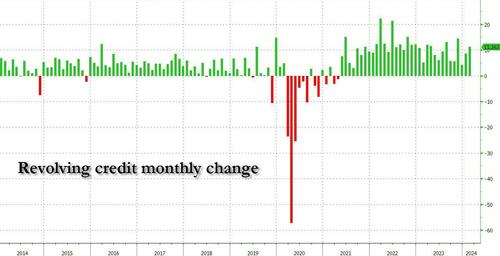

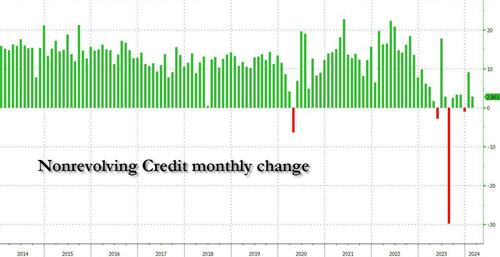

After two months ago we saw an unprecedented halt to growth in both revolving credit (i.e., credit card) growth – which rose by just $1 billion (since revised to $4 billion) – as well as non-revolving (i.e., auto and student loans) which practically actually shrunk by $1 billion – in January things were seemingly back to the American normal, as total consumer credit surged by $19.5BN, compared to the $0.9BN downward revised December print (from $1.561BN originally), driven by a powerful rebound in both credit card and auto loans. Things then continued on autopilot: moments ago the Fed reported that in February consumer credit rose by $14.125BN, roughly flat from the downward revised $17.684BN in January, driven by a powerful surge in revolving credit even as growth in non-revolving credit unexpectedly faded.

Starting at the top, revolving credit in February rose by $11.3 billion, up from an upward revised $8.6 billion…

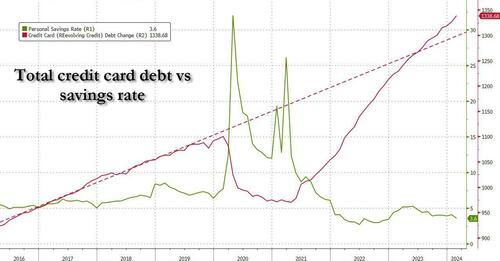

… pushing total revolving credit to a record $1.339 trillion, which as shown in the chart below means that the trendline from the pre-covid era has now been surpassed, while the savings rate is at an all time low.

Meanwhile, on the non-revolving credit side, “number also go up“, but by much less, rising by just $2.8 billion, down from the $9.1 billion increase in January, and hitting a record high $3.712 trillion after unexpectedly declining by $1 billion in December.

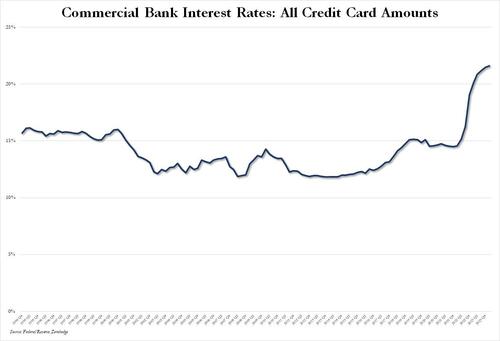

The latest acceleration in credit card debt comes as a surprise for several reasons, not least of all that according to the Fed, the average rate across all commercial banks on all credit card amounts just hit a new record high of 21.59% in Q1 ’24, despite the drop in rates observed in late 2023, which is a vivid reminder that while banks are happy to hike credit card rates, they rarely if ever cut them.

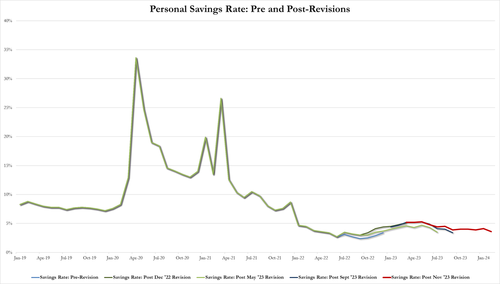

Yet with consumers ever more strapped for actual cash and equity, as the personal savings rate in the US has collapsed from over 5% to 3.6% – the lowest since 2022 – in just a few months…

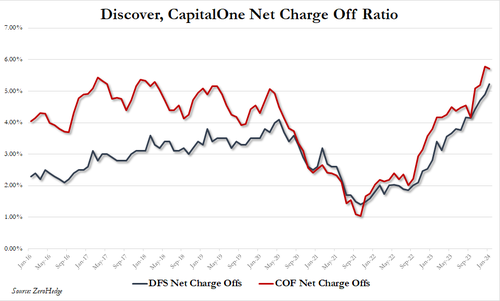

… there is only so much more credit card maxing out that can take place before reality finally sets in, although with an election on the horizon – one which ensures that any credit-card fueled spending must be encouraged – don’t be surprised if the White House instructs banks to just ignore soaring delinquency and charge-off rates…

… as discussed previously in “These Are The 5 Charts The FDIC Does Not Want You Paying Attention To”, only for the hammer to fall on the first day of Trump’s new presidency.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

IF………….if I had a credit card I would max that fucker out on gold and ammo and stiff MC/Visa.

Its time to start thinking out of the box my friends.

I have been saying that a long time,you really do not care about your credit score build it up well,and then…..,melt it down on preps!

Whats a “credit score” ?

Slavery vis usury

Well,in many cases voluntary slavery though do feel some folks using cards for just the living basics,and yes,the private bankers behind the govt. set it up so that was necc.,in minecraft those people would be all removed.

If you can’t pay your credit card off every month don’t use it. I learned that the hard way with a POS wife, now an ex-wife.

NGL. Took out a new 18mo 0% apr credit card with my near perfect credit so I can buy a barn now and have it paid off before the interest is do.

The same people that are trillions in debt due to a failed monetary system want to regulate everyone else on financial services and give people credit scores?

Around my neck of the woods, people are still out and about, fully adjusted to the $3.30 a gallon gas, sky-high grocery bills, and shopping centers are packed. Even if gas hits $30-$50 a gallon, people will still be out and about, shopping and spending, unless something happens.