The Recession of 2011?

By John Mauldin

August 20, 2011

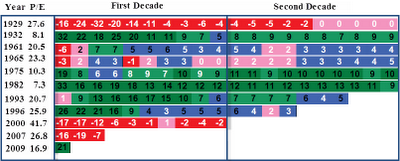

The data this week was just ugly. Even the uptick in the leading economic indicators, seized upon by so many talking heads, must have a large asterisk beside it. This week we look at the increasing probability that we are headed for recession, and the follow-on implications. Then I take a perilous and speculative journey into the realm of the political, commenting on Texas (and my) Governor Rick Perry’s rather interesting comments about the Fed and Ben Bernanke. There is a lot to cover, and lots of charts, so we will jump right in. But please read at the end about two events coming up in the next few months that you might be very interested in attending.

It was relatively easy for me to forecast the recessions of 2001 and late 2007 over a year in advance. We had an inverted yield curve for 90 days at levels that have ALWAYS heralded a recession in the US. Plus there were numerous other less accurate (in terms of consistency) indicators that were “flashing red.” (For new readers, an inverted yield curve is where long-term rates go below short-term rates, a [thankfully] rare condition.)

And since stocks drop on average more than 40% in a recession, suggesting that you get out of the stock market was not such a challenging call. Although, when Nouriel Roubini and I were on Larry Kudlow’s show in August of 2006, we got beaten up for our bearish views. And you know what? The stock market then proceeded to go up another 20% in the next six months. Ouch. That interview is still on YouTube at http://www.youtube.com/watch?v=9AUoB7x2mxE. Timing can be a real, um, problem. There is no exact way to time markets or recessions.

My view then was based on the inverted yield curve (as an article of faith) and, not much later in 2006, my growing alarm as I realized the extent of the folly of the subprime debt debacle and how severe a crisis it would become. I changed my assessment from a mild recession to a serious one in early 2007 as my research revealed more and more fault lines and the damning interconnection of the global banking system (which has NOT been fixed, only made worse since then). I should note that my early views were rather Pollyannaish, as I thought (originally) that losses to US banks would only be in the $400 billion range. I keep telling people that I am an optimist.

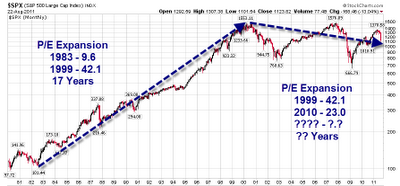

With the Fed artificially holding down rates on the short end of the curve, we are not going to get an inverted yield curve this time, so we have to look for other indicators to come up with a forecast for the US economy. We grew at less than 1% in the first half of the year. That is close to stall speed. And that was with a full dose of QE2! So now, let’s look at a series of charts that cause me to be very concerned about the near-term health of the economy. Then we turn to Europe and problems compounding there.

Last year I was having a discussion with Lance Roberts of Streettalk Advisors in Houston about how to build an indicator that might give us a clue as to the direction of the economy. Most indicators use one or two data points and thus can be suspect.

For instance, the Philly Fed Economic Index went from 3.2 in July to -30.7 in August, helping to tank the market. Almost every subcomponent (new orders, employment, etc.) was not just down but negative. This was truly a shocker. You can see the gory details at http://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2011/bos0811.cfm.

The Empire Index (New York) went from -3.8 to -7.7. The Empire Index suggests that the August ISM manufacturing number will be 49, or in a state of negative growth. The Philly Index suggests a very dismal 42, which if true would suggest we are already in recession. But these are regional indexes.

Now, just for fun, let’s look at a combined index that David Rosenberg created from the Philly Index plus the Michigan Consumer Confidence Index. (Those of us old enough can remember Jack Nicholson playing the Joker in Batman back in 1989. When Batman escaped with the help of something from his tool kit, Nicholson said, “Where does he get all those wonderful toys?” When I read Rosie’s newsletter, I have the same reaction. “Where does he get all those wonderful charts?” He swears he makes them himself. I stand in awe.)

Notice that with Rosie’s combined index where it is today, we are either at the beginning of a recession or already in one. And the Philly Fed Index is consistent with a 90% chance of a recession.

And that is again consistent with the following chart from Rich Yamarone, which I used last month but that bears looking at again. Rich is chief economist at Bloomberg. (By the way, for Conversation subscribers, I just recorded a powerhouse session with Rich, which will be available as soon as we can get it transcribed.)

I previously wrote, in late July:

“And the last chart is one I had not seen before, and is interesting. Rich notes that if year-over-year GDP growth dips below 2%, a recession always follows. It is now at 2.3%.”

Oops. Last week David Rosenberg updated that chart. This from Rosie:

If Rich is right, then the next revisions to second-quarter GDP will be down from an already abysmal 1.3%. And the growth in the second half is not going to be all that good for jobs and consumer spending

But these are charts of single data points. You can quibble that the Philly Fed could be influenced by something local or that the 1.6% number might be different this time. So Lance Roberts of Streettalk Advisors (with me looking over his shoulder) created an index that combines a number of economic indexes in an effort to build an index that is not subject to single (or double) indicators. The Streettalk/Mauldin Economic Output Index is composed of a weighted average of the following indexes:

Chicago Fed National Activity Index

Chicago PMI

The Streettalk ISM Composite Index

Richmond Fed Manufacturing Survey

Philly Fed Survey

Dallas Fed Survey

Kansas City Fed Survey

The National Federation of Independent Business Survey

Leading economic indicators

Note that there are six regional and national indicators, plus the NFIB survey, which is national. Lance’s index is not driven by one region or index or survey. When the combined indicator falls below 30, it has always indicated either that we are in a recession or about to be in one. The chart is overlaid, below, against GDP and LEI (leading economic indicators) – both tend to have a fairly high correlation to our Economic Output Composite Index. And LEI is currently supported by the yield spread and money supply (more on that below).

A few quick notes before the chart. First, note the increases in the index with the onset of QE1 and QE2 and the sharp drops when QE ends. The red at the end of the chart is the recent drop, and it takes us into recession territory. Recessions are indicated by gray bands

Note: I will be speaking at the Streettalk conference on October 14 in Houston, and tickets are currently on sale at www.streettalklive.com. David Rosenberg will also be speaking. They put on a very good conference at a reasonable price.

Now, a comment on the uptick in the leading economic indicators this week. Even the ECRI noted that it was because two of the financial components added to the positive numbers. One was the sharp rise in M2 money supply. But a lot of that is because people are going to cash, which is not all that positive from a macro viewpoint. The other is the steepness of the yield curve, which is being manipulated at the short end. Without their positive contributions, the index would be down 0.5%, down three of the last four months, and in a pattern that led to a recession in late 2007. Coincidence?

One last chart from Batman, I mean Rosie. Here he gives us the latest data from Larry Meyer’s Macroeconomic Advisers, where they track the real GDP index (inflation-adjusted). It is also in recession territory.

Housing is terrible. Existing-home sales were bad. The inventory for homes for sale grew, even as mortgage rates are at all-time lows. A 30-year mortgage is at 4.15%. It is possible we could see a 30-year mortgage with a “3” handle if we slip into recession. I could go on and on about the negative data, and may do so in future letters, but I will resist writing another book tonight, as we have a few other topics to cover.

To say that the government of Europe is dysfunctional is an no-brainer. The bright side is that it makes the US government look slightly better, and that’s not saying a lot. This past week Nicholas Sarkozy asked Angela Merkel out, so they could decide what to do about the euro crisis. What they said was, we need yet another eurozone governing body overseeing fiscal debt and promises by governments not to run large deficits – like that has ever worked. And they unequivocally said “non” and “nein” to the idea of eurobonds, which everyone else says is vital if the euro is to survive. Oh, and we will harmonize our tax structures within five years. As if that solves the crisis today. Note to Nick and Angela: the problem is not tax structures, it is debt that cannot be repaid.

Lars Frisell is the chief economist for the Swedish group that regulates that nation’s banking system. Yesterday he was quoted as saying:

“It won’t take much for the interbank market to collapse. It’s not that serious at the moment, but it feels like it could very easily become that way and that everything will freeze.” (hat tip, Art Cashin)

My friend Porter Stansberry wrote today:

“In Europe, the problem is a bit different … and slightly more technical. Most of the debt in Europe is held by the big banks, not the sovereigns. Look at just two French banks, for example. Credit Agricole and BNP Paribas have combined deposits of a little more than 1 trillion euro. But they hold assets of 2.5 trillion euro. Those assets equal France’s entire GDP.

“And those are only two of France’s banks. Right now, the tangible capital ratios of these banks have fallen to levels that suggest they are probably bankrupt – like UniCredit in Italy and Deutsche Bank in Germany. BNP’s tangible equity ratio is 2.85%. Credit Agricole’s tangible equity ratio is 1.41%. (UniCredit’s is 4.42%, and Deutsche Bank’s is 1.92%).

“These banks have long been instruments of state policy in Europe. They’ve funded all kinds of government projects and favored industries. Making loans is far more popular with politicians than demanding repayment for loans. As a result, these banks are left with nothing in the kitty to repay their depositors. If there’s a run on these banks (and there will be), how will they come up with money that’s owed?”

I totally agree (although Porter is wrong about US debt). If there is a sovereign debt credit crisis in Europe, it is entirely possible that 80% of Europe’s banks will be technically insolvent, depending on the level of the crisis. Frisell could be eerily prescient. We gave them subprime; they may pay us back with their own crisis and in spades, as Dad used to say.

I really need to do a whole letter on Europe again soon. The next real crisis in Europe that is not bought off with yet more debt will push the world into recession. It is that serious. That is why the ECB keeps ignoring its charter and taking on bank debt and buying sovereign debt they know will be marked down.

The entire world economy now swings on the German voters and whether they will take on all of Europe’s debt, risking their own AAA status and putting themselves at serious risk. Supposedly, Finland wants collateral from Greece if it contributes its portion of a guarantee. Think every other country will not want some of that action? I simply do not have the space to go into it tonight, but this is VERY serious. Maybe next week. And just as I was getting ready to hit the send button, economy.com sent me an email entitled “Article: Europe’s Leaders Know the Way but Lack the Will, by Tu Packard. Summary: The stability facility lacks credibility.”

That more than sums it up. Dysfunctional indeed.

We now need to turn to Governor Perry, our newest candidate for president.

I have been asked many times what I think about Governor Perry getting into the presidential race. Over six months ago he told me personally there was no way he would run, and he was serious when he said it. I believed him. But what I think happened in the interim is that he looked at the field of candidates and said, “I can play in that league.” And as long as he can keep from making any more gaffs like he did with his Fed comments, he can indeed play in the current field. He has the charm of being plainspoken and blunt, and that might just play well this year. Whether the country is ready for another Texan is a different question.

(Sidebar: my personal bet is that there are at least two and possibly three other potential candidates who would be taken seriously if they got into the race. They, too, have got to be saying, “Is this all I’m up against? I can play in this league. In fact, I might just be the MVP.” The lure of the presidency is a powerful one. My bet is we have not seen the final field of candidates. And it is not impossible that a challenger emerges on the Democratic side as well. Obama’s poll numbers, even among Democrats, are not good. This is a very interesting political year and as wide open as I can remember.)

But however injudicious Perry’s actual remarks were, he is right to call into question Fed actions. Why do I as your humble analyst get that right and politicians don’t? Let me be clear. I want a VERY independent Fed. I do not want Congress or the President dictating Fed policy. I do not like Senators holding up Fed nominations for political gain, whether it was Dodd fighting Bush over his nominees or current GOP senators fighting Obama over his. That is simply wrong in every way. But I think Fed actions are fair game for comment and disagreement. And I agree with Perry that QE2 was not helpful. It was not very wise policy – but that is a long way from “treasonous.” Let’s see if the electorate gives him a “mulligan” on that comment.

Think about this. The Fed announced this week that it would extend low rates until 2013. They are practically pushing people into higher-risk assets in a search for yield, at PRECISELY the time we may be slipping into recession, which will put those assets at their highest risk. I think this could end in tears and land those who are close to retirement in even worse shape.

Note to Governor Perry: If you want to learn how to properly criticize the Fed and the US government, go read the last ten speeches of another Texan, Dallas Fed President Richard Fisher (who should be the next Fed chair!). Let’s take a look at a few paragraphs from his latest speech, this week (again, hat tip Art Cashin).

“I have spoken to this many times in public. Those with the capacity to hire American workers―small businesses as well as large, publicly traded or private―are immobilized. Not because they lack entrepreneurial zeal or do not wish to grow; not because they can’t access cheap and available credit. Rather, they simply cannot budget or manage for the uncertainty of fiscal and regulatory policy. In an environment where they are already uncertain of potential growth in demand for their goods and services and have yet to see a significant pickup in top-line revenue, there is palpable angst surrounding the cost of doing business. According to my business contacts, the opera buffa of the debt ceiling negotiations compounded this uncertainty, leaving business decision makers frozen in their tracks.

{Mauldin note: Opera buffa (Italian; plural, opere buffe) is a genre of opera. It was first used as an informal description of Italian comic operas variously classified by their authors as ‘commedia in musica.’ Us Texans have our literary abilities.}

“I would suggest that unless you were on another planet, no consumer with access to a television, radio or the Internet could have escaped hearing their president, senators and their congressperson telling them the sky was falling. With the leadership of the nation―Republicans and Democrats alike―and every talking head in the media making clear hour after hour, day after day in the run-up to Aug. 2 that a financial disaster was lurking around the corner, it does not take much imagination to envision consumers deciding to forego or delay some discretionary expenditure they had planned.

“Instead, they might well be inclined to hunker down to weather the perfect storm they were being warned was rapidly approaching. Watching the drama as it unfolded, I could imagine consumers turning to each other in millions of households, saying: ‘Honey, we need to cancel that trip we were planning and that gizmo or service we wanted to buy. We better save more and spend less.’ Small wonder that, following the somewhat encouraging retail activity reported in July, the Michigan survey measure of consumer sentiment released just recently had a distinctly sour tone.

“Importantly, from a business operator’s perspective, nothing was clarified, except that there will be undefined change in taxes, spending and subsidies and other fiscal incentives or disincentives. The message was simply that some combination of revenue enhancement and spending growth cutbacks will take place. The particulars are left to one’s imagination and the outcome of deliberations among 12 members of the Legislature.

“Now, put yourself in the shoes of a business operator. On the revenue side, you have yet to see a robust recovery in demand; growing your top-line revenue is vexing. You have been driving profits or just maintaining your margins through cost reduction and achieving maximum operating efficiency. You have money in your pocket or a banker increasingly willing to give you credit if and when you decide to expand.

“But you have no idea where the government will be cutting back on spending, what measures will be taken on the taxation front and how all this will affect your cost structure or customer base. Your most likely reaction is to cross your arms, plant your feet and say: ‘Show me. I am not going to hire new workers or build a new plant until I have been shown what will come out of this agreement.’

“Moreover, you might now say to yourself, ‘I understand from the Federal Reserve that I don’t have to worry about the cost of borrowing for another two years. Given that I don’t know how I am going to be hit by whatever new initiatives the Congress will come up with, but I do know that credit will remain cheap through the next election, what incentive do I have to invest and expand now? Why shouldn’t I wait until the sky is clear?’”

You can read the whole speech at http://www.dallasfed.org/news/speeches/fisher/2011/fs110817.cfm. In addition to his reasoning for his latest dissent at the Fed, Fisher also goes into detail about the Texas job-growth machine, which is what Perry will be touting.

Again from Art Cashin:

Bullard, of the St. Louis Fed, said “Policy should be set by the state of the economy, not according to the calendar,” pointing to the Fed’s decision to stand pat until mid-2013.

Next came the Philly Fed’s Plosser, who said, “There is a price to be paid” for monetary policy and that the Fed’s decision was “inappropriate policy at an inappropriate time.”

Now that, Rick, is how to take the Fed to task.

If we are headed into recession, and I think we are, then the stock market has a long way to go to reach its next bottom, as do many risk assets. Income is going to be king, as well as cash (and cash is a position, as I often remind readers).

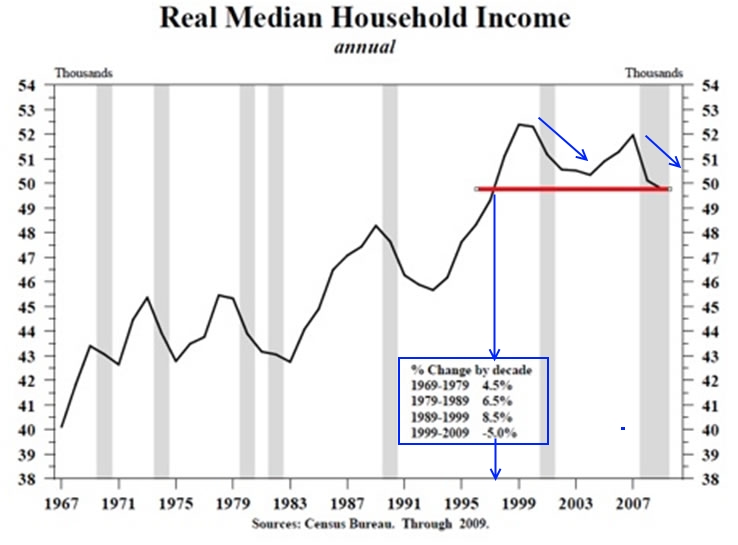

If we go into recession, we’ll know several things. Recessions are by definition deflationary. Yields on bonds will go down, much further than the market thinks today. And while the Fed may decide to invoke QE3 to fight a deflation scare, the problem is not one of liquidity; it is a debt problem.

It is not unusual for a recession to last a year, which means it could well take us into next summer and election season. And while the NBER (the people who are the “official” recession scorecard keepers) will tell us when the recession started, about nine months after it has, it is unlikely they will give an all-clear before the election.

There is little stomach for more fiscal stimulus. The drive is to cut spending. Fed policy is impotent. Unemployment will rise yet again and tax receipts will fall and expenses related to unemployment benefits will rise, putting further pressure on the deficit. Already, 40 million of our citizens are on food stamps. Wal-Mart notes that shoppers come into their stores late at night on the last day of the month and wait until midnight, when their new allotment of food stamps is activated.

It is hard to see at this moment what pulls us out, other than the blood, sweat, and tears of American entrepreneurs. Fisher is right; the US government should create certainty, create policies to foster new business, and get out of the way.

So, I guess I am going out on a limb, without any help from an inverted yield curve, and saying that we will be in recession within 12 months, if we are not already in one. This will be unlike any recession we have seen, as there is not much that can be done, other than to just get through it as best we can. Sit down and think about your own situation and prepare.

And frankly, for those of us who are entrepreneurs, this will offer some very interesting opportunities. I am not one for digging a hole and crawling in it. Stay aware of what can be done and create your own solutions!

Source: JohnMauldin.com (http://s.tt/134MA)

![[Review & Outlook]](http://sg.wsj.net/public/resources/images/ED-AI932_1stimu_NS_20090127200020.gif)