In the last episode, we followed post-World War One arrangements to return to a gold standard generally; the little-known Recession of 1920-1; the Strong-Norman dynamic duo; the Weimar collapse; the easy money that put the roar in the Roaring 20s; Black Thursday and Hoover’s seeds of the New Deal.

An overture: February, 1929, Montague Norman comes to the United States for secret meeting with Secretary of the Treasury, Andrew Mellon. Also, he confers with Federal Reserve directors, presumably to agree to a coordinated approach to the impending bubble collapse.

Let it be?

Surely it was only a coincidence that the Federal Reserve advisory to member banks was to liquidate their stock market holdings. Paul Warburg had also told stockholders of his International Acceptance Bank:

If the orgies of unrestrained speculation are permitted to spread, the ultimate collapse is certain not only to affect the speculators themselves, but to bring about a general depression involving the entire country.

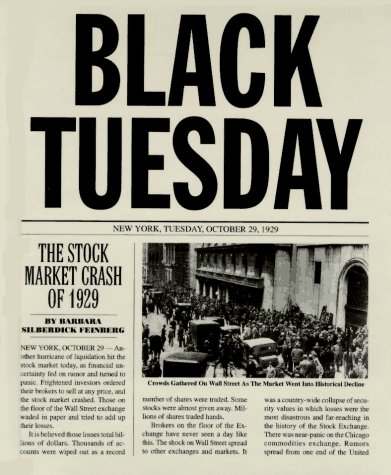

After Black Thursday

The stock market crash of 1929 did not cause the Great Depression but it was a warning. Too much speculation, animal spirits, hid the underlying truth of much productivity increase since the 1920-1 correction.

A voice crying in the wilderness at the time:

I was one of the only ones to predict what was going to happen. In early 1929, when I made this forecast, I said that there would be no hope of a recovery in Europe until interest rates fell, and interest rates would not fall until the American boom collapses, which I said was likely to happen within the next few months.

What made me expect this, of course, is one of main theoretical beliefs that you cannot indefinitely maintain an inflationary boom. Such a boom creates all kinds of artificial jobs that might keep going for a fairly long time but sooner or later must collapse. Also, I was convinced that after 1927, when the Federal Reserve made an attempt to stave off a collapse by credit expansion, the boom had become a typically inflationary one.

Friedrich Hayek

Irving Fisher had a different viewpoint, thought stocks would rebound, had skin in the game and got skinned. By 1933, he had rejected equilibrium and developed his theory of debt-deflation. He reckoned that speculation and overconfidence were less important than the risk factor of debt.

I fancy that over-confidence seldom does any great harm except when, as, and if, it beguiles its victims into debt.

It took three years for the market to find a bottom. With Hoover doing his bit along the way: wage controls, assisted by the Smoot-Hawley tariff, public works like the Hoover Dam, increased corporate taxes, the increase in the top tax bracket from 25% to 63% and more.

Coolidge on political action:

When depression in business comes, we begin to be very conservative in our financial affairs. We save our money and take no changes in its investment. Yet in our political actions we go in the opposite direction …

When times are good we might take a chance on a radical government. But when we are financially weakened we need the soundest and wisest of men and measures.

Silent Cal also said that Hoover had given him nothing but advice (as Secretary of Commerce) and all of it bad. Coolidge also labelled him “Wonder Boy” back then.

Hoover’s good intention of maintaining wages ran down a rocky road: some businesses followed the ‘patriotic’ duty foisted on them by cutting staff; others simply went out of business. Oh well. To compensate, the administration by April 1930 pumped public works spending to the highest point in five years.

And then there were the farmers. Having been lured into acquiring more land through easy money, and consequent overproduction, supply outran demand. Prices were falling. Deflation! Shock, horror, but Hoover’s tariff was part of the fix. Irving Fisher and 1027 other economists signed a letter to Hoover begging him to veto the bill, because of the unintended consequences.

The irony is, getting rid of tariffs (they were regressive!) was the justification for the income tax. Also, over the preceding fifteen years, U.S. exports surpassed foreign imports – what domestic price improvement would be made would be offset by reduced or curtailed export income. And, not to mention, higher food prices tended to disadvantage the poor sap buying groceries.

And by early 1930, unemployment was up to nine percent anyway.

That was the year Paul Warburg published his The Federal Reserve System: Its Origin and Growth. (1930) From Vol. 1:

While technically and legally the Federal Reserve note is an obligation of the United States Government, in reality it is an obligation, the sole actual responsibility for which rests on the reserve banks … The government could only be called upon to take them up after the reserve banks had failed.

Hoover tried an each-way bet for his tariff: he would not veto it, contingent on his independent commission overseeing and setting prices domestically after review of local and foreign statistics. But the executive could veto the conclusions of the committee …

Inevitably, retaliation happened. First, the Swiss, upset about their watch exports, boycotted all U.S. Imports. Add Italy, France, India, Canada and dozens of others.

To make matters worse, the U.S. was owed debts from foreigners from the war years and after. Without cross-trade under the gold exchange standard such repayments easily fell into arrears. Shooting yourself in both feet is not a sound foundation to stand on.

Hoover had been dubbed “the Great Engineer” for the world-class firm he founded in 1908 and his reputation expanded for his humanitarian efforts in organizing food shipment to central Europe during WW1 and even into Russia in 1921. By the 1932 election, voters remembered he had supported Prohibition and its unintended consequences and the near-death spiral of unemployment up above 24.1% and rising, more raised income taxes across the board, the Bonus Army and other Hoovervilles.

The New Deal Era

Franklin Delano Roosevelt won 42 of the 48 states in the 1932 election.

Russians Hopeful of ‘a New Deal’

New York Times dispatch from abroad. November 10, 1932

FDR’s first national radio speech in April, 1932 on the campaign trail focused on the underdog: “the Forgotten Man”. No, hardly the one written by William Graham Sumner. The new, improved version was of the “forgotten, the unorganized but indispensable unit of economic power.”

The inauguration on March 4, 1933 was the last such transition date. The Twentieth Amendment changed inauguration date to January 4 – it was ratified on January 23, 1933 but took effect on October 15, 1933.

In his 20-minute speech, Roosevelt asserted

that the only thing we have to fear… is fear itself

along with the greed … of bankers and businessmen, unscrupulous money changers, the falsity of material wealth, to put people to work, and requesting broad Executive powers.

The following day, he asked Congress for a bank holiday and initiated one by personal edict. On March 9, the retroactive Emergency Banking Act was signed; it included the process for reopening the banks and a few other obscure matters. Ten thousand banks had failed from 1929 to 1932; the current bank panic and runs on the banks by scared depositors was the justification for the bank holiday of four days, breathing space for legislation to cope.

By the end of the month, three-fourths of the closed banks were returned to business as usual.

More or less … Fractured reserve banking had received unlimited amounts of Federal Reserve currency to restore their solvency.

On March 12, 1933 FDR inaugurated his fireside chats. He asked the public to banish fear. A day later, citizens stood in line having raided their mattresses and restored half of their currency that had been ‘hoarded’ during the crisis.

Executive Order 6102

Technically, this was signed on April 5, 1933. In reality it was already a fait accompli due to the Emergency Banking Act. This had incorporated provisions from the never repealed 1917 Trading with the Enemy Act and a subsection dealing with the Federal Reserve Act and the Secretary of the Treasury. There had also been a stopgap Executive Order 6073 on March 10.

Curse those dirty hoarders was the excuse. So 6102 demanded confiscation of gold coin, gold certificates, and bullion, on pain of fine and/or imprisonment.

Oh, there were exemptions, private citizens could keep about 5 troy ounces of gold. At this time, the official price of gold was $20.67 but millions of Americans riding the rails in search of jobs and food probably did not get to exercise that option.

Those working with gold, jewelers, artisans, and so on, could maintain some working stock. And coins of numismatic value were exempt, not likely having any relevance on Main Street, though.

All else was to be returned to the Federal Reserve or their agents.

Act in haste, repent by modification: 6102 was altered by 6111, 6260 and 6261 later in the year. Even so, there was an ‘oops’: New York attorney Frederic Barber Campbell had in 1932 deposited a total of 5000 troy ounces of gold bullion at Chase National and demanded its return in September 1933. The bank cited the various executive orders and Campbell sued.

Then a federal prosecutor indicted Campbell for failing to report and failure to surrender said gold. That prosecution failed due to the error that the Secretary of the Treasury was to have signed the order instead of the president. Like they say, though, the house always wins. The right of the government to confiscate was affirmed anyway. Bye bye, bullion.

The Gold Reserve Act of 1934 sorted out all the inconsistencies and further added that gold clauses in private contracts were unenforceable. Previously, such clauses had been used to demand payment in weight of gold, on the basis one would be protected from government debasement of the money.

But that Act was yet to come and would legitimize the answer to the 1933 problem the administration faced.

Significant other activity that year was the Banking Act of 1933, aka the Glass-Steagall Act. This created the Federal Deposit Insurance Corporation – and the Federal Open Market Committee. Second was the acceptance of the 21st Amendment to the Constitution on December 5, 1933. This added some tax revenue to the government coffers.

Those old Liberty Bonds …

The chickens were coming home to roost. Aside from the interventions to help the British, the U.S. Entry into World War One was partly paid for by about 70% inflation. The public bought the Liberty Bonds – with a little push – which were gold denominated. Series one, two, and three had rolled over into a fourth in 1918 at ever more favorable rates.

For many years, the Treasury had ‘bled’ gold to pay the interest on these bonds and other debts. By 1933, the outstanding debt in gold was $22 billion and the Treasury had only $4.2 billion in the kitty.

Default was FDR’s answer but it wasn’t called that. No, the justification was shored up by blaming hoarders, the failing banks and a downturn of the economy that no one could have anticipated. The role of the Federal Reserve System in pumping the money supply for World War One and its severe contraction that led to the 1920-1 depression never entered the public discourse. James Warburg, son of Paul (one of the Jekyll Island gang) served as one of FDR’s advisors. So, too, did Irving Fisher, who’d believed his own stock market theories enough to invest the family fortune in 1929 and lost.

The bank holiday and gold confiscation went hand in hand to solve the problem that the U.S. Government simply could not pay its debts in gold.

Of course, the mantra always sounded that the most important issue was to save the banks. Another belief, supported by ‘repealing the law of supply and demand’ was artificially maintaining high prices. To assist in this and ‘help’ the farmers, 10 million acres of cotton would be plowed under; 5 million hogs and 2 million cattle would be destroyed. Of course, Hoover had helped the farmers first with the artificial raising of prices and the tariff, and loans to farmers, FDR built on this foundation with the Agricultural Adjustment Administration, and other acronym soup varieties.

Various critics complained that gold confiscation was effectively taking the country off the gold standard. FDR said it was only temporary and his Treasury Secretary William Woodin said the charge was “ridiculous and misleading.” The next step of cancelling the gold clause of private contracts did not reassure the critics.

Uncertainty ruled the day, not least amongst foreigners. FDR’s bizarre official setting of the gold price did not help.

“If anybody ever knew how we really set the gold price through a combination of lucky numbers, etc., I think they would be frightened.”

Secretary of the Treasury Henry Mortenthau

While all this was happening, the ghost of Bryan raised its Populist head. Factions, particularly in the western states, were calling for a return to a bimetallic standard. FDR’s “pump and dump” began in 1933, followed by the Silver Purchase Act of 1934. The Treasury regularly bought silver at above market rates, tripling the value to one-third of its gold reserves. The metal itself had tripled in value in just two years.

“Whenever in the judgment of the President such action is necessary to effectuate the policy of this act, he may by Executive order require the delivery to the United States mints of any or all silver by whomever owned or possessed. The silver so delivered shall be coined into standard silver dollars or otherwise added to the monetary stocks of the United States as the President many determine; and there shall be returned therefor in standard silver dollars, or any other coin or currency of the United States, the monetary value of the silver so delivered less such deductions for seigniorage, brassage, coinage, and other mint charges as the Secretary of the Treasury with the approval of the President shall have determined: Provided, That in no case shall the value of the amount returned therefor be less than the fair value at the time of such order of the silver required to be delivered as such value is determined by the market price over a reasonable period terminating at the time of such order.”

excerpt from Proclamation 2092 (emphasis mine)

Unintended (?) consequences: China, traditionally on a silver-backed currency, and faced with an artificial market price for silver, did all the wrong things. Ultimately, the private banks were nationalized by the Nationalist government, unredeemable paper money to solve the problem was issued.

Fiat on. The Nationalist government debased their currency, fell eventually and the communists took charge of the country. Mexico was whacked by that 1934 Act also.

January 31, 1934 – the ‘gold letter day’ when the official price was set at $35, rather a significant devaluation of the dollar from the former $20.67 and the Treasury held its “my preciousss”. Only a few lucky individuals in the U.S. owned any gold for decades.

Earlier in January, FDR asked Congress for $10.5 billion for recovery programs. On the 31st, he signed the Farm Mortgage Refinancing Act. Several more farm relief measures were undertaken.

On June 6, FDR signed the Security Exchange Act establishing the SEC. First chairman, Joseph Kennedy.

That Silver Purchase Act which was signed on June 19 also established the National Labor Relations Board. And June 28 was very busy:

- the start of the Federal Housing Administration

- Taylor Grazing Act reserves 8 million acres

- Tobacco Control Act imposes quotas

- Federal Farm Bankruptcy Act imposes moratorium on foreclosures

The Second New Deal, 1935-1938

A significant style of administration change is notable in this period, as presented in FDR’s annual message to congress.

1935 gave America the Works Progress Administration, National Labor Relations Act, the Social Security Act, Resettlement Act, Rural Electrification Administration, the Wagner Act, Federal Credit Union Act, Revenue Act and more, including a Neutrality Act. The Banking Act of 1935 officialized the FDIC as a permanent agency. Keynesianism in its glory.

The next three years saw the Soil Conservation Act, United States Housing Authority, and 1936 was noteworthy for the Treasury order to build the gold repository at Fort Knox. Just as well …

So many changes, so many improvements. So much uncertainty.

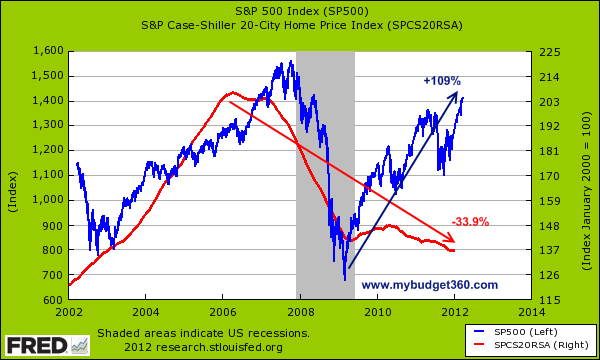

Who really cared that the stock market was slowly climbing out of the abyss. Not everyone agreed with FDR’s policies, the Supreme Court overturned some of them. Meanwhile, Main Street was not singing happy days are here. Unemployment in October, 1933 was 22.9 percent, November, 23.2% and still sinking; January, 1934 at 21.2%, November, 23.2%. July, 1935, 21.3%.

By December, 1936 the rate was improved, 15.3%; a month later, 15.0%.and at 13.5 in August, 1937.

But. FDR’s tax fiddling had unintended consequences: the undistributed profits tax on companies ate into reserves and employers who had retained workers could not now afford to do so. Credit lay fallow as businesses hesitated to invest. Stock prices began falling, illuminating the inconvenient truth that companies had been losing money for years. And in the heartland, 15,000 farm families left the drought and headed west.

Also, the administration attempt to balance the budget was an unexpected U-turn. No wonder people were confused and uncertain. At any rate, the market was like Black Tuesday redux. The embezzlement by Richard Whitney, head of the NYSE, didn’t help nor even his conviction and imprisonment.

By January, 1938, unemployment was up to 17.4% in this ‘recession within a depression’. Naturally there was a decline in the stock market. Despite all the cartelization of industries under the New Deal, greedy businessmen were demonized. Yet even Keynes told FDR that the recession was more than a monetary problem:

“It is a mistake to think businessmen are more immoral than politicians.”

If there was uncertainty in business and among the general public, it was only a reflection of the dithering shifts of administration policy. Wendell Willkie made speeches on the ‘the terrifying effect of its random targeting of businesses had on the general economy.’

One sign of the times was the election of 1938. The Republican brand had lost members in both houses in 1930, with further declines in 1932, 1934, and 1936. But this time, they gained eight in the House, eight in the Senate, and eleven governors. The times they were a’changing. Meanwhile, news from Europe looked more and more grim.

In the election of 1940, Wendell Willkie had won his party’s nomination with some difficulty but offered a classical liberal platform:

“I say that we must substitute for the philosophy of distributed scarcity the philosophy of unlimited productivity. I stand for the restoration of full production and reemployment by private enterprise in America.”

Roosevelt, though, had some advantages. Massive spending on jobs across the country and 42 millions enrolled in Social Security certainly helped. FDR had also diminished the rhetoric against business. Still, he lost some Democrats over the choice of running for a third term (what would George Washington have said?)

Willkie tried the ploy of claiming FDR would secretly plunge American into a world war and though it may have cost some support, FDR’s pledge ‘he would not send ‘American boys into a foreign war saw a resounding win of 27 million against Willkie’s 22 million. Electoral College: 449-82.

The Selective Training and Service Act of 1940, enacted September 16, was the first peacetime conscription in American history. The initial term was for twelve months.

In early 1941, FDR asked for an extension which passed the House by a single vote.

The unemployment rate perforce went down considerably. After the Day of Infamy, a new, improved selective service act extended the term of duty to two years after the war. Pearl Harbor saw thousand of volunteers a day later and thousands more conscripted. In all, over 10 million were enrolled in the military.

And thus began the myth of ‘wartime prosperity’.

When we return, a look at the real wartime economy and the post-war boom.

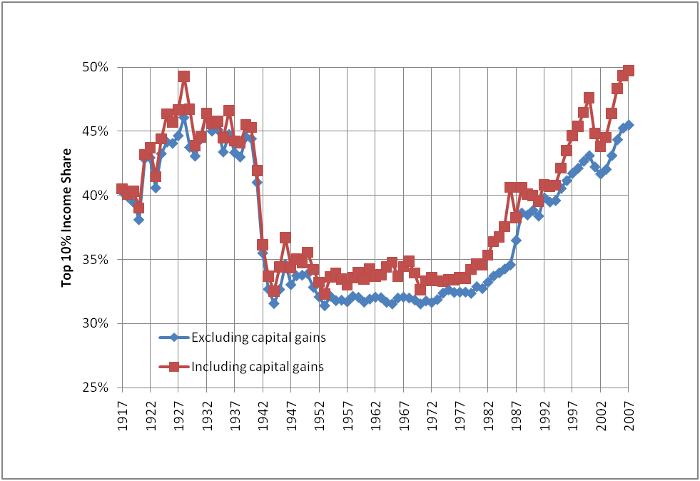

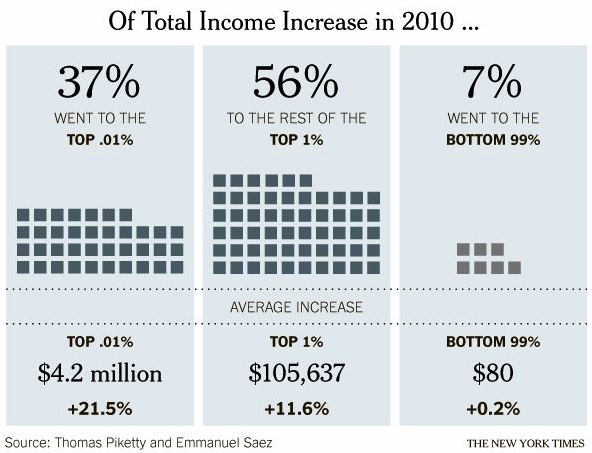

Nobody ever talks about generational conflict. Who wants to bring up that the old are eating the young at the dinner table? How are you going to mention that to your boss? If you’re a politician, how are you going to tell your donors? Even the Occupy Wall Street crowd, while rejecting the modes and rhetoric and institutional support of Boomer progressives, shied away from articulating the fundamental distinction that fills their spaces with crowds: young against old.

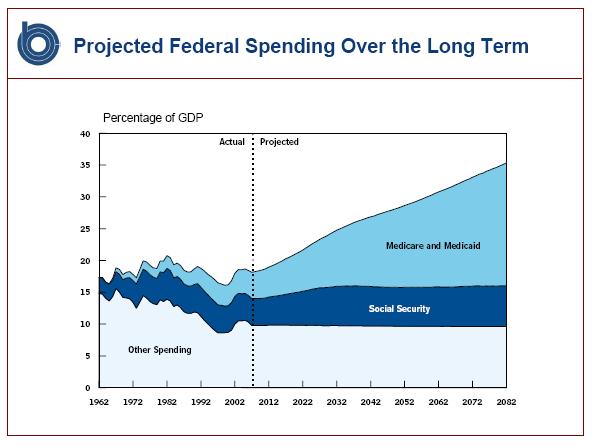

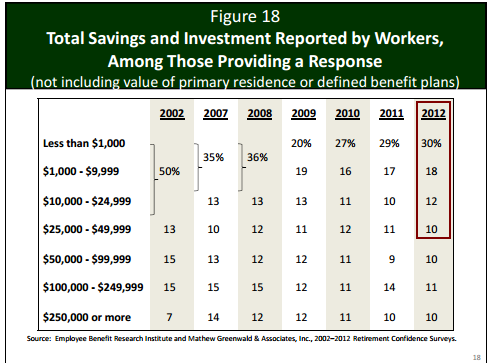

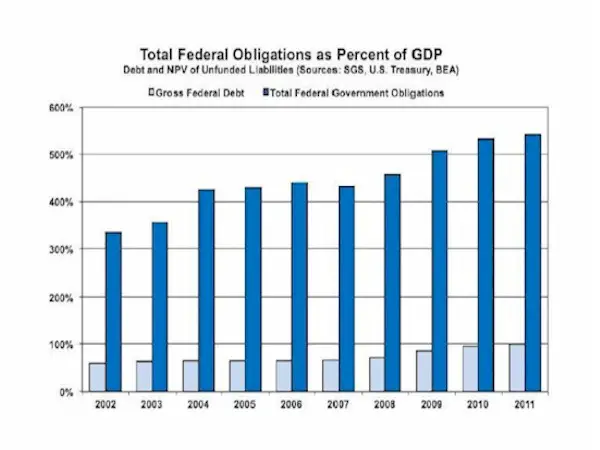

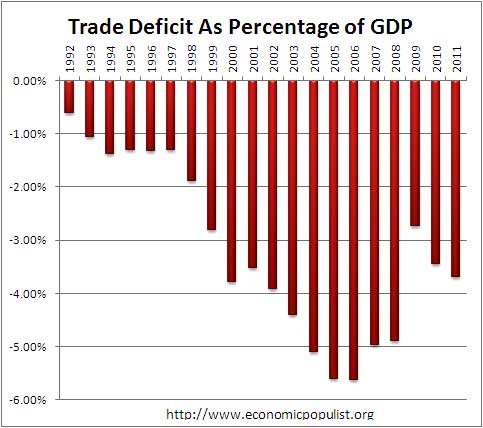

Nobody ever talks about generational conflict. Who wants to bring up that the old are eating the young at the dinner table? How are you going to mention that to your boss? If you’re a politician, how are you going to tell your donors? Even the Occupy Wall Street crowd, while rejecting the modes and rhetoric and institutional support of Boomer progressives, shied away from articulating the fundamental distinction that fills their spaces with crowds: young against old. Only 58 percent of Boomers have more than $25,000 put aside for retirement, so the rest will either starve or the government will have to pay for them. But the government’s future ability to pay is decreasing rapidly precisely because the Boomers splurged so heavily during the Bush and Clinton years. Public debt per person in the United States currently stands at $33,777. George W. Bush inherited a public-debt-to-GDP ratio of 32.5 percent and brought it up to 54.1 percent during a period of economic growth. (The money borrowed from the future paid for massive tax cuts, with no serious reductions in domestic spending, two expensive wars, and a prescription-drug benefit added to Medicare.) Under Obama, the debt-to-GDP ratio has risen to 67.7 percent and is projected to rise to 74.2 percent this year.

Only 58 percent of Boomers have more than $25,000 put aside for retirement, so the rest will either starve or the government will have to pay for them. But the government’s future ability to pay is decreasing rapidly precisely because the Boomers splurged so heavily during the Bush and Clinton years. Public debt per person in the United States currently stands at $33,777. George W. Bush inherited a public-debt-to-GDP ratio of 32.5 percent and brought it up to 54.1 percent during a period of economic growth. (The money borrowed from the future paid for massive tax cuts, with no serious reductions in domestic spending, two expensive wars, and a prescription-drug benefit added to Medicare.) Under Obama, the debt-to-GDP ratio has risen to 67.7 percent and is projected to rise to 74.2 percent this year.