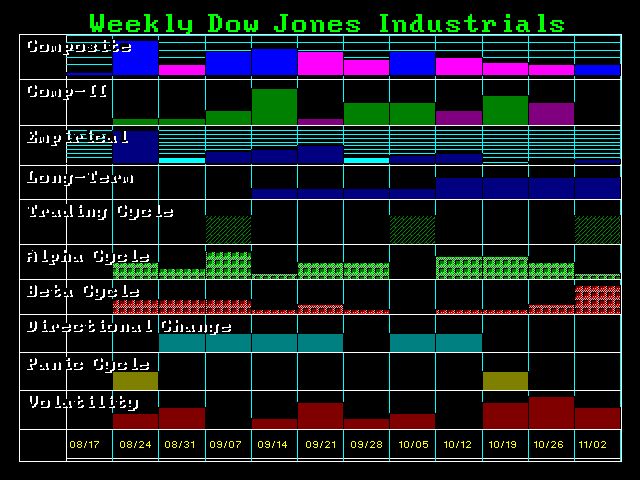

The failure of the Dow to close above 17007 confirms that we are not yet ready to take off to the upside. We needed a closing ABOVE 17007 to firm up the market to state definitively that the August low will hold and new highs are ahead. We needed a minimum closing ABOVE 16632 to firm up short-term support. The closing BELOW 16632 does not provide a Monthly Sell Signal; it is a warning that the Dow remains vulnerable going into September. Only a monthly closing BELOW 15550 would have been a MAJOR SELL SIGNAL that key support has held. Consequently, the close of August was not strong enough to avoid a retest of the lows. Therefore, the Dow did not finish in a position that would imply NEW LOWS ahead just yet and there was no confirmation of a bullish development.

Tag: Crash

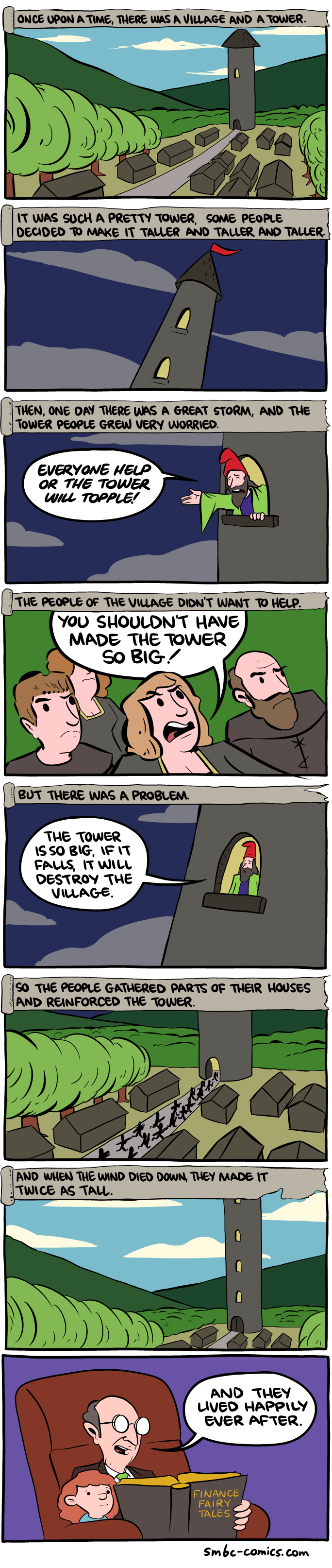

WE SHOULD HAVE LET IT FALL

What If The “Crash” Is As Rigged As Everything Else?

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Take your pick–here’s three good reasons to engineer a “crash” that benefits the few at the expense of the many.

There is an almost touching faith that markets are rigged when they loft higher, but unrigged when they crash. Who’s to say this crash isn’t rigged? A few things about this “crash” (11% decline from all time highs now qualifies as a “crash”) don’t pass the sniff test.

Exhibit 1: VIX volatility Index soars to “the world is ending” levels when the S&P 500 drops a relatively modest 11%. The VIX above 50 is historically associated with declines of 20% or more–double the current drop.

When the VIX spiked above 50 in 2008, the market ended up down 57%. Now that’s a crash.

Exhibit 2: The VIX soared and the market cratered at the end of options expiration week (OEX), maximizing pain for the majority of punters. Generally speaking, OEX weeks are up. The exceptions are out of the blue lightning bolts such as the collapse of a major investment bank.

Continue reading “What If The “Crash” Is As Rigged As Everything Else?”

ROLLING A WHEELBARROW OF DYNAMITE INTO A CROWD OF FIRE JUGGLERS

John Hussman has the right to gloat on this Black Monday morning as global stock markets meltdown under the weight of central bank created debt, insane debt financed corporate buybacks, and stock valuations rivaling 1929 and 2000 levels. He has been scorned, ridiculed and laughed at by the Ivy League educated sociopathic Wall Street titans of greed and avarice. Only in a warped, manipulated, corrupt, rigged financial world would those who speak the truth, use facts, and honestly assess the markets based on historical relationships would a man like John Hussman be abused by the elitist Wall Street lemmings. He has too much integrity and class to lower himself to the level of Wall Street hucksters. His letter this week is heavy on substance, facts, and sound reasoning. Therefore, it is of no use to CNBC cheerleaders or Wall Street shysters. His lessons are timeless.

Rather, the key lesson to draw from recent market cycles, and those across a century of history, is this:

Valuations are the main driver of long-term returns, but the main driver of market returns over shorter horizons is the attitude of investors toward risk, and the most reliable way to measure this is through the uniformity or divergence of market internals. When market internals are uniformly favorable, overvaluation has little effect, and monetary easing can encourage further risk-seeking speculation. Conversely, when deterioration in market internals signals a shift toward risk-aversion among investors, monetary easing has little effect, and overvaluation can suddenly matter with a vengeance.

He wrote this letter over the weekend before the plunge in Chinese shares and the opening decline of 1,110 points on the Dow. There has been no specific event or tragedy which triggered the start of this global equity collapse. Hussman describes the explosion perfectly. The Fed and other central bankers around the world have loaded the wheelbarrow with dynamite (debt) and rolled into the den of rookie Wall Street fire jugglers. The Chinese dropped the torch (currency devaluation) and the world is blowing up like a Chinese sodium cyanide plant.

Continue reading “ROLLING A WHEELBARROW OF DYNAMITE INTO A CROWD OF FIRE JUGGLERS”

MARGIN CALL MONDAY

If you were wondering what happens when margin debt is at the highest level in history and the market abruptly drops because a corrupt Chinese central banker devalued their currency, welcome to Black Monday 2015. I hope you aren’t leveraged. Enjoy the show. The calls from Wall Street bankers and CNBC talk show morons for a bailout to follow shortly.

LOOK OUT BELOW

It is pretty self evident that commodities and stocks move in the same direction. If the global economy is booming demand for oil, copper, agricultural commodities and other industrial metals rises – producing higher prices. If the global economy is booming corporations are generating higher profits, which lead to higher stock prices. Pretty simple.

It seems the central bankers, politicians and corporate titans of the world thought they could overcome the laws of supply and demand. They thought adding $50 trillion of debt, dropping interest rates to zero, and buying back stock could defeat the laws of supply and demand.

Not gonna happen. Commodity prices have fallen 45% since 2011 and are now in free fall. They are far lower than they were at the 2009 crisis lows. Look very closely at the chart below. What do you think happens to stocks next?

Dow 5,000? Yes, it could happen

Such a scenario can’t be completely ruled out

Don’t be surprised if stock markets stabilize or bounce back in the next couple of days. Markets are due at least a short-term rally after this week’s dramatic plunge. This usually happens after a sell-off, no matter what the next big move is going to be. It doesn’t mean anything.

But anyone who automatically assumes this is another easy “buying opportunity” is talking nonsense.

For the past couple of years, Wall Street’s perma-bulls have had it their way. They’ve been gloating openly as stocks went up and up and up, seemingly without pause.

It got to the point that those warning about valuations and danger signs had been mocked into silence — or were simply ignored.

Not now.

I don’t mean to be alarmist or to induce panic, but someone needs to tell the public that there is a plausible scenario in which the U.S. stock market now collapses by another 70% until the Dow Jones Industrial Average falls to about 5,000. The index tumbled more than 3% to 16,460 on Friday.

Dow 5,000? Really?

For 30 years, stock prices have been increasingly boosted by financial factors: collapsing interest rates and Federal Reserve manipulation, culminating most recently in ‘quantitative easing.’

I’m not predicting that will happen, but contrary to what the bulls tell you, it cannot be completely ruled out.

And even if that ranks as an outlier and a worst-case scenario, there are other, more likely scenarios where the Dow falls to somewhere between 10,000 and 12,000.

CORPORATE DEBT – ROAD TO OBLIVION IN A BEAR MARKET

Any article that starts with a quote from Jim Grant is guaranteed to be a fact based, common sense, reasoned analysis of our warped, debt saturated, over-valued, Federal Reserve rigged financial markets. John Hussman starts his weekly letter with this quote from Jim Grant:

“The way to wealth in a bull market is debt. The way to oblivion in a bear market is also debt, and nobody rings a bell.” – James Grant

We’ve been in a Fed QE and ZIRP induced six year bull market that has been sputtering since QE 3 ended in October 2014. Leveraging yourself to the hilt and piling into the stock market has been the road to riches for six years, just as leveraging to the hilt in real estate was the road to riches from 2002 through 2007, and leveraging to the hilt in internet stocks was the road to riches from 1998 through 2000. Of course, the dot.com and housing road to riches detoured into ditches that wiped out trillions of phantom wealth, just as the current road is leading to a grand canyon size ditch.

Total credit market debt has reached all-time highs. The de-leveraging of consumers, liquidation of insolvent Wall Street banks, and bankruptcies of zombie retailers, real estate developers, and mall owners was postponed by Federal Reserve intervention, changing accounting rules to hide bad debt, political shenanigans, and taxpayers paying for the extreme risk taking by bankers and corporate CEOs. Total credit market debt sits at $59 trillion, up from $52 trillion in 2009 at the depths of the recession. This increase has been entirely driven by a $5.3 trillion increase in government debt and a $1.6 trillion increase in corporate debt. The propaganda about corporations flush with cash is bold faced lie. Corporations have increased their debt load by 25% since 2009.

As Dr. Hussman points out, the Fed has encouraged this behavior by the biggest corporations on the planet with their suppression of market interest rates and their gift of $3 trillion to the Wall Street banks. Corporate CEOs are supposed to be the smartest guys in the room, but they haven’t been able to grow their businesses through innovation, creativity, new products, or new investments in plant and equipment. Their entire playbook consists of outsourcing jobs to foreign countries, keeping wages below the level of inflation, and borrowing cheaply from Wall Street banks to buyback their stock and boost earnings per share, so their stock price will go higher, enriching themselves.

Continue reading “CORPORATE DEBT – ROAD TO OBLIVION IN A BEAR MARKET”

The Chinese Growth Engine is Sputtering

Guest Post by Jeff Desjardins

By the turn of the millennium, China was the sixth most productive nation in the world with a GDP comparable with France or Italy at US$1.2 trillion.

Economic growth didn’t stop there, and GDP increased ten-fold over the last fifteen years to surpass US$10 trillion. In “real” terms using PPP, China is now actually the largest economy in the world.

The rest of the world has benefited extensively from China’s coming out party. Cheap products flooded the shelves of the developed world, and China bought the world’s raw materials when no one else wanted them. Unfortunately, every good time must come to an end.

It hasn’t exactly been a secret that China’s economy has been slowing. The above radar graph from a research note by Credit Suisse shows that the economic news out of China has been tough to swallow as of late. Today, China rattled global markets even further by announcing a devaluation of the yuan by 1.9% to combat poor exports, which fell by 8.3% in July. This is the country’s largest currency devaluation since 1994.

FED LUNACY IS TO BLAME FOR THE COMING CRASH

This week John Hussman’s pondering about the state of our markets is as clear and concise as it’s ever been. He starts off by describing the difference between an economy operating at a low level versus a high level. He’s essentially describing a 2% GDP economy versus a 4% GDP economy. We have been stuck in a low level economy since 2008. And there is one primary culprit for the suffering of millions – The Federal Reserve and their Wall Street Bank owners. They are the reason incomes are stagnant, the labor participation rate is at 40 year lows, savers can only earn .25% on their savings, and consumers have been forced further into debt to make ends meet. Meanwhile, corporate America and the Wall Street banks are siphoning off record profits, paying obscene pay packages to their executives, buying off the politicians in Washington to pass legislation (TPP) designed to enrich them further, and arrogantly telling the peasants to work harder.

In economics, we often describe “equilibrium” as a condition where demand is equal to supply. Textbooks usually depict this as a single point where a demand curve and a supply curve intersect, and all is right with the world.

In reality, we know that economies often face a whole range of possible equilibria. One can imagine “low level” equilibria where producers are idle, jobs are scarce, incomes stagnate, consumers struggle or go into debt to make ends meet, and the economy sits in a state of depression – which is often the case in developing countries. One can also imagine “high level” equilibria where producers generate desirable goods and services, jobs are plentiful, and household income is sufficient to demand all of that output.

The problem is that troubled economies don’t just naturally slide up to “high level” equilibria. Low level equilibria are typically supported and reinforced by a whole set of distortions, constraints, and even incentives for the low level equilibrium to persist. In developing countries, these often take the form of legal restrictions, price controls, weak property rights, political and civil instability, savings disincentives, lending restrictions, and a full catastrophe of other barriers to economic improvement. Good economic policy involves the art of relaxing constraints where they are binding, and imposing constraints where their absence allows the activities of some to injure or violate the rights of others.

In the United States, observers seem to scratch their heads as to why the economy has shifted down to such a low level of labor force participation. Even after years of recovery and trillions of dollars directed toward persistent monetary intervention, the economy seems locked in a low level equilibrium. Yet at the same time, corporate profits and margins have pushed to record highs, contributing to gaping income disparities.

Continue reading “FED LUNACY IS TO BLAME FOR THE COMING CRASH”

SOMETIMES THEY DO RING A BELL AT THE TOP

I’m starting to get the feeling the scorn and ridicule heaped upon Dr. Hussman by the Wall Street shysters is about to be thrown back in their faces. Of course, he isn’t an I told you so type of person. He’s an analytical investor who bases his thinking upon historical facts and valuation methods that have proven accurate over the last 100 years of investing. His two key principles on investing are flashing red. Corporate revenues and profits are falling. The attitude of investors regarding risk is shifting from greed to fear. With valuations at record highs, margin debt at epic levels, and professional investors extremely bullish, even the hint of fear will begin the collapse. It’s already happened twice in the last fifteen years and Hussman called the previous two collapses too.

If I were to choose anything that investors should memorize – that will serve them well over a lifetime of investing – it would be the following two principles:

1) Valuations control long-term returns. The higher the price you pay today for each dollar you expect to receive in the future, the lower the long-term return you should expect from your investment. Don’t take current earnings at face value, because profit margins are not permanent. Historically, the most reliable indicators of market valuation are driven by revenues, not earnings.

2) Risk-seeking and risk-aversion control returns over shorter portions of the market cycle. The difference between an overvalued market that becomes more overvalued, and an overvalued market that crashes, has little to do with the level of valuation and everything to do with the attitude of investors toward risk. When investors are risk-seeking, they are rarely selective about it. Historically, the most reliable way to measure risk attitudes is by the uniformity or divergence of price movements across a wide range of securities.

I should make the point that these principles aren’t new. They capture the same principles I laid out in October 2000, at the beginning of a market collapse that would take the S&P 500 down by half and the Nasdaq 100 down by 83%. They capture the same principles that prompted me to turn constructive in April 2003 after that collapse. They capture the same principles I laid out in July 2007, just before the global financial crisis took the S&P 500 down by 55%.

CHINA JUST SHIT THE BED

China shit the bed overnight. The shit is now hitting the fan. Shit is fucked up and bullshit. I’m not shitting you.

Stock markets don’t fall by 8.5% in one day unless there is some major shit happening beneath the surface. A comparable drop in the US stock market would be 1,500 points. Do you think a few Wall Street assholes would shit their pants if that happened? Do you think there would be a few margin calls as that shitty scenario played out?

Here’s the deal. The Chinese authorities have attempted everything they could possibly do to stop their over-leveraged, over-bought, over-hyped, corrupt, fraudulent markets from falling. They have threatened imprisonment for selling, disallowed short selling, stopped allowing trading on thousands of company stocks, and propped up their markets with trillions of yuan poured into the gaping hole.

Between the end of June and early July, the Chinese government announced at least 40 measures to prop up the market, including an interest-rate cut by the central bank and establishing a stabilization fund to outright buy stocks. All together, Chinese authorities are estimated to have mobilized as much as 5 trillion yuan, almost 10% of the gross domestic product, to halt panic sales.

It’s all been for naught. Fear is now trumping greed. The infallibility of central bank manipulators is being revealed to be false. They are nothing but money printing academic fools doing the bidding of greedy bankers and corrupt politicians. This is only the beginning of the end. There are thousands of points to go, billions to vaporize, and millions of lives to be ruined.

Welcome to the Fourth Turning. No shit.

Chinese Stocks Suffer Second Biggest Crash In History, 1,500 Companies Halted Limit Down

Submitted by Tyler Durden on 07/27/2015 06:32 -0400

This was not supposed to happen.

After pledging, investing and otherwise guaranteeing the Chinese stock market to the tune of 10% of GDP, and intervening on at least 40 different occasions in the past month ever since China’s stock bubble burst in late June, with the subsequent crash nearly taking the Shanghai Composite red for the year, overnight China officially lost control for the second time, when after a weak start to the Monday trading session, things turned very ugly in the last hour, when the Shanghai Composite plunged by 8.48%, closing nearly at the lows, and tumbling some 345 points for its biggest one-day drop since February 2007 and its second biggest crash in history!

The selling was steady throughout the day, but spiked in the last hour on concerns China would rein in its market-supporting programs following IMF demands to normalize its relentless market intervention. According to Bloomberg’s Richard Breslow: “fear that the extraordinary support measures employed to hold up the market may be scaled back caused heavy afternoon selling resulting in a down 8.5% day.” Of course, one can come up with any number of theories to explain the plunge: for example the PBOC did not buy enough to offset the relentless selling.

The last thing the communist party and the PBOC wanted was another massive sell off after having not only fired the “bazooka” but come up with a different bazooka to halt “malicious sellers” virtually every day, including threats of arrest.

SHANGHAI PLUNGING – LOOK OUT BELOW

I love those fantasy stories about central bankers being all-powerful and able to levitate stock markets forever. They make me all warm and fuzzy. In case you hadn’t noticed, the Chinese central bankers and communist party politicians have been desperately trying to stop their stock market from crashing. EPIC FAIL!!!

It plunged another 5% overnight. They have halted trading on 40% of their stocks and it keeps falling. They ban short selling and it continues to fall. They ban the press from talking negatively about the stock market and it keeps falling. They instruct their government agencies to buy stocks and it continues to fall. The omnipotence of central bankers is being proven to be a fraud.

Anyone who doesn’t think the US markets could drop 32% in a month is just drinking the central bank kool-aid. Our markets plunged 55% from their 2008 highs in a matter of months. And the majority of the losses occurred on 10 trading days. Think about that for a second.

ON THE EDGE OF PANIC

It was a bad day in the market. It was down 2%. That’s nothing in the big picture. The market is up 300% since 2009. A 2% move shouldn’t be a problem in a normal market. But, we have an extremely overvalued abnormal market, propped up by excessive levels of debt and hundreds of billions in corporate stock buybacks. These CEO titans of industry are driven by greed and personal ambition. They aren’t smart enough to grow their businesses, so they have bought back their stock at record high prices in order to boost Earnings Per Share and their own stock based compensation packages.

They did the exact same thing in 2007, just before the last crash. These spineless Ivy League educated whores always buy high and sell low. In 2009, when their stocks were selling at bargain prices, they bought nothing. They are gutless front runners with no vision, leadership skills, or sense of morality. With markets in turmoil, these slimy snakes will hesitate to buy back their stock. Fear will overtake their greed. This form of liquidity for the stock market will dry up in an instant.

MARKET DROPS 350 POINTS

Wall Street Ivy League MBA Investing Geniuses

The Wall Street Lemming Brigade stares at their highly sophisticated computer programs that tell them all to do the same thing at the same time. It works great on the way up. It tends to create havoc on the way down.

I’m patiently waiting for the jumping to begin.

Recession time bomb ticking faster, louder

Americans are unprepared for the trillions they will lose again

Yes, the clock’s ticking louder, louder, warns the Economist, “only a matter of time before the next recession strikes.” Unfortunately, the “rich world is not ready.” America’s not prepared. You are not ready.

Get it? America’s 95 million investors are at huge risk. Remember the $10 trillion losses in the crash and recession of 2007-2009? The $8 trillion lost after the dot-com technology crash and recession of 2000-2003? This is the third big recession of the century. Yes, America will lose trillions again.

Especially with dead-ahead predictions like Mark Cook’s 4,000-point Dow correction. And Jeremy Grantham’s warning of a 50% crash around election time, with negative stock returns through the first term of the next president, beyond 2020. Starting soon.

Why is America so vulnerable when the next recession hits? Simple: The Fed’s cheap-money giveaway is killing America. When the downturn, correction, crash hits, it will compare to the 2008 crash. The Economist warns: “the world will be in a rotten position to do much about it. Rarely have so many large economies been so ill-equipped to manage a recession,” whatever the trigger.

Continue reading “Recession time bomb ticking faster, louder”