“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.” – John Maynard Keynes – The Economic Consequences of the Peace

While Barack Obama vacations on Martha’s Vineyard this week he’ll be thinking about his grand vision to save America – again. There is one thing you can say about Obama – he’s predictable. He promises to unveil his “new” plan for America in early September. The White House said Obama will give a speech after the September 5 Labor Day holiday to outline measures to boost hiring and find budget savings that surpass the $1.5 trillion goal of a new congressional deficit-cutting committee. It is heartening to see that Barack has turned into a cost cutter extraordinaire. He should be an inspiration to the Tea Party, except for one little problem. The plan he unveils in a few weeks will increase spending now and fret about spending cuts at some future unspecified date.

I can reveal his plan today because the White House has already leaked the major aspects of his plan. He will call for an extension of the Social Security payroll tax cut of 2% for all working Americans. This was supposed to give a dramatic boost to GDP in 2011. Maybe it will work next time. He will demand that extended unemployment benefits be renewed. Somehow providing 99 weeks of unemployment benefits is supposed to create jobs. It’s done wonders thus far. He will propose some semblance of an infrastructure bank or tax cuts to spur infrastructure spending. It will include a proposal for training and education to help unemployed people switch careers. He will attempt to steal the thunder from the SUPER COMMITTEE of 12 by coming up with $2 trillion of budget savings by insisting the Lear jet flying rich fork over an extra $500 billion.

You may have noticed that followers of Keynesian dogma like Paul Krugman, Larry Summers, Brad Delong, Richard Koo, John Galbraith, every Democrat in Congress, and every liberal pundit and columnist have been shrieking about the Tea Party terrorists and their ghastly budget cuts that are destroying our economy. They contend the stock market is tanking and the economy is heading into recession due to the brutal austerity measures being imposed by the extremists in the Republican Party. There is just one small issue with their argument. It is completely false. It is a bold faced lie. This is 2011. The economy has been in freefall since January 1. No spending cuts have occurred. Nada!!! As the CBO chart below reveals, the horrendous slashing of government will amount to $21 billion in 2012 and $42 billion in 2013. Of course, those aren’t even cuts in spending. They are reductions in the projected increases in spending. Politicians must be very secure in the knowledge that Americans are completely ignorant when it comes to anything other than the details of Kim Kardashian’s wedding and who Snooki is banging on Jersey Shore.

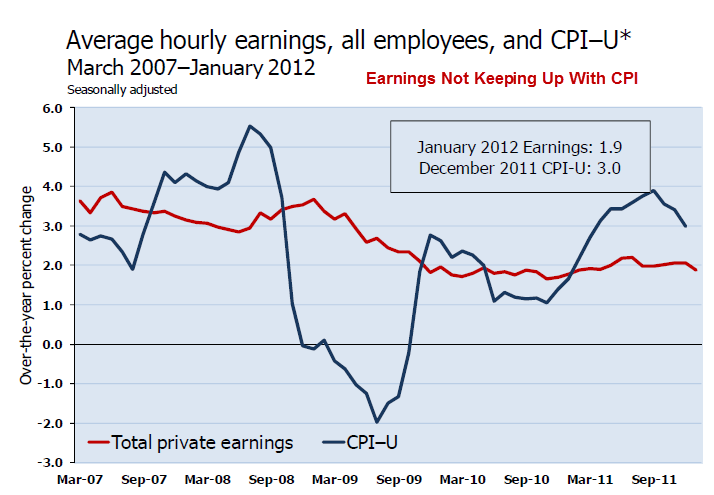

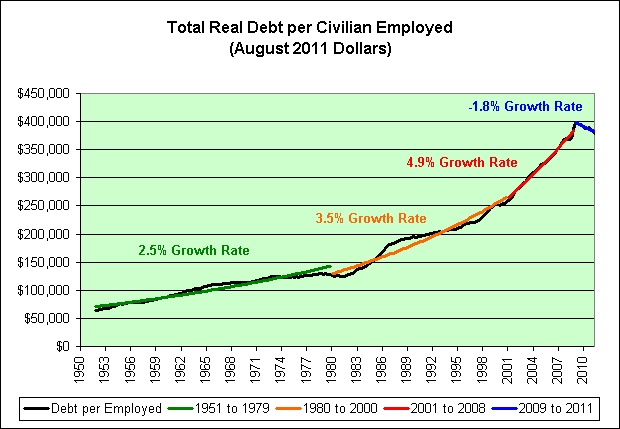

I’d like to remind the Harvard educated Keynesian economists that Federal government spending is currently chiming in at $3.8 trillion per year. Federal spending was $2.7 trillion in 2007 and $3.0 trillion in 2008. Keynesians believe government spending fills the gap when private companies are contracting. Obama has taken Keynesianism to a new level. Federal spending will total $10.8 trillion in Obama’s 1st three years, versus $8.4 trillion in the previous three years. Even a Harvard economist can figure out this is a 29% increase in Federal spending. What has it accomplished? We are back in recession, unemployment is rising, forty six million Americans are on food stamps, food and energy prices are soaring, and the middle class is being annihilated. The standard Keynesian response is we would have lost 3 million more jobs, we were saved from a 2nd Great Depression and the stimulus was too little. It would have worked if it had just been twice as large.

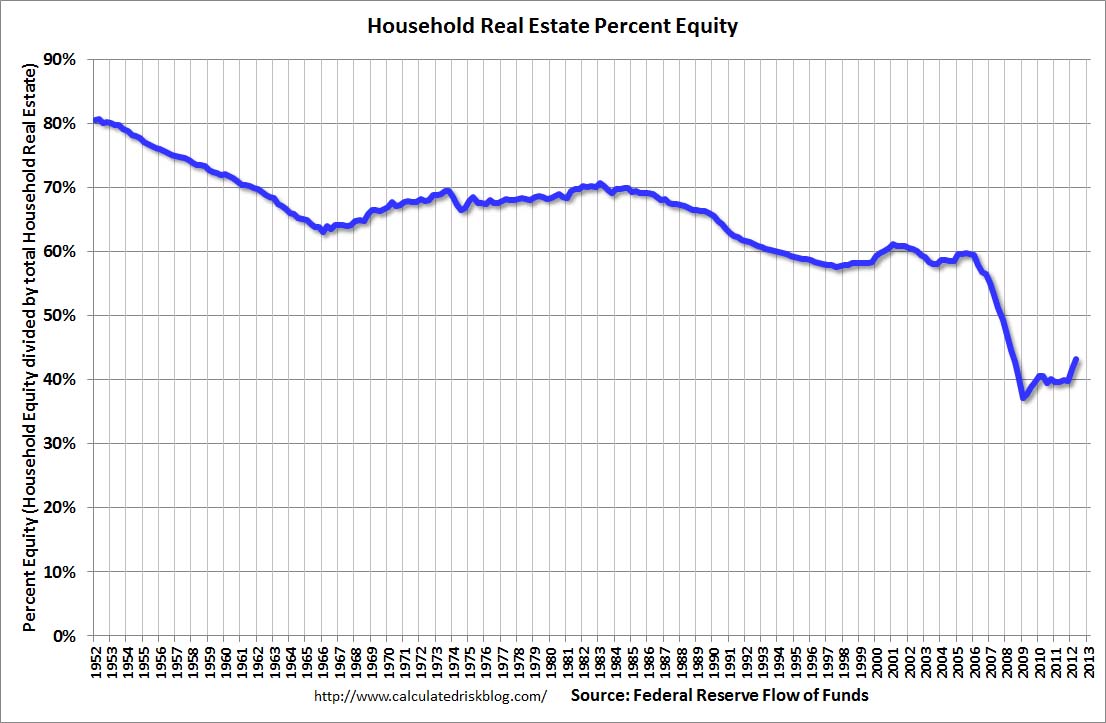

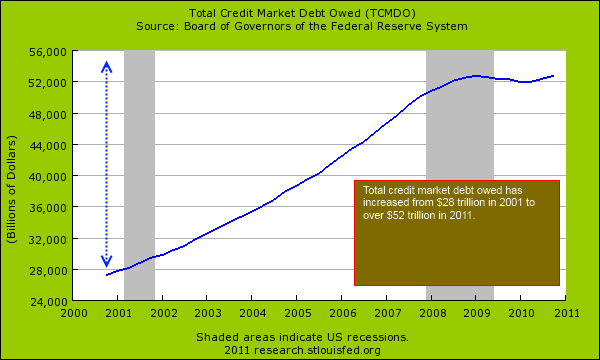

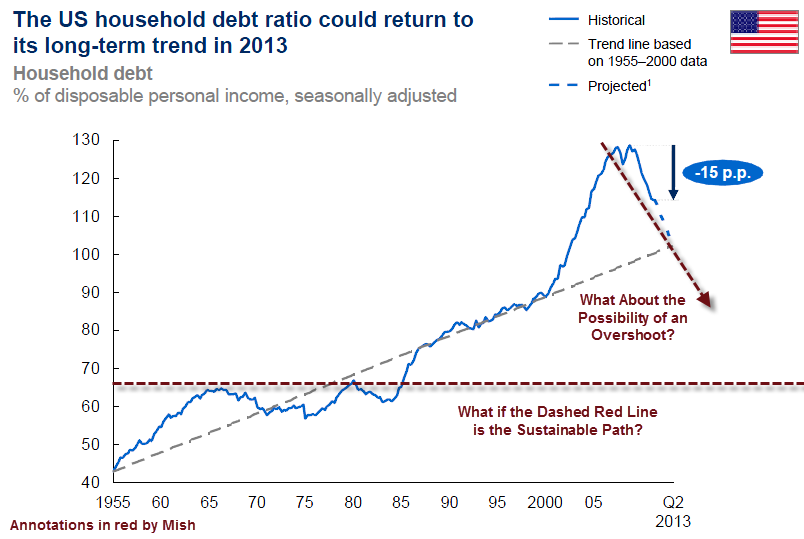

The 2nd Great Depression was not avoided, it was delayed. Our two decade long delusional credit boom could have been voluntarily abandoned in 2008. The banks at fault could have been liquidated in an orderly bankruptcy with stockholders and bondholders accepting the consequences of their foolishness. Unemployment would have soared to 12%, GDP would have collapsed, and the stock market would have fallen to 5,000. The bad debt would have been flushed from the system. Instead our Wall Street beholden leaders chose to save their banker friends, cover-up the bad debt, shift private debt to taxpayer debt, print trillions of new dollars in an effort to inflate away the debt, and implemented every wacky Keynesian stimulus idea Larry Summers could dream up. These strokes of genius have failed miserably. Bernanke, Paulson, Geithner and Obama have set in motion a series of events that will ultimately lead to a catastrophic currency collapse. We have entered the 2nd phase of the Greater Depression and there are no monetary or fiscal bullets left in the gun. Further expansion of debt will lead to a hyperinflationary collapse as the remaining confidence in the U.S. dollar is exhausted. We are one failed Treasury auction away from a currency crisis.

John Maynard Keynes argued the solution to the Great Depression was to stimulate the economy through some combination of two approaches: a reduction in interest rates and government investment in infrastructure. Investment by government injects income, which results in more spending in the general economy, which in turn stimulates more production and investment involving still more income and spending and so forth. The initial stimulation starts a cascade of events, whose total increase in economic activity is a multiple of the original investment.

It sounds so good in theory, but it didn’t work in the Depression and it hasn’t worked today. It is a doctrine taught in every business school in America with no actual results to support it. Who needs facts and actual results when a good story believed and perpetuated by non-thinking pundits will do? Every Keynesian play in the playbook has been used since 2008. The American people were told by Obama and his Keynesian trained advisors that if we implemented his $862 billion shovel ready stimulus package, unemployment would peak at 7.9% and would decline to 6.5% by today. The cascade of recovery was going to be jump started by a stimulus package that equaled 27% of the previous year’s entire spending. Obama’s complete package was implemented. The outcome was an eye opener. If you show a Keynesian this chart, their response would be: “Imagine how bad it would have been if we didn’t spend the $862 billion.”

John Maynard Obama got everything he asked for in January 2009. He had both houses in Congress and did not need to consult Republicans to pass his Keynesian $862 billion porkulus bill. It seems that $252 billion, or 29% of the package was nothing more than transfer payments. Of course, according to Keynesians, the $252 billion should have had a multiplier effect when it was handed out. I think they were right. Obama was able to multiply the number of people on food stamps in January 2009 from 32 million to the current tally of 45.8 million. The monthly food stamp transfer payment has gone from $3.6 billion to $6.1 billion. Keynesians should be thrilled by this success story.

![[Review & Outlook]](http://sg.wsj.net/public/resources/images/ED-AI932_1stimu_NS_20090127200020.gif)

Obama’s Keynesian dream bill included:

- $1 billion for Amtrak, the federal railroad that hasn’t turned a profit in 40 years.

- $2 billion for child-care subsidies.

- $50 million for that great engine of job creation, the National Endowment for the Arts.

- $400 million for global-warming research.

- $2.4 billion for carbon-capture demonstration projects.

- $650 million on top of the billions already doled out to pay for digital TV conversion coupons.

- $8 billion for renewable energy funding.

- $6 billion for mass transit that had a low or negative return on investment.

- $600 million more for the federal government to buy new cars. Uncle Sam already spends $3 billion a year on its fleet of 600,000 vehicles.

- Congress earmarked $7 billion for modernizing federal buildings and facilities.

- The Smithsonian received $150 million.

- The Department of Education got $66 billion, more than the entire Education Department spent a just 10 years ago. $6 billion of this subsidized university building projects.

Obama declared in December 2008 there were shovel ready projects across the land that would create immediate jobs. Too bad he didn’t tell the American public only $30 billion of the $862 billion mountain of pork was earmarked for highways and bridges. Obama declared his stimulus would create 3.5 million jobs, later changed to “create or save”. There were 144 million Americans employed in January 2009. Today, there are 139 million Americans employed. Obama gives the term “success story” a new meaning. The Keynesians had their chance and now they want a do-over. Sorry, that isn’t how it works in the real world. As Speaker Nancy Pelosi put it, “We won the election. We wrote the bill.” No truer words have ever been spoken.

As we know, that was only the beginning of our Keynesian debt nightmare. Let’s do some critical thinking and assess the results of Obama’s other Keynesian solutions:

- The Homebuyer Tax Credit cost taxpayers $27 billion or $43,000 per additional house sold. The Keynesians handed 3.9 million people $7,000 to do something they were going to do anyway. They lured first time home buyers into the market. Since the credit expired, median home prices have fallen $15,000 and continue to fall. This wonderful government program has created more underwater homeowners and did nothing to stabilize the housing market or home prices.

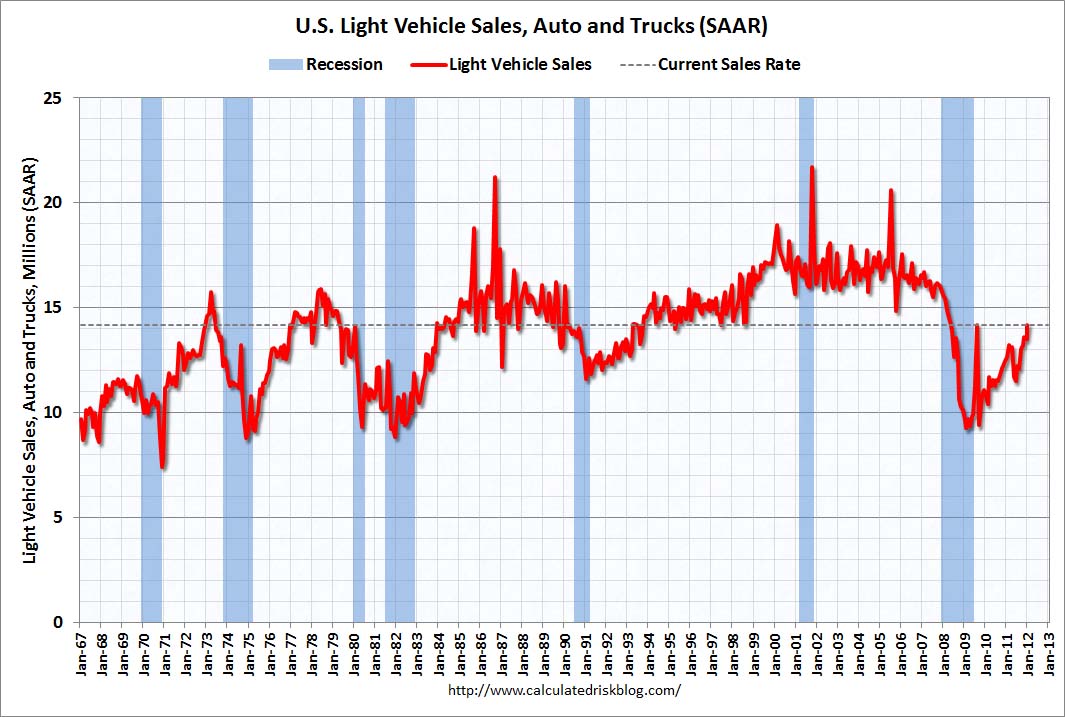

- Cash for Clunkers cost taxpayers $3 billion. An incremental 125,000 cars were sold at a cost of $24,000 per car. This Keynesian dream program lured more people into debt and warped the used car market by destroying used cars and driving up prices for poor people who couldn’t afford a new car. There were no carryover benefits except for government controlled union car makers.

- Obama’s HAMP program allocated $11 billion to supposedly allow 4 million homeowners to modify their mortgages, reduce their monthly mortgage payments and avoid foreclosure. HAMP has proven a colossal failure that has done more to harm than help debt-laden homeowners. It has achieved slightly more than 500,000 permanent modifications, 40% of which the Treasury expects to default. Far more borrowers have dropped out of the program than successfully achieved permanent loan modification. These borrowers, along with those who later default, will often be left with larger outstanding debt, worse credit scores, and less home equity.

- Obama even handed $30 billion to the largest homebuilder corporations in the country, run by billionaires like Bob Toll, by allowing them to carry back their losses and wipe out tax liabilities in prior years. This did wonders for the housing market. It did stimulate bonus payments for the CEOs of these companies.

- Billions of tax revenue was lost by handing out $1,500 tax credits for people to buy new windows, doors, and appliances they were going to buy anyway. We are still waiting for that multiplier effect.

The usual suspects are now declaring that we can’t make the same mistakes FDR made in 1937 resulting in a dramatic downturn in 1938. As usual, the Keynesian storyline about the Great Depression is false.

Depression Keynesian Fallacy

One thing to remember is that while the depression that started in 1929 may have come to a bottom in 1933, it took a long time to recover. There was a cyclical recovery in 1937, and why was that? Roosevelt had the good luck to have been elected dead flat at the bottom. So it wasn’t his policies that cured the last depression, it was luck and good timing, combined with the fact that they were creating a lot of money after Roosevelt took the dollar off the gold standard. That resulted in a false recovery, from 1933 to 1937, and it went downhill again. – Doug Casey

Keynes′ theory suggested that active government policy could be effective in managing the economy. Rather than seeing unbalanced government budgets as wrong, Keynes advocated what has been called countercyclical fiscal policies, that is, policies that acted against the tide of the business cycle: deficit spending when a nation’s economy suffers from recession or when recovery is long-delayed and unemployment is persistently high—and the suppression of inflation in boom times by either increasing taxes or cutting back on government outlays. He argued that governments should solve problems in the short run rather than waiting for market forces to do it in the long run. Keynes had too much faith in the wisdom of politicians and Federal Reserve bankers. They mastered the art of deficit spending, but fell a little short on paying off the debts during boom times. About $14.6 trillion short so far.

The Great Depression had the same origins as our current Greater Depression. The three Republican administrations of the 1920s practiced laissez-faire economics, starting by cutting top tax rates from 77% to 25% by 1925. Non-intervention into business and banking became government policy. These policies led to overconfidence on the part of investors and a classic credit-induced speculative boom. Gambling in the markets by the wealthy increased. While the haves got richer, millions of have-nots lived below the household poverty line of $2,000 per year. The rip roaring party came to an abrupt end in October 1929, with the Great Stock Market Crash.

Between 1929 and 1932, the market fell 89% from its high. The Keynesian storyline is that Herbert Hoover’s administration did nothing to try and revive the economy. It took Franklin Delano Roosevelt and his New Deal Keynesian policies to save the country. It’s a nice story, but entirely phony. Between 1929 and 1933 the Hoover administration increased real per-capita federal expenditures by 88%, not exactly the austerity measures described in fantasy stories concocted by the mainstream media.

Bureau of Economic Analysis National Income and Product Accounts Table

|

Table 1.1.6A. Real Gross Domestic Product, Chained (1937) Dollars [Billions of chained (1937) dollars]

|

| |

1929

|

1930

|

1931

|

1932

|

1933

|

1934

|

1935

|

1936

|

1937

|

1938

|

1939

|

| Gross domestic product |

87.3

|

79.8

|

74.6

|

64.9

|

64.0

|

71.0

|

77.3

|

87.4

|

91.9

|

88.7

|

95.9

|

| Personal consumption expenditures |

63.1

|

59.7

|

57.8

|

52.6

|

51.5

|

55.1

|

58.5

|

64.5

|

66.8

|

65.8

|

69.4

|

| Gross private domestic investment |

12.2

|

8.1

|

5.1

|

1.5

|

2.3

|

4.1

|

7.6

|

9.7

|

12.2

|

8.0

|

10.3

|

| Net exports of goods and services |

0.8

|

0.4

|

0.2

|

0.0

|

-0.1

|

0.2

|

-0.5

|

-0.3

|

0.1

|

0.9

|

1.0

|

| Government consumption expenditures and gross investment |

9.2

|

10.2

|

10.6

|

10.2

|

9.9

|

11.1

|

11.5

|

13.4

|

12.8

|

13.8

|

15.0

|

The Great Depression officially lasted from 1929 until 1940. What is not well known is that real GDP was at the same level in 1936 as it had been in 1929. In no small part because real GDP soared by 37% between 1933 and 1936. The unemployment rate in 1929 was 5%. In 1936, even after real GDP had recovered to pre-depression levels, the unemployment rate was still 15%. It spiked back to 18% in 1938 and stayed above 15% until World War II. Tellingly, in 1936, private domestic investment was 21% below the level of 1929.

By contrast, government expenditures surged by 46% between 1929 and 1936. With the government creating new agencies and employing people in make-work projects, private industry was crowded out. The extensive governmental economic planning and intervention that began during the Hoover administration swelled drastically under Roosevelt. The bolstering of wage rates and prices, expansion of credit, propping up of weak firms, and increased government spending on public works prolonged the Great Depression.

The facts powerfully contradict the notion endorsed by Krugman and other Keynesian devotees that the supposed 1937-38 Depression within the Great Depression was caused by Roosevelt slashing spending. In fact, real GDP only dropped by 3.5% in 1938 and rebounded by 8.1% in 1939. What actually collapsed in 1938 was private investment, which fell 34%. By contrast, government spending declined by only 4.5% in 1938, proving that Roosevelt did not drastically cut spending. To the extent that he eased up on the accelerator, it was by cutting back on useless jobs programs like those provided by the Works Progress Administration and the Public Works Administration. Austerity did not derail the recovery.

The reason private investment collapsed in 1938 was Roosevelt’s anti-business crusade. He denounced big business as the cause of the Depression. In March 1938, FDR appointed Yale University law professor Thurman Arnold to head the antitrust division of the Justice Department. Arnold soon hired some 300 lawyers to file antitrust lawsuits against businesses. Arnold launched cases against entire industries, with lawsuits against the milk, oil, tobacco, shoe machinery, tires, fertilizer, railroad, pharmaceuticals, school supplies, billboards, fire insurance, liquor, typewriter, and movie industries.

Paul Krugman’s recent veiled yearning for a war or staged crisis to revive the economy through spending to fight the war is another Keynesian fallacy perpetuated by the mainstream media. These mindless non-critical thinking talking heads actually believe World War II ended the Great Depression. Doug Casey obliterates their fantasy:

“People say that World War II cured the Depression, but in fact, it made it worse. As bad as things were in the ‘30s, they were worse during the war in the ‘40s. You couldn’t get shoes. You couldn’t get gasoline. You couldn’t get tires. You couldn’t get just about anything that was being used for the war. The war prolonged and deepened the Depression. The thing that ended the Depression was not the war but the fact that since people could not consume, they were forced to save. That delayed consumption resulted in a huge amount of savings, and that’s what caused the recovery in the late 1940s.”

The fact that the entire world was left in smoldering ruins after World War II, except for the United States, may have contributed slightly to our recovery from the Great Depression.

According to Murray Rothbard, in his book America’s Great Depression, the artificial meddling in the economy was a disaster prior to the Great Depression, and government efforts to prop up the economy after the crash of 1929 only made things far worse. Government intrusion delayed the market’s correction and made the road to complete recovery more difficult. Today’s myopic politicians, captured monetary authorities and Harvard trained Keynesian economists have learned the wrong lessons from the Great Depression. The upshot will be a second Greater Depression and further impoverishment of the dwindling middle class. The implications of more wasteful government stimulus programs, more quantitative easing and more debt are: further debasement of the currency and ultimately a hyperinflationary collapse. The great economist John Maynard Keynes understood currency debasement:

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

How to Cut Spending While Actually Increasing Spending

“Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.” – John Maynard Keynes – The Economic Consequences of the Peace

Obama’s plan to revive America will be announced with great fanfare in two weeks. We know for sure he will propose these two brilliant ideas:

- Extending unemployment compensation again at a total 2012 cost of $65 billion. Because we know that paying people to not work creates millions of jobs. The multiplier effect is off the charts. Why work when you can watch The View and chow down on cheese doodles purchased with your SNAP card for 99 weeks?

- Extending the payroll tax cut at a total 2012 cost of $100 billion. This was supposed to give a dramatic boost to the economy in FY11. Have you noticed any boost? A Keynesian will argue, “Imagine if we hadn’t done it.” A critical thinker might ask: Is it prudent to increase the unfunded Social Security liability by another $100 billion and hand the bill to future unborn generations, so we can buy a new IPod 2 today?

It is a certainty that Obama will announce an infrastructure bank or some variation to spur investment in our national infrastructure that is crumbling by the day. Top Keynesian, and architect of the Obama stimulus plan, Larry Summers has been blathering about this for months. Even though the first stimulus plan was sold as an infrastructure plan, they mean it this time. As usual, the storyline is false. You can’t drive anywhere in this country and not be inconvenienced by road widening, bridge building, and repaving projects. The Keynesians act like infrastructure projects are highly unusual and need new Federal dollars to jump start the engine. The fact is that every Federal, State and municipal government has a capital fund that is budgeted every year. Most of the projects have multiple year lead times. They require planning and coordination. The reason we have 160,000 structurally deficient or obsolete bridges and thousands of miles of crumbling underground pipes is because politicians decided to spend their budgets on something more useful like train museums, murals, turtle crossings, and studies on the mating habits of ferrets.

The country has lost approximately seven million jobs since 2007. Five million of the jobs were lost in sales industries and manufacturing industries. There are 139 million jobs in America today and only seven million, or 5% of all jobs, in the construction industry. How do Keynesians expect to revive the job market with an infrastructure bank that will benefit, at most, 5% of the U.S. workforce? Let me guess. They will propose billions of new spending on education so they can retrain sales clerks from Wal-Mart into architects for designing 160,000 new bridges.

Barack Obama will stand in front of the American people and lie. He is a born again cost cutter, who will propose new spending. As anyone with a calculator can figure out, the two guaranteed proposals from his upcoming speech will increase spending by $165 billion in 2012. If you go back to the handy dandy chart from the CBO showing the “horrific spending cuts” from the recent debt ceiling deal you will see these “cuts” total $122 billion between 2012 and 2014. Barack will wipe out all of the supposed savings through mid 2015 with his new Keynesian plan. But don’t worry. His plan will have huge spending cuts in 2017 after his hoped for 2nd term is finished. Keynesians always promise to cut spending once their current emergency ends.

The Keynesians had their chance. They controlled the Presidency and both houses of Congress. A Keynesian runs the Federal Reserve. They implemented everything they proposed. The $862 billion porkulus program, the $700 billion TARP program, home buyer tax credits, energy efficiency credits, loan modification programs, zero interest rates, QE1 and QE2. They increased social welfare transfers for Social Security, Unemployment Compensation, food stamps, Medicare, Medicaid, and Veterans by $600 billion since 2007, a 35% increase in four years. No one has foiled their plans. The Tea Party didn’t really exist until 2010. They didn’t lose the House until November 2010. They cannot blame the Tea Party extremists, but they do.

The Keynesians have successfully increased Federal spending by $1.1 trillion, or 41% since 2007, and are running deficits exceeding 10% of GDP, but they call the Tea Party extremists. Domestic investment is still 9% below 2008 levels as the Federal government has crowded out the small businesses that create the jobs in this country. And now the Keynesians declare we need more stimulus, more programs, more debt, more quantitative easing and lower interest rates. It just wasn’t enough the first time. You have to give the Keynesians credit. Despite the utter absolute failure of every scheme they have implemented, they will worship their models and theories until they successfully collapse our economic system. Then they’ll blame the Tea Party terrorists who foiled their plans.

None of the Keynesian solutions worked during this crisis, just as they didn’t work during the Great Depression. The solution was simple, yet painful. The banking system needed to be saved, not the banks. The bad debt needed to be purged from the system. Wall Street criminals needed to be prosecuted. Bondholders and stockholders needed bear the losses from their foolish investments. Saving and investment in the country needed to be encouraged, while borrowing and consuming needed to be discouraged. Our leaders have failed to lead. The American people have failed to accept the consequences of their actions. And now we are going to pay a heavy price as Ludwig von Mises predicted:

“There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.”

![[Review & Outlook]](http://sg.wsj.net/public/resources/images/ED-AI932_1stimu_NS_20090127200020.gif)