You can’t open a newspaper or watch a business news network without seeing or hearing that consumers and businesses have been de-leveraging. The storyline as portrayed by the mainstream media is that consumers and corporations have seen the light and are paying off debts and living within their means. Austerity has broken out across the land. Bloomberg peddled this line of bull last week:

US Household Debt Shrank 1.5% in the Second Quarter

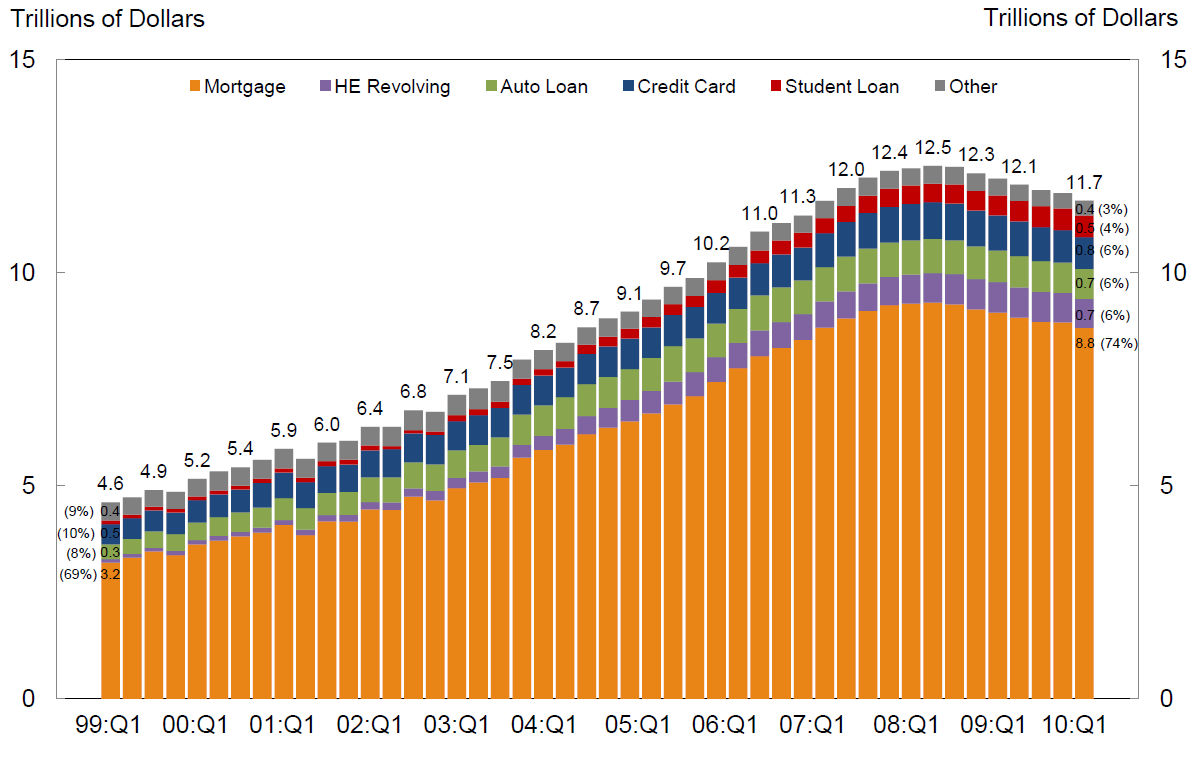

American households pared their debts last quarter, closing credit card accounts and taking out fewer mortgages as unemployment persisted near a 26-year high, a survey by the Federal Reserve Bank of New York showed.Consumer indebtedness totaled $11.7 trillion at the end of June, a decline of 1.5 percent from the previous three months and down 6.5 percent from its peak in the third quarter of 2008, according to the New York Fed’s first quarterly report on household debt and credit.The report reinforces forecasts for a slowing economy in the second half of 2010 as consumers hold back on spending and rebuild savings.

One has to wonder whether the mainstream media and the clueless pundits on CNBC actually believe the crap they are peddling or whether this is a concerted effort to convince the masses that they have done enough and should start spending. Consumer spending as a percentage of GDP is still above 70%. This is well above the 64% level that was consistent between 1950 and 1980. Consumer spending was entirely propped up by an ever increasing level of debt. The American economy will never recover until consumer spending drops back to the 64% range that indicates a balanced economic system. For the mathematically challenged on CNBC and in the White House, this means that consumers need to reduce their spending by an additional $850 billion PER YEAR. Great news for the 1.5 million retailers in America.

Below is a chart that shows total credit market debt as a % of GDP. This chart captures all of the debt in the United States carried by households, corporations, and the government. The data can be found here:

http://www.federalreserve.gov/releases/z1/current/accessible/l1.htm

Total credit market debt peaked at $52.9 trillion in the 1st quarter of 2009. It is currently at $52.1 trillion. The GREAT DE-LEVERAGING of the United States has chopped our total debt by 1.5%. Move along. No more to see here. Time to go to the mall. Can anyone in their right mind look at this chart and think this financial crisis is over?

During the Great Depression of the 1930’s Total Credit Market Debt as a % of GDP peaked at 260% of GDP. As of today, it stands at 360% of GDP. The Federal Government is adding $4 billion per day to the National Debt. GDP is stagnant and will likely not grow for the next year. The storyline about corporate America being flush with cash is another lie. Corporations have ADDED $482 billion of debt since 2007. Corporate America has the largest amount of debt on their books in history at $7.2 trillion.

Now we get to the Big Lie about frugal consumers paying off debts, cutting up those credit cards, and eating Raman noodles 5 nights per week. Household and non-profit debt, which includes mortgages, credit card debt, auto loans, home equity loans, and student loans peaked at $13.8 trillion in 2008. After two years of supposed deleveraging, frugality and mass austerity, the balance is $13.5 trillion. Consumers have buckled down and have paid off 2.2% of their debts, it seems. Not exactly going cold turkey, but it is a start.

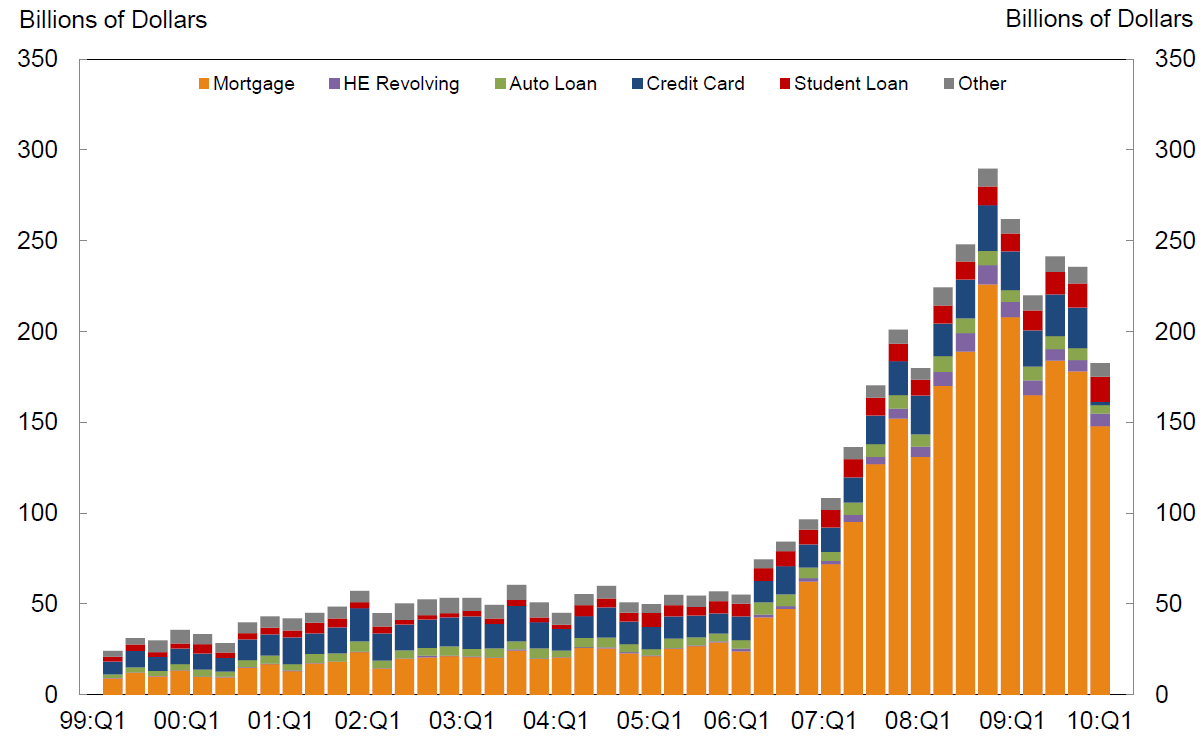

But wait. Consumer debt outstanding is $300 billion lower. If you hadn’t noticed, the banks in the United States have been taking a few losses on their loans over the last couple years. A simple search of the Federal Reserve website reveals that banks have charged off 5.66% of all their loans in the last two years. The charge off rate in the 2nd quarter of 2010 was 6.66%. To verify for yourself go to the Federal Reserve website:

http://www.federalreserve.gov/releases/chargeoff/chgallsa.htm

So, let’s get down to the nitty gritty. If consumer debt was $13.8 trillion at the end of 2008 and the banks have since written off 5.66% of that debt, total write-offs were $800 billion. If total consumer debt now sits at $13.5 trillion, then consumers have actually taken on $500 billion of additional debt since the end of 2008. The consumer hasn’t cut back at all. They are still spending and borrowing. It is beyond my comprehension that no one on CNBC or in the other mainstream media can do simple math to figure out that the deleveraging story is just a Big Lie.

The truth is that the debt has simply been shifted from criminal Wall Street Banks to the American taxpayer. These consumer debts were created in a private transaction between individuals and these banks. When the loans went bad, the consumer should have lost their home, car, etc., and their credit rating should have been ruined, keeping them out of the credit market for a number of years. If the banks that made these bad loans made too many, they should have failed and had their assets liquidated in bankruptcy. Instead, the Federal Government has inserted the American taxpayer into the equation by using our tax dollars to prop up insolvent Wall Street banks and allowing screw-ups who took on too much debt to live in houses for over two years without making a mortgage payment.

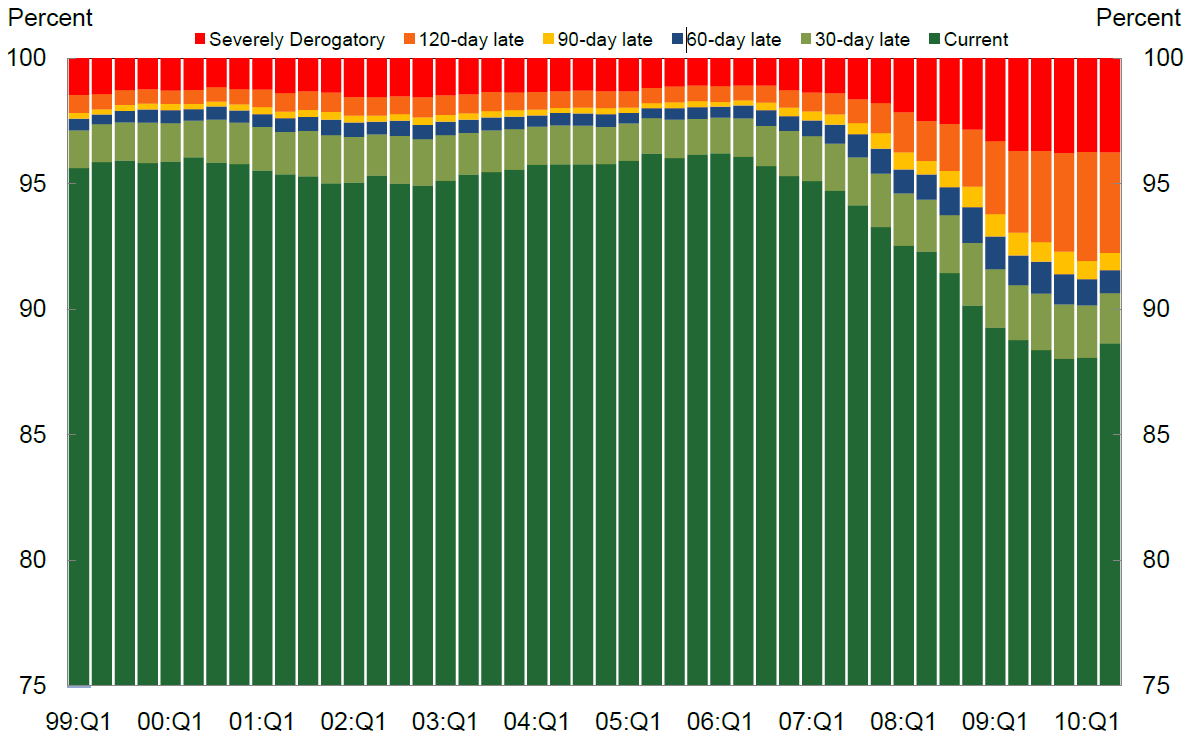

The Big Lie will eventually lose out to the grim truth. America’s economy is built on a debt based foundation of sand and the tide of reality is relentlessly eating away at that foundation of debt. Collapse is just a matter of time. The charts below from the Federal Reserve paint a grim picture of reality.

Total Debt Balance and its Composition

Total Balance by Delinquency Status

New Seriously Delinquent Balances by Loan Type

“To contract new debts is not the way to pay old ones.” George Washington

Mr. Quinn,

Allow me to inform your readers that Hedge Funds are included in the Private Households line item in Federal Reserve data. Consumers have been de-leveraging substantially, and Hedge Funds have been more than willing to lever-up on their behalf.

For the correct data set on consumer credit, go to the St. Louis Fed:

http://research.stlouisfed.org/fred2/graph/?chart_type=line&s%5B1%5D%5Bid%5D=TOTALNS&s%5B1%5D%5Brange%5D=5yrs

Hmmm, I guess I will have to wait for Jim to analyze the St Louis Fed data (I’m certainly too lazy and ignorant to do it myself).

Mr. Quinn’s essential message that overall debt has shrunk only slightly is still important. But it appears that the crucial part of the argument is the opposite of what he is stessing. The government has thrown three to four trillion at the problem but has still not managed to maintain or expand consumer debt.

I have no faith in either Wall Street or Washington, having worked for one and with the other (as well as having been educated by Washington). Overall debt will be increased. Call it QE 2, Helicopter Drops, or Fucking Our Futures. Whatever you call it, the only solution Washington knows is printing. The only way for Wall Street to continue bloating itself is printing.

I would call for a revolution, but I frankly don’t think Americans deserve anything better than what they already gave themselves.

So many leveraged debts, so few solvent counterparties. The lament for these premeltdown times.

Super read!

Short, sour, and to the point!

An Alternative to Capitalism (which we need here in the USA)

The following link takes you to an essay titled: “Home of the Brave?” which was published by the

Athenaeum Library of Philosophy:

http://evans-experientialism.freewebspace.com/steinsvold.htm

John Steinsvold

Great article, I feel sorry for American’s in general. The government has all the blame in this depression.

This has been a set up from day one. Which quite simply was to liquidate our country, better yet liquidate the American Taxpayers. They did it, didn’t they we have been scammed for trillions of dollars. Our children, our grandchildren, and great grandchildren will be paying off this looting.

I love econoporn.

There was an interesting interview with Yra Harris on Big Jim’s site the other day. Harris was talking about people ‘prioritizing’ their debts, with the primary goal of maintaining solvency on their credit cards 1st, so that they would have pork & beans money if it came down to that.

I have to agree with the fact that if people were hurting financially, or say unemployed, there likely wouldn’t be a high priority on paying down debt.

Excellent, Opinionated Bloviator!!!!!!!!

Arguing with Quinny over financial matters is akin to bringing a knife to a gun fight. However I must insist that some deleveraging is going on due to the simple fact that so little leverage is available. Just ask anyone who has tried to get a home loan or mortgage recently. Unless one has loads of equity the loans are not being provided. My father just sold his house and bought a condo with 50% equity and the mortgage required the kids guarantee and was still painful. All in the. Total debt burden was reduced by about $150k. If there is an increase in borrowing I don’t know where it is coming from.

Pat

People who have been living in homes without making mortgage payments aren’t deleveraging. They are using their credit cards to live on. Your Dad could have gotten a $400,000 no doc loan if he was part of Obama’s Free Shit Army. You just need to know the right people.

Now to the important stuff. How come I haven’t been invited to Britingham’s in a year. Am I dead to you guys?

how often are these charts updated?

Quarterly.