Like so many other things in popular American culture, this quaint notion of a “middle class” in the U.S. is at this point nothing more than a myth; a rapidly fading fantasy from a bygone era. As myself and many others have noted for quite some time, the decimation of the middle class began long ago. It really got started in the early 1970′s after Nixon defaulted on the gold standard and financialization began to take over the American economy. Median real wages haven’t increased since that time and the rest is history.

Like so many other things in popular American culture, this quaint notion of a “middle class” in the U.S. is at this point nothing more than a myth; a rapidly fading fantasy from a bygone era. As myself and many others have noted for quite some time, the decimation of the middle class began long ago. It really got started in the early 1970′s after Nixon defaulted on the gold standard and financialization began to take over the American economy. Median real wages haven’t increased since that time and the rest is history.

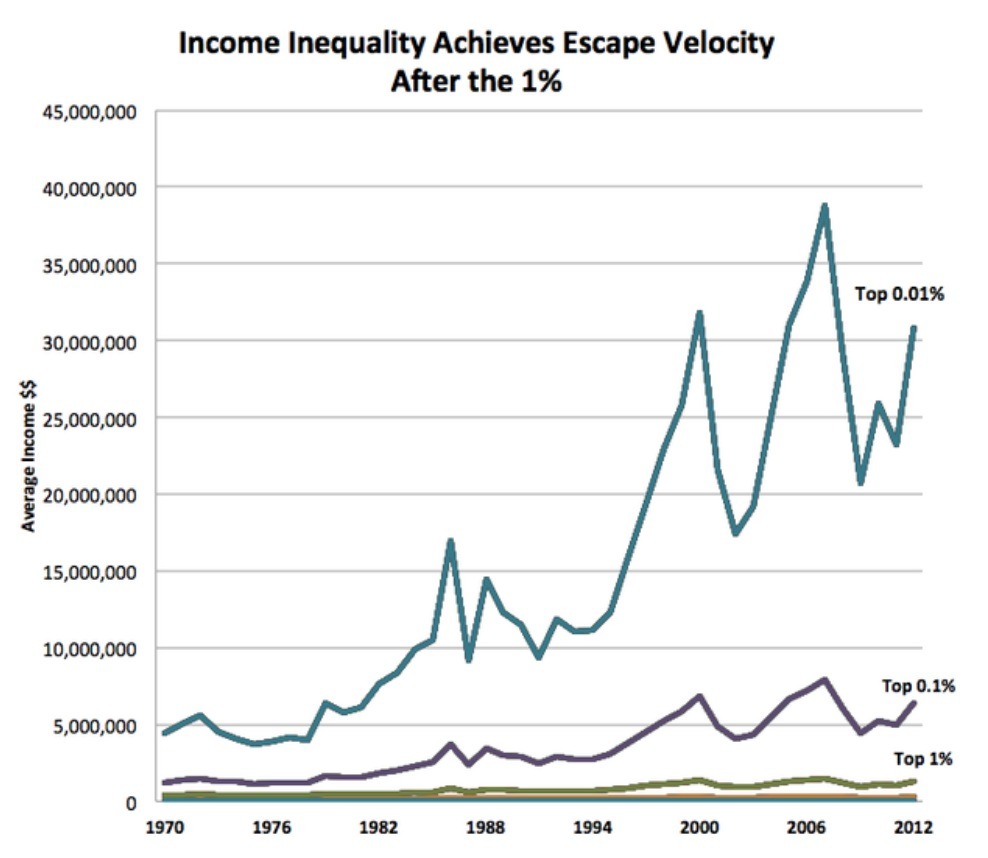

Although the evolutionary process toward oligarchy began long ago, its finishing touches have been applied in recent years. This has been easily achieved by the Federal Reserve and U.S. government’s response to the financial crisis, which was and continues to be characterized by an intentional funneling of all the nation’s wealth into the hands of their patrons; the 0.01%. As the chart below demonstrates clearly (and as I highlighted in the post: Where Does the Real Problem Reside? Two Charts Showing the 0.01% vs. the 1%), it is the tiny oligarch class that is reaping all of the benefits.

The was further demonstrated in full color recently in a report by Oxfam International, which showed that 85 people have as much wealth as the poorest 3.5 billion on earth. There is nothing moral, decent or “free market” about such an outcome. It can only happen in a world characterized by militarism, exploitation, cronyism and fraud. We are living in a global feudalism.

In case you needed any more proof of our current predicament, the Washington Post notes that:

Nostalgia is just about the only thing the middle class can still afford. That’s because median wealth is about 20 percent lower today, in inflation-adjusted dollars, than it was in 1984.

Yes, that’s three lost decades.

Now, as you might expect, the middle class has been hit particularly hard by the Great Recession and the not-so-great recovery. It’s all about stocks and houses. The middle class doesn’t have much of the former, but it does have a lot of the latter. And that’s bad news, because, even though the crash decimated both, real estate hasn’t come back nearly as much as equities have. So the top 1 percent, who hold more of their wealth in stocks, have made up more of the ground they lost. But, as the Russell Sage Foundation points out, the slow housing recovery means that, in 2013, median households were still 36 percent poorer than they were a decade earlier.

Though, to put that in depressing perspective, it’s still a heckuva lot better than households in the bottom 25 percent, whose wealth never grew during the good times, and then plunged 60 percent during the bad ones. That’s because, for both the middle and working classes, real wages have been stagnant the past 30 years, and housing equity has taken a nosedive.

So what if the stock market is up? Most Americans are too dead broke to own equities, and in fact, an increasing amount need debt and welfare just to survive. Meanwhile, Obama is hosting $32,000 a plate fundraisers all over California, while the median wage in America is only $27,000.

That’s just how the oligarchs like it.

Full article here.

In Liberty,

Michael Krieger

[img]www.mikecornelison.com/wp-content/uploads/2012/08/cmon-baby-gimme-one-more-chance[/img]

why can’t I get the picture of the savior, ‘cmon baby, give me one more chance….’ to show up. Help.

[img ?w=500&h=661[/img]

?w=500&h=661[/img]

Hope this works……..

How many liberals or die hard republicans for that matter, if you showed them this article, or any article that explains what has been going on for too many years, would stop and listen.

To me that is the key. Stucky has a great post of What woke you up. It’s fantastic to read all the different responses, but we are so few against so many.

Re the middle class – they are screwed because they have nothing to offer. No skills, no education, no high intelligence. They cannot command high incomes, as supply for them is high and demand for them is nil. So they forevermore will be screwed – the world will not pay them high wages for low skills and abilities.

Re the .001 percent – I do not really know.

I would start by implementing inheritance taxes on huge transfers of wealth (multi-billions). At least it would keep the multi-billionaire folks from consolidation wealth generation to generation.

Trusts need to be dealt with as well. A flat tax needs to be implemented, and all deductions/loopholes need to be tossed. Forced distribution of excess retained earnings needs to be considered. Corporate taxes need to be revised/eliminated, and loopholes eliminated to entice the trillions of dollars held overseas to return.

I would stop printing money. I would put caps on CEO compensation. I would eliminate high speed trading. I would require banks to be properly capitalized. I would require boards of directors to have limited terms. I would require all executive compensation be reported – all of it.

Just off the top of my head, those are a few things that can be done.

“… It can only happen in a world characterized by militarism, exploitation, cronyism and fraud. We are living in a global feudalism….”

My mind has been returning to just this thought, over and over. We traded monarchy, royalty, and theocracy, democracy, to come full circle back to serfs and lords. Except this time it is to the oligarchy, and a pretend representative government.

Those that refuse to learn history are doomed to repeat it. Amazing how many old “meaningless” cliches have ended up being So. Damned. True.

Those that trade freedom for security will have neither.

First they came for the drug addicts (unionists) but I wasn’t a drug addict (unionist), so I did nothing.

A penny saved is a penny earned.

Time squandered can never be recovered.

Give them an inch and they’ll take a mile.

An apple a day keeps the doctor away.

I could add dozens more. So could most of you. Seems the old ways, and folks, weren’t as crazy as we have been taught.

And, contrary to popular belief, the reason the middle class had died is the death of small business.

It is directly related to our loss of wealth and income. Small business was once the grease of the engine for this country and the middle class.

The industrialists, banksters, academics, politicians, unions, and health care (pharm, docs, hospitals, equipment, etc) freaking conspired to directly wipe out American small business and donate their customers to the remaining, growing, giants. Constitutional warnings against monopolies be damned. (Amazing how foreseeing those guys were)

At one time, not that freaking long ago really (40 years), small business employed 75% of all non-government/non-profit workers. 75 fucking per cent.

Which means that American small business either made the thing, made the thing to go in another thing, or sold the thing, or serviced the thing, in over 75% of all private transactions.

Today, the birth/death rate of small business has plummeted. The percentage of jobs was estimated at 45% over 8 years ago – there is no freaking way it is that high now. The death of what made us the economic powerhouse that we were is the problem.

Meanwhile the academics, and statists, and globalists, and those at the Washington Post, continue to put the cart before the horse. It isn’t about freaking “stocks and real estate.”

It IS about the intentional, multi-layered, multi-level planned, destruction of the American Small business and everything it once did for us, the American middle class.

We buy more shit than we ever did when our small biz was humming. We lived within our means and bought quality over quantity. Now, our GDP is ridiculously large compared to the reality I see of foreign components, foreign processing, foreign sales that we spend our fiat on. Yeah, the end product may be expensive, but when it is made in Asia, then shipped here, the percentage of that GDP counted gross that sticks to the hands of American workers is disgustingly small. Shipping, government inspectors at borders, a couple sales guys, maybe a warehouse or distribution point. Maybe. Less more and more as the mega-nationals automate, off shore, and play games to avoid our draconian tax laws. The same laws that wiped out a big percentage of those old middle class small businesses.

I drive past closed and shuttered businesses daliy. From here, to there, and all over. Owning a business that sells to other small (and some large) businesses kinda forces me too. And, while there are few “hotspots” of commerce and construction, they invariably revolve around government subsidies for soon-to-fail “green” tech, roads, and medical government subsidies.

Meanwhile, even more of us little guys give the hell up and close our doors. From our local politicians and unions, to the county, state and Federales, not freaking one of them – or these so called economic and societal experts – have been able to equate reality with their precious statistics and studies.

Until the day that more small guys throw up shingles, than take them down, there won’t be a recovery for the middle class.

Sadly, I’ve come to the conclusion that there is exactly 0.00000your fat ass% chance of that recovery happening with the regulations, fines, rules, intelligence coming out of school, lack of capital due to increasing costs and gubment mandates, further poverty and default of the fiat.

Recovery. just. ain’t. going. to. happen.

These tools will still be scratching their heads and wondering “why?” They’ll pull out their charts and look at the things that matter not, and refuse to include the things that are unavoidable.

SISO, once again.

*sigh*

TE – my partner and I are convinced that there is no way we can survive many more years. We are having the life-blood squeezed from us. Slowly, but surely, the bastards are getting us. No matter how well we run the business, there are just too many parasites having a nibble. No one parasite is fatal, but combined, the bastards suck out a lot of blood.

Too many layers of government, too many increasing regs and costs – it is a slow, ever-increasing sucking away of our life blood. One day we will simply fold up the tent – the effort will not be worth the reward. We will not go broke – we will simply have had enough, and when the return is too little, we will close the doors. It is a cost benefit analysis.

It is painful to run a small business (medium size in my case), even when you are making money. The pain of dealing with customers, employees, suppliers, and layers of government is substantial indeed. It takes a goodly amount of income incentive to overcome that pain in my case, and when it reaches a point that I deem to be out of balance, I will pull the plug.

@LLPOH, I feel your pain. At least you are able to articulate the problem and realize the why, which is the reason you will get away without losing everything.

The vast majority, I am afraid, do not have such knowledge, do not want such knowledge, and are too indebted to the banks to do the same.

Sad really.

I deal with most of the compliance here, and only because hub refuses to. His view on his business, its future, the value of our building, and his stock portfolios is exactly the same as the masses. As for government correspondence, which seems to come more and more, it is all my problem.

When this place goes it will be under the weight of fines, or mandates, or a bankster. My guess, since we have managed to pay down/trade assets for nearly $2 million in debt in less than a decade, is it will be some fine from the IRS or the like.

They fined a friend of ours $150,000 for failure to file three 941 reports. Even though he paid all taxes on time, and even though in over 20 years of business he never missed a report before, nor after. Unfreakingbelievable.

It is just too much.

But, as with everything, there will remain some opportunities for those that can outsmart the system. The problem is us guys with business knowledge, expertise and capital, are reaching our Galt moments and/or our I-can’t-take-one-more-freaking-bureaucrat moments.

I’m sorry you are facing such horrible choices, and I personally know all too well how horrible it is to look someone(s) in the eye and tell them there is no more money to pay them, nor work to be paid for.

A little part of me dies when I’ve had to do it. Even though I know it was the only way to survive, it still sucks.

And, sadly, it will again. Worse part is my son and his girlfriend are now 1/3 of our workforce. *sigh*

1999

Me – (the evangelist) says in X years, which would put the demise of the USA around 2040…

My son – that’s stupid.

TE – it is really sad. Moreso for folks such as yourself, than for me. My race is almost run.

One thing I see, time and again, is folks that bury their heads in the sand, much as you say re your husband. It is too hard to comply with the regs, or they do not have the skills, and so they ignore the paperwork. One day the feds/EPA/IRS etc comes knocking, and then all is lost, maybe even their freedom.

My partner got hit for $100k over 20 years ago. He still keeps his head buried, and without me the regs would go unheeded, and eventually he would be taken down in a big way. And he is as bright and hard-working as they come. He simply cannot bring himself to do those things he feels are of no value, no matter what the layers of govt say. Even after he was nearly sent bankrupt those many years ago, he cannot change.

They have long believed the small business camel can carry an infinite amount, so long as you load it slowly. The back breaking straw has arrived.

The govts are so desparate for money they do jot understand wat they have done – small business is seem as a milk cow, and so they milk it. They cannot give up on adding ever increasing straws, as they are addicted to generating ever increasing revenue from the cow. The cow has died and they as yet do not know it.

My doomstead is well underway now, and I am looking forward to exiting the rat race.

All the best, TE.

All the best to you too, Llpoh, I have hopes that the doomstead holds, and that you and yours survive the shitstorm. I feel the same about (most) here.

Don’t feel sad for me. I’m a realist, and a fighter, and I grew up with little, so having little again truly isn’t the horror it would be for some, like the hub whom has never truly known want, nor poverty, a day in his blessed life. Daddy always provided, exact opposite of me.

I also have skills, and fortitude, and enough snark, smarts and attitude, plus a full contingent of guardian angels that I’ve always known were around even when I denied them with my breath.

I feel for my kids, my son knows the changes from the 80s to today, my daughter only knows today’s materialistic, narcissistic, bubble-wrapped, existence. At least my son is aware, and has skills and fortitude too. We will both get my wee one (and now his) on the same path.

All of this shit could be fixed so easily. Outlaw central banks. Everyone, every business & every govt would instantly be forced to live within their means. It’s what the media talking heads might call an “organic solution” because once you remove the means of excess, ALL kinds of “problems” just solve themselves. The stench of death would be among us for awhile but that too would have benefits.

Three decades is spot on. Wife joined the work force and you had more than one credit card. Debt has done the middle class a death blow.