On October 2 the BLS reported absolutely atrocious employment data, with virtually no job growth other than the phantom jobs added by the fantastically wrong Birth/Death adjustment for all those new businesses springing up around the country. The MSM couldn’t even spin it in a positive manner, as the previous two months of lies were adjusted significantly downward. What a shocker. At the beginning of that day the Dow stood at 16,250 and had been in a downward trend for a couple months as the global economy has been clearly weakening. The immediate rational reaction to the horrible news was a 250 point plunge down to the 16,000 level. But by the end of the day the market had finished up over 200 points, as this terrible news was immediately interpreted as good news for the market, because the Federal Reserve will never ever increase interest rates again.

Over the next three weeks, the economic data has continued to deteriorate, corporate earnings have been crashing, and both Europe and China are experiencing continuing and deepening economic declines. The big swinging dicks on Wall Street have programmed their HFT computers to buy, buy, buy. The worse the data, the bigger the gains. The market has soared by 1,600 points since the low on October 2. A 10% surge based upon lousy economic info, as the economy is either in recession or headed into recession, is irrational, ridiculous, and warped, just like our financial system. This is what happens when crony capitalism takes root like a foul weed and is bankrolled by a central bank that cares only for Wall Street, while throwing Main Street under the bus.

The employment situation continues to deteriorate on a daily basis as Challenger, Grey & Christmas has reported layoff announcements by major corporations in 2015 that already exceed the total announcements in 2014. This is the reality versus the BLS 5.1% unemployment rate fantasy. Retail sales, which make up two thirds of the economy, are putrid and confirm the dreadful employment market. Corporate profits among S&P 500 companies have fallen for two straight quarters and are picking up steam in a negative direction, as accounting shenanigans cannot disguise falling revenue forever. Earnings per share estimates for future quarters fall on a daily basis.

Every manufacturing and services survey flash recession warning. Despite propaganda from the NAR, government and the MSM, the housing market is dead in the water. Major home builders continue to report declining orders as new home sales are plummeting and existing home sales, without NAR adjustments, show a negative trend. But prices continue to rise as that has been the Fed’s purpose all along – to repair Wall Street bank balance sheets at any cost. Sacrificing the well being of tens of millions of senior citizens and millennials has been well worth it for Ben ($300,000 per Wall Street bank speaking engagement) and Janet, as the million dollar banker bonuses have done wonders for high end NYC penthouses and beachfront estates in the Hamptons.

The awful U.S. economic data pales in comparison to the absolute implosion occurring in China, as they desperately falsify economic growth data, threaten to prosecute stock sellers, censor truth tellers, bail out failing government entities, and manipulate their currency, to fend off impending disaster. Europe wallows in an ongoing depression as youth unemployment in most EU countries ranges between 20% and 50%. A bankrupt union of socialist states, dependent solely on central bankers issuing more debt to pay off old debt, have signed their own death warrant by allowing themselves to be overrun by hordes of Muslim refugees.

As John Hussman explains, the global economic situation has gotten so bad, central bankers have again come to the rescue by promising to prop stock markets up like they’ve been doing for the last six years.

The market rebound of recent weeks has essentially been grounded in exuberance that the global economy is deteriorating so quickly that central banks will insist on accelerating their monetary interventions. While both corporate earnings and revenues are now in retreat, we also see enthusiasm about the remaining economic activity being captured by a handful of winner-take-all companies. Those two dynamics largely summarize the tone of the market here.

U.S. economic data unequivocally indicates a recessionary environment on par with 2001 and 2008. Those periods did wonders for the wealth of stock investors, if you recall.

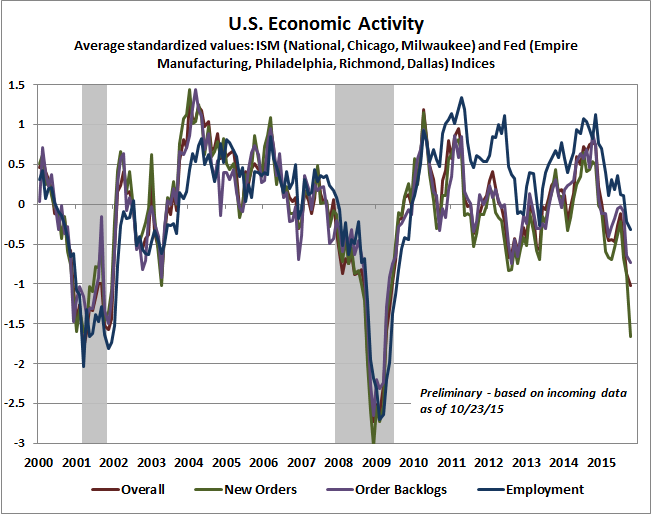

The following chart updates our standard economic review of regional and national Fed and purchasing managers’ surveys. The October Philadelphia Fed report was particularly weak on the new orders front, which is complicated by the fact that it’s also one of the more reliable surveys as an indication of broad economic activity. The chart below reflects available data through Friday.

The Pavlovian dog response of Wall Street traders to any hint of monetary easing or continued ease is as predictable as a monthly billion dollar fine being paid by an upstanding Wall Street financial institution. Obscene valuations, plunging corporate profits, and a low volume extremely narrow advance are not the ingredients of a new bull market. They are the ingredients of a dead cat bounce.

The underlying thesis, of course, is that monetary easing — regardless of its fruitless effects on the real economy — is a reliable signal that the financial markets are open for speculation. Valuations are the central driver of long-term investment returns, while market returns over shorter portions of the market cycle are primarily driven by the preference of investors to seek or avoid risk. At present, valuations remain obscene and market internals remain unfavorable. Credit spreads remain wide, and despite last week’s market advance, the percentage of individual stocks above their own respective 200-day moving average hardly budged, increasing only from 37% to just over 38%. Our broader measures of market internals remain unfavorable here as well.

The pessimism overriding the markets from August through October was warranted, based on reality, facts and historically accurate valuation methods. The 1,600 point reversal has been based solely on hope and faith in central bankers who have failed miserably in spurring economic recovery with their monetary machinations. With valuations at nose bleed levels, rising P/E ratios due to declining earnings, record margin debt, and overly optimistic bulls, years of gains are poised to evaporate.

It’s essential to keep in mind that the equity market moves in cycles between extreme optimism, rich valuations, and poor prospective returns at market peaks, to extreme pessimism, favorable valuations, and high prospective returns at market lows. Even a run-of-the-mill bear market decline typically wipes out more than half the gain of the preceding bull market. Based on our current methods of classifying market return/risk profiles, the most severe market losses across history are captured by observable conditions that have emerged only about 9% of the time — a subset that that includes the present.

The coming violent devastating crash, which will not be avoided through further central banker intervention, has been perpetuated, financed and encouraged by the Federal Reserve. They have trained the Wall Street Pavlovian dogs to salivate at the ringing of the QE/ZIRP bell. They’ve managed to delay the day of reckoning, but will not permanently fend off reality. Booms fueled by easy money, ALWAYS go bust.

The dogmatists running global central banks have encouraged investors to believe that volatility and downside risk have been, and can sustainably be, removed from the financial markets. No — by encouraging the illusion that normal cyclical fluctuations have been eliminated from the dynamics of the markets and the economy, the result has been far more risk taking, far heavier issuance of low-quality and covenant-lite debt, far more yield-seeking misallocation of capital, and far more extreme equity valuation in this cycle than would have been possible otherwise. The consequence will be far more violent market behavior over the completion of the cycle than investors would have faced otherwise.

We’ve seen it all before. Two epic stock market collapses within the last fifteen years have been long forgotten by the Wall Street lemmings who ignore the fact the Fed eased during both market collapses. The fact the Fed has absolutely no ability to ease further as the economy deteriorates doesn’t seem to bother the perpetual bulls. Their level of historical ignorance is only matched by their hubris and arrogance.

The declines and recoveries we’ve seen over the past year are nothing that we did not also see during the extended 2000 and 2007 top formations. Once persistently overvalued, overbought, overbullish conditions were followed by deteriorating earnings growth and a breakdown in market internals, the goal wasn’t to speculate on rebounds, but only to limit the amount of frustration one had to endure during the top formation — in anticipation of the more severe market losses that followed.

Denial and putting trust in Ivy League educated academics who are terminally wrong in their predictions, policies, and solutions is not a logical plan. It’s a recipe for disaster and another 50% haircut.

Based on the most historically reliable valuation measures, the S&P 500 would have to lose literally half of its value for prospective returns to rise to that level. A 50% market loss isn’t a worst-case scenario. Given current valuations, it’s the standard, run-of-the-mill outcome that investors should expect over the completion of this cycle.

As John Hussman points out, we are about to be transported back to the wonderful days of 1929. Time is growing short as the grains of sand in the hourglass run out.

Investors are now facing the second most extreme episode of equity market overvaluation in U.S. history (current valuations on similar measures already exceed those of 1929). The belief that zero interest rates offer no alternative but to accept risk in stocks is valid only if one believes that stocks cannot experience profoundly negative returns. We know precisely how similar valuation extremes have worked out for investors over the completion of the market cycle, and those outcomes have never been deferred indefinitely. The only question at present is how many grains are left in the hourglass.

Obama’s legacy of a stock market miracle will be preserved at all costs. This means the fed won’t lift off the easy money gas pedal until well into 2016. The pantywaists in the GOP won’t fight raising the debt ceiling, ensuring the Federal Government will continue the profligate spending, and finally the facebooks, yahoos, googles, NBC, ABC, CBS, CNN, FOX will continue to put the happy face on an otherwise shitty economy. Oh, and the most important, Citadel will be there at 2AM when everyone is asleep to buy a few $mil worth of S&P futures, just enough to kick all the algorithms into buy mode anytime the market is ready to fall off the cliff.

The longer an inevitable event is delayed, the more likely it becomes. That which is unsustainable will not be sustained.

The author imputes a lot of anthropomorphic emotional judgments on what is nothing but computer algorithms running as designed. Also the whole system might be characterized that way _ running to plan of its designers to their benefit. Move along nothing to see here.

@TC

This is PRECISELY why there will be a Great Default.

When one steps back and surveys the landscape in its entirety, it becomes glaringly apparent NOTHING will change until “they” (TPTB – Wall. St. and the Pols) run the entire show straight into the ground. They aren’t going to change a thing because they’re raking in money hand-over-fist and know someday, the show will end.

Meantime, it’s “every man for himself,” and screw those unlucky enough not to be on the inside. Period.

October 24, 1929: The start of the disaster

http://bit.ly/1k0OMcv

Almost everyone with a pension or retirement plan will be wiped out if the market crashes.

And, of course, it will be someone else’s fault with nothing at all their own fault for having their money in it in the first place.

So, if you’re putting money into the markets through your retirement account or mutual fund investment plans you might want to consider the downside at least as dillegently as you are hoping for the upside.

I find it amazing: The Founding Fathers made free speech our most important right. Yet, most people seem to ignore the facts that are spoken.

Absolutely at some point “they” will pull the plug and let the market crash. Dimon, Bernanke, Blankfein and Yellen all know when. Certain priveleged class politicians will get the memo too. Unfortunately for you and I, we’re not on the list.

Greetings,

I know that things are bad but after the can kicking and magic juggling I’ve seen over the last 7 years, I no longer trust any prediction. I agree that the money printing and zero interest will continue until our current worst president in history is out of office.

In the end, none of us really wants to see this get any worse because the final rabbit that these monsters can pull out of their hat is WAR. Frankly, I do not see how our special little snowflakes are going to protect us once things get difficult. I’m not sure we can win the next one.

U.S. consumer confidence retreats in October to 97.6

By Greg Robb

Published: Oct 27, 2015 10:01 a.m. ET

WASHINGTON (MarketWatch) — The Conference Board said Tuesday that consumer confidence in October fell to a reading of 97.6, down from a revised 102.6 in September. Economists polled by MarketWatch expected a 102.1 reading from the initial September reading of 103.0, which was the highest level since January.

Services sector gauge at lowest level since January: Markit

By Steve Goldstein

Published: Oct 27, 2015 9:49 a.m. ET

WASHINGTON (MarketWatch) — Service sector output growth fell to a nine-month low in October, according to the Markit Flash U.S. services purchasing managers index released Tuesday. The index fell to 54.4 in October from 55.1 in September, which means it’s still above the 50 mark indicating growth. Markit attributed the slowdown to slowing new business growth and more cautious spending patterns.

Why Did The Market Surge In October? Here Is The U.S. Treasury’s Explanation

Submitted by Tyler Durden on 10/27/2015 09:42 -0400

We have heard many explanations for the torrid market rally since last September, ranging from the rational – short squeeze – to the generic – “bad news is good news under central planning” to the deranged – “ignore the news, the U.S. economy is actually stronger and China is recovering.” And now, courtesy of the U.S. Treasury’s Office of Financial Research, here is the official explanation from the government itself.

Shift in Monetary Policy Expectations Supports Risk Assets

Risk assets such as equities, corporate bonds, and emerging market currencies appreciated notably in October, recovering somewhat from the sharp losses in recent months. The catalyst for the rally appeared to be weaker U.S. labor market data, which delayed the expected start of monetary tightening by the Federal Reserve. Extraordinarily accommodative monetary policy has supported risk asset prices since the global financial crisis and this month’s market reaction suggests that these prices may still be contingent on accommodative policy. It remains to be seen whether current U.S. asset price ranges can be sustained once the Federal Reserve begins to raise interest rates, broadly expected to occur between December and June.

Global risk assets advanced on expectations for continued or additional accommodative policy among central banks in advanced economies

U.S. equities have rebounded strongly in October, although fundamentals remain weak. The S&P 500 index has rallied since the start of October and is up 10 percent from its August low (Figure 3). As with the broader rally in risk assets, this rebound has been attributed to the delay in an expected Federal Reserve rate hike. The rebound has occurred in the face of weaker U.S. equity fundamentals, such as the slowdown in global growth, negative effects of a stronger U.S. dollar on earnings, and continued weakness in the energy sector. For the third quarter, analysts continue to expect negative revenues and earnings for energy stocks, with modestly positive growth for non-energy S&P 500 stocks. Emerging market assets have rebounded, following months of deterioration.

Emerging market currencies have rallied since the start of October (Figure 4), led by a 5 percent to 8 percent appreciation in commodity-sensitive currencies. Emerging market equities and credit have alsoadvanced. Despite the rebound in emerging market assets, some of the recent gains also represent a technical recovery driven by covering of short positions and moderation of excessively bearish sentiment. Overall, emerging market economic fundamentals remain very weak. In its latest World Economic Outlook, the International Monetary Fund (IMF) downgraded its forecast for emerging market growth.

In summary: central banks and a “covering of short positions” better known as the fundamentals of the New Paranormal.

Don’t like it? Then the following from BofA will make your blood boil:

Global weakness is OK for US markets as long as the Fed refrains from hiking rates, and vice versa it would be OK from a markets perspective for the Fed to begin hiking rates if global weakness diminishes (but not OK if US data rebounds in isolation). Hence risk assets have rallied for three weeks prompted by the turn to weaker US data that began with the weak September jobs report, as the Fed’s rate decision is understood to be completely data dependent. However, clearly for the market rally to be sustained it would be helpful if next week’s FOMC statement tilted dovish by acknowledging this turn to weaker US data.

It would be easier if they just asked the Fed to admit it will only hike if the S&P500 is at or above 2100, the VIX is below 14, and it can only do so on an uptick.

But does this not prove that it is fakery and/or the money driving the market is not the money of the muppets as they would prosper and increase their wealth. Why should fakery matter? Can you show me where the muppet’s pensions and retirement plans have increased greatly in value as the Dow closing number has gotten higher and higher?

The big flush down the Wall Street toilet bowl won’t come til Hitlery takes the WH in the next selection/election. She will say she inherited the mess and no one had seen it coming. Same con different day………..same as it ever was.

The YoY EPS?

After the 2008 blow out (but actually, long before) there was NO WAY companies were going to have increased gains (YoY) on the basis on increased consumer spending re: credit.

Its been smoke-mirrors ever since: layoffs, FX and accounting gimmicks, stock buybacks & stock manipulation, etc. All measures that offer diminishing-returns which will run their course sooner rather than later. While it’s propelled the market to new highs, just like a plane executing a neat straight up trajectory, when it reaches it’s apex, it’s gonna stall…violently.

Meanwhile the Lumpen are lead to believe “All is well…go shopping, spend and be happy!”

What a pathetic crock of crap we’ve been fed these last 7-8 years. Anyone who hasn’t made the effort to see through it is in for one rude awakening.

STAND BACK

Take a look at the “BIG” picture. Global Shipping:

Baltic Dry Index (BDI)

From it’s high of 4,507 November 20, 2009 Now sitting at 759

China Containerized Freight Index (CCFI)

The index fell below 800 for the first time in it’s history in early July this year.

The index currently sits at 752.21 The worst level ever!

Shanghai Containerized freight Index (SCFI)

Down 52% from February this year and down 46% from it’s inception in 2009

Harpex Index

From a high of 1,483 in 2005 Now sitting at 370

Global shipping has collapsed. If you look deeper into rail car loadings, the DOW transports, diesel fuel usage, bunker fuel demand, etc. You will see a very grim picture indeed.

There was NO RECOVERY for Main Street. The past 7 years have seen nothing but a deepening recession, that is now rolling into a full blown depression.

My father lost his life savings in a trick insider deal. So Stocks were always a casino rigged against everyone but the extremely wealthy…to me.

I hear people say “Banks don’t pay interest…don’t give them money to hold your money.”

So what’s wrong with a savings account in a credit union? Your money helps little people in your town have cars to go to work, repair their house, etc.

Some even have stocks AND a mortgage…what sense does that make? Do they figure the taxes on selling stock for domestic needs?

Isn’t it worth a little loss to have actual money you can use for tires and repairs without a credit card?

Gold is dead money…how can you let your money just lay there. Money is manure…it’s meant to circulate. But not on Wall Street…there’s a big pin ahead for that bubble.

Another great, truthful, piece Admin. And congrats on reaching your $10K goal!

Thanks to everyone who generously helped in reaching the goal.

We raised $12K last year. Still two months left in the year. Let’s obliterate that mark. I await the tsunami of money pouring in.