Whether you think there has been a housing “recovery” or not is a matter of perspective. Sales are indeed up 117% since the 2010 low, but that low was literally the worst level in the history of this data (since 1963) as a percentage of population growth. It was the Great Depression of Housing, the only possible result of the greatest housing bubble since the 1920s, if not in history. While sales have rebounded since that low, the current sales rate has barely recovered to the levels seen at the recession lows of 1991 and 1982. This rebound is little more than a dead cat bounce after 6 years of recovery, and now it may be faltering.

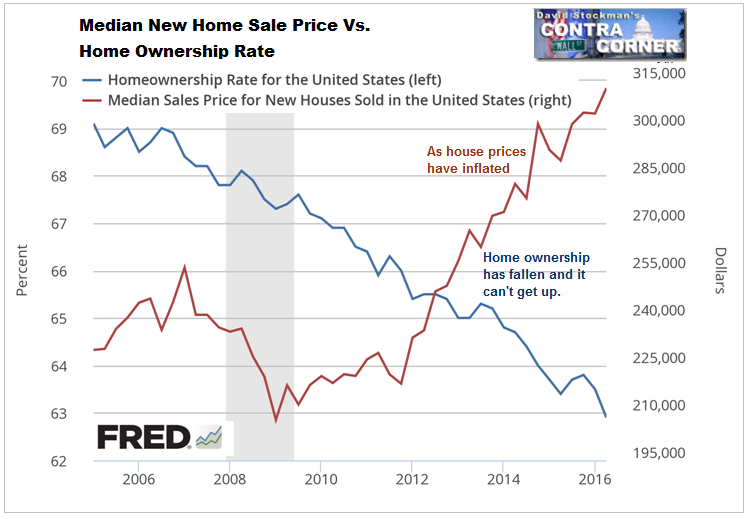

Mainstream economists give the Fed credit for stimulating this “recovery.” But, in fact the Fed has created a Catch 22 with no way out. The only thing the Fed has stimulated is house price inflation while destroying interest income on savings for millions of ordinary Americans, especially former middle class retirees. With mortgage rates pushed down to all time lows, house prices have consequently inflated at a rate that offsets the buyer’s savings in the interest component of the mortgage. Meanwhile American savers have lost not only massive purchasing power, but also have been forced to consume principal. The Fed has not stimulated sales but it has succeeded in transferring wealth away from those who can least afford it to those who least deserve it.

Had mortgage rates stopped falling at higher levels, house price inflation would have been stunted. More of a buyer’s mortgage payment would have been apportioned toward the higher interest component of the payment and less toward inflating the purchase price.

But the Fed got the result it intended. It wanted to inflate prices to save the banks from their stupidity and criminality. Decisions were made at the highest levels of the Fed and the Federal Government to not only let the banks off the hook, but to rescue them. The only way to do that was to forego prosecution of massive criminal wrongdoing, and to engineer price inflation, so that the criminal perpetrators of the fraud that drove the Great Bubble would be free to re-offend.

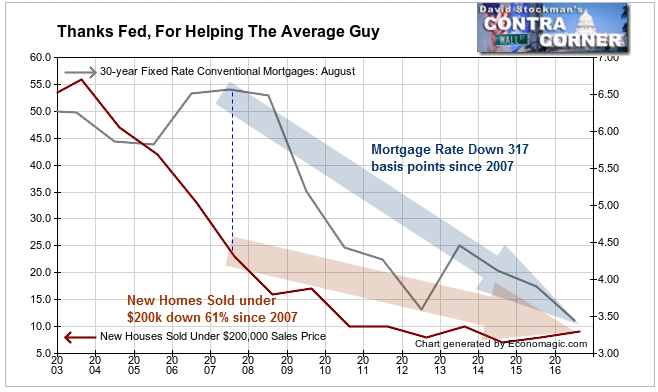

The Fed’s claim of trying to help the typical consumer is hogwash. The benefits of the low interest rate policy have flowed only to the upper income strata. In our monthly updates of our “Thanks Fed For Helping the Average Guy” we see that the chance of the “average guy” to buy a new home remains virtually nil. Not only has there been no recovery in homes priced under $200,000, sales in that price range have essentially disappeared in spite of the world’s major central banks pushing mortgage rates down. Builders no longer have any interest in producing product in that price range because demand has weakened so much at that level. People at the reported median US household income simply can’t afford to buy houses regardless of the fact that they may be borderline qualified.

Prior to the housing crash, most new homes sold were in the under $200,000 price range.Since 2007, mortgage rates have been cut nearly in half. Yet production and sales of homes in the under $200,000 range have continued falling, now down 61% since 2007.

Builders have shifted their efforts to the $200-$400k range, where they still have some margin, and can move enough inventory to earn a profit. The higher the price of the home, the more profitable it is for a builder. Unfortunately, homes priced above $230,000 are beyond the reach of households earning the reported median household income of $56,000, a figure which itself we believe is overstated. Because of central bank driven housing inflation, and suppression of household income growth (also partly attributable to ZIRP) home ownership is increasingly out of reach for an ever growing percentage of US households

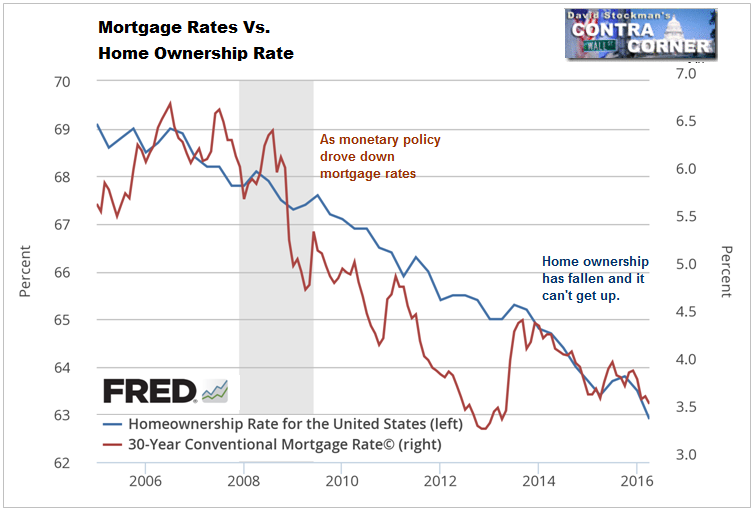

If monetary policy were helping the housing market, the rate of homeownership should be at least stable. Instead, as mortgage rates have been consistently suppressed since 2007, homeownership has fallen concurrently.

The problem is that as the Fed and its cohort central banks have been busy pushing down long term interest rates, that has pushed house prices up so fast that there has been no increase in affordability.

During and after the 2007-2010 crash, homeownership fell due to the massive increase in foreclosures. The foreclosure crisis began to recede in 2012. Since then the drop in the homeownership rate has not been because of people losing their homes, it has been because fewer people can afford to purchase, even in spite of the world’s central banks subsidizing buyers with absurdly low interest rates. As we’ve shown, the subsidy is self defeating. It does not benefit buyers.

Meanwhile, the only US regions that have seen any rebound at all in new home sales have been the West and Southwest. The Northeast and the Midwest remain absolutely dead in the water. In the Northeast, sales are down 60% relative to the 1991 recession low. Let that sink in for a moment–not versus the bubble peak, but since the low of a recession 25 years ago, when the US population was 25% less than today. Sales in the Midwest are down 12.5% since the 1991 low.

Lest you think that the West is going great guns, its sales are only up 8% since 1991. That is in spite of US population growing by 25% in those 25 years. The West has grown even faster– 45% since 1991.

The issue in the West is an ever growing affordability crisis. It too is largely driven by the central bank interest rate subsidy of the past 8 years. It has reignited a massive housing bubble throughout California, the nation’s largest housing market. Tiny 3 bedroom bungalows in the suburbs of San Francisco now go for more than a million dollars. Absurd.

Finally, the South has seen a surge of 35% in new home sales since 1991. But that’s is less than half the population growth of 72%. A long term demographic-geographic shift drives growth in the South. This trend has gone on for decades. Fed policy has nothing to do with it, other than to inflate prices.

Notably, even after recovering from the 2007-09 crash, all regions remain well below the levels of the 2001 recession low.

The argument that the Fed policy of ZIRP and suppression of long term interest rates through QE bond purchases has stimulated housing simply does not hold water. It has stimulated house price inflation, and that price inflation has fully offset the cost-reduction effect of the interest subsidy to home borrowers. At the same time Fed policy has cost millions of savers trillions in interest income that could have boosted not only consumption, but also cash available for down payments on home purchases. The idea that low interest rates stimulate the economy by stimulating housing is The Big Lie.

The Fed has created a situation where the housing industry is so dependant on the massive interest rate subsidy that any uptick in rates is likely to cause a cataclysm. The Fed and its cohorts are responsible for this mess. They have left themselves, and us, with no way out.

Lee Adler first reported in 2002 that Fed actions were driving US stock prices. He has tracked and reported on that relationship for his subscribers ever since. Try Lee’s groundbreaking reports on the Fed and the forces that drive Macro Liquidity for 3 months risk free, with a full money back guarantee.

thank you for posting this here

i have been following Lee’s work since 2000 over at capitalstool.com.

He has been better than anybody following the twists and turns in the market created by the fed.

i would urge everybody to read his writings.

http://www.zerohedge.com/news/2016-09-27/once-bustling-greenwich-turns-frugal-home-contracts-are-down-80-and-trophy-cars-pile

I was part of a family owned custom home builer company. Before 2008 we sold anywhere from 12 to 16 homes a year in the $250,000 to $650,000 Range. After 2008 we built around 1 home a year. There has been NO recovery here since 2008, Ohio.

I tell you, lovey an I can’t wait for the next planned bubble pop.

we will be buying all those foreclosed houses from the bank for pennies on the dollar.

I can’t tell you how much the fed is actually doing to help us here at the top.

Not only is there inflation in the price of a house, but property taxes are also sky high on these inflated homes. Even when house prices fall, you are stuck with the huge tax. Just another way the government screws us.

Don’t forget house insurance…Even when house prices fall, you are stuck with home insurance rates that are up over 100% – since the crisis…

While I agree with almost all of your analysis and data, one point is overlooked. That is the house flippers. In Florida for example the flippers at out buying everything available between 90,000 and 150,000 that they then revamp with cheap facial crap, and resell for upwards of 200,000 or more. These homes come from the massive Fed buyout 2009-2012 of the foreclosures from the big banks where they paid full mortgage price to the banks, then let them go a little bit at a time to desperate retirees ( if the home is a real wreck) and flippers. The flippers usually get there first with anything decent because most are sold at auction. This is just another way the FED has manipulated the market to cover the losses of big banks, and to fool the housing market to the detriment of the workers and savers of this country. Sad but true!

That is an excellent point also Big D–house flippers in my area disgust me. I’ve seen neighbor’s homes gobbled up, refurbished and then jacked up 150k.

Another factor which was brushed upon in the article are the millennials. They are strapped with exorbitant college debt and also marrying much later.

Young couples-married and ready to begin families are at dropping rates in our society. Throw in student loans, credit card debt and the enormous expense of raising even 1 child with both parents working ( as well as the ZIRP which inhibits saving for down payments mentioned by the author) and it is a perfect formula to create a stagnant home ownership rate……

Young, old, middle class–we are all getting screwed by these .01% crooks and their failed or intentional financial mechanizations.

The bankers will buy up everything offered or vulnerable

and buy it very cheap, thus owning most of the country.

Then they’ll sell it for big money to the internationalists,

and our elderly will barely make it, or be starved out.

Basterds. India and China will take over.

So where are people living? More people in each house? If population is rising faster than home building, as the article suggests, that must be the answer. I have not seen stats on that, but a lot of kids are living at home, so it seems reasonable it is the case.

Re prices – prices can only go up if there is demand at the higher price. Average wage earners will be unable to come up with the down payments. But a great many higher income families will – or prices would not be skyrocketing.

The whining about flippers is pathetic. Go buy a house, renovate it, flip it yourselves, and quit bitching about those with the initiative to do it, and who assume the risk.

This was said by a man much smarter than yourself.

“I believe that banking institutions are more dangerous to our liberties than standing armies,” Jefferson wrote. ” If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.”

LLPOH

Do you have kids? Maybe some grandchildren? Does this not matter?

Maybe you’re an internationalist?

Wip – I have no idea what you are talking about.

Anyway, Jefferson’s IQ was somewhere between 138 and 152, depending on who you ask. If that is a reliable gap, I measure up just fine. Go figure.

Does what not matter? High prices? I have said it a million times – the US middle class is living far beyond its means, and its means need to drop substantially. And it will. Bubbles come, bubbles go.

Prior to recent decades, home ownership rates were always around 45 – 50%. I suspect this will be the rate again as the dust settles.

What the fuck is an internationalist? I am a realist. Americans live beyond their means, have every Igadget known to man, new cars, debt out the wazoo, and bleat because they cannot afford a home? Fuck me dead.

By some measures, housing is very affordable at the moment, because interest rates are so low. A lower repayment as a percentage of income now exists than is the norm.

The problem is that people cannot come up with the deposit.

Maybe if they understood the concept of saving, they could scrape together a proper deposit.

But no, they want it now. They do not want to save for several years to get the deposit together. Dammit – I want the house now!

Say the house is $400k, and you need 20% = $80k. Save the fucking money up and quit crying. Give up the booze, the eating out, the new cars, etc.

One of my kids has saved $20k so far THIS YEAR, albeit on a salary well above the average, but not extreme being new to the job market. So in a few years, the money will be there for a nice deposit.

The people getting screwed by the low rates are the retirees. That is where the screwing is happening.

Given that the average joe has zero savings, whether the house is $250k or $500k makes no difference – they don’t have the $50k deposit, much less the $100k.

If they can’t reliably save up $80k for a deposit, how will they be able to reliably pay the mortgage, taxes, insurance and upkeep?

Llpoh, are all of your chirrens with you at your doomstead or are they still here in the land of diminishing returns? Did your OZ citizenship deal extend to the kids? I know one of them was playing BB but got injured.

I built my own house, cut price way down that way, 2400 square feet and appraised at over 150,000. Another problem I see is people are not allowed to do it this way in a lot of places due to construction regulations, that needs to change.

Good God LLPOH, you said you were smaat.

“…because interest rates are so low.”

What do you think made homes so expensive?

Surprise the cycle of boom bust since 1913 is alive but on life support . The massive haves , bought everything including government . Naturally now this will continue till there is nothing left and all the haves will discover they over played this hand and there is no way to predict to what degree of catastrophic end will be but it will be bad , “real bad”

In interesting comment I found in the comment section of a video interview with Case shiller….

Why Long Term Low Interest Rates will lead to an uncontrollable Deflationary Asset Spiral …

Low interest rates encourage a hunt for yield amongst investors. They also encourage corporations, both large and small, to take advantage of this anomalous situation. It is anomalous because never before in history have lenders essentially paid borrowers to take their money. As a result, there is significant growth in global debt both at the public and private level. Under normal conditions, this explosion in lending would lead to a tightening of the supply of funds available, leading to increasing interest rates. Money is as much a commodity as gold or silver.

Instead, Central Banks have been maintaining and expanding the supply of funds to stimulate growth in the global economy. Interest rates are a function of supply and demand. What is interesting about Central Bank intervention is that it is totally misplaced. As this article will show, the natural global economic system is pushing back in an equal and opposite way, nullifying the Central Banks efforts. Economists have been puzzled by the slow growth in the economy. Yet the reason for the slow growth is obvious as this article will explain.

Much of our economic system is based on workers saving during their working lives and then receiving their invested savings back over their retirement years. Much of these savings are put into real estate which makes up another pillar of the financial system. Another significant part of our economic system is savings funds to provide for adverse or catastrophic events, otherwise known as insurance. Demographics globally are leading to a growing aging and retiring population in Asia, Europe and the United States, particularly amongst the Developed Nations and China, where the demand for the return of funds in the form of retirement income is expanding rapidly. These demographics will remain elevated for the next twenty years.

These retirees have been hoping to receive a reasonable income from savings accumulated during their their working years and from the institutions that have been managing their savings. As a result of the sustained low interest rates, those retirees and those institutions are discovering that the income from those savings is not sufficient to last through the remainder of the retirees’s lives or to meet the returns that had been expected. Worse, medical technology has advanced at such a pace over the passed 40 years that the retirees are now going to live 10 to 20 years longer than they had expected. Some economists and commentators have argued that the retiree will just go back to work to replace the lost income. Unfortunately the system favors younger employees as they are less costly. In addition, the mechanization of the workplace has eliminated many of the jobs the retiree was suited for and new skills are required to sustain the previously held income.

Faced with this situation, the retiree and investment institution is forced to replace the income that was expected by the sale of assets. If one thinks of these actions as a seesaw, interest rates have been pushed down to an extreme eliminating interest income. Assets have been pushed up to an extreme (as a result of the very low interest rates) creating new asset wealth.

Now (both insurance and pension) institutions are being forced to sell the new asset wealth gain to replace the loss of income and fund pension and annuity payout requirements. Essentially, the equilibrium in the system has been pushed to two extremes that are now in the process of self-correction back to stasis.

The problem for the global economy is that this growing and continual need to sell assets is and will have a continuing and equally negative effect on the ability of the economy to grow. This growing need to replace income by asset sales may and mostly likely will lead to a stampede to the exit. As more and more people realize that low interest rates may be around for a long time, they will see the advantage in being first to raise cash through the sale of assets because being late to the party would mean they get less for their assets. If any one is in any doubt that this process has already begun, they should investigate the recent behavior of large pension and retirement institutions – although those institutions would be loathe to admit to their behavior for fear of tipping off their competition. There is already a 30% spread between bid and offer for high end real estate in many parts of the US.

Large numbers of pension and retirement institutions selling assets, in concert, to replace income lost from low interest rates can and most likely will lead to a collapse in asset prices globally, as bid prices will disappear, as the market senses the growing crowd of sellers. This process cannot be stopped by Central Banks lowering interest rates still further because those Central Banks have already lowered rates to close to zero, if not in some cases, to negative rates. Central Banks are in a “Catch-22”. If they normalize interest rates, they will crash asset prices and if they keep interest rates low, they will crash asset prices.

The Central Banks stated solution is to raise rates slowly. This is equally dangerous because it is the maintenance of low interest rates that is putting a brake on the global economy and accelerating the stampede towards the sale of assets.

Politically Central Banks will not change their policy because it is better for them to excuse themselves by saying, ‘We did everything we could to keep interest rates low to maintain asset prices’ ,where in reality, it was the low interest rates that crashed the system.

The solution to the problem is to accept that asset prices are going to crash and to raise rates as rapidly as possible to normalize the economy. That is not going to happen. As a result, we will have to sustain a long period of asset deflation which, as its momentum grows, will end in a violent crash. The longer interest remain at current low levels, the more violent the crash.

One only has to worry how this will impact the banks and financial institutions that have been weakened by low interest rates when they find their loan-to-value ratios get crushed by this phenomenon and governments are surprised to find that they will have to revisit their policy of too big to fail.

There is a clear message here to Central Banks and to the Bernanke experiment. We understand that the initial intent was to protect individuals from a depression. Carrying on the experiment is sadly leading to a crushing deflationary spiral and an even worse outcome. Allow natural forces come back into play before more damage is done. Raise interest rates to a normalized (3%) level at a more rapid pace. Slow and measured does not head-off the coming storm.

THIS SITUATION WILL RESOLVE ITSELF BY A VERY SUDDEN, UNEXPECTED AND RAPID BACK-UP IN LONG TERM RATES.

What will cause a back-up in long term rates ?

1. Constriction of movement of labor – the Mexico Wall, migration restrictions in Europe etc.

2. Low unemployment. Low unemployment combined with low labor mobility will lead to rising unit labor costs.

3. Declining earnings caused by the rise in labor costs in a market with high P/Es

4. Rising import costs – see increased shipping costs … https://www.quandl.com/data/LLOYDS/BDI-Baltic-Dry-Index

LLOYDS | Baltic Dry Index

http://www.quandl.com

Data Source: Lloyd’s List: Dataset Name: Baltic Dry Index: Updated: about 12 hours ago, on 22 Sep 2016: Validate: http://www.lloydslist.com/ll/sector/markets/market …

Shipping costs are rising vertically.

5. Sales of U.S. Treasuries by China, Japan and Saudi Arabia at an accelerating rate as they seek to prop up their economies

This combination will lead to skyrocketing inflation and rapidly falling earnings. This combination will happen suddenly and unexpectedly. It is easy to figure out what happens next.

Nine countries—Austria, Britain, Denmark, France, Germany, Italy, Poland, Portugal and Spain—have public-sector pension liabilities of more than 300% of GDP, according to Citigroup.

Further reading : http://www.telegraph.co.uk/business/2016/09/21/un-fears-third-leg-of-the-global-financial-crisis-with-epic-debt/