“Over the last thirty years, the United States has been taken over by an amoral financial oligarchy, and the American dream of opportunity, education, and upward mobility is now largely confined to the top few percent of the population. Federal policy is increasingly dictated by the wealthy, by the financial sector, and by powerful (though sometimes badly mismanaged) industries such as telecommunications, health care, automobiles, and energy. These policies are implemented and praised by these groups’ willing servants, namely the increasingly bought-and-paid-for leadership of America’s political parties, academia, and lobbying industry.” – Charles Ferguson – Predator Nation

The Federal Reserve released its Survey of Consumer Finances last week. It’s a fact filled 80 page report they issue every three years to provide a financial snapshot of American households. As you can see from the chart above, the impact of the worldwide financial collapse has been catastrophic to most of the households in the U.S. A 39% decline in median net worth over a three year time frame is almost incomprehensible. Even worse, the decline has surely continued for the average American household through 2012 as home prices have continued to fall. Median family income plunged by 7.7% over a three year time frame and has not recovered since the collection of this data 18 months ago. Even more shocking is the fact that median household income was $48,900 in 2001. Families are making 6.3% less today than they were a decade ago. These figures are adjusted for inflation using the BLS massaged CPI figures. Anyone not under the influence of psychotic drugs or engaged as a paid shill for the financial oligarchy knows that inflation is purposely under reported in order to keep the masses sedated and pacified. The real decline in median household income is in excess of 20% since 2001.

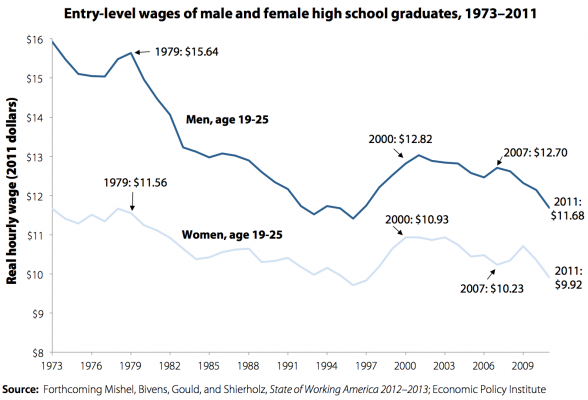

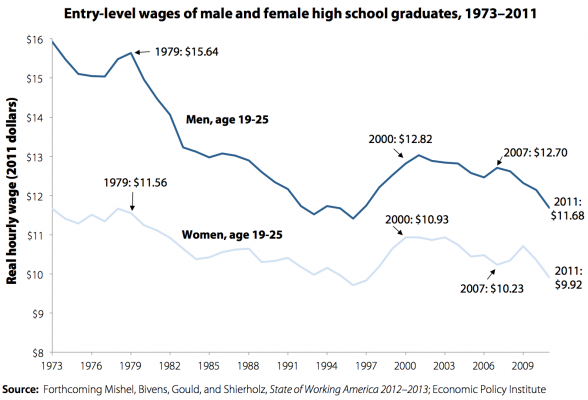

The destruction of the blue collar jobs has been underway since the early 1970s. And the relentless decline in real blue collar wages has followed a bumpy downward path for decades. Sadly, the average person doesn’t understand the insidious destruction caused to their lives by the Federal Reserve generated inflation, as they actually believe their wages today are higher than they were in 1973. The reality is the oligarchy has used foreign wage differentials and the perceived benefits of globalization to ship manufacturing and now service jobs to Asia while using their captured mainstream media to convince the average American that this has been beneficial to their lives. Using one of their 15 credit cards to buy cheap foreign goods made by people who took their jobs was never so easy. I wonder if the benefits of being able to buy cheap Chinese electronics, toxic dog food, and slave labor produced igadgets outweighed the $2.3 trillion increase in consumer debt, 27% decline in real wages, 7 million manufacturing jobs lost since the mid-1970s, 46 million people on food stamps, $15 trillion increase in the National Debt since 1978, and a gutted decaying industrial base.

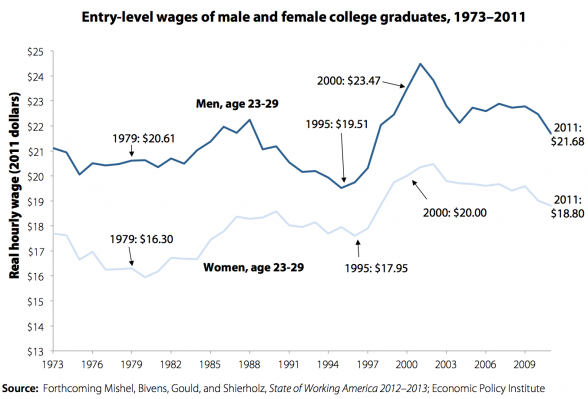

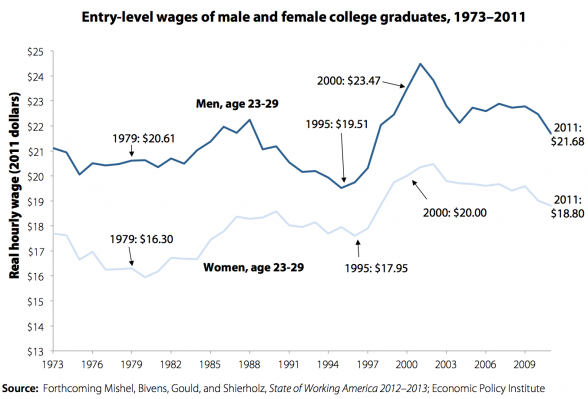

Not only have the oligarchs gutted our industrial base, resulting in enormous job losses among middle aged industrial workers, but they are now in the process of impoverishing the youth of this country by sucking them into crushing college debt with the false promise of decent paying jobs when they graduate with a degree in feminist studies from the University of Phoenix. The fabricated mantra that a college education guarantees a good paying job and a better future is not borne out by the facts. There are over 4,800 institutions of higher learning in this country, with only about 50 considered elite. There are another few hundred top notch institutions, with a few thousand mediocre schools and hundreds of for profit on-line diploma mills exploiting the easy Federal government debt to lure millions into their profit scheme of bilking unemployed naïve middle aged dupes and eventually the American taxpayer. The average student loan debt per student is $29,000. Student loan debt outstanding has risen from $200 billion in 2000 to over $1 trillion today. The Federal Government is blowing another bubble. They are the issuer, regulator and guarantor of these loans. They are making the loans with teaser rates to the ultimate in subprime borrowers – students without jobs going for worthless degrees at mediocre schools. The taxpayer is on the hook for the billions in loses that will surely follow. The payoff for this quadrupling of debt has been an 8% real decline in wages for college graduates since 2000. The monetary policies of the Federal Reserve and bipartisan fiscal policies of our government have led to this dreadful job market for the middle class.

The mainstream media dutifully reported a few key highlights from the Federal Reserve report and moved onto more important issues like Snooki’s pregnancy and the octomom’s new porno gig. We certainly couldn’t expect business journalists at Bloomberg, CNBC, NYT, or CNN to actually analyze the data, produce an intelligent dialogue of the causes, and reach a conclusion that the affluent and influential on Wall Street and in Washington DC caused the average family in this country to endure tremendous hardship while the oligarchy plundered and pillaged the countryside, stuffing their pockets with ill-gotten gains. Each of the ideological camps within the oligarchy trot out the usual suspects to blame the other ideological camp, while doing nothing to change the existing paradigm. Krugman and Carville are assigned the task of blaming Republican policies and dogma for the demise of the middle class. Obama and his minions already had their press release prepared, blaming George Bush and claiming the median family has made tremendous strides since he assumed command in2009. Mitt Romney (worth $250 million), whose pocket change exceeds the annual median household income of $45,800, feels the pain of the average American family and proposes a tax decrease for billionaires and less overbearing regulation on the honorable Wall Street banks in order to help the average family. It’s nothing but Kabuki Theater as the characters play their assigned parts in this elaborate display. Gary Wills cuts right to the chase:

“Yet while the rest of the populace was suffering, the rich just got richer. In 2009 and 2010, years in which millions were unable to find work, the top one percent reaped 93% of the ‘recovery’ income, and corporations are making more than they ever did. And the Republicans can still propose even further cuts in the taxes of ‘job creators’ whose only job creation has been for their own lawyers and lobbyists.”

What you will not receive from the corporate mouthpieces in the mainstream media is an explanation of where the money went, who stole it and why it happened. The theme from the media is the loss in net worth and decade long decline in household income was unavoidable and due to circumstances beyond anyone’s control. This is a false storyline perpetrated by those who have stolen your money. It’s been a bipartisan screw job and it was initiated by Clinton, Rubin, Gramm and Leach, who deregulated the banking system in 1999 by repealing the Glass-Steagall Act, but made it clear the Greenspan Put would always be in place to protect the banks from their own recklessness, greed and hubris. As a result, Wall Street could go ahead and take irresponsible financial system destroying risks in pursuit of vast riches, knowing they could count on the unlimited checkbook of Uncle Sam if things went south, and that’s exactly what happened. Heads they won, tails you lost. It’s good to own the politicians, regulators, and media.

Dude, Where’s My Net Worth?

“Sometime around the year 2010, Xers will hit a hangover mood like that of the Lost in the early 1930s and the Liberty in the late 1760s: a feeling of personal exhaustion mixed with a new public seriousness. The members of this forty- and fiftyish generation will fan out across an unusually wide distribution of personal outcomes, reminiscent of a night at the bingo table. A few will be wildly successful, others totally ruined, and the largest number will have lost a little ground since the days of Boomer midlife.” – Strauss & Howe – Generations – 1991

Neil Howe and Bill Strauss wrote their first generational theory book six years prior to their epic Fourth Turning prophecy. It appears they nailed it. Generation X households saw their net worth crushed, with a 54% loss in three years. The Baby Boomer households also took a beating in this banker engineered financial collapse. The Silent generation has survived this downturn relatively unscathed. Most of the Silents traded down from their primary residence at or near the top of the housing boom. As Neil Howe points out:

“Most sold or annuitized their financial assets at a much better moment in the history of the Dow. Even if they didn’t, they are more likely than Boomers or Xers to be getting retirement checks from defined-benefit corporate or government plans that are unaffected by the market.”

The Millenials and late Xers did not lose much because they didn’t have much to lose. Most did not own a house or stocks. As the economy continues to deteriorate the generational tension builds. The Silents and Boomers, who vote in large numbers, have not and will not vote for anyone who attempts to reform our entitlement system and make it economically viable over the long-term for young people just entering the job market.

The false storyline about the 2007 through 2010 being an aberration in the long term path to prosperity for the average American family is refuted by the following chart.

This chart paints a long-term picture of generational inequality that has been going on over the last three decades. Over three decades the Silent generation has seen their median real net worth increase by 133%, while GenX has seen their median real net worth decrease by 55% compared to the same age cohort in 1983. Only those 55 and over have seen a real improvement in their net worth over the last 27 years. Considering this period encompassed a seventeen year bull market and the GDP grew from $3.5 trillion to $15.7 trillion, a 450% increase, a few bucks should have trickled down to the average household. Even on an inflation adjusted basis, GDP has risen 125% since 1983. Evidently the economic policies supported by both parties across decades have not floated all boats – just the yachts. Age is only part of the equation. Class is the other piece. There is a class war being waged and the Buffett, Dimon, Blankfein, Romney, Clinton, Koch and the rest of the ultra-wealthy oligarchs are winning. We are now in the midst of a Fourth Turning and the corrupt, dysfunctional, amoral social order will be swept away before the climax of this Crisis.

“Through the Third Turning and into the initial stages of the Fourth, the Silent will prosper, Boomers will cope with declining expectations, and Gen-Xers will get hammered. Throughout history, we have argued, inequality both by class and by age reaches its apogee entering the Crisis era. Indeed, part of the historical purpose of the Crisis is to tear down dysfunctional institutions, vacate positions of entitlement and privilege, rectify the inequality, and create a tabula rasa on which the rising generation can build something new.” – Neil Howe

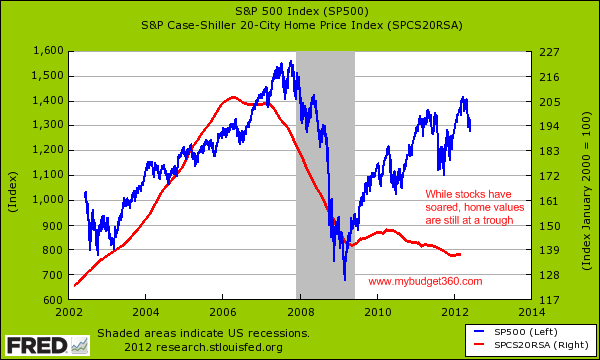

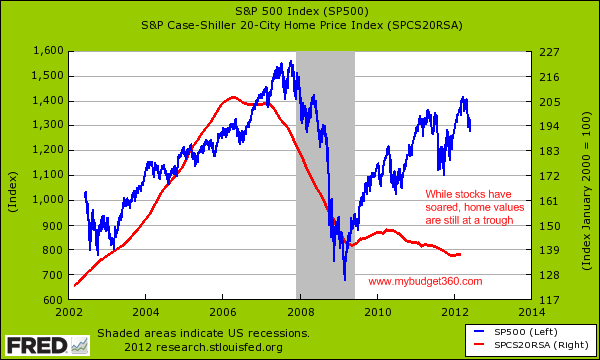

The reason for the epic collapse of middle class net worth is quite simple when viewed from a 10,000 foot elevation. The great descent in net worth was primarily due to the bursting of the Federal Reserve created real estate bubble. The Case Shiller Home Price Index plunged 28% between 2007 and 2010. The wealth destruction was concentrated among the working middle class because their homes accounted for the vast majority of their household net worth. For the wealthy, housing is a fraction of their vast net worth, while for the lowly poor; homeownership is now only a dream. Of course, between 2000 and 2007 anyone that could fog a mirror was encouraged by George Bush, Barney Frank, the National Association of Realtors, Alan Greenspan, and Wall Street shills to “own” a home. With home prices having fallen an additional 7% since 2010, the middle class has seen a further decline in their net worth. Meanwhile, Ben Bernanke’s ZIRP, QE1, QE2, Operation Twist, and the upcoming “Operation Screw the Middle Class Again” have succeeded in expanding the net worth of millionaires, billionaires and the bonuses of Wall Street bankers, while destroying the fragile finances of little old ladies and middle class risk adverse savers.

Once you dig into the details beneath the thin veneer of Bernaysian obfuscation, you realize the corporate mainstream media storyline of middle class decline has a veiled storyline of a powerful, connected 1%, enriched at the expense of the middle class.

In Part 2 of this three part series I will examine who stole your net worth and in Part 3 why they stole your net worth. Part 4 will require pitchforks, torches and a guillotine.