“You see in this world there’s two kinds of people, my friend. Those with loaded guns, and those who dig. You dig.” – Blondie – The Good, the Bad and the Ugly

“There are two kinds of people in the world, my friend. Those who have a rope around their neck and those who have the job of doing the cutting.” – Tuco – The Good, the Bad and the Ugly

The economic peril that we find ourselves confronted with, has been ninety-eight years in the making. The confluence of debt, demographics, delusion, and denial has left the country at the precipice of annihilation. There are two kinds of people in the world, those who control the money and those that are controlled by those who control the money. The last century has been marked by a methodical looting of the good (working middle class) by the bad (Federal Reserve & bankers) and supported by the ugly (Washington D.C. politicians). When historians pinpoint the year in which the Great American Empire began its downward spiral they will conclude that year to be 1913. In this dark year for the Republic, slimy politicians, at the behest of the biggest bankers in the country, created a private central bank that has since controlled the currency of the United States. This same Congress staked their claim as the most damaging group of politicians in US history by passing the personal income tax in the same year. These two acts unleashed the two headed monster of inflation and taxation on the American people.

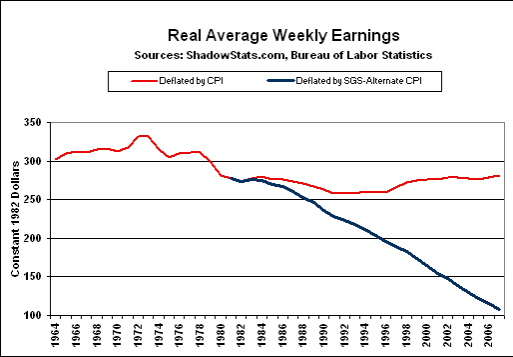

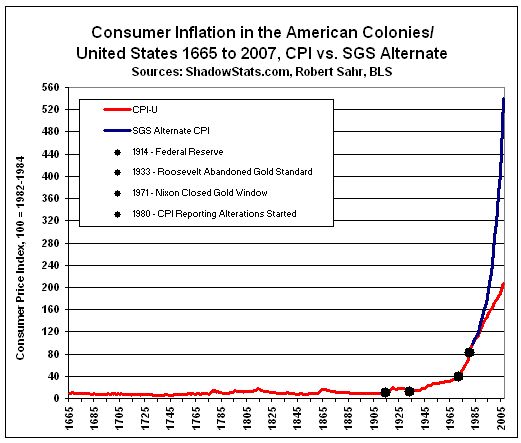

The government began keeping official track of inflation in 1913, the year the Federal Reserve was created. The CPI on January 1, 1914 was 10.0. The CPI on January 1, 2011 was 220.2. This means that a man’s suit that cost $10 in 1913 would cost $220 today, a 2,172% increase in ninety-eight years. This is a 95.6% loss in purchasing power of the dollar. The average American does not understand the insidious nature of central bank created inflation. It makes you think you are wealthier while you are driven into abject poverty. The Federal Reserve and politicians have pulled the wool over your eyes. The CPI was 30.9 in 1964. Today, it is 223.5. This means prices have risen 723% since 1964. The only problem is your wages have not risen at the same rate, even using the government manipulated CPI. Using a true CPI figure, average weekly earnings are 64% below what they were in 1964. This explains why a family of five could live well with one parent working in 1964, but even with both parents working and accumulating debt in prodigious amounts, the average family cannot live as well today.

It is not a coincidence that the percentage of the working age population employed bottomed in 1964 at 59%. The participation rate rose steadily for the next thirty six years, topping out in 2000 at 67.1%. The employment to population ratio also bottomed at 55% in 1964. It rose to 64.4% by 2000. It seems that future historians will mark the year 2000 as the peak of the American Empire. Apologists for the Federal Reserve and politicians who have steered this country since 1964 would argue the increase in the percentage of the population working was a positive development. Nothing could be further from the truth.

The American middle class was forced to send both parents into the workforce just to keep up with the ever declining real weekly earnings. The Federal Reserve created inflation has methodically destroyed the American dream for the middle class. As both parents had to go into the workforce, American children were left to fend for themselves or be raised by strangers in daycare centers. The pressure of trying to keep up with inflation strained families to the breaking point. The number of divorces per thousand marriages was 10 in the early 1960s. It more than doubled to 22.6 by 1980 and still resides at 17 today. There are many factors for the disintegration of the traditional family unit, but the financial strain on families to maintain a consistent standard of living due to relentless inflation has been a key factor.

From the founding of our country there had been constant conflict between corrupt bankers trying to control the currency of the nation to further their own enrichment at the expense of the people and a few courageous leaders willing to fight them. The bankers won the century old battle in 1913.

Den of Vipers & Thieves

“I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank…You are a den of vipers and thieves. I have determined to rout you out and, by the Eternal, I will rout you out.” – Andrew Jackson

The First Bank of the United States was created in 1791. Alexander Hamilton, the 1st Secretary of the Treasury, proposed this bank and convinced a hesitant President Washington to agree. John Adams and Thomas Jefferson were against the concept. It favored the moneyed classes of the North versus the agrarian South. The bank was given a 20 year charter and President James Madison let it expire in 1811. He understood the true nature of the banking interests:

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance”.

Madison had to renew the charter in 1816 as the War of 1812 resulted in large government debts. Politicians always turn to bankers when funding wars and programs to get them re-elected. As usual, once unshackled, the bankers immediately caused a boom through their loose monetary policies. The Bank created a fake boom by 1818 through its reckless lending, which encouraged speculation in land. This lending allowed almost anyone to borrow money and speculate in land, sometimes doubling or even tripling the prices of land (remind you of another time in recent history?). In the summer of 1818, the national bank managers realized the bank’s massive over-extension, and instituted a policy of contraction and the calling in of loans. This recalling of loans simultaneously curtailed land sales and slowed the U.S. production boom due to the recovery of Europe. The result was the Panic of 1819. There was a wave of bankruptcies, bank failures, and bank runs; prices dropped and wide-scale urban unemployment struck the country. By 1819 many Americans did not have enough money to pay off their property loans. Do you see any difference between 1816 – 1819 and 2005 – 2011? Central banks don’t eliminate financial panics, they cause them. Booms and busts have always existed. They have become more common and extreme since the unleashing of greedy corrupt central bankers in the U.S., going back two centuries.

Andrew “Old Hickory” Jackson became President in 1829 and proceeded to declare war on the Second National Bank. He was the first and only President in U.S. history to pay off the National Debt. He worked tirelessly to rescind the charter of the Second Bank of the United States. His reasons for abolishing the bank were:

- It concentrated the nation’s financial strength in a single institution.

- It exposed the government to control by foreign interests.

- It served mainly to make the rich richer.

- It exercised too much control over members of Congress.

- It favored northeastern states over southern and western states.

President Jackson believed that only Congress should be responsible for the issuance and control of the currency. Delegating that duty to powerful New York bankers was distasteful to him:

“If Congress has the right to issue paper money, it was given to them to be used … and not to be delegated to individuals or corporations”

President Jackson vetoed the extension of their bank charter in 1832. He redirected government tax revenue to other state banks. The Second Bank of the United States was left with little money and, in 1836, its charter expired and it turned into an ordinary bank. Five years later, the former Second Bank of the United States went bankrupt. Those who believe that a central bank is essential to economic progress need to examine the “free banking” period from 1837 to 1861. In the last five years of the Second Bank’s existence prices rose by 28%. Over the next 25 years, prices in the U.S. fell by 11%. We experienced the dreaded deflation. Did deflation destroy America? Not quite. GDP grew from $1.5 billion in 1836 to $4.6 billion in 1861. Deflation is only fatal to debtors. Inflation is the friend of lenders and the moneyed classes.

The American Civil War brought about the National Banking Act of 1863, which created a network of national banks. Politicians always need bankers to fight their wars and Abraham Lincoln was no different. By 1870 there were 1,638 national banks. This did not eliminate the booms and busts that punctuate human history, but the booms and busts were not scientifically created by a small cabal of bankers. With thousands of banks, those who made bad lending decisions failed. The economy withstood the periodic panics and continued to grow. The GDP of the U.S. grew from $7.6 billion in 1863 to $39 billion by 1913, with virtually no inflation. The Federal government ran surpluses or very small deficits during this entire time period. These facts refute the argument that a strong central bank was necessary to keep our economic system operating smoothly. It seems the Big Lie was not invented by the Nazis.

Creature from Jekyll Island – Control the Money, Control the Country

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. No longer a government by free opinion, no longer a government by conviction and vote of majority, but a government by the opinion and duress of a small group of dominant men.” – President Woodrow Wilson

Any impartial assessment of inflation throughout the history of the United States confirms that from the beginning of our nation through the War of 1812, the Mexican American War, the Civil War, the Spanish American War and the Industrial Revolution, the country experienced virtually no inflation as bankers were kept from controlling the U.S. currency and our legal tender was backed by gold. The creation of the Federal Reserve in 1913 and the closing of the gold window by Richard Nixon in 1971 unleashed a tsunami of inflation that continues to inundate our country today, killing the once prosperous middle class.

The Rothschilds of London understood that a fiat currency system would benefit the few (bankers & politicians) who understood it and the masses would be too ignorant to understand they were being screwed:

“Those few who can understand the system (check book money and credit) will either be so interested in its profits, or so dependent on it favors, that there will be little opposition from that class, while on the other hand, the great body of people mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear it burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

The House of Rothschild had been the dominant banking family in Europe for two centuries. They were known for making fortunes during Panics and War. Some claimed they would cause Panics in order to take advantage of those who panicked. American bankers learned the lesson well. The Panic of 1907 was the used as the reason for creating the Federal Reserve. A small cabal of powerful U.S. banking interests understood that if they could control the currency of the U.S., they could control the country, its politicians, and its people.

In 1906, Frank Vanderlip, Vice President of the Rockefeller owned National City Bank, convinced many of New York’s banking establishment they needed a banker-controlled central bank that could serve the nation’s financial system. Up to that time, the House of Morgan had filled that role. JP Morgan had initiated previous panics in order to initiate stronger control over the banking system. Morgan initiated the Panic of 1907 by circulating rumors the Knickerbocker Bank and Trust Co. of America was going broke. There was a run on the banks creating a financial crisis which began to solidify support for a central banking system. During this panic Paul Warburg, a Rothschild associate, wrote an essay called “A Plan for a Modified Central Bank” which called for a Central Bank in which 50% would be owned by the government and 50% by the nation’s banks.

In November 1910 a secret conference took place on Jekyll Island off the coast of Georgia. Those in attendance were: Paul Warburg, Bernard Baruch, Senator Nelson Aldrich, Colonel House, Frank Vanderlip, Benjamin Strong, Charles Norton, Jacob Schiff, and Henry Davison. From this meeting of the most powerful bankers and politicians in the country came the plan for a Central Bank. This conference was unknown until 1933. In 1935, Frank Vanderlip wrote in the Saturday Evening Post: “I do not feel it is any exaggeration to speak of our secret expedition to Jekyll Island as the occasion of the actual conception of what eventually became the Federal Reserve System.”

Behind the scenes these powerful men were formulating the plan for a Federal Reserve System. There was no outcry from the public to implement this plan. The public knew nothing of this. The Aldrich Plan was renamed the Federal Reserve Act and pushed forward by Paul Warburg and Colonel House. Warburg essentially wrote the Act and pressured Congressmen to see his way or lose the next election. Colonel House, who had socialist leanings, was the top advisor to President Wilson.

The Glass Bill (the House version of the final Federal Reserve Act) had passed the House on September 18, 1913 by 287 to 85. On December 19, 1913, the Senate passed their version by a vote of 54-34. More than forty important differences in the House and Senate versions remained to be settled, and the opponents of the bill in both houses of Congress were led to believe that many weeks would elapse before the Conference bill would be taken up. The Congressmen prepared to leave Washington for the annual Christmas recess, assured that the Conference bill would not be brought up until the following year. The creators of the bill then pulled the ultimate swindle on the American public. In a single day, they ironed out all forty of the disputed passages in the bill and quickly brought it to a vote. On Monday, December 22, 1913, the bill was passed by the House 282-60 and the Senate 43-23. This meant that the single most important piece of legislation ever passed by the Senate was missing the votes of 26 Senators because it was passed during the Christmas recess. President Wilson, at the urging of Bernard Baruch, signed the bill on December 23, 1913.

The Road to Hell is Paved by Central Bankers

“Banking was conceived in iniquity, and was born in sin. The Bankers own the Earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen, they will create enough deposits, to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But if you wish to remain the slaves of Bankers, and pay the cost of your own slavery, let them continue to create deposits.” – Sir Josiah Stamp (President of the Bank of England in the 1920’s, the second richest man in Britain)

The results speak for themselves. The Federal Reserve has been in existence for ninety eight years and over that time the U.S. Dollar has lost 95.6% of its purchasing power. In other terms, the bankers who have controlled our currency since 1913 have generated 2,172% of inflation in just under a century. In the prior one hundred years, when the country was growing by leaps and bounds, there was virtually no inflation. I’m not sure the average person fully understands this concept. To put it in layman’s terms, something that cost $4.40 in 1913 will cost you $100 today. A pair of boys’ school shoes cost 98 cents in 1913. You could purchase three loaves of bread for 10 cents. You could purchase six rolls of toilet paper for 26 cents. The truly frightening impact on the American middle class has happened since Richard Nixon closed the gold window in 1971 and allowed the Federal Reserve to print money unfettered by consequences and slimy politicians to make irresponsible unfulfilled promises as bribes for votes. This chart should worry even the most ignorant of the masses.

| Items | 1971 | 2010/11 | % Increase |

| Average Cost of new house | $28,000 | $273,000 | 975% |

| Median HH Income | $10,300 | $47,000 | 456% |

| Average Monthly Rent | $150 | $750 | 500% |

| Cost of a gallon of Gas | $0.40 | $3.80 | 950% |

| Average New Car Price | $3,430 | $29,200 | 851% |

| United States postage Stamp | $0.08 | $0.44 | 550% |

| Movie Ticket | $1.50 | $7.89 | 526% |

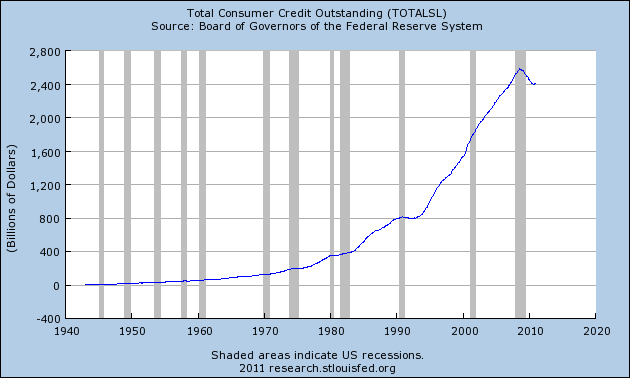

Even with the proliferation of two worker households since 1971, household income has not come close to keeping up with the costs of daily living. The average American’s standard of living has declined dramatically over the last forty years and they don’t even know it. Americans have become the slaves of bankers and pay the cost of their own slavery through inflation and debt. It is not a coincidence that consumer debt, which was virtually non-existent prior to the 1960s, began to take off in the 1970s and went nearly parabolic from the early 1990s until the 2008 financial collapse. As the Federal Reserve and political class created inflation, which reduced your standard of living, the bankers who own the Federal Reserve and control the politicians used their slick marketing machine to convince you that acquiring goods using vast quantities of debt was just as good as buying things with cash you saved.

Who benefits from inflation and the issuance of trillions in debt to average Americans? Based upon the decades of gargantuan Wall Street profits, mammoth bonuses paid to bank executives, and fact that Washington politicians absconded with trillions from American taxpayers to save their Wall Street masters, it appears that bankers and politicians are the beneficiaries. A gutted, indebted, jobless, demoralized middle class were the recipients of the downside of inflation and debt. Without a Central Bank issuing a fiat currency, with no constraints, none of this could have happened.

The Federal Reserve is primarily responsible for the destruction of the American middle class. In 1915, according the Federal Reserve annual report, they operated with 35 total employees. Today, they operate with over 20,000 employees and the cost to operate the system exceeds $3.3 billion. The Federal Reserve has failed on every one of its stated mandates:

- It was created to stabilize the banking system and keep bank panics from occurring. Within sixteen years of its creation it caused the near collapse of the banking system and the Great Depression. The stagflation of the 1970s was caused by Fed policies. The Savings & Loan crisis was created by their policies. The internet bubble, housing bubble and eventual financial collapse were caused by Federal Reserve blunders. There have been 18 recessions since the creation of the Federal Reserve.

- The stable prices mandate has been a wretched failure, as the Fed has manufactured 2,171% of inflation and destroyed 96% of the currency’s purchasing power. This manufactured inflation has enabled the creation of our welfare/warfare state.

- The Federal Reserve mandate of moderate long-term interest rates has clearly not been met. The Fed Funds Rate has plotted a path of extremes over the decades, ranging from 0% to 19%, not exactly stable. The Federal Reserve has consistently set rates too low, leading to credit bubbles, which always pop and end in recession or depression.

- The mandate of maximum employment has also been a miserable failure. The easy credit policy of the Federal Reserve during the 1920s led to the Great Depression with unemployment rates exceeding 20%. Unemployment has averaged between 5% and 15% consistently since the formation of the Federal Reserve. The true unemployment rate today exceeds 15%.

- The Federal Reserve was supposed to supervise and control the activities of banks. Instead, under Alan Greenspan and Ben Bernanke, they stepped aside and let banks take preposterous risks while giving an unspoken assurance that the Fed would clean up any messes they caused with their debt based enrichment schemes. This total dereliction of duty and gross regulatory negligence led the greatest financial collapse in history.

The American working middle class (Good) have been deceived by the Federal Reserve, the banks that control them (Bad) and the Washington DC political class (Ugly) into believing that a fiat currency, un-backed by gold, supported by systematic inflation is beneficial to their wealth. This has been the Big Lie for the last century and has positioned the country for an epic collapse. Presidential candidate Ron Paul has been the lone voice of sanity in Washington DC for the last two decades and his assessment of the Federal Reserve while questioning Ben Bernanke in 2009 needs to be understood by every American:

“The Federal Reserve in collaboration with the giant banks has created the greatest financial crisis the world has ever seen. The foolish notion that unlimited amounts of money and credit created out of thin air can provide sustainable economic growth has delivered this crisis to us. Instead of economic growth and stable prices, (The Fed) has given us a system of government and finance that now threatens the world financial and political institutions. Pursuing the same policy of excessive spending, debt expansion and monetary inflation can only compound the problems that prevent the required corrections. Doubling the money supply didn’t work, quadrupling it won’t work either. Buying up the bad debt of privileged institutions and dumping worthless assets on the American people is morally wrong and economically futile.”

I’ve now completed three parts of the five part series, documenting the downfall of the great American Empire. Part four, Outlaw Josey Wales, will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

The smell of revolution is in the air.

Nice research Jim, good historical primer for the novice.

RE

RE

The next is your favorite – Outlaw Josey Wales.

I’ll need to channel you for Unforgiven.

Nice work, admin. Clear and concise. It is essays like this that are going to allow the masses to focus on our enemies, The Whores of the Monetary System.

Ilene and I are on the same page. Could this be coincidence (check out the title)?

http://www.zerohedge.com/article/good-bad-and-fukushima

One of your best ever, Jim. Or as one the guys in my golf group says, “Well done, Weldon.”

Woodrow Wilson was a fool and Colonel House knew it.

Three great post .Looking forward to 4 and 5 .

a hard rains a gonna fall on the banker wizards as their magic spell on america weakens and we fools awake to the shit that we have to live with

.hanging would be to good for them.maybe we need our own jacobins and robespierre.

meet my irish friend–gil o’teen

For further reading if one is so inclined

http://www.llsdc.org/attachments/files/109/FRA-LH_H-Rpt-63-69-pp-1-74.pdf

House Report No. 69, 63d Congress to accompany H.R. 7837, submitted to the full House by Mr. Glass, from the House Committee on Banking and Currency, September 9, 1913.

http://www.llsdc.org/attachments/files/105/FRA-LH-PL63-43.pdf

Text of the original Federal Reserve Act, U.S. Congress, 1913.

Jim…keep this up and you’ll be a resident of Gitmo in no time.

Buckhed

I’ll cut a deal where I turn over my 7,000 members to stay out of Gitmo.

Jim…I’ll tell them you are our leader…..I can only hold my breath so long when they waterboard me dude !!!

Buckhed

I will reveal that RE is the biggest danger to the government and they will send a drone to destroy his log McMansion.

I’m so mad that I was born in 1970.

Admin,

What say you to those who would call you a conspiracy theorist? Thanks for the edumacation.

Snake

Who would call me a conspiracy theorist? I deal with facts, not conspiracies.

You state that JP and John D were at Jekyll. That is the first time I have read that. Can you provide the source for follow up.

Thanks

You might as well set up a good perimeter on this thread, Admin. I sense this is another viral article sure to bring the conspiracy theorists in.

I love that picture of Jackson fighting the many headed central banking monster.

Bounty hunter going after Blondie, knocked on the door:

Bounty hunter: So, here you are Blondie.

Blondie: Well, another bounty hunter looking for money.

Bounty hunter: A man gotta make a livin’.

Blondie: Dyin’ ain’t much of a livin’

Blondie sends a slug instead of money into the bounty hunter.

That’s the movie. Here’s real life. Bond hunter going after Geither:

Bond hunter: I’m after returns a hell of better than lousy 1% from those stinking Treasuries.

Geithner: Well, another bond hunter looking for money.

Bond hunter: A man gotta make a livin’.

Geithner: I’m goin’ to issue $1.4 trillion bond returning 2% ’cause default ain’t much of a living’.

Bond hunter sends a slug through a huge pile of 2% bond paper, yelling “Die, die you stinking Treasuries. I need 8% to make a livin’ !”

I was going to settle for a simple glass of wine with dinner. After reading this, I think something stronger is in order.

Tuco: [trying to read a note] “See you soon, id…” “id…” “ids…”

Blondie: [taking the note] “Idiots”. It’s for you.

Excellent work.

We have eaten the fruit of our own destruction, there is no easy way out, no political fix and certainly none from those sons of Icarus housed in the Federal Reserve Bank, a building that, appropriately enough, could easily have been designed by Albert Speer. The dialectical process is fully formed, the intrinsic flaws of the American led debauchery of inflated credit and fiat currencies is being shredded, slowly at first but soon with an astounding speed.

What amazes me still is how docile the American people have become. Lobotomized by reality TV and American Idol the sheeple of the United States have shown no revulsion against the inequities of the increasingly transparent plutocratic rule of a narrow elite in finance, big business and the entrenched political class that serves them.

It is called Fascism. But there is no resistance—yet. There are no Steinbeck’s in our fractured and delusional intellectual landscape to garner a following of minds and souls in their words; no Father Coughlin’s to have millions of eager ears to the radio, regardless of his erratic message. (Read his “Somebody Must Be Blamed” address to the nation). With the mass media controlled by a propaganda regime that would have made Goebbels jealous, the socioeconomic disruption that lies around the next American corner will be of an even greater magnitude than most can imagine in order for the cathartic cleansing of the falsehoods upon which today’s false capitalism is so tenuously built. Except for a growing, but still relatively insignificant voice of the few that can see through the fog, we are for the most part, rudderless on an uncharted and turbulent ocean as a result.

“It is utterly impossible for me to build a life on a foundation of chaos, suffering and death. I see the world being slowly transformed into a wilderness, I hear the approaching thunder that one day, will destroy us too. I feel the suffering of millions. And yet, when I look up at eh sky, I somehow feel that everything will change for the better; that this cruelty too will end, that peace and tranquility will return once more. In the meantime, I must hold on to my ideals. Perhaps the day will come when I will be able to realize them!” Anne Frank, Saturday, July 15, 1944

Keep it up, Jim.

oops, left out the opening phrase from a philosopher I am found of:

“The life of a people ripens a certain fruit; its activity aims at the complete manifestation of the principle which it embodies. But this fruit does not fall back into the bosom of the people that produced and nurtured it; on the contrary, it becomes a poison-draught to it. That poison-draught it cannot let alone, for it has the insatiable thirst for it: the taste of the draught is its annihilation, though at the same time the rise of a new principal” Hegel, 1804

Thanks for this great primer! Unfortunately I think if there is revolution and destabilization the “unforgiven” will simply hop on their private planes, cargo holds packed with gold, and fly to Monaco or some other haven and live out their lives in luxurious peace.

The lack of justice to those in the previous eras you outlined should be a demonstration of the weak will of the public to extract their pound of flesh. Not a single Rothschild, Morgan or other notorious financier has ever hung, nor will their successors.

Paul:

A cargo hull full of gold will be an heavy package…

History is fraught with men crashing/ sinking with cargo hulls filled with gold whilst fleeing.

Cargo holds full of gold tend to be pretty heavy.

Just what I’ve heard.

Jim

Thanks for another informative featured commentary. You would never hear MSM provide the facts and truth you have presented in this piece.

Admin – unfortunately, much of this article falls outside any area I feel competent to comment upon. I thank you for your efforts, as always, and will lurk around the post looking to defend the honor of the righteous as need be, but so far, the posters seem to be honest, intelligent folk.

The federal government owns scores of millions of boarded-up foreclosed homes.

They should sell these homes for whatever they might bring before they ask to raise the debt ceiling.

Also note, not one federal employee or federal employee contractor has been laid off, despite there being literally millions of federal employees and contractors who do absolutely nothing for their paycheck every week.

I do not agree with Ron Paul. I say, stop printing Food Stamps. Stop paying for all the asinine hospital visits of welfare recipients who have nothing wrong with them that can be cured.

The government hasn’t only NOT tightened its belt. It has unbuckled its belt and let its pants drop to the ground.

Fire Bernanke. And -finally- indict Geithner for tax evasion.

Foreclose on the banks who are in the least bit of trouble after 14 trillion dollars in bank stimulus.

If they raise the debt ceiling, the ensuing inflation is a loss we will all incur to our wages, to our savings and to our possession-assets. And none of us will ever get any of it back. They are stealing from us to give more money to the banks and to the throngs of Washington D.C. insiders who buy their dole.

Pull the plug on Fannie Mae and Freddy Mac -completely and NOW-

Overnight end them both.

Wake up tomorrow -to the new reality- and you will be amazed how soon real entrepreneurs will seize the opportunity to serve their communities.

None of this is rocket science.

Don Robertson

http://MaineArtists.US

Limestone, Maine

“The next is your favorite – Outlaw Josey Wales.”-Admin

Best quote of any Eastwood film:

GET READY LITTLE LADY.

[img [/img]

[/img]

Actually not said by Clint, but by Chief Dan George in the role of Lone Watie. He had most of the best lines in that film, and his delivery is just impecable.

[img [/img]

[/img]

“We thought about it for a long time, “Endeavor to persevere.” And when we had thought about it long enough, we declared war on the Union. ”

“I’m an Indian, all right; but here in the nation they call us the “civilized tribe”. They call us “civilized” because we’re easy to sneak up on. White men have been sneaking up on us for years. ”

RE

The “Secret of Oz” is great but here is one I posted a few days ago that I think is extremely relevant.

20 minute video that you can show to your kids too

Aptly titled “The American Dream” (no not the Carlin skit, but just as good imho)

I will take issue with one aspect of this post, which is the claim made that the Free Banking Era was any better than the periods of Central Banking. A few quotes:

“During the free banking era, the banks were short-lived compared to today’s commercial banks, with an average lifespan of five years. About half of the banks failed, and about a third of which went out of business because they could not redeem their notes”

“The Free Banking Era: More than 30,000 Different Notes in Circulation

Suppose you found a wallet filled with paper money sometime during the Free Banking Era, which was from 1836 to 1866. This wallet might contain a yellow two-cent note issued by the New York druggist Matthew’s Bros. You also might find a three-cent note issued by the Peabody Ladies Furnishing Store in Massachusetts. The most attractive of the bunch might be a pink 25-cent note issued by the Hyson Tea Company in New York. Imagine using some of these notes to pay for something at the store! During the Free Banking Era, consumers could not be sure that merchants would accept their paper money. Although merchants were able to certify currency as genuine by consulting registries called Bank Note Reporters, approximately one-third of all paper money during the Free Banking Era was estimated to be counterfeit.

Before the Free Banking Era went into effect, it was difficult for banks to obtain a commercial charter. During the Free Banking Era, state authorities were created with the sole purpose of issuing bank charters. Any private or municipal authority could operate a bank as long as it could satisfy a minimal set of conditions. The instability of the Free Banking Era was especially obvious in the state of Michigan, where the State legislature passed the General Banking Law of 1837. This law immediately transformed Michigan’s banking industry. More than 55 banks were organized in Michigan within one year of the liberal banking law–most of them with the sole purpose of issuing paper money.

Almost all of the banks formed under Michigan’s General Banking Law failed or went broke within two years. Some of these “broken banks” attempted to fool bank inspectors by keeping a barrel of nails with a top layer of gold coin as their “reserves.” The Bank of Battle Creek, Michigan, had its teller, Tolman W. Hall, run out the back door whenever a noteholder would enter the bank. Another unscrupulous tactic was to locate banks’ main offices in remote wilderness areas. These “wildcat banks” would often shuttle the same sack of coins from one location to another to convince the occasional bank inspector that the bank was solvent. One wildcat bank, the Farmers Bank of Sandstone, reportedly offered to redeem its notes in the local merchandise: a sandstone whetstone for each one-dollar note. ”

This could not have been a very good period to be living and trying to save money or be confident of commerce. The record of recessions and panics during the period is awful.

“Name Dates[nb 2] Duration Time since previous recession Business activity [nb 3] Trade & industrial activity[nb 3] Characteristics

1836–1838 — ~2 years ~2 years —32.8% — A sharp downturn in the American economy was caused by bank failures and lack of confidence in the paper currency. Speculation markets were greatly affected when American banks stopped payment in specie (gold and silver coinage).[3][14] Over 600 banks failed in this period. In the south the cotton market completely collapsed.[9]

late 1839–late 1843 — ~4 years ~1 year -34.3% — This was one of the longest and deepest depressions. It was a period of pronounced deflation and massive default on debt. The Cleveland Trust Company Index showed the economy spent 68 months below its trend and only 9 months above it. The Index declined 34.3% during this depression.[15]

1845–late 1846 — ~1 year ~2 years −5.9% — This recession was mild enough that it may have only been a slowdown in the growth cycle. One theory holds that this would have been a recession, except the United States began to gear up for the Mexican–American War which began April 25, 1846.[13]

1847–48 recession late 1847–late 1848 ~1 year ~1 year −19.7% — The Cleveland Trust Company Index declined 19.7% during 1847 and 1848. It is associated with a financial crisis in Great Britain.[15][16]

1853–54 recession 1853 –Dec 1854 ~1 year ~5 years −18.4% — Interest rates rose in this period, contributing to a decrease in railroad investment. Security prices fell during this period. With the exception of falling business investment there is little evidence of contraction in this period.[3]

Panic of 1857 June 1857–Dec 1858 1 year

6 months 2 years

6 months −23.1% — Failure of the Ohio Life Insurance and Trust Company burst a European speculative bubble in United States’ railroads and caused a loss of confidence in American banks. Over 5,000 businesses failed within the first year of the Panic, and unemployment was accompanied by protest meetings in urban areas. This is the earliest recession to which the NBER assigns specific months (rather than years) for the peak and trough.[5][8][17]

1860–61 recession Oct 1860–June 1861 8 months 1 year

10 months −14.5% — There was a recession before the American Civil War, which began April 12, 1861. Zarnowitz says the data generally show a contraction occurred in this period, but it was quite mild.[15] A financial panic was narrowly averted in 1860 by the first use of clearing house certificates between banks.[9] ”

In short here, while in no way do I support the idea of Central Banking, neither do I think Free Banking in any way solves the problems of corruption in banking, and most certainly does not protect anyone’s investments any better than Central Banking does. It is no panacea.

RE

Also well to remember is what concluded the Free Banking Era. The War of Northern Aggression.

[img [/img]

[/img]

RE

Admin, great article !

“I will reveal that RE is the biggest danger to the government and they will send a drone to destroy his log McMansion.”-Admin

I am ready for the Drones. I sold off a few shares of the Bolivian Mine to buy one of these to supplement the Barret .50 Cal BMG

[img [/img]

[/img]

I picked it up on Ebay for $15K. A bargain.

I am in the process of dropping Frag Mines all over the property here

[img]http://notesfromthefield.typepad.com/.a/6a00e008d4b89f8834012876fc4a9d970c-pi[/img]

I am currently negotiating with the North Koreans to trade my Picasso for a Suitcase Nuke

[img [‘img]

[‘img]

Come and get me you Scumbags!

[img [/img]

[/img]

LOL

RE

are there links to the other 2 parts of this piece?

Damn good article Jim. Might be one of your best. Really helps explain in a consise way why the Federal reserve sucks.

Nice work Jim . We the People need this to go viral.

For any interested in educational opportunity, well worth the view time.

The Money Masters – Full

http://www.youtube.com/watch?v=JXt1cayx0hs

THE MONEY MASTERS is a NON-FICTION, historical documentary that traces the origins of the political power structure. The modern political power structure has its roots in the hidden manipulation and accumulation of gold and other forms of money. The development of fractional reserve banking practices in the 17th century brought to a cunning sophistication the secret techniques initially used by goldsmiths fraudulently to accumulate wealth. With the formation of the privately-owned Bank of England in 1694, the yoke of economic slavery to a privately-owned “central” bank was first forced upon the backs of an entire nation, not removed but only made heavier with the passing of the three centuries to our day. Nation after nation has fallen prey to this cabal of international central bankers.

If you like this film, support real research by purchasing the full quality DVD here

http://www.themoneymasters.com/430-2/

NEW – Secret of Oz DVD (Updated version of The Money Masters)

http://www.themoneymasters.com/430-2/

A minor qubbile, and I haven’t finished reading the post yet, but:

That WW quote is definitely suss. It seems to be a pastiche from an earlier speech, with additions. Curiously, I tried Snopes on this some time back, and found some explication. Tonight, no. It seems to have disappeared into their memory hole. For what that’s worth.

As near as I can gather, PART of it is correct, from a speech he gave, but the context is different.

Just sayin’ …

Great series, Jim. We’ll circulate latest installment at Tea Party meeting.

On related note, we’re formulating a national Tea Party movement to demand 401K managers pledge they will not allow Feds to seize our private retirement accounts. (see Irish government announcement this week)

If they don’t meet our demands, we move our 401K accounts to funds that sign the pledge.

What do you think of this idea?

Mary

If the US government tried to seize my retirement funds after I’ve saved for 25 years, I’ll be loading my shotgun and heading to Washington DC.

..where are parts I and II ?

Links to parts One and Two:

I added links to the first two parts at the end of the article.

Great article Jim, BUT….hmmmmm…. secret meetings off the coast, dark plots by powerful men, the populace is duped for decades and doesn’t even know how it all happened….Wait a minute!!

This is a CONSPIRACY THEORY!!!

Credit where it’s due Jim,

great article – one of your finest to date.

RE will be easy to locate by following the empty cans of Napa extra thick chili-con carne, trail of thin gruel excrement and the discarded Sam Adams beer bottles

Andrew Jackson by H.W. Brands had the snake editorial cartoon labeled as Jackson vs. Biddle. Jackson hated bankers because the shortage of currency in the West (Tennessee at that time) and they were forced to barter cotton, slaves, crops, etc. Trading slaves was used against Jackson in the elections, but the slaves were an asset class to get deals done. Bankers starved the New West of capital, because they did not have their profit fingers in the commerence pie.

Today we have Goldman Sacks with their fingers in everything, and betting against their own customers. Today banks are still a “Den of VIpers and Thieves”, who take the profits amongs themselve and the losses to the taxpayers.

Admin.,

Credit do and English Rose tooooooooooooo! WoW

“Today we have Goldman Sacks with their fingers in everything, and betting against their own customers. Today banks are still a “Den of VIpers and Thieves”, who take the profits amongs themselve and the losses to the taxpayers.”-Welsh

Banking whether run Centralized or in smaller chunks of Free Banking has inherent weaknesses which make it inherently corrupt. There is no way to run an honest banking system, besides the fact there is no way to pay interest except in an ever expanding Ponzi of further loans.

RE

Shockingly, Financial Sense published this article this morning. I guess they didn’t read my blistering takedown of their site.

Jim is a true patriot. Let us not forget our founding fathers. Back then, the MSM would have been reporting how great everything was under British rule, how they provided for our needs, how great our economy was doing, and how much gratitude we owed them. Thankfully for all of us, some brave men knew otherwise.

The message is getting out. Many people are aware of what Obama/Pelosi/Bernake/Geitner/Reid, Wall Street and the Fed are doing. As always happens in history, a door will open, a critical mass will be reached, an excitatory valence reached, and the people will rise up. And it will happen because of the groundwork of Patriots like Jim.

I hate to bring religion into the fray, and I’m know little about religion, but the only time Jesus got violent was when he went after the “money changers,” the bankers of his time. Guess what, they were ripping people off. Think how violent his father, God, is going to be with the con men, criminals in Washington and Wall Street when they finally get theirs.

“I know not why any one but a school-boy in his declamation should whine over the Commonwealth of Rome, which grew great only by the misery of the rest of mankind. The Romans, like others, as soon as they grew rich, grew corrupt; and in their corruption sold the lives and freedoms of themselves, and of one another. […] A people, who while they were poor robbed mankind; and as soon as they became rich, robbed one another.”

It has been said that the United States would not be destroyed from without, but from within. Corruption and sloth (Ignorance) have taken hold in every aspect of American life. Virtue is all but dead today.

Wherever we look, we find corruption. From all levels of government, we see corruption. Even if we can not see it, we can smell it. From ball fields, university campuses, board rooms, editorial offices, trading floors, military bases, etc…corruption and sloth prevail. The political, social and economic realms are all infected with the cancer of corruption.

It is my view, that once a country has reached the point where corruption reigns supreme, it has reached the point of no return.

bon!

E cono mystics say “West borrows to pay int. cant pay prin.

U . . . S . . total pub pv debts to cover boomers c$191t , (12 zero) c two hundred trillion

gdp $14t/yr. p i i g s broke.

bon! oops sory 4 2 posts?

E cono mystics say “West borrows to pay int. cant pay prin.

U . . . S . . total pub pv debts to cover boomers c$191t , (12 zero) c two hundred trillion

gdp $14t/yr. p i i g s broke.

The 17th amendment passed by Congress on May 13, 1912 and ratified on April 8, 1913, created the proper conditions for the FRB to flourish. The Senate Committee on Banking and Currency was also created in 1913.

The 17th amendment changed the way in with senators are chosen. The senate was designed to be the body of Congress that represents state government interests. Originally state legislatures appointed senators. Under the amendment, senators are elected by popular vote.

I contend that this change was pushed hard by monied interests in order to capture the senate. The senate has morphed into a body of practically untouchable at large legislatures whoring for the highest bidder. This change has brought us to the point where states hire lobbyist’s to represent them in Washington DC. Where the fuck are esteemed members of “The Club?”

Today, senators represent the city state of Washington DC. Of course, there are exceptions, but very few. The game show hosts disguised as senators serve their masters from Wall Street and the Pentagon very well.

I also contend that the US Senate is the most corrupt institution in the United States, and has been for a long time. The Fed has no better friend in the world. I am for repealing the 17th amendment. Does it get any uglier than the the US Senate?

“The smell of revolution is in the air.”

Indeed.

…and it will look something like this

[img [/img]

[/img]

RE