The Wall Street shysters running the payday loan shops in urban shitholes around the country are certainly satisfied with the government operated public school system. They prefer their customers to be ignorant and unable to calculate their true cost of borrowing. It’s good for profits. Michael Snyder wants these customer service centers shut down. If that happened, 50% of the commerce in West Philly would come to a halt. Only the 50% from EBT cards would be left.

Shut Them Down! – Payday Loan Companies Are Making Billions Preying On The Misery Of The Poor

And it just isn’t small, disreputable banks that are involved in these practices. The truth is that some of the largest banks in America are now making payday loans…

Some, including U.S. Bank, Fifth Third Bank and Wells Fargo, offer payday loans under names such as Ready Advance, Fast Loan and Early Access, according to the Center for Responsible Lending (CRL). They can carry interest rates averaging between 225 and 300 percent, CRL said.

Others major banks not making such loans directly, but instead they are investing millions of dollars in the companies that do make the loans. Bank of New York Mellon Corp., JPMorgan Chase and Bank of America are just some of the major banks that have invested large amounts of money in the payday loan industry.

These financial institutions are making billions of dollars by exploiting the people in our society that are the most vulnerable. As I showed the other day, the bottom 90 percent of America is systematically getting poorer, and many Americans in desperate financial situations have found the easy cash provided by the payday loan companies to be irresistible. The following are some statistics about payday loans from a recent Pew Research study...

-Fifty-eight percent of payday loan borrowers have trouble meeting monthly expenses at least half the time. These borrowers are dealing with persistent cash shortfalls rather than temporary emergencies.

-Only 14 percent of borrowers say they can afford to repay an average payday loan out of their monthly budgets.

-Seventy-eight percent of borrowers rely on information from lenders—who sell these loans as a safe, two-week product—when choosing to borrow money. This reliance reinforces the perception that payday loans are unlike other forms of credit because they will not create ongoing debt. Yet the stated price tag for a two-week, $375 loan bears little resemblance to the actual $520 cost over the five months of debt that the average user experiences.

-While payday loans are often presented as an alternative to overdrafting on a checking account, a majority of borrowers end up paying fees for both.

-Some borrowers ultimately turn to the same options they could have used instead of payday loans to finally pay off the loans. Forty-one percent need an outside cash infusion to eliminate payday loan debt– including getting help from friends or family, selling or pawning personal possessions, taking out another type of loan, or using a tax refund.

-By almost a three-to-one margin, borrowers favor more regulation of payday loans. A majority of borrowers say the loans both take advantage of them and that they provide relief. Despite feeling conflicted about their experiences, borrowers want to change how payday loans work.

But those statistics don’t really convey the real world consequences that these predatory loans have. Many Americans have lost everything that they had after they turned to payday loans. In fact, it is estimated that at least 50,000 Americans a year go bankrupt due to payday loans.

A recent NBC News article profiled Raymond Chaney, a 66-year-old military veteran that had his life totally destroyed by these predators…

For Raymond Chaney, taking out a payday loan was like hiring a taxi to drive across the country. He ended up broke — and stranded.

The 66-year-old veteran from Boise lives off of Social Security benefits, but borrowed from an Internet payday lender last November after his car broke down and didn’t have the $400 for repairs. When the 14-day loan came due, he couldn’t pay, so he renewed it several times.

Within months, the cash flow nightmare spun out of control. Chaney ended up taking out multiple loans from multiple sites, trying to to stave off bank overdraft fees and pay his rent. By February, payday lenders — who had direct access to his checking account as part of the loan terms — took every cent of his Social Security payment, and he was kicked out of his apartment. He had borrowed nearly $3,000 and owed $12,000.

“I’m not dumb, but I did a dumb thing,” said Chaney, who is now homeless, living in a rescue mission in Boise.

Is there anyone out there that still wants to argue that we should not shut these predators down?

Sadly, many Americans in poor communities have very few alternatives to the payday loan companies. In recent years, the large banking chains have been systematically closing down branches in poor neighborhoods while expanding in wealthy neighborhoods at the same time. Since the Federal Reserve is paying banks not to lend money, it doesn’t make a lot of sense for them to make high-risk loans to poor Americans who may not be able to pay them back. And recent regulations passed by Congress have made it not very profitable to offer checking accounts to poor people. In many poor communities all over the country, it has now gotten to the point where it is becoming extremely difficult to find a bank branch anywhere.

So payday loan companies have been more than happy to fill the void.

But don’t look down on those that have taken out payday loans. The truth is that almost all of us have willingly allowed ourselves to become enslaved to the system at one point or another.

For example, in a previous article entitled “Money Is A Form Of Social Control And Most Americans Are Debt Slaves“, I pointed out the utter foolishness of constantly carrying a balance on a credit card. In that article, I included a great explanation from a former Goldman Sachs banker about how incredibly crippling credit card debt can be…

On the debt side of things, how much does your credit card company earn if you carry just an average of a $5,000 credit card balance, paying, say, 22% annual interest rate (compounding monthly) for the next 10 years?

In your mind you owe a balance of only $5,000, which is not a huge amount, especially for someone gainfully employed. After all, $5,000 is just a quick Disney trip, or a moderately priced ski-trip, or that week in Hawaii. You think to yourself, “how bad could it be?”

The answer, including the cost of monthly compounding, is $44,235, or about 9 times what it appears to cost you at face value.

This is why one of the top things that I recommend for getting prepared for the economic crisis that is coming is to get out of debt.

You do not want to be enslaved to financial predators when everything starts falling apart all around you.

So do any of you have any payday loan or credit card horror stories to share? Please feel free to share what you have to say by posting a comment below…

Oh, cry me a river. Predators? I’m glad someone has found a way to make money off stupid people – hell, they’re just a drain on the rest of us. Grow half a brain, learn basic math, be responsible, and live within your means. Then you will never need to take out a payday loan. Problem solved.

I see no problem with these payday loan providers. They provide a willing customer with a service, even though that service is nothing more than stripping idiots from their money but it atleast it is conscentual.

That can’t be said about atrocities like Obamakill, SS, Fed Inc Tax, etc ad infinitum….

From the Western Sky website —- “WESTERN SKY FINANCIAL is owned wholly by an individual Tribal Member of the Cheyenne River Sioux Tribe”

You see what is happening here? The Injuns are getting even with the fuckin’ White Man.

**** Breaking News **** — They will be replacing their cunt whore girl with another cunt whore; [/img]

[/img]

[img

Black woman does Western Sky parody commercial. Some good moments …

“They don’t even give you free liquor to ease the pain while you’re losin’. What the fuck is up with that?”

Clearly it’s the government’s fault. They need to disburse Welfare and Disability cash on a daily basis, and not just once a month. People drink malt liquor and buy cigarettes daily, they need their money daily. This could easily be accomplished by doubling government entitlement money to said programs to $2 trillion per year (from the measly $1.1 trillion spent now). This additional stimulus would put our economy into overdrive and we would once again be the economic dynamo that powers the rest of the world.

If the government can run the lottery, maybe they can take over the payday loan business….perhaps put the losers who can’t pay to work on the prison farm. JPM could actualy administer the loan program, and Fannie Mae and Freddie Mac could guarantee the paper.

Usury in the amount that these payday loans charge is nothing more than a bonus to them over the common level of interest rates that banks charge. It used to be illegal in this country until the criminal minds in congress changed the laws.

Usury of this type is also amoral and always has been. It takes advantage of ignorant people and makes them into financial slaves to the benefit of the loan shark. Usurious Contracts while no longer unlawful in commercial law are still of bad taste and amoral to common decency. The Uniform Commercial Code, UCC smells rotten when it supports this amount of usury.

Shut’em down.

So what if some money pirate has to find a real job to make a living rather than scamming poor people and being a bigger parasite than the EBT people.

And BTW they also target our military folks. These payday places ring military bases like a fungus infection.

And I wouldn’t shed a tear if the FSA and others didn’t wake up one day and beat the owners of these store front usury owners to death. In fact I hope they do. No one will miss these parasites.

No one is forced to borrow from payday lenders.

No one is forced to gamble in a casino.

No one is forced to hire a financial planner (salesman, that is) to manage their money.

No one is forced to rack up debt on an 18% credit card.

All of these choices will make you lose money. But they are voluntary and should continue to be legal. Life is hard, and it’s harder if you’re stupid. Take responsibility for yourself, stop being a whiny-assed victim, and don’t be ignorant. If you’ve made choices in life that have backed you into a corner to the point that you must resort to a payday lender, stop blaming the payday lender and question your own choices.

Get rid of ’em? Hell, I have thought about going into competition with them. There are five military bases within six hours of my home and that would be my target customer. I would set my rates at actual (shadowstats) inflation plus 7.5%. I would finance the whole thing myself. I’d only loan to active duty military who could prove enlistment duration. I’d keep the loans small and educate the idiots about why they should avoid payday loans. Oh the irony! I’d buy gold and silver on the side at very competitive rates as well.

The best part about loaning to the military is that if they fail to pay, you simply send a note to their commander and they make sure you get paid. The only other people I’d loan to would be those with serious collateral but that might end up more like a pawn shop situation and I don’t need that.

Oh yeah, that little squaw on the Western Sky commercials is rather hot. Fail to pay that loan back and she probably shows up at your house, whips out a dick bigger than yours and fucks you to death with it!

I_S

Jo

I’m the last person to advocate for getting rid of businesses but this sort has to go. They are parasitical and destructive in nature. They suck money out of a community and make it worse.

What they do used to be called loansharking and extortion in a earlier time when people knew right from wrong.

Sadly we’ve become so depraved as a society we now condone a gang of parasites to prey on the weak, desperate and foolish. Just because people are poor doesn’t give you or anyone else the excuse to screw them over or justify it being done by others.

If I sound like a bleeding heart lib, so what. Wrong is wrong. You folks here bitch all the time when Uncle Sam or the Banksters bend you over for another ass r**e. Yet you turn around and support a bunch of poor whites and blacks getting bent over by a bunch of parasites.

Don’t you get we’re in this together. That the parasite class has it’s claws in all strata of society now.

” … that little squaw on the Western Sky commercials is rather hot.” —- IS

Only with a lot of makeup and perfect lighting. Otherwise, she is rather plain bordering on homely.

Her name is Amanda Howell …. born in Santa Clara, CA ….. grew up in Fairfield, CT … attended Ohio State University majoring in Fashion Merchandising. She about as Indian as me … Chief StuchenRunningDeer.

Here she is auditioning for some part. YIKES!!!!!!!!!! And she sucks as an actress too.

http://www.youtube.com/watch?v=ADyDumrVimE

Caveat emptor still rules. A lot of business makes money from being stupid. Lotteries are one example – and they are sponored by the goobermint. Which is worse? Goobermint screwing you, or a business.

No one makes anyone use this “service”. If they outlawed businesses that preyon the stupid, Apple would fall, McDonalds would fall, Coke would go under, etcetcetc. Further, the biggest organization preying on the stupid is the fed govt.

Bah. Stupid people will always be prey.

Western Sky girl, Amanda Howell, without makeup. [/img]

[/img]

[img

“Get rid of ‘em? Hell, I have thought about going into competition with them.” —– IS

IndenturedServant quickly buys a truck to get started. [/img]

[/img]

[img

Hell at least you already know they are screwing you. Nothing like getting your bank statement and seeing the surprise fees on your account. I have never taken out a loan from one of these places, but what options are there when you have an emergency? An actual bank loan? Yeah, like they loan money to anybody anymore. If you want an over priced house or GM car, yeah, they are there for you. There is no such thing as a small loan anymore. It is more beneficial to hook you on a large loan for the long term. There is not enough interest profit, for the banks or decent lender, to be worth their time.

Many years ago when I first started seeing these places I needed a couple dollars to make it to the end of the week. When they gave me the terms of the loan I said to myself I believe I can make it till Friday. Have to thank my parents for teaching me the value of money.

[img [/img]

[/img]

Apparently, that truck is no longer available.

“Yet you turn around and support a bunch of poor whites and blacks getting bent over by a bunch of parasites.” — The Cynic

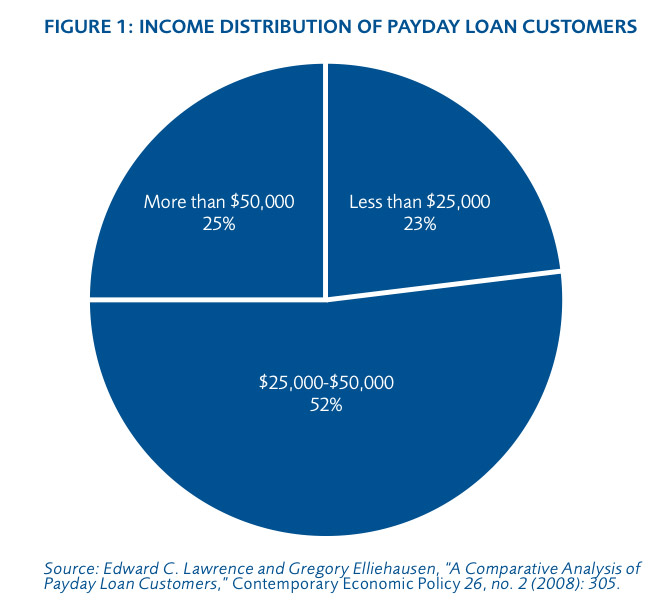

Looks to me like 75% of payday loans are made to people who are not poor.

[img [/img]

[/img]

IndenturedServant Payday Loans — Facebook Page [/img]

[/img]

[img

LOL Stucky!

I_S

Stucky – you making fun of my peeps?

And re Injuns getting even, if we managed to kill off a high percentage of whites, take 90+ percent of all land and resources they control, and starve the rest, we still would not be even. Old history. Oh well. Injuns lost. We should have attacked whitey on sight. Thanksgiving my ass – that would have been a perfect time for a raiding party to take all the pilgrims’ winter provisions. No good deed goes unpunished.

There are a lot of women out there suffering from domestic abuse by the men they married. They get beat up with broken bones, blackened faces, and even have miscarriages from being kicked in the stomach or thrown down stairs during pregnancy. But I guess it is alright because they voluntarily married the man.

Not to mention all the scams out there that catch people because of fast talking snakes and lures that catch otherwise smart people.

The loan sharks making loans from these payday loan businesses are catching many people in desperate situations and taking unfair advantage. A desperate person is not in their right mind just like a severely ill person is not in their right mind. Oh hell, why don’t we just forget all our other traditional ways of helping our neighbors and just prey on weak neighbors. I say “other” because we used to have laws against this sort of usury. But as our politicians and business leaders became corrupt we started throwing out all the laws that protect us from shady business practices. Now fraud and unfair business practices are happening in our most trusted institutions.

Do all the good you can

By all the means you can

In all the ways you can

In all the places you can

At all the times you can

To all the people you can

As long as ever you can

– John Wesley

An aspiration to work towards. Payday loan companies fail on all counts and do not fit into a just society.

They should shut them down because no doubt this industry is taking advantage of the desperate. But those who don’t own any property can`t take title loans so their only option is payday loans.