In Part 1 of this article I detailed the insane solutions proposed and executed since 2008 by our owners as they attempt to retain and further expand their ill-gotten wealth, acquired through fraud, deceit, swindles, and the brilliant manipulation and exploitation of the masses through Bernaysian propaganda techniques. Madness has engulfed the entire world, with a concentration of power in the hands of a few psychopathic financial elite wielding an inordinate and dangerous expanse of power over the lives of the common man. They are a modern day version of Al Capone, except their weapons of choice aren’t machine guns, but a printing press, peddling debt, creating derivatives of mass destruction, and peddling heaping doses of disinformation. The contemporary criminal class wears Hermes suits, Rolex watches and diamond studded pinky rings, drops $500 to dine at Masa in NYC, travels by chauffeured limo, lives in $10 million NYC penthouse suites, occupies luxurious corner offices in hundred story glass towers, and spends weekends hobnobbing with the other financial elite at their villas in the Hamptons. They have nothing but utter contempt for the lowly peasants who depend upon a weekly paycheck to make ends meet. Why work when you can steal $1 or $2 billion from farmers with no consequences?

The willfully ignorant masses are kept at bay by the selling them a false dichotomy of Republicans versus Democrats, conservatives versus liberals, and capitalism versus socialism. The ruling class distracts the public with fake wars on poverty, drugs and terror, while using these storylines to further enrich themselves and keep the public alarmed and frightened. We’ve been “fighting” the wars on poverty and drugs for over four decades and poverty is at record levels, while drugs are easier to obtain than candy in a candy store. The war on terror is nothing more than a corporate arms dealer welfare plan. The end of the Cold War put a real crimp in the bottom lines of Lockheed Martin and the rest of the peddlers of death. 9/11 and the subsequent undeclared wars in Iraq, Afghanistan, Libya and now Syria, with Iran on the horizon, have been a godsend to the bottom lines of the corporations Eisenhower warned about in 1961. In reality, the politicians are interchangeable and bought off by corporate and special interests. The people are sold a fable, and controlled opposition is the fairy tale. They perpetuate the welfare/warfare state that enriches Wall Street, the military industrial complex, the healthcare service complex, politically connected mega-corporations and the corporate media propaganda complex. The American people are given the illusion of choice by their keepers. The system is rigged. The real decisions are made by unelected secretive men who operate in the shadows and use their wealth to direct the decision making of the politicians, government bureaucrats, and corporate entities that benefit from those decisions. Edward Bernays described a society that existed in the 19th Century, 20th Century, and has now grown to immense proportions in the 21st Century:

“Political campaigns today are all sideshows…A presidential candidate may be ‘drafted’ in response to ‘overwhelming popular demand,’ but it is well known that his name may be decided upon by half a dozen men sitting around a table in a hotel room…The conscious manipulation of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country.” – Edward Bernays

The manipulation of the masses has been perfected by the ruling class through decades of corporate mass media messaging the purposeful dumbing down of the populace through government public school education that teaches children how to feel rather than how to think. The conscious manipulation of the masses has been designed to produce obedient non-thinking consumers of corporate products, educated to believe the accumulation of material goods with debt constitutes wealth, to fear whatever the government tells them to fear, and never look up from their iGadgets long enough to actually think for themselves. We are bombarded with Orwellian memes designed to keep us sedated and pliant, as the ruling class pillages the national wealth and expands their power and control over our lives.

Conform; Stay Asleep; Do Not Question Authority; Obey; Consume; Reproduce; Submit; Watch TV; Buy; Follow; Doubt Humanity; No New Ideas; Feel, Don’t Think; Fear; Accumulate; Honor Apathy; Believe Experts; Surrender; Spend; No Independent Thought; Win; Want More; Hate; Succumb To Desire; Yield To Power; Choose Safety Over Liberty; Choose Security Over Freedom

This insane world was created through decades of bad decisions, believing in false prophets, choosing current consumption over sustainable long-term savings based growth, electing corruptible men who promised voters entitlements that were mathematically impossible to deliver, the disintegration of a sense of civic and community obligation and a gradual degradation of the national intelligence and character.

Are You Sane?

“A sane person to an insane society must appear insane.” – Kurt Vonnegut – Welcome to the Monkey House

Vonnegut and Huxley’s social commentary reveals a basic truth that societies and human beings have been prone to bouts of madness over the course of decades and centuries. Humans are a weak species, susceptible to the vagaries of greed, lust, gluttony, wrath, sloth, envy and pride. The seven deadly sins are in full bloom today, as the American empire descends through Dante’s inferno of reality TV, celebrity worship, religious zealotry, adulation of wealthy titans, military conquest and worship of false idols. Over the centuries humans have gone mad over tulips, farm land, stocks, and real estate. The easily duped American populace has been victimized by multiple bubbles bursting since the creation of the Federal Reserve in 1913. The contention that a central bank run by private banking interests would promote a safer financial system and a stable currency is laughable. The Federal Reserve and the bankers who control it have created three stock bubbles, the largest housing bubble in history, a bond bubble and the mother of all debt bubbles, while destroying 95% of the dollar’s purchasing power in the last 100 years.

There is a common denominator in all the bubbles created over the last century – Wall Street bankers and their puppets at the Federal Reserve. Fractional reserve banking, control of a fiat currency by a privately owned central bank, and an economy dependent upon ever increasing levels of debt are nothing more than ingredients of a Ponzi scheme that will ultimately implode and destroy the worldwide financial system. Since 1913 we have been enduring the largest fraud and embezzlement scheme in world history, but the law of diminishing returns is revealing the plot and illuminating the culprits. Bernanke and his cronies have proven themselves to be highly educated one trick pony protectors of the status quo.

Greenspan’s easy money policies, manufacturing of negative real short term interest rates, regulatory malfeasance and unspoken promise to bail out Wall Street whenever their excessive risk taking threatened to burn down the financial system, led to 50% stock market crash in 2000/2001, a 40% plunge in national home prices, and another 55% stock market crash in 2008/2009. While Ivy Leaguers Bernanke, Paulson, Hubbard, Krugman, and Bush were too obtuse or too blinded by their ideology to recognize the fraudulent housing and stock market bubbles, honest clear thinking men like Robert Shiller, John Hussman, and Ron Paul recognized the bubbles well in advance and understood the consequences to the average American.

“Like all artificially-created bubbles, the boom in housing prices cannot last forever. When housing prices fall, homeowners will experience difficulty as their equity is wiped out. Furthermore, the holders of the mortgage debt will also have a loss.” – Ron Paul – 2003

What Ron didn’t realize was the peddlers and packagers of fraudulent mortgage debt on Wall Street would walk away unscathed when the bubble they created popped. Trillions of net worth was vaporized due to the policies, solutions, and programs designed and implemented by Bernanke and his Wall Street co-conspirators. The losses should have been borne by those who made the loans. Instead they were borne by the American taxpayer and future unborn generations. David Stockman, in his no holds barred book about the Wall Street and K Street crony capitalist criminals, rails against the Federal Reserve led rescue of the profligate destroyers of capital markets:

“At the end of the day, this trillion-dollar infusion of capital and liquidity from the public till had a single overarching effect: it nullified in its entirety the impact of Mr. Market’s withdrawal of a similar magnitude of funding from the wholesale money market. So the very monetary distortion – the availability of cheap overnight funding in massive quantities – upon which the Wall Street financial bubble had been built had now been recreated at the lending windows of the Fed, FDIC, and the US Treasury.

The opposite path of liquidating the Wall Street bubble was eschewed, of course, not only because it would have meant massive losses to speculators in the stock and bonds of Goldman Sachs, Morgan Stanley, JP Morgan, and the remaining phalanx of the walking wounded. Crony capitalism also triumphed because in muscling the system during the white heat of crisis, Wall Street had plenty of intellectual cover. The fact is, mainstream economists of both parties were trapped in a Keynesian dead end, proclaiming that the solution to the crushing national debt load which had actually triggered the financial crisis was to pile on more of the same.

Accordingly, banks which were “too big to fail” couldn’t be busted up, since they were allegedly needed to shovel more credit onto already debt saturated household and business balance sheets. Likewise, speculators who should have suffered epochal losses during the meltdown were resuscitated by Fed-engineered zero interest rates in the money market, thereby quickly reviving the same massively leveraged “carry trades” in commodities, currencies, equities, derivatives, and other risk assets which had brought on the crisis in the first place.” – David Stockman – The Great Deformation – The Corruption of Capitalism in America

The working middle class was forced at gunpoint to bail out billionaire bankers who had been fraudulently inducing feeble minded dupes and trailer trash to purchase $500,000 McMansions with negative amortization no doc subprime mortgages, while bullying appraisers into inflating appraisals, buying off the rating agencies, selling the toxic derivatives to their clients, and then shorting the very same derivatives. They subsequently committed foreclosure fraud by robo-signing legal documents. Describing these modern day Shylocks as heartless, cruel, lecherous, avaricious demons understates the vileness and contemptibility of their nature. Ben Bernanke and Hank Paulson blatantly lied to the depraved, gutless members of Congress and to the easily hoodwinked fearful American public about the threat of our financial system collapsing unless the Wall Street banks were saved. This false storyline is still peddled today and believed by millions of willfully ignorant crony capitalist devotees. The financial system wasn’t going to collapse. The stock prices of JP Morgan, Goldman Sachs, Citigroup, Bank of America, AIG, Morgan Stanley, GE, and Wells Fargo were collapsing. The wealth of the financial elites that run the country was in peril. The depositors in these banks wouldn’t have lost a penny, but the shareholders and bond holders would have been wiped out. The personal wealth of Dimon, Mack, Lewis, Prince, Immelt, Blankfein and the other titans of finance took precedence over the rule of law and the negative consequences of excessive risk taking and control fraud.

True free market capitalism embraces the concept of creative destruction. Poorly run companies fail and are replaced by well-run companies. Bankruptcy law worked perfectly during the liquidation of Washington Mutual. The orderly liquidation of the Too Big to Trust Wall Street banks would have resulted in billions of bad debt being discharged, with the losses being borne by the executives who mismanaged the banks and the investors who were foolish enough to fund the disastrous schemes perpetrated by those executives. The FDIC would have kept depositors whole. The privatization of illicit bank profits from 2002 through 2007 and the socialization of the 2008 through 2010 bank losses are proof that we are experiencing a warped, immoral, crony capitalism that enriches the well-connected and impoverishes the working middle class. Our political, economic and financial systems have been captured by corporate and special interests. This corruption will prove fatal, as the vested interests destroy the system through their myopic greed. We’ve allowed a small cadre of malevolent men to gamble away the nation’s future with impunity from all laws, regulations and any sense of morality, under the guise of capitalism. These men and the nation will pay a high price for these transgressions. The punishment will fit the crimes.

“People of privilege will always risk their complete destruction rather than surrender any material part of their advantage.” – John Kenneth Galbraith – The Age of Uncertainty

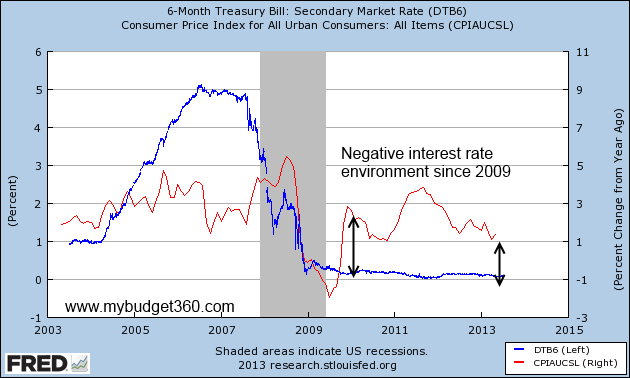

The chart below reveals the criminal plan as implemented by Bernanke, the Obama administration and the Wall Street banks. Instead of allowing insolvent financial institutions to fail, $700 billion of taxpayer funds were syphoned from the economy and handed to them. Bernanke has since stuffed their coffers with another $2.4 trillion he printed out of thin air. The purpose of this insane transfer of national wealth from the people to the parasites was not to help Main Street. Forcing the FASB to allow these criminal bankers to mark to unicorn rather than mark to market, buying their toxic mortgages, and providing billions in free money was done to cover-up the fact they are insolvent. Their balance sheets and the Federal Reserve balance sheet are choking on bad debt. The ongoing foreclosure/rent to own scam was designed to drive up home prices and allow the bankers to exit their toxic mortgages with a profit. The criminally insane bankers have used the trillions in excess funds to syphon off billions in stock market gains, with assurances from Ben that QE to infinity will always be there. They know if their gambling leads to losses, Ben will come to the rescue.

The purpose of banks was supposed to be to lend money to businesses and consumers so they could make long-term investments that helped expand the economy. These Wall Street cretins didn’t loan money to people and businesses in the real world. It was much easier to generate risk free returns and program their HFT supercomputers to buy, buy, buy. By driving real interest rates below zero for the last four years, Bernanke has stolen $400 billion per year from senior citizens living on the edge and transferred it to bloodsucking bankers. Anyone with money in a bank account is losing money. This was designed to force muppets back into the stock market where they will be fleeced for the third time in the last thirteen years.

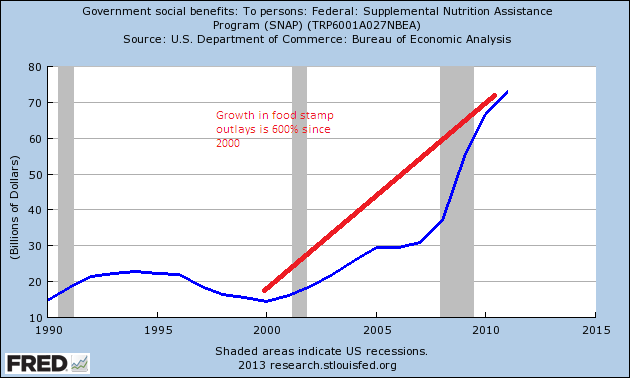

Bernanke’s rescue measures have been a smashing success for the .1%. Wall Street is generating record levels of profits and paying out record levels of bonuses to themselves for a job well done. The stock market is at an all-time high, while the middle class is eviscerated by relentless inflation in energy, food, healthcare, clothing, tuition, rent and taxes. Reality does not match the propaganda touted by the financial elite. Ask the 47.7 million people on food stamps.

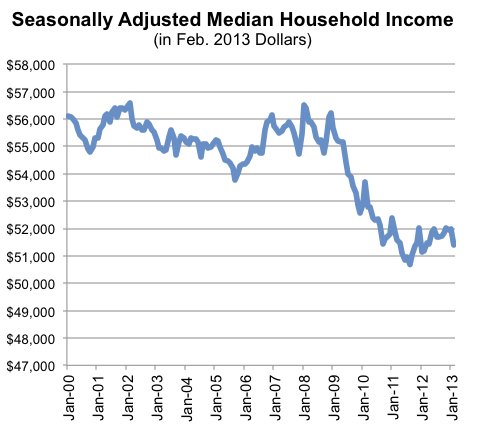

The economic recovery narrative propagated by Wall Street paid economists, Wall Street controlled media pundits, and Wall Street bought off politicians is nothing but unmitigated bullshit. True unemployment, that doesn’t falsely exclude the unemployed who have thrown in the towel, is north of 20%, with youth unemployment exceeding 40%. The “solutions” implemented by our owners have led to a 10% collapse in the median household income since 2008. If the middle class is seeing their real incomes decline, while their living expenses are rising by 5% per year, how can the economy be recovering? It can’t. Bernanke’s banker welfare program and Obama’s $1 trillion deficits, along with accounting fraud and under-reporting of inflation, have produced the illusion of recovery.

Dimitri Orlov summarizes our modern financial system and sets the table for the coming collapse:

“The main tools of modern finance are mystification, obfuscation and hypnosis. What is different now is that all the governments have already shot all of their magic bailout bullets. The guilty parties are still at large, richer than they were before this crisis and probably thinking that the next crisis will make them even richer.” – Dimitri Orlov – The Five Stages of Collapse

The questions that must be answered are: How did we allow this to happen? Are we blameless? Can our course be reversed?

Time to Look in the Mirror

“The America of my time line is a laboratory example of what can happen to democracies, what has eventually happened to all perfect democracies throughout all histories. A perfect democracy, a ‘warm body’ democracy in which every adult may vote and all votes count equally, has no internal feedback for self-correction. It depends solely on the wisdom and self-restraint of citizens… which is opposed by the folly and lack of self-restraint of other citizens. What is supposed to happen in a democracy is that each sovereign citizen will always vote in the public interest for the safety and welfare of all. But what does happen is that he votes his own self-interest as he sees it… which for the majority translates as ‘Bread and Circuses.’

‘Bread and Circuses’ is the cancer of democracy, the fatal disease for which there is no cure. Democracy often works beautifully at first. But once a state extends the franchise to every warm body, be he producer or parasite, that day marks the beginning of the end of the state. For when the plebs discover that they can vote themselves bread and circuses without limit and that the productive members of the body politic cannot stop them, they will do so, until the state bleeds to death, or in its weakened condition the state succumbs to an invader—the barbarians enter Rome.” – Robert A. Heinlein

Robert Heinlein has been dead for twenty five years. He wrote these words decades ago. His vision of a state bleeding to death is being played out as we speak. Ben Franklin had an inkling the Republic we were given would not be sustained. The success of our nation hinged upon the wisdom, self-restraint, morality, and civic mindedness of its citizens. Our form of governance was never perfect. Nothing is perfect. Adam Smith’s free market capitalism was based upon true competition, but with an underlying moral code. The rule of law meant something. Those who stole, cheated or broke the law were punished. Bankers and their usurious machinations were frowned upon. They were tolerated as a necessary evil, but they certainly weren’t admired and celebrated. When their greedy schemes to loot the populace went too far, a courageous leader would step forth and rout out the vipers and thieves:

“You are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out.” – Andrew Jackson

Bankers gained more power after the Civil War as oil was discovered, the country grew rapidly, and the robber barons built their fortunes on debt and the backs of the poor. But still, there were leaders like Teddy Roosevelt who stood up to the banking and corporate interests. The die was finally cast in 1913 with the introduction of the income tax, the creation of the Federal Reserve and allowing the people to directly elect their Senators. A century of central banking has led to: a century of war; a century of currency debasement; a transformation from a hard-working, saving, producing society into an irresponsible, debt based spending, consuming society; and the degradation of our society into a mob of egotistical techno-narcissists, who have chosen bread and circuses over freedom, liberty and self-reliance. At first it happened gradually, but accelerated rapidly once Nixon removed the last vestiges of control over greedy bankers, corrupt politicians, and gluttonous voters. The transformation from an industrious nation of savers into a slothful nation of consumers has reached its zenith. Financialization Nation has been built on a pyramid of debt. The youth of today have been left with an un-payable debt burden and as Bill Bonner points out, the endgame will likely be violent and bloody:

“That’s a heavy burden. It is especially disagreeable when someone else ran up the debt. Then you are a debt slave. That is the situation of young people today. They must face their parents’ debt. Even serfs in the Dark Ages had it better. They had to work only one day out of 10 for their lords and masters. As it stands, young people in the U.S., Europe and Japan are expected to work their whole lives to pay for things their parents and grandparents consumed decades earlier.

Let’s see. Deny a young person work and you deny him a career. Deny him a career and you deny him a way to support a family. Deny him a family life and who knows what happens? Will today’s young people accept their lot… and remain in docile debt servitude their whole lives? Or will they rise up and burn T-bonds in public spaces… rampage down Wall Street… and perhaps hang Ben Bernanke in front of the New York Federal Reserve?” – Bill Bonner

The pyramid of debt was built brick by brick over the last century, as an unelected, secretive, unaccountable cabal of private banker pharaohs has controlled the currency of the nation and worked on behalf of the vested corporate and banking interests that control the country. Shortly after its devious creation in 1913, they enabled Woodrow Wilson to wage a war he promised to keep the nation out of. The central bank’s easy money policies during the 1920s led to an unsustainable credit driven boom in stocks, bonds and real estate. As usual, their belated monetary tightening was too late to avoid the 1929 Crash. Federal Reserve and government intervention after the crash prolonged the Depression for over a decade. The Crash of 1929 proved once again that bankers could not be trusted. Their insatiable greed and reckless thirst for more and more riches required checks on their ability to destroy our economic system. The 38 page 1933 Glass-Steagall Act made sure commercial banking was kept separate from investment banking (gambling), keeping the productive activity of helping businesses grow isolated from the parasitic activity of speculation. This clear, concise, understandable law kept bankers from destroying the lives of millions for 66 years, until a bipartisan screw job repealed the law and unleashed the kraken upon the unsuspecting public. Bernanke’s QE to infinity driven stock market gains over the last few years are reminiscent of another historic time, and this story also hasn’t reached its ultimate climax.

“A major boom in real stock prices in the U.S. after ‘Black Tuesday’ brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937, and a third crash. Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.” – Robert Shiller

The destruction of Europe, Russia and Japan during World War II and the Bretton Woods system that made the USD supreme across the world kept the economic peace for the next quarter century. A confluence of events in the late 1960s and early 1970s set the stage for the ultimate collapse of our faith based monetary system. LBJ’s Great Society welfare programs and our disastrous foray into Southeast Asia began the insane welfare/warfare dynamic that has required more and more debt to sustain. Nixon realized the debt expansion needed to pay for an ever expanding state could never be achieved with the Bretton Woods/gold pegged currency system. In 1971 Nixon unilaterally canceled the direct convertibility of the USD to gold. It ushered in the era of freely floating currencies, relentless inflation, financial bubbles, debt accumulation, consumerism, and the rise of the corporate/fascist propaganda state. Using government supplied CPI statistics, the dollar had lost 75% of its purchasing power between 1913 and 1971. Since 1971 it has lost 83% of its remaining purchasing power. And Ben Bernanke has the guts to publicly state his worries about the ravages of deflation.

The years 1913 and 1971 will be seen by future historians as infamous dates when marking the decline of the great American empire. Prior to 1971, the New York Stock Exchange barred the public listing of investment banks. After the exchange repealed this ban, the large investment banks (Lehman Brothers, Morgan Stanley, Merrill Lynch, Goldman Sachs, Bear Stearns) converted from partnerships, where the senior employees owned the company and were responsible for all of its liabilities, profits and losses, into publicly owned corporations, where executives’ incentives become aligned with outside shareholders, who demanded short-term profits and higher stock prices at the expense of long term sustainability. The partnership structure provided a mechanism of restraint, self-control, fiscal responsibility and cautiousness. If the bank failed, the partners’ net worth would be wiped out. Their incentives were for the long-term sustainability of the business and they were discouraged from taking undue risks that might produce huge short term profits, but might also destroy the firm. Shame and a sense of responsibility to fellow partners was a strong deterrent to obscene risk taking. The unholy combination of allowing investment banks to go public and repealing Glass Steagall in 1999, created a greed driven uncontrollable Too Big To Control brutish monstrosity consuming the world in its desire for more. It will only be stopped when it chokes to death while gorging on what’s left of the middle class.

The citizens, formerly known as the hard working American middle class, must accept their share of responsibility for the desperate circumstances we face. Some are guiltier than others, but we only need look in the mirror to find the culprits in allowing the bankers, politicians, military industrial complex, mass media and vested corporate interests to gain control over our country. The introduction of the credit card by Wall Street bankers as a must have for every citizen in the early 1970s coincided with the inflationary demons unleashed from Pandora’s Box by Nixon and the Federal Reserve, along with the peak of cheap U.S. oil production. Thus began four decades of real wages declining and consumer debt soaring. A nation of people that believed in saving before purchasing were given the freedom to spend money they didn’t have. The statistics paint a picture of a society gone mad:

- Credit card debt grew from $5 billion in 1971 to $856 billion today, a 17,000% increase in forty-two years. GDP rose from $1.2 trillion to $16.6 trillion, a mere 1,400% increase. Real GDP only grew by 300%. Wages have grown from $600 billion to $7 trillion, a 1,200% increase. Real disposable personal income per capita grew from $17,200 to $36,800, a 200% increase.

- Non-revolving debt (auto, student loan) grew from $127 billion in 1971 to $1.98 trillion today, a 1,600% increase.

- There are over 600 million credit cards in circulation within the U.S. and Americans charged over $2.1 trillion last year.

- Over 40% of Americans carry a balance on their credit card from month to month, with an average balance of $8,200 and an average interest rate of 13%.

- 40% of all low and middle income households must rely on their credit cards to pay basic living expenses like rent, mortgage, utilities, groceries, real estate taxes, income taxes, along with their “needed” iPhones, HDTVs, bling, stainless steel appliances, and tattoo artwork.

- Wall Street banks have written off over $300 billion in credit card debt since 2008 (and passing the bill to taxpayers), while bilking their customers out of $60 billion per year in late fees and overdraft fees.

Despite the storyline of austerity, consumer credit outstanding has reached an all-time high of $2.84 trillion because Bernanke and his Wall Street puppeteers require perpetual debt expansion to keep their Ponzi scheme alive. Federal government dispensation of loans to subprime student borrowers has helped mask the true unemployment rate and Federal government doling out of subprime auto loans through Ally Financial and their crony Wall Street partners has created a fake auto recovery. The Blackrock/Wall Street “rent to own” faux housing recovery was designed by our owners to lure clueless math challenged dupes back into the housing market. Our entire economy is nothing but a confidence game at this point.

The four decade long orgy of debt couldn’t have ensued if our currency had remained linked to the barbaric relic – gold. The apologists and lackeys for the vested interests scorn and ridicule the notion of our economic system being burdened with any checks or balances. This is where the interests of those in power and those being ruled have coincided, as a fiat based monetary system allowed unlimited spending to keep the welfare/warfare state growing, enriching the crony capitalists, deepening the power of the state, and providing the masses with foreign made trinkets, baubles, corporate logoed clothing, techno-gadgets, and pimped out financed wheels. The concepts of self-restraint, discipline, saving for a rainy day, prudence, discretion, and deferred gratification are rarely displayed in modern day America. In a case of mass delusion, Americans have convinced themselves to live for today, recklessly ignore their futures, irresponsibly spend money they don’t have on things they don’t need, neglect their civic duty towards future generations, choose ignorance over knowledge, and vote for spineless politicians who promise them entitlements that are mathematically impossible to honor. The public’s foolish attitude towards debt accumulation matches the arrogance of our gutless intellectually dishonest leaders.

“When people pile up debts they will find difficult and perhaps even impossible to repay, they are saying several things at once. They are obviously saying that they want more than they can immediately afford. They are saying, less obviously, that their present wants are so important that, to satisfy them, it is worth some future difficulty. But in making that bargain they are implying that when the future difficulty arrives, they’ll figure it out. They don’t always do that.” – Michael Lewis – Boomerang

The manner in which our leaders are governing the country and citizens are living their lives can only be considered normal in relation to residing in a profoundly abnormal society. The American Dream of having the opportunity for upward mobility through educating yourself, working hard, accumulating wealth methodically by spending less than you earn, and reaching your full potential as a caring loving human being has been replaced by a perverted nightmare where we run on a hamster wheel for our entire lives trying to achieve the new American dream of accumulating throw away material goods, working to make the payments for McMansions, SUVs, stainless steel appliances, and iGadgets you rent from bankers, while driving yourself into an early grave by consuming mass quantities of processed poison and the stress created by trying to achieve the lifestyle sold to us by Madison Ave. maggots, Wall Street shysters and the mainstream media propagandists. The corporate fascists tell you what to believe, which “enemy” to fear, how you should look, what to eat, what drug to take for the illnesses caused by the food they lured you to eat, the kind of house you need to impress your friends and family, and the car you need to drive to impress your neighbors. As George Carlin aptly pronounced: “It’s called the American Dream because you’d have to be asleep to believe it.” – either asleep or insane.

“Normal is getting dressed in clothes that you buy for work and driving through traffic in a car that you are still paying for – in order to get to the job you need to pay for the clothes and the car, and the house you leave vacant all day so you can afford to live in it.” – Ellen Goodman

Our profoundly abnormal society of materialistic zombies, who mindlessly obey the commands and marketing messages of the financial elite, has staked their futures and the future of the country on the wisdom and brilliance of an Ivy League academic who never worked a day in the real world, didn’t spot the largest fraudulent housing bubble in world history, and whose unlawful acts as Federal Reserve chairman have enriched the banking whores who destroyed the country and impoverished what remains of the dying middle class. It’s the height of insanity for the American people to trust these crooked high priests of finance to cure a disease they spread with their immoral, traitorous policies over the last century. Bernanke and his lackeys, in a desperate last gasp gamble to prolong their fiat currency pillaging of the peasants, have rolled the dice with QE to infinity, accounting fraud, and further enrichment of their corporate masters.

“Viewed as a religious cult, modern finance revolves around the miracle of the spontaneous generation of money in a set of rituals performed by the high priests of central banking. People hang on the high priests’ every word, attempting to divine the secret meaning behind their cryptic utterances. Their interventions before the unknowable deity of global finance assure them of economic recovery and continued prosperity, just as a shaman’s rain dance guarantees rain or ritual sacrifice atop a Mayan pyramid once promised a bountiful harvest of maize.” – Dimitri Orlov – The Five Stages of Collapse

Bernanke will eventually roll craps. When he does, the collapse will be epic and 2008 will seem like a walk in the park. In Part 3 of this article I will speculate on the timing, scope and consequences of the coming collapse. It’s not going to be a happy ending, especially for the existing social order.

[img [/img]

[/img]

The Mafia is more honest than the US government. The Mafia doesn’t kill women, children, & innocent old people. They also keep their word, don’t tax U to death, & run balanced budgets.

Well, that’s what I’ve heard…

A great rant. I love it.

My only quibble: the FDIC could not have covered the losses in any way, shape, or form back in 2008 or today. It is completely and totally reliant on an insolvent government which is reliant on a bankrupt citizenry.

The shit storm is going to be epic. Epic!

Excellento followup Jimbo! Goes up tomorrow on the Diner.

RE

http://doomsteaddiner.net

Here is the musical version of the prose article.

Brahms symphony #4 [1885]

Morality, work, joy, pleasure, hope, life –> conflict, despair, warfare, death, destruction, collapse,

Great music is great for a reason.

So I was look at the devaluation of the dollar chart at the beginning. I had never noticed before that the dollar vastly started losing value during the WW1 and had the steepest decline while the US was involved in under handed trade to Europe. After the war we lent money to Germany. It wasn’t until the Wiemar hyperinflation began that we started to see the dollar get stronger. The only rising of valuation of the dollar was in 2 years. That was after the stock market bottomed out. Even o everybody except the US.

Every declining part of that chart is market by a new war over seas. Korea, Vietnam, Nicaragua, and then we see 30 years of the worse foreign policy beginning in 1983.

Creation of the FED and Bretton Woods only made our over seas conquests possible. Thanks old dead men who are gone and don’t have to suffer the consequences.

Admin – thanks for the article! It is going to take a lot of study to appreciate it in full.

I have recently been seeing much more clearly what has happened re the financial system, and these thoughtslarge echo what you said about reasons for the existence of banks. I believe that a bank’s first purpose is to hold my money for me, to make it easier for me to go about my life. For many a long year, they used this money to make loans for the purchase of hard assets, or for capital equipment, etc. The loans they made were backed up by hard assets, and so, for the most part my money was always secured by hard assets. In a falling hard-asset market, I could lose money, but my purchasing power remained relaticely intact. Banks shifted from loan against hard assets to loaning for consume-goods, to betting on all kinds of risky ventures, etc., and so my money is no longer secured by hard assets, and bak deposits are seriously at risk.

Banks should simply not be allowed to loan money against anythig but hard assets. If someone wants to be in the credit card business, for instance, they should raise capital to be in that business. They simply should not be allowed to make risky loans with bank deposits. It is the road to ruin, and we are too far down that road to recover, I am afraid.

It is this willingness to make unsecured loans that has seen consumers enter into wildly unsustainable patterns of debt. It will end in tears. As will the governments promotion and implementation of the welfare state.

In the article, you say “By driving real interest rates below zero for the last four years, Bernanke has stolen $400 billion per year from senior citizens living on the edge and transferred it to bloodsucking bankers.” Respectfully, I have to disagree with this set of facts.

There are some 40 million + seniors in the US. That figure of $400 billion, if a 5% interest rate loss is assumed, would imply that on average the seniors have $200,000 in interest bearing assets. They simply do not have such assets. The median assets held by over 65s is currently around $170,000. However, that figure includes housing. The median net worth excluding housing is around $28,000 per year.

Now, I am sure that bankers have had a lot to do with driving down the value of all assets. But fact is, low interest rates are not depriving the average granny/grandpa of $10,000 each. The number is more like $1500 each, and the total of lost interest would be more in line with $60 billion and not $400 billion, again assuming inteest rates are 5% below what they should be. I am not certain they are 5% below long-term averages. I think a reasonable return is in the 6 to 7 percent range.

[img [/img]

[/img]

Fact is, granny simply has saved very little during her lifetime, on average, and has caused a lot of damage to herself by failing to properly prepare for her dotage. Granny has to wear the lion’s share of her distressed position.

Excellent, well laid out and presented article! Not sure why Mr. Orlov seems to take exception to this site, but I find it refreshing and challenging yet informative and sometimes combative. In other words, it’s not a “run of the mill” site and that’s what I like about it. Keep up the good work and I’m really looking forward to Part 3!

Sorry ’bout that. Trya gain for that chart of interest rates.

[img [/img]

[/img]

“Not sure why Mr. Orlov seems to take exception to this site”-OH

Dmitry has a low opinion of everybody in the Collapse Blogosphere except Dmitry.

RE

Like some others. Hope all is well.

This was even better than part 1. I can’t wait for part 3.

Is there a part 3 ?

Old Buck

As soon as I write it.

LLPOH

People are receiving $400 billion less interest income today than they received in 2008. I probably should have said Seniors & Savers, but it is senior citizens who lived on a fixed income that have been screwed the worst by Bernanke.

I don’t think you can necessarily blame Bernanke for reduction in Interest Income.

Interest can only be paid off in a GROWING economy. If the economy is in fact shrinking, then you cannot pay interest.

All signs are that the economy is undergoing “negative growth”, which is just Newzspeak for Contraction. The economy developed during the Industrial Revolution has been completely dependent on extraction of Fossil Fuels at ever greater rates of consumption.

Plateauing of Extraction rates is evident on all the charts, going back at least to 2007 or so. Beyond that, you are seeing Demand Destruction across the board, consum[tion rates for Gas here and in Eurotrashland are falling rapidly, people simply cannot affor to buy the stuff at the prices it is going for.

CB ZIRP policy is a reaction to the fact that there is no real growth occurring here in consumption, because it CANNOT grow. The cheap energy necessary to keep it growing simply is no longer available.

RE

ZIRP was theft from savers and put into the vaults of the criminal banks, who used it to invest in the stock market and pay themselves bonuses. Growth or no growth doesn’t matter. We’re talking hard cash that was going into the bank accounts of little old ladies in 2007, but is not anymore.

It’s that simple.

Admin – thanks. I for one am receiving a shitload less. I long ago abandoned stocks, even tho I would be making a killing now. I just expect a major collapse in the Dow to come – it is long overdue seems to me.

You have packed tons into this one, and I will need a lot of time to digest this sucker. Really well done. As above, I get angry every time I think about banks using my money tomake non-secured loans. What evil bastards. That should be the provence, and only the provence, of folks using their own money. To use deposits to make those unsecured loans should be a hanging offence.

And to all you dicks giving me thumbs down on my first post, please note the Admin says I am right, in his own, roundabout way. Hell, that is as close to apologizing/outright admitting he made a mistake as he will ever come. I am gonna print out this page and have it framed. I do not care if it was simply a typo or just too much literary license. I am so happy I could just spit.

ZIRP is a reaction to No Growth. It does prevent savers from earning interest on savings, but thing is there is no interest to earn in the real sense. The economy is shrinking. You cannot pay interest when investmenst are losing value, that is an impossibility. It is remarkable in fact that Zero Interest has kept the system floating this long. Really at this point, you should have Negative Interest.

RE

Bond Losses at Federal Reserve Top $192 Billion

Ron DeLegge, Editor

August 2, 2013

The yield on 10-year U.S. Treasuries (^TNX) has surged 66% over the past three months. And bond investors, especially those with jumbo-sized positions, are getting hammered. How much money has the Federal Reserve lost?

At the end of July, the Federal Reserve held $1.98 trillion in U.S. Treasuries. (See chart below) That figure represents just over half of the Fed’s $3.6 trillion balance sheet.

Scott Minerd, the Global Chief Investment Officer at Guggenheim Partners notes:

“Our estimate shows that the spike in bond yields since the first quarter of this year has caused a mark-to-market loss of $192 billion on the Fed’s holding assets, equivalent to approximately all of the unrealized gains that the Fed had accumulated since it began to implement quantitative easing in late 2008. Although in keeping with their own accounting principles the Fed does not record mark-to-market losses, a continued increase in bond yields would incur actual losses should the central bank decide to sell assets.”

Investments benefiting from rising rates are leveraged short Treasury ETFs like the ProShares UltraShort US Treasury 20+ Bond ETF (NYSEARCA:TBT) and the Direxion Shares US Treasury 20+ 3x Bear Shares (NYSEARCA:TMV). Both ETFs have jumped between 30% to 50% over the past three months. Not bad when considering the total U.S. bond market (NYSEARCA:AGG) has lost 2.83% while long-term U.S. Treasuries have fallen an even harder 11% year-to-date.

AUDIO: “The Lance Armstrong of the Investment Business”

Granted, the Bernanke & Co. does not value its massive bond portfolio on a mark-to-market basis. But the surge in interest rates has already erased almost $200 billion in the Federal Reserve’s capital. But that’s not all.

If interest rates continue to head higher, the value of the Fed’s liquid assets that it could sell would decline and further undermine its capital cushion. And if the velocity of rate increases intensifies, the Fed, with only $62 billion in capital, could see its entire capital base completely wiped out.

This could have a serious domino effect. It could paralyze the Fed’s ability to defend the dollar’s purchasing power, causing Treasury prices (NYSEARCA:TLT) to fall further and thereby push interest rates even higher. Just imagine the unimaginable; a weakened and impotent Fed.

Admin,

Enough of the sugar coating, say it like it really is!

llpoh,

i got exactly what you were saying (which is why i gave you a thumbs up). for what it is worth, some people thumbs down when a graph or pic isn’t sized so it can be viewed (has happened to me on occasion), we are a bunch of finicky STM’s

i think a lot depends on what “seniors” we are talking about. my grandmother came from Greece, my grandpa was a HS dropout and went into the navy and they lived meagerly (other than constantly buying lottery tix) while she worked odd and end jobs after the kids got a little older and she has been sitting on a perpetually depreciating $800k for a while now (she rents an apt and is likely an outlier with those assets). and then there is her son (my pops) who receives a federal pension in retirement and has less than $100k in the bank adn lives in a $380k house.

the ones really getting screwed today are the ones that experienced the great depression on some level because they saved for a rainy day. i fear many of the people entering “senior” status haven’t experienced a truly rainy day but it is coming and it won’t be kind.

i also agree with the initial comments on banks, i think the whole idea of fractional reserve lending needs to go the way of the dodo. just like naked short-selling, selling or loaning of products or capital you don’t own is 100% fraud and should be prosecuted as such.

admin,

i’ll be posting this on The Strangest Brew later today and am looking forward to part 3. I hope it includes something like this for the peeps like Bernanke.

[img [/img]

[/img]

1. Teddy Roosevelt was no Big Trust Buster. In fact, his was arguably (and Woods argues it well) the first “Modern Presidency.”

2. The Fed didn’t cause a credit contraction in 1930-32. Milton Friedman’s position that it did so is spectacularly at odds with the actual facts during that time. The Fed was desperately trying to stimulate more borrowing and spending during the 1930’s. It all failed. The Fed can only create credit when people oblige. They didn’t, so the Fed was impotent.

3. The “excess reserves” on bank balance sheets are simply debts to the Fed. The Fed is unlikely to just “take a beating.”

4. You nailed it in the comment on how much the Fed is LOSING as interest rates rise. The Fed has had 4 waves of QE, the largest of which has been running since last fall. Interest rates have been CREEPING HIGHER since a year ago.

The Fed does not control interest rates.

The Fed does, however, get its ass handed to it when rates rise on the trillions of dollars of debt on its books.

Think the Fed will continue to QE (i.e., accept more and more and more bonds onto its balance sheet) even as bonds sink, sink, sink in value?

I doubt it.

Somewhere along this reversal of a 3 decade trend toward lower rates the Fed will be FORCED to stop QE’ing, and then Katy Bar The Door!

Bonds collapse in value, shrinking the credit component of the money supply.

This is exactly what occurred in 1930-1932, only this time the credit overhang is a thousand times higher than 1930.

Harry P, Everyone has been induced to trust “the system.”

Anyone literally saving their cash under the mattress has been crucified.

This has been a naked plan to push everyone’s wealth into the “on the books” system where it can be taxed, seized, attached, confiscated, or bled in myriad ways.

Wealth that is not on someone else’s ledger horrifies the People Controllers. This is why constant debasement of the money supply has been the goal for a lifetime.

Even people who are worried about stocks today just put their money in a bank….and all the banks remain insolvent on a mark-to-market basis.

What if that great Cornucopia of All Things, the FedGov, can’t make good on FDIC insurance? What happens if the USA’s central bank does the same thing as the EU’s, and in order to make the central bank’s books whole they “bail in” from everyone’s bank accounts?

Never in living memory have more processes been arrayed to rob people of their life’s savings and force them into perpetual dependence on the political system.

Well said. I believe we are in the hands of “respectable” gangsters. The system has been corrupted.

see links below:

http://graysinfo.blogspot.ca/2013/07/are-these-some-of-respectable-gangsters.html

http://graysinfo.blogspot.ca/2013/07/herding-serfs-into-new-world-order.html

http://graysinfo.blogspot.ca/2012/12/are-we-seeing-institutionalized.html

http://graysinfo.blogspot.ca/2013/02/the-international-community-of-gangsters.html

I just received an email from my new server company telling me that someone attempted to hack into TBP today.

I guess the NSA/Fed doesn’t like the tone of my article.

What if that great Cornucopia of All Things, the FedGov, can’t make good on FDIC insurance?”

They can’t.

What happens if the USA’s central bank does the same thing as the EU’s, and in order to make the central bank’s books whole they “bail in” from everyone’s bank accounts?

Do over…..

dc wrote:

“What if that great Cornucopia of All Things, the FedGov, can’t make good on FDIC insurance?”

They can’t. Not if the whole system collapses. Approx. $10 Trillion in deposits and approx. $42 Billion in the FDIC fund.

“What happens if the USA’s central bank does the same thing as the EU’s, and in order to make the central bank’s books whole they “bail in” from everyone’s bank accounts?”

Then I will probably say to my hubby: “I told ya so.”

When I checked my bank account this morning is contained the princely sum of $5.84. I’ ve been layed off at least 3 times from companies that I thought I’d retire from. I live in a 950 square foot house on a hill and own two 20 year old cars. I’m not complaining, some people are just born smarter than others and are able to make more money, however I seem to be caught up in the squeeze between the current system that wants more of my blood and yet continues to wreck the economy, and the coming system that will consider me an old parasite and want to turn me into Soylent Green. And I’m quite sure I won’t taste good either.

Admin, For all the time and effort you put into this piece, thank you for Part 2. Excellent essay eloquently articulating from many angles what TPTB have done, are doing, and what they hope to continue doing. Awesome writing with artful word choice, charts, pictures, statistics, quotes, html, logic, and vision. You put your ♥ & soul in this one! A++

The Purchasing Power of the Dollar 1913-2013 pic/chart is a blaring alarm going off.

♥ for the Pyramid Scheme pic – with the pyramid from the dollar; the metaphors for the pyramid of debt and the unaccountable cabal of private banker pharaohs.

♥ As George Carlin aptly pronounced: “It’s called the American Dream because you’d have to be asleep to believe it.” – either asleep or insane.

crum,

great comment, shit’s probably gonna get real, relatively soon but being able to live off what you got actually gives you an advantage for what is coming.

just pray it doesn’t go down tomorrow, because tomorrow is tuesday and you know what tuesday is, right???

[img [/img]

[/img]

I read it. Still absorbing it. There isn’t any new information really here, but the presentation is very…

in your face.

I’m tired man, and only at the age of 27. I think I would have been happier if I would have just stayed on the farm and became a farrier.

The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.

-Ernest Hemingway

We think that generations move history along and prevent society from suffering too long under the excesses of any particular generation. People often assume that every new generation will be a linear extension of the last one… Instead, every generation turns the corner and to some extent compensates for the excesses and mistakes of the midlife generation that is in charge when they come of age. This is necessary, because if generations kept on going in the same direction as their predecessors, civilization would have gone off a cliff thousands of years ago.

– Neil Howe author of The Fourth Turning

There are two broad issues affecting banking. One of them is the structure of the banks themselves, of the industry. The other is the rules, if you like, under which the banks operate. There was a big opportunity to change the structure of the industry. The FDIC is actually quite good at taking over banks and resolving them. In the case of small banks, what they usually do is merge them into bigger ones, find partners, so that the insurance fund isn’t touched at all. In the case of larger banks, it’s more complicated. You have to rip it up—sell it, close parts of it; you might have had to touch the insurance fund. But the result would have been a smaller overall banking sector in relation to the economy, achieved very quickly. And some part of the leadership class of bankers would have been gone, on the beach, replaced by middle managers and bankers from elsewhere who were not implicated in the same practices. And the result of that would have been a clean audit of the books of the taken-over bank—a straightening out of all kinds of practices that banks should not be engaged in anyway. Regulatory arbitrage, tax arbitrage, would have been a much smaller piece of the business—the government is not going to run a bank that’s in the process of facilitating tax evasion, just for example (at least one hopes).

– James Kenneth Galbraith

“I think we are going to see a series of bankruptcies. I think the rise in interest rates is the fatal sign which is going to ignite a derivatives crisis. This is going to bring down the derivatives system (and the financial system). There are (over) one quadrillion dollars of derivatives and most of them are related to interest rates. The spiking of interest rates in the United States may set that off.”

-Hugo Salinas Price

Articles like this is why I continue to prep.

Admin, kudos and thanks for putting together a great article. A big part of why I visit this site (other than to laugh off Llpoh’s feeble attempts to get under my skin) is to get a perspective on things that starts from a different vantage point than my own.

One thing I’ve noticed over the past several years of depending mainly on well-researched non-MSM sites and sources is the way that MANY people are looking at events from different perspectives (right, left, libertarian, communitarian, socialist, capitalist) and reaching almost identical conclusions. I don’t know whether to be encouraged or discouraged by this. On the one hand, it’s encouraging to see non-MSM voices of multiple perspectives coalescing around the reality that, to put it bluntly, shit is fucked up and shit. On the other hand, it gives a pervading sense of dread to realize that if people coming from the left AND the right see it that way, then shit must be REALLY fucked up and shit.

The more I’ve looked into this, I’ve come to agree with the likes of Morris Berman, John Michael Greer and, to an extent, Dmitry Orlov. The only way to really thrive to the maximum extent possible as all of this goes down may be to take a monastic approach of preserving all of value that you can, and linking up with and combining efforts with those who want to do the same. A large part of this kind of approach, especially in a world of diminishing energy and material resources, is to accept a life of material/financial poverty. Because when you have to choose between pursuing money for the sake of getting a new gadget or pursuing knowledge to preserve and even revitalize important artisan skills, the second path does not tend to open a path to financial/monetary riches.

I also think that Charles Eisenstein is on to something with his advice to look at yourself as a conduit to spread surplus wealth around in order to create circles of gratitude (the basic foundation of a gift economy) rather than trying to accumulate it out of a sense of scarcity. Orlov riffs on this as well. Since TPTB control the game, they make the rules — and for those of us who are counting on a nest egg to see us through — whether that takes the form of cash, stocks and bonds, large land holdings, even precious metals — we may end up gravely disappointed when it evaporates in front of our eyes as the rules are suddenly changed.

And yet, as much as I have come to feel these things in my bones, I cannot bring myself to take the leap necessary to withdraw from these systems, because I have just been so conditioned over 40 years to accept them as the way things are….

At times like after reading this article, when my head is throbbing from another whack of the doom and gloom that is before us, it’s time to pick up my scythe and go mow for a while. Everything looks and feels better after a half-hour or more of swinging that razor-sharp blade and seeing the grass go down without so much of a hum from and engine or a whiff of gasoline….

Please tell us what you really think and quit holding your thoughts back!

@The Dude – I trim our hedges with a machete I keep nice and sharp, and well oiled.

The neighbors look at me like I’ve grown a second head, and the local hang out spot full of teenagers just kind of stare, but its certainly therapeutic.

I also demo’d my driveway and parking pad using nothing but a sledge hammer and a crowbar. Again, more stares, and the teenagers just stared slack jawed.

I told my wife if one of them had the nuts to walk over and offer help I was going to pay him $15/hr, but they all just stayed on their own side of the street.

@ TPC — One of the best things about not relying on power tools for yardwork that I’ve found is that it’s better than a gym membership. I don’t have a tractor and thought about getting one for a while, but then I realized I’d lose out on all the great exercise I get hauling mulch and wood chips by the wheelbarrow.

I’d rather spend my hours mowing with a scythe, hacking brush with a machete, hauling shit by wheelbarrow, splitting firewood with a maul or axe, and digging postholes by hand with the sun on my face that just about anything else. Definitely more than driving to a gym to run on a treadmill while watching the Kardashians on TV.

Admin wrote:

“I guess the NSA/Fed doesn’t like the tone of my article.”

Well the monkeys like it just fine.

U-no-who ES.

Admin: ” I just received an email from my new server company telling me that someone attempted to hack into TBP today.”

Does your server company have the capability of tracking the source of the “attempted hack?” I bet it costs extra! Bastards!

Admin, Hugo Salinas Price is correct, I think.

If (IF) the derivatives market implodes, blows up the TBTF banks beyond the orbit of Neptune and far beyond the possibility of “bail-out,” and the value of outstanding treasury debt (and muni’s, etc.) falls as fast as debt collapsed from 1929 to 1932, then there are but two paths in the immediate aftermath:

1) we go to barter, and a two-month period of mutual slaughter ensues as hungry people are eaten by hungrier people who have fewer scruples, or

2) we continue to see the dollar used as money, and those who retain access to banknotes (cronies of the gov’t, banksters, drug lords, and people stuffing mason jars with 20’s) will be the “haves,” and those who thought credit (cards, bank loans, and deposit accounts) was permanent will be the “have-nots.”

I’d rather avoid the Zombie Apocalypse and go with Door #2.

I expect dollars to rise in purchasing power (reversing your graph), prices for most things to collapse downward, debtors to be wiped out, then lenders to be wiped out, and ultimately even people who thought they were being conservative (eschewing stocks in favor of lousy CDs or Muni funds) to be crushed.

I think I need to open a firm that builds Zombie Apocalypse Shelters.

Great stuff James. Bout time to buy some more silver & lead.

Dupe – I have just been screwing with you for fun. Jury is still out on you. If i really wanted to get after you, you would know it. You have made one really ignorant post, which is why you blipped up on the radar. Maybe you will survive. We will see.

I am going to have to go check if Admin stole in like a thief in the night to amend his little typo. Normally that is his way, then he posts some comment about how I am going blind, senile, and that my syphilis needs treatment as he then claims to have never posted such a thing. Gotta give him credit – he is quite devious when needs be.

will be looking forward to part 3 Thank you

“The contemporary criminal class (in the U.S.) wears Hermes suits, Rolex watches and diamond studded pinky rings, drops $500 to dine at Masa in NYC, travels by chauffeured limo, lives in $10 million NYC penthouse suites, occupies luxurious corner offices in hundred story glass towers, and spends weekends hobnobbing with the other financial elite at their villas in the Hamptons.”

—-Admin, in his opening remarks

That’s an accurate description of the founders of Colombia’s Cali drug cartel in the 1980s and 1990s. They were the most intelligent global criminals in history. You just need to substitute the names of Lloyd Blankfein and his ilk.

Australia’s unclaimed money …

Somewhere in the dark past of the land of oz, the federal government decided a seven-year limit on accounts not claimed. Bank accounts, superannuation, insurance, shares, etc.. Oh no, that wasn’t good enough for a government which promised a surplus and only missed by $30.1 billion. So they dropped that to a three-year figure.

No account transaction in three years and the Australian Securities and Investments Commission slurps it. $677 million up for grabs.

One of the first lootings was from ‘guest worker’ superannuation funds. I guess those that went back home assumed there was a safe nest egg waiting for them after age 65.

Kris Sayce, writing in The Pursuit of Happiness: “The money goes straight from the Australian Tax Office (ATO) into the government’s consolidated revenue.

In other words, the government spends it.

Naturally, it hopes savers never ask for their money back. That way the government gets money for free (even though it has to mark it as a liability on the books).”

~~~

Canberra is happy to expend much on hammering smokers (even thought only 20% of the people use tobacco and it brings in twice the annual revenue of the alcohol tax.) They advertise a Quit campaign and if everyone did, it’d be another $6 billion annual revenue ‘lost’. But they were a bit more silent about the three-year change …

http://www.news.com.au/money/cost-of-living/family8217s-anger-as-leonard8217s-secret-fortune-claimed-by-the-government/story-fnagkbpv-1226690750065

[snip]

… covertly accumulated an extraordinary $2.42 million. The hard way. There was no Lotto win. There was no inheritance.

Just scrimping – he serviced his 1992 Ford Laser himself until his passing. And saving – every spare cent of his Sydney Water Board wage was invested with care.

“He went without on a daily basis,” said grandson Mark, who asked that his surname also be withheld.

Mark had no idea “Pop” was a millionaire miser. Nor did the rest of the family until after his passing.”

~~~

I had various employment and paid into superannuation but when I went looking for my ‘lost super’, none could be found. Two firms succumbed to hostile takeovers, one went bankrupt, etc. and I wonder where my money went? Probably a lot of disconnect the dots along the way.

Excellent analysis in this article above. I enjoyed the poetry in the expression of the PROBLEMS.

Of course, when it comes to “solutions,” those are extremely problematic, since, as everyone who looks at history expects, (and as was expressed in a quote from Hemingway in an Administrator comment above) WHEN this runaway debt insanity causes itself to collapse into chaos, we are practically guaranteed to get death insanities, in the form of more genocidal wars, along with democidal martial law … Those will probably become so extreme that is is practically impossible to be “prepared” for them …

My THEORETICAL notions about how we should think about this, inside of the current context, as well as the most probable contexts of collapsing into chaos, wars, and martial law, probably have no practical point. But nevertheless, I will state some of my points of view regarding the ideas which “should” enable us to resolve these problems better, and therefore, with better understanding, and so, maybe mitigate the coming collapse, and build something better thereafter?

My basic view is that

EVERYONE has some power to rob and to kill …

GOVERNMENTS are the assembling channelling

of the power to rob, and to kill to back up robbery,

i.e., taxation, that drives its fiat money to fruition.

The basic history was War Kings, making the states,

whose “sovereign powers” were covertly taken over

by the Fraud Kings, biggest gangsters or banksters.

HOWEVER, no good solutions can be built on top of

refusing to face the basic facts that EVERYONE IS

basically operating as a robber, while the big banks

were simply the ‘best’ at organizing their robberies,

while others were brainwashed to not understand,

and moreover, to NOT WANT TO UNDERSTAND.

Therefore, I find NO ideologies or religions,

that I am aware of, being scientific enough.

INSTEAD, I regard things through BASIC AXIOMS that

there is & must be combined money/murder systems!

I regard “money” as being measurements backed by murder.

That exists both in the practical short-term,

as well in the theoretical, longer terms too!

In the short-term, the banksters dominate the systems NOW

because of the history of their applying the methods of basic

organized crime, in order to take control of governments.

In the longer term, political economy is inside human ecology.

The death controls are the central concept in human ecology.

The debt controls are, and must necessarily be based upon

the death controls, or the murder systems, backing them up.

The basic problems we face were always inherent in the package deal of militarism, where success was based on deceits, and spies were the most important soldiers. The ONLY thing that is different is that advances in science and technology have made us become trillions of times more powerful, and able to use information … BUT, those capacities were primarily channeled to get better at being dishonest and backing that up with violence.

The emergence of the current systems run by the Fraud Kings, through their central banks, was implicit in the emergence of the War Kings before them. The PROBLEM was always that short-term success was achieved through deceits, backed by destruction. Those who were best at doing that prevailed. Governments were created in the crucible of conflicts, whereby the sovereign powers of states were based on organized lies, operating organized robberies. Those powers were covertly taken over by the best organized and biggest gangsters, the banksters.

In the short term, it was practically impossible for anyone else to stop those who were the best at being applying the methods of organized crime from taking control over civilization. Indeed, civilizations were ALWAYS built by those who were the previously best at doing that. However, all of those triumphs are inherently problematic, because they are based on the “success” of legalized lies, being backed by legalized violence. That violence can never make those lies become true. THAT is the deeper driving force for WHY our society has become more and more insane, and is therefore headed towards a series of psychotic breakdowns.

We are looking at the paradox of final failure from too much “success.” Each short-term increment of the success of backing up lies with violence creates a system of social lies which becomes more and more insane, and further removed from more objective facts about the realities in which those triumphant lies are operating!

Just how deep this problem goes is difficult to overstate! When considering the quote from Edward Bernays presented above in this article, remember that Bernays lived a long life, dying at the end in a comfortable state of wealth, made from effectively promoting political and commercial lies. HOW and WHY did Bernays, and his kind, become so successful? To quote from contemporary popular television culture, Bernays was a kind of scientific Mad Man, who prepared the way for a host of subsequent “Mad Men,” as in the TV series with that title, who were like cave men in suits.

I recommend a much deeper kind of scientific revolution is theoretically necessary. Specifically, I would point out that everything we understand today tends to be understood as energy systems, however, our basic concept of entropy is BACKWARDS, and therefore, pretty well everything we understand backwards, and indeed, we tend to be living inside of a Bizarro Mirror World Fun House, where EVERYTHING tends to systematically be proportionately backwards and distorted.

When thermodynamics was first developed, the entropy equations that emerged gave the measurements of power negative values. Those doing that did not like it, and therefore, they inserted an ARBITRARY minus sign into the entropy equations, so that their measurements of power would end up being expressed in positive values. When thermodynamics was extended to become information theory, the same entropy equations extended the same profound philosophical error, which reversed the meaning on entropy, and therefore, pretty well reversed the ways that we understood all energy systems.

The vast majority of psychology has actually been employed to make people become more insane, rather than become saner. Most of the money spent on taking advantage of the science of psychology was spent to drive people to become crazier, or to take more advantage of their weaknesses, rather than enable them to overcome their weaknesses.

The only genuine solutions should be based upon better dynamic equilibria between different systems of organized lies, operating organized robberies. The PROBLEM is that false fundamental dichotomies, and their related impossible ideals, have been too successfully brainwashed into becoming the beliefs of too many people. Therefore, the best professional liars and immaculate hypocrites have been able to gain too much social power. The DEEP PROBLEMS of civilizations go back to the inherent paradoxes of militarism, where warfare was the oldest and best developed social science, BUT, success in warfare was based on deceits!

We are STUCK muddling through the madness that society ended up being controlled by its most labile components, which were the people that were the best at being dishonest, and backing that up with violence. Human civilizations are energy systems which go down their own paths of least resistance, which, in human terms, are their paths of least morality. Organizing resistance to change what those paths of least resistance become is a good idea. However, that should be based on more radical truths, which appreciate HOW and WHY our society became based upon the triumphs of huge lies, backed up with lots of violence.

The PROBLEMS are that the contradictions between advances in other sciences, like physics and biology, are NOT matched by any commensurate advances in political science, because we deliberately refuse to become any more thoroughly scientific about ourselves, since, IF we tend to do that, we discover that our whole society is being controlled by the best professional liars and immaculate hypocrites, and there are deeper reasons for how and why that happened!

Attempts to understand our civilization tends to plunge us through an infinite tunnel of deceits … How far down the rabbit hole does Alice go? How far up the tornado does Dorothy go? To what degree can we understand our current Bizarro Mirror World by going through the looking glass?

In my opinion “TRYING TO STAY SANE IN AN INSANE SOCIETY” takes us through the THE PHILOSOPHY OF SCIENCE, to generate paradigm shifts there which SHOULD be applied to POLITICAL SCIENCE. In my opinion, this article does a GREAT JOB of presenting the problems, but does not go deep enough to deal with them in sufficiently better ways …

Of course, given that the real driving forces to try to fix these problems will be that our civilization will be collapsing into chaos, due to the paradoxes of final failure from too much “success” at controlling itself with force backed frauds, it is quite impossible to predict how bad that crazy collapse is going to get, and so, whether there will be any possible good resolutions then ???

Crum says:

“want to turn me into Soylent Green. And I’m quite sure I won’t taste good either.”

bob tastes funny

Blair – I have not as yet read yor post, as I got sidetracked by hitting your name so as to see what site you are affiliated with. For the love of god, I sure as hell hope SSS does not hit that button and research your position. Oterwise, you are doomed. Seriously, if I were you, I would be digging a bunker even as I type this.

SSS – take a gander at old Blair’s affiliated site. We are all waiting for your response.

I will get the popcon ready. This should really get interesting.

Llpoh, I couldn’t make it half way through Blair’s post. After taking your advice and checking him out, it all became very clear why.

He and WHD should get together.

Admin, really good doom post.Maybe you should write a book on the subject.

Blair

I admit I had to read it twice but I appreciate what you wrote.

Deceit joined with the desire for power and the ability and willingness (freewill) of individuals and groups to use deceit to achieve, maintain and enhance power over the rest of us is as old as civilization.

Apparently its reached a tipping point of sorts where all the compounded deceits cannot be walked back and chaos is unavoidable – yet without a thorough understanding of the “energy systems” of humanity, the how and why behind the inevitability of deceit winning, we are destined to repeat the process.

Human civilizations are energy systems which go down their own paths of least resistance, which, in human terms, are their paths of least morality.

But if freewill is acknowledged then perhaps the “path of least morality” is not a given?

Perhaps progress of our species includes moral evolution?

The desire to control how others choose to use their minds, to expand their consciousness is ALSO as old as civilization – and perhaps it’s because deceit is more obvious when an individual makes the effort to step back, to look at the big picture, to study the energy and entropy of the societal system and “sees” what the hell is really going on – and that is the last thing TPTB would like to see happen.

Thanks for taking my mind to higher place first thing in the morning.

And Admin – thank you for another great essay – I look forward to part III.

Admin,

I see David P still loves you on Zerohedge. He must sit up nights waiting for another of your posts so he can be first.

EF

efarmer

David Pierre leaves his beloved sheep whenever I post an article. He puts the insane in insanity. I picture him foaming onto his keyboard as he pounds away about his 9/11 drivel.

He desperately wants me to respond to his gibberish. I ignore him because he is nothing but a pitiful troll, filled with hatred and venom. That makes him even angrier.

He is now taking it out on the sheep.

Please keep writing, and I hope eventually your work will see a far greater audience.

Thanks.

Ron

Great article. This article reminds me of the book Equalize Now that documents the cynicism of the political elite. http://equalize-now.org/