John Hussman does his version of Mike Tyson’s – “Everybody has a plan until they get punched in the face.”

Everybody is an investment genius until the market turns south and the hammer comes down.

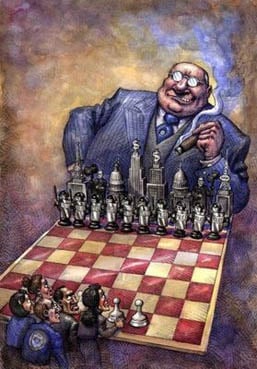

So yes, this time is different. It is different because the Federal Reserve’s zero-interest rate policy has starved investors of all sources of safe return, forcing them to accept risk at increasingly higher prices and progressively dismal long-term prospective returns. More importantly, this time is different because warning signs that appeared at every major pre-crash market peak have persisted and escalated, without resolution, far longer than they have done so historically. Reckless? Shortsighted? Probably. But like dot-com speculation, flipping overpriced houses, and getting a “yield pickup” by holding subprime mortgage debt on margin, reckless and shortsighted speculation always looks like enlightened investment genius until the hammer drops.

With the most reliable valuation measures more than 110% above their historical norms, on average (and allowing that numerous historically unreliable measures look just fine, as Janet Yellen will attest), we remain concerned that equities are no longer competitive even with a very long period of zero risk-free returns. Again, our broad measures of valuation imply a 10-year S&P 500 nominal total return averaging just 1.9% annually, and negative total returns on horizons of 7 years and less. Certain measures imply even worse, including the ratio of market capitalization to GDP, which Warren Buffett observed in a 2001 Fortune interview is “probably the best single measure of where valuations stand at any given moment.” The chart below shows that measure (left scale, log, inverted) against actual subsequent 10-year S&P 500 total returns (right scale).

Taken individually, we can find points in history where either market valuations, or bullish sentiment, or overbought conditions have been more extreme at one time or another than they are at present. Taken together, a syndrome of overvalued, overbought, overbullish conditions has uniquely identified the most extreme market peaks in history, and we’ve never observed this entire syndrome extended to more persistent and uncorrected excesses than we have in the present cycle.

The persistent amplification of overvalued, overbought, overbullish conditions appears much like games such as “Don’t Break the Ice” or “Don’t Break the Camel’s Back” – the latent risks increase progressively, but everything seems fine until it suddenly isn’t.

Read John Hussman’s Weekly Letter

Bank Bailout: Bankster Says Only Gun to Head Will Oblige TARP Repayment

“Banks that received billions during the Federal Reserve created implosion of the subprime real estate market say they are not obliged to make good on repaying the money.

From The Wall Street Journal:

Maryland Financial Bank, one of six banks included in the government’s auction this week of stakes it received as part of its crisis-era bailout program, enjoys an unusual luxury: It doesn’t have to make good on the money it still owes taxpayers.

The Journal reports when the TARP program “was hastily assembled in the frantic days of 2008, the government was interested in making sure the capital was widely available to banks of all sizes” and banks that issued noncumulative shares as repayment figured out how to delay and ultimately stiff tax payers.

The Towson, Md., bank, which received $1.7 million in the Troubled Asset Relief Program in 2009, is a beneficiary of a quirk that placed stricter rules on some recipients of financial aid than on others.

Specifically, some of the banks that received TARP money aren’t obligated to make good on dividend payments they have missed. That leaves the banks with a dilemma of either fulfilling their obligations to taxpayers at the expense of their own balance sheets, or keeping the money for themselves. Banks can protect themselves and their shareholders by skipping the payments. Shelling out optional payments to the U.S. government could even be interpreted as a breach of duty to shareholders.

Maryland Financial’s CEO, Robert Chafey, said only physical violence will force him to make good.

“We don’t have a gun to our head to pay this dividend, so why would we pay?” Mr. Chafey said in a February interview, according to the Journal.

http://www.globalresearch.ca/bank-bailout-bankster-says-only-gun-to-head-will-oblige-tarp-repayment/5387951

[img [/img]

[/img]