Ticking away the moments that make up a dull day

You fritter and waste the hours in an offhand way.

Kicking around on a piece of ground in your home town

Waiting for someone or something to show you the way.

Tired of lying in the sunshine staying home to watch the rain.

You are young and life is long and there is time to kill today.

And then one day you find ten years have got behind you.

No one told you when to run, you missed the starting gun.

I stumbled across two mind blowing charts yesterday that had me pondering how generations of Americans had frittered their lives away, spending money they didn’t have on things they didn’t need, utilizing easy to acquire debt, and saving virtually nothing for their futures or a rainy day. We are a nation of Peter Pans who never grew up. While I was driving home from work, one of my favorite Pink Floyd tunes came on the radio and the lyrics to Time seemed to fit perfectly with the charts I had just discovered.

We were all young once. Old age and retirement don’t even enter your thought process when you are young. Most people aren’t sure what they want to do for the rest of their lives when they are in their early twenties. Slaving away at your entry level low paying job, chasing the opposite sex, getting drunk, and having fun on the weekends is the standard for most young people. But you eventually have to grow up. Because one day you find ten years have got behind you. No one tells you when to grow up. And based on the charts below, tens of millions missed the starting gun.

I graduated college in 1986 and started my entry level CPA firm job, making $18,000 per year. I did live at home for a year and a half before getting an apartment with a friend. I was able to buy a car, pay off my modest student loan debt, go out on the weekends, and still save some money. I was in my early 20’s and had opened a mutual fund account at Vanguard. Anyone who entered the job market from the mid 1970s through the mid 1980’s, which would be the late Baby Boomers and early Generation Xers, had job opportunities and the benefit of low stock market valuations.

P/E ratios of the market were single digits in the late 70s and early 80s, versus 20 today. Dividend yields on stocks averaged 5% for the S&P 500, versus 1.9% today. The Dow bottomed out at 759 in 1980, while the S&P 500 bottomed at 98. A 20 year secular bull market was about to get under way. Baby Boomers and Generation Xers had the opportunity of a lifetime. Even after six years of the bull, when I graduated from college the Dow stood at 1,786 and the S&P 500 stood at 521. I had just begun to invest when the 1987 crash wiped out 20% in one day. It meant nothing to me. I didn’t have much to lose, so I just kept investing.

The 20 year bull market took the Dow from 759 to 11,722 by January 2000. The S&P 500 rose from 98 to 1,552 by March 2000. You also averaged about a 3% dividend yield per year over the entire 20 years. Your average annual return, including reinvested dividends, exceeded 17%. Anyone who even saved a minimal amount of money on a monthly basis, would have built a substantial nest egg for retirement. If you had invested in 10 Year Treasuries, your annual return would have exceeded 11% over the 20 years. Even an ultra-conservative investor who only put their money into 5 year CDs would have averaged better than 7% per year over the 20 years.

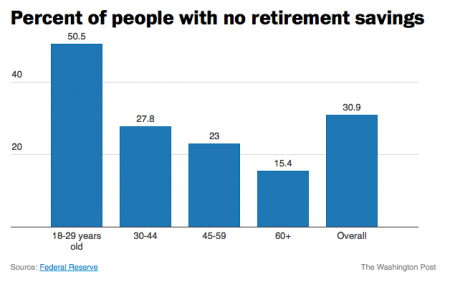

Even with the two stock market collapses since 2000, your average annual return in the stock market since 1980 still exceeds 11%. That’s 34 years with an average annual total return of better than 11%. Every person who had a job over this time frame should have accumulated a decent level of retirement savings. That is why the chart below is so shocking. Over 15% of all people 60 and older and 23% of people 45 to 59 years old have NO retirement savings. None. Nada. Zilch. This means 25 million Boomers and Xers are stuck living off a Social Security pittance and choosing between keeping the heat on or eating a feast of Ramen noodles and Friskies. It seems they let 30 years get behind them. They missed the starting gun.

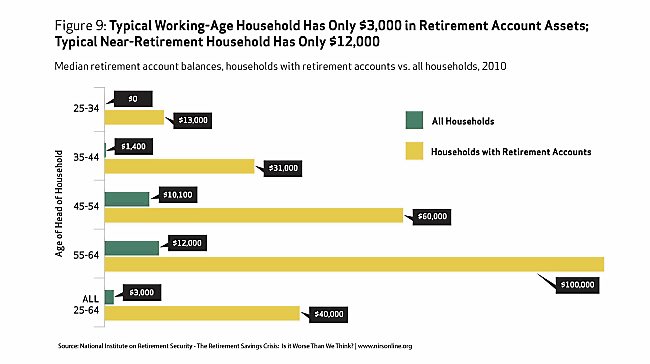

I’m not shocked that over 50% of 18 to 29 year olds have no retirement savings. With the terrible job market, declining real wages, massive levels of student loan debt, two stock market crashes in the space of eight years, and 4% annual returns since 2000, young people today have neither the means nor trust in the system to save for retirement. Their elders had no such excuse. Just a minimal amount per paycheck saved over the last 30 years would have compounded to well over $100,000, even at modest salary levels. It is disgraceful that 25 million people over the age of 45 have saved nothing for their retirement. Far more disgraceful is the median household retirement balance of $3,000 for all working age households. There are 122 million households in this country and 61 million of them have $3,000 or less in retirement savings.

The far worse data points are the $12,000 median retirement balance of aged 55 to 64 households and the $10,100 median retirement balance of aged 45 to 54 households. These people are on the edge of retirement and have less than one year’s expenses saved. There is no legitimate excuse for this pitiful display of planning. These people had decades to save, strong financial market returns, and if they worked for a decent size organization – matching contributions to their retirement accounts. They didn’t need a huge salary. They didn’t need to save 20% of their salary. They didn’t have to be an investing genius. A savings allocation of just 3% to 5% would have grown into a decent sized nest egg after a few decades of compounding.

We know from the data in the chart, it didn’t happen. The concept of delayed gratification is unknown to the millions of nearly broke Boomers and Xers, shuffling towards an old age of poverty, misery and regret. A 64 year old has a life expectancy of about 20 years. They’ll have to budget “very” frugally to make that $12,000 last. The question is how did it happen. I don’t buy the load of crap that you can’t judge people as groups. I judge people by their actions, not their words. I know you can’t lump every Boomer and Xer into one box. Individuals in every generation have bucked the trend, lived within their means, saved for the future, and accumulated significant nest eggs for their retirement. But the aggregate numbers don’t lie. The majority of those over the age of 45 have squandered their chance at a relatively comfortable retirement. These are the people who most vociferously insist the government do something about their self created plight. It’s their right to free healthcare, free food, subsidized housing, free utilities, higher minimum wages, and a comfortable government subsidized retirement. They are wrong. They had a right to life, liberty and the pursuit of happiness. It was up to them to educate themselves, get a job, work hard, and accumulate savings.

The generations of live for today, don’t worry about tomorrow Americans over the age of 45 have no one to blame but themselves. They bought those 4,500 sq foot McMansions with negative amortization 0% down mortgages. They had to keep up with the Jones-es by putting in granite counter-tops, stainless steel appliances, home theaters, Olympic sized swimming pools, and enormous decks. They have HDTVs in every room in their house and must have every premium cable channel, along with the NFL package. They upgrade their phones every time Apple rolls out a new and improved version. They pay landscapers to manicure their properties. They lease new BMWs every three years. They have taken exotic vacations on an annual basis. They haven’t packed a lunch for themselves since they were 16 years old. Eating out for lunch and dinner has been a staple of their existence for decades. That morning Starbucks coffee is a given. A new wardrobe of name brand stylish clothes for every season is a requirement because your neighbors and co-workers are constantly judging you. Nothing proves you’re a success like a Rolex watch, Canali suit, Versace boots, or Gucci handbag. The have it now generations got it then and have virtually nothing now because they acquired all of these things with debt.

Real cumulative household income is up 10% since 1980. Consumer debt outstanding has risen from $350 billion in 1980 to $3.267 trillion today. That is a 933% increase. We’ve had decades of faux prosperity aided and abetted by Wall Street shysters, corrupt politicians, mega-corporation mass merchandisers, and Madison Avenue maggots trained in the methods of Edward Bernays to convince willfully ignorant consumers to consume. And consume we did. Saving, not so much. You can blame the oligarchs, bankers, retailers, and politicians for the fact you didn’t save, but it rings hollow. No matter how much propaganda is spewed by the ruling class, we are still individuals with free will. The older generations had choices. Saving money requires only one thing – spending less than you make. Most Boomers and Xers chose to spend more than they made and financed the difference. When the average credit card balance is five times greater than the median retirement account balance, you’ve got a problem. The facts about our consumer empire of debt are unequivocal as can be seen in these statistics:

- Average credit card debt: $15,593

- Average mortgage debt: $153,184

- Average student loan debt: $32,511

- $11.62 trillion in total debt

- $880.3 billion in credit card debt

- $8.05 trillion in mortgages

- $1.12 trillion in student loans

I don’t blame those in their 20’s and 30’s for not having retirement savings. Anyone who entered the workforce around the year 2000 has good reason to not trust the system or their elders. There have been two stock market collapses and every asset class is now extremely overvalued due to the criminal machinations of the Federal Reserve. There are far less good paying jobs. Real wages keep declining. They were convinced by their elders to load up on student loan debt, leaving them as debt serfs. The Wall Street/Federal Reserve scheme to boost home prices and repair their insolvent balance sheets has successfully kept young people from ever being able to afford a home. So you have young people unable to save, invest or spend. You have middle aged and older Americans with little or no savings, mountains of debt, low paying service jobs, and an inability to spend. The only people left with resources are the .1% who have captured the system, peddle the debt, and reap the rewards of consumption versus saving. They may be able to engineer a stock market rally to further enrich themselves, but they can not propel the real economy of 318 million people. Our consumer society is dying – asphyxiated by debt – shorter of breath and one day closer to death.

I’d love to offer some sage advice on how to fix this problem, but it’s too late. Too many people missed the starting gun. More than ten years got behind them. No one is going to come to the rescue of people who never saved for their future. The Federal government has already made $200 trillion of entitlement promises it can’t keep. State governments have made tens of trillions in pension promises they can’t keep. They can’t tax young people who don’t have jobs. Older generations who think the government is going to rescue them from their foolish shortsighted choices are badly mistaken. Their benefits are likely to be reduced because the unsustainable will not be sustained. The 45 to 64 year old cohort who chose not to save can run and run to try and catch up with the sun, but it’s too late. It’s sinking. Their plans have come to naught. They are destined for lives of quiet desperation. There is nothing more to say.

So you run and you run to catch up with the sun but it’s sinking

Racing around to come up behind you again.

The sun is the same in a relative way but you’re older,

Shorter of breath and one day closer to death.

Every year is getting shorter; never seem to find the time.

Plans that either come to naught or half a page of scribbled lines

Hanging on in quiet desperation is the English way

The time is gone, the song is over,

Thought I’d something more to say.

Don’t mean to hijack this fine article … but it looks like I’ll be going to the hospital shortly.

At 10:15AM this morning Ms Freud became a grandmother for a second time, this time to a 9lb3oz (holy shit!!) baby girl.

They named her Rena. (long “e” … REE-nah).

Rena??? fuckmedead. My first immediate thought was it sounds like renal failure. Poor kid is off to a bad start ….

see ya later

Jim…great article as always.

The 11% return is relative to when you were getting out of the market. If you were about to retire in 2008-9 and hadn’t made prudent adjustments to your investment strategy then you got soaked with huge losses. This happened to a lot of folks. Now they’re trying to chase down bigger ROI in a bubble market .

My parents lost 100K in the down turn of 2008-9 . My mom has since made it back and then some and she made changes to her stategy at my urging. I loved her feelings about the loss, she told me ” We didn’t lose 100K…you did…that was part of your inheritance ” . LOL

The wonderful thing is my parents were frugal, saved lots of money and even if mom lost everything in the market she’d still live a comfortable life based on other assets etc.

Congrats Stuck…give the family my best and my wishes for a long and happy life for Rena .

I hope Rena isn’t a failure.

Hindsight is 20/20.

A thoughtful person could have looked at market conditions at any time 1982 to now and concluded the trend was unsustainable.

I call bullshit on anyone who claims they forecasted that people would embrace the delusional narrative that fuels this decades-long orgy of debt creation and its embrace as wealth.

Sometimes, despite some of the shit sandwiches I have eaten over the years, I still marvel at my good luck…

I married well. The missus is outstanding with finances. Each month, she puts away something in savings. She doesn’t tell me, and I don’t want to know. If I know, then I’ll want to spend it on something.

The only note we have to pay is the farm, and we actually overpay on that, so we’ll be paid off years ahead of schedule.

No car note. Every month, the credit card is paid off in full. We don’t use that much – She’s gotten me in the habit of “if we can’t pay cash for it, then we don’t buy it”.

If we need something that actually costs some bucks – say, like new livestock – then we figure out when we need to have them by (breeding schedules, etc) and work backwards, saving enough each month to purchase them by the time we need them.

All of this, from her… bless her heart, if not for her, I’d be sunk… and y’all best believe I let her know how much she is appreciated. You don’t kill the Golden Goose… you dote on it, take care of it… make it feel appreciated..

The deeper people dig themselves into debt, the wealthier people collectively feel.

Who has the balls to claim they saw that Cargo Cult becoming the world’s dominant religion?

Jim – Precious metals aren’t currently “overvalued” – rather the reverse. Stand with Rand and BC-LR to all

Congratulations Stucky, Nothing nicer than a new family member to love and enjoy.

So, going forward, the rest of us tax serfs will be paying for boomers who didn’t save, minis who can’t save and our savings will be redistributed?

Somebody wake me up………………

When an ocean of IOU’s “counts” as wealth, EVERYTHING is overvalued.

All that overvaluation will disappear when the hive-mind wakes up and realizes that the IOU’s are worth perhaps 10 cents on the dollar.

Just because a plane keeps flying higher once the fuel gauges read empty doesn’t mean it can fly forever.

So, going forward, the rest of us tax serfs will be paying for boomers who didn’t save, minis who can’t save and our savings will be redistributed?

Somebody wake me up…………

Hi Card, Yes, according to the lefties we are evil people who fucked them, that is why we have money and they don’t.

They don’t believe the part about working hard, savings, doing without, not buying on credit, getting a second job etc.

The fact that most of them pissed their weekly pay out the head of their dick, is a taboo subject that political correctness doesn’t allow us to bring up.

I have been fortunate to be self employed in the software industry 1971 – 2001 – and made a very good living. My wife is a homemaker and mother. Even though we lived within our means – it was pretty hard to save any significant sum of money till around 1990 – when I started making $100,000 a year.

I come to the defense of many of the people who have not saved:

Our economy / society is structured to MAKE you spend money. You can’t do anything without a car, and usually two cars – with that comes maintenance / insurance / repairs. With inflation comes rising home prices and property taxes. Don’t forget that scam / racket healthcare. A single crown on a tooth costs $1200. I just got a filling – $350. All this is take home pay – after taxes. Taxes – sales / income state and federal and FICA eat up earned income.

Basically, many are just on the ‘Hamster Wheel of Life”. I can see why they say: The hell with it, I’m going to use my credit card for a vacation. It’s foolish – but I can see why.

My other beef is ‘investment people’ – hell if they knew how to invest to get these great returns – they wouldn’t need clients – they could be billionaires with their own money. You need to be real careful about funds with loads, or no-load funds with ‘expenses’.

The problem isn’t only that Boomers and Gen Xers didn’t save money. They also didn’t start businesses and worked for other people. When everybody was buying in the 1980s-2000s too many were consuming. America is a nation of employees and it is glaringly obvious. Even crappy financial gurus knew you have to invest in yourself first.

Some of us did save, then between our own bad decisions, bad advice, and the casino we call a market, it went away.

My kid brother worked two jobs through high school, he saved his money and bought his first home for 50% cash down, they didn’t leave the house until the second baby came along and there literally was no room. He paid more than 50% cash for his next house too.

Then, the unthinkable happened, a company with a long track record of surviving the 80s downturn (barely), and employee owned, went out of business.

My brother went from making $65k in a tiny town with a tiny mortgage (that he could afford), to unemployment.

When after a year he was still making less than $30k, but got an opportunity to move to a big city which meant a much bigger salary, but it also meant a much bigger cost of living. He cashed his 401k out to put down on his new house and thankfully made money off his old house in a bad market with no real jobs (sold to a retired boomer).

Mine was lost when my ex husband convinced me to take my (non-retirement) savings and help him with his IRS debt. Within a year of nearly bankrupting myself for our common goal, he decided his secretary was the better choice.

Anyway, my bad decision.

Then, I hooked up with a business guy that needed my help to stay in business, but couldn’t pay me my going rate. I decided to work for my future instead of my today.

Thankfully, a mere decade later we have knocked nearly $2 million of debt down to a small-ish mortgage on our building and built up quite the sizeable savings (again).

Here is the problem. And it is also the problem for close to ALL that have been scrimping, working and doing the smart thing of saving for tomorrow.

Our tomorrow savings are 100% contingent on the full faith and credit of the US gub and FR.

My gut tells me that all of us that have been doing the right thing, are going to be in the same freaking boat as those that didn’t.

If the banks declare holidays, the stock market returns to “normal,” the government defaults on something, exactly how long are those amassed fortunes going to be left alone by a banking system and government hell bent on keeping their own golden status quo?

My guess is less time than it takes the MSM to tell us about it.

Cyprus was the trial run, and it went so well the IMF declares that all “struggling” economies do the same. One time thing, of course.

Not only do the upcoming old need to get busy and start saving, they also need to simultaneously repair their health and lives for the upcoming games.

If there is but one thing my years of research on monetary and societal collapse have taught me, it is that wealth in our modern society is fleeting, and what we think we own today could be blowing away on the winds of change tomorrow.

Nicely done Admin. Thanks for your continued caring and words. They have helped me so very much.

Congrats Stuck! New babies are still miracles and blessings, even if their futures look bleak today.

Jim–

Thank you for taking the time to do what you do. Just a quick story-

I’m 32 and have been a huge Floyd fan since 1994 when I saw the Division Bell Tour live. I’ve been a reader on your site since 2010, kind of right after I saw Roger Waters The Wall live. A concert which woke my ass up about the realities of this world that are hidden in plain site, a concert which demanded that I dig deeper. Long story short, it lead me to your site and other similar ones.

At that time I was 28 and doing basically exactly as you described people in their 20’s- Slaving away at my (at the time) entry level low paying job, chasing the opposite sex, getting drunk, and having fun on the weekends. I had maybe $2,000 to my name, a car note, below average credit, and fully running on the hamster wheel month to month. At that time, I had no idea the extent to which that the American people were being pillaged, and had no idea that I was for all intents and purposes a card carrying member of the ignorant masses.

Since I began reading your site– and reading every damn thing I could, every day, for at least an hour per day, (TBP, ZH, Jesse’s, Huxley, Orwell, Milton Mayer, etc.) for the last 4+ years– my entire life course has changed for the better, dramatically. My overall awareness has grown leaps and bounds, although I recognize there is always room to grow, and have devoted my time to doing just that. Back in 2010 I had no concept of anything finance related. I blew $ on the typical bullshit 20-somethings blow their $ on. Today, I can’t remember the last time I’ve blown my hard earned money on the bullshit I used to, I could give a 2 fucks about the Joneses, brew my own damn coffee, bring my own lunch to work, cook my own dinner every night and stash away all the savings I can each month. I have no debt, no credit cards, and got enormous pleasure when I sat across from my bank manager as she looked at my like I had 4 heads when I informed her of that. She was in shock, and asked me how I could have built any credit. I said I paid all my bills on time, paid back my student loans, paid my car note off. She tried signing me up for a credit card, and I said I wanted nothing to do with it, but I was curious about what limit I’d get. Next time I walk in she pulls me to her cubicle and tells me how much debt I could run up (my limit, lol), and tells me my credit score. She said if anyone ever tries to offer you not the best interest rate, have them call me. I just smiled in satisfaction at her.

I could go on and on about all the positive changes that have come about for me since I crossed paths on the interwebs with Jim Quinn.

I guess I just want you to know you have reached some of us 20-somethings (now 30-somethings) out there, and I will remain forever grateful for that.

Thanks dude, I appreciate you.

Floyd

That almost brought a tear to my eye. When I’m toiling away on my computer and wondering whether it is worth the time and effort to write what I’m thinking, I never visualize people like yourself out in the real world actually being influenced by what I write.

Normally it’s just the shit throwing monkeys who comment every day and tell me whether I’m full of shit or accurate in my assessment.

With 3 Millennial boys I know our future depends upon people like yourself and them to lead us through the Crisis.

Comments like yours are what keep me doing this,even when I get tired and depressed.

Thank you.

They call it an economic recovery.

Minnie’s will have to buckle down and work 3 jobs to pay for the boomers retirement.

BUCKHED,

Your mom has a very DRY sense of humor LOL.

“Minnie’s will have to buckle down and work 3 jobs to pay for the boomers retirement.”

I wouldn’t want to be holding my breath waiting for that to come about Sensetti.

Love this article!!!

“When appearing to be wealthy is more important than being wealthy, we’ve reached the point of collective insanity!”

From:

The Joy of Skinny—Finances

Admin,

You should definitely write more articles aimed at Millennials specifically. I found your articles years ago explaining the 2008 crash On Seeking Alpha while looking for anybody writing about the Fourth Turning.

Great article Admin. My wife and I drive 9 and 13 year old vehicles, have a very small mortgage and pay for our kids college. They will leave college with relatively small loans, which my wife and I will gladly help them with. We are quite frugal, I do the majority of the home repairs, we buy what we need, not what we want. I have packed lunch every day since the early 1980s, and today I still pack lunch for me and my wife. We both have 401Ks and my wife will probably retire with a small pension if the system does not melt down before then.

Still sometimes I wonder if the people who spent it all and borrowed more may have it right. They enjoyed life in the present and when TSHTF the majority of us will be in the same leaky boat. Being a cheap bastard my whole life I don’t think I can change. At least I have skills and a full woodworking shop. I may be old, but I can still climb on a roof and do roofing and sidewall, as I did last weekend and will be doing this weekend.

Bob.

Nah, it’s all bullshit. The machines are going to save us.

The big problem is the FSA is going to come after our savings. To catch fish you have to go fishing where the fish are. Look out here they come.

Stuck, babies are precious. Rena is a good name, she was my Mom. Billy ditto on wife comments.

@BostonBob: “Still sometimes I wonder if the people who spent it all and borrowed more may have it right. They enjoyed life in the present and when TSHTF the majority of us will be in the same leaky boat.”

For us ‘serfs’ (not the top 0.1%) we have raw, capitalism. Don’t need ya – bye. Got bought out – bye. Too old (make too much) – bye, outsourced to India? China? perhaps you have an employment contract – ha!

Someone with a modest amount in a 401k – say $100,000. All they have to have happen is be out of work for a year or two – that’s what happened back in 2008. Then you’re wiped out.

Meanwhile Solindra, GM, Chrysler, etc get the bail outs.

Way to go Floyd. Also congrats to Admin for having saved yet another. It is refreshing to see the “lights” come on for another.

We live in a world where most think the Jim Quinn’s are full of shit, I know I quit trying to tell the story at least a couple years ago. Most think we are crazy, interesting times.

Kudos to you for your perseverance and all that you do.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Three causes especially have excited the discontent of mankind; and, by impelling us to seek remedies for the irremediable, have bewildered us in a maze of madness and error. These are death, toil, and the ignorance of the future..”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

Articles aimed at millennials is a good idea. It’s really pretty simple though.

MILLENNIALS, LISTEN UP! YOU:

-are being fucked over to a greater extent than any generation since the lost generation of World War One;

-your future prospects, as of today, are terrible, with “peasant” and “serf” being the most likely descriptions of your life path if you don’t change things;

-are not going to get anywhere, anywhere by simply voting for one of the two faces of the oligarch party, signing petitions, or doing social media crap;

-you need to un-brainwash yourselves of all the liberal/advertising crap you’ve been brainwashed with since you were a toddler. People are not all equal, government is not your friend, and many people do not have good intentions for you or anyone else.

-YOU NEED TO PUT DOWN YOUR FUCKING “SMART”PHONE FOR A DAY AND PAY ATTENTION TO WTF IS GOING ON AROUND YOU. YOUR “SMART”PHONE IS A BRILLIANT PACIFICATION DEVICE THAT HAS TURNED MOST OF YOU INTO INFANTS.

-but, if you actually wake up, pay attention, and start doing things collectively – meaningful things, like the original flavor of Occupy! before it got co-opted – then you can change the world. Try to change it for the good.

My 2 renminbi.

The two charts don’t match up. For exampe, the 1st says 31% don’t have retirement savings. The 2nd says all have an avg of 3K but if you exclude those with no savings, you have 40K. To make this math work 92.5% of people don’t have any savings! Must be big differences in how they were put together. Regardless they are both depressing.

“you need to un-brainwash yourselves of all the liberal/advertising crap you’ve been brainwashed with since you were a toddler. People are not all equal, government is not your friend, and many people do not have good intentions for you or anyone else.”

This needs to be said over and over again. Because the truth is Millennials have been brainwashed and they don’t realize it to its full extent until they already have student loans to pay off.

Stephanie, I’m older than a millennial (I’m Gen X, though not by a lot), I’ve been reading on various TBP-like topics for 6+ years now (financial issues, financial collapse, social rotting, peak oil, etc…) and I am still only starting to identify just how much brainwashing I’ve experienced. I’m sure I’m far ahead of most, even many of the TBP crowd, but the rabbit hole goes very, very deep. I have found JM Greer’s writings to be extremely illuminating on this subject. He has a number of books, and a weekly blog at:

http://thearchdruidreport.blogspot.com/

I would particularly recommend last week’s entry for starting to lift the veil off of the assumptions shared by nearly all Americans, which are not the only way of doing things:

http://thearchdruidreport.blogspot.com/2014/11/dark-age-america-hoard-of-nibelungs.html

No one is being screwed who isn’t asking for it.

The main effect of the current folly is to see overconsumption of everything. Yes, to the extent this includes capital (including misallocation of resources that won’t be recoverable) it will make young people worse off, but the main reapers of what’s being sown are those in the 35-70 crowd. Over 70’s won’t last long enough to care that much, and those under 35 will have time to recover and retool.

The rest of us are HOSED.

@persnickety,

You lost me at “collective.”

The swamp we’re in is entirely a result of people acting in herds. It may be natural, it may be unavoidable, but it sure shouldn’t be encouraged.

My biggest mistake was getting married . The other we want talk about.I’m afraid I would be laughed off site.As a result I’ll probably be working till the day the Lord takes me to heaven.

One problem is they don’t teach economics in high school. I don’t remember. one course being offered. Most get out of school and even college still ignorant of economics .Hell ,I only started learning after I lost my job in 2008.I’m doing ok here at FedEx. Just ordered some more Gold coins.

Good job Jim ,don’t give up.Who knows one day you may end up on FOX business channel.

TE @ 12:21 +1,000 I agree with you 100%, we have the same fears that after a lifetime of doing the right thing and saving for the future, helping our kids get their lives started, living within our means, staying out of debt, buying used cars and keeping them in good repair, growing our own food and on and on, that a day will come and it will all be gone and all the effort and sacrifice will have been for naught. How will the population react to that? The people that didn’t have anything to lose in the first could give a crap less and that would be the majority of the people. What recourse would the people that basically got robbed have? Again that is the kind of crap that keeps us up at night because we don’t think it is that far away.

Admin – Enjoyed the article, the subject is an eye opener, these are the articles you write that I send to my kids and tell them to read them, and they do. It helps emphasize the messages I repeat and try and get them to understand, it’s amazing how much more they pay attention and agree when the message is coming from somebody other than their old man. Human nature I guess. Your posts have helped make me look smarter to them and it helps open their eyes to the world around them and makes them think more about how they need to take care of their business and avoid the pitfalls and mistakes that their friends are making. Your reach is probably farther and broader than you realize. Thanks for that.

It is what it is. The great reset is coming so even if Boomers had saved for retirement they will still get wiped out in the end. The individual who really prepared for the future lives in a rural location and is self sufficient. Time will prove me correct.

Admin – you must have been reading my rants the last few days. A lot of this stuff was in there. Great job, and great minds think alike and all that.

There is a lot of ranting around the MSM re “inequality”. It annoys the shit out of me in general. Imagine what would be the case if instead of racking up debt for disposable consumer shit, and blowing every penny, instead the sheeple had invested 10% of their income each year in productive assets. The “inequality” gap would be much different. The economy would be much different – it would be booming along sustained by investment and expenditure based on income and not debt.

And I doubt that all the good jobs would have been exported – all the capital being invested would have been a boon to local employers and industry. If anything, bad jobs would have been exported, and good jobs kept, instead of the reverse.

And that is why the screams of inequality annoy me so much – a huge portion of the blame lays at he feet of those doing the screaming, but they are to fucking dense to understand. Living on debt, above one’s means, eating the seeds instead of sowing them and cannabalizing the machines instead of using them to produce, has contributed mightily to the death spiral the country is in. And allowing a huge percentage of the population to produce zero (the FSA) and just consume has had an incalculable detrimental effect.

It all could have been different. It was once different.

Dutchman – no offense, but I think you are being a bit of an apologist for the dickheads doing the wrong things. Folks once saved and invested. That they rather blow everything in pursuit of personal instant gratification is totally stupid.

Your comments re jobs going overseas, etc., ignore what I said above – if folks had invested and not spent and consumed, they would have control over vast amounts of capital and production, and what is happening would not be happening. If instead of $12k in expenditure, if the savings was $300k per person, the impact on industries of all kinds would be incalculable. Instead of just the megarich controlling things, common folks would be able to exert influence decisions.

Do you think the rich want the rest in debt and poor? Damn right – it gives the rich total control over all capital. The poor did not have to buy in. But they did by the tens and hundreds of millions. They will reap the whirlwind.

Llpoh

I had been pondering this article for a couple days and your recent comments certainly influenced the final product and conclusions. We are 100% in sync when it comes to this subject matter. People like RE can come up with dozens of reasons why they didn’t save. It’s nothing but bullshit, as you have pointed out with your workers making $50,000 per year.

The way to accumulate wealth is to spend less than you make. It’s that simple. Delayed gratification is hard when you are bombarded by marketing messages 24/7 to spend, spend, spend. But the final choice are made by each individual. No one forced the Boomers and Xers to spend more than they made. They chose to do it.

You and I, and many other regulars on this site, chose to spend less than they made and live beneath their means in order to secure a better future.

I have absolutely no sorrow for the older people who are now screwed. They screwed themselves.

I don’t know if I feel good about the information in this article or not.

On the one hand, I find out I have roughly 10x the retirement savings of the ‘average’ person in my age cohort. On the other hand, that = less than 1 year of very frugal living expenses in 2014.

On the one hand, I have zero debt (no car loan, no CC balance, no student loans, no mortgage). On the other hand, I am unable to buy a home in the inflated market (thus no mortgage) and my paid-off college degree cost me a helluva lot more and got me a hell of a lot less in terms of a job/pay/benefits than Boomers got with a free high school diploma – thus the diploma I paid more for gets me less.

On the one hand, I can gloat about the fact that I’ve been ‘smarter’ with my money and more independent and self-sufficient than the average person my age. On the other hand, welfare moms make a little more than I do (if I remember correctly, a welfare mooch reaps the equivalent rewards of $65k/year worker – I am under that mark by a bit).

On the one hand, I can be happy that I’m a planner and doing the ‘right’ things in life. On the other hand, the majority of fucktards have all done the wrong things, for decades before I was even an adult, living the high life of easier accumulation, conspicuous consumption and instant gratification – and any meager net worth I struggle, sacrifice and save for will likely be consumed by the fucktard spenders anyway.

SAH – I just got back to you on the “Fed” thread. These are the highlights:

You are doing fine. The road is hard and long. You are halfway there. It is easy to despair. Don’t change course.

When it comes to savings, do at least 10%. If you think you can’t do it, think of it as circumsion. If they can cut off 10% of THAT, you can cut 10% of anything.

Dutchman, right on the money. Jim, noone can compete with slave labor. What about the people who worked hard their whole lives to save 300 grand, figuring 5 or 6 per cent plus social security and a paid off house, they would be fine? Bennie counterfeiting 3.5 trillion means they can’t get any safe return on thay money. What about the guy with a million dollars tied up in his factory, who wakes up one day to find home depot selling finished goods for cheaper than he can buy the raw materials?

BTW – say 50 million folks had $300k instead of $12k, they would control an additional $15 TRILLION in capital.

That would have crushed the inequality issues by and large. That would have taken money from the oligarchs that was spent on consumer crap. That would have changed the damn world.

The oligarchs thank those who spend spend spend for their contributions.

Congratulations Stucky on your grand-daughter, hope your Daughter enjoys every moment of motherhood. My favorite Aunt was named Rena, she was the very definition of a lady- perfect homemaker and wife, composed, sweet and the best cook in the family. I will always miss her oyster casserole on Thanksgiving. Great old time name.

A big part of our current problem is looking at everything in terms of dollars. A guy with a fortune who has no children dies alone. If you spend the end of your life being cared for by low wage non-English speaking strangers rather than your loved ones, and a big balance in your bank aqccount, was it worth it?

I understand the need for money but there’s a lot more for you to invest in- relationships, skill sets, productive land, your education, child rearing- and to profit from later in your life. We’ve been brainwashed, tricked, bamboozled and lied to for so long we’re even talking about this amongst our awakened brethren like a group of hostages suffering from Stockholm syndrome.

I’m grateful that someone keeps us informed about the fraud of our economic system, but I am also bummed out that more people haven’t taken that information and changed their frame. This system has proven one thing to me beyond any shadow of a doubt and that is that they have extraordinary tools, tricks, controls and strategies to maximize their reign. We may implode within the year or it may drag out for another century, there’s no telling. Trying to game their system by continuing to invest in it reminds me of the kid held down by the bully and being smacked with his own hands while the bully asks- “Why do you keep hitting yourself?”

Good luck Stuck with whatever ails you.

Star – if enough folks had saved, there would be myriad investment opportunities. Bank deposits are not investments as such. You need to broaden your thinking.

“Over 15% of all people 60 and older and 23% of people 45 to 59 years old have NO retirement savings. None. Nada. Zilch. This means 25 million Boomers and Xers are stuck living off a Social Security pittance and choosing between keeping the heat on or eating a feast of Ramen noodles and Friskies.”-JQ

That’s actually lower numbers than I would expect.

By definition, 50% of people make less than the median income. That today is $51K. How much money could you save on $51K after taxes, insurance etc gets taken out?

The Bottom Quartile is making poverty level wages of $25K and less. They obviously cannot save money.

You can do a lot better than Ramen Noodles and Friskies though on a SS budget.

RE

RE evidently didn’t comprehend the article. He speaks about today and how no one can save. The article was about the time frame from 1980 until 2000 and the old fucks like himself who didn’t save squat during the greatest bull market in history. It sounds like RE is making excuses for his own failure to save, even though his daddy was a Wall Street executive.

No nest egg RE?

That is disgraceful for someone of your age and wisdom. 🙂

Lipoh, what are you going to buy, commercial real estate? Ask jim about that one, he’s commented quite extensively. There are two kinds of businesses now, those with acess to bennies unlimited counterfeit money at zero per cent, and everyone else. Think you can compete against that at anything? Give me an example. I didn’t think so.

Star – seriously, do not be so stupid. If you have money, there are still opportunities. Not all commercial property is dead. There are some outstanding small businesses for sale if you have money. There are some residential rental opportunities. There are some farming opportunities. There are opportunities your feeble mind cannot even conceive of out there.

As always, buyer beware.

Why would I need to ask Jim about investments? He is a smart guy, with tremendous insight and knowledge, but I suspect my portfolio is outside his knowledge base. His expertise lies in areas outside high net wealth individuals, I am reasonably sure. If I want or need advice re investments, I have specialist advisors to provide it.

Really, you are being exceedingly stupid.

Star – can I compete? You better fucking believe it, you knitwit. I run a successful business and have done for decades. Just because you are too dull to be able to figure out how to make money doesn’t mean everyone is. I make more in a year than idiots like you make in a lifetime.

Seriously, do you really think no one can be successful?

Unfuckingbelievable how stupid some folks are.

Ok, i get the part about me being stupid. Wanna compare assets, son? Because you still are fluttering all over the place and still can’t give me one example of a business or even a business segment that would be a safe place to put money without the threat of being run over by big money.

Besides the fact a minimum of 25% of Amerikans don’t make enough money to save, you have other factors.

For instance, my mother would not put money into the Stock Market, because her belief from the Great Depression was that Stocks were unsafe. So all she ever got was about 2-3% on CDs.

Many people also believed their McMansions were their savings, that the value would always go up. However, all the equity they put in was lost in the crash of 2008-9.

Beyond that, as has been noted on these pages many times, the cost of living has gone up faster than incomes, so many people took out HELOC loans to make up the difference. They also clearly could not save money.

To be able to save money, you have to have surplus all the time, and that is not true for most average wage earners. Despite myths to the contrary, not all Boomers had high paying jobs, nor did all GenXers. So only 23% with no savings is actually a small number.

RE

RE with his usual bullshit based on nothing but his opinion.

As noted in the article and proven from the facts CD rates were double digits during the 80’s, still around 7% for most of the 90s and still 5% as late as 2007. You are full of shit about your mother and 2% CD rates.

Choices RE. Buying a McMansion was a choice. They fucked up and screwed themselves.

As noted, the annual return on stocks was 17% from 1980 to 2000. The cost of living did not go up 17% per year Mr. deflation.

You’re are nothing but a one trick pony and whenever I post FACTS that obliterate your storyline, you should just shut the fuck up, because you look like a fool when I point out your lies and mistruths.

Stick to doom. You don’t do financial issues too well.

I’m still waiting for your ebola epidemic. Shouldn’t we have 10,000 cases in the US based on your previous blatherings?