Ticking away the moments that make up a dull day

You fritter and waste the hours in an offhand way.

Kicking around on a piece of ground in your home town

Waiting for someone or something to show you the way.

Tired of lying in the sunshine staying home to watch the rain.

You are young and life is long and there is time to kill today.

And then one day you find ten years have got behind you.

No one told you when to run, you missed the starting gun.

I stumbled across two mind blowing charts yesterday that had me pondering how generations of Americans had frittered their lives away, spending money they didn’t have on things they didn’t need, utilizing easy to acquire debt, and saving virtually nothing for their futures or a rainy day. We are a nation of Peter Pans who never grew up. While I was driving home from work, one of my favorite Pink Floyd tunes came on the radio and the lyrics to Time seemed to fit perfectly with the charts I had just discovered.

We were all young once. Old age and retirement don’t even enter your thought process when you are young. Most people aren’t sure what they want to do for the rest of their lives when they are in their early twenties. Slaving away at your entry level low paying job, chasing the opposite sex, getting drunk, and having fun on the weekends is the standard for most young people. But you eventually have to grow up. Because one day you find ten years have got behind you. No one tells you when to grow up. And based on the charts below, tens of millions missed the starting gun.

I graduated college in 1986 and started my entry level CPA firm job, making $18,000 per year. I did live at home for a year and a half before getting an apartment with a friend. I was able to buy a car, pay off my modest student loan debt, go out on the weekends, and still save some money. I was in my early 20’s and had opened a mutual fund account at Vanguard. Anyone who entered the job market from the mid 1970s through the mid 1980’s, which would be the late Baby Boomers and early Generation Xers, had job opportunities and the benefit of low stock market valuations.

P/E ratios of the market were single digits in the late 70s and early 80s, versus 20 today. Dividend yields on stocks averaged 5% for the S&P 500, versus 1.9% today. The Dow bottomed out at 759 in 1980, while the S&P 500 bottomed at 98. A 20 year secular bull market was about to get under way. Baby Boomers and Generation Xers had the opportunity of a lifetime. Even after six years of the bull, when I graduated from college the Dow stood at 1,786 and the S&P 500 stood at 521. I had just begun to invest when the 1987 crash wiped out 20% in one day. It meant nothing to me. I didn’t have much to lose, so I just kept investing.

The 20 year bull market took the Dow from 759 to 11,722 by January 2000. The S&P 500 rose from 98 to 1,552 by March 2000. You also averaged about a 3% dividend yield per year over the entire 20 years. Your average annual return, including reinvested dividends, exceeded 17%. Anyone who even saved a minimal amount of money on a monthly basis, would have built a substantial nest egg for retirement. If you had invested in 10 Year Treasuries, your annual return would have exceeded 11% over the 20 years. Even an ultra-conservative investor who only put their money into 5 year CDs would have averaged better than 7% per year over the 20 years.

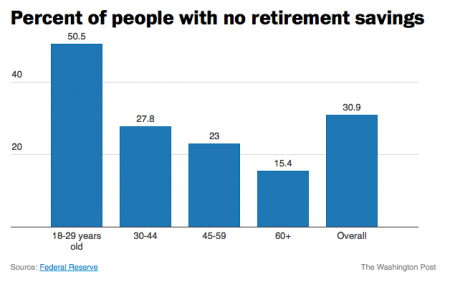

Even with the two stock market collapses since 2000, your average annual return in the stock market since 1980 still exceeds 11%. That’s 34 years with an average annual total return of better than 11%. Every person who had a job over this time frame should have accumulated a decent level of retirement savings. That is why the chart below is so shocking. Over 15% of all people 60 and older and 23% of people 45 to 59 years old have NO retirement savings. None. Nada. Zilch. This means 25 million Boomers and Xers are stuck living off a Social Security pittance and choosing between keeping the heat on or eating a feast of Ramen noodles and Friskies. It seems they let 30 years get behind them. They missed the starting gun.

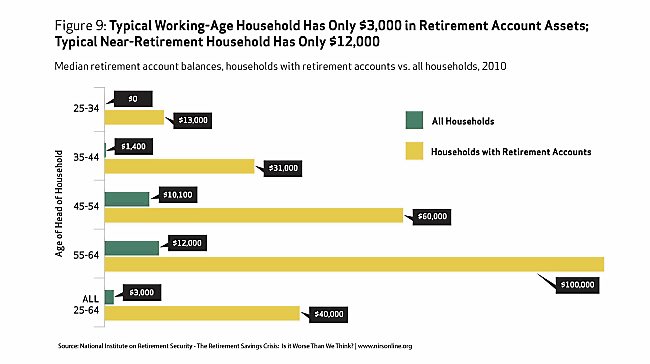

I’m not shocked that over 50% of 18 to 29 year olds have no retirement savings. With the terrible job market, declining real wages, massive levels of student loan debt, two stock market crashes in the space of eight years, and 4% annual returns since 2000, young people today have neither the means nor trust in the system to save for retirement. Their elders had no such excuse. Just a minimal amount per paycheck saved over the last 30 years would have compounded to well over $100,000, even at modest salary levels. It is disgraceful that 25 million people over the age of 45 have saved nothing for their retirement. Far more disgraceful is the median household retirement balance of $3,000 for all working age households. There are 122 million households in this country and 61 million of them have $3,000 or less in retirement savings.

The far worse data points are the $12,000 median retirement balance of aged 55 to 64 households and the $10,100 median retirement balance of aged 45 to 54 households. These people are on the edge of retirement and have less than one year’s expenses saved. There is no legitimate excuse for this pitiful display of planning. These people had decades to save, strong financial market returns, and if they worked for a decent size organization – matching contributions to their retirement accounts. They didn’t need a huge salary. They didn’t need to save 20% of their salary. They didn’t have to be an investing genius. A savings allocation of just 3% to 5% would have grown into a decent sized nest egg after a few decades of compounding.

We know from the data in the chart, it didn’t happen. The concept of delayed gratification is unknown to the millions of nearly broke Boomers and Xers, shuffling towards an old age of poverty, misery and regret. A 64 year old has a life expectancy of about 20 years. They’ll have to budget “very” frugally to make that $12,000 last. The question is how did it happen. I don’t buy the load of crap that you can’t judge people as groups. I judge people by their actions, not their words. I know you can’t lump every Boomer and Xer into one box. Individuals in every generation have bucked the trend, lived within their means, saved for the future, and accumulated significant nest eggs for their retirement. But the aggregate numbers don’t lie. The majority of those over the age of 45 have squandered their chance at a relatively comfortable retirement. These are the people who most vociferously insist the government do something about their self created plight. It’s their right to free healthcare, free food, subsidized housing, free utilities, higher minimum wages, and a comfortable government subsidized retirement. They are wrong. They had a right to life, liberty and the pursuit of happiness. It was up to them to educate themselves, get a job, work hard, and accumulate savings.

The generations of live for today, don’t worry about tomorrow Americans over the age of 45 have no one to blame but themselves. They bought those 4,500 sq foot McMansions with negative amortization 0% down mortgages. They had to keep up with the Jones-es by putting in granite counter-tops, stainless steel appliances, home theaters, Olympic sized swimming pools, and enormous decks. They have HDTVs in every room in their house and must have every premium cable channel, along with the NFL package. They upgrade their phones every time Apple rolls out a new and improved version. They pay landscapers to manicure their properties. They lease new BMWs every three years. They have taken exotic vacations on an annual basis. They haven’t packed a lunch for themselves since they were 16 years old. Eating out for lunch and dinner has been a staple of their existence for decades. That morning Starbucks coffee is a given. A new wardrobe of name brand stylish clothes for every season is a requirement because your neighbors and co-workers are constantly judging you. Nothing proves you’re a success like a Rolex watch, Canali suit, Versace boots, or Gucci handbag. The have it now generations got it then and have virtually nothing now because they acquired all of these things with debt.

Real cumulative household income is up 10% since 1980. Consumer debt outstanding has risen from $350 billion in 1980 to $3.267 trillion today. That is a 933% increase. We’ve had decades of faux prosperity aided and abetted by Wall Street shysters, corrupt politicians, mega-corporation mass merchandisers, and Madison Avenue maggots trained in the methods of Edward Bernays to convince willfully ignorant consumers to consume. And consume we did. Saving, not so much. You can blame the oligarchs, bankers, retailers, and politicians for the fact you didn’t save, but it rings hollow. No matter how much propaganda is spewed by the ruling class, we are still individuals with free will. The older generations had choices. Saving money requires only one thing – spending less than you make. Most Boomers and Xers chose to spend more than they made and financed the difference. When the average credit card balance is five times greater than the median retirement account balance, you’ve got a problem. The facts about our consumer empire of debt are unequivocal as can be seen in these statistics:

- Average credit card debt: $15,593

- Average mortgage debt: $153,184

- Average student loan debt: $32,511

- $11.62 trillion in total debt

- $880.3 billion in credit card debt

- $8.05 trillion in mortgages

- $1.12 trillion in student loans

I don’t blame those in their 20’s and 30’s for not having retirement savings. Anyone who entered the workforce around the year 2000 has good reason to not trust the system or their elders. There have been two stock market collapses and every asset class is now extremely overvalued due to the criminal machinations of the Federal Reserve. There are far less good paying jobs. Real wages keep declining. They were convinced by their elders to load up on student loan debt, leaving them as debt serfs. The Wall Street/Federal Reserve scheme to boost home prices and repair their insolvent balance sheets has successfully kept young people from ever being able to afford a home. So you have young people unable to save, invest or spend. You have middle aged and older Americans with little or no savings, mountains of debt, low paying service jobs, and an inability to spend. The only people left with resources are the .1% who have captured the system, peddle the debt, and reap the rewards of consumption versus saving. They may be able to engineer a stock market rally to further enrich themselves, but they can not propel the real economy of 318 million people. Our consumer society is dying – asphyxiated by debt – shorter of breath and one day closer to death.

I’d love to offer some sage advice on how to fix this problem, but it’s too late. Too many people missed the starting gun. More than ten years got behind them. No one is going to come to the rescue of people who never saved for their future. The Federal government has already made $200 trillion of entitlement promises it can’t keep. State governments have made tens of trillions in pension promises they can’t keep. They can’t tax young people who don’t have jobs. Older generations who think the government is going to rescue them from their foolish shortsighted choices are badly mistaken. Their benefits are likely to be reduced because the unsustainable will not be sustained. The 45 to 64 year old cohort who chose not to save can run and run to try and catch up with the sun, but it’s too late. It’s sinking. Their plans have come to naught. They are destined for lives of quiet desperation. There is nothing more to say.

So you run and you run to catch up with the sun but it’s sinking

Racing around to come up behind you again.

The sun is the same in a relative way but you’re older,

Shorter of breath and one day closer to death.

Every year is getting shorter; never seem to find the time.

Plans that either come to naught or half a page of scribbled lines

Hanging on in quiet desperation is the English way

The time is gone, the song is over,

Thought I’d something more to say.

SAH – you need to take a breath and re-evaluate. You are still young. Just working a job and being thrifty is not enough. You need to work, educate, save, and be thrifty over decades. You have not done that yet, and you ma have left out some steps and/or time/effort.

You said you worked nine years as a paralegal. What education do you have? Paralegal does not strike me as a financial mecca, so in my opinion you worked nine years for little professional gain. That experience has not given you a competitive advantage in your current field.

What hours are you currently working? How are you making up any educational or experience deficit? How are you separating yourself from your competition? Do you have a mentor?

Working and being thrifty is not enough. You have to be smarter, better educated, harder-working, than your competition, and also financially smart.

Hand on heart – have you really done enough? Have you spent 20,000 hours educating yourself? If not, why not?

You have done much right. But the road is long and hilly.

Llpoh says: “By the time I as 29 I was running major manufacturing plants, plants with many hundreds of employees working for me and dozens of managers younger than me. So I say again bullshit. I would have eaten this current batch of pussies alive.”

You were 29 approximately when? 1980? I was 29 in 2007. There basically aren’t any manufacturing plants in the USA to manage anymore. Your story illustrates just how obsolete the old model is. If you had been 29 in 2007, would that opportunity even exist? There have to be manufacturing jobs to have manufacturing managers.

How much did undergrad and grad cost in the 1970s? Do you think how quickly college prices have gone up, and how much wages have stagnated and declined has no effect?

I’m happy for you, old man. I really am. You got the golden ticket. Congrat-u-fucking-lations, you had the good fortune of being born a member of the most fortunate and lucky generation in the entire course of human history, and you made the most of it. And now you get to watch your children and grandchildren inherit a world that is in far worse shape than you found it. Must feel good. No wonder the denial.

Carlos – you are an idiot. I held a 15 – 20 hour a week job, plus classes plus study. Routinely worked fifteen hour days.

I went to a top business school for my MBA. Top MBA schools work you to death. Their reps depend on putting out grads that have extreme work ethics. We lost half the class the first year.

Law school – so fucking what. There are thousands of law degree mills out there. Any dolt can get one. You are exhibit one proving that.

Like so many others Carlos the shithead thinks just because he was not capable of that kind of workload, no one is.

How is that degree mill piece of paper working out for you, asshole?

SAH – public schools today cost less than the schools I went to. Nice try there, tho. A person can still get an education without going into terminal debt. Work a full time job and go to school full time is one option. That is 80 hour weeks. It can be done. The horror!

You are making excuses. Today, I would perhaps chosen a different field. Software a likely option. You have to adapt.

Keep telling yourself it is impossible. I am sure that will work out for you in the long run.

Believe or do not. Do or do not. Whatever.

Was 29 in the late 80s.

[img [/img]

[/img]

Llpoh – I went to a better school than you did – my alma mater is in New Haven, CT.

DC – there are thousands and thousands of very profitable small businesses available now and over the next fifteen years. Anyone interested need only ask any small to kid-sized accounting firm to find them. Those firms ill have clients desperate to retire, but cannot offload their businesses to allow them to do so.

If a person is creative, they can get into one very cheaply. Buy half. Owner finance. Sweat equity. Etc etc.

But the buyer must have good skills and work ethic. Otherwise avoid this option like the plague.

You think Yale is better! Bah. Humbug. Dartmouth is a teaching college, or was in my time. Yale is a research institute. Good school tho. Going to Yale should not have lead to insurmountable debt load. The Ivies do not tend to work that way.

[img [/img]

[/img]

SAH – crisis and adversity offer especially ripe opportunity for some. You can be the some.

Folks dan still go to state schools and work part or full time to get an education. They will need to supplement that with personal study to really get educated though.

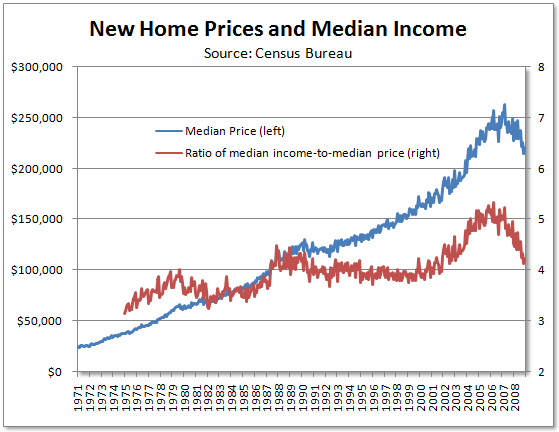

SAH take a look at interest rates for houses back in the seventies and early eighties. Guess why maybe prices were lower then. Current interest rates are much more favorable.

That last chart is crap.

^ I agree with both those statements.

llpoh, take a look at the FED thread.

llpoh

Please let up just for one moment so we kin all take the time to vomit. What a sanctimonious redman you are.

Hey, here’s an alternative perspective – maybe instead of being some kind of single minded automton who whittles away his youth in a supporting role for the American industrial complex, Billy Jr decides to travel Europe while his knees kin still handle some walkin. Maybe with a broader experiential base in his youth he’ll be able to find something better to do in his 60’s than whittle away his evenings bragging about how everyone should wish they had followed the same depressingly narrow career path as our favorite little injun did.

What about that llpos?

IS – you are 47. You have positioned yourself for promotion and have done the right things.

What I say really is this. If people spend decades doing the right things, acquiring the right skills, getting the right education, saving and being thrifty, invariably something good will come of it.

People get promoted. Or they get good at finding bargain investments for their money. Or they get good enough to start their own business. Something good inevitably happens. Luck is the intersection of hard work and preparation, or something like that the saying goes.

Will it work for every single person. No, I suppose it will not. But I have never known anyone to do it that does not end up in a pretty good spot.

Sometimes folks do all the wrong things and still end up covered in roses. But I do jot like their odds – that is pure luck.

Do the right things, get better than the competition, and luck has a way of finding you. It is a giant economy. There will be winners, for sure. And the competition gets worse and worse. They give up, or do not prepare, or convince themselves it is impossible.

What is impossible is a dirt poor redskin offspring from a dustbowl Okie going to an Ivy, getting an MBA, running big factories around the world and growing a successful business. That is impossible. Look it up – the stats will tell you so. It cannot be done. It is impossible.

Hard work, education, thrift, saving will overcome a lot of bad odds. I know it for sure and certain.

Dumbass billy’s wife. By the time I was early twenties I had travelled the world, and had studied at a couple of Europe’s finest universities. Gee, I guess you can have it all. But I did it with a plan. The plan you propose for little billy is bullshit in the long run. Hope he likes Alpo in retirement.

You know nothing about me. Envy is a terrible thing.

“The final outcome of credit expansion is general impoverishment”

Ludwig von Mises

Llpoh

You should see the comments on other websites that posted this article. They are outraged that I question their lack of savings. Nothing but excuses and finger pointing. They can’t refute my facts, so they just resort to vitriol. Boomers are so predictable. It’s never their fault. The greatest 20 year bull market in history and they somehow failed to save a dime. Nothing but sob stories, as if every person on this earth hasn’t dealt with adversity and setbacks in life.

The number of whiny pussies in this country is breathtaking to behold. Personal responsibility is an unknown concept. Frugality is laughed at.

They will get no sympathy from me.

They should take the Foo Fighters new song to heart.

The author is simply looking at the effects of something without examining the causes.

If the boomers hadn’t gone out and spent their money in the economy and saved/invested it instead, would the returns have been the same?

If people hadn’t bought BMWs, Rolexs, Big homes, expensive vacations, HD TVs what would have been the economic effects and, more importantly, what would have been the effects on his investment portfolio?

My point is, one persons financial asset it another persons debt and, looking forward, that “asset” is not going to be worth a great deal.

lank35

The author is simply saying that the way to accumulate wealth is to spend less than you make. Don’t try to refute the truth with bullshit. You seem to think consumption creates wealth. Savings is turned into investment – capital investment. Spending money you don’t have generates nothing.

If people hadn’t OVERSPENT on BMWs, Rolexes, McMansions with money they did not have, we wouldn’t have had the tremendous booms and busts of the last 14 years.

Your point is wrong. Most people from ages 45 and up have virtually no financial assets and are in debt up to their eyeballs. That is due to their choices.

I hear nothing but excuses and redirection from people who chose not to spend less than they made.

IT’S THAT FUCKING SIMPLE!!!!!

Admin – Same is happening here a bit. Folks want excuses. No sympathy for me either.

Glad you stirred the dumbshits up!

Admin, I could not be bothered to address the prick. If he does not understand savings results in capital which results in production which results in economic benefit, he is a complete dullard. Nice response to him.

I only spoke in reference to Govt. State Pensions and there comparison to the private sector:

not the other stuff.

My mom retired in 1995 and sold her house. All the money went into CDs because she did not think the Stock Market was safe.

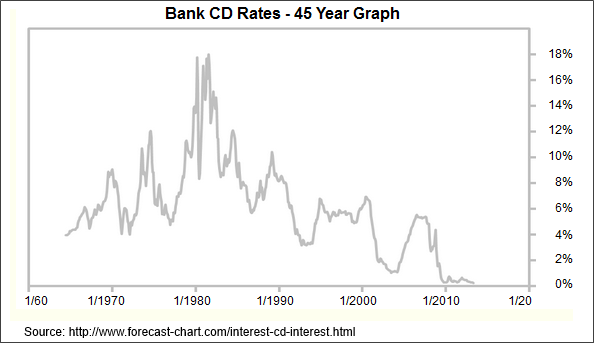

Here is the graph of historical CD interest for the last 45 years.

[img [/img]

[/img]

The highest rate she ever got through the period was around 6%, and it was often lower. When she died and the bank wanted me to roll over the CD, the interest rate was between 2-3%

RE

RE

Are you capable of reading for comprehension? The fucking article talks about 1980 through 2000. Get that through your thick fucking skull. You read what you want to read and pick and choose your facts. The article was about what Boomers and Xers did from 1980 through 2000 when any idiot could have gotten fantastic returns in stocks, bonds, CDs or money markets. The article is about saving, not about investing.

You attempt to misdirect the conversation. It’s what you do.

Why don’t you send me another email whining about me being mean.

You are out of your league on financial matters. Stick to your bullshit global warming doom and the impending ebola kill off of America.

Your drivel is tiresome and repetitious. You are a one trick pony. Have you posted this article on the Diner, or are you too afraid to let your 10 readers see the truth?

@ Reply RE

When i look at that graph I see a wonderful investment opportunity for a saver from about Jan 1960 to about Jan 2002.

You must remember RE, that the principal was fully insured and there were no commissions. For someone like your mom who wanted to avoid stock market risk and volatility, she did OK in my book.

Had she been able to capture those wonderful yields of the Volcker era, the compounding from those glorious years for savers would have enhanced her over all yield significantly.

Slow and steady compounding, minimal risk, adds up to some serious dough for the conscientious saver.

It’s the old turtle and hare story, and she was able to sleep at night.

There’s a simple point that the younger folk here miss completely or just don’t believe. It was always hard, and usually required extraordinary effort to gain an equity stake in life if you started from ordinary circumstances. It might have been easier to get a decent job and go through life on cruise, but to truly rise wasn’t going to happen without being the most relentless beast in your jungle.

@Reply starfcker

Not sure about that star,

With the advent of mutual funds, DRIPS, IRA’s, 401k’s etc it became relatively easy to get an equity stake in America with very limited amounts of capital.

The financial industry came up with endless products for the small investor of limited means to get a piece of the pie. Major firms like Vanguard, Fidelity, Dreyfus etc. were constantly advertising and promoting equity related savings programs for small investors, as well as most Blue Chip corporations with DRIP plans. Many were even commission free or no load as they were called.

Star – I think maybe we dan get along. I will ask Steph not to pee in your soup.

Golden – the issue is that the boomers did not do it, easy, hard, whatever. They saved nada. And now they are looking for scape goats and to steal from the young.

Fuck them. Ignorant evil assholes. I am ashamed of my generation.

GO, i’m not talking about little paper claims. I’m talking about owning and harnessing the means of production. No disrespect at all to working hard and salting a bit away. My friends and peers all own and run old school businesses. All my family on my mom’s side raise cattle and citrus. Production. Farming, mining, manufacturing. Real fucking GDP. 40 hours a week won’t get you there.

Llpoh

Shirley you realize not every injun gits ter go ter europe. If you ain’t totally plum ass fill of shit which is my inclernation, you have to understand it takes a shit load of wage slaves ter support yer imaginary previous life.

You also must realize, being a dirty stinking savage, that alpo truly ain’t that bad when mixed with a generous portion of ketchup and slathered on some wunderbread. When Billy was findin his self ( at the business end of a 300 lb negro) and not generating any SNAP benefits me n Billy Jr raided the neighbors dog bowl many a time.

First, I’d like to say that I was not trying to be an ass saying Admin shows disdain for all groups; if he wasn’t willing to expose fuckedom’s foibles everywhere he sees them, he wouldn’t be a great journalist.

On with my comment:

I felt all 39 lashes from admins whip. if only we had had a crystal ball, we were the generation that landed on our knees after Viet Nam, high gas prices and 20% unemployment in some places, it was only Reagan’s morning in America bullshit that got us spending again.

The market flew upwards once Reagan began easing the double digit interest rates Carter imposed to fight inflation. I recall thinking this run up couldn’t last and the crash of 87 proved it. Even when we heard wild predictions the market would go to 10,000 and a book predicted Dow 30,000 we kept looking over our shoulder for another crash.

The Clinton market bubble became a formula for every president after him. No president wants to be the president that lost Wall Street. Even if you have to start a meaningless war in the middle east. The market is going to 55,000, you’ll see.

Golden – the issue is that the boomers did not do it, easy, hard, whatever. They saved nada. And now they are looking for scape goats and to steal from the young.

Fuck them. Ignorant evil assholes. I am ashamed of my generation.

I hear you lipoh and feel the exact same way.

They were always very immature, and many of them ridiculed folks that worked hard and saved. It is very trite and I apologize but the old Grasshopper and Ants story always comes to mind in this discussion

Sorry Star, Should have known you were on a different level, forgive the new boy here, still learning.

[img [/img]

[/img]

“Had she been able to capture those wonderful yields of the Volcker era, the compounding from those glorious years for savers would have enhanced her over all yield significantly.”-GO

In the 1980s she was making just about enough money to make the mortgage payments. The house WAS her savings. There was no extra money around to drop into CDs at that time. As an investment it did pretty good for her since it was purchased for I think $35K and sold for around $150K. Had she retired a few years later she would have done much better, as the NYC RE market skyrocketed, and it resold for $300K.

She didn’t have to live off the interest, it was bonus money since she had SS and a Pension from one of her jobs.

In order to save money and invest you have to have a surplus. If you make at or below the median income in any given time period, your bills generally don’t allow for much savings.

RE

Llpoh takes a bucket of shit on this thread. Too bad. He says ….

“It takes thirty years (to accumulate wealth) ……. thirty years folks. No fucking shortcuts.”

He’s right. Then again, he may be wrong. It may take longer.

“Success is 90% perspiration and 10% inspiration.” Tiresome advice, but true.

“Golden – the issue is that the boomers did not do it, easy, hard, whatever. They saved nada. And now they are looking for scape goats and to steal from the young.

Fuck them. Ignorant evil assholes. I am ashamed of my generation.

I hear you lipoh and feel the exact same way.”

Actually, this is not true. Most folks in the 45-54 Age Range category have savings of $50K or more. The Median amount of savings for this demographic is $101K

http://www.learnvest.com/2012/11/retirement-savings-by-age-how-do-you-compare/

Ages 45-54

Among 45- to 54-year-olds, the greatest percentage (56%) had savings of between $25,000 and $499,999. The median amount saved in this age range was $101,000.

A full fifth of respondents in this age group had $100,000 to $249,999 dollars saved for retirement, making this the top answer for people of these ages.

But, unfortunately, a slightly smaller percentage had more than half a million saved than in the 33-44 age group: 6% in this age group have over half a million dollars while 8% in the lower age group have that much.

Also, 15% still have savings of $24,999 or less, which indicates they need to focus heavily on saving until they retire.

Almost a quarter (23%) said they did not know or preferred to not reveal how much they have in retirement.

RELATED: What We Can Learn From Would-Be Retirees

Want to dissect the results for yourself? Check out our chart.

Amount Saved 25-32 33-44 45-54

Less than $5,000 26% 6% 6%

$5,000 to $9,999 15% 7% 5%

$10,000 to $24,999 15% 15% 4%

$25,000 to $49,999 16% 9% 10%

$50,000 to $99,999 7% 17% 13%

$100,000 to $249,999 8% 13% 20%

$250,000 to $499,999 1% 8% 13%

$500,000 to $999,999 0% 7% 3%

More than $1,000,000 0% 1% 3%

Don’t know/Prefer not to say 12% 17% 23%

Average $37,000 $157,000 $219,000

Median $12,000 $61,000 $101,000

Obviously, the amount anyone has depends on how high their income was over the savings period. The top fifth percentile with $250K or more in savings likely had high incomes through their years of savings.

It’s a myth that Boomers did not save. Plenty of Boomers saved, the Boomers who made higher than the median income. This is commons sense.

RE

Re quotes some obscure survey of 1,300 fucking people who had retirement plans as his response to an article, based on comprehensive Federal Reserve data of actual facts.

What a pathetic douchebag debater.

Excellent summation with respect to llpoh and admin. It really is as simple as spending less than you make and saving some for tomorrow. My life mirrors llpoh both in years and time spent at the job. The extra hours I put in years ago allowed me to pay shit off much faster than my peers and they all lived for the day. I am having the last laugh, and really couldn’t give two shits about their plight in life.

None of them listened then as none will listen today. Turtle always wins the race.

RE – that is a link to a fucking survey. Survey says….. Horseshit.

All economic and demographic statistics are gathered by Surveys. The US Census is a Survey.

RE

Obviously I won’t post an Ideological article like this one on the Diner, anymore than I would post any of the trash you write in your 30 Blocks of Squalor or People of Walmart articles. Its all Libertarian Propaganda. I post your articles that do good economic analysis, and this one does not qualify. It is complete trash.

You accuse me of lieing about what the return rates were on CDs, when the records are right there for everyone to read. You lie through your teeth and accuse me of lieing. You are full of shit, a complete ideologue and propaganda artist.

I did write a rebuttal to this piece of trash, it is up on the Diner now. Obviously I will not send it your way for a Cross Post. LOL.

RE

RE

Fuck you. You are so fucking stupid you can’t read your own fucking chart. The chart confirmed exactly what I said in the article.

You’re fucking done on TBP. I will never post your drivel again.

Don’t send me another email, you fucking piece of shit.

Enjoy the sound of one hand clapping on your website.

“Stucky, congratulations on little Rena. What is her middle name… ” ——— Maggie

Her middle name is “Grace”. (BTW … my first name is ‘Nicholas’ …ha!)

We went to see her again yesterday. Lots of babies are butt-ugly … but not baby Rena (and I would be truthful if she was). She’s just ADORABLE. I held her for an hour. Interesting how when you put your finger in the palm of her hand … she immediately latches onto it, even while sleeping. If only my moobs produced milk, I would have fed her.

I am stunned ……. STUNNED, I tell you!!! …………….. that Llpoh’s post @4:31 is getting thumbs down.

I can only assume those people are either jealous, or simply cry “bullshit!” about working hard …. for the man.

Due to WWII, my dad never even completed grade school. Came to this country with a couple bucks in his pocket. He’s about 90 now. Has some money, not much but lives comfortably enough, house paid for, and such things. He worked his ass off, and saved ….. and with the exception of the house, NEVER EVER bought anything on credit. Never owned a credit card …. still doesn’t even have a debit card …. in his life. That’s about it.

But, I’m sure SAH and Clams would say …….. “THAT WAS THEN … THIS IS NOW …. IT CAN’T BE DONE NOW!!!!!!!!”. This is a crockery of shittery.

Hewlett Packard (USA) back in 1989 was divided into four regions. In 1989 I was recognized as HP’s number 1 employee in the Midwest Region (for the sales and pre-sales and support organizations). Honestly, I wasn’t the sharpest tool in the shed. HP tended to hire Ivy Leaguers and those from Top Universities …. not those from podunk NJ colleges … and so I competed against thousands of those folks. I won for one reason, and one reason only. I followed my father’s footsteps. Persistence! I decided that nobody, and I mean NOBODY was going to out-work me. And, they did not. So, I won.

So, go ahead and vote this down as well. THAT doesn’t take much work.

I’m writing a post that will go up the day before Thanksgiving … no title yet, but it will be about correcting perceptions and myths about the American Indian. I’m certainly not qualified to write about it, but I know how to do research …. that’s a LOT of work.

I love work.

RE

“One should not shit where one eats”

—-old Austrian proverb

You stepped over the line, Sweet Jeebus, you stepped over the line.

Now YOU’RE toast!

Got regrets?

Feel free to post any of my original articles on DD … I need moar followers!! (even though they hardly ever get more than a few comments)

Nice going Stucky. I’m sure your strong character and marvelous personality had a lot to do with your success at HP as well.

Rena appears to have totally captured your heart already; she sounds like one awfully sweet young lady.

Golden, no apology nesessary. Lipoh, i like to rumble, we’re fine. Jim’s timeline isn’t random, it coincides with Reagan. It was the best time ever to start a business. Government just got out of your way. It was extremely hard to raise capital, but if you were young and energetic, the sky was the limit. Work ethic, long term planning, resiliance, delayed gratification

Several posters comment on not having enough income to save and invest. I never in my life got a steady paycheck over 300 bucks. So i worked overtime, got a second job, worked for tips, hustled. I bought my first house after an 18 month stint bartending. All my coworkers let that cash burn a hole in their pocket, i took mine home and saved it

RE bites the dust. He has always bit the hand that feeds him. What a cur.

Thanks Stuck. Amazing that you post that my post was good, and you get thumbs up, while the original gets shat upon. People cannot stand the idea of hard work. They call you a liar if you tell them how it was. My kid is currently working huge hours in grad school. Not quite what I did as he does not have to hold a job, but around 90 hours per week. It has come as a shock to his system, but he at least had some idea it as going to happen.

Thanks SSS. Wish you would post more.

You, and 100 others, sent your e-mail to the wrong address. I was talking about State Pensions.

Admin – you have shown remarkable restraint with RE over the years. I remember all the times he would scream you were censoring and hindering free speach if you would not post one of his steaming piles of shit. All the while he censored comments on his blog (justified it by saying he does not censor but only moves comments he does not like – to hidden areas on the blog no one can find).

And he expects you to post his articles, and ADMITS half his traffic comes from your site. And then has the nerve to badmouth your stuff, and refuse to cross post it.

He is, was, and always will be a steaming pile of shit.

Just read the comments on this article at ZH. And I thought some posters here were dumb. I have never seen so many lame ass excuses in my life. Ie:

1987 crash scared me so I stopped investing

Divorced

Child support

Lost my job

My parents did not teach me how to handle money

Lost it all in 2001.

Etc etc etc.

Fucking bunch of losers.

Preach on you stinky red devil. If the entire world was like you we’d all be drinkin ballvennies double wood every night and have one uh the inflatable weiner and whatnot. We could all devote our off time to interweb forums, rubbin all them dumbasses noses in the putrid shit of their wasted lives. If I knew who you really was I’d seek you out cuz Billy don’t have the same drive as you.

I’ll give llpoh one thing. Working hard, foregoing creature comforts, eating out, vacations etc does pay off. No doubt about it. Always has, always will. I do wonder if those things will be enough for minnies to achieve a comparable level of success to that achieved by llpoh. One of the things that boomers and gen x’ers benefitted from was an ample supply of hard working successful individuals and entrepreneurs in their families and communities. “Good Examples” if you will. I think there is less of that nowadays. If ideas are not being inspired by success of those around you then success tends to die out like fatherhood and family in inner shitty black communities.

Another thing is that a nice, big house, good job, nice cars and nice stuff has, for a long time been seen as symbols of success. Too many people acquire these things and incorrectly assume that they are now successful and maybe they are but the point is long term success. Each of us has a model of success in our minds, from first time poster Floyd (above) to LLPOH. Some might achieve what I have and consider it a success (I don’t….yet) and others like llpoh achieve their level of success and then relax. LLPOH apparently has reached the success level he was aiming for and is not beginning to relax and enjoy the fruits of the years of sacrifice. Still others like Warren Buffet, David Rockefeller, Bill Gates achieve llpoh’s level of success and keep digging well into their 60’s, 70’s, 80’s and beyond and become stupid rich.

I happen to agree that there is NO SUBSTITUTE for several decades of hard, unrelenting work and sacrifice except for dumb luck. Of the two, hard work is the only one you can control.

I’m 47 and my wife and I have always lived a pretty frugal life though not as frugal as llpoh claims to have lived and despite living below our means, saving money, foregoing temporary satisfactions and working hard it was not until 2005 that my wife and and I began to notice that those things were beginning to pay off. Savings started to look like “real money” as in we had more than we ever really thought we would have. It’s odd but it just sort of sneaks up on you. It’s sort of like paying a 30 year mortgage. For a long time that principal balance never seems to drop but then you notice the principal part of the payment begins exceeding the interest portion. You begin to see signs that your hard work is paying off. I think the hard part is to not get fooled and relax. Keep digging. Re-double you efforts even if only for a few years. Maybe take a second job for a few hours a day if OT is no available to you. Even if only for a couple years. Put all bonuses, raises and secondary income towards debt or savings. It will pay off!

I have Friday, Saturday and Sunday off every week and I’m thinking about taking a second job for two days each weekend just to get a little further along. I don’t “need” the income but the long, cold, dark days of winter would be a great time to earn some extra FRN’s to increase my savings.

My biggest obstacle to achieving my modest goal of economic security, besides the ciminal theft by my govt., is the fact that I no longer trust the markets. I understand that reward comes with risk and I’m willing to tolerate some risk but I’m not willing to tolerate outright theft or complete devaluation of “paper” assets. Hard assets may someday make me wildly rich but they come with significant risk in the current environment. My savings should be working as hard for me as I worked for them by now but I do not trust the markets. How the hell do I get past that today?