Ticking away the moments that make up a dull day

You fritter and waste the hours in an offhand way.

Kicking around on a piece of ground in your home town

Waiting for someone or something to show you the way.

Tired of lying in the sunshine staying home to watch the rain.

You are young and life is long and there is time to kill today.

And then one day you find ten years have got behind you.

No one told you when to run, you missed the starting gun.

I stumbled across two mind blowing charts yesterday that had me pondering how generations of Americans had frittered their lives away, spending money they didn’t have on things they didn’t need, utilizing easy to acquire debt, and saving virtually nothing for their futures or a rainy day. We are a nation of Peter Pans who never grew up. While I was driving home from work, one of my favorite Pink Floyd tunes came on the radio and the lyrics to Time seemed to fit perfectly with the charts I had just discovered.

We were all young once. Old age and retirement don’t even enter your thought process when you are young. Most people aren’t sure what they want to do for the rest of their lives when they are in their early twenties. Slaving away at your entry level low paying job, chasing the opposite sex, getting drunk, and having fun on the weekends is the standard for most young people. But you eventually have to grow up. Because one day you find ten years have got behind you. No one tells you when to grow up. And based on the charts below, tens of millions missed the starting gun.

I graduated college in 1986 and started my entry level CPA firm job, making $18,000 per year. I did live at home for a year and a half before getting an apartment with a friend. I was able to buy a car, pay off my modest student loan debt, go out on the weekends, and still save some money. I was in my early 20’s and had opened a mutual fund account at Vanguard. Anyone who entered the job market from the mid 1970s through the mid 1980’s, which would be the late Baby Boomers and early Generation Xers, had job opportunities and the benefit of low stock market valuations.

P/E ratios of the market were single digits in the late 70s and early 80s, versus 20 today. Dividend yields on stocks averaged 5% for the S&P 500, versus 1.9% today. The Dow bottomed out at 759 in 1980, while the S&P 500 bottomed at 98. A 20 year secular bull market was about to get under way. Baby Boomers and Generation Xers had the opportunity of a lifetime. Even after six years of the bull, when I graduated from college the Dow stood at 1,786 and the S&P 500 stood at 521. I had just begun to invest when the 1987 crash wiped out 20% in one day. It meant nothing to me. I didn’t have much to lose, so I just kept investing.

The 20 year bull market took the Dow from 759 to 11,722 by January 2000. The S&P 500 rose from 98 to 1,552 by March 2000. You also averaged about a 3% dividend yield per year over the entire 20 years. Your average annual return, including reinvested dividends, exceeded 17%. Anyone who even saved a minimal amount of money on a monthly basis, would have built a substantial nest egg for retirement. If you had invested in 10 Year Treasuries, your annual return would have exceeded 11% over the 20 years. Even an ultra-conservative investor who only put their money into 5 year CDs would have averaged better than 7% per year over the 20 years.

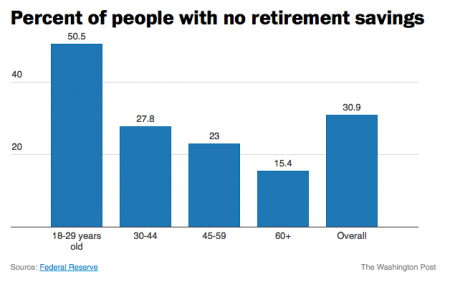

Even with the two stock market collapses since 2000, your average annual return in the stock market since 1980 still exceeds 11%. That’s 34 years with an average annual total return of better than 11%. Every person who had a job over this time frame should have accumulated a decent level of retirement savings. That is why the chart below is so shocking. Over 15% of all people 60 and older and 23% of people 45 to 59 years old have NO retirement savings. None. Nada. Zilch. This means 25 million Boomers and Xers are stuck living off a Social Security pittance and choosing between keeping the heat on or eating a feast of Ramen noodles and Friskies. It seems they let 30 years get behind them. They missed the starting gun.

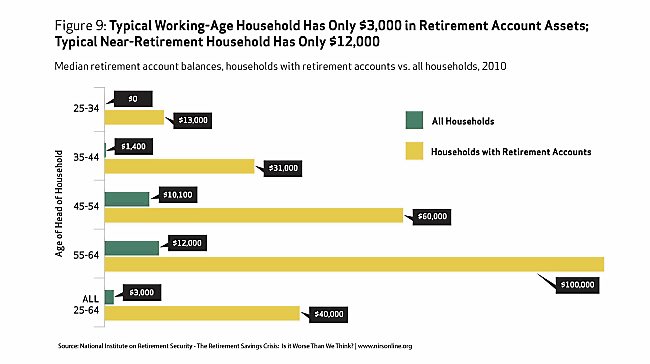

I’m not shocked that over 50% of 18 to 29 year olds have no retirement savings. With the terrible job market, declining real wages, massive levels of student loan debt, two stock market crashes in the space of eight years, and 4% annual returns since 2000, young people today have neither the means nor trust in the system to save for retirement. Their elders had no such excuse. Just a minimal amount per paycheck saved over the last 30 years would have compounded to well over $100,000, even at modest salary levels. It is disgraceful that 25 million people over the age of 45 have saved nothing for their retirement. Far more disgraceful is the median household retirement balance of $3,000 for all working age households. There are 122 million households in this country and 61 million of them have $3,000 or less in retirement savings.

The far worse data points are the $12,000 median retirement balance of aged 55 to 64 households and the $10,100 median retirement balance of aged 45 to 54 households. These people are on the edge of retirement and have less than one year’s expenses saved. There is no legitimate excuse for this pitiful display of planning. These people had decades to save, strong financial market returns, and if they worked for a decent size organization – matching contributions to their retirement accounts. They didn’t need a huge salary. They didn’t need to save 20% of their salary. They didn’t have to be an investing genius. A savings allocation of just 3% to 5% would have grown into a decent sized nest egg after a few decades of compounding.

We know from the data in the chart, it didn’t happen. The concept of delayed gratification is unknown to the millions of nearly broke Boomers and Xers, shuffling towards an old age of poverty, misery and regret. A 64 year old has a life expectancy of about 20 years. They’ll have to budget “very” frugally to make that $12,000 last. The question is how did it happen. I don’t buy the load of crap that you can’t judge people as groups. I judge people by their actions, not their words. I know you can’t lump every Boomer and Xer into one box. Individuals in every generation have bucked the trend, lived within their means, saved for the future, and accumulated significant nest eggs for their retirement. But the aggregate numbers don’t lie. The majority of those over the age of 45 have squandered their chance at a relatively comfortable retirement. These are the people who most vociferously insist the government do something about their self created plight. It’s their right to free healthcare, free food, subsidized housing, free utilities, higher minimum wages, and a comfortable government subsidized retirement. They are wrong. They had a right to life, liberty and the pursuit of happiness. It was up to them to educate themselves, get a job, work hard, and accumulate savings.

The generations of live for today, don’t worry about tomorrow Americans over the age of 45 have no one to blame but themselves. They bought those 4,500 sq foot McMansions with negative amortization 0% down mortgages. They had to keep up with the Jones-es by putting in granite counter-tops, stainless steel appliances, home theaters, Olympic sized swimming pools, and enormous decks. They have HDTVs in every room in their house and must have every premium cable channel, along with the NFL package. They upgrade their phones every time Apple rolls out a new and improved version. They pay landscapers to manicure their properties. They lease new BMWs every three years. They have taken exotic vacations on an annual basis. They haven’t packed a lunch for themselves since they were 16 years old. Eating out for lunch and dinner has been a staple of their existence for decades. That morning Starbucks coffee is a given. A new wardrobe of name brand stylish clothes for every season is a requirement because your neighbors and co-workers are constantly judging you. Nothing proves you’re a success like a Rolex watch, Canali suit, Versace boots, or Gucci handbag. The have it now generations got it then and have virtually nothing now because they acquired all of these things with debt.

Real cumulative household income is up 10% since 1980. Consumer debt outstanding has risen from $350 billion in 1980 to $3.267 trillion today. That is a 933% increase. We’ve had decades of faux prosperity aided and abetted by Wall Street shysters, corrupt politicians, mega-corporation mass merchandisers, and Madison Avenue maggots trained in the methods of Edward Bernays to convince willfully ignorant consumers to consume. And consume we did. Saving, not so much. You can blame the oligarchs, bankers, retailers, and politicians for the fact you didn’t save, but it rings hollow. No matter how much propaganda is spewed by the ruling class, we are still individuals with free will. The older generations had choices. Saving money requires only one thing – spending less than you make. Most Boomers and Xers chose to spend more than they made and financed the difference. When the average credit card balance is five times greater than the median retirement account balance, you’ve got a problem. The facts about our consumer empire of debt are unequivocal as can be seen in these statistics:

- Average credit card debt: $15,593

- Average mortgage debt: $153,184

- Average student loan debt: $32,511

- $11.62 trillion in total debt

- $880.3 billion in credit card debt

- $8.05 trillion in mortgages

- $1.12 trillion in student loans

I don’t blame those in their 20’s and 30’s for not having retirement savings. Anyone who entered the workforce around the year 2000 has good reason to not trust the system or their elders. There have been two stock market collapses and every asset class is now extremely overvalued due to the criminal machinations of the Federal Reserve. There are far less good paying jobs. Real wages keep declining. They were convinced by their elders to load up on student loan debt, leaving them as debt serfs. The Wall Street/Federal Reserve scheme to boost home prices and repair their insolvent balance sheets has successfully kept young people from ever being able to afford a home. So you have young people unable to save, invest or spend. You have middle aged and older Americans with little or no savings, mountains of debt, low paying service jobs, and an inability to spend. The only people left with resources are the .1% who have captured the system, peddle the debt, and reap the rewards of consumption versus saving. They may be able to engineer a stock market rally to further enrich themselves, but they can not propel the real economy of 318 million people. Our consumer society is dying – asphyxiated by debt – shorter of breath and one day closer to death.

I’d love to offer some sage advice on how to fix this problem, but it’s too late. Too many people missed the starting gun. More than ten years got behind them. No one is going to come to the rescue of people who never saved for their future. The Federal government has already made $200 trillion of entitlement promises it can’t keep. State governments have made tens of trillions in pension promises they can’t keep. They can’t tax young people who don’t have jobs. Older generations who think the government is going to rescue them from their foolish shortsighted choices are badly mistaken. Their benefits are likely to be reduced because the unsustainable will not be sustained. The 45 to 64 year old cohort who chose not to save can run and run to try and catch up with the sun, but it’s too late. It’s sinking. Their plans have come to naught. They are destined for lives of quiet desperation. There is nothing more to say.

So you run and you run to catch up with the sun but it’s sinking

Racing around to come up behind you again.

The sun is the same in a relative way but you’re older,

Shorter of breath and one day closer to death.

Every year is getting shorter; never seem to find the time.

Plans that either come to naught or half a page of scribbled lines

Hanging on in quiet desperation is the English way

The time is gone, the song is over,

Thought I’d something more to say.

Star – I listed several. What, you too stupid to read?

No investments are risk free. No such thing as “safe”. That is why there are things like “diversify”, due diligence, etc.

Compare assets my ass – if you had any, you would know this shit.

But my best advice for folks that have the skills, and are of the appropriate age, and not risk adverse, is to snap up one of the great many profitable small businesses out there where the owners are wanting to retire. They can be had at huge discounts to actual value. Owners are desperate to sell up. They are high risk, high reward. They can return over 50% a year on investment. So if you can milk the cow for around three to four years, you recover your investment, and the rest is gravy. But you need the capital, the skills, and the work ethic to make to go. But it offers a great chance to get rich.

Hey lipoh, if i drop your name, can i get free guacomole on my burrito?

Worth a try. Maybe you will get Steph Shepard as waitress. She loves me! But she may also spit in your iced tea, too. Nothing is risk free.

RE – your point re the bottom tranches is accurate, to a greater or lesser extent. They are NOT the issue, in my opinion.

The issue is that those say between the fortieth and 85th percentile of earnings are saving far below what they could. If those folks saved and invested properly, the nature of the country would shift massively. Those folks are capable of packing away/investing probably $5k to $25k per year. If they were smart and frugal. And by that I mean non-housing assets.

But it did not happen. So welcome to Fucksville, population 300 million.

Billah

Where’d ya go? Speaking of burritos, I ate 14 microwaved ones and now I have the runs superbad. It’s way more then the makeshift portajon kin handle so somebody other than me er Billah Jr’s gonna have to handle this brim full 5 gallon bucket. Git yer buck toothed gaggle faced ass hole home pronto. We have a category 5 emergency right the middle of our living room.

I have folks working for me that have made 50k or so a year, steadily, for thirty years. Some of them are millionaires and multi-millionaires now. (Around six). Steady savings and investment and frugal living have made them rich.

Interestingly, every one of them was foreign born. Except one.

Tink. The sound of the penny dropping.

Good article: But, you missed a major point. Government employees. They are millionaires.

Guaranteed 8% per year with a 2% Cola. In Oregon their contribution is zero. Average 30 year

retirement is $50,000.00 a year which requires with a COLA 1.5 Million. Try saving 1.5 million

by age 55 while raising a family. Saving $2,000 a year at 6% is more realistic. Just think if your Social Security paid 6% per year compounded over 40 years; become very rich. Do the math.

Fred Starkey

I didn’t miss that point. Those government employees will not receive what they were promised because the money isn’t there. It’s nothing but a promise and when the next financial crisis crushes the finances of the Feds and States, those promises will vaporize. Ask the government workers in Stockton and Detroit.

I love it when Admin kicks RE in the nuts.

As I mentioned, RE’s point re the bottom 20 percent being unable to save is true enough.

But Admin is totally right – the problem is that those able to save did not. Ignorant fucksticks spent everything they made, and then some.

The entire world would have been different if the majority of people had just a tiny smidgen of common sense.

Hard work, thrift, planning for the future was to damn difficult, because I can have a big TV now on credit issued by a benevolent bank.

It is despicable.

Some of this predates me. I was ten years old in 1980 and didn’t graduate from college until 1992. The job market was bad, and I only made $14,500 a year at my first full-time job (so I worked a second job for about six years) but on the good side I didn’t have much debt when I graduated. As time went on, I got better full-time jobs and better second jobs. After three years, my second job paid better than my first full-time job had paid, and I was on my third full-time job by then so that paid better, too.

Anyway, I didn’t want to start investing for retirement until I got myself weaned down to one job, because I was around 28 by then and had never done anything since college graduation but work two jobs and really wanted to have a life.

At the end of 1999, I had about $16K in my very first 401K, but then lost that much over the next three years. However, during those years my 401K balance grew because of how much I was putting into it.

By the end of 2007, I had earned nearly $32K on my investments, only to lose $42K in 2008. It was at that point I realized this was all bullshit. The only people who make money on 401Ks are the people selling them. I waited until the market went back up to my break-even point and got out. Then bought gold, and have been screwed ever since.

So now I invest in learning new skills (just got extensive training in Hyperion this month – as a contractor, no less!) and only work half the year.

If I had to do things differently, I would never have bothered with the financial industry. I would have spent every last dime paying off my home – which I did anyway, but I would have done it sooner – and spent less time working at the shitty jobs available in the current day labor market.

Aaron Clarey is singing my anthem with this:

http://www.returnofkings.com/28771/youll-never-find-a-good-corporate-job-like-your-parents-did

Oh, and uh, was I forgetting something? Oh yes!

Don’t have kids.

No offense to Stucky, who always makes me laugh. Maybe you’ll make your granddaughter laugh too, someday. She’ll need it.

Lipoh, at least you have a sense of humor. I’ll uptick you for that. Peace

Excellent article, Admin. Your disdain for Boomers, and now GenXers, has always been palpable.

“The far worse data points are the $12,000 median retirement balance of aged 55 to 64 households and the $10,100 median retirement balance of aged 45 to 54 households. These people are on the edge of retirement and have less than one year’s expenses saved. There is no legitimate excuse for this pitiful display of planning.”

Exactly. You have built a case for a legitimate indictment of two entire generations. The stress of being in that situation would have killed me years ago. Fortunately, I didn’t play that game.

Star, llpoh comes from a different time, but he’s hanging onto his small business with the last bare threads of his sanity, and he’s done some good. You have to respect that. And he does have a sense of humor – glad you see that.

You must be younger, though, and you are speaking truth about the way things are now. And you have a sense of humor, too!

Peace, indeed!

Admin – thanks. Truly. You have a way of seeing and communicating that is a gift. Me, I tend to bludgeon.

I have been telling folks that it takes THIRTY years of hard work, frugality, etc., to get to where youeed to be.

They look at me like I have three heads. “no way in hell I am going to do that! I deserve a big house, a BMW, and nice vacations now, goddammit!”

Bullshit.

Here is my economic life in a nutshell:

Between 20 and 30, i educated myself and got experience in valuable fields. A couple of wrong turns, but by 30 I could command good salaries, and I avoided stupid debt. Just about cleared student loan debt.

30 to 40 I began to consolidate – drove a 20 year old car for the decade. Saved money. Bought into a business and mortgaged every thing I owned and then some. Did not eat out during the entire decade, save on my tenth wedding anniversary. Not once otherwise.

40 – 50 paid off my business debt early in the decade. Upgraded house and paid it off in a year. Packed away money, but lived frugally – no big trips, rarely ate out, etc. bought more business stock. Kept consolidating.

50 – 60 Eureka! Reached point by 50 where I had more than I needed for rest of my life. Buy what I want, go where I want, live where I want, drink what I want, drive what I want, do whatever the fuck I want. Investments keep churning out income.

For thirty fucking years I kept my eye on the goal. No varying from the plan. Work, educate, save, thrift. No buying shit. No going into debt except to buy income producing assets. No driving nice cars, no nice vacations, nada. We lived without. We had a goal, and that was it. We did not suffer – we lived just fine. But no extras, even when we had a nice stash in our forties.

I can remember the day I told my wife – honey, we are there. Whatever you want or need, go for it forever more. We went a bit hogwild for a while. Just because. Now we spend on whatever we want, but tend to really only be extravagant on travel. And booze. We like good booze.

It will not work entirely the same for everyone. But it will work to a greater or lesser degree.

It takes thirty years. Admin is there now – the next ten years are the money years for him. He made his future the last thirty. The next ten simply will cement it.

Thirty years folks. No fucking shortcuts.

Please spare me the “but I work hard and deserve some luxuries” bullshit. Talk to the hand.

Thirty years of discipline to assure you are set for the long run.

Star – just trying to keep it lively. All is cool. We need some fights just to keep comments rolling. Admin deserves these articles to be debated and discussed.

Thanks PJ! Glad your plan is working.

I suppose I was fortunate, did save and retired 4 years ago at 58. I even tacked on 10 years of public sector work to get a small defined benefit pension that pays for my health insurance. Paid cash for a condo on the water, bought a small boat and had a million dollars when I quit. I should feel secure but I don’t. Too many things can go wrong. Have gone wrong in the past.

I have in my possession my great grandfather’s financial statements from the 1930’s. He was a very wealthy man. Net worth reached over $3 million dollars in 1931. Owned real estate, a bank and an insurance company. He died in 1936 and it was all gone. He was too leveraged to survive the Depression.

There is very little you can own that is really secure. Physical assets are great if you own them free and clear but most people do not have enough money to own the kind of prime physical assets that can endure an economic upheaval and governments have a way of confiscating assets when times are rough. Gold can be made illegal to own. In fact, our government did make it illegal to own and, let’s face it, my small stock of gold coins is worth no more today than when I bought them 6 years ago, especially given inflation and the 28% capital gains tax put on physical gold . Should gold go to $2500 per ounce the government could simply treble the tax too. Don’t think they won’t either.

Yeah its better to have saved, paid off your debt and arrived at today with a nice nest egg but when the underlying economy is built on unsustainable debt and paper financial assets no one is really rich or secure.

“The issue is that those say between the fortieth and 85th percentile of earnings are saving far below what they could. If those folks saved and invested properly, the nature of the country would shift massively. Those folks are capable of packing away/investing probably $5k to $25k per year. If they were smart and frugal. And by that I mean non-housing assets. “-LLPOH

Except Jim’s figures indicate that only 15% of people older than 60 don’t have savings, which means that 85% of people in this age range DO. Therefore, people between the 40th & 85th percentiles do have savings. Most people I know in my age range have some kind of savings and/or pensions to supplement SS. Personally I got 2 pensions due me when I retire plus a 401K plus SS plus the Booze Bucks. Sadly of course, I think by that time the Monetary System will be toast and it will all be quite worthless.

The people mostly unable to save are the more recent generation, but again since the Dollar is toast anyhow, what’s the point in saving them? Spend them now on Preps while they still have some value! If you have some surplus after that, feel free to buy some Gold too!

RE

Re – are you dense? All households of age 55 – 64 have 12k savings. Ie nada.

SSS says:

Excellent article, Admin. Your disdain for [insert group name here], has always been palpable.

Fixed it for you, SSS.

but again since the Dollar is toast anyhow, what’s the point in saving them? Spend them now on Preps while they still have some value! If you have some surplus after that, feel free to buy some Gold too!

RE

Are you now suggesting that Gold might have some value after the dollar or financial system goes caput? Who wised you up on that point? Gold bugs were all ass holes last I heard from you.

If you really feel that way why haven’t you cashed in your 401K early, paid the penalty and stocked up on preps while you still can?

A can of beans in the hand is worth a full case in the bush.

[img]http://ts1.mm.bing.net/th?id=HN.607992379625310871&pid=1.7[/img]

I agree with what Llpoh and Administrator say about steady saving and investment.

That’s the key to your future and your family’s future.

Fred Starkey makes a good point about too many goverment pensions being outrageous.

I know from friends’ situations that what Starkey says is true.

One is being paid 168% by the State of ___ of his final average salary. Two others are being paid from a third to a half more in retirement income than when they were working.

I quit looking online after that. What I found upset me too much.

Fortunately I’ve followed the L and A saving approach. For me it has usually been spend a third, save a third, and pay a third for taxes. Fortunately taxes usually haven’t been that high.

Read what Llpoh writes about five posts above. “Work, educate, save, thrift,” and think about his advice.

I agree with it.

You should too and you should teach it to your kids and grandchildren

Oh, one other comment… Mostly my cheapest pleasures have been my most enjoyable and most memorable. Mostly entertaining myself and creating with family and friends have been the best times and entertainments. In my life mostly less has been more.

Read what Llpoh writes about five posts above. “Work, educate, save, thrift,” and think about his advice.

I agree with it.

You should too and you should teach it to your kids and grandchildren

Great posting Jackson. As for the education part; the greatest lesson ever taught to me about thrift and saving was the miracle of compound interest.

No lesson of more value when it comes to investing or finance in my opinion. I do all I can to drill it into my grandchildren, it’s not an easy task but well worth the effort.

Llpoh, actually I followed pretty much the same plan as you. But it only took me 20 years instead of 30 because I stayed single and didn’t have kids. I do think others here have a point, though, as our esteemed TeresaE (or TE) has pointed out in the past, those who sacrifice immediate gratification for long term security are going to find they get neither.

Me, I can only assign percentages. Will the entire financial system collapse during my lifetime? I give it a 60% yes and 40% no. That 60% yes is why I invested heavily in precious metals, and the 40% no is why I still have money in IRA accounts. (Not that this has worked out well for me in the last couple of years, but we shall see – there are two or three decades to go yet.)

As for now, I am only 44 and just want the next twenty years to be better – the last ten have sucked. That means working less and enjoying life more, since work is not a source of enjoyment, meaning, fulfillment, or purpose for me. (It’s just a paycheck.) Because really, who in their right mind would wake up to an alarm clock every morning, drive to a building where you can’t even open the windows, and sit in a cubicle for eight hours?

You are right, as you said in a previous thread, that eventually health problems will slay me. I know that. Health problems lay everyone down eventually. If you don’t die from something, you die from nothing. I’ll get a reverse mortgage when I’m 60 and keep working a few months of the year until I just can’t find a job anymore.

In 35-40 years, when I am 80-85, I don’t think there will be Medicare or any such shit to fix my ailments. By that time, I’ll be old and useless and in failing health, and there won’t be any “other people’s money” to sustain me, nor would I want them to. Speaking of percentages, the likelihood that I’ll have to off myself someday, when I myself become a useless eater? 70%. But I don’t believe it is a sin (my life belongs to me, not “God” or anyone else), and besides by then I will probably want to. I’m not going to want to live in pain, with failing eyesight, unable to do the things I enjoy.

But so what? I have quite a bit of time yet to enjoy. And “enjoy” is my purpose. When the time comes, at least I’ll head for the white shores on my own terms, not mouldering away in a damn nursing home like my grandmas did.

If I have anything left over when I die, it’s going to my sweety’s (if he is not still alive, either) niece or the pug rescue network.

Oh my Gawd, pirate jo makes me want to squirt out another Billy jr just cuz I can, and hon, don’t burn up any more of yer lonely boring life sniffing yer own farts in an anonymous cubicle. Maybe you should adopt one uh them brownies from over yonder.

If you want to retire check out Early Retirement extreme and Mr. Money Mustache.

” All households of age 55 – 64 have 12k savings.”-llpoh

That’s ridiculous. Obviously ALL households of age 55-64 do NOT have $12K in Savings, since my household fits that demographic and I have way more than that. Where do you come up with nonsense statistics like this?

RE

“Are you now suggesting that Gold might have some value after the dollar or financial system goes caput?”-GO

No, I am suggesting when you have all the preps you can possibly use and still have surplus FRNs, feel free to sprinkle them around in whatever floats your boat.

RE

On average asshole.

I guess there will be a whole lot less boomers retiring. Not the end of the world, and they will get to keep on spending. Good for the economy.

But bad if you are a young person looking to take that older persons job.

Even on average that is a worthless statistic. If you take the bottom 25% with Zero Savings into the average, obviously the average will be drawn down a lot by this.

Next, the Savings doesn’t figure in the Pensions many people receive from companies they worked for, as well as Union Pensions, Military Pensions etc. So you don;t really know from this precisely what percentage of people are stuck living on just SS at retirement.

Pensions are of course a form of savings, deferred compensation which of course assumes the company you worked for never goes outta biz and Da Goobermint never goes outta biz or runs out of money. In fact, Da Federal Goobermint has a fund to pick up pension payments from companies that went belly up over the years, the Pension Benefit Guarantee Fund.

http://www.pbgc.gov/

My best guess would be the people with no savings at all worked in low paid service economy jobs their whole lives, and probably were at or below the poverty line for most of the time. The next quartile probably has very low savings but some other forms of pensions.

Moving up the line to the top half, likely the higher your income through the period the more you have in savings. I am sure there are a few people who made 6 Figure incomes around with no savings, but I think it is a very small number. I personally have never met anyone who had income in this category who is without some sort of addition to their SS check.

RE

Great article Jim… – I’ve followed and loved your work for years.

Those still in this rigged game can use all the help they can get – just trying to lend a helping hand here if one might be needed.

For anyone fortunate enough to be still prudently riding the waves of the stock market via index funds or ETF’s, and wondering what to do when confronted with that “should-I-stay-or-should-I-go” moment, they may wish to consider some time tested guidance to avoid the inevitable train wrecks like the ones in 2002 and 2008. Can’t say when they’re coming exactly, but come they will.

This guidance system is very inexpensive, easy-to-use, and effective. Check it out at http://longtermtrendmonitor.elliottwavetechnology.com/ and let me know if you have any questions.

There’s a big end of year campaign in progress too > see here: http://eepurl.com/8M4Jv

Jim, I hope you don’t think I’m spamming your site – just trying to help out with what I’m good at is all – thanks again for your incredible body of work – its classic!

What these charts always seem to leave out is that a huge amount of these people don’t need to have a saved a penny because they have a pension, generously provided by the real working tax payer. Why should a teacher bother saving a dime when they are guaranteed a salary in retirement along with full health benefits? Until we nix all pensions, it will not be a level playing field. A minority of us support the rest.

One of my good friends runs a multi doctor family practice. To hire an experienced jewish american doc costs him 120,000-140,000. Another guy i know is a fireman with the city of hollywood. His total compensation was 154,000. He sat for the leiutenant exam, a 3 hour test. 15 of these positions open. Pass the test, get a 22 per cent bump in salary, benefits, pension, everything. He passed. He now costs the city 188,000. a year. For a fireman. With a high school diploma. Hollywood has 3 or 4 assistant city attorneys that make 325,000. per year. Chief supreme court justice john roberts makes 225,000.

@Billy

A very old, but appropriate joke for you and your wise wife;

Bill and Alice had been married for 42 years, when one day Bill returned home from work very distraught. Alice, being a perceptive wife, asked, “Husband, what’s troubling you?”

Bill replied, “Darling, sit down. I must tell you some very bad news. We are broke. We are Bankrupt. We are paupers. Our Accountant has stolen everything we saved for our retirement. He is somewhere in South America and we will never find him or receive justice.”

Alice stood from her chair, clasped Bills hand and said, “Come with me my love. We’re going to take a drive in the car. Please trust me when I tell you that by the time we return to our home, you will be happy again.”

A few minutes later, Alice is driving down Main Street. She tells Bill, “do you see that office building there where all the tenants are attorneys? We own that.”

Several blocks further down the road, Alice says, “See that apartment complex where 80% of tenants are between the age of 52 and 82 years old and receiving government pensions? We own that.”

On the outskirts of town, 40 minutes into the drive, Alice informs Bill, “See this little grocery store that does most of its business using SNAP and EBT government subsidies? We own it too! We’re very wealthy, Bill. Please don’t fret. No doubt, our accountant will be murdered by durg lords soon”

Bill should be happy, but he is confused. He yells, “What do you mean, we own this and we own that? I’ve told you we are broke!”

Alice explains, “Remember our wedding night? I told you my mother explained that every time we made love, you should place $5.00 dollars under my pillow. No exceptions. I’ve saved and invested all of that money. So, Sweetheart, we have no worries. I’ve been a good wife and we are safe.”

After arriving home, Bill is angry and pacing the floor and Alice is confused.

“Husband, I can’t believe that my good news hasn’t relieved your troubled mind.”

“Oh, Alice, why the hell didn’t you charge me $10.00 dollars!?!?”

Nice story Hallie, except what happens when the Lawyers don’t have clients who can pay and then they can’t pay the rent on the apartment complex? What happens when the grocery store doesn’t have shoppers because the SNAP Cards are cut off? All those $5 Investments are worth diddly squat.

Reminds me of Driving Miss Daisy.

RE

https://www.youtube.com/watch?v=BR0oZ2pnhyg

Llpoh, in case you still read this, et.al.

Describing what worked from 1974 to now is like drawing a treasure map for the Nuesatra de Atocha. You accomplished much, but it was done under conditions that no longer pertain, a fact endlessly propounded on this website.

Listen to yourselves.

T.E. describes how she sees great danger in holding any class of investment and all appear to nod in agreement. Then a dozen people discuss the need to save, save, save.

Save in what?

Stocks? What do we see discussed endlessly here?

Real Estate, businesses (Llpoh?), gold,……………What?

Llpoh, the world is awash in overcapacity. I salute the entrepreneurs who can, in this environment discern a promising niche, but when I see someone trying to sell their businesses I see Goldman Sachs selling overpriced businesses at the top to the muppets lined up like sheep at a slaughterhouse.

This is the largest credit bubble in human history. Either that statement is true and all paths to wealth of the past few decades are OVER, or it’s false——– which is it?

I save like there’s no tomorrow. More than my entire net paycheck gets socked away because for all practical purposes I don’t have anything better to do with it. I’ve been a saver most of my life, but I’ve suffered the fate of the pessimist living in times of manic optimism. I’ve missed the huge opportunities presented during times of rampant silliness. Boo hoo, woe is me…..not at all.

My point?

Can we all just attempt to be consistent?

@Hallie, I don’t think most people can get rich, or build a real estate empire, from an investment of just $100 or so. I’m guessing you’ve not been married.

Now, if it was $5 a time for sex before getting married, then your starting investment would be larger by about 15 orders of magnitude.

As a group, the Boomers were not educated in the principles and advantages of investing. Neither our parents nor the educational system taught us that one of the imperative tasks of young adulthood is to strategize for lifelong financial health. In our ignorance, we were easy prey for the deformed capitalism that has held sway over the past 50 years, and now a heavy price is being extracted.

Economically, the worst thing that happened to the Boomers was the invention of the credit card.

@DC Sunsets – this has been my point exactly on this thread & the Fed Has Wrought thread.

I’ve worked, behaved & used my money in “the right ways” for the past 23 years (since I started working in 1991 at age 14). As it stands now, I have basically NOTHING to show for it. Nothing meaning, NO DEBT (school loans paid off, no CC debt, no car debt, mortgage debt, etc) but I also have essentially NO ASSETS. I haven’t been able to buy a home, I have no IRA or 401k. I do have a paid off 9 year old car, 2 kids I send to private elementary school (to the tune of $9,000/year), about $15,000 in precious metals (mostly worth that much because I’ve bought at lows, gained value through rising prices – i bought a few ounces gold when it was $300ish, a good chunk of silver at $11-12, few oz of palladium at $300), I have just about 3 months emergency fund in a simple savings account, and some guns. That is it. I don’t own a home.

I am 37, rounding the corner to age 40. If i were this age 25 years ago, and had made similar judgments and behaviors in the 1970s-1990s, I would be in a more solid financial position. Guaranteed. All the $ i had to spend on inflated college cost (to get out of debt)… my jobs with lower pay and benefits… I’ve had to work a lot harder, and save a lot more just to end up with NOTHING (no debt) than previous generations had to do to own SOMETHING (like a home and retirement fund).

The path to financial stability and wealth that used to lead to things like home ownership and retirement… in this era, with my “real working” starting point being ~ the year 2000… Well, the best thing you get out of it anymore is NOTHING (no debt). The bubble means I can’t/won’t own a HOME or STOCKS. Cash (my savings account) is actually devaluing.

Because of my age cohort, my good decisions have gotten me extremely diminished returns compared to what it used to get people. It fucking sucks.

Also, I promise you, the way I think and behave, if I were 25 years older I would at this point have grown-ass children, and either an off-the-grid self sufficient mini farm or $300,000+ saved to expatriate to Paraguay. Instead, I have struggled my way through from 1995 (age 18) – today (age 37), done way better than most of my peers, and all I have is NOTHING (just no debt) to show for it. I have 2 little kids, and here the crisis is. WTF.

Its a hard time for the oldsters. I get it. But it is even harder for them to admit that for the people down stream from them that doing the “right things” like education, thrift, and save (which they did in the 1960s-2000s) doesn’t get you anything in the 2000s-forward. They can’t admit that there is no more reward for good behavior. I’ve done education (debt), thrift (low wages & no bennies require this), and save (all going to pay off debt), and what do I have? Nothing. And the crisis is here.

Bottom line:

It’s a credit bubble. Stocks are skyrocketing in response to yet ANOTHER announcement of VAST debasement of money.

Hyperinflation? Damn straight!!!! It’s all flowing into STOCKS!

I’m sorry, but not 1 in a million people seem to get this. The rich are getting richer only in the sense that they’re all in a little club and accepting each other’s IOU’s in the poker game’s pot. Each hand that’s played has the “winner” sitting there with rising piles of IOU’s ———

—– FROM OTHER PLAYERS. If you don’t understand this, then you can’t understand this moment in history.

Those PILES of IOU’s are propping up the nominal values of stocks, (paradoxically) bonds, land, businesses, homes, gold coins, silver bars, etc., etc., etc., etc., ad nauseum.

As long as the players believe each other’s IOU’s can be made good, the game continues. We are clearly in a hyperinflation, where wheelbarrows of IOU’s are being pushed into brokerage houses every hour of every day.

Normally, IOU’s are actually as good as gold. This is what we’re all used to, and informs our decisions and perceptions.

Only in rare, perhaps once-in-300-years credit manias are there vastly more IOU’s issued than can be “cashed” eventually. No one with an IQ over 70 thinks the current IOU ocean is “money good,” but as Wolf wrote on his website, it’s Party now, Apocalypse Later.

I still think my guess is that this keeps going until it doesn’t. Everyone then who holds “stuff” (businesses, gold, land, homes, stocks, bonds, etc.) will suddenly find there’s no bid for any of it. Those who own such things on leverage will soon NOT OWN THEM.

First, everything that’s not nailed down will go (figurative) up on eBay. Prices will crash for everything that can be sold.

Next, banks will probably lock up (a couple years into the crisis, not imminently.)

Then Congress, in its members’ infinite wisdom, will try to print banknotes in sufficient quantity to reflate the economy. It is at this point that I imagine those who retained access to dollars (cash or whatever form that one can hold onto) will want to trade dollars for productive assets, gold, etc.

No one knows the future, but this seems the most plausible progression to me. Not TEOTWAWKI, but a complete inversion of the paths that previously led to success.

Of course, I’ve been wrong for 20 years, so my opinion’s value might be reasonably questioned. Logic does not guide the world as we know it. That’s the lesson I’ve learned these past two decades.

I think of cash today like a gold bug thought of 1 oz maple leafs prior to 1999.

To carry the analogy, is it 1994 (and there are still huge losses to be endured before “cash” bottoms and the inflation stops) or is it 1999/2001, and we’re near the point where central bank inflation peaks, the value of cash stop declining precipitously and the entire last 20 years goes into reverse?

Gold declined a VAST % in real terms from 1980 until the double-bottom 1999/2001, then it rocketed higher, from $253/oz to $1920(?) or so, and remains about $1200.

Twenty years of hard money people getting sledge-hammered year in and year out while millions of words of newsletters extolled the virtues of owning the yellow metal.

What if a lifetime of continuous compound inflation, rising exponentially in recent times (just flowing into GDP statistics instead of food & fuel) to sledge-hammer savers (and force them into playing “who is holding the armed hand grenade”) is about to finally reverse?

“…young people today have neither the means nor trust in the system to save for retirement.”

That 2nd point is crucial. People are realizing the stock market is a rigged game. Sure, you can ride it up with the right funds, but danger looms constantly. Most people who have 401ks don’t have the wits and wherewithall to manage them.

TE: “Not only do the upcoming old need to get busy and start saving, they also need to simultaneously repair their health and lives for the upcoming games.”

Nice quote (with the MockingJay Hunger Games III movie starting today).

BostonBob: “Still sometimes I wonder if the people who spent it all and borrowed more may have it right. They enjoyed life in the present and when TSHTF the majority of us will be in the same leaky boat. Being a cheap bastard my whole life I don’t think I can change.”

Take pride in knowing you did the right thing, BostonBob, regardless of what’s to come.

RE: “You can do a lot better than Ramen Noodles and Friskies though on a SS budget.”

That is a totally arbitrary statement–and depends on what your SS payment is vis-a-vis your expenditures. Further down you mention the Pension Benefit Guarantee Fund. They don’t guarantee squat and if you have a lump sum+monthly pension benefit the PBGF won’t pay you the lump sum, AND your monthly could be reduced.

LLOPH – keep bringing the tough love and sound advice.

Admin – thanks for the fine article which garners all the comments, which are valuable inof themselves.

Personally, I’ve made more bad financial decisions that I can count, but am slowing righting the ship,

so to say. My pension with a large telecom just offered an early buy-out @ 150% of the lump sum of what I could get if I wait out the remaining 4 years to when I’d be 100% vested, and I’m taking the money and running–straight to an fixed index annuity. The yields may not be as big as a good stock market year but I’m guaranteed not to lose money in a down market. For a risk-averse person like myself at my age, that has some comfort. Plus there are no fees and I get an immediate 15% bonus on the upfront amount I’m purchasing. This company has been in business since the 1890s (yes, thats >100 years), is the 2nd largest financial asset company in the world, and is in Europe, and is A++ rated. There is also a rider that pays double the monthly payout if you are confined to a nursing home, although I’d rather die in my own home. So I feel confident I’m doing something right for me and wife (she inherits it with the same benefits after I pass on). Some of the funds in the annuity I selected paid >14% last year. I’ll be happy for half that much. I know some people have negative opinions of annuities but this makes sense in my situation. I will still have assets in a traditional 401k, a modest amount in a CD, enough cash reserves to get my son through his last 2 years of college plus a 6-month cash emergency fund.

The concern now is if our guv pulls a Cyprus on us and grabs money from overseas assets as well as 401ks and the like.

Other than that, I just hope to remain employed another 5 years. Then it’s off the the cabin on the lake for the rest of my days where I hope to live a modest but enjoyable retirement, God willing.

[img [/img]

[/img]

Hi Rise Up. Your concern about a Cyprus style bale in concerns and worries me as well.

One has only to see what happened last night in our country by our community organizer President.

There is little doubt in my mind that he views your money and mine a his, and property rights laws as

silly old fashioned stuff the white man thought up.

As long as him, and his kind are in office we stand threatened.

This is a great article to return to TBP and read. We got moved. Nick retired and we are now devoting all of our time to finishing the inside of the log home on our little piece of the Ozarks. The “tax assessor” is anguished over the fact that we do not plan to live in the log home until after the 1st of the year. He said to let him know if we decide to camp out in the log home even one night in 2014. Uh, right… you will indeed be the first person we will tell, so you can tax us on our hard fought savings all our lives for an extra year. I’m planning to make his life as miserable as possible. I discovered that it is ACTUALLY his wife who was elected County Tax Assessor and she just drives him around and sits in the car while he snoops around to see if you have any new property. WTF?

Stucky, congratulations on little Rena. What is her middle name… my cousin named her son Drew, because she thought it clever. He went to college and is now “loren” his middle name. Drew is NO MORE.

Nick and I saved every dime I made after returning to work when our son turned 10. Owe nothing. Working for ourselves now and loving every minute of it. Son came down last weekend from college and I took a nice picture of him in front of our life savings well spent (uploading to Photobucket to share later) I don’t know if we have as much money saved as all the advisors will tell us we need, but I think we have enough. Enough is a lot less than they think it is when you know how to be self sufficient and don’t have anyone to impress.

EXCELLENT analysis for the article, and very timely. There is another issue that MUST be considered re the whipsawing that happened in 87 and 2008, which has been eliminated for years as shown by the parabolic vertical S & P chart. Chas Smith covers it well here:

http://www.oftwominds.com/blognov14/post-bubble11-14.html

To those of you saying that things are different today and what used to work no longer works I say this:

Bullshit. Stop making excuses. You just don’t want to do the hard yards, you want to be gratified now and not tomorrow, you want an excuse. I do not buy it at all.

In fact, I think it highly likely that folks that do the hard work may be even more likely to succeed now than thirty years ago.

Why? Because current competition sucks. College students are studying 12 hours per week. I studied fifty. People are getting in debt instead of saving. People are avoiding responsibility instead f embracing it.

For instance, my accountant says their biggest challenge is finding new partners – young accountants do not want to do it. He says t has NEVER been easier to make partner at his firm, as there is no competition.

Here are my work hours over the decades:

Undergrad: 60 hours per week

Grad school: approx. 105 hours per week

20- 30: 90+ hours per week

30 – 40: 75+ hours per week

40 – 50 70 hours per week approx.

50+: 25 hours per week and up, depending on exact circumstance. 15 weeks a year off.

How many of you saying it will not work put in those kind of hours getting an education?

How many put in those hours getting experience and skills in your twenties? How many put in those hours during your thirties and forties grinding your competition into dust?

Sound of crickets.

You think that that kind of effort and dedication and planning and execution will go unrewarded given the current opposition and sense of entitlement out there? Really?

From a young age I was promoted over the top of older and very experienced managers. By the time I as 29 I was running major manufacturing plants, plants with many hundreds of employees working for me and dozens of managers younger than me.

So I say again bullshit. I would have eaten this current batch of pussies alive.

Cling to the “it will not work today” fairytale if it helps you avoid the truth or avoid confronting what you need to do.

You think that putting in 4000 to 5000 hours a year for thirty years will not pay off, when everyone else is working 1800 and going into debt? That is ridiculous.

Aren’t there any online colleges where you can take your classes at the local strip joint?

Meant to say dozens of manages older than me. I was always the youngest senior manager.

Coyote if there are I am sure you will find them. Hope that works out for you!

Hey Llpoh,

You are either a liar or a loser. Anyone working that many hours is only one or the other.

Incidentally, I call bullshit. You worked 15 hrs/day in grad school? Bullshit. I did three degrees including Law and didn’t work that much per day, even when I was teaching. Unless you are a slave, you are not working that much. That is your third option, by the way.