TBP readers may look upon this as a review – perhaps a small quick refresher – on what money is, why and why the “money” we use isn’t.

I enjoyed it – short and to the point.

MA

________________________________________________________________________________________

Precious metals investors (and even precious metals commentators) have a tendency to put the cart before the horse. We familiarize ourselves with the dramatic economic fundamentals which have an enormous impact on the value of precious metals (and the prices for all hard assets). We study the parameters of supply and demand for gold and silver. But we frequently omit learning about the intrinsic properties of these amazing metals.

With gold and silver, we are dealing with two metals which have an unparalleled combination of beauty and utility. As the principal metals used in our jewelry for thousands of years; we understand the aesthetic appeal of these metals before we even finish our childhood. However; it is when we consider gold and silver as tools rather than decorations that these two metals really begin to shine.

To begin with; both gold and silver possess a plethora of superb metallurgical properties. This makes them superior to all other metals in a host of industrial applications, across the entire spectrum of industry. We are generally more familiar with the industrial uses of silver than gold, and proportionately we use a far greater proportion of our silver in industrial applications than gold.

Why is this? Simply, we have deemed most of all the gold ever mined in our history as being “too valuable” to use industrially, and even too valuable to use as jewelry. What greater utility is there for gold which surpasses its value in industrial applications and jewelry? When we utilize it as the tool known as “money.”

To understand why this is so; we must first ask ourselves an even more fundamental question. What is “money”? This is a question where most members of our population would stumble badly in attempting an answer. They erroneously believe that what they carry around in their purses and wallets is “money”, when (in fact) it is mere currency.

True money possesses four necessary qualities:

- It must be “a store of value”.

- It must be rare or precious.

- It must be uniform.

- It must be easily and evenly divisible.

Readers who have researched this topic previously will have undoubtedly seen different versions of this definition. However, studied closely, such differences are revealed as just semantics. This definition (and other, parallel definitions) provides us with all of the necessary and important characteristics of one the most important of all human tools.

At the top of the list; money must be a store of value. Indeed, it is this quality which is the primary distinction between real money and mere currency. True “money” must preserve the wealth of the holder.

It is common knowledge that in the 100-year history during which the Federal Reserve has had the statutory responsibility of preserving the value of the U.S. dollar that it has lost more than 98% of its purchasing power. This tells us two things. The Federal Reserve has been an utter failure in discharging its primary responsibility; and the U.S. dollar is not money.

Conversely; since literally the days of Rome, an ounce of gold has been sufficient to fully clothe a man in the fine attire of his era. Two thousand years ago; that ounce of gold would have purchased a quality toga, sandals, and belt. In more recent centuries; it has been sufficient to buy a finely-tailored suit. Gold is money; the wealth of the holder is preserved.

Why does gold pass the test as a store of value, while the U.S. dollar (reserve currency of the world) fails miserably? We find the answer to that in looking at the other three properties of money.

Money must also be rare or precious. This characteristic is the primary reason why some items do store value and others do not. Gold and silver preserve/protect our wealth (superbly) because these metals are rare and precious.

Their rarity is a simple function of the relative scarcity of these metals in relation to other metals. The “precious” quality of gold and silver is two-fold. Both of these metals possess undeniable aesthetic appeal, and both possess tremendous versatility as metals. They are beautiful and useful (i.e. valuable).

Conversely, the U.S. dollar and all of our other paper currencies are neither rare nor precious. With near-infinite money-printing today; these scraps of paper have never been more abundant. And the paper they are printed on is so worthless we throw it away as garbage.

The final two characteristics on our list provide us with the means of separating merely adequate money from good money. Good money must be uniform, meaning that every unit of currency must be identical to every other unit. This is why (for example) gemstones could never be “good money”. The value of every unit of that currency would differ slightly, making commerce totally impractical.

Similarly; the final attribute of money is also a test of practicality: it must be easily and evenly divisible. Historically, metals have been our first/best choice as monies because once refined they can be easily divided into physically identical units, which are also durable.

Why have gold and silver (alone among all substances) retained their status as “money” for thousands of years? Because these metals are more than “good money”; they are perfect money.

The Metal of the Sun is the perfect money of governments (and the wealthy). It is abundant enough to provide adequate, physical supply for such purposes, but too rare for most of our routine, daily commerce. Conversely, the Metal of the Moon is the perfect money of the people. It is rare/precious enough to still preserve their wealth, while existing in sufficient abundance to function as our principal tool of daily commerce.

The original gold/silver price ratio (roughly 5,000 years ago) was 13:1, commemorating the fact that there are thirteen cycles of the Moon for every cycle of the Sun (one year). Incredibly; the natural occurrence of these metals in the Earth’s crust is at a ratio of roughly 17:1. Perfect money.

It is once we understand the intrinsic properties of money that we realize our primary imperative in swapping the worthless scraps of paper in our wallets for valuable, eternal gold and silver. These two metals provide perfect vessels for storing (and protecting) our wealth, while the bankers’ paper currencies are merely (and deliberately) ‘leaky buckets’.

The Federal Reserve is the biggest counterfeit operation on earth. That’s the real reason the US dollar is almost worthless. The Federal Reserve system and Fractional Reserve banking must be abolished but the banking families and the monetary elites will fight ever step of the way.Going to be interesting to watch.

If what he is saying is true…that paper money is not real money … then most of the wealth in this country is imaginary wealth. It’s not real.It’s all a delusion .I just realized I am poor if the dollar is not real money. I have some silver and gold but not by the pounds. I have a house but what’s it worth in real money?

What an article, absolutely loved this refresher course on real money.

[img [/img]

[/img]

[img [/img]

[/img]

Is that a golden nipple?

One other money rule, you can’t make it, like paper dollars.

Hi Card, Like Jim Grant said in that exemplary presentation at the Cato Institute that admin posted;

“WHAT CAN SOMETHING BE WORTH THAT COSTS NOTHING TO PRODUCE”

To be more precise, money is, it functions as, a medium of exchange, a unit of account, and a store of value. It traditionally has the following properties: divisible, fungible, portable, durable and rare.

Obviously, the dollar is not rare, and thus cannot be used as a store of value. This is readily apparent to anyone with two eyes and a functioning brain. Use paper currency for the medium of exchange and gold as the store of value.

Buckskins, mirrors, conch shells, tobacco, salt, barley, cows, tea leaves, peppercorns, blankets, and even bat shit.

What do they have in common? They were all used as money.

So, isn’t money whatever people say (or, accept) it to be in terms of payment for goods or services, or the repayment of debt?

Back in 10th grade Angelo Falcone owed me twenty bucks in paper money. He never could scrounge up the dough, so I accepted a box of Playboy magazines as payment … much better paper, in other words.

Hi Stucky, The moneys you mention were used locally by differing groups of people. They were never universally recognized as money by the entire world. nor were they unique and divisible or impervious to the elements. Gold is inert.

What kind of tea, what shape and size of conch shell, what type of cows, old, young, what health were they in, did that or their weight reflect on their value and how much. Wool or cotton blankets?

One oz of gold is the exact same as another oz of gold, no matter where it comes from, how old or young it is. what shape or form it is given, no matter what part of the world it was mined from.

These reasons and many others are the reason it evolved to be the real money of the human race.

“To those advocates of independent paper moneys who also champion the free market, I would address this simple question: “Why don’t you advocate the unlimited freedom of each individual to manufacture dollars?” If dollars are really and properly things-in-themselves, why not let everyone manufacture them as they manufacture wheat and baby food?”

Murray Rothbard – Free Market – Money – Dollar – Fiat Money – Freedom – Manufacturing

“Unlike the days of the gold standard, it is impossible for the Federal Reserve to go bankrupt; it holds the legal monopoly of counterfeiting (of creating money out of thin air) in the entire country.”

Murray Rothbard – Fraud – Gold – Federal Reserve – Bankrupt – Money – Monopoly

“I have a house but what’s it worth in real money.”

It will fluctuate with the fiat currency you are dealing with on a daily basis bb.

Lets say your house can be sold for 200 grand today and lets say gold is 1000 dollars an oz.

Forgetting taxes and commissions it would be worth 200 oz of gold today and would fluctuate daily depending on these variables.

Golden Oxen

Makes sense. Thanks!

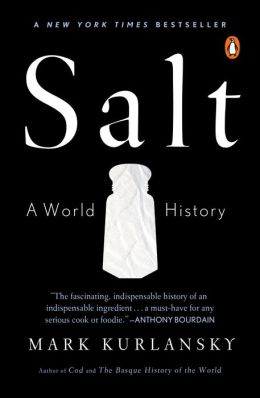

BTW, I’ve posted this here before but you’re new here. I read this book several years ago … it’s really a terrific read …. yeah, about salt!! You can get it used on Amazon for a few bucks.

[img [/img]

[/img]

Archie already put it simply: “Use paper currency for the medium of exchange and gold as the store of value.”

Peter Schiff has a fun little read; How an economy grows, and why it crashes. He used fish as his example for a medium of exchange.

Hey card, you been reading FOFOA?

Stucky that’s a great read. The author is kind of a leftie douche waffle but it is a good book.