Two recent surveys, along with numerous other studies and data, reveal most American households to be living on the brink of catastrophe, but continuing to act in a reckless and delusionary manner. There have certainly been economic factors beyond the control of average Americans that have resulted in real median household incomes remaining stagnant for the last 36 years. The unholy alliance of mega-corporations, Wall Street and bought off corrupt politicians have gutted the nation of millions of good paying jobs under the guise of globalization, while utilizing debt, derivatives and financial schemes to enrich themselves. The malfeasance of the sociopathic privileged class does not discharge the personal responsibility of citizens for living within their means. A lack of discipline, inability to delay gratification, failure to understand basic mathematical concepts, materialistic envy, absence of critical thinking skills, and a delusionary view of the world have left the majority of Americans broke and in debt.

The data that captured my attention was how little the average American household has in savings. Roughly 62% of Americans have less than $1,000 in savings and 21% don’t even have a savings account, according to a new survey of more than 5,000 adults conducted this month by Google Consumer Survey for personal finance website GOBankingRates.com. This dreadful data is reinforced by a similar survey of 1,000 adults carried out earlier this year by personal finance site Bankrate.com, which also found that 62% of Americans have no emergency savings for a medical crisis, car repair, or unanticipated household expenditure.

The fact is these are not highly unlikely scenarios. They happen every day as part of our routine existence. Everyone gets sick. Every car eventually needs new tires or an engine repair. Every home will need a new hot water heater or roof at some point. It is foolish and short sighted to not expect “unexpected” expenditures. Living in the moment and fulfilling your immediate desires may feel good today, but leaves you susceptible to disaster tomorrow. Gradually building a rainy day fund over time is what adults should do. Only immature children operate with no safety net. Everyone has an excuse for why they end up living on the edge, but the data exposes us to be an infantile nation of spendthrifts incapable of distinguishing between wants and needs. It might be understandable for young adults who are burdened by student loan debt and entry level jobs to have little or no savings, but the data for older Americans is most disturbing.

It seems 51% of all Generation X adults between the ages of 35 to 54, in the prime earning years of their lives, have ZERO savings, the highest among all age cohorts, with over 20% of them not even having a savings account. This is incomprehensible and reveals an almost juvenile approach to life. Approximately 70% of all 35 to 54 year old households have $1,000 or less in savings. These are people who should have been working for the last 10 to 30 years. To not have put aside more than $1,000 is beyond irresponsible, and the justification of earning no interest on savings is disingenuous as they could have earned 5% up until 2008. This shocking state of affairs can’t only be laid at the feet of the evil bankers and rich corporate titans.

Every person has to accept personal responsibility for their own life. There is one sure fire way to accumulate savings and that is to spend less than you earn. It sounds simple, but the vast majority of Americans have chosen to live beyond their means by allowing themselves to be lured into debt by the Wall Street debt peddlers and their Madison Avenue media maggots selling dreams to willfully ignorant delusional consumers. Consumer dependent corporations hawking autos, electronics, glittery baubles, fashionable attire, toxic processed sludge disguised as food, and other slave produced Chinese crap, require a vast unlimited supply of easy money debt to keep profits rolling in. And the Federal Reserve has been willing and able to accommodate them.

Those who control the levers of this perverted economic system utilize Fed easy money, propaganda advertising messages, and the susceptibility of an oblivious populace, suffering from delusions of grandeur, to create generations of debt enslaved hamsters running on the wheel of life. But, we were not forced into this enslavement. Millions have chosen to live lives of quiet desperation in order to keep up with the Joneses. They would rather portray themselves as successful and wealthy, rather than make the necessary sacrifices required to achieve success and wealth. Everyone has the ability to live beneath their means. Millions have made the choice to do so. The chart above shows 10% to 20% of people do have $10,000 or more in savings, including young people. Many are average middle class Americans, not the despised 1%.

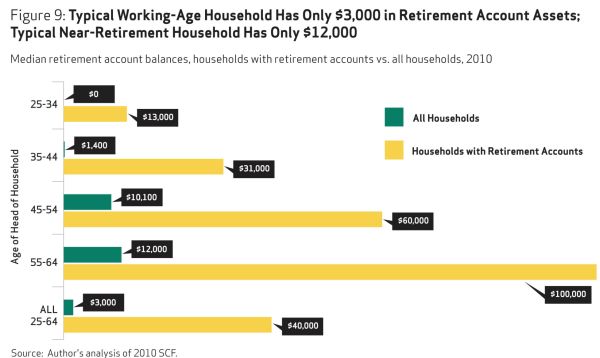

It is certainly not easy to accumulate savings in an economy stacked against the working middle class, but it is possible. It requires self-discipline, deferring gratification, patience, budgetary skills, staying employed, and not coveting your neighbors’ possessions. The lack of short-term savings is not an isolated data point. It is representative of a nation of narcissistic live for today ne’er-do-wells who rarely concern themselves with the future or the consequences of their actions. They haven’t been putting all their spare cash into their retirement plans either. When you realize the typical household between the ages of 35 to 54 has less than $10,000 saved for their retirement, the mass delusion becomes clear. How could Boomers, who have worked for 30 to 40 years, and experienced the greatest bull market in history (1981 – 2001) have only $12,000 of retirement savings as they approach retirement?

These are median figures, so half the households have even less retirement savings. It requires decades of living above your means to accumulate such little in savings. The apologists for the non-saving masses often argue Americans were utilizing their homes as a store of wealth to be used in retirement. This is just another false storyline, as the savings poor public used their homes like an ATM machine from 2001 through 2008, extracting hundreds of billions to spend on granite countertops, exotic Caribbean vacations, home theaters, BMWs, Olympic sized pools, bling, and new boobs for mommy. Equity in homes plunged from 60% to below 40% in the space of a few years and has only recovered to 55% after the Fed induced faux housing recovery. There are still millions of homeowners underwater, with the next leg down guaranteed to add millions more.

The millions of American households living on the edge and headed for a poverty stricken old age have a million excuses for why they never saved a dime. These are the same people who will demand the government save them from their own foolishness and irrational life choices. They will demand the rich (anyone who worked hard, saved, and planned for their future) be taxed more, so they don’t have to live with the consequences of their reckless disregard for common sense and self-discipline. These people should have read some Shakespeare in high school, and maybe they wouldn’t be in this predicament.

“The fault, dear Brutus, is not in our stars, but in ourselves.” – William Shakespeare, Julius Caesar

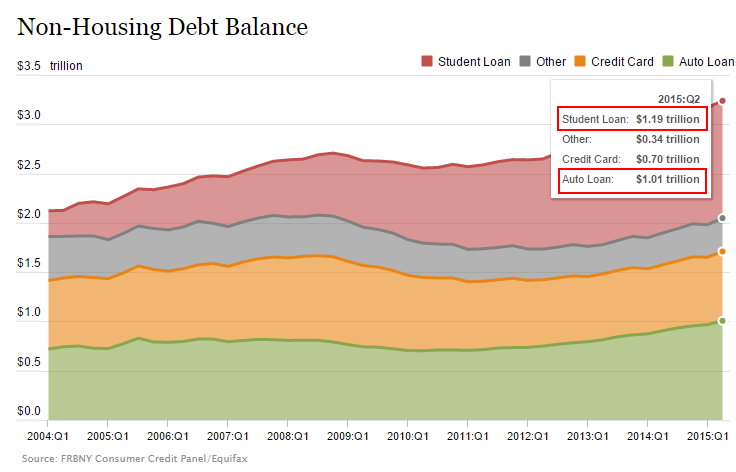

We are all responsible for our own lives and our own decisions. It isn’t complicated regarding how to save money. But it is hard. It requires simple math skills like addition, subtraction, multiplication and division – concepts not thought too important in our government controlled educational system. It requires self-control, acting like an adult, and distinguishing between what you want versus what you need. It’s OK to splurge once in a while, but since around 1980, multiple generations have been binge spending in an orgy of debt debauchery unmatched in human history. Since 1980 the U.S. population has gone up by a factor of 1.42, GDP has expanded by a factor of 6.3, and consumer debt has exploded by a factor of 10. The amount of consumer debt per person in 1980 was $9,300. Today, the total is an astounding $65,200 per person, a 700% increase in 35 years. We owe $21 trillion of mortgage, credit card, student loan and other debt to the felonious Wall Street bankers. This nation has gone insane.

“In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule.” – Friedrich Nietzsche

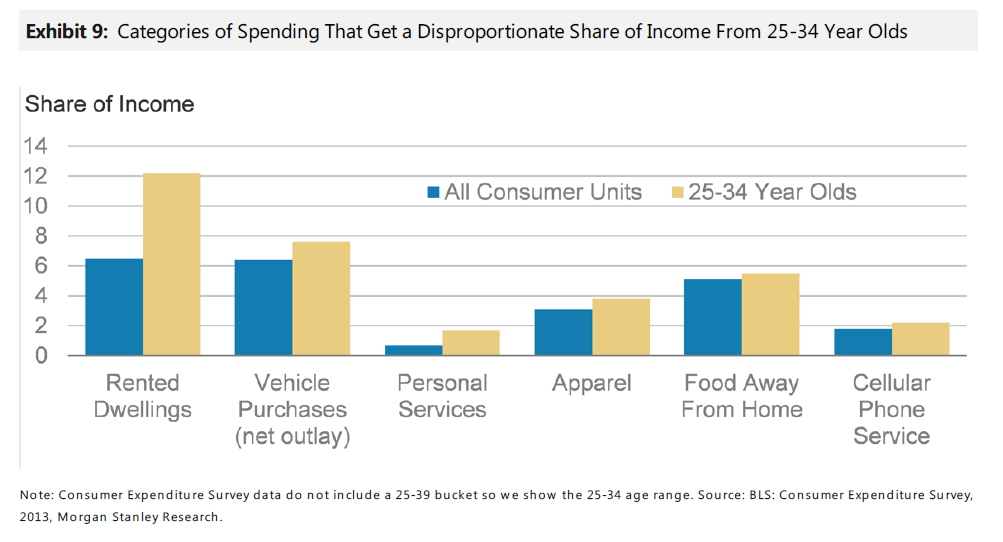

With a median household income of about $56,000 and median net wages per worker of $29,000 it is fairly easy to grasp the monthly inflow of a middle income household. In Median World, taxes will take about a 16% chunk out of those figures, so the median household ends up with about $4,000 of take home pay per month. If they own a median priced home of $189,000, their monthly mortgage payment would likely be about $850. Add another $200 to $300 per month for property taxes and you are on the hook for $1,100 per month. A median rent figure would be in the same ballpark, unless you live in SF, NYC or a few other overpriced markets. This is where many people go off course, allowing themselves to be lured into more house than they can really afford with low down payments guaranteed by the government, driving the monthly housing burden north of $1,500. McMansion envy has destroyed more lives in the last ten years than any other delusion.

Food, clothing, utilities, and home upkeep expenses could total $1,500 per month for a family with kids. If one or both parents are stuck with student loan debt, a monthly payment of $200 to $400 would be normal. There isn’t much spare change left to fund their remaining needs, wants and desires. But their neighbors and coworkers are all driving new cars. They can’t be seen driving a used 10 year old clunker. People will think they’re poor. Shallow appearances are all that matter to a vast swath of America. According to Edmunds.com, the average monthly payment on a new vehicle is $479. We can’t have one spouse driving a new car, while the other slums it on public transportation, so two newer cars will add another $900 or so of expenses to the monthly budget.

Wall Street and the automakers are only too glad to offer those with good credit a 7 year 0% loan, guaranteeing a permanent status of being underwater on your loan until you must have that new model after four years, rolling the underwater loan into the next purchase. The permanent leasers convince themselves they are making a good deal as they sign their lives away every three years without understanding the financial implications of the leases. And then there are the 20% subprime auto buyers who pretend to pay until the repo man shows up in the middle of the night. This delusion of debt is how annual auto sales have soared from 10 million in 2009 to almost 18 million today.

I’m on the road every day and it is mind boggling to see the number of newer $30,000 to $50,000 vehicles cruising the highways and byways of America. Even in the poverty stricken neighborhoods of West Philly, brand new BMWs, Cadillacs, and other $25,000 or more vehicles are parked in front of dilapidated hovels and low income housing complexes. Virtually none of these vehicles are owned outright. Americans are essentially renting their luxury wheels so they can appear successful. The way to become financially successful on a modest income is to buy used cars and drive them for ten or more years. The years of no car payment can be directed into savings. Very few people chose this path. That is why auto loan debt has now exceeded $1 trillion, up 40% since 2010. Wall Street wants you in perpetual debt and millions have bought it hook line and sinker. But at least they appear prosperous to their neighbors, while they’re really in debt up to their eyeballs.

The choice to indulge in driving over-priced ornamental transportation basically leaves the average household with little or no discretionary income at the end of the month. But that doesn’t stop spendthrift nation from becoming addicted to their mobile phones and binge watching reality TV. The average American, who had never heard of a mobile phone in 1990, now can’t go 20 seconds without checking their phone. And they are paying through the nose for the privilege of staying terminally connected. We have smart phones for dumb people. Even welfare recipients without jobs, living in low income housing and dependent on food stamps, somehow find the funds to have a smartphone in their hand 24/7. Maybe directing those funds towards books might give them a better chance of exiting poverty.

In one survey, 46% of Americans with mobile phones said their monthly bill was $100 or more and 13% said their monthly bill topped $200 per month. The average individual’s cell phone bill was $73 per month last year, a 33% increase since 2009, according to J.D. Power & Associates. When they aren’t texting, tweeting, or facebooking on their iGadgets, they are watching basic cable boob TV at average price of $100 per month, up 39% since 2010. But our connoisseurs of crapola need the NFL Package, HBO, Showtime, Netflix, and on demand porno. Tricked out smart phones and cable packages are not necessities. They are wants. Wasting $200 to $300 per month on narcissistic compulsions is a choice.

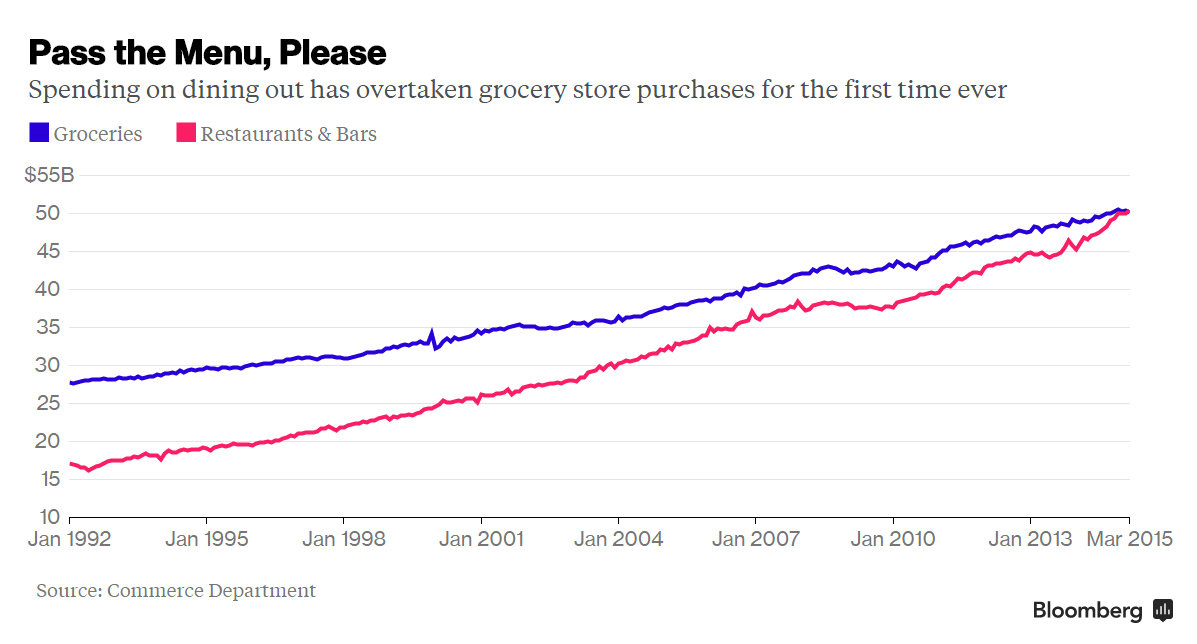

Possibly the largest squandering of resources occurs on a daily basis, as Americans spend money they don’t have on $5 lattes, toxic fast foodstuff, craft beers, and whatever else strikes their fancy. According to the most recent Bureau of Labor Statistics consumer expenditure surveys, the typical household spends $2,625 each year, or around $219 per month, on food away from home. Those in higher income brackets spend the most on restaurants at around $370 per month. Millennials, with the least amount of discretionary funds, view dining out as a social event, and choose fun and frivolity over finances. The concept of brown bagging your lunch for $1 rather than spending $10 at Paneras, or brewing a pot of coffee for 25 cents rather than paying $5 at Starbucks is inconceivable to the live for today credit card cowboys and cowgirls.

Dining out is the ultimate personal choice and a huge factor in the non-existent savings of American households. Over the last two decades Americans have abandoned the frugality of buying food at the grocery store on sale, using coupons in favor of eating out at a hefty premium on a daily basis. The result has been a $10 billion gap in spending between groceries and dining out being obliterated by an army of live for today for tomorrow we can make the minimum payment on our credit card juveniles. Not only has this penchant for satiating their hunger contributed greatly to their lack of savings, but has been financed on their credit cards. That $25 Applebees dinner, financed at 18% interest over the next ten years ends up costing $54. Multiply this foolishness hundreds of times per year over decades and you understand why Boomers have less than $1,000 in savings accounts and $12,000 or less in retirement savings. It’s just math.

The expenditures detailed above don’t include healthcare, entertainment, vacations, government extractions (tolls, fees, fines, taxes) and assorted other miscellaneous wastes of money. It is pretty clear the monthly outflow exceeds the monthly inflow for the majority of Americans. That is why the average household has credit card debt of $7,500 and those carrying a balance pay an average interest rate of 14% on their $16,000 ball and chain. This is on top of an average mortgage obligation of $155,000 and average student loan commitment of $32,000. The Wall Street hucksters are only too happy to help you finance a lifestyle well above your true means. They borrow from the Fed at .25% and charge you 10% to 20% for the use of credit created out of thin air. They always win. The willfully ignorant are thrilled they can now pay their IRS bill, property taxes, utilities, and just about every daily expense with a credit card. They fail to acknowledge the insanity of their chosen lifestyle path.

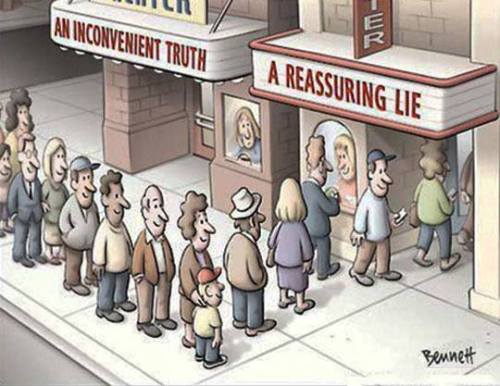

I still remember something my sophomore English teacher Mr. McGrath taught the class, based upon the writings of Aristotle. Human beings are rational, sentient, living, corporeal substances. What separates us from animals is our ability to think and act in a rational manner, rather than just on instincts and urges. Based on what has occurred in this country over the last 35 years, I’m starting to question the rational part. It’s almost as if a mental illness has befallen a majority of Americans. The Deep State and their minions on Wall Street and the corporate media certainly attempt to mold and manipulate the minds of the masses, but at the end of the day people are free to disregard those messages and live meaningful lives on their own terms. Even though living above your means has become “normal”, it is only normal in relation to our profoundly abnormal society. Telling people the truth today is meaningless, as they don’t want their illusions destroyed. But destroyed they will be, when this teetering edifice of debt comes crashing down on their heads.

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives, that they do not even struggle or suffer or develop symptoms as the neurotic does.” They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.” – Aldous Huxley – Brave New World Revisited

“Sometimes people don’t want to hear the truth because they don’t want their illusions destroyed.” – Friedrich Nietzsche

To summerize, yoots are blowing more of somebody else’s money out their asses than previous generations.

Who the fuck wrote this article?

Fuck you buddy.

Do you know how many Gen X Men I personally know, who were 100% COMPLETELY WIPED OUT by divorce? How much you gonna save when paying alimony + child support?

Do you know how many Gen X Men I personally know, who used to be small business owners, and were completely 100% COMPLETELY WIPED OUT during the 2008 – 2009 crisis, never to recover?

I burned 70k of working capital and my personal 50k cash savings trying to keep my business afloat after the crushing we received early 2009. Business NEVER recovered. We went from a 25 person shop to a one person shop today.

I would also have zero cash savings if it were not for my PM’s. So tell me again how stupid and short-sighted I am.

Sightseer

Fuck you too. I don’t give a fuck about your personal situation. If you are too fucking stupid to understand math, medians and averages I can understand why you have fucked up your life.

Thanks for providing an example of clueless asshole Americans.

Let’s have a pity party for poor Sightseer who screwed up his business and blames everyone else for his failure.

Kind of a depressing article for me because I know I have SQUANDERED a lot of money … SHITLOADS … in my life. I bet I’ve blown $30k or more just on coffee and smokes. Can I live life over? No? Ok, well fuckit then.

“Who the fuck wrote this article? Fuck you buddy.” ——— Sightseer

Llpoh wrote it.

Looks like this will be an article that brings out the trolls who refuse to accept personal responsibility for fucking up their own lives. It’s always someone else’s fault. The bankers forced them into debt. They just had to buy that 4,000 sq ft McMansion with 3% down. How could they possibly drive a 10 year old Honda Civic to work.

Blah, blah, blah.

I’m sick and tired of this country of losers blaming others for their bad decisions.

Yea, this is the paragraph that set me off about Gen X:

“It seems 31% of all Generation X adults between the ages of 35 to 54, in the prime earning years of their lives, have ZERO savings, the highest among all age cohorts. Over 20% of them don’t even have a savings account. This is incomprehensible and reveals an almost juvenile approach to life. Approximately 70% of all 35 to 54 year old households have $1,000 or less in savings. These are people who should have been working for the last 10 to 30 years. To not have put aside more than $1,000 is beyond irresponsible, and the justification of earning no interest on savings is disingenuous as they could have earned 5% up until 2008. This shocking state of affairs can’t only be laid at the feet of the evil bankers and rich corporate titans.”

We are getting divorced raped

We are getting our businesses crushed

We have the highest rate of suicide of any age group

We are getting crushed the worse of all age groups by Obamacare

We can’t get jobs due to age discrimination

It’s almost as if Gen X White Males have been specifically targeted for destruction, but the author calls us juvenile.

Sightseer

I’m a 52 year old white male. Fuck the WE. I’m not you. Those are your personal circumstances and are not representative of an entire Generation. So fuck you asshole. If you don’t like the articles on this site, go to a Gen X pity party site and wallow in your pity.

You won’t get any here.

Wow the fucking Stockholm syndrome on this site is un-believable, I have been reading the site for a while and would not have expected to see it here.

Ah, but those folks do have a savings account, it just has your name on it.

So, bury your head in the sand, ignore TONS of statistics saying people are getting CRUSHED by the economy, and blame the victim.

Got it.

You have a really lousy place here.

Sightseer

You reek of bitterness as I’m sure none of your woes are in any way your fault. Provide the TONS of statistics asshole. I’ve provided mine.

What a surprise. Sightseer is playing the victim card as if life’s hard knocks don’t affect everyone. Like you’re the only person who has faced adversity.

I have a place where reality is embraced. If you think it’s lousy, don’t let the door hit you in the ass on the way out.

I would also be deeply distrustful of that data about the millenials- how much of that money they claim to have in an account are student-loan proceeds that are yet to be spent?

I await the arrival of Llpoh to vanquish the delusional trolls who will be outraged by the thought of spending less than you make.

Not just the Gen X’ers……. I’m in my retirement years, and I know so many of my age group that have no savings either. NONE!! They blew it all on vacations, fancy cars, you name it. If it weren’t for SS they would have nothing.

When I ask them how could this have happened, their completely clueless. They thought that they were going to win the lottery, make it big in the stock market… yada yada. When you ask them about “personal responsibility” they laugh at you, in your face. They chide you because you don’t have all the vacations and shiny new toys like they did.

Fair enough…. We’ll see who fairs best when the government well eventually runs dry.

Not saying this is a reason some folks don’t have savings accounts but it is. As of this morning per Bankrate.com interest rates on savings accounts:

Rate APY Rate APY

Total Bank Average 0.04 0.04 0.02 0.02

Total Thrift Average 0.12 0.12 0.15 0.15

National Average 0.09 0.09 0.08 0.08

Really what is the point for some people to have a savings account, people that don’t trust the banks to hold their money and don’t want to play in the rigged stock market. I know a lot of people that just hoard cash, coin and PM in their gun safes. Still savings for sure but not conventional. I have heard young folks say things like ” the interest rates are basically zero so why bother”, so it has become a mindset oftheirs not to save that continues as long as banks keep rates at zero.

Peaceout

They didn’t have savings in 2008 when you could get 5% interest. They were borrowing money from their over-inflated houses as fast as they could and spending it on vacations, cars, gadgets, and home improvements.

” ….. ignore TONS of statistics saying people are getting CRUSHED by the economy, and blame the victim.” ————- Sightseer

I am going to try to be reasonable with you.

WHAT THE FUCK ARE YOU TALKING ABOUT???

How about the tremendous articles Admin writes which crush the BLS? What about his detailed analysis of all the companies in this country which are Dead Men Walking? C’mon man …. do you REALLY believe that Admin doesn’t realize “people are getting CRUSHED by the economy”?? Of course, he does!! And, I believe you KNOW this to be true.

You interjected YOUR personal situation into the mix. Nothing wrong with that …. I have been know to do that quite a bit. But, you are clearly upset because Admin isn’t responding with the “warm & fuzzies”. Rather, — and you should know this also — he is big, VERY BIG, on personal responsibility. He is not one to suffer excuses … despite the horrible economy.

Look, I met the guy in NYC a couple weeks ago. He is a MEAN motherfucker. VERY MEAN. Downright nasty and mean. We passed a homeless guy sleeping on the street. I put a buck in the guy’s tin can. Admin kicked the guy in the nuts! Twice! Yelled at the guy to “get a fucking job!!”. On the other hand, he (and HZK) bought me ALL my beers, and food!! You see, he’s a very complex guy. Very passionate. And deep deep down in his vile blackened heart, he’s one helluva guy. Seriously.

So, before you get all butt-hurt and leave, maybe you should re-evaluate YOUR reactions …. and tell Admin you just busted a nut temporarily, and that it has passed. He is quick to forgive and forget. Really.

Stuck

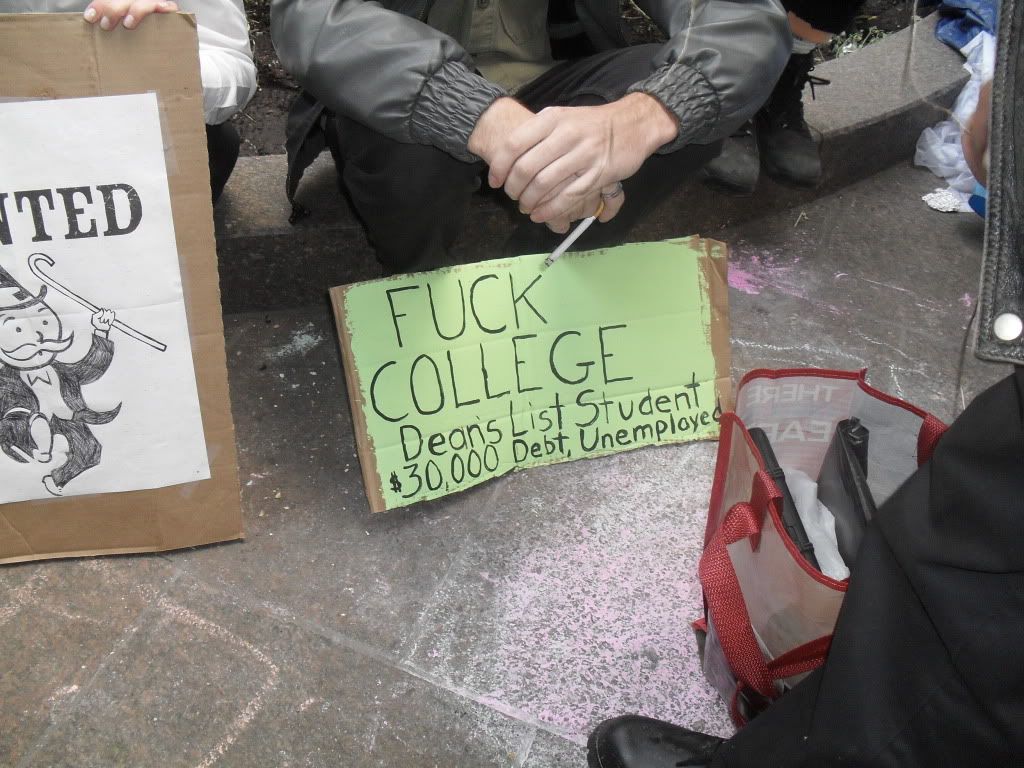

To be honest, he was carrying this sign. Then I asked him for the $20.

Admin , One reason I always enjoy your financial articles is I always feel richer and smarter .I always think at least I’m not as dumb as some people. I do have areal savings account buried under my mom’s house. I am fortunate enough to have 5000 in cash in my truck at all times for repairs or fuel.I have made some terrible choices when it comes to women but through it all I have managed to keep a job and save money.Yes ,I needed this .Thanks.

Yes, we are responsible for our actions and yes, I have made plenty of mistakes, but Gen-Xers have been well and truly fucked by the system–many of us just starting out in careers when the dot com bubble burst…then we were just getting back on our feet for the 2007-2009 economic clusterfuck.

I spent my late twenties and early thirties unemployed, underemployed and pretty fucking miserable…looking back there are plenty of things I would have done much differently…but I was still operating under a false paradigm (work, save, grow a nestegg, retire in comfort) that worked so well for my parents.

And now? Work for a great small company and monthly expenses are covered…but we are not really saving–at least not aggressively. And yes, we do have cars with long financing terms(but very low interest rates). I hate the idea, but in this system it makes sense. We probably could (barely) pay them both off now, but to what advantage? The loan is essentially free. It is a ridiculous system, as we all know, but it is the only one we got right now.

Sure, we have over 10k in savings, but no retirement accounts. What would be the point? In what way could we invest some digital fiat and reasonably expect it to not only still exist, but actually to have grown in 25 years?

No, I fully believe, now is a time to sit on the sidelines financially. Saving is absolutely the right thing to do, if one is saving sound money…but saving a clearly dying fiat? Please.

So, we hang on. We are comfortable…sure, we have the car loans, the cell phones, the cable package…

I guess the real point is no one knows how this thing is going to break. no one. Car loans won’t really matter if no one can buy gas. Savings accounts with huge balances won’t matter if/when bailins begin. Your 401K balance won’t matter much if/when there are riots on the streets of every city in America.

We are at a perilous and completely unprecedented point in history. Old rule and old wisdom (at least in a financial sense) have little bearing during the first Fourth Turning of the nuclear/technological age.

I hope, there will be a period of new growth, optimism, peace and prosperity after this period of extreme crisis (in other words a new High). If so, again hopefully we can get back to sound money and true financial wisdom.

For right now, I view saving (at least in traditional ways) to be like painting your house during a hurricane. Normally a wise, forward-looking thing to do, but under current circumstances a little silly.

It is not that expensive to own and use a modern smartphone. I bought my LG G2 off swappa for $100. It is a great phone with a snapdragon 800, large 1080p screen, 16GB of storage, and 2GB RAM. I use the Ringplus VIP Pepper plan with 1000 SMS addon which gives 250 minutes, 1500 texts, and 280MB of 4G data. How much does it cost? $4 a month. Four dollars. For basically limitless texting (unless you’re under 18, in which case 1500 texts is not quite enough, but they do have a 5000 SMS addon for $8 too lol)

Kind of like people on “diets.”

If you don’t don’t fewer calories than you burn, your diet will never work.

The math is relentless.

Admin – I get that the savings and lack of personal responsibility across all age groups is abysmal and unconscionable and quite frankly shocking to people like us that have sacrificed real time gratification for long term stability. I was just relating experience of what I’ve heard recently as excuses not to, or alternatives to conventional savings.

In this day and age, with all the vehicles at our disposal, to not set money aside for the long haul is criminal IMHO. With exception to the most dire of situations it seems you should be able to set aside something no matter how modest. I know a comment like this will spark a lot of contradiction from people that are in hard situations but so be it.

One thing we taught our kids from an early age was the power of saving and compounding and how saving as much as you could early in life will provide huge benefits in the future. Take advantage to the fullest of your 401k plans at work, open up an IRA account and fund it to the max every year, take advantage of tax free earnings over a life time, etc. They were smart enough to see the benefits over the long haul and have been doing what they can in spite of only working in low paying entry level jobs. They have learned to budget their lives with what is left and don’t seem overly miserable about not having cash for near term gratification items such as going to the latest over priced trendy bar/restaurant, latest block buster or rock concert.

Life lessons are hard, always have been and it pisses me off to no end that money that is being taken away from my earnings is going towards the folks that were not smart enough or responsible enough to take care of their own shit when they had the chance to. The people that had no choice because of whatever situation, no problem, that becomes a societal responsibility. But the folks that lived large and tried to impress the neighbors and flaunted all their shit in front of the folks that spent a life time towing the line and taking care of their business, I would say to them suck it. No soup for you!

@Iconoclast421: do you know who cares? Whofa King cares. That’s who.

I am a young gen-xer. I’ve had my own business for about 7 years. It has ups and downs. Still better than being a cog in big corporation. I have considerable savings, most of which are attributable to the first several years of my career when I earned X dollars and spent between 1/3 and 1/2 of X for all my expenses. I wasn’t living like a king, but I had a new car and a decent apartment. And I built up savings that continue now.

The single biggest issue I’ve had saving is the lack of any meaningful return on fixed income options. I’ve been earning .4% at best since 2008, and often 0%. You can put money away but its value is eaten up by inflation. Yes, I know about PMs. This is a terrible time in which to invest. Saving is worthwhile, but you’re stuck in 1st gear without investment return. Still, my emergency fund would let me buy a new car in cash, not that I would want to do so.

(1) with ZIRP there’s no point in having a savings account; ANY inflation means you lose money over time

(2) with “bail-in legislation” the law in U.S., Europe, most places, anything you save in a bank account can be taken in a heartbeat to bail out the bankers when they make bad decisions.

(3) anyone who ADMITS to having savings in any form is painting a big target on their own back, that the NSA can see from across the planet. Anyone who asks knows that I am dead broke, because I tell them so.

There is NO BENEFIT to you to answer any question on any topic posed by anyone; if they agree with you, you gain nothing. If they DISAGREE with you, YOUR NAME goes on a list of “hoarders”, “homeland extremists”, “domestic terrorists” or whatever, and you become a candidate for “audit”, “internment”, “detention”, or “collateral damage”. If you understand this, why do you answer anyone, ever, on any subject? If you (and megafellowtravelers) lie to the pollsters / research studies / data collectors, why would believe / trust any figure published, especially figures published by the government?

I don’t know if everyone is telling the truth or lying; I only know what I do / have / own, and I’M NOT TELLING!

“Japan’s economy is stuck in a prolonged stagnation because consumers’ disposable income is too low and business saving is too high.” ———– http://livingeconomics.org/article.asp?docId=3

I know the above article is not talking about PERSONAL savings. Nevertheless, one can’t win for losing. Not saving enough? Bad!! Saving too much? Bad!!

The Japs stopped saving years ago.

jamesthewanderer says: “…I don’t know if everyone is telling the truth or lying; I only know what I do / have / own, and I’M NOT TELLING!”

===========================

Word of mouth is not necessary for the IRS/NSA/CIA/Big Gov to know EVERYTHING about you. They know from your tax returns, any credit card transaction, bank accounts, etc., not to mention your phone, text, and e-mail conversations.

So it doesn’t matter what you tell anyone. We all have targets on our backs.

EASY to fix ? Try kicking the immigrants OUT. TRY voting for TRUMP.

TRY working outside the USA. TRY to keep out of the US military it is NOT a job.

TRY working OFF the books.

TRY being a PHONY illegal immigrant for the BIG BENEFITS.

TRY going to GERMANY for collage tuition is free to all. the jobs are there as are the new immigrants “the immigrants KNOW the best spots vote with your FEET!

Millennial who was raised to believe in personal responsibility checking in.

I only have 18k in our savings account, it was up to 30 but we pulled a bunch for home improvements and used a chunk of it to pay off a student loan.

Our goal is to keep 20-30k in savings “in case of emergency” while using extra to pay off student loans early, and fix up our rather modest house.

A couple of weeks ago my Son who is 24 was at house party and had to endure a young lady complaining about having $69,000 student loan with no job. I asked him what she studied.

Answer

Early childhood development. I’m sure this snowflake was sitting there sipping Coronas her Daddy bought while typing away on 600 dollar Iphone.

And I am supposed to feel sorry for her.

This is the rule for me.

If you are broke you can’t afford an Iphone.

If you have one don’t complain that you have no money for food.

I have observed several “typical” households in our neighborhood which seems to be somewhat representative of the country. The 20 somethings all live at home or are being supported in some way by their hard working parents with very few exceptions. The best family unit gig is the 2 income no kids (DINKS). the ones across the street are both nurses for past 25 years, they get excellent retirement and throw off so much cash they just got back from Italy for a month, besides having their house paid off. Meanwhile, back in the real world, any couple with kids has education to pay for ( in our neighborhood the public schools are a disaster) so kids go to parochial or private. In sum, I would agree divorce throws a damper on the party, but the key is to stay married and apparently have no kids. Out.

Measuring this by “accounts” is useless. Not only do a significant portion of the population not have jobs or earn enough to save at all, but “savings accounts” earn next-to-nothing anyway…perhaps many people’s “savings account” is in the stock market, their house or a “checking account”.

This fixation with useless “account” measurement smacks of the equally-useless “employment” data, which remains stuck in the 1970s, measuring only “big companies”, “insured” jobs and failing to say anything at all about the quality of those jobs…

Keditanstalt

Do you read for comprehension? There are 147 million people employed. Your drivel is what is useless. The lack of savings is confirmed by the lack of retirement savings and home equity that reached record lows a few years ago. The data is unequivocal and is not coming from the government.

Ignoring the facts doesn’t make them not true.

Bury your head back in the sand.

The problem stems from government corruption and the crony capitalism that ensues. Businesses bribe our lawmakers. Lawmakers make it so workers can’t fight for descent wages. Businesses have more money to bribe lawmakers. Every politician that accepts corporate PAC or lobby money should be shuffled off to jail. But they won’t because our judicial system is just as corrupt. Do you know how a lawyer becomes a judge? That’s right he bribes the party in power. So before he even hits the bench his hands are dirty. It’s a never ending cycle of corruption.

Flem

So you have no say in the life choices you make? The government and businesses are living your life for you? They make you spend more than you bring home? You have no personal responsibility?

It seems my thesis is being confirmed.

Well, I’m Gen-xer and I saved enough cash to easily buy a couple top of the line Beemer or Mercedes on an average-Joe salary. How?

1. I drive a bullet-proof 2001 Toyota with roll up windows which was a HUGE upgrade over my prior POS Hyundia which looked like hell.

2. I took that savings and eliminated all my debt except for my house. I hope to have the house paid off in another 5 years.

3. I cancelled cable TV a decade ago along with all the other unnecessary monthly bills.

4. I didn’t get married. Look: If I’m rocking $500k-800k net worth but my girl has 50k of debt in student loans and credit cards, guess what? DON’T MARRY THEM.

5. Don’t reproduce. Everyone I know is miserable in their life of slavery to their spoiled brats kids.

I pass beemers and benzes every day and think: Sucker….And you know what? I’M RIGHT.

Don’t look to tax people like me down the road for your stupid decisions.

That’s the point of the article folks. Quit trying to impress everyone with your fake wealth and generate some real wealth.

Good luck!

DING DING DING

Captain Obvious wins comment of the day. At least someone gets it.

I can’t wait to see the Zero Hedgers go ballistic and blame everyone but themselves for their problems.

“Warning: If you are reading this then this warning is for you. Every word you read of this useless fine print is another second off your life. Don’t you have other things to do? Is your life so empty that you honestly can’t think of a better way to spend these moments? Or are you so impressed with authority that you give respect and credence to all that claim it? Do you read everything you’re supposed to read? Do you think every thing you’re supposed to think? Buy what you’re told to want? Get out of your apartment. Meet a member of the opposite sex. Stop the excessive shopping and masturbation. Quit your job. Start a fight. Prove you’re alive. If you don’t claim your humanity you will become a statistic. You have been warned.”

Chuck Palahniuk, Fight Club

Tough one, most here seem to agree that if a generation is wiped out by macro forces it was inevitable but when any isolated incidence pops up, its dismissed as a personal failing. Too bad that these days mistakes are built to last, very few can just get up and go again. At the same time, you don’t know till you try, but most who fail these days will find the ladders’ been pulled up. One by one the winner/loser account is becoming unbalanced and the rage of the remaining just goes unheard. I guess it can only be determined from a personal view or risk judging others based on partial facts.

I’ve got my story too, but at the end of the day – its my fate. I’m not ready now due to a serious risk miscalculation – but at the same time the business I’m in is less than healthy despite diversity and no debt. In the end, I’m not where I should be for retirement – and it is on my mind constantly. I’ve learned to try while fighting feelings of failure and regret and can assure you, its a journey in and of itself. I wonder what others will do when they have a week to compress the same emotions into.

“… the lack of retirement savings…”??

As Peaceout wrote earlier, “Really what is the point for some people to have a savings account…”…going on to point out that gold, guns, cash etc. is quite likely too. Which is why this fixation on “bank accounts” very likely misses most of the population.

My “savings account” is a paid-off house and long-held physical gold, together with bargain-basement mining stocks. I keep as little as possible in a “bank account”, for purposes of both safety and privacy.

Not many will do THAT I admit…but many people consider their (mortgaged) house, LOC, 401K, money market stuff, business, even their car or boat as their “savings”.

I agree with you that such people are heading for disaster but there you go..

I used debt as a tool: Get a short-term loan in order to buy something on which I could make a profit. This was separate from my 8-5 job.

“Find a need and fill it”: After I dropped out of the 8-5 world, I bought a backhoe and dumptruck (good used) and became the only-available sand/gravel fella in the small community. Saved as much of my profits as I could. Bought cheap land in small tracts.

Built my own house my self. Wound up at $42/sq-ft for 1,400 sq-ft on 15 acres, including a separate garage and a very good water-well system. Sold it three years ago for 120/sq-ft.

Now in a no-debt structure but for running expenses and low ad valorem taxes. Comfy and happy. Pretty much prepped for “no matter what”.

Captain Obvious wins? Don’t get married…..don’t have kids as a core thesis to…..success? Fuck that. Live below your means, +1, otherwise maybe for some but jeez, reads like a formula for a lonely guy later.

Tommy:

Getting married is just giving creditors two people to go after in the event of a problem. I keep my relationships between myself and my girl. I don’t see any need to get the state involved.

If it was customary for guys to marry other guys into “friendships” and either one of them can snatch each others cash and run for no reason, would you do that too?

It’s like starting a business together. If I come to the table with 500k and you come to the table with $50k of debt is that a good idea for me? Hell no.

If you want kids, great! But people need to realize the “fun” is over and it’s a lot of work. Don’t have the kids and then complain about your boring life and lack of cash.

Boomer Doomer – The Other Side Of High Rents

Submitted by Tyler Durden on 10/20/2015 14:45 -0400

Baby boomers now in their 50s have lower incomes, wealth, homeownership rates and more debt than generations before them, according to a report from the Harvard Joint Center for Housing Studies and the AARP Foundation. A third of Americans 50 and older spend more than 30% of their income on housing, while 37% of those 80 and older spend more than 30% on housing.

* * *

Rising rents have been cited as a reason millennials aren’t moving out of their parents’ basements. But, as MarketWatch’s Amy Hoak details, higher rents could force some boomers to move in with their children.

So says Don Lawby, president of the Real Property Management franchise, a property management company based in Utah. He says it is shaping up to be a crisis for some boomers for the following reasons:

The average rent for a three-bedroom single-family home in the U.S. was $1,363 in the third quarter of 2015, a 5.7% increase over the last year, according to Real Property Management and Rent Range, a rental information company.

Workers 55 and over have, on average, saved only $150,300 for retirement, according to a Fidelity report from 2013. Assuming they withdraw 4% of their savings for income in retirement, their savings will generate about $500 a month, Lawby figured. With Social Security benefits, monthly income will average $1,791 (using figures from the Social Security website).

That monthly income means the average retiree is likely to have a housing budget of $609 to $681 a month (going by the recommendation that 34% to 38% of income be used toward housing costs), way below the cost of renting a three-bedroom home.

Rental growth rates are the highest they’ve been since the recession, said Ryan Severino, senior economist and director of research for Reis, Inc., a provider of commercial real estate information. Reis data shows that rents rose more than 4% over the last 12 months.

“Vacancies have been tight for a very long period of time,” Severino said. “That kind of environment gives landlords leverage to raise rents.” Rents are eventually expected to taper off, however, as more apartment inventory hits the market, he added.

Yet some don’t see that tapering off happening soon. A recent Rent.com survey of more than 500 property managers predicted rents would rise an average of 8% over the next year. Eighty-eight percent of property managers surveyed said they raised their rent in the last 12 months. The report also found that rental vacancies were at a 20-year low.

Steep rises in rent make it very difficult for tenants to keep up, “unless you’re in the job market and in a position where your salary is moving with the cost of living as it increases,” Lawby said. And he’s not just talking about retirees already living on fixed incomes. If you are a boomer who lost a job during the downturn, it is quite possible that your employment opportunities have been limited and salary increases have stalled, he added.

“The boomers, they’ve come into an environment that, generally speaking, hasn’t been positive financially for many of them,” Lawby said.

Captain Obvious, fair enough – I think I made it clear ‘whatever’ and still made my case for me. But a reason to not getting married should be anything other than keeping creditors at bay in the event of an unforeseen issue(s)…..that’s just universally odd. Period. Two dudes? Where the fuck did that come from? And lastly, I’m not complaining about my kids. Me no get you. But that’s okay on TBP. See you around.

I guess Im one of the people dragging the millenials stats down. I rent, but have almost no debt. I have saving, and 100% agree that saving money is the keyto happiness later in life, but I have seen what the banks do with other people’s money, and I chose not to save money in the traditional way.

And for all those flaming this article, looks like admin hit a little too close to home. I look at those thing he goes on about, and think about how much fucking money I have wasted on those very things. It doesn’t seem like a big deal or much of a waste of money to spend 20$ on Jersey mikes subs for me and the wife for lunch, but it really does add up, especially over the years. I’m not near as guilty of the mindless spending and thoughtless consumption as most of my generation, but I have done it too. Especially the alcohol/bar tabs the first 5 years of my 20’s, jesusfuckinchrist that was a lot of money. oh well, rather than get mad or upset about it, Im just glad I learned my lesson and don’t do that shit anymore.

Sightseer said:

“Do you know how many Gen X Men I personally know, who were 100% COMPLETELY WIPED OUT by divorce?”

That would be their own fault dipshit. They chose vapid women who had a nice asses, huge tits (which they probably paid to “enhance”) and did unbelievable things to their dicks when the should have been choosing a real life partner. They should have been looking for someone who shared their values, morals and goals and would have made good mothers for their children. But no, they chose the one who could suck a mean dick and then thought, in many cases, if my wife is this good there has got to be someone better so let me play the field a bit.

Men and women from my generation (GenX) were the biggest whores and sluts I’d ever seen until the Minnies came along. You reap what you sow dumbasses!

The ones who really suffered through absolutely no fault of the own are your retarded, directionless, “everyone gets a trophy” children.

So you and your wives ruined each others lives, ruined your children’s lives and suffered the loss of a business that was built on the unsustainable practice of cashing the equity out of your houses for ever and ever……………and who’s fault is that again?

This comment thread is shaping up to be a doozy. I predict 150 comments at a minimum. There is much ball kicking to be done.

They chose vapid women who had a nice asses, huge tits (which they probably paid to “enhance”) and did unbelievable things to their dicks when the should have been choosing a real life partner. They should have been looking for someone who shared their values, morals and goals and would have made good mothers for their children.

—————————————————————

Can I have both? This either or stuff is depressing.

Admin – sorry to be late to this party. I have ben doomstead prepping non-stop.

Hell, even SSS buys into the fallacy. The other day he said as many middleclass folks are doing the right things than are not, then I kicked him in the nuts with the same figures you are using. Have not seen him since.

Boohoo – I married an earthpig who took all my money. But it was not my fault. She took all my money.

Boohoo – my earthpig squirted out a bunch of earthpiglets who I gotta feed now, but it was not my fault.

Boohoo – my business tanked and I poured $150k down the shitter before I realized it had tanked, but it was not my fault.

Fuck me. Is anything their fault? If they forget to wipe their ass, it is not their fault.

I mentioned the young man I recently met – early twenties, growing a business, working 100 hour weeks, avoiding debt, not hiring people when he can work more hours himself, delaying marriage, hustling his ass off, and well on the way to retiring at thirty.

What say these whiny ass losers model themselves after this kid? No-o-o, that is too damn hard. Fuck hard work, thrift, delayed gratification. “Gotta go bang me an eartpig, run me up some debt, have some piglets I cannot afford, and blame someone else when it all turns to shit”.

What a bunch of pussy losers.

Real nice article, Admin..

Peaceout said:

“I know a lot of people that just hoard cash, coin and PM in their gun safes.”

No offense but that is not smart at all. A gun safe is not a safe. Most offer almost no fire protection and about the same amount of theft protection. Many so called “gun safes” can be broken into with two large screwdrivers or a couple of pry bars. A battery powered sawzall will cut the top off of one in less time than it takes to pry one open.

A gun safe will keep your kids and their friends out and may stop a smash and grab thief who is in a hurry but that’s about it.

If you’re going to store valuables at home, which is NOT a good idea, you want a UL listed safe rated not less than TL-15. Better still, find multiple, off-site “storage” locations. Private vault space and the bank of mother Earth are good options.

Llpoh

And most of the pussy losers wear thumb rings. Remember this immortal picture?

[img [/img]

[/img]

IS – one of my first purchases before moving into my doomstead was a thousand pound safe. A very small safe, but took 4 guys and special equipment to get it in the door. And that is before it is bolted down.

Admin – yes, I remember. What a bloodbath that was. I won, of course. It just took you a couple years to realize it! Newbies have no idea what it was like around here.

It is sad that you present facts, as always, and the sheep go apeshit. You did not make that stuff up – they cannot stand the sight of themselves in the mirror, so blame you for their reflection. What dipsticks.

I’m 45 (Gen X) and have minimal savings as I deliberately keep my checking and saving account balances low due to zero to negative returns and excessive risk of bail-ins. By the metric of savings in an account, I have under $1000. However, I have no debt (paid off over $100k of student loans and a large mortgage), have plenty of assets, regularly pre-pay known expenses (inflation hedge + provides short-term reduction in burn rates if no money comes in), regularly invest in my own businesses, and could convert assets to cash if needed in a few days. Yes, we paid too @#$$#@ much for the house and yes the economy has sucked for Gen X’rs like myself with multiple rounds of unemployment, financial repression, zero return investment environments, lack of hiring, downsizing, outsourcing, etc. And Yes – I am bitter and pissed off about how Gen X’s income and future has been stolen. However, we’re marginally OK because we built our asset base, DIY’d, stayed home, and paid off debt when our neighbors (who paid the same overpriced amounts for their homes) constantly bought lots of junk, bought new cars every couple of years, went on lots of expensive vacations, hired expensive contractors instead of DIY, and otherwise lived beyond their means and wasted their resources such that they are one paycheck away from bankruptcy. You can save and prepare for the future even in a true @#$%$@#% environment but it takes some discipline and effort that lazy sheep seem to be incapable of having.

I don’t know why we bother reporting the generation, American producers as a whole are being destroyed by an all consuming upper-class and under-class.

The upper class being the oligarchs, and the under-class being the socialists.

The upper buys off the lower while keeping their boot heel in the face of the middle class, and the middle class also is carrying the lower.

Shit really never does change, does it?

Tommy:

Hey, thanks man for understanding my odd way of looking at things, and I respect your opinion too.

IMHO, registering my female relationship with the state (getting married) is no less odd than registering a friendship with the state.

Imagine that?

So you get to a certain age…people start talking: Joe and Bill have been friends for 10 years and they still haven’t registered their friendship with the state? Geesh…what is wrong with them? Are they doing okay?

And if that was what EVERYONE else was doing then you’d probably feel pressure to do it too.

Most people just do whatever everyone else does without stopping and thinking about it. They dress like each other, compete with fake wealth, go to the latest bars, they mimic each other like monkeys.

A lot of people out there need to stop and think about their decisions:

Is a fancy car really going to make me happy when I can barely afford the payment?

Do I really need the state involved in my personal relationships with women?

Do I really want to have kids? Can I afford it? Is that really for me?

What makes me happy the most?

If a new car makes someone THAT HAPPY, then they should totally buy it. But it seems like most people just waste their money on meaningless garbage trying to look cool, and that is just SAD.

What is this? Junior High School? Grow a set and be your own man for God’s sake. SEt your own trends, don’t follow mindlessly.

Rant complete. Thank you.