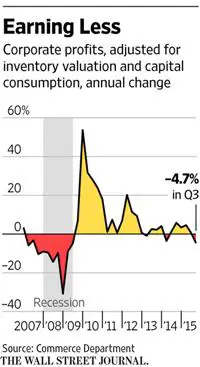

If 2015 was the year in which no investment strategy worked, 2016 is looking like the year in which all economic policies fail. Already, at what should be the blow-off peak of a long expansion, US corporate profits are instead rolling over:

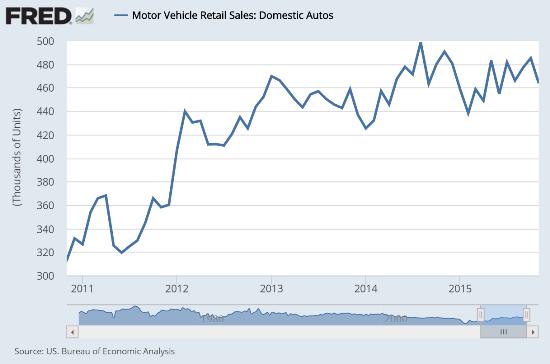

In recent quarterly reports, most companies blame their dimming fortunes on the strong dollar’s impact on foreign sales, an assertion that’s borne out by recent declines in industrial production. We’re selling less real stuff abroad, so factories are making less:

The huge bright spot in an otherwise bleak manufacturing landscape is auto sales, which have snapped back nicely:

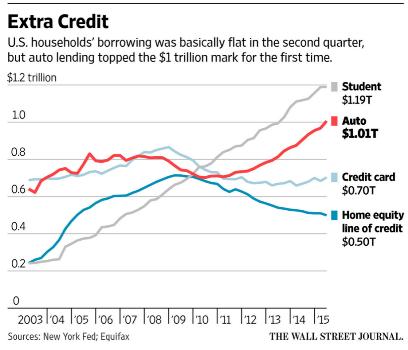

But they’ve apparently been floating on a tide of extremely easy credit. In 2010, fewer than a tenth of car loans were for more than six years. Today the average loan is nearly that long. During the same expansion, outstanding auto credit rose from $600 billion to over a trillion. Car buyers are now challenging college students for the title of most clueless borrower. So expect all those breathless accounts of the bulletproof US auto market to be replaced with laments about empty showrooms in the near future.

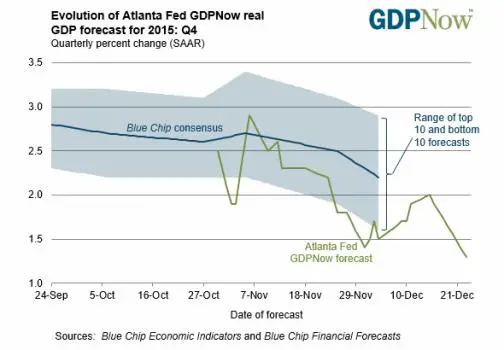

Add it all up and you get an economy that’s carrying some serious weight on its shoulders and rapidly losing momentum. Here’s the Atlanta Fed’s latest GDP Now reading, which puts Q4 growth at less than 1.5%:

None of which is especially noteworthy. Expansions usually start to look like this after six or seven years, especially those fueled by subprime lending.

What is noteworthy that these trends are playing out in an environment when all the other major economies are also rolling over and the US Fed has just begun a tightening cycle. That makes 2016 a uniquely scary year.

Hurry, more QE please.

From 1950’s – 1990’s, the U.S. was productive (mfg) and saved, and prospered.

Today, savings is outlawed by by Obama with ZIRP.

Today, productivity (mfg’ing) has been sent offshore with Trade Deals, starting with NAFTA (Clinton) and continued with Bush and Obama.

QE is for the rich multinational corp’s.

Your gov’t, working for you.

Trump will inherit a real mess from these QE/ZIRP/MORON criminals.

” We’re selling less real stuff abroad, so factories are making less: …………”

Less the result of a strong dollar, IMO, than the result of our “Free Trade” treaties impacting the productive American worker and Corporations with unrestrained competition from foreign labor with working conditions and pay so far below ours there really isn’t even a way to adequately compare it.

But I’m no expert, just a average guy that has watched things develop over the last thirty or so years, so maybe my opinion is of no value.

Just another debt brick in the debt wall.

With the global economy ‘debt car’ approaching that wall at full throttle and NO brakes!

http://www.cnbc.com/2015/12/30/2015-was-the-hardest-year-to-make-money-in-78-years.html

Alert! Alert!

Get out of debt now any way you can.

Not that it will save us…but it is better

than having to live in someone’s basement.

Does anyone know if mainstream mortgages in the US have payment on demand clauses? I know that VA mortgages don’t but I’ve read that during the Great Depression many mortgage loans were called in when things went south and many lost their homes.

Anon above was I.

“Does anyone know if mainstream mortgages in the US have payment on demand clauses?” —-IS

They almost all do ….. although the wording “payment upon demand” may not be specifically used.

However, almost every mortgage (I’ve never seen one without it) has an Acceleration Clause …. a terminology used in mortgage agreements that require the borrower to pay off the loan immediately if certain conditions are met, such as missing 3 or more consecutive payments or selling the home … all of which is effectively a payment on demand.

@specops this scenario will determine if Trump is actually a businessman or just someone to perpetuate the game of the pocb’s .

Myself , as a manager , know how to cut costs or increase sales to make sure I don’t cut costs.

What does the government actually produce? Other than tyranny , I do not know.

Vast majority of so called government is unconstitutional , which goes back to my post on the Incorporated USA.

There are vast riches from a collective that filter down to the masses , but at what cost?

Near as I remember Latin , Stucky , mortgage means DEATH GRIP .

Working on my cognitive dissonance concerning the so called government , adding pluses and minuses and I fear the outcome actually . On the other hand , what if TPTB are actually helping the average person ? At what cost to freedom tho is my question I think .

I believe the cost is too high . Everything is semi ok atm , but if they got to get rid of the velvet glove um shit gets exponential .

Thanks Stuck. I know that our VA mortgage has no such demand or acceleration clause. I was told that they are not allowed by the VA since the VA “backs” the loan. Still, both my wife and I read the docs thoroughly before signing.