Guest Post by Martin Armstrong

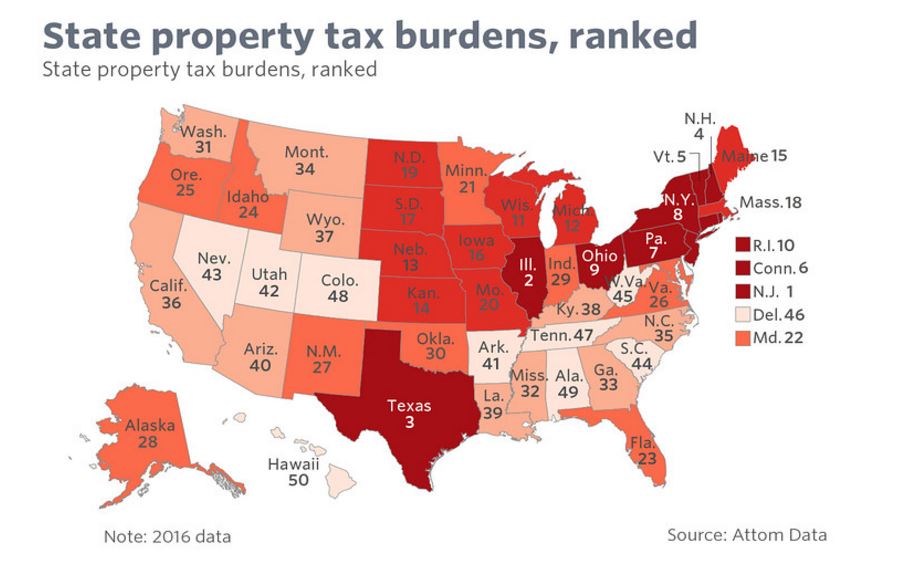

The latest report on property tax comparisons within the USA has been released. A report from Attom Data shows just how nuts things are becoming with regard to taxes. Property taxes have become really insane in the North. The average annual property tax bill in Alabama in 2016 was $776 compared to the the highest average is New Jersey where it stands at $8,477.

The latest report on property tax comparisons within the USA has been released. A report from Attom Data shows just how nuts things are becoming with regard to taxes. Property taxes have become really insane in the North. The average annual property tax bill in Alabama in 2016 was $776 compared to the the highest average is New Jersey where it stands at $8,477.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

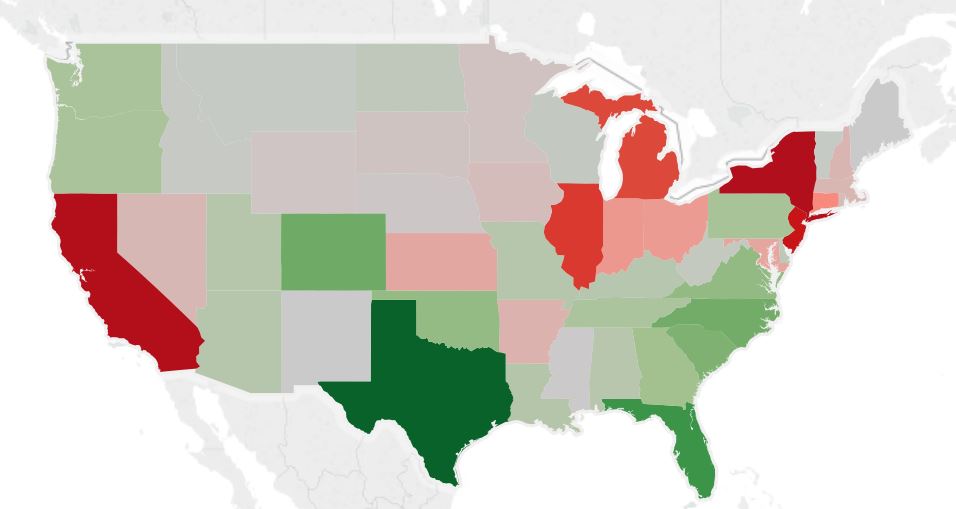

Now filter in the State Income Taxes and what emerges is human nature. For all the people who complain about multinational companies moving offshore and then deny that it is tax related and try to characterize that as simply labor is cheaper, need to look more closely. The multinational companies I restructured we looked at the whole picture. Wages were a small part and only one component. What was the amount of social taxation on top of the wages, property taxes in a region, and then the corporate tax. Gee – it looks like the individual is making the same analysis.

The net migration of people within the United States mirrors the same thing taking place corporately on a global scale. They are leaving the highest taxed states and moving to the lower taxed states. Taxes are more than just what you pay, they push up the cost of living because everyone is paying a higher tax rate and raises all consumer goods. I took a friend out with his family down from NJ and they bought ice cream cones here in Florida. The bill was about half that of what they pay at the Jersey shore. I said see: high taxes ripple through everything within the economy raising the price of everything you buy. The net bottom line – taxes rob much more of your disposable income than anyone actually attributes to government directly.

CO, which I left several years ago, has a law that states 55% of accessed property taxes are to be paid by commercial interests-yeah I know, we all end up paying but it does help to keep residential taxes down a bit. Hence their ranking at 48.

Now in Texas, my experience with the state ranked 3 is that property taxes(Lord am I really saying this?) are reasonable, especially in locales out of a city jurisdiction. Plus there is no state income tax which is nice. Plus plus, our legislature meets only every 2 years.

“No man’s life, liberty or property are safe while the Legislature is in session.” Gideon Tucker. Have also seen it attributed to Twain.

Even though the Texas tax rate of roughly 2.7% is high, the market values are substantial below the coasts.

Property taxes, income taxes, sales taxes, commuter taxes, highway tolls, it all has to be factored in, depending upon the individual’s situation. It’s all just one big shell game by the state and local governments, trying to make it impossible for a citizen to make any sort of rational comparison between locations. I hope to retire in a few years and am in the enviable position of being able to retire anywhere in the U.S. that I choose…but it’s beyond painful to try to compare different possibilities!

Retiring to the Delaware beaches looks like a good play. Very low property taxes, no sales tax, and the income tax doesn’t matter that much in retirement. Corporations based in Wilmington supply much of the taxes because the Delaware Holding Company scam is played by every S&P 500 company.

Florida is one of the best. No income tax, and outside of the big metros, property taxes are cheap. Sales tax in my county is 6%. And in the wintertime the windchill gets down into the 60’s. Brrrrr….. And a yard full of bananas, and pineapples, and mangos, and oranges, and lychees, not too bad.

Too many gators, mosquitoes, and foreigners.

That’s the tradeoff, Jim. In the metro areas, too many foreigners. In the sticks, too many mosquitos and gators. I hate all three.

And full of sinkholes (thousands yet undiscovered), wildfires, hurricanes, lightning, Disney, NASA…..

Admin,

How is the Delaware Holding Company a scam?

There are entire buildings where Wilmington banks rents out single rooms to major corporations so they have domicile in Delaware. I did it when I was at IKEA. You then make intercompany loans to your other entities in other states, resulting in huge state tax savings because the interest isn’t taxable in Delaware and you created an expense in PA. It’s legal, but it’s a scam.

Quick: how much are your property taxes? If you own real estate and pay property taxes, you probably know the answer to that question within 10%. Quick: how much did you pay in state income tax last year (assuming you don’t live in TX, FL or WA)? Chances are you don’t have any earthly idea. IMO, that’s why income taxes are worse.

My property tax here in the East Valley of Phoenix was $1185 last year, but that does not include fire protection which is separate at $495. My state tax was $827, but I got to designate $800 of that as donations to the Salvation Army and a local high school. We had one morning with a very slight frost this past winter.

Wonder what the total individual tax burden of each of the States is (Just in State taxes, not including the Federal ones)?

Armstrong contends that the trend is for government to be coming for more and more taxes going forward. I tend to believe him.

Property taxes are particularly onerous for me, continual uptrend, it’s a lot like renting, and I haven’t had a mortgage in ages.

Ever notice that it seems like when there’s a real estate bust after a real estate boom property taxes never go down as fast during the bust as they went up during the boom?

At least it seems that way, I have no proof it is so.

California only ranks where it does because millions are still “protected” by Prop. 13 and the severe limits it placed on existing home taxes. Without such limits, the taxation would be so, so much worse.

I wonder what the true tax numbers are everywhere. This includes the usual property, sales, & income taxes down to those taxes nobody talks about or even notices. Look at your utility bills. On my electric bill there’s a consumption tax & a local consumer tax. On the phone/internet bill there are various other taxes & surcharges. The gas tax in VA is low, but we have what they call a personal property tax on all vehicles, boats, trailers, large tools, etc., so I get to pay $95/year to the county for the privilege of owning a 12 yr. old truck that’s been taxed every year since I moved here after paying a sales tax on the original purchase price. Even fucking Amazon charges me sales tax on anything not 3rd party when the origin state is nowhere near my home state. No other out of state mail order company charges sales tax.

[img [/img]

[/img]

Actually, if you are a consumer, you pay EVERY tax. ALL taxation is passed on to the consumer in one way or another. A good list of the direct and VISIBLE taxes, but that is what makes all the rest so appalling – most Americans are ignorant enough to not realize that businesses DON’T pay taxes…only individuals do.

taxes: taxfoundation.org

freedom: freedominthe50states.org

I don’t bitch about taxes too much. WA has no income tax, my property tax is about $1200 and sales tax is under 9%. Our spending habits have been decreasing continuously since 2008 and food is not taxed. I only bitch when every single bond measure raising taxes gets passed. Our local plantation owners always scream bloody murder about how they have no choice but to cut police, fire and library services and the sheople get right in line and vote to keep less of their own money.

Given the proclivities of those living west of the Cascades, it remains a mystery to me how WA still does not have an income tax…

Liberals are clearly more fond of spending other peoples money than they are of spending their own money. Across the board income tax = spending their own money.

In my Georgia county, property taxes are 17.5xxx mils of which about 11 mils is for the school system with about 2200 students. Seems to be an OK school system, however the retirement scam for teachers will blow up some day. Sales tax is 7%, car tags 30 bucks for a 20 year old car, gas has been $2.00 to $2.20 or so for the past year. State income tax doesn’t apply at my income level and age. So, at this stage of life and location my tax burden is reasonable and my only gripe is that property taxes are due in December. Oh, and except for food and gas, our retail purchases are mostly on the internet, no shipping, no taxes.

in Texas, the way the locals raise money is not by raising taxes, but by doubling assessed valuation. tax increases have to be voted on by the public. raising assessed valuation is only voted on by the county commissioners , never goes to the public. net effect. taxes are doubled. in East Texas, we get lots of mosquitoes. flooding. most places in E. Texas are subject to bad flooding. the river floods, ok, but the creeks can not drain, so you get flooding along every creek. the soil is thin layer of wind blown dust from the great plains over caliche clay. next effect, the clay is already holding all the water it can, so any additional water is runoff into already flooded creeks. rural property value is based on elevation and how deep down the clay is.

and the other bad thing about Florida is that it is the lightening capital of the US.