From Lee Travis of Defiant Thinking

When I first woke up to the unsustainable and incredibly fragile nature of our financial system, I was convinced that the markets – already starting to bubble up in 2011 – would collapse. AT. ANY. MOMENT. And yet here we are, with the Dow over 21,000, more than triple the low that we saw just eight years ago, when it hit 6,627.

So what gives? And what do these record gains (which don’t correspond to any great economic or political developments) mean about the potential for a future crash?

What gives is that the central banks are much more imaginative, and much more aggressive, than anyone thought they would ever be. After the Fed “saved” the world economy by pumping trillions of liquidity into the system, it started changing the rules of the game – such as allowing banks to hide bad assets with “mark to fantasy” rules, introducing “quantitative easing” (ie naked money printing), and reducing the rate of interest to 0%.

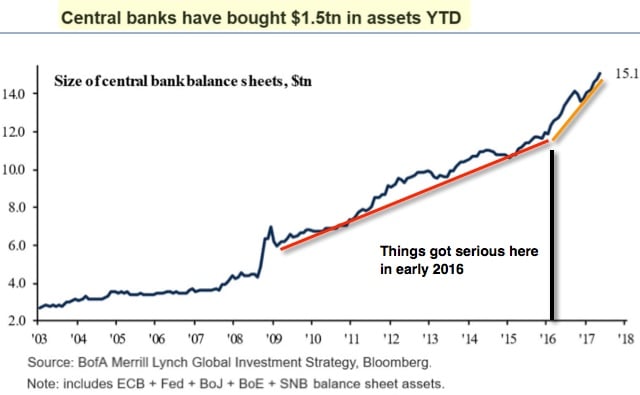

Central banks around the world have coordinated their efforts, with several reducing official interest rates well below 0% and printing money – sorry, I mean quantitatively easing – at an unimaginable pace. This chart from Peak Prosperity shows the incredible amount that central banks – in this case, BOJ and ECB at the moment – are printing to shore up the global economy:

Where is that money going, and why? Well, it’s going into financial assets mostly. The Bank of Japan is directly buying Japanese index funds; the Swiss National Bank is one of the top holders of Apple stock. And in aggregate, central banks’ portfolios of stocks and bonds continues to grow.

But why? Most people think it’s for the “wealth effect,” where people see their portfolios grow, feel better about the economy, and go spend money. And that might be part of it, though a record low percentage of Americans (52%) own any stocks at all.

No, I think the reason is much larger, and more critical.

When the Fed lowered interest rates to 0%, they helped borrowers (who we desperately need in a debt-based system). Who did they hurt? Savers – people who need a return on their investment. For most of us, that means older people trying to live off their investments, and certainly those people have been devastated. But the category also includes pension firms and insurance companies.

Traditionally, pensions and insurance firms invested quite a bit in bonds, which used to be a safe place to get a reasonable return. But now, with no return to be had, they’ve had to shift to riskier investments: The stock market. Pensions are already underfunded somewhere between $2.3 to $6 trillion, and that assumes they get really high returns – something like 7% or 8% per year on their investments. If the stock market crashes, they’ll be completely wiped out. And when pensions and insurance companies go down, they’re taking the rest of the economy with them.

So I no longer think we’ll see a stock market crash – at least not one that we’ll then recover from. Central banks will keep this going as long as they can, crash-free regardless of world events. But if it does actually crash, then buckle up – because it will CRASH in a way we’ve never seen before.

Will the stock market crash?

Of course it will, the same as it has several times before.

The question is when, next week or sometime after it hits, say, 35,000 some number of years from now?

Or will it just stabilize somewhere close to where it is now and stay that way for a few decades till earnings catch up enough to justify the prices going higher again?

My personal feeling (and reinforced by the indicators I watch closely) is that a market crash – definition – an uncontrolled drop in market pricing that cannot be stopped is now impossible. The powers in charge have had almost 9 years to fix their systems so they control EVERYTHING. We have allowed it to happen, in the naïve thought that they care about us, and would NEVER use it to THEIR advantage.

No, the more likely scenario is a controlled demolition.

The way this will work is that the people connected, and in the know, – you know who they are if you are on this blog – will be informed through their channels of the coming necessary demolition, and proceed to move their money in to the avenues that they are all told are going to be more fruitful. Then they will proceed to either pay no attention to, or in some cases (Goldman) actively short those same assets, we the sheeple will be actively encouraged to buy (or be priced out forever, of course).

We, the tax paying public and 401K sheeple, will of course be uninformed of the necessary and coming controlled demo – after all, the owners must have someone to sell to before the demolition begins.

At that point, the markets will just slowly bleed, through fits and starts for many years. Gradually souring any of the day traders, weekend warriors, “investors” etc. to stocks, therefore making even good assets cheaper. Then, of course the owners will begin moving from the investments they bought previously, in to stocks again. This will be coincidentally the same time when the media will come out with articles such as “the death of stocks for the new generation” and “will Real Estate ever come back” and “the new generation is skeptical on investments” etc.

Thus, unfortunately, is the way of the world now.

I think you’ve just described “stagflation”. Aah, those ’70’s.

Depends how long the Banksters want to keep the circle jerk going.

Yes the stock market will crash. It will crash from 28000 to around 23000. It will be a sea of red. The problem is, it will at no point fall below where it is today. Then they will print a batshit crazy amount of money and it will jump to 35000.

I think the problem is the unit of measure. There will be a crash in purchasing power represented by the stock and bond markets. There will be a bull market in the indexes. The dollar and the other currencies are a confidence game. And it will go on until people 1) have an alternative and 2) lose confidence.

hey, good comment. Some of the largest stock market gains came from places like Venezuela where the currency is collapsing. I think Venezuela market was up 400% one recent year (but don’t hold me on this as completely accurate).

The problem for stocks is they represent ‘earnings’ and Central Banks can’t manufacture profits. They can allow multiples to grow by keeping interest rates down but they can’t generate cash flow.

What are they going to do if auto sales fall to 15 million? If people decide they cannot afford or do not need iPhone X. If advertisers realize Facebook clicks do not for sales make? If people lose their jobs or max out their credit what can they buy and if they don’t buy what happens to profits.

I have only semantic issues with your comment, but they’re important ones: Of course, they can manufacture profits. Profits are nothing more than a line on an accounting spreadsheet. Non-GAAP (MUBSAP) is a perfect example of “manufacturing profits.” They cannot manufacture real production by throwing currency around. Same with cash flow, they can ramp up cash flow all the live long fuckin day. They cannot create genuine wealth by pumping “cash” everywhere.

These may seem like nit-picks, but I am a huge believe that a lack of defining terms is one of the most fundamental issues in our bullshit system…and it is not on accident.

Unit 472

You mentioned central banks cannot generate cash flow

That is true assuming cash flows between willing buyers and sellers

When central banks become the buyers and private companies become the sellers, the stocks increase because more money goes in than comes out.

But this is not natural for the money paid to purchase stocks does not come from private wealth

From a cash flow standpoint, how can we be better off if we cannot identify who is flowing the cash if it is central banks and not individuals or private businesses?

How can we be better off if central banks own more of this puffed-up wealth?

You are correct. Stocks are governed by supply and demand. Nothing more. Earnings per share only matter when people that could lose money are buying them. A central bank cannot lose money, as they produce it out of thin air. They can determine the supply-demand equation simply by sucking up all of the excess inventory. They have no worry about losing money, as they have no margin clerk. I have seen buys of millions of S&P futures before the open any given day in the market. Not even a TBTF bank is going to take on that much risk in one shot. No way. Even their caged compliance officers would have a fit. No, there is only one entity that can throw that kind of firepower at a market with reckless abandon. All you can do is know how they are rigging the game, and take advantage of it to get some of those freshly printed notes in your possession.

What number is associated with stock “markets” is inconsequential. All that matters is that the rubes have confidence. The stock “markets” could ramp up to infinity (look at stock market charts from Wiemar or Zimbabwe)–but confidence can be entirely eroded. The stock “markets” do not put food on the table…no it takes billions of barrels of oil, itself transported all over the world, then refined into diesel fuel for tractors and into fertilizers of over-stressed soil, then all that food has to be picked and shipped (on average over 1500 miles) to get to John and Jane Q’s table. Oh, yeah and it takes MILLIONS of workers going to work everyday for a currency they believe has value.

If that massively complex, inefficient and fragile system breaks down it won’t matter in the least if the DOW is at 2000 or 50000.

So if the insurance companies go down, what does that mean for policy holders? I assume it means no more policy right or is this limited to specific types of insurance companies? The only thing I’m concerned with is the term life policies my wife and I have.

Most states have a guarantee fund for insurance companies that fail.What usually happens is that they find another company to take over the failed company and the guarantee fund funds any shortfalls.The same way bank failures are handled.The bank closes Friday pm as 1st National of Bumfuk and opens Mon am as Farmers & Merchants Bank of Peoria.

If many insurance cos. start failing though,the funds will rapidly go belly up themselves.

Thanks Tampa.

Tell us something we don’t already know.

It’s a crooked NYC game and it depends on whether you are on the inside or not. When Global Cooling is obvious even to Al Gore, both the Shlock Market and NYC will crash.

just a thought:

with the advent of Algos now controlling most of the volume, and, the fact that there is a plunge protection team always available to prop up markets, and that fact that there are “circuit breakers” that will stop markets from dropping more than 10% in a trading day, I say:

why worry? the worst that can happen is a %10 drop in any single day, and when that day happens, then you can think about pulling out of the casino.